Professional Documents

Culture Documents

ILAM FAHARI I REIT - Audited Finacncials 2020

Uploaded by

An AntonyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ILAM FAHARI I REIT - Audited Finacncials 2020

Uploaded by

An AntonyCopyright:

Available Formats

ILAM

ILAM FAHARI I-REIT

AUDITED CONDENSED RESULTS

FOR THE YEAR ENDED 31 DECEMBER 2020

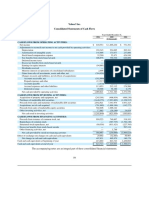

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME CONSOLIDATED STATEMENT OF CASH FLOWS

2020 2019 2020 2019

(KShs) (KShs) (KShs) (KShs)

Revenue 324,669,579 353,886,007 Cash flows from operating activities

Rental and related income 341,156,587 344,346,639 Cash generated from operations 160,356,537 115,335,771

Straight-lining of lease income (16,487,008) 9,539,368

Net cash inflow from operating activities 160,356,537 115,335,771

Other income 22,875,975 25,323,607

Cash flows from investing activities

Interest income 22,412,016 24,996,287

Sundry income 463,959 327,320 Additions to investment property (11,195,803) (19,705,947)

Operating expenses (229,611,646) (225,636,051) Additions to property and equipment (210,150) (11,543,938)

Property expenses (97,242,732) (114,211,367) (Increase)/decrease in investment securities 88,488,054 (155,116,238)

Bad debts provision (33,118,966) (122,941)

Net cash inflow/outflow from investing activities 77,082,101 (186,366,123)

Fund operating expenses (99,249,948) (111,301,743)

Cash flows from financing activities

Increase in fair value of investment property 30,091,205 21,654,685

Distribution paid (135,729,225) (135,729,225)

Fair value adjustment to investment property 13,604,197 31,194,053

Straight-lining of lease income 16,487,008 (9,539,368) Net cash outflow from financing activities (135,729,225) (135,729,225)

Net movement in cash and cash equivalents 101,709,413 (206,759,577)

Net profit for the year 148,025,113 175,228,248

Cash and cash equivalents at beginning of year 96,063,143 302,822,720

Other comprehensive income - -

Cash and cash equivalents at end of year 197,772,556 96,063,143

Total comprehensive income attributable to unit holders for the year 148,025,113 175,228,248

NOTES 2020 2019

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (KShs) (KShs)

2020 2019 Basic and headline earnings

(KShs) (KShs)

Basic earnings - comprehensive income attributable to unit holders for the 148,025,113 175,228,248

ASSETS period

Non-current assets Adjusted for:

Investment property 3,481,400,000 3,456,600,000 Fair value adjustment to investment property (including straight-line lease (30,091,205) (21,654,685)

accrual movement)

Fair value of investment property for accounting purposes 3,385,601,287 3,344,314,279

Straight-line lease adjustment 95,798,713 112,285,721 Headline earnings 117,933,908 153,573,563

Property and equipment 14,525,608 15,615,047 Adjusted for:

3,495,925,608 3,472,215,047 Straight-line lease accrual movement 16,487,008 (9,539,368)

Current assets Distributable earnings 134,420,916 144,034,195

Investment securities 150,437,699 238,925,753 Distributable earnings per unit (KShs) 0.74 0.80

Trade and other receivables 39,610,337 71,245,082 Basic earnings per unit (KShs) 0.82 0.97

Cash and cash equivalents 197,772,556 96,063,143 Headline earnings per unit (KShs) 0.65 0.85

387,820,592 406,233,978 Weighted average units in issue (units) 180,972,300 180,972,300

Total assets 3,883,746,200 3,878,449,025 Units in issue at the end of the period (units) 180,972,300 180,972,300

EQUITY & LIABILITIES

Capital and reserves COMMENTARY

Trust capital 3,479,540,745 3,479,540,745

1. Basis for preparation

Revaluation reserve 140,417,484 126,813,287 The audited condensed consolidated financial statements of ILAM Fahari I-REIT (“the REIT”) for the year

ended 31 December 2020 have been prepared in accordance with the requirements of International Financial

Retained earnings 155,780,508 157,088,817 Reporting Standard (IFRSs) and the Capital Markets (Real Estate Investment Trusts) (Collective Investment

Schemes) Regulations, 2013.

3,775,738,737 3,763,442,849

The consolidated financial statements for the year ended 31 December 2020 were audited by KPMG Kenya

Current liabilities and received an unqualified audit opinion. These will be available on the REIT’s website as detailed in Note

5 below.

Trade and other payables 108,007,463 115,006,176

2. Business review

Total equity & liabilities 3,883,746,200 3,878,449,025

Net earnings decreased by 16% to KShs 148.0 mln in 2020 (2019: KShs 175.2 mln). The decrease was

Net asset value per unit 20.86 20.80 mainly due to reduction in fair value gain on revaluation of investment property compared to prior year

against the backdrop of Covid-19 pandemic whose impact is a material valuation uncertainty in the short to

medium term.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Distributable earnings decreased by 7% to KShs 134.4 mln (2019: KShs 144.0 mln). The decline was

mainly due to higher property expenses arising from a significant provision for bad debts as a result of

Trust capital Revaluation Retained Total non-performance of the anchor tenant at Greenspan Mall. This was partially offset by a reduction in fund

reserve earnings operating expenses after the REIT Manager temporarily reduced their fees by 10% to cushion the investors

during a particulalrly difficult year. Tax leakages at the subsidiary level continued to dampen the performance

KShs KShs KShs KShs during the year where KShs 13.9 mln (2019: KShs 16.5 mln) was provided against irrecoverable withholding

taxes. The subsidiary tax legislation whose publication was slowed down by the pandemic is expected to

2020 be completed in 2021. The legislation will curb the leakages in 2021 as it will pave way for issuance of tax

Balance at 1 January 2020 3,479,540,745 126,813,287 157,088,817 3,763,442,849 exemption certificates to the REIT subsidiaries.

Total comprehensive income 3. Distribution

REIT Manager has recommended and the Trustee has approved a first and final distribution of KShs.

Net profit for the year - - 148,025,113 148,025,113 108,583,380 in relation to the year ended 31 December 2020 (2019: KShs. 135,729,225) subject to

unitholder approval at the annual general meeting scheduled for 16 April 2021. The distribution amounts to

Transfer to non-distributable reserve - 13,604,197 (13,604,197) -

60 cents per unit (2019: 75 cents per unit) and is payable by no later than 30 April 2021.

Transactions with owners of the REIT

4. Change of REIT Manager

Distribution - - (135,729,225) (135,729,225) On 20 May 2020, STANLIB Kenya Limited (“SKL”) together with The Co-operative Bank of Kenya Limited

(“Co-op Bank”) and ICEA LION Asset Management (“ILAM”) in their respective capacities as the outgoing

Balance at 31 December 2020 3,479,540,745 140,417,484 155,780,508 3,775,738,737 REIT Manager, REIT Trustee and the incoming REIT Manager announced that all the conditions precedent

in relation to the transfer of the management of the REIT (including the approvals of the Capital Markets

Authority and the Competition Authority of Kenya) have been fulfilled, with the result that such transfer

2019 became effective on 18 May 2020 (the Effective Date) and has been implemented. ILAM is accordingly now

the Manager and Promoter of the REIT.

Balance at 1 January 2019 3,479,540,745 95,619,234 148,783,847 3,723,943,826

5. Website information

Total comprehensive income The REIT Manager’s annual report and audited financial statements will be available on the ILAM Fahari I-REIT

Net profit for the year - - 175,228,248 175,228,248 website at www.ilamfahariireit.com from 31 March 2021.

Transfer to non-distributable reserve - 31,194,053 (31,194,053) - Approval of the financial statements

The financial statements were approved for issue by the Trustee and the Board of the REIT Manager on 18

Transactions with owners of the REIT March 2021 and signed on their behalf by:

Distribution - - (135,729,225) (135,729,225)

Balance at 31 December 2019 3,479,540,745 126,813,287 157,088,817 3,763,442,849

__________________________ __________________________ __________________________

Henry Karanja Andrew Ndegwa Einstein Kihanda

Trustee Compliance Officer Chairman Chief Executive Officer

The Co-operative Bank of Kenya ICEA LION Asset Management ICEA LION Asset Management

Limited Limited Limited

You might also like

- Standard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Document1 pageStandard Chartered Bank Ghana PLC: Unaudited Financial Statements For The Period Ended 30 September 2021Fuaad DodooNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- Access BankDocument1 pageAccess BankFuaad DodooNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- Access 2021 q3 Financials QTRDocument1 pageAccess 2021 q3 Financials QTRFuaad DodooNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- ICD Audited Consolidated FS Dec 2019Document144 pagesICD Audited Consolidated FS Dec 2019Muhammad Haroon KhanNo ratings yet

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet

- Access Full Year Financials 2020 WebDocument2 pagesAccess Full Year Financials 2020 WebFuaad DodooNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- Subject To Central Bank of Oman ApprovalDocument1 pageSubject To Central Bank of Oman ApprovalAttaNo ratings yet

- Un-Audited Financial Statements For The Six Months Ended June 30, 2021Document1 pageUn-Audited Financial Statements For The Six Months Ended June 30, 2021Fuaad DodooNo ratings yet

- Swayansu Sahoo (200409120049)Document6 pagesSwayansu Sahoo (200409120049)BigBox Audio LibraryNo ratings yet

- Unaudited Financial Statements For The Period Ended 30 September, 2021Document2 pagesUnaudited Financial Statements For The Period Ended 30 September, 2021Fuaad DodooNo ratings yet

- QIB FS 30 June 2022 English SignedDocument26 pagesQIB FS 30 June 2022 English SignedMuhammad AbdullahNo ratings yet

- GT BankDocument1 pageGT BankFuaad DodooNo ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 30 September 2021Fuaad DodooNo ratings yet

- BK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210Document3 pagesBK Group PLC Financial Results: Net Interest Income 51,762,974 46,360,210chegeNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- UBA - June2021 FN StatementsDocument2 pagesUBA - June2021 FN StatementsFuaad DodooNo ratings yet

- Yahoo Annual Report 2006Document2 pagesYahoo Annual Report 2006domini809No ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- MR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Document15 pagesMR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Mzm Zahir MzmNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- Top Glove 2020, 2021Document3 pagesTop Glove 2020, 2021nabil izzatNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- Cash Flow Statement Lourdesllanes2022 FINALDocument5 pagesCash Flow Statement Lourdesllanes2022 FINALDv AccountingNo ratings yet

- CAL BankDocument2 pagesCAL BankFuaad DodooNo ratings yet

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- Statement of Cash Flows: Jeffrey I. OrfrectoDocument5 pagesStatement of Cash Flows: Jeffrey I. OrfrectoDanhilson VivoNo ratings yet

- Half - Prime Bank 1st ICB AMCL Mutual Fund 10-11Document1 pageHalf - Prime Bank 1st ICB AMCL Mutual Fund 10-11Abrar FaisalNo ratings yet

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- AirtelDocument2 pagesAirtelShraddha RawatNo ratings yet

- Cash-Flow-Statement (1) Marvell TechnologiesDocument5 pagesCash-Flow-Statement (1) Marvell TechnologiesRuthNo ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2022Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2022nellyNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Xiezhong International Holdings Limited 協 眾 國 際 控 股 有 限 公 司Document39 pagesXiezhong International Holdings Limited 協 眾 國 際 控 股 有 限 公 司in resNo ratings yet

- + UpdatedDocument22 pages+ UpdatedRobert ManjoNo ratings yet

- Ford 18Document6 pagesFord 18Bhavdeep singh sidhuNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Vitrox q22020Document16 pagesVitrox q22020Dennis AngNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Dic FS Ann e 20 03 2023Document77 pagesDic FS Ann e 20 03 2023MarizeteNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Unconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010Document1 pageUnconsolidated Statement of Cash Flows: For The Year Ended December 31, 2010maqsoom471No ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- Airbus SN Q3-2020Document21 pagesAirbus SN Q3-2020paulouisvergnesNo ratings yet

- Adb Fin Statement - Dec 2020 - Final 2Document2 pagesAdb Fin Statement - Dec 2020 - Final 2Fuaad DodooNo ratings yet

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDocument1 pageNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Reit Managers Report in Terms Of-Regulation 1013 5th Schedule 2018Document67 pagesReit Managers Report in Terms Of-Regulation 1013 5th Schedule 2018An AntonyNo ratings yet

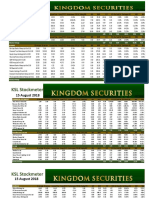

- KSL StockmeterDocument5 pagesKSL StockmeterAn AntonyNo ratings yet

- Kingdom Securities Limited - Stock Picks and Stockmeter - February 8th 2021Document4 pagesKingdom Securities Limited - Stock Picks and Stockmeter - February 8th 2021An AntonyNo ratings yet

- ReitsDocument58 pagesReitsAn AntonyNo ratings yet

- II. Ordinary and Necessary ExpensesDocument20 pagesII. Ordinary and Necessary ExpensescolNo ratings yet

- Chapter 12 Differential Analysis STDDocument15 pagesChapter 12 Differential Analysis STDjacks ocNo ratings yet

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviNo ratings yet

- Zhujiang IronDocument9 pagesZhujiang Ironrajendra_samy100% (1)

- MGT8200 - Chapter 3Document9 pagesMGT8200 - Chapter 3Si WongNo ratings yet

- Bonifacio Gas v. CIRDocument31 pagesBonifacio Gas v. CIRaudreydql5No ratings yet

- ACAAP2 - Week 8 MODULE - Audit of Prepaid Expenses, Deferred Charges and Other Current LiabilitiesDocument8 pagesACAAP2 - Week 8 MODULE - Audit of Prepaid Expenses, Deferred Charges and Other Current LiabilitiesDee100% (1)

- Turkish Tax SystemDocument3 pagesTurkish Tax Systemapi-3835399No ratings yet

- Brotherhood Labor Unity Vs ZamoraDocument2 pagesBrotherhood Labor Unity Vs ZamoraattyalanNo ratings yet

- U.S. and Global Imbalances: Can Dark Matter Prevent A Big Bang?Document11 pagesU.S. and Global Imbalances: Can Dark Matter Prevent A Big Bang?Pao SalazarNo ratings yet

- (Template) BAC-2-Module-1-Review-of-Basic-AccountingDocument4 pages(Template) BAC-2-Module-1-Review-of-Basic-AccountingCharmaine Montimor Ordonio100% (1)

- Global Ice Cream - Data MonitorDocument44 pagesGlobal Ice Cream - Data MonitorPrathibha Prabakaran100% (1)

- Generally Accepted Accounting Principles (GAAP)Document7 pagesGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNo ratings yet

- SaaS Metrics MLR ExternalDocument23 pagesSaaS Metrics MLR Externalsl7789No ratings yet

- Tax Booklet As of 10 November 2016 PDFDocument20 pagesTax Booklet As of 10 November 2016 PDFmaronbNo ratings yet

- Intro To CmaDocument21 pagesIntro To CmaRima PrajapatiNo ratings yet

- Chapter - 8Document17 pagesChapter - 8Maruf AhmedNo ratings yet

- Bharti Airtel Offer LetterDocument365 pagesBharti Airtel Offer LetterPranav BhatNo ratings yet

- First-In First-Out (FIFO) Method - Example - Inventory ValuationDocument2 pagesFirst-In First-Out (FIFO) Method - Example - Inventory Valuationmig007100% (1)

- Hotel Asset Management Business PlanDocument18 pagesHotel Asset Management Business PlanNguyễn Thế PhongNo ratings yet

- 06 Current Assets ManagementDocument2 pages06 Current Assets ManagementQamber AbbasNo ratings yet

- Answer Q1: How Big Is The Work Boot Market (Expressed in Euros) ? Does Duraflex Get More of Its Revenue From Work Boots or Casual Boots?Document11 pagesAnswer Q1: How Big Is The Work Boot Market (Expressed in Euros) ? Does Duraflex Get More of Its Revenue From Work Boots or Casual Boots?Marc Marendaz ChevallierNo ratings yet

- Orchid Hotel-An IntroductionDocument1 pageOrchid Hotel-An IntroductionSai VasudevanNo ratings yet

- Double Taxation - Rates of WithholdingDocument6 pagesDouble Taxation - Rates of Withholdingunderstated1313100% (1)

- The Companies Act (Cap .85) : Eastern African Fine Coffees Association (Eafca)Document14 pagesThe Companies Act (Cap .85) : Eastern African Fine Coffees Association (Eafca)Nakul Chandak0% (1)

- Concept of Social Cost Benefit AnalysisDocument25 pagesConcept of Social Cost Benefit AnalysisSunny KhushdilNo ratings yet

- Project of T.Y BbaDocument49 pagesProject of T.Y BbaJeet Mehta0% (1)

- Kenyon StoresDocument123 pagesKenyon StoresSourav AggarwalNo ratings yet

- IDirect KalpataruPower Q2FY20Document10 pagesIDirect KalpataruPower Q2FY20QuestAviatorNo ratings yet

- MRF & JK Tyre Case StudyDocument12 pagesMRF & JK Tyre Case StudyNishant Thukral67% (3)