Professional Documents

Culture Documents

Revenue - Practical Question - Week 3 of 3 2024 - PDF

Revenue - Practical Question - Week 3 of 3 2024 - PDF

Uploaded by

kdmd.wwOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue - Practical Question - Week 3 of 3 2024 - PDF

Revenue - Practical Question - Week 3 of 3 2024 - PDF

Uploaded by

kdmd.wwCopyright:

Available Formats

Practical Question – Week 3

UNIVERSITY OF JOHANNESBURG

COLLEGE FOR BUSINESS AND ECONOMICS

DEPARTMENT OF COMMERCIAL ACCOUNTING

FAC22A2

UNIT 3: Revenue Practical – Week 3 (Adapted from IFRS: Applications Questions and

Solutions)

Learning objectives

• Know how to classify items on the statement of financial position

• Know the difference between income and revenue

• Know how to allocate the contract price/transaction price to different POs and recognise

revenue

• Know how to process journal entries

• Know how to present IFRS 15 transactions in financial statements

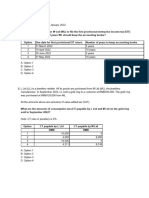

Alpha Ltd is a company that sells building materials. On 1 January 2020, Alpha Ltd entered into

a contract to transfer sand and cement to Beta Ltd in return for a consideration of R100 000. The

two products are considered to be separate performance obligations.

• The following information is available at the inception of the contract:

Product Stand-alone selling price Cost to complete the contract

Sand R45 000 R30 000

Cements R75 000 R60 000

Alpha Ltd delivered sand to Beta Ltd on 30 January 2020 and the cement on 27 February

2020. Beta Ltd settled the amount due on 5 March 2020.

The bank account balance on 1 January 2020 was R50 000. No other transactions, relating

to Bank, took place other than the ones mentioned above.

Ignore VAT in this question.

Required:

Part A

a. How should Alpha LTD classify the sand and cement on its statement of financial

position before selling it? (2 marks)

b. How should Alpha Ltd account for the sale of the two products once they have been

transferred to Beta LTD? (2 marks)

c. How much of the transaction price is allocated to the cement? (5 marks)

d. How much discount did the customer receive in this contract? (2 marks)

e. How much is the contract profit at the end of Contract? (2 marks)

f. Provide ALL the general journal entries arising from the transactions in the

accounting records of Alpha Ltd for the reporting period ended 31 December 2020.

Give reasons for the entries in the form of a journal narration. (13 marks)

Part B

g. Provide an extract of the financial statements of how the above transaction will

be presented assuming Alpha Ltd has the following year ends:

Ignore comparatives

1. 31 January 2020 (8)

2. 28 February 2020 (8)

3. 31 March 2020. (8)

You might also like

- Commonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiDocument37 pagesCommonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiCIBIL CHURUNo ratings yet

- Business and Management Paper 2 HLDocument7 pagesBusiness and Management Paper 2 HLZEEL PATELNo ratings yet

- Air Thread ReportDocument13 pagesAir Thread ReportDHRUV SONAGARA100% (2)

- Acer Global DataDocument23 pagesAcer Global DataMhamudul HasanNo ratings yet

- Fabm2 SLK Week 2 - 3 SCIDocument11 pagesFabm2 SLK Week 2 - 3 SCIMylene SantiagoNo ratings yet

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- Assignment #1 Questions ONLY (ISpace)Document4 pagesAssignment #1 Questions ONLY (ISpace)ziqingyeNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- BCOM Y3 - ACC 3 - June 2020 Take Home AssessmentDocument4 pagesBCOM Y3 - ACC 3 - June 2020 Take Home AssessmentNtokozo Siphiwo Collin DlaminiNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Fac22a2 SuppDocument11 pagesFac22a2 Suppsacey20.hbNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Accounts and Statistics 2Document41 pagesAccounts and Statistics 2BrightonNo ratings yet

- RT 301 - September 2020 EMA1 - QuestionDocument8 pagesRT 301 - September 2020 EMA1 - QuestionsibambonotheteleloNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- Fac11a1 SuppDocument9 pagesFac11a1 Suppsacey20.hbNo ratings yet

- PAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadDocument132 pagesPAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadHadeed HafeezNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument12 pagesAccounting P1 NSC Nov 2020 EngTlhago PitseNo ratings yet

- 2022 BCTA July 2021 EOS Exam - Financial ReportingDocument9 pages2022 BCTA July 2021 EOS Exam - Financial ReportingsimbaNo ratings yet

- CH 10 - Trade ReceivablesDocument8 pagesCH 10 - Trade Receivablesmarksman471No ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- Listing Exchange BSE FloorDocument41 pagesListing Exchange BSE FloorSAROJNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument11 pagesAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaNo ratings yet

- Corporate Reporting Paper 3.1 July 2023Document32 pagesCorporate Reporting Paper 3.1 July 2023Prof. OBESENo ratings yet

- Assignment 2Document7 pagesAssignment 2Dharminee GanesanNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- Vat Questions: GARFIELD (Mar/Jun 16)Document3 pagesVat Questions: GARFIELD (Mar/Jun 16)Rabi HashimNo ratings yet

- Tax3226N 3247N October 2024 AssignmentDocument10 pagesTax3226N 3247N October 2024 AssignmentKeaTumi Bokang LeagoNo ratings yet

- 6.annexure F-HFMN330-1-JAN-JUN2023-FA1-GT-V3-31012023-3Document7 pages6.annexure F-HFMN330-1-JAN-JUN2023-FA1-GT-V3-31012023-3Katlego MosehleNo ratings yet

- Unit 2 - (IAS 10) Events After The Reporting Date (2022) - UlinkDocument10 pagesUnit 2 - (IAS 10) Events After The Reporting Date (2022) - UlinkChalé DarwinNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- CAF 1 FAR1 Autumn 2023Document6 pagesCAF 1 FAR1 Autumn 2023z8qcsqfj8dNo ratings yet

- FAC3702 MayJun2011 SolutionsDocument20 pagesFAC3702 MayJun2011 SolutionsItumeleng KekanaNo ratings yet

- Exchange Plaza, C-1, Block-G, Bandra-Kurla: Mumbai-400001Document167 pagesExchange Plaza, C-1, Block-G, Bandra-Kurla: Mumbai-400001ksp200014No ratings yet

- R2.TAXM - .L Question CMA June 2021 Exam.Document7 pagesR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNo ratings yet

- Assessment 3 RemovedDocument6 pagesAssessment 3 RemovedTariro ManyikaNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- Aug 2022 Final Exam Far 160Document9 pagesAug 2022 Final Exam Far 160adreanamarsyaNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- FAC11A1Document9 pagesFAC11A1sacey20.hbNo ratings yet

- F1 FIOO - L-December-2020Document8 pagesF1 FIOO - L-December-2020Laskar REAZNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- RTP PDFDocument45 pagesRTP PDFsumanmehtaNo ratings yet

- Cma January-2022 Examination Operational Level Subject: F1. Financial OperationsDocument9 pagesCma January-2022 Examination Operational Level Subject: F1. Financial Operationsnatsu broNo ratings yet

- Corporate Reporting Paper 3.1Document27 pagesCorporate Reporting Paper 3.1Obeng CliffNo ratings yet

- BritanniaDocument269 pagesBritanniaAnushkaa GuptaNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmuleNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Acc G11 Ec Nov 2022 P1 QPDocument10 pagesAcc G11 Ec Nov 2022 P1 QPTshenoloNo ratings yet

- Sales Tax Past Papers - Practical Questions - 2011 To 2022Document25 pagesSales Tax Past Papers - Practical Questions - 2011 To 2022Arif AliNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- BCG - ACC3 - 28 June 2021 - S1Document5 pagesBCG - ACC3 - 28 June 2021 - S1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- TXCHN 2022 Dec QDocument18 pagesTXCHN 2022 Dec Qshaunzacharia007No ratings yet

- LTCC Pas11Document1 pageLTCC Pas11Anna CharlotteNo ratings yet

- ACCOUNTING P1 GR11 QP NOV 2023 - EnglishDocument12 pagesACCOUNTING P1 GR11 QP NOV 2023 - EnglishChantelle IsaksNo ratings yet

- Baker Street Cinema Quiz 2a Student ResponseDocument15 pagesBaker Street Cinema Quiz 2a Student ResponseAli Zain ParharNo ratings yet

- Accounts and Statistics 4Document41 pagesAccounts and Statistics 4BrightonNo ratings yet

- CA Examination September 2020 Q ADocument416 pagesCA Examination September 2020 Q AChisanga ChilubaNo ratings yet

- Cement & Concrete Building Components World Summary: Market Values & Financials by CountryFrom EverandCement & Concrete Building Components World Summary: Market Values & Financials by CountryNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Hau Giang Pharma: Taisho Is Helping DHG To Boost Its CapabilitiesDocument15 pagesHau Giang Pharma: Taisho Is Helping DHG To Boost Its CapabilitiesNgo TungNo ratings yet

- 330 Running Case StudyDocument5 pages330 Running Case StudyvibhanshuNo ratings yet

- Practice Exam Chapters 1-4 Solutions: Problem IDocument6 pagesPractice Exam Chapters 1-4 Solutions: Problem IJesse NgaliNo ratings yet

- Working Capital Mgt. of GrasimDocument50 pagesWorking Capital Mgt. of GrasimKanthesh ReddyNo ratings yet

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual May 2008Document58 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual May 2008MarcyNo ratings yet

- Invoice: Bernie Allen LTDDocument20 pagesInvoice: Bernie Allen LTDTheMissTehNo ratings yet

- Ratio AnalysisDocument11 pagesRatio Analysisbhatriyan606No ratings yet

- A Study On Financial Planning For Salaried Employee and For Tax Saving at Smik Systems, Coimbatore CityDocument5 pagesA Study On Financial Planning For Salaried Employee and For Tax Saving at Smik Systems, Coimbatore CityAniket MoreNo ratings yet

- Akm1 CHP4Document44 pagesAkm1 CHP4Janeth SalvadoreNo ratings yet

- Texhong Textile GroupDocument23 pagesTexhong Textile GroupHatcafe HatcafeNo ratings yet

- Internet CafeDocument16 pagesInternet CafeKamal Shah67% (3)

- ORG. MngtQ2 MODULE 5 WEEK 14Document9 pagesORG. MngtQ2 MODULE 5 WEEK 14chinie mahusayNo ratings yet

- Chapter 5-Financial PlanDocument39 pagesChapter 5-Financial PlanJC LaraNo ratings yet

- Pfizer Annual Report 2015Document134 pagesPfizer Annual Report 2015Ojo-publico.comNo ratings yet

- Gma FSDocument13 pagesGma FSMark Angelo BustosNo ratings yet

- WAC Report Beck Taxi Nimesh Barot 102128Document14 pagesWAC Report Beck Taxi Nimesh Barot 102128Nimesh Barot100% (2)

- Ifa-I Chapter OneDocument33 pagesIfa-I Chapter Onehasenabdi30No ratings yet

- Net Operating IncomeDocument5 pagesNet Operating IncomeNishant NagpurkarNo ratings yet

- Adjusting Process PDFDocument47 pagesAdjusting Process PDFJohn Oliver D. OcampoNo ratings yet

- Financial Management Issues in Retail BusinessDocument65 pagesFinancial Management Issues in Retail BusinessHemant Sarang50% (12)

- FrameworkDocument5 pagesFrameworkBernadette Cunanan Ramos0% (1)

- 202E02Document20 pages202E02plaestineNo ratings yet

- Beston Global AssignmentDocument13 pagesBeston Global AssignmentTayyaba TariqNo ratings yet

- Aim vs. Oum: Revenue RecognitionDocument3 pagesAim vs. Oum: Revenue RecognitionbalajicivNo ratings yet

- DWA 2009 Q2 Earnings Call TranscriptDocument13 pagesDWA 2009 Q2 Earnings Call Transcriptdieu thuyenNo ratings yet

- Foundation Accounting Test 1 CH 1 May 2024 Test Paper 1701933622Document7 pagesFoundation Accounting Test 1 CH 1 May 2024 Test Paper 1701933622Akshat AgarwalNo ratings yet