Professional Documents

Culture Documents

Chap 1 Basicluol

Uploaded by

Alex DcostaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 1 Basicluol

Uploaded by

Alex DcostaCopyright:

Available Formats

BASICS OF INCOME 1

“VLEARN RACAP”

Income-tax is the most significant direct tax. Entry 82 of the Union List i.e., List I of

Seventh Schedule to Article 246 of the Constitution of India has given the power to

Income Tax Parliament to make laws on taxes on income other than agricultural income.

Income-tax is a TAX levied on the TOTAL INCOME of the PREVIOUS YEAR of every

PERSON.

Income-tax Act, 1961 – governs the levy of income-tax in India.

Income-tax Rules, 1962 – formulated for proper administration of the Act.

Annual Finance Act – Amendments in the Income-tax Act, 1961 are effected every

year through the Annual Finance Act.

Components of

Circulars – issued by CBDT to clarify the meaning and scope of certain provisions of

Income Tax

the Act.

Notifications – issued to give effect to the provisions of the Act/ make or amend

Rules.

Court decisions – interprets the various provisions of income-tax law.

A person includes an individual, Hindu Undivided Family (HUF), Association of Persons

Person

(AOP), Body of Individuals (BOI), a firm, a company etc.

Previous year is the financial year immediately preceding the assessment year i.e., it is the

financial year ending on 31st March, in which the income has accrued/received.

Concept of Previous

In case of a newly set-up business, the previous year would be the period beginning with

year (P.Y.) and

the date of setting up of the business or profession or, as the case may be, the date on

Assessment Year

which the source of income newly came into existence, and ending on 31st March.

(A.Y.):

Assessment year (A.Y.): Assessment year means the period of twelve months

commencing on the 1st April every year.

Exceptions to the rule that income is charged to income-tax in the Assessment Year

following the previous year:

The income of an assessee for a previous year is charged to income-tax in the assessment

year following the previous year. However, in the following cases, this rule does not apply

and the income is taxed in the previous year in which it is earned.

Exceptions to Above

(i) Shipping business of non-resident [Section 172]

Case

(ii) Persons leaving India [Section 174]

(iii) AOP/BOI/Artificial Juridical Person formed for a particular event or purpose

[Section 174A]

(iv) Persons likely to transfer property to avoid tax [Section 175]

Discontinued business [Section 176]

Tax has to be computed by applying the rates of tax mentioned in the Annual Finance

Tax Liability Act and the rate specified under the Income- tax Act, 1961, as the case may be.

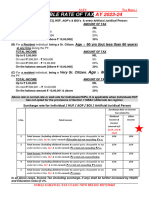

Individual (not

opting for the The Tax rates are as under:-

provisions of

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.1

section 115BAC) Total Income (in Rs.) Rates of

Tax

(i) Upto ₹ 2,50,000 (below 60 years) Nil

(ii) Upto ₹ 3,00,000 (60 years or above but less than 80 years and

resident in India)

(iii) Upto ₹ 5,00,000 (above 80 years and resident in India

₹ 2,50,001/ ₹ 3,00,001, as the case may be, to ₹ 5,00,000 [in cases (i) 5%

and

(ii) above, respectively]

₹ 5,00,001 to ₹ 10,00,000 20%

Above ₹ 10,00,000 30%

HUF/AOP/BOI/AJP AS APPLICABLE TO INDIVIDUAL BELOW 60 YEARS

Firm/LLP/Local 30%

Authority

Total Income In (₹) Rates of

Co-operative Tax

Society (not opting

Upto ₹ 10,000 10%

for the provisions of

₹ 10,001 to ₹ 20,000 20%

Section 115 BAD)

Above ₹ 20,000 30%

Domestic Company Foreign Company

Company (not Total turnover or gross receipts in Other domestic

opting for the

the P.Y. 2019 20 ≤ ₹ 400 crore companies

provisions of section

25% 30% 40%

115BAA/115BAB)

Individual/ HUF/ AOP/ BOI/ Artificial juridical person

(i) Where the total income (including dividend income and capital 10%

gains chargeable to tax u/s 111A and 112A) > ₹ 50 lakh but is ≤

₹ 1 crore

(ii) Where the total income (including dividend income and capital 15%

gains chargeable to tax u/s 111A and 112A)> ₹ 1 crore but is ≤ ₹

2 crore

Surcharge

(iii) Where the total income (excluding dividend income and 25%

capital gains chargeable to tax u/s 111A and 112A)> ₹ 2

crore but is ≤ ₹ 5 crore

Rate of surcharge on the income-tax payable on the Not

portion of dividend income and capital gains chargeable to exceeding

tax u/s 111A and 112A 15%

(iv) Where the total income (excluding dividend income and 37%

capital gains chargeable to tax u/s 111A and 112A)> ₹ 5

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.2

crore

Rate of surcharge on the income-tax payable on the Not

portion of dividend income and capital gains chargeable to exceeding

tax u/s 111A and 112A 15%

(v) Where the total income (including dividend income and capital 15%

gains chargeable to tax u/s 111A and 112A) > ₹ 2 crore in cases

not covered in (iii) and (iv) above

Firm/Limited Liability Partnership/Local Authorities/Co-operative societies (other than a co-operative society

opting for section 115BAD)

Where the total income > ₹ 1 crore 12%

Domestic company (other than a domestic company opting for section 115BAA or section 115BAB)

Total income > ₹ 1 crore but is ≤ ₹ 10 crore 7%

Total income is > ₹ 10 crore 12%

Foreign company

Total income > ₹ 1 crore but is ≤ ₹ 10 crore 2%

Total income is > ₹ 10 crore 5%

Rebate under section 87A: Rebate of up to ₹ 12,500 for resident individuals having total income of up to ₹ 5

lakh. “Health and Education cess” on Income-tax: 4% of income-tax and surcharge, if applicable

;,

Question 1

Mr. Raj has a total income of ₹13,00,000 for P.Y. 2021-22, comprising of income from house property and

interest on fixed deposit. Compute his tax liability for A.Y. 2022-23 assuming his age is -

(a) 37years

(b) 65years

(c) 83years

Assume that Mr. Raj has not opted for the provisions of section 115BAC.

Solution

a) Computation of tax liability of Mr. Raj (age 37years)

Tax liability:

First ₹ 2,50,000 Nil

Next ₹ 2,50,001 – ₹ 5,00,000 @5% of ₹2,50,000 ₹12,500

Next ₹ 5,00,001 – ₹ 10,00,000 @20% of ₹5,00,000 ₹1,00,000

Balance = ₹13,00,000 (-) ₹ 10,00,000 @30% of ₹ 3,00,000 ₹90,000

₹2,02,500

Add: Health and Education cess@4% ₹8,100

₹2,10,600

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.3

b)Computation of tax liability of Mr. Raj (age 65years)

First ₹ 3,00,000 Nil -

Next ₹ 3,00,001–₹ 5,00,000 5% of ₹ 2,00,000 ₹10,000

Next ₹ 5,00,001–₹10,00,000 @ 20% of ₹ 5,00,000 ₹1,00,000

Balance i.e., ₹13,00,000 minus₹ 10,00,000 30% of ₹ 3,00,000 ₹90,000

₹2,00,000

Add:Health and Education cess@4% ₹8,000

₹2,08,000

c) Computation of tax liability of Mr. Raj (age 83years)

First ₹5,00,000 Nil -

Next ₹5,00,001 – ₹10,00,000 @ 20% of ₹5,00,000 ₹1,00,000

Balance i.e., ₹13,00,000 minus₹ 10,00,000 @ 30% of ₹3,00,000 ₹90,000

₹1,90,000

Add: Health and Education cess@4% ₹7,600

₹1,97,600

Question 2

Compute the tax liability of Mr. Raja (aged 42 years), having total income of ₹51.5 lakhs for the Assessment

Year 2022-23. Assume that his total income comprises of salary income, income from house property and

interest from saving bank account. Also, assume that Mr. Raja has not opted for the provisions of

section115BAC.

Solution

Computation of tax liability of Mr. Raja for the A.Y. 2022-23

Particulars ₹

(A) Tax payable including surcharge on total income of 51,50,000

₹2,50,000 – ₹ 5,00,000 @5% 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% 1,00,000

₹ 10,00,000 – ₹ 51,50,000 @30% 12,45,000

Total 13,57,500

Add: Surcharge @10% 1,35,750 14,93,250

(B) Tax Payable on total income of ₹50 lakhs 13,12,500

(₹12,500 plus ₹1,00,000 plus ₹12,00,000)

(C) Total Income less ₹50 lakhs 1,50,000

(D) Tax payable on total income of ₹50 lakhs plus the 14,62,500

excess of total income over ₹50 lakhs (B+C)

(E) Tax payable: Lower of (A) and (D) 14,62,500

Add: Health and education cess @4% 58,500

Tax Liability 15,21,000

(F) Marginal Relief (A – D) 30,750

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.4

Alternative Method:

(A) Tax payable including surcharge on total income of ₹ 51,50,000

₹ 2,50,000 – ₹ 5,00,000 @5% ₹ 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% ₹ 1,00,000

₹ 10,00,000 – ₹ 51,50,000 @30% ₹ 12,45,000

Total ₹ 13,57,500

Add: Surcharge @10% ₹ 1,35,750 ₹ 14,93,250

(B) Tax Payable on total income of ₹ 50 lakhs (₹12,500

plus ₹1,00,000 plus ₹ 12,00,000) ₹ 13,12,500

(C) Excess tax payable (A)-(B) ₹ 1,80,750

(D) Marginal Relief (₹1,80,750 – ₹1,50,000, being the

amount of income in excess of ₹ 50,00,000) ₹ 30,750

(E) Tax payable (A)-(D) ₹ 14,62,500

Add: Health and education cess @4% ₹ 58,500

Tax Liability ₹ 15,21,000

Question 3

Compute the tax liability of Mr. Akash (aged 55 years), having total income of ₹ 1,02,00,000 for the Assessment

Year 2022-23. Assume that his total income comprises of salary income, income from house property and

interest from fixed deposit account. Also, assume that Mr. Akash has not opted for the provisions of section

115BAC.

Solution

Computation of tax liability of Mr. Akash for the AY 2022-23

Particulars ₹ ₹

A) Tax payable including surcharge on total income of

₹1,02,00,000 12,500

₹2,50,000 – ₹5,00,000 1,00,000

₹5,00,000 – ₹10,00,000 @20% 27,60,000

₹10,00,000 – ₹1,02,00,000 @30%

Total 28,72,500

Add: Surcharge @ 15% 4,30,875 33,03,375

B) Tax payable on total income of 1 crore 28,12,500

(₹12,500 + ₹1,00,000 + ₹27,00,000)

Add: Surcharge @ 10% 2,81,250

30,93,750

C) Total income (-) ₹1 crore 2,00,000

D) Tax payable on total income of ₹1 crore (+) excess of total income 32,93,750

over ₹1 crore (B+C)

E) Tax payable: Lower of (A) and (D) 32,93,750

Add: Health and education cess @ 4% 1,31,750

Tax liability 34,25,500

F) Marginal relief (A-D) 9625

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.5

Alternative Method:

(A) Tax payable including surcharge on total income of

₹ 1,02,00,000

₹ 2,50,000 – ₹ 5,00,000 @5% ₹ 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% ₹ 1,00,000

₹ 10,00,000 – ₹ 1,02,00,000 @30% ₹27,60,000

Total ₹ 28,72,500

Add: Surcharge@15% ₹ 4,30,875 ₹ 33,03,375

(B) Tax Payable on total income of ₹1 crore (₹ 12,500

plus ₹ 1,00,000 plus ₹ 27,00,000) plus surcharge ₹ 30,93,750

@10%

(C) Excess tax payable (A)-(B) ₹ 2,09,625

(D) Marginal Relief (₹ 2,09,625 – ₹ 2,00,000, being the ₹ 9,625

amount of income in excess of ₹ 1,00,00,000)

Tax payable (A) - (D) ₹ 32,93,750

Add: Health and education cess @4% ₹ 1,31,750

Tax Liability ₹ 34,25,500

Question 4

Compute the tax liability of Mr. Deepak (aged 57 years), having total income of ₹2,02,00,000 for the

Assessment Year 2022-23. Assume that his total income comprises of salary income, income from house

property and interest from fixed deposit account. Also, assume that Mr. Deepak has not opted for the provisions

of section 115BAC.

v

Solution

Computation of tax liability of Mr. Deepak for the A.Y. 2022-23

Particulars ₹ ₹

(A) Tax payable including surcharge on total income

of ₹2,02,00,000

₹ 2,50,000 – ₹ 5,00,000 @5% 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% 1,00,000

₹ 10,00,000 – ₹ 2,02,00,000 @30% 57,60,000

Total 58,72,500

Add: Surcharge @25% 14,68,125 73,40,625

(B) Tax Payable on total income of ₹2 crore

(₹12,500 plus ₹1,00,000 plus₹57,00,000) 58,12,500

Add: Surcharge @15% 8,71,875

66,84,375

(C) Total Income less ₹2 crore 2,00,000

(D) Tax payable on total income of ₹2 croreplus 68,84,375

the excess of total income over ₹2 crore(B+C)

(E) Tax payable: Lower of (A) and (D) 68,84,375

Add: Health and education cess @4% 2,75,375

Tax Liability 71,59,750

(F) Marginal Relief (A – D) 4,56,250

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.6

Alternative Method:

Particulars ₹

(A) Tax payable including surcharge on total income of ₹ 2,02,00,000

₹ 2,50,000 – ₹ 5,00,000 @5% ₹ 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% ₹ 1,00,000

₹ 10,00,000 – ₹ 2,02,00,000 @30% ₹ 57,60,000

Total ₹ 58,72,500

Add: Surcharge @25% ₹ 14,68,125 73,40,625

(B) Tax Payable on total income of ₹ 2 crore (₹ 12,500 plus 66,84,375

₹1,00,000 plus ₹ 57,00,000) plus surcharge @15%

(C) Excess tax payable (A)-(B) 6,56,250

(D) Marginal Relief (₹ 6,56,250 – ₹ 2,00,000, being the 4,56,250

amount of income in excess of ₹ 2,00,00,000)

Tax payable (A) - (D) 68,84,375

Add: Health and education cess @4% 2,75,375

Tax Liability 71,59,750

Question 5

Compute the tax liability of Mr. Rajesh (aged 57 years), having total income of ₹5,02,00,000 for the

Assessment Year 2022-23. Assume that his total income comprises of salary income, income from house

property and interest on fixed deposit account. Assume that Mr. Rajesh has not opted for the provisions of

section 115BAC.

Solution

Computation of tax liability of Mr. Rajesh for the A.Y. 2022-23

Particulars ₹ ₹

(A) Tax payable including surcharge on total income of

₹ 2,50,000 – ₹ 5,00,000 @5% 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% 1,00,000

₹ 10,00,000 – ₹ 5,02,00,000 @30% 1,47,60,000

Total 1,48,72,500

Add: Surcharge @37% 55,02,825 2,03,75,325

(B) Tax Payable on total income of ₹5 crore

(₹12,500 +₹1,00,000+ ₹1,47,00,000) 1,48,12,500

Add: Surcharge @25% 37,03,125

1,85,15,625

(C) Total Income (-) ₹2 crore 2,00,000

(D) Tax payable on total income of ₹ 5 crore plus 1,87,15,625

the excess of total income over ₹5 crore(B+C)

(E) Tax payable: Lower of (A) and (D) 1,87,15,625

Add:Health and education cess @4% 7,48,625

Tax liability 1,94,64,250

(F) Marginal relief (A-D) 16,59,700

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.7

Alternative Method:

Particulars ₹

(A) Tax payable including surcharge on total income of ₹ 5,02,00,000

₹ 2,50,000 – ₹ 5,00,000 @5% ₹ 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% ₹ 1,00,000

₹ 10,00,000 – ₹ 5,02,00,000 @30% ₹ 1,47,60,000

Total ₹ 1,48,72,500

Add: Surcharge @37% ₹ 55,02,825 2,03,75,325

(B) Tax Payable on total income of ₹5 crore 1,85,15,625

(₹12,500 plus ₹1,00,000 plus

₹ 1,47,00,000) plus surcharge @15%

(C) Excess tax payable (A)-(B) 18,59,700

(D) Marginal Relief (₹ 18,59,700 – ₹ 2,00,000, 16,59,700

being the amount of income in excess of

₹ 5,00,00,000)

Tax payable (A) - (D) 1,87,15,625

Add: Health and education cess @4% 7,48,625

Tax Liability 1,94,64,250

Question 6

Compute the marginal relief available to X Ltd., a domestic company, assuming that the total income of X

Ltd. is ₹ 1, 01,00,000 for A.Y.2022-23 and the total income does not include any income in the nature of

capital gains. Assume that the company has not exercised option under section 115BAA or 115BAB.

[Note - The gross receipts of X Ltd. for the P.Y.2019-20 is ₹402 crore]

Solution

The tax payable on total income of ₹1,01,00,000 of X Ltd. computed @32.1% (including surcharge @7%) is

₹32,42,100. However, the tax cannot exceed ₹31,00,000 (i.e.,the tax of ₹ 30,00,000 payable on total

income of ₹ 1crore plus ₹1,00,000, being the amount of total income exceeding ₹1 crore). Therefore, the tax

payable on ₹1,01,00,000 would be ₹31,00,000. The marginal relief is₹1,42,100 (i.e., ₹32,42,100 -

₹31,00,000).

Question 7

Compute the marginal relief available to Y Ltd., a domestic company, assuming that the total income of Y

Ltd. for A.Y.2022-23 is ₹10,01,00,000 and the total income does not include any income in the nature of

capital gains. Assume that the company has not exercised option under section 115BAA or 115BAB.

[Note - The gross receipts of Y Ltd. for the P.Y.2019-20 is ₹410 crore]

Solution

The tax payable on total income of ₹10,01,00,000 of Y Ltd. computed@ 33.6% (including surcharge @ 12%)

is ₹ 3,36,33,600. However, the tax cannot exceed ₹ 3,22,00,000 [i.e., the tax of ₹3,21,00,000 (32.1% of

₹10 crore) payable on total income of ₹10 crore plus ₹1,00,000, being the amount of total income

exceeding₹10 crore]. Therefore, the tax payable on ₹10,01,00,000 would be ₹3,22,00,000. The marginal

relief is ₹14,33,600 (i.e.,₹3,36,33,600-₹3,22,00,000).

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.8

Question 8

Mr. Sanjay aged 30 years, has a total income of ₹4,50,000, comprising his salary income and interest on

bank fixed deposit. Compute his tax liability for A.Y.2022-23.

Solution

Computation of tax liability of Mr. Sanjay for A.Y.2022-23

Particulars ₹

Tax on total income of ₹4,50,000

@5% of ₹2,00,000 (₹4,50,000 – ₹2,50,000) 10,000

Less: Rebate u/s87A(Lower of tax payable or ₹12,500) 10,000

Tax liability Nil

Question 9

Who is an “Assessee”?

Solution

As per section 2(7), assessee means a person by whom any tax or any other sum of money is payable under the

Income-tax Act, 1961.

In addition, the term includes –

Every person in respect of whom any proceeding under the Act has been taken for the assessment of –

his income; or

the income of any other person in respect of which he is assessable; or

the loss sustained by him or by such other person; or

the amount of refund due to him or to such other person.

Every person who is deemed to be an assessee under any provision of the Act;

Every person who is deemed to be an assessee in default under any provision of the Act.

Question 10

Mr. Agarwal aged 40 years and a resident in India, has a total income o f ₹ 4,50,00,000,

comprising long term capital gain taxable under section 112A of ₹ 55,00,000, short term capital gain

taxable under section 111A of ₹65,00,000 and other income of ₹3,30,00,000. Compute his tax liability for

A.Y.2022-23. Assume that Mr. Kashyap has not opted for the provisions of section 115BAC.

Solution

Particulars ₹

Tax on total income of ₹4,50,00,000

Tax on 54L @10% 5,40,000

Tax on 65L @15% 9,75,000

Tax on other Income of 3,30,00,000 97,12,500

Total Income 1,12,27,500

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.9

surcharge @15% on (15,15,000) 2,27,250

surcharge @25% on 97,12,500 24,28,125

Total 1,38,82,875

HEC@4% 5,55,315

Total tax Payable 1,44,38,190

WWW.VLEARNCLASSES.COM |CA VIJAY SARDA | 8956651954 | BASICS Page 1.10

You might also like

- Inter QuestionnareDocument23 pagesInter QuestionnareAnsh NayyarNo ratings yet

- Bos 44566Document24 pagesBos 44566Bhavani KannanNo ratings yet

- Income Tax Quick Recap CapsulDocument24 pagesIncome Tax Quick Recap CapsulAmanNo ratings yet

- Income Tax Law - A Capsule For Quick Recap IPCC Nov 18Document28 pagesIncome Tax Law - A Capsule For Quick Recap IPCC Nov 18k moviesNo ratings yet

- Chapter 1 - Basic ConceptsDocument4 pagesChapter 1 - Basic ConceptschoudharyNo ratings yet

- 4 Direct Tax RevisionDocument149 pages4 Direct Tax RevisionDeep MehtaNo ratings yet

- 18878sm DTL Finalnew Cp1Document28 pages18878sm DTL Finalnew Cp1manisha maniNo ratings yet

- Chapter-1 Basic Concepts PDFDocument11 pagesChapter-1 Basic Concepts PDFBrinda RNo ratings yet

- DT IntroductionDocument40 pagesDT Introductionprashanthreddy02234No ratings yet

- Gnesh - Thakkar.7 Ncometaxguru/ Ajigneshthakkar: Poured in by MeDocument111 pagesGnesh - Thakkar.7 Ncometaxguru/ Ajigneshthakkar: Poured in by Mepandeyaman7608No ratings yet

- DT AmendmentsDocument32 pagesDT AmendmentsDharshini AravamudhanNo ratings yet

- Ajit Kumar SatapathyDocument32 pagesAjit Kumar Satapathyajitkumarsatapathy3No ratings yet

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelNo ratings yet

- Direct Tax Chapter 1 To 10 AmendedDocument45 pagesDirect Tax Chapter 1 To 10 AmendedAsad RizviNo ratings yet

- Basics of Income TaxDocument15 pagesBasics of Income TaxPriya Lakshimi. PNo ratings yet

- IncomeTax MaterialDocument91 pagesIncomeTax MaterialSandeep JaiswalNo ratings yet

- Supplementary Paper 7 16 June2020Document24 pagesSupplementary Paper 7 16 June2020avneetNo ratings yet

- Supplementary Paper 7 16 June2020 - RevisedDocument30 pagesSupplementary Paper 7 16 June2020 - RevisedINFO ACCNo ratings yet

- India Union Budget 2022: Full Text of The Memorandum of The Finance BillDocument199 pagesIndia Union Budget 2022: Full Text of The Memorandum of The Finance BillIndia BudgetNo ratings yet

- Mega Marathon Direct Tax. YtDocument257 pagesMega Marathon Direct Tax. Ytsubroshakar gamerNo ratings yet

- Direct Tax Study & Overview": Project Report On "Document28 pagesDirect Tax Study & Overview": Project Report On "Ashish SinghNo ratings yet

- 01 Important DefinitionsDocument7 pages01 Important DefinitionsmijjinNo ratings yet

- Amendment Finance Act 2009Document66 pagesAmendment Finance Act 2009Sanjay GuptaNo ratings yet

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarNo ratings yet

- Name: Swati Rohra Course:Bcom (H) BCH2017035Document12 pagesName: Swati Rohra Course:Bcom (H) BCH2017035shreyaNo ratings yet

- Applied Direct TaxationDocument548 pagesApplied Direct TaxationVarun SinghNo ratings yet

- Ch-1 To 4 - FY 22-23Document56 pagesCh-1 To 4 - FY 22-23SaNo ratings yet

- Income Tax Law & PracticeDocument60 pagesIncome Tax Law & Practicesebastianks94% (17)

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Incoem Tax Final PDFDocument138 pagesIncoem Tax Final PDFRam IyerNo ratings yet

- CA Final May 2020 Last Minute Revision PDFDocument390 pagesCA Final May 2020 Last Minute Revision PDFLaxmisha GowdaNo ratings yet

- CA Final May 2020 Question Bank PDFDocument1,624 pagesCA Final May 2020 Question Bank PDFAjay JosephNo ratings yet

- Senior Citizens and Super Senior Citizens For AY 2022-2023 - Income Tax DepartmentDocument10 pagesSenior Citizens and Super Senior Citizens For AY 2022-2023 - Income Tax DepartmentsudheeralladiNo ratings yet

- Volume 1 - 100 Pages May-Nov 21Document100 pagesVolume 1 - 100 Pages May-Nov 21ca shahNo ratings yet

- TDS Ready ReckonerDocument29 pagesTDS Ready ReckonerShivani Singh ChandelNo ratings yet

- Indian Taxation SystemDocument15 pagesIndian Taxation SystemassatputeNo ratings yet

- Tax Laws Updates For June 2013 ExamsDocument68 pagesTax Laws Updates For June 2013 Examsnisarg_No ratings yet

- Submitted by in The Guidance of Faculty of Commerce Invertis University, BareillyDocument27 pagesSubmitted by in The Guidance of Faculty of Commerce Invertis University, BareillyBariq BadarNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsPrince kumarNo ratings yet

- TaxationDocument10 pagesTaxationIshika ChauhanNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument13 pagesIncome Tax in India - Wikipedia, The Free EncyclopediaAnonymous utfuIcnNo ratings yet

- Finance Bill, 2012: Provisions Relating To Direct TaxesDocument36 pagesFinance Bill, 2012: Provisions Relating To Direct Taxesfriend_foru2121No ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- IT CircularDocument65 pagesIT Circularnavdeepsingh.india8849100% (2)

- Axis Factsheet April 2020Document57 pagesAxis Factsheet April 2020GNo ratings yet

- Bansi Mehta BudgetBooklet2022Document94 pagesBansi Mehta BudgetBooklet2022Avinash GarjeNo ratings yet

- Unit-1 IT 2023-24Document11 pagesUnit-1 IT 2023-24avinashhpv7785No ratings yet

- Income Tax India Basic DetailsDocument28 pagesIncome Tax India Basic DetailsrupaparaNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 21127, Ahmad, Assignment 5, IFDocument5 pages21127, Ahmad, Assignment 5, IFmuhammad ahmadNo ratings yet

- ILAM FAHARI I REIT - Audited Finacncials 2020Document1 pageILAM FAHARI I REIT - Audited Finacncials 2020An AntonyNo ratings yet

- Cost-Volume-Profit Analysis: Measuring, Monitoring, and Motivating PerformanceDocument33 pagesCost-Volume-Profit Analysis: Measuring, Monitoring, and Motivating PerformancehellboyzsNo ratings yet

- Rules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedDocument2 pagesRules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedemilsonusamNo ratings yet

- Percukaian (Taxation) 2022Document15 pagesPercukaian (Taxation) 2022Faiz IskandarNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document20 pagesFundamentals of Accountancy, Business and Management 1Lhana Denise100% (5)

- Investment DetectiveDocument5 pagesInvestment DetectiveNadya Rizkita100% (1)

- W.C PPT by MeDocument70 pagesW.C PPT by Meramr9000No ratings yet

- Internal Revenue Manual - 1.33Document13 pagesInternal Revenue Manual - 1.33purpelNo ratings yet

- Accounting Installment LiquidationDocument11 pagesAccounting Installment LiquidationElkie pabia RualNo ratings yet

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDocument6 pagesPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariNo ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Rosetta Stone Case StudyDocument3 pagesRosetta Stone Case StudyEric100% (2)

- Chapter 4: Analysis of Financial StatementsDocument50 pagesChapter 4: Analysis of Financial StatementsHope Trinity EnriquezNo ratings yet

- Kuwait Finance House AustDocument2 pagesKuwait Finance House AustchairunnisanovNo ratings yet

- PGBPDocument189 pagesPGBPumakantNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruTed Mosby100% (1)

- AASB 112 Fact SheetDocument4 pagesAASB 112 Fact SheetCeleste LimNo ratings yet

- Financial Planning and ForecastingDocument20 pagesFinancial Planning and ForecastingSyedMaazNo ratings yet

- Introduction AdvertisingDocument82 pagesIntroduction AdvertisingselbalNo ratings yet

- Pi ECO Vietnam Project Abstract & Summary 7 March 2019Document11 pagesPi ECO Vietnam Project Abstract & Summary 7 March 2019ICT Bảo HànhNo ratings yet

- Start Day Trading NowDocument44 pagesStart Day Trading Nowfuraito100% (2)

- Ashoka BuildconDocument11 pagesAshoka Buildconpritish070No ratings yet

- Export ProcedureDocument19 pagesExport ProcedureDenis SamuelNo ratings yet

- Risk Management Presentation April 22 2013Document156 pagesRisk Management Presentation April 22 2013George LekatisNo ratings yet

- 01 CTD Intercompany72Document33 pages01 CTD Intercompany72Sumanth AmbatiNo ratings yet

- Jurnal 2 - Alaeto Henry Emeka (2020) - Determinants - of - Dividend - Polic - NigeriaDocument31 pagesJurnal 2 - Alaeto Henry Emeka (2020) - Determinants - of - Dividend - Polic - NigeriaGilang KotawaNo ratings yet

- Transaction Summary - 10 July 2021 To 6 August 2021: Together We Make A DifferenceDocument2 pagesTransaction Summary - 10 July 2021 To 6 August 2021: Together We Make A Differencebertha kiaraNo ratings yet

- Manual TAX 1. 2019 20 PDFDocument35 pagesManual TAX 1. 2019 20 PDFkNo ratings yet

- 01 CA Inter Audit Question Bank Part 1 Chapter 0 To Chapter 3Document146 pages01 CA Inter Audit Question Bank Part 1 Chapter 0 To Chapter 3Yash SharmaNo ratings yet