Professional Documents

Culture Documents

LAW 213 - Reviewer - Midterm

Uploaded by

Ainah Barataman0 ratings0% found this document useful (0 votes)

5 views3 pagesPlease refer at your own risk.

Original Title

LAW 213_Reviewer_Midterm

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPlease refer at your own risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesLAW 213 - Reviewer - Midterm

Uploaded by

Ainah BaratamanPlease refer at your own risk.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

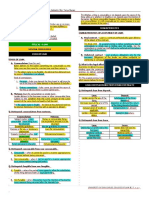

Mutuum and Commodatum

TITLE XI: LOAN MUTUUM vs. COMMODATUM

MUTUUM COMMODATUM

CREDIT, defined. equivalent amount to same thing to be

refers to belief or trust by a person in another’s ability be returned (subject returned (subject matter

to comply with an obligation. matter is fungible) is nonfungible)

may be gratuitous or essentially gratuitous

CREDIT TRANSACTIONS, defined. onerous

refers to the contracts or agreements based on said ownership goes to ownership retained by

trust or credit. borrower or bailee lender or bailor

refers to personal may involve real and

property only personal property

Scope of Credit Transactions

referred to as loan for referred to as loan for

1. Principal Contracts of Loan (Commodatum & consumption use or temporary

Mutuum) and Deposit (belief, trust, or faith) possession

2. Accessory Contracts (generally depends on borrower, because of lender, because of his

the existence of principal contracts and his ownership, bears ownership, bears risk of

strengthens the belief by the security given) risks of loss loss

a. Personal Guaranty – person’s personal can be generally while generally obliged

credit is involved. obliged to pay only at to return object at end of

b. Real Guaranty – if real property – end of period period, still in some

contracts of real mortgage and cases the return can be

antichresis; if personal property – demanded even before

contracts of pledge and chattel mortgage the end of the period

3. Preference and Concurrence of Credit not personal in personal in character

character

General Provisions

CONSUMMABLE vs. NON-CONSUMMABLE

Art. 1933. By the contract of loan, one of the NON-

CONSUMMABLE

CONSUMMABLE

parties delivers to another, either something not

a movable which a movable which can

consumable so that the latter may use the same

cannot be used in a be used in a manner

for a certain time and return it, in which case the manner appropriate to appropriate to its nature

contract is called a commodatum; or money or its nature without its without its being

other consumable thing, upon the condition that being con- sumed. consumed.

the same amount of the same kind and quality

shall be paid, in which case the contract is FUNGIBLE vs. NON-FUNGIBLE

simply called a loan or mutuum. FUNGIBLE NON-FUNGIBLE

if the intention is to if the intention is to

Commodatum is essentially gratuitous. allow a substitution of compel a return of the

the thing given identical thing given

Simple loan may be gratuitous or with a

stipulation to pay interest. BAILMENT, defined.

The delivery of property by one person to another in

In commodatum the bailor retains the ownership trust for a specific purpose, with a contract, ex- press

of the thing loaned, while in simple loan, or implied, that the first shall be faithfully executed

ownership passes to the borrower. and the property returned or duly accounted for

when the special purpose is accomplished or kept

Loans under the Old Law. until the bailor reclaims it.

1. Civil Loan – governed by the Old Civil Code;

and Parties in Bailment.

2. Commercial Loan – governed by the Code of 1. Bailor – giver; and

Commerce. 2. Bailee – recipient.

Two kinds of Loan under the New Civil Code. Consideration or Cause in a Bailment of Loan

1. Mutuum or Simple Loan; and 1. Borrower – the acquisition of the thing.

2. Commodatum. 2. Lender – the right to require the return of the

same thing or its equivalent.

REVIEWER: Midterm Coverage Reference: J. Edgardo L. Paras Barataman-Abdulcadir

Mutuum and Commodatum

CREDIT (as applied to Loans), defined. there can be NO compensation of

The ability to borrow money or thing by virtue of the compensation of credits things deposited with

confidence or trust reposed by a lender that the each other (except by

borrower will pay what he may promise. mutual agreement).

LOAN vs. RENT OR LEASE LOAN vs. IRREGULAR DEPOSIT

LOAN RENT OR LEASE IRREGULAR

LOAN

Lender loses his Owner of property does DEPOSIT

property for the not lose his ownership; borrower can use and depository can also use

borrower becomes the he merely loses control will return only at end of (as distinguished from a

owner thereof. thereof in a limited way period generally case of a regular

for the duration of the deposit where

rent or lease. depositary cannot

The relationship is one The relationship is one generally use)

of lender and borrower of lessor and lessee. lender has no irregular depositor has

(creditor and debtor). preference over other preference

creditors

In Re Guardianship of Tamboco, et al. essential cause is essential use is the

No, because this was a loan and not a deposit. NECESSITY of special benefit for

borrower depositor (as his money

Although it was not expressly agreed that

is being safeguarded)

Chuatongco could use the money, this can

nevertheless be inferred from the fact that

LOAN vs. SALE

Chuatongco was obliged to pay interest.

LOAN SALE

Real contract Consensual Contract

Government v. Phil. Sugar Estate Dev. Co. Generally unilateral bilateral and reciprocal

The money was given as an investment and not as because only borrower

a loan. It is difficult to see how this contract can be has obligations

con- sidered a loan. There was no date fixed for the

return to be made for the money. Furthermore, the Form of Interest.

sugar company was not to receive anything for the Herrera v. Petrophil Corp.

use of said sum until after the capital had been fully A loan must be in the form of money or something

repaid, which is not consistent with the general idea circulating as money. It must be repayable

of loan. absolutely and in all events.

LOAN vs. DISCOUNTING OF A PAPER Escalation Clause

DISCOUNTING OF A Insular Bank of Asia and America v. Salazar

LOAN

PAPER Escalation clauses are valid stipulations in

interest is deducted in interest is taken at the commercial contracts to maintain fiscal stability and

advance expiration of a credit to retain the value of money in long-term contracts.

double-name paper Single-name paper

However, the enforceability of such stipulations is

subject to certain conditions:

Herrera v. Petrophil Corp.

1. the increased rate imposed by the lender

The difference between a discount and a loan or

does not exceed the ceiling fixed by law or

forbearance is that the former does not have to be

the monetary board;

repaid.

2. the increase is made effective not earlier

than the effectivity of the law or regulation

LOAN vs. DEPOSIT

authorizing such increase; and

LOAN DEPOSIT

3. the remaining maturities of the loans are

purpose — to grant its purpose —

more than 730 days as of the effectivity of the

USE to borrower SAFEKEEPING by

depositary (who law or regulation authorizing such an

generally cannot use) increase.

generally, the borrower the return of deposited

pays only at end of things can be Art. 1934. An accepted promise to deliver

period demanded by the something by way of commodatum or simple

depositor at any time loan is binding upon the par- ties, but the

relationship is that of relationship is that of commodatum or simple loan itself shall not be

lender (creditor) and depositor and perfected until the delivery of the object of the

borrower (debtor) depositary contract.

REVIEWER: Midterm Coverage Reference: J. Edgardo L. Paras Barataman-Abdulcadir

Mutuum and Commodatum

Nature of the Contract of Loan

Commodatum and loan are real contracts. They are

perfected by the delivery of the object loaned. On the

other hand, consensual contracts are perfected by

mere consent.

Need for Delivery

A delivery is either real or constructive, is essential.

Consent of the Parties

The borrower and the lender must of course consent

either personally or through an authorized agent.

Acceptance need not be actual.

Consensual Contract of Future Loans

There can also be a consensual contract created by

an accepted promise to deliver something by way of

commodatum or simple loan.

REVIEWER: Midterm Coverage Reference: J. Edgardo L. Paras Barataman-Abdulcadir

You might also like

- Week 5 - Credit Transactions_AADLDocument11 pagesWeek 5 - Credit Transactions_AADLkristinasarinas4No ratings yet

- Credit Transaction Premid HONGDocument87 pagesCredit Transaction Premid HONGJetJuárezNo ratings yet

- Loan Kinds ExplainedDocument16 pagesLoan Kinds ExplainedCarlos JamesNo ratings yet

- CREDIT TRANSACTIONS AND LOAN CONTRACTSDocument10 pagesCREDIT TRANSACTIONS AND LOAN CONTRACTSJay Kent RoilesNo ratings yet

- credit-transactions_compressDocument12 pagescredit-transactions_compressjobelleann.labuguenNo ratings yet

- REY ALMON T. ALIBUYOG CREDIT TRANSACTIONSDocument4 pagesREY ALMON T. ALIBUYOG CREDIT TRANSACTIONSRey Almon Tolentino AlibuyogNo ratings yet

- Credit Transactions by Pineda PDFDocument12 pagesCredit Transactions by Pineda PDFNyl John Caesar GenobiagonNo ratings yet

- CBNotes: Credit Transactions ExplainedDocument7 pagesCBNotes: Credit Transactions ExplainedJimcris Posadas HermosadoNo ratings yet

- Bailment: (Pactum de Commodando)Document19 pagesBailment: (Pactum de Commodando)Jerry YanNo ratings yet

- Credit CasesDocument22 pagesCredit CasesKatrina San MiguelNo ratings yet

- GN 2017 Cred TransDocument60 pagesGN 2017 Cred TransAlfonso Dimla100% (1)

- PDF Loan Articles 1933 1961 - CompressDocument16 pagesPDF Loan Articles 1933 1961 - CompressAndreaaAAaa TagleNo ratings yet

- Article 1933-1940Document4 pagesArticle 1933-1940Maricon AsidoNo ratings yet

- Credit Transactions CompleteDocument168 pagesCredit Transactions CompleteDevilleres Eliza DenNo ratings yet

- Summer Reviewer: A C B O 2007 Civil LawDocument46 pagesSummer Reviewer: A C B O 2007 Civil LawMiGay Tan-Pelaez90% (20)

- Credit LawDocument19 pagesCredit Lawlorence rebon100% (1)

- GN - Credit Transactions - NEWDocument66 pagesGN - Credit Transactions - NEW8s7k97vpwvNo ratings yet

- CREDTRANS 2SR 1st EXAM TSNDocument71 pagesCREDTRANS 2SR 1st EXAM TSNMa Gloria Trinidad ArafolNo ratings yet

- CredTrans 1st Exam NotesDocument17 pagesCredTrans 1st Exam NotesErika Cristel DiazNo ratings yet

- Credit TransDocument25 pagesCredit TransPete Bayani CamporedondoNo ratings yet

- CreditTransactions Reviewer IncompleteDocument41 pagesCreditTransactions Reviewer IncompleteMary Ann Isanan0% (1)

- CreditTransactionsReviewer CompleteDocument43 pagesCreditTransactionsReviewer CompleteFrancess Mae AlonzoNo ratings yet

- CREDIT TRANSACTION PRE-MID ‘13Document27 pagesCREDIT TRANSACTION PRE-MID ‘13alyza burdeosNo ratings yet

- Credit Transaction NotesDocument16 pagesCredit Transaction NotesAntoinette Janellie TejadaNo ratings yet

- CREDIT TRANSACTIONS PREMIDTERM REVIEWDocument23 pagesCREDIT TRANSACTIONS PREMIDTERM REVIEWSam SumaNo ratings yet

- Credit 1st HalfDocument36 pagesCredit 1st HalfLex AnneNo ratings yet

- Credit Transactions GuideDocument12 pagesCredit Transactions GuidermelizagaNo ratings yet

- Reviewer in Credit Transactions by Ateneo 2007 EditionDocument47 pagesReviewer in Credit Transactions by Ateneo 2007 Editionsoyoung kimNo ratings yet

- Credit-Transaction SanbedaDocument21 pagesCredit-Transaction SanbedawewNo ratings yet

- Handouts For Credit TransactionsDocument15 pagesHandouts For Credit TransactionsIrene Sheeran100% (1)

- I. Pledge and Mortgage Essential Requisites Promise To DeliverDocument4 pagesI. Pledge and Mortgage Essential Requisites Promise To DeliverZaaavnn VannnnnNo ratings yet

- BLR LoansDocument4 pagesBLR LoansNicole Reign EscusaNo ratings yet

- CreditTransactions PDFDocument42 pagesCreditTransactions PDFjbandNo ratings yet

- Somera de Leon CredTrans PDFDocument60 pagesSomera de Leon CredTrans PDFpipo100% (2)

- Mutuum CommodatumDocument12 pagesMutuum CommodatumArceli MarallagNo ratings yet

- Differentiate essential terms of commodatum, mutuum, deposit, and guaranteeDocument1 pageDifferentiate essential terms of commodatum, mutuum, deposit, and guaranteeKAYE JAVELLANANo ratings yet

- Credit Transactions ReviewerDocument35 pagesCredit Transactions ReviewerSime SuanNo ratings yet

- Credit Transactions PNDocument47 pagesCredit Transactions PNSAMANTHA VILLANUEVA MAKAYANNo ratings yet

- San Beda ReviewerDocument33 pagesSan Beda Reviewermerren bloomNo ratings yet

- Rice, Oil, Gasoline, Water, Etc.) - Any Other Kind of Movable Property ThatDocument5 pagesRice, Oil, Gasoline, Water, Etc.) - Any Other Kind of Movable Property ThatCyreen SaliendresNo ratings yet

- Credit Transaction Reviewer - CompressDocument34 pagesCredit Transaction Reviewer - CompressFelicity Jane BarcebalNo ratings yet

- In Writing: Regularity. Once A Lawyer Affixes His Notarial Seal, There Is An Attachment ofDocument4 pagesIn Writing: Regularity. Once A Lawyer Affixes His Notarial Seal, There Is An Attachment ofdaryllNo ratings yet

- REVIEWER IN CREDIT TRANSACTIONS AND BAILMENT CONTRACTSDocument79 pagesREVIEWER IN CREDIT TRANSACTIONS AND BAILMENT CONTRACTSIra Francia AlcazarNo ratings yet

- Understanding Mutuum ContractsDocument10 pagesUnderstanding Mutuum ContractsApril ToledoNo ratings yet

- Credit Transactions ReviewerDocument128 pagesCredit Transactions ReviewerMich-s Michaellester Ordoñez Monteron100% (1)

- Bigger Problems: Major Concepts for Understanding Transactions under Islamic lawFrom EverandBigger Problems: Major Concepts for Understanding Transactions under Islamic lawNo ratings yet

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesFrom EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNo ratings yet

- The 250 Questions Everyone Should Ask about Buying ForeclosuresFrom EverandThe 250 Questions Everyone Should Ask about Buying ForeclosuresNo ratings yet

- The Great Recession: The burst of the property bubble and the excesses of speculationFrom EverandThe Great Recession: The burst of the property bubble and the excesses of speculationNo ratings yet

- Contingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementFrom EverandContingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Landlord And Tenant Relationship: Fast & Easy Solutions To Tenancy Problems; In Simple English, For EveryoneFrom EverandLandlord And Tenant Relationship: Fast & Easy Solutions To Tenancy Problems; In Simple English, For EveryoneRating: 5 out of 5 stars5/5 (1)

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Law 314 Pil2 Ivestment LawDocument3 pagesLaw 314 Pil2 Ivestment LawAinah BaratamanNo ratings yet

- Case DigestDocument2 pagesCase DigestAinah BaratamanNo ratings yet

- Full TextsDocument98 pagesFull TextsAinah BaratamanNo ratings yet

- Finals Reviewer Crim ProDocument17 pagesFinals Reviewer Crim ProAinah BaratamanNo ratings yet

- Finals Reviewer PropertyDocument6 pagesFinals Reviewer PropertyAinah BaratamanNo ratings yet

- Corporate Powers IntroDocument2 pagesCorporate Powers IntroAinah BaratamanNo ratings yet

- Paras ObliCon SummaryDocument48 pagesParas ObliCon SummaryMsTheIntrovert96% (48)

- The Negotiable Instruments LawDocument3 pagesThe Negotiable Instruments LawAinah BaratamanNo ratings yet

- Defective Contracts ObliCon PaladinsDocument3 pagesDefective Contracts ObliCon PaladinsAinah BaratamanNo ratings yet

- Jurisdiction Labor Law II PaladinsDocument2 pagesJurisdiction Labor Law II PaladinsAinah BaratamanNo ratings yet

- VORNADO'S NYC FOCUS AND GROWTH DRIVERSDocument42 pagesVORNADO'S NYC FOCUS AND GROWTH DRIVERSDaniel GoytrNo ratings yet

- IELTS MONEY VocabularyDocument4 pagesIELTS MONEY VocabularyVera ErastovaNo ratings yet

- National Law University Odisha: Transfer of Property ActDocument33 pagesNational Law University Odisha: Transfer of Property ActIshwar MeenaNo ratings yet

- 1 How Much Would The Gerrards Have To Put DownDocument1 page1 How Much Would The Gerrards Have To Put Downtrilocksp SinghNo ratings yet

- Gin BilogDocument14 pagesGin BilogHans Pierre AlfonsoNo ratings yet

- High Yield Bonds Market Structure, Valuation, and Portfolio StrategiesDocument689 pagesHigh Yield Bonds Market Structure, Valuation, and Portfolio StrategiesFurqaan Syah100% (1)

- Here's How To Transfer Land Titles in The Philippines - LamudiDocument4 pagesHere's How To Transfer Land Titles in The Philippines - LamudiEloisa YepezNo ratings yet

- Truth-In-Lending-Act-HandoutDocument6 pagesTruth-In-Lending-Act-HandoutHazel Anne QuilosNo ratings yet

- Axis Bank Loan and Deposit AnalysisDocument42 pagesAxis Bank Loan and Deposit AnalysisArunachalam MBANo ratings yet

- Fintech: Ecosystem, Business Models, Investment Decisions, and ChallengesDocument12 pagesFintech: Ecosystem, Business Models, Investment Decisions, and ChallengesOscar Javier Ojeda Gomez100% (1)

- Promissory Note With Restructuring Agreement Promissory NoteDocument5 pagesPromissory Note With Restructuring Agreement Promissory NoteJomarc Cedrick GonzalesNo ratings yet

- (15-00293 428-33) Expert Rebuttal - PayneDocument9 pages(15-00293 428-33) Expert Rebuttal - PayneJessie SmithNo ratings yet

- SECURITIZE Real-Estate-TokenizationDocument33 pagesSECURITIZE Real-Estate-TokenizationNoamNo ratings yet

- Know All Men by These Presents:: General Power of AttorneyDocument2 pagesKnow All Men by These Presents:: General Power of Attorneysweetlunacy00No ratings yet

- Determinants of Capital Adequacy Ratio of Commercial Banks in NepalDocument15 pagesDeterminants of Capital Adequacy Ratio of Commercial Banks in NepalSabinaNo ratings yet

- Transfer Act SummaryDocument21 pagesTransfer Act SummaryMasud Khan ShakilNo ratings yet

- Enforcement of Security Interest Secured Creditor'S Rights: Group 5 Credit TransactionDocument22 pagesEnforcement of Security Interest Secured Creditor'S Rights: Group 5 Credit Transactionmc_abelaNo ratings yet

- Somes v. Government of The Phil. Islands, GR L-42754, Oct. 30, 1935, 62 Phil. 432Document2 pagesSomes v. Government of The Phil. Islands, GR L-42754, Oct. 30, 1935, 62 Phil. 432Gia DimayugaNo ratings yet

- Credit Transactions 2023 BarDocument174 pagesCredit Transactions 2023 Barrussel leah mae malupengNo ratings yet

- GR No 130722 Litonjua vs. L&R Corp.Document3 pagesGR No 130722 Litonjua vs. L&R Corp.Jeremae Ann CeriacoNo ratings yet

- Investment Overview: Issuer & ObjectiveDocument2 pagesInvestment Overview: Issuer & ObjectiveCocoNo ratings yet

- Housing Finance: Innovative Financial ServicesDocument7 pagesHousing Finance: Innovative Financial ServicesParth MuniNo ratings yet

- 115 - Radio Corporation of The PH Vs Jesus Roa, Et Al (1935)Document2 pages115 - Radio Corporation of The PH Vs Jesus Roa, Et Al (1935)Bibi JumpolNo ratings yet

- VCE SUMMMER INTERNSHIP PROGRAM (Financial Modellimg Task 3)Document10 pagesVCE SUMMMER INTERNSHIP PROGRAM (Financial Modellimg Task 3)Annu KashyapNo ratings yet

- Property Secrets: The 44 Most Closely GuardedDocument491 pagesProperty Secrets: The 44 Most Closely GuardedJavier MNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationAppraiser PhilippinesNo ratings yet

- In Company 3.0 - Corporate Finance - SB - Glossary - A-ZDocument13 pagesIn Company 3.0 - Corporate Finance - SB - Glossary - A-ZОля ИгнатенкоNo ratings yet

- Business Law Unit 3Document11 pagesBusiness Law Unit 3Fahamida AkterNo ratings yet

- The Role of The Commercial and Development Banks in Nigeria As Recognised Under The LawDocument9 pagesThe Role of The Commercial and Development Banks in Nigeria As Recognised Under The LawSeedu ElijahNo ratings yet

- Write A Short Note On ICICI LTDDocument12 pagesWrite A Short Note On ICICI LTDbackupsanthosh21 dataNo ratings yet