Professional Documents

Culture Documents

Liquidation of Companies

Liquidation of Companies

Uploaded by

Vasu JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liquidation of Companies

Liquidation of Companies

Uploaded by

Vasu JainCopyright:

Available Formats

LIQUIDATION OF COMPANY

Introduction to Chapter

Liquidation is the legal procedure by which the company comes to an end.

‘B’ List Contributories

The shareholders who transferred partly paid shares (otherwise than by operation of law or by death)

within one year, prior to the date of winding up may be called upon to pay an amount (not exceeding the

amount not called up when the shares were transferred) to pay off such creditors as existed on the date of

transfer of shares and cannot be paid out of the funds otherwise available with the liquidator, provided

that the existing shareholders have also failed to pay the amount due on the shares.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

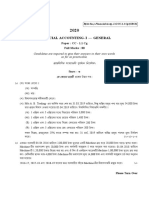

Question Inter May 2018 (5 Marks)

In a liquidation which commenced on 11th November, 2019 certain creditors could not receive payments

out of the realization of assets and out of the contributions from "A" list contributories.

The following are the details of certain transfer, which took place in 2018 and 2019:

Share holders Number of shares Date of ceasing to be Creditors

transferred at the date of member remaining unpaid

ceasing to be member and outstanding

C 2,500 1st September, 2018 5,000

P 1,500 1st January, 2019 9,000

D 2,000 1st April, 2019 12,000

B 700 1st August, 2019 13,500

S 300 15th September, 2019 14,500

All the shares were ₹ 10 each, ₹ 5 paid up. Ignoring expenses of and remuneration to liquidators show

the amount to be realised from various persons listed above.

Solution

Statement showing the liability of ‘B’ list contributories

Name Date Unpaid Incremental 1500 2000 700 300

Debt P D B S

P 1/01/19 9,000 9,000 3,000 4,000 1,400 600

D 1/04/19 12,000 3,000 -- 2,000 700 300

B 1/08/19 13,500 1,500 -- -- 1,050 450

S 15/09/19 14,500 1,000 -- -- -- 1,000

Total (A) 3,000 6,000 3,150 2,350

Maximum Liability (B) 7,500 10,000 3,500 1,500

Actual liability 3,000 6,000 3,150 1,500

(Lower of A & B)

Working Notes:

1. C will not be liable since he transferred his shares prior to one year preceding the date of winding up.

2. P will not be responsible for further debts incurred after 01.01.2019 (from the date when he ceases to

be a member). Similarly, D & B will not be liable for the debts incurred after the date of their transfer

of shares.

3. The increase between 1st August 2019 and 15th September 2019, is solely the responsibility of S.

Liability of S has been restricted to the maximum allowable limit of ₹ 1,500.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

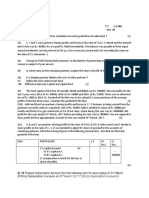

Question Inter Jan 2021 (10 Marks)

In the winding up of a company, certain Creditors could not receive payments out of the realization of

assets and out of contribution from "A" list contributories. Liquidation started on 1st April, 2020. The

following persons have transferred their holdings before winding up:

Shareholders Number of shares Date of Transfer Amount due to creditors on the date of

transferred such transfer

O 1,000 04.04.2019 42,000

P 300 02.02.2019 25,000

Q 200 08.09.2019 57,000

R 1,400 11.11.2019 85,000

S 800 02.02.2020 66,000

T 1,400 01.03.2020 95,000

The shares were of ₹ 100 each, ₹ 70 being called up and paid up on the date of transfers. 'X' was the

transferee of shares held by S. 'X' paid ₹ 30 per share as calls in advance immediately on becoming a

member. Ignoring Expenses of Liquidation, Remuneration of Liquidator, etc. work out the amount to be

realized from the above contributories.

Solution

‘P’ will not be liable as he has transferred his share prior to one year preceding the date of winding up.

‘S will not be liable as his transferee X paid calls in advance on becoming the member.

Statement showing the liability of ‘B’ list contributories

Name Date Unpaid Incremental 1000 200 1400 1400

Debt O Q R T

O 04/04/19 42,000 42,000 10,500 2,100 14,700 14,700

Q 08/09/19 57,000 15,000 - 1,000 7,000 7,000

R 11/11/19 85,000 28,000 - - 14,000 14,000

T 01/03/20 95,000 10,000 - - - 10,000

Total (A) 10,500 3,100 35,700 45,700

Maximum Liability (B) 30,000 6,000 42,000 42,000

Actual liability 10,500 3,100 35,700 42,000

(Lower of A & B)

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Question Inter Nov 2020 (5 Marks)

In a winding up of a company creditor remain unpaid. The following persons had transferred their

holdings before winding up.

Shareholders Number of shares Date of Transfer Creditors remaining unpaid & out-

transferred standing on the date of such transfer

D 1000 01.01.2019 8,500

E 400 15.02.2019 13,500

H 700 15.03.2019 19,000

J 900 31.03.2019 22,000

K 1000 05.04.2019 31,000

The shares were of ₹ 100 each, ₹ 80 being called up and paid up on the date of transfers.

(1) A member G, who holds 200 shares died on 28th Feb., 2019 when the amount due to creditors was ₹

16000. His shares were transmitted to his Son X.

(2) R was the transferee of shares held by J. R paid ₹ 20 per share as calls in advance immediately on

becoming a member.

(3) The liquidation of the Company commenced on 1st February, 2020. Then the liquidator made a call

on the present and past contributories to pay the amount.

You are required to quantify the maximum liability of the transferors of shares mentioned in the above

table.

Solution

Statement showing the liability of ‘B’ list contributories

Name Date Unpaid Incremental 400 200 700 1000 Total

Debt E G/X H K

E 15/02/2019 13,500 13,500 2,348 1,174 4,108 5,870 13,500

G/X 28/02/2019 16,000 2,500 - 263 921 1,316 2,500

H 15/03/2019 19,000 3,000 - 316 1,105 1,579 3,000

K 05/04/2019 31,000 12,000 - 2,000 - 10,000 12,000

Total (A) 2,348 3,753 6,134 18,765 31,000

Maximum Liability (B) 8,000 4,000 14,000 20,000

Actual liability 2,348 3,753 6,134 18,765

(Lower of A & B)

Working Note:

(1) The transferors are D, E, H, J and K. When the transferees pay the amount due as “present”

member contributories, there will not be any liability on the transferors. It is only when the

transferees do not pay as “present” member contributories then the liability would arise in the case of

“past” members as contributories.

(2) D will not be liable to pay any amount as the winding up proceedings commenced after one year

from the date of the transfer.

(3) J also will not be liable as the transferee R has paid the balance ₹ 20 per share as call in advance.

(4) E, G/X, H and K will be liable, as former members, to the maximum extent as indicated, provided

the transferees do not pay the calls.

(5) X to whom shares were transmitted on demise of his father G would be liable as an existing member

contributory. He steps into the shoes of his deceased father. His maximum liability would be at ₹ 20

per share on 200 shares received on transmission i.e. for ₹ 4,000.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Liquidator’s Statement of Account

The statement prepared by the liquidator showing receipts and payments of cash in case of voluntary

winding up is called “Liquidators’ statement of account”. There is no double entry involved in the

preparation of liquidator’s statement of account. It is only statement presented in the form of an account.

While preparing the liquidator’s statement of account, receipts are shown in the following order:

(a) Amount realised from assets are included in the prescribed order.

(b) In case of assets specifically pledged in favour of creditors, only the surplus from it, if any, is entered

as ‘surplus from securities’.

(c) In case of partly paid up shares, the equity shareholders should be called up to pay necessary amount

(not exceeding the amount of uncalled capital) if creditors’ claims/claims of preference shareholders

can’t be satisfied with the available amount. Preference shareholders would be called upon to

contribute (not exceeding the amount as yet uncalled on the shares) for paying of creditors.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Preferential Payments (Section 327)

In a winding up, subject to the provisions of section 326, there shall be paid in priority to all other debts-

a) all revenues, taxes, cesses and rates due from the company to the Central Government or a State

Government or to a local authority at the relevant date, and having become due and payable within

the twelve months immediately before that date;

b) all wages or salary including wages payable for time or piece work and salary earned wholly or in part

by way of commission of any employee in respect of services rendered to the company and due for a

period not exceeding four months within the twelve months immediately before the relevant date,

subject to the condition that the amount payable under this clause to any workman shall not exceed

such amount as may be notified;

c) all accrued holiday remuneration becoming payable to any employee, or in the case of his death, to

any other person claiming under him, on the termination of his employment before, or by the winding

up order, or, as the case may be, the dissolution of the company;

d) unless the company is being wound up voluntarily merely for the purposes of reconstruction or

amalgamation with another company, all amount due in respect of contributions payable during the

period of twelve months immediately before the relevant date by the company as the employer of

persons under the Employees’ State Insurance Act, 1948 or any other law for the time being in force;

e) unless the company has, at the commencement of winding up, under such a contract with any insurer

as is mentioned in section 14 of the Workmen’s Compensation Act, 1923, rights capable of being

transferred to and vested in the workmen, all amount due in respect of any compensation or liability

for compensation under the said Act in respect of the death or disablement of any employee of the

company:

k) all sums due to any employee from the provident fund, the pension fund, the gratuity fund or any

other fund for the welfare of the employees, maintained by the company; and

l) the expenses of any investigation held in pursuance of sections 213 and 216, in so far as they are

payable by the company.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

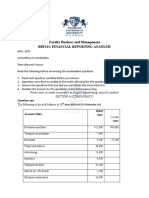

Question

X Ltd. went into Voluntary Liquidation on 31st March, 2020, when their Balance Sheet was as follows:

Liabilities Rs.

Issued and subscribed capital :

10,000 12% cumulative preference shares of Rs. 100 each, fully paid 10,00,000

10,000 equity shares of Rs. 100 each, Rs. 75 paid 7,50,000

20,000 equity shares of Rs. 100 each, Rs. 60 paid 12,00,000

Reserves & Surplus:-

Profit & Loss Account (6,25,000)

Securities Premium 1,00,000

12% Debentures secured by a floating charge 10,00,000

Interest outstanding on Debentures 1,20,000

Bank Loan (Secured by Land & Building) 10,00,000

Creditors 8,50,000

Total 53,95,000

Assets

Land & Building 19,60,000

Plant & Machinery 15,50,000

Furniture 6,75,000

Patents 2,45,000

Stock 2,80,000

Trade Receivables 6,04,000

Cash at Bank 81,000

Total 53,95,000

Preference dividends were in arrear for 1 year. Creditors include preferential creditors of Rs. 1,00,000.

Balance creditors are discharged subject to 4% discount.

Assets are realised as under:

Land & Building 24,50,000

Plant & Machinery 9,00,000

Furniture 2,85,000

Patents 90,000

Stock 2,80,000

Trade Receivables 3,15,000

Expenses of liquidation amounted to Rs. 45,000. The liquidator is entitled to a remuneration of 3% on all

assets realised (except cash at bank) & 2% on payment made to unsecured creditors including preferential

creditors. All payments were made on 30th June, 2020.

You are required to prepare the Liquidator's Final Statement of Account as on 30th June, 2020.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Solution

Liquidator’s Statement of Account

Particulars Amount Particulars Amount

To Cash at Bank 81,000 By Liquidation expenses 45,000

To Assets Realized By Liquidator remuneration (W.N-1) 1,46,000

Plant & Machinery 9,00,000 By Preferential Creditors 1,00,000

Furniture 2,85,000 By Debenture holders

Patents 90,000 Debentures 10,00,000

Stock 2,80,000 (+) Interest O/s 1,20,000

Trade receivables 3,15,000 18,70,000 (+) Interest O/s 30,000 11,50,000

(10Lacs x 12% x 3/12)

To Surplus from assets pledged By Unsecured Creditors 7,20,000

(7,50,000*96% )

Realized value 24,50,000 By Preference Shareholders

-Bank Loan (10,00,000) 14,50,000 Capital 10,00,000

To Call from Equity shareholders (+) Pref. D/d 1,20,000 11,20,000

20,000*1 = 20,000 20,000 (10 Lacs x 12% x 1)

By Equity shareholders (Refund)

10,000*14 = 1,40,000 1,40,000

34,21,000 34,21,000

Working Note:

1. Computation of Total Remuneration payable to Liquidator

Particulars Amount

3% on Assets realised (18,70,000 + 24,50,000) 43,20,000 x 3% 1,29,600

2% on payment made to preferential creditors 1,00,000 x 2% 2,000

2% on payment made to unsecured creditors 7,20,000 x 2% 14,400

Total Remuneration payable to Liquidator 1,46,000

2) Final Settlement

Surplus after payment to Preference shareholders 1,20,000

(+) Notional call (20,000 shares x 15) 3,00,000

4,20,000

No. of Shares (20,000 + 10,000) 30,000

Refund per share 14

No. 10,000 20,000

Call - 15

Refund (14) (14)

14 Refund 1 Call

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Question RTP May 2020

A Liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount

distributed to Preferential Creditors and 3% on the payment made to Unsecured Creditors. The assets

were realized for ₹ 37,50,000 against which payment was made as follows:

Liquidation Expenses ₹ 37,500

Secured Creditors ₹ 15,00,000

Preferential Creditors ₹ 1,12,500

The amount due to Unsecured Creditors was ₹ 22,50,000.

You are asked to calculate the total Remuneration payable to Liquidator. Calculation shall be made to

the nearest multiple of a rupee.

Solution

Computation of Total Remuneration payable to Liquidator

Particulars Amount

2% on Assets realised 37,50,000 x 2% 75,000

3% on payment made to Preferential creditors 1,12,500 x 3% 3,375

3% on payment made to Unsecured creditors (Refer W.N) 58,882

Total Remuneration payable to Liquidator 1,37,257

Working Note:

Liquidator’s remuneration on payment to unsecured creditors = Cash available for unsecured creditors

after all payments including liquidation expenses, payment to secured creditors, preferential creditors &

liquidator’s remuneration

= 37,50,000 – 37,500 – 15,00,000 – 1,12,500 – 75,000 – 3,375 = 20,21,625

Liquidator’s remuneration = 3/103 x 20,21,625 = 58,882

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Question ICAI Study Material

Rain Ltd. went into liquidation on 31st March, 2021. Following are the details regarding share capital of

the company:-

I. 30,000 Equity shares of ₹ 100 each, ₹ 80 paid up.

II. 80,000 Equity shares of ₹ 50 each, ₹ 25 paid up.

III. 4,00,000 Equity shares of ₹ 10 each, fully paid up.

Surplus available with the liquidator after payment of all the liabilities ₹ 24,00,000. Distribute this surplus

money among different categories of shareholders.

Solution

Number of equivalent equity shares:

30,000 shares of ₹ 100 each 80 paid up = 30,000 shares of ₹ 100 each 80 paid up

80,000 shares of ₹ 50 each 25 paid up = 40,000 shares of ₹ 100 each 50 paid up

4,00,000 shares of ₹ 10 each fully paid up = 40,000 shares of ₹ 100 each fully paid up

Surplus after payment of all liabilities 24,00,000

(+) Notional call 26,00,000

(30,000 shares x 20) + (40,000 shares *50)

50,00,000

No. of Shares (30,000 + 40,000 + 40,000) 1,10,000

Refund per share 45.4545

Equivalent Shares 30,000 40,000 40,000

Original Shares 30,000 80,000 4,00,000

Call 20 50 -

Refund (45.4545) (45.4545) (45.4545)

Net 25.4545 Refund 4.5455 Call 45.4545 Refund

Amount 30,000*25.4545 40,000*4.5455 40,000*45.4545

7,63,635 Refund 1,81,820 Call 18,18,180 Refund

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

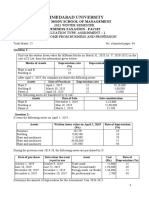

Question Inter Nov 2018 (10 Marks)

Virat Ltd. furnishes the following summarized Balance Sheet as at 31st March, 2020:

Balance Sheet as at 31.03.2020

Amount (₹) Amount (₹)

A. Equity and Liabilities

1. Shareholders’ Fund

(a) Share Capital

10,000, 12% Pref. Shares of ₹ 100 each fully paid up 10,00,000

1,00,000 Equity shares of ₹ 10 each fully paid up 10,00,000

50,000 Equity shares of ₹ 10 each, ₹ 8 paid up 4,00,000 24,00,000

(b) Reserves & Surplus

Profit & Loss A/c (Dr. Balance) (3,50,000)

2. Non-Current Liabilities

12 % Debentures 15,00,000

Loan on Mortgage 4,50,000 19,50,000

3. Current Liabilities

Bank Overdraft 2,75,000

Trade Payables 7,30,000 10,05,000

Total 50,05,000

B. Assets

1. Non-Current assets

Property, Plant & Euipment

Land & Buildings 6,00,000

2. Current Assets

Sundry Current Assets 44,05,000

Total 50,05,000

The mortgage loan was secured against the Land & Buildings. Debentures were secured by a floating

charge on all the assets of the company. The debenture holders appointed a Receiver. The company

being voluntarily wound up, a liquidator was also appointed. The Receiver was entrusted with the task of

realising the Land & Buildings which fetched ₹ 7,50,000 . Receiver also took charge of Sundry current

assets of value ₹ 30,00,000 and sold them for ₹ 28,75,000. The Bank overdraft was secured by a personal

guarantee of the directors who discharged their obligations in full from personal resources. The costs of

the Receiver amounted to ₹ 10,000 and his remuneration ₹ 15,000.

The expenses of liquidator was ₹ 17,500 and his remuneration was decided at 2% on the value of the

assets realised by him. The remaining assets were realised by liquidator for ₹ 12,50,000. Preference

dividend was in arrear for 2 years. Articles of Association of the company provide for payment of

preference dividend arrears in priority to return of equity capital.

Prepare the accounts to be submitted by the Receiver and the Liquidator.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Solution

Receiver’s Statement of Account

Particulars Amount Particulars Amount

To Assets Realized 28,75,000 By Receiver expenses 10,000

To Surplus from Assets pledged By Receiver Remuneration 15,000

Realized value By Debenture holders

(Land & Building) 7,50,000 Debentures 15,00,000 15,00,000

-Mortgage Loan (4,50,000) 3,00,000 By Surplus transferred to Liquidator 16,50,000

31,75,000 31,75,000

Liquidator’s Statement of Account

Particulars Amount Particulars Amount

To Surplus received from Receiver 16,50,000 By Liquidation expenses 17,500

To Assets Realized 12,50,000 By Liquidators remuneration 25,000

(12,50,000 x 2%)

By Unsecured Creditors

Directors for Bank OD 2,75,000

Trade Creditors 7,30,000 10,05,000

By Preference Shareholders

Capital 10,00,000

(+) Pref. D/d 2,40,000 12,40,000

(10,00,000 x 12% x 2)

By Equityshareholders

1,00,000 shares @ 4.75 4,75,000

50,000 shares @ 2.75 1,37,500 6,12,500

29,00,000 29,00,000

Working Note:

Surplus before payment to Preference shareholders 18,52,500

Less: Payment to Preference shareholders (12,40,000)

Surplus after payment to Preference shareholders 6,12,500

(+) Notional call (50,000 shares x 2) 1,00,000

7,12,500

No. of Shares (50,000 + 1,00,000) 1,50,000

Refund per share 4.75

50,000 1,00,000

Call 2 -

Refund (4.75) (4.75)

2.75 Refund 4.75 Refund

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Statement of Affairs

FORMAT OF STATEMENT OF AFFAIRS

Particulars Estimated

RealisableValue

Assets not specifically pledged (List A)

Debtors

Bills Receivable

Stock

Furniture & Fixtures

Cash in hand

Calls in Arrears

Estimated value of assets not specifically pledged

Assets specifically pledged (List B)

Particulars Est. Real. Due to secured Deficiency ranking Surplus carried to

Value creditors as unsecured last column

Estimated total assets available for preferential creditors, debenture holders secured by

a floating charge and unsecured creditors

Summary of Gross Assets

Estimated Realizable value of assets specifically pledged

Estimated Realizable value of assets not specifically pledged

Total Assets

Liabilities

Gross Liabilities Liabilities

Secured creditors (as per List B) to the extent to which claims are

estimated to be covered by assets specifically pledged

Preferential creditors (as per List C)

Balance of assets available for debenture holders secured by

floating charge and unsecured creditors

Debenture holders secured by floating charge (as per List D)

Balance of assets available for unsecured creditors

Unsecured creditors (as per List E)

Estimated deficiency as regards creditors (difference between gross

assets and gross liabilities)

____ Preference shares of ₹__ each (as per List F)

_____ Equity shares of ₹___ each(as per List G)

Estimated surplus/ deficiency as regards members(as per List H)

Note:

1) The above is subject to cost of winding up and to any surplus / deficiency on realisation of assets.

2) There are ___ shares unpaid @ ₹ ___ per share liable to be called up or there are no calls in arrears.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Deficiency Account

DEFICIENCY ACCOUNT (List H)

A. Item contributing to Deficiency

1. Excess of capital & liabilities over assets

2. Net dividend & bonuses during the period

3. Net trading losses after charging depreciation, taxation, interest on debentures,

etc. during the same period

4. Losses other than trading losses written off or for which provision has been made

in the books during period

5. Estimated losses now written off or for which provision has been made for the

purpose of preparing the statement

6. Other items contributing to deficiency

B. Items reducing Deficiency

7. Excess of assets over capital & liabilities on ______

8. Net trading profit during the period

9. Profit & Incomes other than trading profit during the same period

10. Other items

Surplus/ Deficiency as shown by the Statement of Affairs (A) - (B)

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Question ICAI Study Material

‘A’ Ltd is to be liquidated. Their summarised Balance Sheet as at 30th September, 2019 appears as under

Liabilities ₹

5,00,000 equity shares of ₹ 10 each 50,00,000

Secured debentures (on land and buildings) 20,00,000

Unsecured loans 40,00,000

Trade Creditors 70,00,000

Total 1,80,00,000

Assets

Land & Building 10,00,000

Other Property, Plant & Equipment 40,00,000

Current Assets 90,00,000

Profit & Loss Account 40,00,000

Total 1,80,00,000

Contingent Liabilities are:

For bills discounted 2,00,000

For excise duty demands 3,00,000

On investigation, it is found that the contingent liabilities are certain to devolve and that the assets are

likely to be realised as follows:

Land & Building 22,00,000

Other Property, Plant & Equipment 36,00,000

Current Assets 70,00,000

Taking the above into account, prepare the Statement of Affairs.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Solution

Statement of Affairs of A Ltd.

Particulars Estimated

Realisable

Value

Assets not specifically pledged (List A)

Other Property, Plant & Equipment 36,00,000

Current Assets 70,00,000

Estimated value of assets not specifically pledged 1,06,00,000

Assets specifically pledged (List B)

Particulars Est. Real. Due to secured Deficiency ranking Surplus carried to

Value creditors as unsecured last column

Land & Buil. 22,00,000 20,00,000 - 2,00,000 2,00,000

Estimated total assets available for preferential creditors, debenture holders secured by a 1,08,00,000

floating charge and unsecured creditors

Summary of Gross Assets

Estimated Realizable value of assets specifically pledged 22,00,000

Estimated Realizable value of assets not specifically pledged 1,06,00,000

Total Assets 1,28,00,000

Liabilities

Gross Liabilities Liabilities

20,00,000 Secured creditors (as per List B) to the extent to which claims are -

estimated to be covered by assets specifically pledged

3,00,000 Preferential creditors (as per List C) – for demand of excise duty 3,00,000

Balance of assets available for debenture holders secured by floating 1,05,00,000

charge and unsecured creditors

- Debenture holders secured by floating charge (as per List D) -

1,12,00,000 Unsecured creditors (as per List E): 1,12,00,000

1,35,00,000 Estimated deficiency as regards creditors (difference between gross 7,00,000

assets and gross liabilities)

5,00,000 Equity shares of ₹ 10 each (as per List G) 50,00,000

Estimated deficiency as regards members/ contributories 57,00,000

Working Note: Computation of Unsecured Creditors (List E)

Unsecured Loans 40,00,000

Trade creditors 70,00,000

Liability for bills discounted (Contingent) 2,00,000

1,12,00,000

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Question IPCC May 2016 (16 Marks)

From the following particulars, prepare a Statement of Affairs and Deficiency Account for submission to

official liquidator of Sun City Development Ltd., which went into liquidation on 31st March, 2020:

Liabilities ₹ ₹

6,00,000 Equity shares of ₹10 each, ₹8 paid-up 48,00,000

6% 2,00,000 Preference shares of ₹10 each 20,00,000

Less: Calls in arrear (1,00,000) 19,00,000

5% Debentures having a floating charge on the assets 20,00,000

(interest paid up to 30th September, 2019)

Mortgage on Land & Building 16,00,000

Trade Payable 53,10,000

Wage Payable 4,00,000

Secretary's Salary Payable @ ₹ 5,000 p.m. 60,000

Managing Director's Salary Payable @ ₹ 30,000 p.m. 1,20,000

Assets Estimated to Book value

produce

Land & Building 26,00,000 24,00,000

Plant & Machinery 26,00,000 40,00,000

Tools & Equipments 80,000 4,00,000

Patents & Copyrights 6,00,000 10,00,000

Inventory 14,80,000 17,40,000

Investments in the hand of a Bank for an Overdraft of 38,00,000 34,00,000 36,00,000

Trade Receivables 12,00,000 18,00,000

On 31st March, 2015 the Balance Sheet of the Company showed a General Reserve of ₹ 8,00,000

accompanied by a debit balance of ₹ 5,00,000 in the Profit & Loss Account.

In 2016, the Company made a profit of ₹ 8,00,000 and declared a dividend of 10% on Equity Shares.

The Company suffered a total loss of ₹ 21,80,000 besides loss of stock due to fire to the tune of ₹ 8,00,000

during financial years ending March 2017, 2018 and 2019. For the financial year ended 31st March,

2020, accounts were not made. The cost of winding-up is expected to be ₹ 3,00,000.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Solution

Statement of Affairs of Sun City Development Ltd.

Particulars Estimated

Realisable

Value

Assets not specifically pledged (List A)

Trade receivables 12,00,000

Inventory 14,80,000

Plant and Machinery 26,00,000

Tools and Equipment 80,000

Patents and copyrights 6,00,000

Unpaid calls 1,00,000

Estimated value of assets not specifically pledged 60,60,000

Assets specifically pledged (List B)

Particulars Est. Real. Due to secured Deficiency ranking Surplus carried to

Value creditors as unsecured last column

Investments 34,00,000 38,00,000 4,00,000 -

Land & Building 26,00,000 16,00,000 - 10,00,000

60,00,000 54,00,000 4,00,000 10,00,000 10,00,000

Estimated total assets available for preferential creditors, debenture holders secured by a 70,60,000

floating charge and unsecured creditors

Summary of Gross Assets

Estimated Realizable value of assets specifically pledged 60,00,000

Estimated Realizable value of assets not specifically pledged 60,60,000

Total Assets 1,20,60,000

Liabilities

Gross Liabilities Liabilities

50,00,000 Secured creditors (as per List B) to the extent to which claims are -

estimated to be covered by assets specifically pledged

Preferential creditors (as per List C)

4,20,000 (4,00,000+20,000 maximum for 4 months) 4,20,000

Balance of assets available for debenture holders secured by 66,40,000

floating charge and unsecured creditors

20,50,000 Debenture holders secured by floating charge (as per List D) 20,50,000

Balance of assets available for unsecured creditors 45,90,000

Unsecured creditors (as per List E)

58,70,000 (4,00,000+53,10,000+40,000+1,20,000) 58,70,000

1,33,40,000 Estimated deficiency as regards creditors (difference between 12,80,000

gross assets and gross liabilities)

6% 2,00,000 Preference shares of ₹ 10 each (as per List F) 20,00,000

6,00,000 Equity shares of ₹ 10 each, 8 paid (as per List G) 48,00,000

Estimated deficiency as regards members (as per List H) 80,80,000

Note:

1) The above is subject to cost of winding up estimated as ₹ 3,00,000 and to any surplus / deficiency on

realisation of assets.

2) There are 6,00,000 shares unpaid @ ₹ 2 per share liable to be called up.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Working Notes: Trial Balance to ascertain the amount of loss for the year ended 31st March, 2020

Dr. Cr.

Land & Building 24,00,000

Plant and Machinery 40,00,000

Tools and Equipments 4,00,000

Patents and Copyrights 10,00,000

Inventories 17,40,000

Investment 36,00,000

Trade Receivables 18,00,000

Equity Capital 48,00,000

6% Preference share capital 19,00,000

5% Debentures 20,00,000

Interest Outstanding 50,000

Mortgage on Land & Building 16,00,000

Trade Creditors 53,10,000

Owing for Wages 4,00,000

Secretary’s Salary 60,000

Managing Director’s Salary 1,20,000

Bank Overdraft 38,00,000

Profit & Loss Account (Bal. Fig.) 51,00,000

2,00,40,000 2,00,40,000

Reserve & Surplus Account*

Amount Amount

1.4.2015 To Profit & Loss A/c 5,00,000 1.4.2015 By Balance b/d 8,00,000

(Transfer)

31.3.2016 To Dividend- Equity 4,80,000 31.3.2016 By Profit for the year 8,00,000

Preference 1,14,000

1.4.16 to To Profit & Loss A/c 21,80,000 31.3.2020 By Balance c/d 51,00,000

31.3.19 (Loss)

To Loss of Stock 8,00,000

31.03.20 To Profit & Loss A/c 26,26,000

(Loss) (Bal. Fig.)

67,00,000 67,00,000

*Alternatively make Statement of P&L Acc.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

List H - Deficiency Account

A. Item contributing to Deficiency

1. Excess of capital & liabilities over assets on 1-4-2015 Nil

2. Net dividend & bonuses during the period (4,80,000 + 1,14,000) 5,94,000

3. Net trading losses after charging depreciation, taxation, interest on debentures, 48,06,000

etc. during the same period (₹ 21,80,000 + ₹ 26,26,000)

4. Losses other than trading losses written off or for which provision has been made 8,00,000

in the books during the same period - stock loss

5. Estimated losses now written off or for which provision has been made for the

purpose of preparing the statement:

Plant and Machinery 14,00,000

Tools and equipments 3,20,000

Patents and copyrights 4,00,000

Inventories 2,60,000

Investments 2,00,000

Debtors 6,00,000 31,80,000

6. Other items contributing to deficiency Nil

93,80,000

B. Items reducing Deficiency

7. Excess of assets over capital & liabilities on 1st April, 2015 (8,00,000 – 5,00,000) 3,00,000

8. Net trading profit during the period 8,00,000

9. Profit & Incomes other than trading profit during the same period -

10. Other items - Profit expected on Land & Building (26,00,000 - 24,00,000) 2,00,000

13,00,000

Deficiency as shown by the Statement of Affairs (A) - (B) 80,80,000

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

Overriding Preferential Payments

Overriding Preferential Payments (Section 326)

(1) In the winding up of a company under this Act, the following debts shall be paid in priority to all

other debts:

(a) workmen’s dues; and

(b) where a secured creditor has realised a secured asset, so much of the debts due to such secured

creditor as could not be realised by him or the amount of the workmen’s portion in his security (if

payable under the law), whichever is less, pari passu with the workmen’s dues:

Explanation.—For the purposes of this section, and section 327—

(a) “workmen”, in relation to a company, means the employees of the company, being workmen within

the meaning of section 2(s) of the Industrial Disputes Act, 1947.

(b) “workmen’s dues”, in relation to a company, means the aggregate of the following sums due from the

company to its workmen

Question Inter Nov 2020 (5 Marks)

Beekey Limited is being wound up by the tribunal. All the assets of the company have been charged in

favour of the company's bankers to whom the company owes ₹ 2.50 crores.

The company owes following amounts to others:

Dues to workers - ₹ 62,50,000

Taxes payable to Government - ₹ 15,00,000

Unsecured creditors - ₹ 30,00,000

You are required to compute with reference to the provisions of the Companies Act, 2013, the amount

each kind of creditors is likely to get if the amount realized by the official liquidator from the secured

assets and available for distribution among creditors is only ₹ 2,00,00,000.

Solution

Section 326 of the Companies Act, 2013 talks about the overriding preferential payments to be made

from the amount realized from the assets to be distributed to various kind of creditors. According to the

proviso given in the section 326 the security of every secured creditor should be deemed to be subject to a

pari passu charge in favour of the workman to the extent of their portion.

Workman's Share to Secured Asset = Amount Realized X Workman ' s Dues

Workman ' s Dues +Secured Loan

Workman's Share to Secured Asset = 2,00,00,000 X 62,50,000

62,50,000 +2,50,00,000

= 2,00,00,000 X 1/5

Workmen’s share to Secured Assets = ₹ 40,00,000

Amount available to secured creditor is ₹ 200 Lakhs – 40 Lakhs = 160 Lakhs

Hence, no amount is available for payment of government dues and unsecured creditors.

The copyright of these notes is with C.A. Nitin Goel

No part of these notes may be reproduced in any manner without his prior permission in writing.

You might also like

- OpenD6 Character SheetDocument2 pagesOpenD6 Character SheetJason Patterson100% (1)

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Week 1 Practice Questions and TemplateDocument8 pagesWeek 1 Practice Questions and TemplatealexandraNo ratings yet

- 1Document4 pages1sushi100% (1)

- AFAR ProblemsDocument45 pagesAFAR ProblemsElena Llasos84% (31)

- Exotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsFrom EverandExotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsNo ratings yet

- Referral AgreementDocument6 pagesReferral AgreementVico LingNo ratings yet

- International Vs Domestic Arbitration in Mauritius by Alladin YaseenDocument25 pagesInternational Vs Domestic Arbitration in Mauritius by Alladin YaseenSenior MysteryNo ratings yet

- Labor Law Notes Labor Relations 2Document8 pagesLabor Law Notes Labor Relations 2jutesterNo ratings yet

- Patent BasicsDocument44 pagesPatent BasicsnusratkayNo ratings yet

- Suncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingDocument6 pagesSuncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingolaNo ratings yet

- AFAR ProblemDocument27 pagesAFAR ProblemCj BarrettoNo ratings yet

- Sps Cha Vs CADocument1 pageSps Cha Vs CAAgz MacalaladNo ratings yet

- Cpa Review School of The Philippines: Advanced Financial Accounting and Reporting German and ValixDocument24 pagesCpa Review School of The Philippines: Advanced Financial Accounting and Reporting German and ValixCAROLINE BALDOZNo ratings yet

- Quiz - Dissolution and Liquidation (Answers)Document8 pagesQuiz - Dissolution and Liquidation (Answers)peter pakerNo ratings yet

- Financial Accounting BMBA 140 Assignment #2 Name (First and Last Name) : Mark John AbanaDocument4 pagesFinancial Accounting BMBA 140 Assignment #2 Name (First and Last Name) : Mark John AbanaEdnalyn PascualNo ratings yet

- PNB vs. Sta. Maria: 015 Agency Couched in Specific Terms - MortgageDocument1 pagePNB vs. Sta. Maria: 015 Agency Couched in Specific Terms - MortgageNichole LanuzaNo ratings yet

- Accounting For Liabilities Part 1Document5 pagesAccounting For Liabilities Part 1방탄트와이스 짱No ratings yet

- Judicial Recognition of A Foreign Divorce DecreeDocument1 pageJudicial Recognition of A Foreign Divorce Decreehaze_toledo5077No ratings yet

- Barretto vs. TuasonDocument25 pagesBarretto vs. TuasonKcompacion0% (1)

- Sem-1 14 BCOM GENERAL CC-1.1CG FINANCIAL-ACCOUNTING-I-1348 PDFDocument11 pagesSem-1 14 BCOM GENERAL CC-1.1CG FINANCIAL-ACCOUNTING-I-1348 PDFJude VascoNo ratings yet

- Liquidation PQ SolDocument5 pagesLiquidation PQ SolKaran MokhaNo ratings yet

- 4 LiquidationDocument9 pages4 LiquidationNIKHIL MITTALNo ratings yet

- Partnership Accounts QuestionsDocument4 pagesPartnership Accounts QuestionsKaleli RockyNo ratings yet

- Advanced FinDocument15 pagesAdvanced FinAliyaaaahNo ratings yet

- Adv Accounting 100 Imp Questions 1642420796 PDFDocument179 pagesAdv Accounting 100 Imp Questions 1642420796 PDFsigeshNo ratings yet

- In Class Exercise (2023)Document7 pagesIn Class Exercise (2023)Waiwan YuenNo ratings yet

- Company Accounts Suggested Answers December 2018 E-Executive-RevisionDocument24 pagesCompany Accounts Suggested Answers December 2018 E-Executive-RevisionjesurajajosephNo ratings yet

- Tutorial Letter 202/1/2020: Financial Accounting Principles For Law PractitionersDocument9 pagesTutorial Letter 202/1/2020: Financial Accounting Principles For Law Practitionersall green associatesNo ratings yet

- Quiz For PartnershipDocument4 pagesQuiz For PartnershipJohn Stephen PendonNo ratings yet

- Quiz Box 2 - QuestionnairesDocument13 pagesQuiz Box 2 - QuestionnairesCamila Mae AlduezaNo ratings yet

- AccountsDocument14 pagesAccountsshrutichoudhary436No ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- Arts Cpa Review: BatchDocument8 pagesArts Cpa Review: BatchKristel Sumabat0% (1)

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Jasa Ocean Edit FINAL RevisiDocument5 pagesJasa Ocean Edit FINAL RevisiAtalariq BudihartoNo ratings yet

- Partnership ProblemsDocument46 pagesPartnership ProblemselijahejtolentinoNo ratings yet

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- IA2Document12 pagesIA2John FloresNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- Installemntdeferred Reporting PenaltiesDocument3 pagesInstallemntdeferred Reporting PenaltiesJane TuazonNo ratings yet

- Chart of Account Print LedgerDocument6 pagesChart of Account Print LedgerkarenNo ratings yet

- Foundation Practice SumsDocument9 pagesFoundation Practice SumsBRISTI SAHANo ratings yet

- In The Books of Anshal LTD Date Particulars JournalDocument10 pagesIn The Books of Anshal LTD Date Particulars JournalANISH DUA IPM 2019-24 BatchNo ratings yet

- Numbers 14 and 15 AccountingDocument3 pagesNumbers 14 and 15 Accountingelsana philipNo ratings yet

- Additional Questions-7Document8 pagesAdditional Questions-7Ak AgarwalNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsPrima FacieNo ratings yet

- Holding Book QuestionsDocument9 pagesHolding Book QuestionskartikNo ratings yet

- Partnership Changes... Goodwill and RevaluationDocument5 pagesPartnership Changes... Goodwill and Revaluationtafadzwa tandawaNo ratings yet

- Test Accounting PT. PesonaDocument26 pagesTest Accounting PT. PesonaWie LianaNo ratings yet

- Additional Questions-5Document14 pagesAdditional Questions-5Shivam Kumar JhaNo ratings yet

- HW2 - Ch2 The Recording Process NewDocument17 pagesHW2 - Ch2 The Recording Process Newvico lorenzoNo ratings yet

- General Provident Fund: Page 1/1Document1 pageGeneral Provident Fund: Page 1/1Vikram SharmaNo ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- S Partnership LiquidationDocument2 pagesS Partnership Liquidationandzie09876No ratings yet

- Untitled FgapqDocument5 pagesUntitled FgapqSusovan SirNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- Assets Liabilities Equity Revenue ExpenseDocument31 pagesAssets Liabilities Equity Revenue ExpenseGmef Syme FerreraNo ratings yet

- Financial Accounting Question BankDocument10 pagesFinancial Accounting Question BankLAKSHMIKANTH.B MEC-AP/MCNo ratings yet

- Assets Liabilities: Cash Equipment Accounts Receivable Medical Supplies Furniture & Fixtures Accounts PayableDocument12 pagesAssets Liabilities: Cash Equipment Accounts Receivable Medical Supplies Furniture & Fixtures Accounts PayableRicah MagalsoNo ratings yet

- 11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentDocument4 pages11-Accountancy WEEKLY-WORK 01.02.2022 Ch-22 Financial Statement - With AdjustmentSandeep NehraNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- FAC125 BT Asgn 1 Win 21Document4 pagesFAC125 BT Asgn 1 Win 21Sanaiya JokhiNo ratings yet

- Partnership ProblemsDocument46 pagesPartnership ProblemsJames R JunioNo ratings yet

- Assignment 1 - Financial Accounting - January 21Document3 pagesAssignment 1 - Financial Accounting - January 21Ednalyn PascualNo ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Obligations and ContractsDocument42 pagesObligations and ContractsCo, Bianca Nicole M.No ratings yet

- Instant Download Biology 4th Edition Brooker Test Bank PDF Full ChapterDocument32 pagesInstant Download Biology 4th Edition Brooker Test Bank PDF Full ChapterPrestonTaylorfper100% (12)

- SEBI AIF RegulationsDocument79 pagesSEBI AIF RegulationsAjay RottiNo ratings yet

- Learnovate E-CommerceDocument7 pagesLearnovate E-CommerceEswar Sai VenkatNo ratings yet

- Intangible Assets LO4 Types of Intangible Assets: ACCT 220 FALL 2020Document9 pagesIntangible Assets LO4 Types of Intangible Assets: ACCT 220 FALL 2020ammad uddinNo ratings yet

- Property Outline Haynes 2020Document25 pagesProperty Outline Haynes 2020Valentyna DickinsonNo ratings yet

- Arbitration & Airline CasesDocument30 pagesArbitration & Airline CasesBianca Marie FlorNo ratings yet

- Seatwork On LeasesDocument1 pageSeatwork On Leasesmitakumo uwuNo ratings yet

- Melvin Berry's Tesla Award OrderDocument3 pagesMelvin Berry's Tesla Award OrderKhristopher BrooksNo ratings yet

- Importance of MemorandumDocument7 pagesImportance of MemorandumHaseeb Fareed67% (3)

- Food Fest Land, Inc vs. Romualdo C. SiapnoDocument12 pagesFood Fest Land, Inc vs. Romualdo C. Siapnopot tpNo ratings yet

- Instant Download Personal Financial Planning 13th Edition Gitman Solutions Manual PDF Full ChapterDocument9 pagesInstant Download Personal Financial Planning 13th Edition Gitman Solutions Manual PDF Full Chapterbasinetspeciesvms100% (10)

- B and T AG Vs Ministry of DefenceDocument43 pagesB and T AG Vs Ministry of DefenceGauri ChauhanNo ratings yet

- FM 1,2,5Document15 pagesFM 1,2,5shaik.712239No ratings yet

- Conflict of Laws in MatrimonyDocument10 pagesConflict of Laws in MatrimonyAnvesha ChaturvediNo ratings yet

- CivilLiabillityHumanRightsViolations Full Oct2022 Compressed 2Document200 pagesCivilLiabillityHumanRightsViolations Full Oct2022 Compressed 2Катерина ЦипищукNo ratings yet

- Lee Vs CA 215 SCRA 752Document2 pagesLee Vs CA 215 SCRA 752Chino CabreraNo ratings yet

- OSCF GuideToOffshoreDocument6 pagesOSCF GuideToOffshoreСаша РађеновићNo ratings yet

- Switch To Desktop Version: Difference Between The Contract of Service and Contract For ServiceDocument5 pagesSwitch To Desktop Version: Difference Between The Contract of Service and Contract For ServiceaidaNo ratings yet

- Course Outline in InsuranceDocument6 pagesCourse Outline in InsuranceCharina BalunsoNo ratings yet

- Crypt LibDocument1 pageCrypt LibJosé Luis Neme PeredaNo ratings yet