Professional Documents

Culture Documents

Tax Return Transcript

Uploaded by

travisdemitriusOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Return Transcript

Uploaded by

travisdemitriusCopyright:

Available Formats

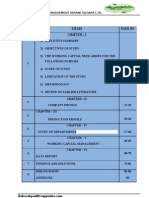

Tax Return Transcript 82-4355211 1120S 201912 GCBR

This Product Contains Sensitive Taxpayer Data

Tax Return Transcript

Request Date: 09-09-2020

Response Date: 09-09-2020

Tracking Number: 100566302651

EIN Provided: 82-4355211

Tax Period Requested: Dec. 31, 2019

Form Number: 1120S

Duplicate Amendment Number: 000

The following items reflect the amount as shown on the return as filed or as adjusted during return processing. It

does not include adjustments to the account after return settlement.

Original Return

NAME(S) SHOWN ON RETURN: GC BROTHERS LLC

ADDRESS: 3010 LBJ FWY STE 130A

DALLAS, TX 75234-7770

CYCLE POSTED: 202035

DLN: 93316-237-08700-0

REMITTANCE: $0.00

RECEIVED DATE: 08-24-2020

Indicators, Codes, and Miscellaneous Information

TAX YEAR BEGINNING: 01-01-2019

CORRESPONDENCE RECEIVED DATE: 00-00-0000

DESIGNEE CHECKBOX: 1

DESIGNEE PHONE NUMBER: 9722474600

TOTAL ASSETS (END): $624,137.00

NUMBER OF SHAREHOLDERS: 0001

SCH M-2: BALANCE AT BEGINNING OF TAX YR: $-21,381.00

SCH N: TOTAL ESTIMATED INCOME EXCLUSION: $0.00

F8586: LOW INCOME HOUSING CREDIT: $0.00

F8611: TOTAL RECAPTURE AMOUNT: $0.00

F8825: TOTAL GROSS RENTS AMOUNT: $0.00

Income

GROSS RECEIPTS: $1,055,010.00

RETURNS AND ALLOWANCES: $0.00

COST OF GOODS SOLD: $381,083.00

GROSS PROFIT PER COMPUTER: $673,927.00

NET GAIN OR LOSS: $0.00

OTHER INCOME: $0.00

TOTAL INCOME: $673,927.00

TOTAL INCOME PER COMPUTER: $673,927.00

MERCHANT CARD AND THIRD PARTY PAYMENT: $0.00

Deductions

COMPENSATION OF OFFICERS: $26,000.00

SALARY & WAGES LESS JOBS CREDIT: $255,372.00

REPAIRS & MAINTENANCE: $6,092.00

BAD DEBTS: $0.00

RENTS: $129,300.00

file:///C/Users/QT/Downloads/itr/itr/htmldone/100566302651-1.html[2/19/2024 2:07:13 PM]

Tax Return Transcript 82-4355211 1120S 201912 GCBR

TAXES & LICENSES: $26,872.00

INTEREST: $0.00

DEPRECIATION (NET): $68,212.00

DEPLETION: $0.00

ADVERTISING: $0.00

PENSION/PROFIT SHARE PLANS: $0.00

EMPLOYEE BENEFIT PROGRAMS: $0.00

OTHER DEDUCTIONS: $170,248.00

TOTAL DEDUCTIONS: $682,096.00

TOTAL DEDUCTIONS PER COMPUTER: $682,096.00

ORDINARY INCOME/LOSS: $-8,169.00

ORDINARY INCOME/LOSS PER COMPUTER: $-8,169.00

Tax and Payments

MANUALLY CORRECTED TOTAL TAX: $0.00

TOTAL INCOME TAX: $0.00

TOTAL INCOME TAX PER COMPUTER: $0.00

ESTIMATED TAX PAYMENTS: $0.00

TAX DEPOSITED (F7004): $0.00

TOTAL PAYMENTS: $0.00

TOTAL PAYMENTS PER COMPUTER: $0.00

OVERPAYMENT WINDFALL PROFIT TAX + TOTAL GAS TAX PER COMPUTER: $0.00

TAX SHOWN ON RETURN: $0.00

ESTIMATED TAX PENALTY: $0.00

TAX DUE: $0.00

CREDIT NEXT YEAR ESTIMATED TAX: $0.00

TOTAL TAX SETTLEMENT AMOUNT PER COMPUTER: $0.00

F8827 REFUNDABLE MINIMUM TAX CREDIT: $0.00

F8996 QUALIFIED OPPORTUNITY FUND: $0.00

TOTAL PHONE TAX REFUND: $0.00

TOTAL PHONE TAX VERIFIED: $0.00

PHONE TAX REFUND: $0.00

PHONE TAX INTEREST: $0.00

PHONE TAX REFUND PER COMPUTER: $0.00

Schedule A - Cost of Goods Sold

INVENTORY BEGIN OF YEAR: $0.00

INVENTORY END OF YEAR: $0.00

Schedule K - Shareholders' Shares of Income, Credits, Deductions, etc

PORTFOLIO INTEREST INCOME: $0.00

ALCOHOL FUELS TAX CREDIT: $0.00

TOTAL PROPERTY DISTRIBUTION: $0.00

INCOME (LOSS): $-8,169.00

Schedule L - Balance Sheets per Books

LOANS TO SHAREHOLDERS END OF YEAR: $0.00

TOTAL ASSETS BEGINNING OF YEAR: $602,581.00

LOANS FOR SHAREHOLDERS END OF YEAR: $629,276.00

CAPITAL STOCK END OF YEAR: $0.00

ADDITIONAL PAID-IN CAPITAL END OF YEAR: $0.00

RETAINED EARNINGS END OF YEAR: $-29,594.00

Form 5884-B - New Hire Retention Credit

PRELIMINARY NEW HIRE RETENTION CREDIT: $0.00

NUMBER OF RETAINED WORKERS:

MERCHANT CARD GROSS RECEIPTS PER COMPUTER: $0.00

NET RECEIPTS PER COMPUTER: $1,055,010.00

This Product Contains Sensitive Taxpayer Data

file:///C/Users/QT/Downloads/itr/itr/htmldone/100566302651-1.html[2/19/2024 2:07:13 PM]

You might also like

- Tax Return Transcript for Elizabeth HartDocument7 pagesTax Return Transcript for Elizabeth HartJames Franklin67% (3)

- 1120 Sample TranscriptDocument3 pages1120 Sample TranscriptEmily KnightNo ratings yet

- IRS New Tax Return TranscriptDocument6 pagesIRS New Tax Return TranscriptFedSmith Inc.0% (1)

- Mazda Cavite Subsidy Request Form SummaryDocument2 pagesMazda Cavite Subsidy Request Form SummaryAirelle Peejay AvilaNo ratings yet

- Internal Revenue Tax Summary of Duties and TaxesDocument2 pagesInternal Revenue Tax Summary of Duties and TaxesLoreta CaperiñaNo ratings yet

- TranscriptDocument6 pagesTranscriptjohn doeNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- Arunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Document1 pageArunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Ganesh KumarNo ratings yet

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument8 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- Sample IRSTax Return TranscriptDocument6 pagesSample IRSTax Return TranscriptnowayNo ratings yet

- Tax computation for Alkem employeeDocument3 pagesTax computation for Alkem employeeMAHESH A TNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument9 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Technocrat Consultancy-Naya Rastriya-Niyatra JVDocument9 pagesTechnocrat Consultancy-Naya Rastriya-Niyatra JVBright Tone Music InstituteNo ratings yet

- Axis Bank July 2019 payslip summaryDocument1 pageAxis Bank July 2019 payslip summaryRohit Kumar33% (3)

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Mio SoulDocument1 pageMio SoulWel GadayanNo ratings yet

- CrystalReportViewer1 3Document1 pageCrystalReportViewer1 3Mehedi HasanNo ratings yet

- Hensley, - Juan - Jaime SabinesDocument2 pagesHensley, - Juan - Jaime SabinesJuan HensleyNo ratings yet

- Payslip 1Document4 pagesPayslip 1Leo MagnoNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- Paycheckstub AllDocument3 pagesPaycheckstub AllMyt WovenNo ratings yet

- Account Ledger - H.O. For AuditDocument224 pagesAccount Ledger - H.O. For AuditMuhammad Zain ShaikhNo ratings yet

- Creative Engineering Consultancy: Balance SheetDocument9 pagesCreative Engineering Consultancy: Balance SheetBright Tone Music InstituteNo ratings yet

- Axis Bank LTD Payslip For The Month of May - 2021Document2 pagesAxis Bank LTD Payslip For The Month of May - 2021Suman DasNo ratings yet

- Jason Matheson Paystub 2Document1 pageJason Matheson Paystub 2wadewilliamsperling1992No ratings yet

- Tax Records SummaryDocument12 pagesTax Records SummaryChristopher ApadNo ratings yet

- Aug 2021 BCCDOR36 UMAIRDocument1 pageAug 2021 BCCDOR36 UMAIRAbrar MattooNo ratings yet

- Sep 2021 BCCDOR36 UMAIRDocument1 pageSep 2021 BCCDOR36 UMAIRAbrar MattooNo ratings yet

- C001 SP RMC3720 202106Document1 pageC001 SP RMC3720 202106suprakash samantaNo ratings yet

- Notice of Assessment 2021 03 22 15 36 05 837221Document4 pagesNotice of Assessment 2021 03 22 15 36 05 837221Joseph HudsonNo ratings yet

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- Venus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020Document1 pageVenus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020pyNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- IBCC Tax Projection Sheet 2022-23Document1 pageIBCC Tax Projection Sheet 2022-23Ankush SinghNo ratings yet

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

- Pay Slip of Feb-2020Document1 pagePay Slip of Feb-2020jawedaman123No ratings yet

- Riopel, Breanna Jul 30, 21Document1 pageRiopel, Breanna Jul 30, 21wadewilliamsperling1992No ratings yet

- SSPOFADVDocument1 pageSSPOFADVfreddieaddaeNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4freddieaddaeNo ratings yet

- Company Assets and Financial Report 2012Document8 pagesCompany Assets and Financial Report 2012Meuthia AlamsyahNo ratings yet

- Sspofadv 2Document1 pageSspofadv 2freddieaddaeNo ratings yet

- IGA69636 SalSlipWithTaxDetailsMiscDocument1 pageIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshNo ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- VRCM9179 Feb 2023Document1 pageVRCM9179 Feb 2023Alluzz AmiNo ratings yet

- B SheetDocument23 pagesB SheetTrishna PodderNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- G9 Banana Economics: Prepared: Sunil Kumar M K, (Fresh2kichen)Document5 pagesG9 Banana Economics: Prepared: Sunil Kumar M K, (Fresh2kichen)mksunilNo ratings yet

- VARIG Recovery Plan by Lufthansa Consulting PDFDocument201 pagesVARIG Recovery Plan by Lufthansa Consulting PDFGuilherme BernabeNo ratings yet

- Sarda Electrical Servicing Began Operations Two Years Ago Its AdjustedDocument1 pageSarda Electrical Servicing Began Operations Two Years Ago Its AdjustedTaimur TechnologistNo ratings yet

- Procedure CFVDocument13 pagesProcedure CFVNDTInstructorNo ratings yet

- Ratio Reviewer 2Document15 pagesRatio Reviewer 2Edgar Lay60% (5)

- Conjoint CaseDocument10 pagesConjoint CaseTinaPapadopoulou100% (1)

- Ind As 109Document26 pagesInd As 109Sandya Gupta100% (1)

- Fundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...Document77 pagesFundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...chao sherpa100% (1)

- CH 03Document56 pagesCH 03Zelalem GirmaNo ratings yet

- Dr-Ayanlade-Tutorial - QuestionsDocument4 pagesDr-Ayanlade-Tutorial - QuestionsAkunwa GideonNo ratings yet

- Tancet Model Question and AnswerDocument21 pagesTancet Model Question and AnswerveeramanikandansNo ratings yet

- Addendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument19 pagesAddendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForKhoo Kah JinNo ratings yet

- LBP not entitled to COLA and BEP on top of basic payDocument2 pagesLBP not entitled to COLA and BEP on top of basic payArki TorniNo ratings yet

- CARTHEL SCIENCE EDUCATIONAL FOUNDATION FUNDAMENTALS OF ABM 2 EXAMDocument3 pagesCARTHEL SCIENCE EDUCATIONAL FOUNDATION FUNDAMENTALS OF ABM 2 EXAMZeus Malicdem100% (1)

- Day 3Document9 pagesDay 3Vanjared OcampoNo ratings yet

- Business Ethics ModuleDocument7 pagesBusiness Ethics ModuleRica Canaba100% (2)

- 2012 Annual ReportDocument66 pages2012 Annual ReportJesus SanchezNo ratings yet

- A Project Report On Working Capital Management Nirani Sugars LTDDocument95 pagesA Project Report On Working Capital Management Nirani Sugars LTDBabasab Patil (Karrisatte)100% (4)

- Practice Problems First MidDocument6 pagesPractice Problems First MidAsif Ali LarikNo ratings yet

- L3 Passport To Success - Solutions BookletDocument52 pagesL3 Passport To Success - Solutions BookletCharles MK ChanNo ratings yet

- Pak Electron Limited (PEL) : Financial PositionDocument5 pagesPak Electron Limited (PEL) : Financial PositionAbdul RehmanNo ratings yet

- RA 6426 As AmendedDocument8 pagesRA 6426 As AmendedPeggy SalazarNo ratings yet

- Winery Start-Up Profile and Business Plan Work Book PDFDocument71 pagesWinery Start-Up Profile and Business Plan Work Book PDFSharadNanapureNo ratings yet

- Industry Analysis and Competitor StrategiesDocument33 pagesIndustry Analysis and Competitor StrategiesNurZul HealMeNo ratings yet

- Advertising's New Medium ReviewerDocument11 pagesAdvertising's New Medium ReviewerBella BrillantesNo ratings yet

- Namma Kalvi 12th Economics Unit 2 Surya Economics Guide emDocument28 pagesNamma Kalvi 12th Economics Unit 2 Surya Economics Guide emAakaash C.K.No ratings yet

- Acn 3Document5 pagesAcn 3Navidul IslamNo ratings yet

- Stata & Finance StudentsDocument104 pagesStata & Finance Studentssurround1No ratings yet

- LK Spto 2018 - Q4Document104 pagesLK Spto 2018 - Q4siput_lembekNo ratings yet

- Asian PaintsDocument22 pagesAsian Paintsardiab100% (1)