Professional Documents

Culture Documents

BAI GIAI Ex 1 2 3 and 5.3

Uploaded by

nhuhuyen.011120030 ratings0% found this document useful (0 votes)

2 views4 pagesOriginal Title

BAI GIAI ex 1 2 3 and 5.3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views4 pagesBAI GIAI Ex 1 2 3 and 5.3

Uploaded by

nhuhuyen.01112003Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Ex 1

a) **Depreciation each year from 2012 to 2015

(40,000 – 2,000)/10= $3,800

Dr Depreciation expense $3,800

Cr Accumulated depreciation $3,800

** Carrying amount = (40,000 – 3,800x4) =$24,800

** Depreciation each year in 2016 and subsequent years

(24,800 – 700)/11 = $2,191

Dr Depreciation expense $2,191

Cr Accumulated depreciation $2,191

b)

** The profit or loss statement 2015 2016

Depreciation Expense 3,800 2,191

** The financial position statement

Accumulated depreciation 3,800x4 =15,200 15,200 + 2,191 =17,391

** Effect on 2015 net income = 3,800 – 2,191 = increase

Ex 2 :

a) **Depreciation expense in 2014

(20,000 -2,000)/10 = $1,800

Dr Depreciation expense $1,800

Cr Accumulated depreciation

**Carrying amount at Jan 1, 2015: 20,000 -1,800x1 = $18,200

**Depreciation expense each year from 2015 and subsequent years

(18,200 -3,000)/9 = $1,689

Dr Depreciation expense $1,689

Cr Accumulated depreciation

b) Present the affects of change in accounting estimate in financial

statement as at 31 Dec, 2015, also present one comparetive period

(2014)

** The profit or loss statement 2014 2015

Depreciation Expense 1,800 1,689

** The financial position statement

Accumulated depreciation 1,800x1 =1,800 1,800 + 1,689 =3,489

** Effect on 2015 net income = 1,800 – 1,689 = 111 increase

Ex 3:

a) **Depreciation expense in 2009

[(20,000 – 2,000)/10]/2 = $900

Dr Depreciation expense $900

Cr Accumulated depreciation

**Depreciation expense each year from 2010 to 2016

(20,000 – 2,000)/10 = $1,800

Dr Depreciation expense $ 1,800

Cr Accumulated depreciation

**Carrying amount at Jan 1, 2017: 20,000 – 1,800x7,5= 6,500

**Depreciation expense each year from 2017 and subsequent years

(6,500 – 2,000)/12,5 = $360

Dr Depreciation expense $360

Cr Accumulated depreciation

b) Present the affects of change in accounting estimate in financial

statement as at 31 Dec, 2017, also present one comparetive period

(2016)

** The profit or loss statement 2016 2017

Depreciation Expense $1,800 $360

** The financial position statement

Accumulated depreciation 1,800x7,5 =13,500 13,500 + 360 =13,860

** Effect on 2017 net income = 1,800 – 360 =1,440 increase

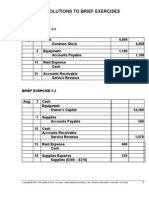

5.3

a) **Depreciation each year from 1 July 2007 to 1 July 2012

(5,000,000 -0)/15 = $333,333

Dr Depreciation expense 333,333

Cr Accumulated depreciation

** Carrying amount = 5,000,000 -333,333x5 = 3,333,333

** Depreciation each year in 2013 and subsequent years

(3,333,333 – 0)/15 = 222,222

Dr Depreciation expense 222,222

Cr Accumulated depreciation

b)

** The profit or loss statement 2012 2013

Depreciation Expense 333,333 222,222

** The financial position statement

Accumulated depreciation 333,333x5 =1,666,665 1,666,665 +222,222 =

1,888,887

** Effect on 2013 net income = 333,333 – 222,222 = 111,111 increase

You might also like

- BÀI GIẢI BÀI TẬP CHƯƠNG 5Document2 pagesBÀI GIẢI BÀI TẬP CHƯƠNG 5Nguyễn MaiNo ratings yet

- CB Lecture 1Document20 pagesCB Lecture 1Tshepang MatebesiNo ratings yet

- Intermediate Accounting Solutions To Exercises 11Document38 pagesIntermediate Accounting Solutions To Exercises 11Hira Farooq100% (1)

- Far Tutor 3Document4 pagesFar Tutor 3Rian RorresNo ratings yet

- ACCA TX Assignment Samantha, Peter and AeDocument14 pagesACCA TX Assignment Samantha, Peter and AeRich KishNo ratings yet

- Depreciation Methods: (Example, Straight Line Depreciation)Document5 pagesDepreciation Methods: (Example, Straight Line Depreciation)munnag01No ratings yet

- GDP, Multiplier and Unemployment in BangladeshDocument5 pagesGDP, Multiplier and Unemployment in BangladeshFahmid HassanNo ratings yet

- Chapter 9Document7 pagesChapter 9jeanNo ratings yet

- IV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods CorpDocument9 pagesIV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods Corpjennie martNo ratings yet

- Multiple Choice Answers and SolutionsDocument11 pagesMultiple Choice Answers and SolutionsLaraNo ratings yet

- Example, Straight Line DepreciationDocument12 pagesExample, Straight Line DepreciationKhadija Karim100% (2)

- Annexure: Σ Q∗P (2006) ΣQ∗P (2011) *100 =Document3 pagesAnnexure: Σ Q∗P (2006) ΣQ∗P (2011) *100 =Ajay SubediNo ratings yet

- Long-Term Construction ContractsDocument12 pagesLong-Term Construction Contractsblackphoenix303No ratings yet

- Tugas 2 Evaluasi Ekonomi Pabrik KimiaDocument9 pagesTugas 2 Evaluasi Ekonomi Pabrik KimiaIllona NathaniaNo ratings yet

- Assignment1 - 12734253Document5 pagesAssignment1 - 12734253Muhammad Daniyal100% (1)

- A. National Income Accounting Refers To The Government Bookkeeping System ThatDocument8 pagesA. National Income Accounting Refers To The Government Bookkeeping System ThatkalehiwotkoneNo ratings yet

- Shehzina Fin AssignmentDocument6 pagesShehzina Fin AssignmentSheikh Roshnee 1731695No ratings yet

- Business Taxable Income Capital Gains: Part A - Non-Capital and Net Capital LossesDocument3 pagesBusiness Taxable Income Capital Gains: Part A - Non-Capital and Net Capital LossesLisa ZhangNo ratings yet

- Example, Straight Line DepreciationDocument3 pagesExample, Straight Line Depreciationkinnera mNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Case Answer (8068)Document3 pagesCase Answer (8068)Ali Al AjamiNo ratings yet

- Self Study Solutions Chapter 3Document27 pagesSelf Study Solutions Chapter 3flowerkmNo ratings yet

- IMT PatanjaliDocument4 pagesIMT PatanjalisquyenNo ratings yet

- Homework 1 - AnswerDocument8 pagesHomework 1 - Answer蔡杰翰No ratings yet

- Annexure: Σ Q∗P (2006) ΣQ∗P (2011) *100 =Document3 pagesAnnexure: Σ Q∗P (2006) ΣQ∗P (2011) *100 =Ajay SubediNo ratings yet

- Understanding Balance Sheet and Financial StatementsDocument21 pagesUnderstanding Balance Sheet and Financial StatementsPGNo ratings yet

- Chapter 19 HWDocument4 pagesChapter 19 HWAarti J. KaushalNo ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Product Equivalents OILDocument24 pagesProduct Equivalents OILLucasNo ratings yet

- Depreciation CH 10Document5 pagesDepreciation CH 10Bitta Saha HridoyNo ratings yet

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- Multiple Choice: Chapter 16 - SolvingDocument19 pagesMultiple Choice: Chapter 16 - SolvingElla LopezNo ratings yet

- Advanced Accounting, Part 1: Determine The FollowingDocument2 pagesAdvanced Accounting, Part 1: Determine The FollowingPaolo RamirezNo ratings yet

- New York City Preliminary Expense Revenue Contract Budget FY2011Document487 pagesNew York City Preliminary Expense Revenue Contract Budget FY2011Aaron MonkNo ratings yet

- Quiz-2 AnswerDocument4 pagesQuiz-2 AnswerArush BhatnagarNo ratings yet

- Exercise Topic 8 Expenditure ApproachDocument5 pagesExercise Topic 8 Expenditure Approachliyana nazifaNo ratings yet

- Comparative Financial StatmentsDocument10 pagesComparative Financial StatmentsRenu Bala JainNo ratings yet

- Accounting Seminar 16: Team 6Document64 pagesAccounting Seminar 16: Team 6Jerilynn YeoNo ratings yet

- MY Solution PaperDocument3 pagesMY Solution Paperyara hazemNo ratings yet

- Example On DepreciationDocument3 pagesExample On Depreciationmohammad sharifNo ratings yet

- AdvAcct Chapter04 Solutions 07.13Document35 pagesAdvAcct Chapter04 Solutions 07.13Andrew Gladue100% (1)

- Chapter 4 SolutionsDocument12 pagesChapter 4 SolutionsSoshiNo ratings yet

- Chapter 3 Fundamental Interpretations Made From Financial Statement Data 1) D 2) B 3) C 4) B 5) B 6) A 7) BDocument4 pagesChapter 3 Fundamental Interpretations Made From Financial Statement Data 1) D 2) B 3) C 4) B 5) B 6) A 7) BJue WernNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Problem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductDocument15 pagesProblem 1-10 (Polk Company) A) Basis of Allocation of Sales Price of Main ProductJPNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Pleasanton City Council Report On Budget Revisions 4/15/2020Document7 pagesPleasanton City Council Report On Budget Revisions 4/15/2020Courtney TeagueNo ratings yet

- Chapter 11Document13 pagesChapter 11jake doinog100% (6)

- Problem Set 1 SolutionsDocument5 pagesProblem Set 1 SolutionsvishakhaNo ratings yet

- Chapter 10 DepreciationDocument3 pagesChapter 10 Depreciationyoussef walidNo ratings yet

- Chapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Document5 pagesChapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Kimberly Claire AtienzaNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- Example 5.7Document7 pagesExample 5.7Omar KhalilNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Airbus Settles Fettling Dust With Clean Air SolutionDocument1 pageAirbus Settles Fettling Dust With Clean Air SolutionstephendixNo ratings yet

- SKF BeyondZero White Paper 12761ENDocument12 pagesSKF BeyondZero White Paper 12761ENdiosmio111No ratings yet

- Final - Far Capital - Infopack Diana V3 PDFDocument79 pagesFinal - Far Capital - Infopack Diana V3 PDFjoekaledaNo ratings yet

- ProEXR ManualDocument44 pagesProEXR ManualSabine BNo ratings yet

- Crew Body Temp: Arrival ArrivalDocument1 pageCrew Body Temp: Arrival ArrivalАлександр ГриднёвNo ratings yet

- Needs Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionDocument2 pagesNeeds Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionAlvin LaroyaNo ratings yet

- Overhead Line SolutionsDocument8 pagesOverhead Line SolutionsDomingo O Chavez PeñaNo ratings yet

- Towards Improvement of The Rights and Duties of Mutawalli and Nazir in The Management And..Document17 pagesTowards Improvement of The Rights and Duties of Mutawalli and Nazir in The Management And..Mutqinah SshiNo ratings yet

- HPDocument71 pagesHPRazvan OracelNo ratings yet

- Makalah MGR Promot - Clma Gravity - p2pd TmminDocument27 pagesMakalah MGR Promot - Clma Gravity - p2pd TmminSandi SaputraNo ratings yet

- 14.symmetrix Toolings LLPDocument1 page14.symmetrix Toolings LLPAditiNo ratings yet

- Hospital DocumentsDocument17 pagesHospital DocumentsRaviraj PisheNo ratings yet

- Analog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Document74 pagesAnalog and Digital Electronics (Ade) Lab Manual by Prof. Kavya M. P. (SGBIT, BELAGAVI)Veena B Mindolli71% (7)

- FM Solved ProblemsDocument28 pagesFM Solved ProblemsElisten DabreoNo ratings yet

- Vibroscreen BrochureDocument12 pagesVibroscreen BrochureVarun MalhotraNo ratings yet

- Mba Mini Project ReportDocument32 pagesMba Mini Project ReportAvneesh KumarNo ratings yet

- BS en Iso 11114-4-2005 (2007)Document30 pagesBS en Iso 11114-4-2005 (2007)DanielVegaNeira100% (1)

- Cir vs. de La SalleDocument20 pagesCir vs. de La SalleammeNo ratings yet

- CodeDocument2 pagesCodeJoao BatistaNo ratings yet

- Collection of Sum of MoneyDocument4 pagesCollection of Sum of MoneyRaf TanNo ratings yet

- MSW - 1 - 2016 Munisicpal Solid Waste Rules-2016 - Vol IDocument96 pagesMSW - 1 - 2016 Munisicpal Solid Waste Rules-2016 - Vol Inimm1962No ratings yet

- Polaris Ranger 500 ManualDocument105 pagesPolaris Ranger 500 ManualDennis aNo ratings yet

- Az 203 PDFDocument337 pagesAz 203 PDFViktors PetrinaksNo ratings yet

- Research and Practice in HRM - Sept 8Document9 pagesResearch and Practice in HRM - Sept 8drankitamayekarNo ratings yet

- Nil Queries Sheet: S. No. ProcessDocument24 pagesNil Queries Sheet: S. No. ProcessTarun BhardwajNo ratings yet

- Law EssayDocument7 pagesLaw EssayNahula AliNo ratings yet

- Beer Distribution Game - Wikipedia, The Free EncyclopediaDocument3 pagesBeer Distribution Game - Wikipedia, The Free EncyclopediaSana BhittaniNo ratings yet

- Books Confirmation - Sem VII - 2020-2021 PDFDocument17 pagesBooks Confirmation - Sem VII - 2020-2021 PDFRaj Kothari MNo ratings yet

- Sick - Photoelectric 4-180 MM v2Document7 pagesSick - Photoelectric 4-180 MM v2Muhammad SumeetNo ratings yet

- Project DescriptionDocument5 pagesProject DescriptionM ShahidNo ratings yet