Professional Documents

Culture Documents

QUESTION 1: Financing Decision (Debt Equity Swap - Leveraged Buyback)

Uploaded by

sairad1999Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QUESTION 1: Financing Decision (Debt Equity Swap - Leveraged Buyback)

Uploaded by

sairad1999Copyright:

Available Formats

WARM UP Advanced Financial Management

WARM UP

QUESTION 1: Financing Decision (Debt Equity Swap – Leveraged Buyback)

DCL Soft Drinks Company is an all equity firm with 200,000 shares outstanding. Its profit after tax is

Rs. 11.2 million and the market value is Rs. 100 million. The firm is now intending to take debt of Rs.

60 million. DCL approached Bank of Punjab for loan and came to know that 50% of the loan amount

would be financed at 10% but for the remaining half of the fund the bank would charge 2% more.

The firm has agreed to accept the financing from Bank of Punjab. DCL is planning to use these

entire funds to repurchase its shares from the market. The tax rate for the company is 30%.

You are required to

a. Determine the effect on earning per share, on the action.

b. Estimate the interest rate on the debt that would disappear the effect on earning per share.

1 Sanjay Saraf Educational Institute

WARM UP Advanced Financial Management

ANSWER:

a. EPS (current)= 11200,000/200,000= Rs.56.

Market price of the shares is Rs 100,000,000/200000 = Rs. 500.

So, with Rs, 60 million the firm can repurchase Rs 60,000,000/500 = 120000 shares

So, after the repurchase number of outstanding shares would be 200000 – 120000 = 80000

EPS (after taking debt and repurchases of share)

Existing PAT – Post Tax additional interest expense

=

Post Buyback no. of shares

11.2 0.7 % 0.5 12%)

= = Rs.82.25

0.08

b. Equating EPS before and after the repurchase we get,

11.2 0.7 r% 0.5 r+2)%)

= = 56

0.08

Or, r = 15%

So, if the rate of interest on debt becomes 15% on first Rs. 30 million and 17% on second Rs. 30

million then effect on EPS would disappear.

2 Sanjay Saraf Educational Institute

WARM UP Advanced Financial Management

QUESTION 2: Capital Budgeting (Make or buy involving TVM and Taxation)

Auto Lamps Ltd. (ALL) is in the business of specialty lamps for automobiles. Most of its products are

made in its own factory while some are outsourced. Currently ALL wants to introduce a new Lamp

for two wheelers, which can be made in its factory or bought from its suppliers.

If ALL wants to produce the Lamp it requires an investment of Rs. 20,00,000 in plant and machinery,

which can be fully depreciated on a straight-line basis over its useful life of 10 years. The cost of

production (excluding depreciation) per Lamp is expected to be Rs. 50. A supplier is quoting a price

of Rs.60 per Lamp and is ready to supply any quantity at the same price. The company’s cost of

capital is 15% and the tax rate is 40%. Assume all cash flows are certain.

You are required to

a. Advise the company (with detailed working notes) whether to Make or Buy the Lamps if the

market demand is for 50,000 Lamps per annum

b. What should be the annual demand (quantity) so that the company can produce on its own and

the NPV is not negative?

3 Sanjay Saraf Educational Institute

WARM UP Advanced Financial Management

ANSWER:

a. Advantage/(Disadvantage) of Making

= Post-tax savings in cost of production due to making + Depreciation tax shield

= {(PVIFA 10 Years, 15%) x Q (P – C) x (1 – t)} + {Dt x (PVIFA 10 Years, 15%) – I}

= {(5.019) x 50,000 (60 – 50) x (1 – 0.40)} + {2,00,000 x 0.40 (5.019) – 20,00,000)}

= (Rs. 92,780)

As making results in losses it is better to Outsource.

P = Purchase price per unit

C = Cost of production per unit

Q = Quantity demanded in the market

t = Tax rate

D = Depreciation per annum = I (1/10)

I = Investment in Fixed assets

PVIFA = Present Value Interest Factor of Annuity

Dt (PVIFA10 Years,15%) - I

b. Minimum demand to avoid losses (Q) =

(PVIFA10 Years,15%) (P - C) (1 - t)

2,00,000 0.40(5.019) - 20,00,000

=

(5,019) (60 - 50) (1 - 0.40)

= 53,081 units.

4 Sanjay Saraf Educational Institute

You might also like

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Cost of Capital Solved ProblemsDocument16 pagesCost of Capital Solved ProblemsHimanshu Sharma85% (207)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Sem 2 Question Bank (Moderated) - Financial ManagementDocument63 pagesSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNo ratings yet

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaDocument9 pages6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghNo ratings yet

- Accounting Entries in SAP FICO - FICO SAP Accounting Postings - SAP Training TutorialsDocument4 pagesAccounting Entries in SAP FICO - FICO SAP Accounting Postings - SAP Training Tutorialsnarender9679100% (1)

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- Cost of Capital Capital - StructureDocument42 pagesCost of Capital Capital - Structurearmailgm67% (6)

- Mock QuizDocument11 pagesMock QuizMichelle MarquezNo ratings yet

- Secretary's Certificate For Account Opening (Domestic Corporation)Document3 pagesSecretary's Certificate For Account Opening (Domestic Corporation)JACQUE ARCENALNo ratings yet

- Some Exercises On Capital Structure and Dividend PolicyDocument3 pagesSome Exercises On Capital Structure and Dividend PolicyAdi AliNo ratings yet

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoNo ratings yet

- Chapter 6 Revenue RecognitionDocument41 pagesChapter 6 Revenue Recognitionsamuel hailuNo ratings yet

- Numericals On Financial ManagementDocument4 pagesNumericals On Financial ManagementDhruv100% (1)

- Engineering Economy Module 2Document33 pagesEngineering Economy Module 2James ClarkNo ratings yet

- Chapter 1 - Introduction To Bank Lending PDFDocument10 pagesChapter 1 - Introduction To Bank Lending PDFH SinghNo ratings yet

- The Following Financial Data Have Been Furnished by A Ltd. and B LTDDocument10 pagesThe Following Financial Data Have Been Furnished by A Ltd. and B LTDNaveen SatiNo ratings yet

- 3A. Capital Structure Leverages Numerical MarkedDocument3 pages3A. Capital Structure Leverages Numerical MarkedSundeep MogantiNo ratings yet

- Test AnswersDocument9 pagesTest AnswersKriti Wadhwa100% (1)

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Forex 16 HW Part 3 HW Extra Q Answer PDFDocument3 pagesForex 16 HW Part 3 HW Extra Q Answer PDFprabhat khandelwalNo ratings yet

- Part 1 - FM & ECO - 27145216 PDFDocument3 pagesPart 1 - FM & ECO - 27145216 PDFMaharajan GomuNo ratings yet

- Unit 2 LeveragesDocument4 pagesUnit 2 Leveragesbhargavayg1915No ratings yet

- 1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerDocument6 pages1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerPratyushNo ratings yet

- CA Intermediate - Financial Management Solve Any 3 Questions From The Following 4 Questions Total Marks - 48 Q1)Document12 pagesCA Intermediate - Financial Management Solve Any 3 Questions From The Following 4 Questions Total Marks - 48 Q1)Sohail Ahmed KhiljiNo ratings yet

- Financial Management SuggestionsDocument7 pagesFinancial Management SuggestionsSundarNo ratings yet

- Fitriyanto - Financial Management Asignment - CH 14 15Document6 pagesFitriyanto - Financial Management Asignment - CH 14 15iyanNo ratings yet

- Practice - Cost of CapDocument6 pagesPractice - Cost of CapShruti AshokNo ratings yet

- Paper14 SolutionDocument15 pagesPaper14 Solutionharshrathore17579No ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- LEVERAGE - Hons.Document7 pagesLEVERAGE - Hons.BISHAL ROYNo ratings yet

- FM+ECO M.Test EM Question 26.02.2023Document6 pagesFM+ECO M.Test EM Question 26.02.2023harish jangidNo ratings yet

- FM NumericalDocument3 pagesFM NumericalNitin KumarNo ratings yet

- CTM Tutorial 3Document4 pagesCTM Tutorial 3crsNo ratings yet

- FM Eco Important 1620388826Document126 pagesFM Eco Important 1620388826Naresh SomvanshiNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- Paper14 SolutionDocument25 pagesPaper14 SolutionGregorio VidadNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- Finc 3310 - Actual Test 3Document5 pagesFinc 3310 - Actual Test 3jlr0911No ratings yet

- Assignment - Leverage - ADocument1 pageAssignment - Leverage - AJijenthiran DuraisamiNo ratings yet

- Capital Budgeting Numericals and CasesDocument5 pagesCapital Budgeting Numericals and CasesAnkur ShuklaNo ratings yet

- Unit 5, 6 & 7 Capital Budgeting 1Document14 pagesUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaNo ratings yet

- Commando Test On FM (COC, CSP, DP) : Ranker's ClassesDocument3 pagesCommando Test On FM (COC, CSP, DP) : Ranker's ClassesmuskanNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- 2nd Assignment of Financial ManagementDocument6 pages2nd Assignment of Financial Managementpratiksha24No ratings yet

- Case Study On LeveragesDocument5 pagesCase Study On LeveragesSantosh Kumar Roul100% (3)

- Assignment 1Document2 pagesAssignment 1Mitch wongNo ratings yet

- Final Exam A142 AnswerDocument10 pagesFinal Exam A142 AnswerNadirah Mohamad SarifNo ratings yet

- FM Assignment 7 - Group 4Document7 pagesFM Assignment 7 - Group 4Puspita RamadhaniaNo ratings yet

- FM Unit 1-5Document260 pagesFM Unit 1-5VINAY BETHANo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Final Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DDocument8 pagesFinal Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DSREYA JAGARLAPUDINo ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- Set ADocument3 pagesSet AManish KumarNo ratings yet

- Financial Management: EPS Rs. EPS RsDocument3 pagesFinancial Management: EPS Rs. EPS RsDank ShankNo ratings yet

- Q1.ABC LTD Has The Following Book Value Capital StructureDocument3 pagesQ1.ABC LTD Has The Following Book Value Capital StructureRishi MishraNo ratings yet

- Tugas FM CH 14 SD 17 - Fitriyanto - NewDocument12 pagesTugas FM CH 14 SD 17 - Fitriyanto - NewiyanNo ratings yet

- Practice Problems CorpFinDocument2 pagesPractice Problems CorpFinSrestha ChatterjeeNo ratings yet

- FFM Exam Feb 2018 IDocument8 pagesFFM Exam Feb 2018 IFidoNo ratings yet

- Ebit Eps AnalysisDocument15 pagesEbit Eps AnalysisGunjan GargNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- Class Questions - Cap BudgetingDocument4 pagesClass Questions - Cap BudgetingMANSA MUDGALNo ratings yet

- Advanced Capital Budgeting 4 CWDocument4 pagesAdvanced Capital Budgeting 4 CWsairad1999No ratings yet

- Case Study 3: Alok Industries: Business ValuationDocument6 pagesCase Study 3: Alok Industries: Business Valuationsairad1999No ratings yet

- Advanced Capital Budgeting 3 CWDocument3 pagesAdvanced Capital Budgeting 3 CWsairad1999No ratings yet

- Bond Class 8Document2 pagesBond Class 8sairad1999No ratings yet

- Business Valuation Amendment ClassDocument3 pagesBusiness Valuation Amendment Classsairad1999No ratings yet

- May 22 RTPDocument12 pagesMay 22 RTPsairad1999No ratings yet

- Amendment File - CA Final Audit - Green EditionDocument24 pagesAmendment File - CA Final Audit - Green EditionsrkNo ratings yet

- Advanced Capital Budgeting 2 CWDocument4 pagesAdvanced Capital Budgeting 2 CWsairad1999No ratings yet

- Steps To Update ULURN Laptop SoftwareDocument2 pagesSteps To Update ULURN Laptop Softwaresairad1999No ratings yet

- Peer Review ScannerDocument7 pagesPeer Review Scannersairad1999No ratings yet

- Advanced Capital Budgeting 3 HW - Q6Document4 pagesAdvanced Capital Budgeting 3 HW - Q6sairad1999No ratings yet

- SFM May 2022 Paper Analysis-New Syllabus-Question 2aDocument13 pagesSFM May 2022 Paper Analysis-New Syllabus-Question 2asairad1999No ratings yet

- Business Valuation Amendment ClassDocument3 pagesBusiness Valuation Amendment Classsairad1999No ratings yet

- 3 Application of ForensicDocument10 pages3 Application of Forensicsairad1999No ratings yet

- IGCSE-OL - Bus - CH - 22 - Answers To CB ActivitiesDocument2 pagesIGCSE-OL - Bus - CH - 22 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- Important Reports in SAP FI: GL Chart of Accounts ListDocument21 pagesImportant Reports in SAP FI: GL Chart of Accounts ListsurendraNo ratings yet

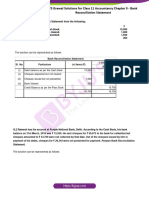

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Amir 12Document3 pagesAmir 12Dani KhanNo ratings yet

- Instructions To Prework On ISSAI Framework StructuresDocument8 pagesInstructions To Prework On ISSAI Framework StructuresCharlie MaineNo ratings yet

- FABM 2 Module 1Document16 pagesFABM 2 Module 1Rene Castillo JrNo ratings yet

- True/FalseDocument5 pagesTrue/FalseMaha HamdyNo ratings yet

- PF I League Tables 2014Document34 pagesPF I League Tables 2014stavros7No ratings yet

- Report On Recruitment of Life Advisors Bharti AXADocument84 pagesReport On Recruitment of Life Advisors Bharti AXAmegha140190No ratings yet

- Business 4079: Assignment 2 Suggested AnswersDocument8 pagesBusiness 4079: Assignment 2 Suggested AnswersyodhisaputraNo ratings yet

- Banking & Financial Services-Unit 1 PDFDocument49 pagesBanking & Financial Services-Unit 1 PDFImran KhanNo ratings yet

- Ap A1Document23 pagesAp A1Liên ĐỗNo ratings yet

- Tugas Resume Chapter 2 Dan Chapter 3Document3 pagesTugas Resume Chapter 2 Dan Chapter 3sri wahyuniNo ratings yet

- Accounting New Syllabus Question PaperDocument7 pagesAccounting New Syllabus Question Paperpradhiba meenakshisundaramNo ratings yet

- Chapter 5. Financial Analysis of Investment ProjectsDocument40 pagesChapter 5. Financial Analysis of Investment ProjectsThư Bùi Thị AnhNo ratings yet

- A. Chart of Accounts Artful Dodger Supply Chain DateDocument26 pagesA. Chart of Accounts Artful Dodger Supply Chain DateYungkee ChowNo ratings yet

- Quiz 4Document7 pagesQuiz 4Vivienne Rozenn LaytoNo ratings yet

- Debit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedDocument1 pageDebit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedRajesh KumarNo ratings yet

- Book 4Document33 pagesBook 4Mohammed Abdul KhuddoosNo ratings yet

- Project Report On Mutual FundDocument79 pagesProject Report On Mutual FundNikita Bhatt100% (1)

- Laporan Individu - Inggih RahayuDocument16 pagesLaporan Individu - Inggih RahayuInggih RahayuNo ratings yet

- Debt Service Coverage Ratio (DSCR) Calculations and ExamplesDocument6 pagesDebt Service Coverage Ratio (DSCR) Calculations and ExamplesRoy Alexander SebayangNo ratings yet

- Kate Myers CaseDocument2 pagesKate Myers CasejavierjpaganNo ratings yet