Professional Documents

Culture Documents

Indirect Tax Customs

Uploaded by

Hemantsinh Parmar0 ratings0% found this document useful (0 votes)

3 views1 pageThe document outlines the sections, units, and weightage of topics that will be covered in Part II of an exam on Customs and Foreign Trade Policy (FTP). Section I will focus most heavily on provisions related to customs duties, exemptions, classification and valuation of goods. Section II will cover import and export procedures, drawback, refunds, and export promotion schemes. Section III provides a brief introduction to customs law, FTP legislation, and concepts related to imports and exports.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the sections, units, and weightage of topics that will be covered in Part II of an exam on Customs and Foreign Trade Policy (FTP). Section I will focus most heavily on provisions related to customs duties, exemptions, classification and valuation of goods. Section II will cover import and export procedures, drawback, refunds, and export promotion schemes. Section III provides a brief introduction to customs law, FTP legislation, and concepts related to imports and exports.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageIndirect Tax Customs

Uploaded by

Hemantsinh ParmarThe document outlines the sections, units, and weightage of topics that will be covered in Part II of an exam on Customs and Foreign Trade Policy (FTP). Section I will focus most heavily on provisions related to customs duties, exemptions, classification and valuation of goods. Section II will cover import and export procedures, drawback, refunds, and export promotion schemes. Section III provides a brief introduction to customs law, FTP legislation, and concepts related to imports and exports.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Part II-Customs and FTP (25 Marks)

Sections Units Weightage Module MTP Past Que Papers

RTP Note

Section I (ii) Levy of and exemptions from customs duties – All provisions 40% -65%

including the application of customs law, taxable the event, a charge of

customs duty, exceptions to levy of customs duty, exemption from

customs duty

1(iii) Types of customs duties

1(iv) Classification of imported and export goods

1(iv) Valuation of imported and export goods

Section II 20% – 45%

1(vi) Import and Export Procedures including special procedures

relating to baggage, goods imported or exported by post, stores

1(ix) Drawback

1(x) Refund

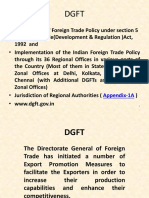

Foreign Trade Policy

2(ii) Basic concepts relating to export promotion schemes provided

under FTP

Section III 1(1) Introduction to customs law including Constitutional aspects 10% – 20%

Foreign Trade Policy

2(1) Introduction to FTP – legislation governing FTP, salient features of

an FTP, administration of FTP, contents of FTP and other related

provisions 2(i) Basic concepts relating to import and export

You might also like

- Reviewer Tariff CustomsDocument49 pagesReviewer Tariff CustomsNoel IV T. Borromeo100% (3)

- Ghana Customs HS CodeDocument737 pagesGhana Customs HS CodeBheki TshimedziNo ratings yet

- BAFA 2000 11 01 Export ControlsDocument27 pagesBAFA 2000 11 01 Export ControlsNishantDeyPurkayasthaNo ratings yet

- Customs Manual 2023Document424 pagesCustoms Manual 2023Hitesh PatilNo ratings yet

- The Union Customs Code (UCC) : Attorney Michael LuxDocument33 pagesThe Union Customs Code (UCC) : Attorney Michael LuxAdnan Ahmad Jafri100% (1)

- 53975bos43334finalold p8Document2 pages53975bos43334finalold p8eswarmaddipatla2003No ratings yet

- Old Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of MarksDocument4 pagesOld Final Course Paper 8: Indirect Tax Laws (100 Marks) : Section-Wise and Skill-Wise Weightage of MarksRaghav TibdewalNo ratings yet

- Indirect Tax GSTDocument1 pageIndirect Tax GSTHemantsinh ParmarNo ratings yet

- @canotes - Final Customs Question Bank May, Nov 20 by ICAI PDFDocument111 pages@canotes - Final Customs Question Bank May, Nov 20 by ICAI PDFPraneelNo ratings yet

- China New Export Control Law Key Changes and ChallengesDocument5 pagesChina New Export Control Law Key Changes and ChallengesNguyễn ViênNo ratings yet

- 4 WTO Schedules of Concessions and Renegotiation of ConcessionsDocument56 pages4 WTO Schedules of Concessions and Renegotiation of ConcessionsKiệt Trần Huỳnh AnhNo ratings yet

- Isai Iga 2023 2Document17 pagesIsai Iga 2023 2Hugo Salas GarciaNo ratings yet

- Stakeholders Courier ServicesDocument10 pagesStakeholders Courier ServicesSukeshan BhookhunNo ratings yet

- EXIM SylabusDocument1 pageEXIM SylabusKashish ShahNo ratings yet

- Study Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax Lawsparam.ginniNo ratings yet

- G Card Q Paper - 2012Document8 pagesG Card Q Paper - 2012logisticsvkcNo ratings yet

- Import and Export Through CourierDocument10 pagesImport and Export Through CourierPrabhmeher NandaNo ratings yet

- International Trade LawDocument2 pagesInternational Trade LawSuganya sundaramNo ratings yet

- Income Tax NotesDocument1 pageIncome Tax NotesLakshmi MeganNo ratings yet

- World Trade Law: Lecture 3: Market Access For Goods and WTO AgreementsDocument51 pagesWorld Trade Law: Lecture 3: Market Access For Goods and WTO AgreementsVân AnhNo ratings yet

- Revised RAE 27aug19Document13 pagesRevised RAE 27aug19DorthyNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Document38 pagesIii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Nanda MunisamyNo ratings yet

- Ca Final NotesDocument2 pagesCa Final NotesShantanuNo ratings yet

- Study Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax Lawsruhi MalviyaNo ratings yet

- GST - Introduction To GST & Concept of SupplyDocument40 pagesGST - Introduction To GST & Concept of Supplydeepak singhalNo ratings yet

- 4 Applied Indirect TaxationDocument316 pages4 Applied Indirect TaxationSanjay VanjayNo ratings yet

- Custom Law - ManualDocument100 pagesCustom Law - Manualmiteshpatel.judicialNo ratings yet

- (Jan-20) MBA (IB), MBA (IBF) & MBA (GL&SCM) Degree Examination Ii Trimester Exim Management (Mib-702) Time: 3 Hours Max - Marks: 60Document2 pages(Jan-20) MBA (IB), MBA (IBF) & MBA (GL&SCM) Degree Examination Ii Trimester Exim Management (Mib-702) Time: 3 Hours Max - Marks: 60aashutoshNo ratings yet

- The Mifid 2 GuideDocument30 pagesThe Mifid 2 GuideNeeraj KumarNo ratings yet

- Principles of Customs: Administratio NDocument46 pagesPrinciples of Customs: Administratio NAlfredo III SantianesNo ratings yet

- FTA Between China & PakistanDocument11 pagesFTA Between China & PakistansaifullahNo ratings yet

- TN MSME Exporters HandbookDocument64 pagesTN MSME Exporters Handbooksooryamovies389No ratings yet

- Ghana Customs HS CodeDocument737 pagesGhana Customs HS CodeKWAKU HACKMAN50% (2)

- Central Excise Act, 1944: Govt. and State Govt. To Levy Various Taxes andDocument10 pagesCentral Excise Act, 1944: Govt. and State Govt. To Levy Various Taxes andShivangi VermaNo ratings yet

- FTP2023 Chapter02Document16 pagesFTP2023 Chapter02Rutul ParikhNo ratings yet

- Final Draft BOC Code of Regulations Jan 17 2012Document573 pagesFinal Draft BOC Code of Regulations Jan 17 2012Michael Joseph IgnacioNo ratings yet

- 2008-04-21 - Trade Policy Review - Report by The Secretariat On ST Kitts & Nevis Rev1 (WTTPRS190KNAR1)Document49 pages2008-04-21 - Trade Policy Review - Report by The Secretariat On ST Kitts & Nevis Rev1 (WTTPRS190KNAR1)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Immediate Release Guidelines: World Customs OrganizationDocument34 pagesImmediate Release Guidelines: World Customs Organizationtheophilus teyeNo ratings yet

- 03 - MaacDocument51 pages03 - MaacFaisal JalalNo ratings yet

- Circular No 08 2023Document6 pagesCircular No 08 2023hossein bastanNo ratings yet

- Pre-Bar Review: Tariff and Customs CodeDocument49 pagesPre-Bar Review: Tariff and Customs CodeJack Pabalan Delos SantosNo ratings yet

- What Is Excise Duty1Document14 pagesWhat Is Excise Duty1dileepsuNo ratings yet

- Primer For Postal ServiceDocument2 pagesPrimer For Postal ServiceAnn CastroNo ratings yet

- GrammerDocument9 pagesGrammerrishabhmehta2008No ratings yet

- Circular 60Document18 pagesCircular 60Mỹ Huỳnh Thị NgọcNo ratings yet

- Business Law OverviewDocument25 pagesBusiness Law Overviewapce501No ratings yet

- Guide Book Product Registration ChinaDocument54 pagesGuide Book Product Registration ChinaanthonyNo ratings yet

- India's Export Control SystemDocument102 pagesIndia's Export Control SystemSwastik GroverNo ratings yet

- SRO 499 PaneltiesDocument2 pagesSRO 499 PaneltiesFaisalallanaNo ratings yet

- Paper 11Document456 pagesPaper 11Anonymous f5qGAcZYNo ratings yet

- PN No 78Document7 pagesPN No 78saurabhNo ratings yet

- CL AsaerDocument32 pagesCL AsaerKing Daniel AzurinNo ratings yet

- EXIM PolicyDocument65 pagesEXIM PolicyJasleen DuttaNo ratings yet

- Manual Customs PCADocument145 pagesManual Customs PCAAvinash kumarNo ratings yet

- Customs Procedure CodesDocument9 pagesCustoms Procedure CodesTSEDEKENo ratings yet

- Applied Indirect TaxationDocument349 pagesApplied Indirect TaxationVijetha K Murthy100% (1)

- ITC IntimationDocument1 pageITC IntimationHemantsinh ParmarNo ratings yet

- Ratio AnalysisDocument22 pagesRatio AnalysisHemantsinh ParmarNo ratings yet

- MDCS Quick Reference by CS Aditi Pant (For CS Professional June 2021 Attempt) - Pareeksha Commerce Academy - LectureKartDocument26 pagesMDCS Quick Reference by CS Aditi Pant (For CS Professional June 2021 Attempt) - Pareeksha Commerce Academy - LectureKartHemantsinh ParmarNo ratings yet

- Plan BDocument7 pagesPlan BHemantsinh ParmarNo ratings yet

- Mail MergeDocument6 pagesMail MergeHemantsinh ParmarNo ratings yet

- FRDocument2 pagesFRHemantsinh ParmarNo ratings yet

- Economic LawDocument1 pageEconomic LawHemantsinh ParmarNo ratings yet

- CostingDocument1 pageCostingHemantsinh ParmarNo ratings yet