Professional Documents

Culture Documents

None

Uploaded by

Donny EmanuelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

None

Uploaded by

Donny EmanuelCopyright:

Available Formats

Question:

✍ None

You can view the question in original Chegg URL page.

Expert answer: 0 0

✍ None

Question:

On January 1, 2019, Paxton Company purchased a 70% interest in Sagon Company for $1,300,000, at which time Sagon Company had retained earnings of

$500,000 and capital stock of $1,000,000. On January 1, 2019, the fair value of the assets and liabilities of Sagon Company was equal to their book value

except for bonds payable. Sagon Company had outstanding a $1,000,000 issue of 6% bonds that were issued at par and that mature on January 1, 2024.

Interest on the bonds is payable annually, and the yield rate on similar bonds on January 1, 2019, is 10%. Paxton Company reported net income from

independent operations of $300,000 in 2019 and $250,000 in 2020. Sagon Company reported net income of $100,000 in 2019 and $120,000 in 2020.

Neither company paid or declared dividends in 2019 or 2020. Paxton uses the partial equity method to account for its investment in Santos.

Despite two profitable years, changes in the market during 2020 for Sagon’s product line have caused Paxton to be concerned about the future profitability of

the unit. The following data are collected to test for goodwill impairment at 12/31/20. (No goodwill impairment has been recorded on the parent’s books.)

Paxton chose to measure goodwill impairment using the present value of future cash flows to estimate the fair value of the reporting unit (Sagon).

Required:

A. Prepare in general journal form the entries necessary in the consolidated statements workpapers for the years ended December 31, 2019, and December

31, 2020. Hint: You may wish to refer back to the section entitled Goodwill Impairment Test in Chapter 2.

B. Prepare in good form a schedule or t-account showing the calculation of the controlling and noncontrolling interest in consolidated net income for the

years ended December 31, 2019, and December 31, 2020.

Answer:

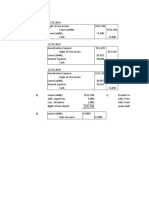

Computation and Allocation of Difference Schedule

Parent Non- Entire

Share Controlling Value

Share

Purchase price and implied value $1,300,000 557,143 1,857,143 *

Less: Book value of equity acquired 1,050,000 450,000 1,500,000

Difference between implied and book value 250,000 107,143 357,143

Unamortized Discount on Bonds Payable (106,143) (45,490) (151,633)

Balance 143,857 61,653 205,510

Goodwill (143,857) (61,653) (205,510)

Balance -0- -0- -0-

*$1,300,000/.70

Present Value on 1/1/2019of 6% Bonds Payable

Discounted at 10%, 5 periods

Principal ($1,000,000 × 0.62092) $620,920

Interest ($60,000 × 3.79079) 227,447

Fair value of bonds $848,367

Face value of bonds 1,000,000

Total Discount $151,633

Amortization of amount of difference between impliedand book value allocated to unamortized discount on bonds payable

(1) (2) (3) (4) (5)

Carrying Interest at 10% Interest at 6% Difference

Year Value (1/1) of Carrying Value of Par Value [(3)-(4)]

2019 $848,367 $84,837 $60,000 $24,837

2020 $873,204 $87,320 $60,000 $27,320

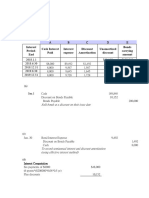

Part A 2019

(1) Equity in Subsidiary Income (.70)($100,000) 70,000

Investment in Sagon Co. 70,000

To eliminate subsidiary income

(2) Beginning Retained Earnings-Sagon Co. 500,000

Capital Stock- Sagon Co. 1,000,000

Difference between Implied and Book Value 357,143

Investment in Sagon Co. 1,300,000

Noncontrolling Interest 557,143

To eliminate investment amount and create noncontrolling interest account

(3) Interest Expense 24,837

Unamortized Discount on Bonds Payable ($151,633 - $24,837) 126,796

Goodwill 205,510

Difference between Implied and Book Value 357,143

To allocate and amortize the difference between Implied and book value

Alternative to entry (3)

(3a) Unamortized Discount on Bonds Payable 151,633

Goodwill 205,510

Difference between Impliedand Book Value 357,143

(3b) Interest Expense 24,837

Unamortized Discount on Bonds Payable 24,837

2020

(1) Equity in Subsidiary Income (.70)($120,000) 84,000

Investment in Sagon Co. 84,000

To eliminate subsidiary income

(2) Beginning Retained Earnings-Sagon Company 600,000

Common Stock- Sagon Company 1,000,000

Difference between Impliedand Book Value 357,143

Investment in Sagon Company ($1,300,000 + $70,000) 1,370,000

Noncontrolling Interest ($557,143 + ($600,000–$500,000) x 0.30) 587,143

To eliminate the investment account and create noncontrolling interest account

(3) Beginning Retained Earnings-Paxton Company 17,386*

Noncontrolling Interest 7,451

Interest Expense 27,320

Unamortized Discount on Bonds Payable ($151,633 - $24,837 - $27,320) 99,476

Goodwill 205,510

Difference between Impliedand Book Value 357,143

To allocate and amortize the differencebetween impliedand book value

*$24,837 x 70% = $17,386

Alternative to entry (3)

(3a) Unamortized Discount on Bonds Payable 151,633

Goodwill 205,510

Difference between Impliedand Book Value 357,143

(3b) Beginning Retained Earnings-Paxton Company 17,386

Noncontrolling Interest 7,451

Interest Expense 27,320

Unamortized Discount on Bonds Payable 52,157

(4) Impairment Loss – Goodwill** 25,510

Goodwill 25,510

**Step 1: Fair value of the reporting unit $1,500,000

Carrying value of unit:

Carrying value of identifiable net assets $1,409,000

Carrying value of goodwill 205,510

1,614,510

Excess of carrying value over fair value $ 114,510

The excess of carrying value over fair value means that step 2 is required.

Step 2: Fair value of the reporting unit $1,500,000

Fair value of identifiable net assets 1,320,000

Implied value of goodwill 180,000

Recorded value of goodwill 205,510

Impairment loss $ 25,510

Part B Controlling Interest in Consolidated Net Income 2019 2020

Paxton Company's Net Income fromIndependent Operations $300,000 $250,000

Paxton Company's Share of Reported Income of Sagon Company 70,000 84,000

Less: Amortization of Difference between Implied and Book Value

Allocated to:

Bonds Payable (17,386) (19,124)*

Controlling Interest in Consolidated Net Income $352,614 $314,876

* $27,320x 70% = $19,124

..........xxxx❤️We are expecting just one like for our effort nothing more than that its save our accounts from block❤️xxx ...............

None

You might also like

- Ch7 Problems SolutionDocument22 pagesCh7 Problems Solutionwong100% (8)

- Soal Debt InvestmentDocument5 pagesSoal Debt InvestmentKyle Kuro0% (1)

- Case 3Document13 pagesCase 3Prezi Toli100% (1)

- Problem: Andres Adi Putra S 43220110067 AKM2-Forum 6Document17 pagesProblem: Andres Adi Putra S 43220110067 AKM2-Forum 6tes doangNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Jawaban Lat Debt & Equity InvestmentDocument10 pagesJawaban Lat Debt & Equity InvestmentYOPIE CHANDRANo ratings yet

- Chapter 19 Assignment IAF410 Excel SheetDocument14 pagesChapter 19 Assignment IAF410 Excel SheetTati AnaNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Chapter 14 - Homework AnswerDocument10 pagesChapter 14 - Homework AnswerSaja AlbarjesNo ratings yet

- Answers To Problems Problem 1: Advantages of LeasingDocument11 pagesAnswers To Problems Problem 1: Advantages of LeasingEvan AzizNo ratings yet

- Phan Tich Tai ChinhDocument16 pagesPhan Tich Tai Chinhbo noloveNo ratings yet

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- Quiz Box 2 - QuestionnairesDocument13 pagesQuiz Box 2 - QuestionnairesCamila Mae AlduezaNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Nudjpia Far and Afar Solutions - Government GrantsDocument3 pagesNudjpia Far and Afar Solutions - Government GrantsKyla Artuz Dela CruzNo ratings yet

- Vederinus Stefanus 86220 0Document9 pagesVederinus Stefanus 86220 0PdoneeverNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Right-of-Use Assets Lease LiabilityDocument10 pagesRight-of-Use Assets Lease LiabilityMoe ChurappiNo ratings yet

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- Assignment1 AnswerDocument4 pagesAssignment1 AnswerziqingyeNo ratings yet

- Problem 1: ComputationsDocument6 pagesProblem 1: ComputationsClarissa BorbonNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Compound Financial Instrument PDFDocument4 pagesCompound Financial Instrument PDFidontcaree123312100% (1)

- The Examiner's Answers F2 - Financial Management March 2013: Section ADocument18 pagesThe Examiner's Answers F2 - Financial Management March 2013: Section Amd salehinNo ratings yet

- Firda Arfianti - LC53 - Eliminating Entries, Noncontrolling InterestDocument3 pagesFirda Arfianti - LC53 - Eliminating Entries, Noncontrolling InterestFirdaNo ratings yet

- Audit of Long-Term Liabilities - SDocument6 pagesAudit of Long-Term Liabilities - SEva DagusNo ratings yet

- MODULE 4 - DiscussionDocument11 pagesMODULE 4 - DiscussionYess poooNo ratings yet

- SBR Practice Questions 2019 - QDocument86 pagesSBR Practice Questions 2019 - QALEX TRANNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- ACAE 15 Activity - Investment in Bonds: Problem 1Document5 pagesACAE 15 Activity - Investment in Bonds: Problem 1Nick ivan AlvaresNo ratings yet

- Ikhsan Uiandra Putra Sitorus - LC53 - Forum Session 5 Eliminating Entries, Noncontrolling Interest Exercise 4-5Document3 pagesIkhsan Uiandra Putra Sitorus - LC53 - Forum Session 5 Eliminating Entries, Noncontrolling Interest Exercise 4-5Ikhsan Uiandra Putra SitorusNo ratings yet

- Gonzalez, John Williever A. - Bonds Payable-Between Interest Dates and SerialDocument4 pagesGonzalez, John Williever A. - Bonds Payable-Between Interest Dates and SerialJohn Williever GonzalezNo ratings yet

- Bonds Payable-Between Interest Dates and SerialDocument4 pagesBonds Payable-Between Interest Dates and SerialJohn Williever GonzalezNo ratings yet

- ACCT336 Solved Exercises - Chapters 14 and 15Document5 pagesACCT336 Solved Exercises - Chapters 14 and 15kareemrawwadNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Practice Solution 1Document8 pagesPractice Solution 1Luigi NocitaNo ratings yet

- Chapter 14 AKM Kieso - Jawab SoalDocument6 pagesChapter 14 AKM Kieso - Jawab SoalNABILAH KHANSA 1911000089No ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- AA Chapter2Document6 pagesAA Chapter2Nikki GarciaNo ratings yet

- Accounting - UCO Bank - Assignment1Document1 pageAccounting - UCO Bank - Assignment1KummNo ratings yet

- Madam CaseDocument30 pagesMadam CaseihtishamNo ratings yet

- Suggested Answers Assignment Notes PayableDocument4 pagesSuggested Answers Assignment Notes PayableKeikoNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- FINC 301 Assignment 2023 1Document8 pagesFINC 301 Assignment 2023 1kd5d26xw5rNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Problem 7-1 Requirement 1: Date Payment Interest PrincipalDocument9 pagesProblem 7-1 Requirement 1: Date Payment Interest PrincipalMarya GonzalesNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- Acctg Lab 5.Document4 pagesAcctg Lab 5.AngieNo ratings yet

- Tugas Akm Ii Pertemuan 13Document5 pagesTugas Akm Ii Pertemuan 13Alisya UmariNo ratings yet

- Loan ReceivablesDocument3 pagesLoan ReceivablesAdam CuencaNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- A1C019118 Jurati Latihan7Document6 pagesA1C019118 Jurati Latihan7jurati100% (1)

- Acc102 Finals All Pages 1Document41 pagesAcc102 Finals All Pages 1Bervette HansNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsKezNo ratings yet

- Adrac Ifrs Training ProgramDocument6 pagesAdrac Ifrs Training ProgramfrancoolNo ratings yet

- Chapter 7 PDFDocument18 pagesChapter 7 PDFJay BrockNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Expert Answer (1)Document3 pagesExpert Answer (1)Donny EmanuelNo ratings yet

- 35179798Document1 page35179798Donny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- Readytoprint Chrome - Com 202428293729Document1 pageReadytoprint Chrome - Com 202428293729Donny EmanuelNo ratings yet

- DownloadDocument3 pagesDownloadDonny EmanuelNo ratings yet

- DownloadDocument15 pagesDownloadDonny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- Screenshot - 2024 03 04 13 40 34 329 - Com - Android.chrome EditDocument12 pagesScreenshot - 2024 03 04 13 40 34 329 - Com - Android.chrome EditDonny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- Chrome - Screenshot - Feb 29, 2024 8 - 57 - 06 PM GMT+07 - 00Document1 pageChrome - Screenshot - Feb 29, 2024 8 - 57 - 06 PM GMT+07 - 00Donny EmanuelNo ratings yet