Professional Documents

Culture Documents

Corporation Law Finals Notes

Uploaded by

Denssel Tolentino0 ratings0% found this document useful (0 votes)

11 views8 pagesCorp Law

Original Title

Corporation-Law-Finals-Notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorp Law

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views8 pagesCorporation Law Finals Notes

Uploaded by

Denssel TolentinoCorp Law

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

Corporation Law Finals Notes 13.

It is FALSE that Delectus Personam in

partnership is applicable to corporate

1. CORPORATION- is an artificial being

setting.

created by operation of law, having the

14. It is TRUE that a corporation organized

right of succession and the powers,

in another country and registered to do

attributes and properties expressly

business in the Philippines under the

authorized by law or incident to its

Corporation Code of which 100% of the

existence.

capital entitled to vote belong to

2. The physical acts of the corporation, like

Filipinos is a Philippine National.

signing of documents, can be performed

15. AGREE that a Corporation Sole has no

only by a natural person duly authorized

nationality.

by corporate by-laws or by special act of

16. It is TRUE that corporate officers cannot

the BOD.

be held personally liable for the

consequence of their acts, for as long as

The four attributes of the corporation:

these are for and on behalf of the

3. It is an artificial being with separate and

corporation, done in good faith and

distinct personality;

within the scope of their authority.

4. It is created by operation of law;

17. It is False that the debt or credit of the

5. It has the right of succession;

corporation is also the debt or credit of

6. It has the powers, attributes and

the stockholders

properties expressly authorized by law

18. It is TRUE that the property of the

or incident to its existence.

corporation is not the property of its

7. It is TRUE that the corporation being a

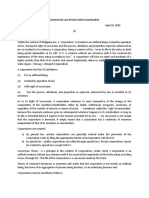

stockholders or members and may not

creature of law, owes its life to the

be sold by the stockholders or members

State, its birth being purely dependent

without express authorization from the

on its will.

corporations BOD/BOT.

8. It is TRUE that corporations can enter

into joint-venture agreements. State the three basic areas where the

9. It is TRUE that a corporation is but an doctrine of the piercing of the corporate veil

association of individuals, allowed to applies:

transact under an assumed name, and

19. Perpetuating fraud

with a distinct legal personality.

20. Defeating public convenience

10. It is FALSE that the legal fiction of

21. Justifying a wrong or defending a crime

separate corporate personality is a

22. It is TRUE that the piercing of the veil

shield for the commission of injustice

cannot be availed of by one who is NOT

and inequity.

a “victim” of fraud or wrong.

11. It is TRUE that Congress can enact a law

23. It is FALSE to say that it is the SEC and

creating a private corporation with a

not the courts which has jurisdiction

special charter.

over piercing of the veil of corporate

12. It is FALSE that stockholders or

fiction cases.

members do not have management

24. It is TRUE that the fact that there was

powers over the assets and operations

merging of personnel, resources, and

of the corporation.

holding offices in the same premises

can be considered sufficient to apply

the piercing doctrine to hold two 32. It is TRUE that no one shall acts as

corporations as one. President and Secretary or as President

25. Place of Incorporation Test- a and Treasurer at the same time.

corporation is considered a national of 33. A Corporation by Estoppel is not a

the country under whose laws it was corporation at all. It is just an equitable

organized. concept which the law utilizes to

26. It is FALSE to say that only corporations protect third parties due to the

whose capital stocks are at least 40% misrepresentation of a group of persons

owned by Filipinos can qualify to exploit as if they constitute a corporation

natural resources. causing damage or loss to third parties.

27. It is FALSE to say that a corporation can Such group of persons will not be

be held liable for a crime committed by allowed to take advantage of such

its officers and can be put into prison. misrepresentation to benefit

28. It is TRUE that, as a rule, a corporation is themselves at the expense of the

not entitled to moral damages because innocent third parties.

not being a natural person, it cannot 34. It is TRUE that no share may deprived of

experience physical suffering or voting rights except those classified and

sentiments like wounded feelings, issued as “preferred” or “redeemable”

serious anxiety, mental anguish, and shares.

moral shock. 35. It is TRUE that, shareholders, both

29. Stock Corporation is a corporation in common and preferred, ae considered

which capital stock is divided into shares risk-takers who invest in capital in the

and authorized to distribute to holders business who can look only to what is

of such shares dividends or allotments left after the corporate debts and

of he surplus profits on the basis of liabilities are fully paid.

shares held. 36. It is FALSE that the life of a corporation

Non-stock Corporation is a corporation commences from the issuance of the

which does not have capital stock or Certificate of “registration” by SEC upon

does not issue stocks and does not filing of the Articles of Incorporation.

distribute dividends or allotment of 37. It is TRUE that the By-Laws of the

surplus profits to its members. Corporation operate merely as internal

30. Independent Director is a person who is rules among stockholders; they cannot

independent of management and free prejudice third persons who deal with

from any business or other relationship corporation, unless they have

which would or could reasonably be knowledge thereof.

perceived to materially interfere with 38. It is FALSE that, in the absence of

the exercise of independent judgement authority from the Board of Directors,

in carrying out all the responsibilities as no person, not even its officers can

a director. validly bind a corporation.

31. It is TRUE that a director who has been 39. Par value shares have a nominal value

elected by virtue of minority’s exercise in the certificate of stock.

of cumulative voting rights may be No-par value shares are those which do

removed only for a cause. not have nominal value.

40. Treasury Shares- are shares of stock 47. It is FALSE to say that the corporate

which have been issued and fully paid birthday is the date the Articles of

for, but subsequently reacquired by the Incorporation is filed before the SEC.

issuing corporation by purchase, 48. Ultra Vires Acts are acts committed

redemption, donation, or through some outside the object for which a

other lawful means. corporation is created as defined by the

41. It is TRUE that, in derivative action, the law of its organization and therefore

real party-in-interest is the corporation beyond the power conferred upon it by

itself, not the shareholders who law. These acts are merely voidable and

instituted it. may be enforced by performance,

ratification, or estoppel. Illegal Acts are

void and cannot be validated.

State the two voting requirements to 49. It is TRUE that, in case of conflict of

amend the Articles of Incorporation: interest, and the director (BOD) acts

against the good of the corporation, he

42. Majority vote of the directors or shall be accountable for the profits he

trustees; and obtained even if he had risked his own

43. The vote or written assent of the funds.

stockholders representing at least 2/3 of 50. A.) The basis for declaration of

the outstanding capital stock or 2/3 dividends are:

members of non-stock corporations. (a) Unrestricted retained earnings; and

44. The TRUST FUND DOCTRINE provides (b) Resolution of the Board, or for stock

that subscription to the capital of a dividends, Board approval with the

corporation constitute a fund to which concurrence of 2/3 of the

the creditors have a right to look for the outstanding capital.

satisfaction of their claim.

45. Pre-emptive right grants the B.) The power to declare dividends

stockholders the option to subscribe to belongs to:

all new issues or disposition of shares of

(a) Board of Directors alone—for cash

any class, in proportion to their

property dividends

shareholdings. The Right of First Refusal

grants the option to purchase from a Board of Directors, with the approval of

registered stockholder any sale or stockholders representing not less than

transfer of his shares. Unlike pre- 2/3 of Outstanding Capital in a meeting

emptive right which is a common-law called for the purpose—for stock

right, the right of first refusal can only dividends.

arise by means of a contractual

51. It is FALSE to say that Derivative Suit is

stipulation, or when it is provided for in

an action brought by “minority”

the articles of incorporation.

shareholders in the name of the

46. It is TRUE that the acts of management

corporation to redress a wrong

pertain to the board and those of

committed against the corporation, for

ownership to the stockholders or

which the director refuse to sue.

members.

52. It is TRUE that the stockholder may own 60. It is TRUE that a foreigner can be a

the share even if he is not holding a member or an officer of a non-stock

certificate of stock. corporation.

53. Merger is when a one corporation (the 61. It is FALSE that membership in a non-

surviving corporation) absorbs another stock corporation is personal to the

one or more corporation/s into a single member, hence, it can be transferred.

corporation.

State the two classes of Religious

Consolidation is one where a new Corporation:

corporation—the consolidated corporation

62. Corporation Sole

—is created, and the existence of all the

63. Religious Societies

constituent corporations shall cease.

64. Corporation Sole is a special form of

54. In a close corporation, any stockholder corporation usually associated with the

can petition the Securities and clergy and consists of one person only

Exchange Commission to break the and his successors, who are

deadlock. incorporated by law to give some legal

55. It is TRUE that, after dissolution, the capacities and advantages.

corporation continues as a body Corporation Aggregate is a religious

corporate for three years for purposes organization composed of two or more

of winding up or liquidation. persons.

65. Because Securities Regulations is

State the rule on suability of Foreign

chiefly intended for the following:

Corporation

(a) Prevention of excesses and

56. Doing business in the Philippines, with a fraudulent transactions, merely by

license: may be sued or proceeded requiring that their details be

against before Philippine Courts or revealed;

administrative tribunals on any valid (b) Placing in the market during the

cause of action recognized under early stags of the offering of a

Philippine Laws. May also sue as well. security, a body of information,

57. Doing business in the Philippines, which operating directly through

without a license: not permitted to investment services and expert

maintain or intervene in any action, investors, will tend to produce more

suit or proceeding in any court or accurate appraisal of a security.

administrative agency. But may be 66. It is FALSE that the SEC is composed of

sued. one chairman and “three”

58. A natural person, trust, or an estate. commissioners who must be all lawyers.

59. The person designated by the single

Enumerate at least four cases where the

stockholder who shall, in the event of

jurisdiction to resolve them has been

the single stockholder’s death or

transferred to from SEC to the regular

incapacity, take the place of the single

courts:

stockholder as director and shall

manage the corporation’s affairs. 67. Fraudulent devices and schemes

employed by directors detrimental to

the public interest and to other firms;

68. Controversies in election, appointment higher.

of directors or trustees;

69. Petition to be declared in state of 73. A BROKER is a person engaged in the

suspension of payments; business of buying and selling securities

70. Appointment of Rehabilitation Receiver for the account of others.

or Management Committee. 74. CALL is transferable option to buy a

71. It is TRUE that SEC is an administrative specified a specified number of shares

agency vested with quasi-judicial at a stated price. PUT is a transferable

powers with the same rank as RTV, so option or offer to deliver a given

that no other RTC, may enjoin the number of shares of stock at a stated

Commissioner of the SEC. price at any given time during a stated

72. Suspension of Payments v. period

Rehabilitation 75. It is TRUE that any security guaranteed

by the Government of the Philippines is

SUSPENSION OF REHABILITATION

an exempt transaction.

PAYMENTS

76. It is TRUE that “Marking the close” is

Applies to Applies to

the buying and selling of securities at

individual business

debtor. organizations— the close of the market in an effort to

single alter the closing price of the security.

proprietorship, It shall be unlawful for an “insider” to sell or buy

partnership, and

a security of the issuer if he knows a fact of

corporation.

special significance which is no generally

The debtor ahs The debtor is

available to the public, except:

sufficient assets insolvent.

to cover his 77. The insider proves that the information

liabilities. was not gained from such relationship;

Secured debtors Secured debtors or

are not affected. are affected by the

78. If the other party selling to or buying

stay order.

from the insider (or his agent) is

Filed by the May be initiated

identified, the insider proves: (1) that he

debtor. by the debtor

(voluntary disclosed the information to the other

rehabilitation) or party; or (2) that he had reason to

by the creditors believe that the other party otherwise is

(involuntary also in possession of the information.

rehabilitation) 79. An Investment Contract is an

There is no The claim of, or investment of money in a common

minimum the aggregate of enterprise with expectation of profits

requirement for claims against the primarily from the efforts of others.

the amount of debtor is at least 80. BULK SALE is the sale of all or

claims. one million or at substantially all of the stocks NOT in the

least 25% of the ordinary course of business.

subscribed capital

stock or partners’ PROBLEMS:

contributions,

whichever is

1. Ace corporation has only 10 A: No, the Plaintiff is incorrect.

stockholders. In the articles of According to jurisprudence, by

incorporation as well as in the by-laws, incorporating in a particular state, a

there is the preemptive right of the corporation thereby agrees that the

stockholders. The same annotation is laws of that state shall be the governing

found in every certificate of stock issued law with respect to the internal affairs

by the corporate secretary. The of a corporation—the internal affairs

stockholders agreed not to list the would generally refer to matters relating

shares of the corporation in any stock to the governance of the corporation as

exchange. Baldo, a stockholder, sold well as the rights and responsibilities of

his shares of stock to Carlo, who is not a officers and stockholders. This is true

stockholder of the company. Is the sale even if the corporation were to operate

valid? in another state or even foreign

countries.

A: No, the sale is not valid because it

was in violation of the stockholders’ In the instant case, the right to inspect

pre-emptive right. Pre-emptive right is corporate books is considered as a

the shareholder’s right to subscribe to matter relating to the corporation’s

all issues or disposition of shares of any internal affairs as it is one of the rights

class in proportion to their of the stockholders. With that being

stockholdings. Since a pre-emptive right said, the law of the place of

is accorded both in the AOI and the By- incorporation prevails, and therefore it

Laws, the disposition of shares must is the law of Florida USA which should

have been offered for subscription first be invoked.

to the shareholders before any outsider.

In the instant case, since the sale was 3. Without securing a license from the

made to Carlo, an outsider and not a SEC, Tony acted as broker in selling the

stockholder, the pre-emptive right of shares of stocks of Pete. Tony demands

the stockholders was violated and payment of his commercial fees for

therefore the sale is void. compensation of his services from Pete.

2. Foreign Corporation doing business in Is the demand valid? Explain.

the Philippines was organized under the

laws of Florida, USA, which under its A: The demand is invalid. Under the

Corporation Law, only a stockholder Securities Regulation Code, a person is

owning at least 3% of the shares may precluded from engaging in the

inspect the corporate books and business of buying or selling of

records. Plaintiff Charles who held less securities in the Philippines as a broker,

than 3% of defendant corporation dealer, or act as a salesman, or an

stockholdings, invoked the Philippine associated person of any broker or

Corporation Law that allowed dealer without registering as such with

stockholders owning less than 3% of the SEC. The right of the broker to

shares to inspect the books. Is the demand payment of commercial fees

plaintiff correct? Explain. for compensation of his services

emanates from his being as such after

due registration with the SEC. Since heavy investment, Mr. “M” became the

Tony is not licensed by the SEC, his firm’s president and, as such, purchased

being a broker and his sale of Pete’s a big number of computers and other

shares are bereft of legality which do electronic equipment from “T’

not entitle him to payment of Corporation on installment basis. “A”

commercial fees, hence, the demand is Corp. paid the downpayment and “T”

invalid. Corp. issued the corresponding receipt.

To his dismay, Mr. “M” discovered that

4. X Corporation owns 65% of the the Articles of Incorporation had not

outstanding shares, entitled to vote in been filed by his friends, so, on the

“A” Corporation. The 70% shares date, he hurriedly attended to the

outstanding in “X” Corporation are matter. No sooner had the certificate of

owned by Pedro, a Filipino, and four of incorporation been issued by the SEC.

its five directors are also Filipinos. What “A” Corp. became bankrupt after three

is the nationality of “X” Corporation? (3) months. Upon being sued by “T”

What is the nationality of “A” Corp. in his personal capacity, Mr. “M”

Corporation? raised among its defenses the doctrine

of de jure corporation and corporation

A: X Corporation (and even A by estoppel. Can the two defenses be

Corporation) is a Philippine National. validly raised?

The Foreign Investment Act provides

that where a corporation and its non- A: The two defenses cannot be raised

Filipino stockholders own stocks in a because they are not available to Mr. M.

SEC-registered enterprise, at least 60% There is no de facto corporation

of the capital stock outstanding and because the Articles of Incorporation

entitled to vote of each of both was not filed with the SEC. There can be

corporations must be held and owned no attempt in good faith to incorporate

by citizen of the Philippines and at least if no Articles of Incorporation was filed

60% of the members of the Board of with the SEC. In addition, Mr. M cannot

Directors of each of both corporations raise the defense that his corporation is

must be citizens of the Philippines, in a de facto corporation to defeat a claim.

order that the corporation shall be Until the personality is attacked by the

considered a Philippine national. Here, State, the de facto corporation can

more than 60% of X Corporation’s continue as a corporation.

outstanding share is owned by a

Filipino, and more than 60% of its Board The allegation that there was a

of Directors are Filipino Citizens. Having corporation by estoppel may be correct

said so, X Corporation is considered a but the same is not a defense against

Philippine National. claimants. The concept of corporation

by estoppel is precisely for the purpose

5. Mr. “M” was invited by his friends to of protecting third persons or creditors.

invest in “A” Corp., a newly organized The defense is established in favor of

firm engaged in money market and third persons with whom the

financing operation. Because of his corporation deals but not in favor of

those who represent themselves as another corporation, taken alone, is not

such corporation although it is not, like sufficient to justify the two corporations

Mr. M. being treated as on entity. If the

subsidiary is used to perform legitimate

However, Mr. M can raise his good faith functions, a subsidiary’s separate

as a defense and claim that his liability existence shall be respected and the

is only up to the extent of his liability of the parent company shall be

investment. Section 20 of the RCCP confined to those arising from their

makes liable as general partners those respective business. This rule I to be

who assume to act as a corporation followed even if the new corporation

knowing it without authority to do so. was the result of a spin-off of a former

division of the parent company. Since

6. Can a corporation be held liable for Magnolia Corp. and Ginebra Feeds. Inc.

criminal offense? If convicted, can it be are to be regarded as distinct and

imprisoned? separate entities from Ginebra Corp.,

they are also to be considered as

A: Generally, if the crime is committed separate and distinct and bargaining

by a corporation or other juridical units.

entity, the directors, officers,

employees, or other officers thereof

responsible for the offense shall be

charged and penalized, precisely

because of the nature of the crime and

the penalty therefor. A corporation

cannot be arrested and imprisoned,

hence, it cannot be penalized for a

crime punishable by imprisonment. But

for crimes with a fine as an imposable

penalty, like criminal liability for

violations of certain provisions of the

RCCP, then the penalty of payment of

fine can be imposed on the corporation

itself.

7. Ginebra Corp. spun-off its ice cream

division to a new Magnolia Corp. and

the feeds and livestock division into

Ginebra feeds, Inc. Will the employees

in the spun-off divisions continue to be

considered within the Ginebra Corp.

bargaining unit?

A: No. The rule is that, the mere fact

that a corporation owns all the stocks of

You might also like

- Soriano ReviewerDocument142 pagesSoriano ReviewerKay100% (2)

- Platon Notes Corporation Code Divina PDFDocument58 pagesPlaton Notes Corporation Code Divina PDFNats MagbalonNo ratings yet

- Anpqp 3.0 en Day-2 FinDocument134 pagesAnpqp 3.0 en Day-2 Fintomyclau100% (3)

- CTM Tutorial 2Document4 pagesCTM Tutorial 2crsNo ratings yet

- Issuance of Watered Stocks or Who, Having: Ego Theory Requires The Concurrence of ThreeDocument4 pagesIssuance of Watered Stocks or Who, Having: Ego Theory Requires The Concurrence of ThreeqwertyuiopkmrrNo ratings yet

- Corporation Law RevDocument2 pagesCorporation Law RevMay Quinto-SalazarNo ratings yet

- Revised Corporation CodeDocument16 pagesRevised Corporation CodeLielet MatutinoNo ratings yet

- RFBT.3405 CorporationDocument22 pagesRFBT.3405 CorporationMonica GarciaNo ratings yet

- Corporation Law Revsec3Document4 pagesCorporation Law Revsec3May Quinto-SalazarNo ratings yet

- When The Veil Is Pierced, The Ones Who Are Originally Considered As Separate and Distinct Will Now Be Directly Liable As ConsequencesDocument4 pagesWhen The Veil Is Pierced, The Ones Who Are Originally Considered As Separate and Distinct Will Now Be Directly Liable As ConsequencesSyl PhietteNo ratings yet

- Notes On Corporation Law (Sec 1-9)Document8 pagesNotes On Corporation Law (Sec 1-9)davemarklazaga179No ratings yet

- Week 1 Corpo Sec. 2-9Document7 pagesWeek 1 Corpo Sec. 2-9Chezka CelisNo ratings yet

- RFBT 3505 - HandoutDocument22 pagesRFBT 3505 - HandoutMister MysteriousNo ratings yet

- Week 2 CorpoDocument18 pagesWeek 2 Corpopretty100% (1)

- RFBT Reviewer Final Pre-BoardDocument1 pageRFBT Reviewer Final Pre-Boardjerdelynvillegas7No ratings yet

- MercRev - CorpoDocument24 pagesMercRev - CorpoA GrafiloNo ratings yet

- Rules in The Determination of Corporate NationalityDocument7 pagesRules in The Determination of Corporate NationalityRafael Renz DayaoNo ratings yet

- Revised Corporation Code of The Philippines Sec. 1-3Document2 pagesRevised Corporation Code of The Philippines Sec. 1-3Nicki Lyn Dela Cruz100% (1)

- Case Doctrines Complete AnnotatedDocument27 pagesCase Doctrines Complete AnnotatedLiz VillarazaNo ratings yet

- When The Veil Is Pierced, The Ones Who Are Originally Considered As Separate and Distinct Will Now Be Directly Liable As ConsequencesDocument4 pagesWhen The Veil Is Pierced, The Ones Who Are Originally Considered As Separate and Distinct Will Now Be Directly Liable As Consequencesirenecosme04No ratings yet

- Corpo Week2 Notes MergedDocument42 pagesCorpo Week2 Notes MergednayhrbNo ratings yet

- Corpo Week2 NotesDocument6 pagesCorpo Week2 NotesnayhrbNo ratings yet

- Corpo Week2 NotesDocument6 pagesCorpo Week2 NotesnayhrbNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by Aquinopinky paroliganNo ratings yet

- Corporation Law Notes SundiangDocument19 pagesCorporation Law Notes SundiangLeni Mae Tristan100% (1)

- Revised Corporation CodeDocument2 pagesRevised Corporation CodeJohn Michael SorianoNo ratings yet

- FINAL - Commercial Law (From Divina Rev)Document22 pagesFINAL - Commercial Law (From Divina Rev)Lynnette ChungNo ratings yet

- LAW ON BUSINESS ORGS Midterm ReviewerDocument6 pagesLAW ON BUSINESS ORGS Midterm ReviewerAdenielle DiLaurentisNo ratings yet

- Sec 1-9 NotesDocument6 pagesSec 1-9 NotesJohn Paul StevenNo ratings yet

- BUSORG2 1st ExamDocument35 pagesBUSORG2 1st ExamXandredg Sumpt LatogNo ratings yet

- Corporation: Republic Act No. 11232 Revised Corporation Code (2019)Document12 pagesCorporation: Republic Act No. 11232 Revised Corporation Code (2019)Steffanie OlivarNo ratings yet

- COMMREV Case DoctrinesDocument16 pagesCOMMREV Case DoctrinesSpaceboy115No ratings yet

- Corporation Code NotesDocument19 pagesCorporation Code NotesApay GrajoNo ratings yet

- Corporation - Atty. Busmente - CRSC - 1: Ipso Facto Be A Suit Against The Unpleaded Corporation ItselfDocument25 pagesCorporation - Atty. Busmente - CRSC - 1: Ipso Facto Be A Suit Against The Unpleaded Corporation ItselfJohnCarrascoNo ratings yet

- PART II - Private CorporationsDocument6 pagesPART II - Private CorporationsWaye EdnilaoNo ratings yet

- Comrev NotesDocument161 pagesComrev NotesJasper BagniNo ratings yet

- Corpo Law Bar Syllabus With NotesDocument7 pagesCorpo Law Bar Syllabus With NotesJ. LapidNo ratings yet

- Bam Examination ReviewerDocument7 pagesBam Examination ReviewerDanah EstilloreNo ratings yet

- VI. Law On CorporationDocument23 pagesVI. Law On CorporationJasmine Marie Ng Cheong0% (1)

- CD Get Corpo Notes Ladia 20 21 CompleteDocument167 pagesCD Get Corpo Notes Ladia 20 21 CompletePoPo Millan0% (1)

- Lecture - Separate Juridical PersonalityDocument10 pagesLecture - Separate Juridical Personalityerikha_aranetaNo ratings yet

- Corp Law NotesDocument9 pagesCorp Law NotesPamela Jane I. TornoNo ratings yet

- Busorg 2 TSN 2023-2024Document3 pagesBusorg 2 TSN 2023-2024Rikka Cassandra ReyesNo ratings yet

- Law Final Outline Part 1Document4 pagesLaw Final Outline Part 1Michelle0No ratings yet

- Law On Business Organization - Module 1 PDFDocument15 pagesLaw On Business Organization - Module 1 PDFJcel JcelNo ratings yet

- Law Midterm ReviewerDocument14 pagesLaw Midterm Reviewerisaah27.tagleNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by AquinoBaesittieeleanor Mamualas100% (1)

- V. Imperial Insurance)Document3 pagesV. Imperial Insurance)Di CanNo ratings yet

- Law On CorporationDocument23 pagesLaw On CorporationChristopher Michael OnaNo ratings yet

- Law Midterm ReviewerDocument14 pagesLaw Midterm ReviewerHarah LamanilaoNo ratings yet

- Chapter 1: Introduction: (236 SCRA 602 (Sept. 21, 1994) )Document142 pagesChapter 1: Introduction: (236 SCRA 602 (Sept. 21, 1994) )Aj MangaliagNo ratings yet

- Revised Corporation Code - ReviewerDocument5 pagesRevised Corporation Code - ReviewerKyle SantosNo ratings yet

- Commercial Law Review Set 2Document13 pagesCommercial Law Review Set 2mina villamorNo ratings yet

- Corporation Law: (Batas Pambansa Bilang 68)Document27 pagesCorporation Law: (Batas Pambansa Bilang 68)NFNL100% (1)

- Ecsalao BlogspotDocument70 pagesEcsalao BlogspotDrew BanlutaNo ratings yet

- Ladia NotesDocument126 pagesLadia NotesFaith Alexis Galano100% (1)

- Corporation Law Doctrines Atty BusmenteDocument6 pagesCorporation Law Doctrines Atty BusmenteKringle Lim - Dansal100% (1)

- Sec 2. - Incorporators: Corporation Defined Corporation and IncorporatorsDocument7 pagesSec 2. - Incorporators: Corporation Defined Corporation and IncorporatorsUfbNo ratings yet

- Note On Corp CodeDocument38 pagesNote On Corp CodeRochelle CiprianoNo ratings yet

- Classification of CorporationDocument3 pagesClassification of CorporationHazel OnahonNo ratings yet

- Diversity and Inclusion in The WorkplaceDocument6 pagesDiversity and Inclusion in The WorkplaceNiMan ShresŤha100% (1)

- CUEGISDocument2 pagesCUEGISAuryn Astrawita HendroSaputri100% (1)

- Student ID: MC190407267 Name: Mehwish Qandil: AssignmentDocument2 pagesStudent ID: MC190407267 Name: Mehwish Qandil: AssignmentHasnain aliNo ratings yet

- Real Estate Investment AnalysisDocument26 pagesReal Estate Investment AnalysisRenold DarmasyahNo ratings yet

- MS494: Total Quality Management: Course Instructor: DR Noor Muhammad Teaching Assistant: Ms MamoonaDocument36 pagesMS494: Total Quality Management: Course Instructor: DR Noor Muhammad Teaching Assistant: Ms MamoonaFurqan YousafzaiNo ratings yet

- Chapter 4 Reviewer Law 2 7Document6 pagesChapter 4 Reviewer Law 2 7Hannamae Baygan100% (1)

- To Generate Facility Plans, The Following Questions Must Be AnsweredDocument30 pagesTo Generate Facility Plans, The Following Questions Must Be AnsweredPuneet GoelNo ratings yet

- BAB 1 - Analisis Perilaku BiayaDocument31 pagesBAB 1 - Analisis Perilaku BiayaKartika Wulandari IINo ratings yet

- AftaDocument6 pagesAftanurnoliNo ratings yet

- Corporate GovernanceDocument5 pagesCorporate GovernanceDani ShaNo ratings yet

- Enabler-Drivers of SCMDocument18 pagesEnabler-Drivers of SCMTlm BhopalNo ratings yet

- Employment Law For BusinessDocument18 pagesEmployment Law For Businesssocimedia300No ratings yet

- Epaycard - Terms Conditions - 2017 NewDocument1 pageEpaycard - Terms Conditions - 2017 NewDrw ArcyNo ratings yet

- Key TermsDocument10 pagesKey Termscuteserese roseNo ratings yet

- BUSINESS ANALYS-WPS OfficeDocument15 pagesBUSINESS ANALYS-WPS OfficeIssachar BarezNo ratings yet

- Customer Experience ManagementDocument25 pagesCustomer Experience Managementtabeth katsandeNo ratings yet

- Entrepreneurial Finance 6th Edition Adelman Test BankDocument25 pagesEntrepreneurial Finance 6th Edition Adelman Test BankWilliamBeckymce100% (53)

- Becoming Digital Industrial: The Future of Productivity and GrowthDocument8 pagesBecoming Digital Industrial: The Future of Productivity and Growthmuhamad erfanNo ratings yet

- Sony ProjectDocument12 pagesSony ProjectfkkfoxNo ratings yet

- Asset Class-Land & BuildingDocument6 pagesAsset Class-Land & BuildingShivamNo ratings yet

- Not Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormDocument16 pagesNot Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormJ. Aryadi P.No ratings yet

- Assignment 3Document6 pagesAssignment 3salebanNo ratings yet

- Advanced Accounting CH 14, 15Document16 pagesAdvanced Accounting CH 14, 15jessicaNo ratings yet

- Ojt ReportDocument33 pagesOjt Reportpandim6477No ratings yet

- Corporate Governance and Role of Board of DirectorsDocument13 pagesCorporate Governance and Role of Board of DirectorsSanjayNo ratings yet

- Csec CXC Pob Past Papers January 2010 Paper 02 PDFDocument5 pagesCsec CXC Pob Past Papers January 2010 Paper 02 PDFjohnny jamesNo ratings yet

- ETL Testing White PaperDocument8 pagesETL Testing White PaperKancharlaNo ratings yet

- Just in Time ProductionDocument2 pagesJust in Time ProductionakshayaecNo ratings yet