Professional Documents

Culture Documents

Finance Inter RTP May 2023

Uploaded by

Bijay AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Inter RTP May 2023

Uploaded by

Bijay AgrawalCopyright:

Available Formats

PAPER - 3: COST AND MANAGEMENT ACCOUNTING

QUESTIONS

Material Cost

1. Reliable India Pvt Ltd is a startup company engaged in manufacturing of Agro Tech product

from a raw material, which is purchased at I190 per kg. The company incurs a handling

cost of 31,470 plus, freight of 770 per order. The incremental carrying cost of inventory

of raw material is I3 per kg per month. In addition, the cost of working capital finance on

the investment in inventory of raw material is ¥20 per kg per annum. The annual production

of the product is 1,50,000 units and 3 units are obtained from one kg. of raw material.

Assume 360 days in a year.

Required:

(i) Calculate the economic order quantity of raw materials.

(i) Determine, how frequently company should order for procurement be placed.

(iii) If the company proposes to rationalize placement of orders on quarterly basis,

determine the percentage of discount in the price of raw materials should be

negotiated?

Employee Cost

2. Following information are available from the cost records of BMR Limited, CALCULATE

Labour turnover rate and Labour flux rate:

No. of Employees as on 01.04.2021 = 9,400

No. of Employees as on 31.03.2022 = 10,600

During the year, 160 Employees left while 640 Employees were discharged and 1,500

Employees were recruited during the year; of these, 400 Employees were recruited

because of exits and the rest were recruited in accordance with expansion plans.

Overhead

3. SANDY Ltd. is a manufacturing company having three production departments, ‘A’, ‘B’ and

‘C’ and two service departments ‘X’ and ‘Y’. The following is the budget for December

2022:

Total®] AR|[ BR| c®[ x@ YR

Direct material 1,60,000( 3,20,000{ 6,40,000( 3,20,000|1,60,000

Direct wages 8,00,000| 3,20,000| 12,80,000| 1,60,000(3,20,000

Factory rent 6,40,000

Power 4,00,000

Depreciation 1,60,000

© The Institute of Chartered Accountants of India

2 INTERMEDIATE EXAMINATION: MAY, 2023

Other overheads 14,40,000

Additional

information:

Area (Sq. ft.) 800 400 800 400 800

Capital value of 32 64 32 16 16

assets () lakhs)

Machine hours 1,600 3,200 6,400 1,600| 1,600

Horsepower of 80 64 32 24 40

machines

Apportionment of expenses of service departments is as under:

A B c X Y

Service Dept. ‘X' 72 24 48 - 16

Service Dept. Y’ 96 56 - 8 -

Required:

(i) PREPARE a statement showing distribution of overheads to various departments.

(i) PREPARE a statement showing re-distribution of service departments expenses to

production departments using Repeated Distribution method. Also CALCULATE

machine hour rate of the production departments 'A’, 'B', 'C'.

ABC Costing

4. Hygiene Care Ltd. is a manufacturer of a range of goods. The cost structure of its different

products is as follows:

Particulars Hand Wash Detergent Dishwasher

Powder

Direct Materials (3 / Pu) 150 120 120

Direct Labour @310/ hour (% / 45 60 75

Pu)

Production Overheads (3 / Pu) 40 50 40

Total Cost (3 / Pu) 235 230 235

Quantity Produced (Units) 30,000 60,000 90,000

Hygiene Care Ltd. was absorbing overheads on the basis of direct labour hours.

Management accountant has suggested that the company should introduce ABC system

and has identified cost drivers and cost pools as follows:

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING

Activity Cost Pool Cost Driver Associated Cost

®)

Goods Receiving Number of Dispatch Order 8,88,000

Inspecting and Testing costs | Number of Production Runs 26,82,000

Dispatching Number of dispatch order 6,30,000

Storage Cost Number of Batches of material 36,00,000

The following information is also supplied:

Details Hand Wash | Detergent Powder | Dishwasher

Batches of material 720 780 900

Number of dispatch order 360 540 600

No. of Production Runs 1,500 2,100 2,400

Number of Dispatch Orders 600 900 1,000

Required:

CALCULATE activity-based production cost of all the three products.

Cost Sheet

5. From the following data of Motilal Ltd., CALCULATE Cost of production:

®)

(i) Repair & maintenance paid for plant & machinery 9,80,500

(i) | Insurance premium paid for inventories 26,000

(iii) | Insurance premium paid for plant & machinery 96,000

(iv) | Raw materials purchased 64,00,000

(v) | Opening stock of raw materials 2,88,000

(vi) | Closing stock of raw materials 4,46,000

(vii) | Wages paid 23,20,000

(viii) | Value of opening Work-in-process 4,06,000

(ix) | Value of closing Work-in-process 6,02,100

(x) | Quality control cost for the products in manufacturing process 86,000

(xi) | Research & development cost for improvement in production 92,600

process

(xii) | Administrative cost for:

- Factory & production 9,00,000

- Others 11,60,000

© The Institute of Chartered Accountants of India

INTERMEDIATE EXAMINATION: MAY, 2023

(xiii) Amount realised by selling scrap generated during the 9,200

manufacturing process

(xiv) Packing cost necessary to preserve the goods for further 10,200

processing

o) Salary paid to Director (Technical) 8,90,000

Reconciliation

6. The financial records of Riva Private Limited showed a net profit of 1,69,500 for the year

ended 31t March, 2022. The cost accounts, however, disclosed a net loss of ¥ 88,500 for

the same period. The following information were revealed as a result of scrutiny of the

figures of cost accounts and financial accounts:

®)

(i) (Administrative overhead under recovered 63,750.0

(ii) Factory overhead over recovered 3,37,500.0

(iii) | Depreciation under charged in Cost Accounts 65,000.0

(iv) | Dividend received 50,000.0

) Loss due to obsolescence charged in Financial Accounts 42,000.0

(vi) | Income tax provided 1,09,000.0

(vii) | Bank interest credited in Financial Accounts 34,000.0

(viii) | Value of opening stock:

In Cost Accounts 4,12,500.0

In Financial Accounts 3,62,500.0

(ix) | Value of closing stock:

In Cost Accounts 3,13,750.0

In Financial Accounts 3,30,000.0

(x) Goodwill written-off in Financial Accounts 62,500.0

(xi) | Notional rent of own premises charged in Cost Accounts 1,50,000.0

(xii) | Provision for doubtful debts in Financial Accounts 37,500.0

Prepare a reconciliation statement by taking costing net loss as base.

Job and Batch Costing

7. Ajobbing factory has undertaken to supply 200 pieces of a component per month for the

ensuing six months. Every month a batch order is opened against which materials and

labour hours are booked at actual. Overheads are levied at a rate per labour hour. The

selling price contracted for is ¥ 80 per piece. From the following data.

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 5

COMPUTE the cost and profit per piece of each batch order and overall position of the

order for 1,200 pieces.

Month Batch Output | Material cost | Direct wages | Direct labour

(Pieces) ) ) (Hours)

January 210 6,500 1,200 240

February 200 6,400 1,400 280

March 220 6,800 1,500 280

April 180 6,300 1,400 270

May 200 7,000 1,500 300

June 220 7,200 1,600 320

The other details are:

Month Chargeable expenses Direct labour

() Hours

January 1,20,000 4,800

February 1,05,600 4,400

March 1,20,000 5,000

April 1,05,800 4,600

May 1,30,000 5,000

June 1,20,000 4,800

Contract Costing

8. XYZLLP, contractors and civil engineers, are building a new wing to a school. The quoted

fixed price for the contract is ¥30,00,000. Work commenced on 1st January 20X2 and is

expected to be completed on schedule by 30 June 20X3.

Data relating to the contract at the year ended 315t March 20X3 is as follows.

®)

Plant sent to site at commencement of contract 2,40,000

Hire of plant and equipment 77,000

Materials sent to site 6,62,000

Materials returned from site 47,000

Direct wages paid 9,60,000

Wage related costs 1,32,000

Direct expenses incurred 34,000

© The Institute of Chartered Accountants of India

6 INTERMEDIATE EXAMINATION: MAY, 2023

Supervisory staff salaries 90,000

- Direct

- Indirect 20,000

Regional office expenses apportioned to contract 50,000

Head office expenses apportioned to contract 30,000

Surveyor’s fees 27,000

Progress payments received from school 18,00,000

Additional information:

1. Plantis to be depreciated at the rate of 25 % per annum following straight line method,

with no residual value.

2. Unused materials on site at 31st March are estimated at ¥ 50,000.

3. Wages owed to direct workers total ¥ 40,000

4. Budgeted profit on the contract is ¥ 8,00,000

5. Value of work certified by the surveyor is ¥ 24,00,000.

6. The surveyor has not certified the work costing % 1,80,000

You are required to PREPARE the account for the school contract for the fifteen months

ended 315t March 20X3, and CALCULATE the notional profit to date.

Process Costing

9. ‘Dairy Wala Private limited’ is engaged in the production of flavoured milk. Its process

involve filtration and boiling of milk after that some sugar, flavour, colour is added and then

letting it cool to fill the product into clean and sterile bottles. For Producing 10 litre of flavour

milk, 100 litre of Raw milk is required, which extracts only 45 litres of standardized milk.

Following information regarding Process — | has been obtained from the manufacturing

department of Dairy Wala Private limited for the month of December 2022:

Items [®)

Opening work-in process (13,500 litre)

Milk 1,50,000

Labour 45,000

Overheads 1,35,000

Milk introduced for filtration and boiling (3,00,000 litre) 15,00,000

Direct Labour 6,00,000

Overheads 18,00,000

Abnormal Loss: 3,000 litres

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING

Degree of completion:

Milk 100%

Labour and overheads 80%

Closing work-in process: 27,000 litres

Degree of completion:

Milk 100%

Labour and overheads 80%

Milk transferred for Packing: 1,18,500 litres

You are required to PREPARE using average method:

(i) Statement of equivalent production,

(i) Statement of cost,

(iii) Statement of distribution cost, and

(iv) Process-I Account.

Joint Product by Product

10. Key Pee Limited produces and sells the following products:

Products Units Selling price at split-off Selling price after

point (%) further processing (%)

A 500000 425 625

B 75000 325 425

Cc 62500 20 30

D 50000 25 -

E 187500 35 50

Cost of raw material ¥ 89,75,000 and other manufacturing ex-penses cost ¥13,67,500 in

the manufacturing process which are absorbed on the products on the basis of their ‘Net

realisable value’. The further processing costs of A, B, C and E are 331,25,000;

< 3,75,000; 31,25,000 and ¥3,75,000 respectively. Fixed costs are 311,82,500.

You are required to PREPARE the following in respect of the coming year:

(a) Statement showing income forecast of the company assuming that none of its

products are to be further processed.

(b) Statement showing income forecast of the company assuming that products A, B, C

and E are to be processed further.

© The Institute of Chartered Accountants of India

8 INTERMEDIATE EXAMINATION: MAY, 2023

Service Costing

11. PREPARE cost statement of Panipat Thermal Power Station showing the cost of electricity

generated per kwh, from the following data.

Total units generated 16,50,000 kWh

®)

Operating labour 21,75,000

Repairs & maintenance 7,25,000

Lubricants, spares and stores 5,80,000

Plant supervision 4,35,000

Administration overheads 29,00,000

Insurance Charges 15,00,000

Fuel Charges 8,00,000

7 kWh. of electricity generated per kg. of coal consumed @ I4.75 per kg. Depreciation

charges @ 5% on capital cost of ¥3,10,00,000.

Standard Costing

12. XYZ Manufacturing Ltd. had prepared the following estimation for the month of January:

Quantity Rate (T) )

Raw Material-DF 1,600 kg. 50 80,000

Raw Material-CE 1,200 kg. 35 42,000

Skilled labour 2,000 hours 40 80,000

Semiskilled labour 1,600 hours 25 40,000

Standard loss in the process was expected to be 10% of total input materials and an idle

labour time of 5% of expected labour hours was also estimated.

At the end of the month the following information has been collected from the cost

accounting department:

The company has produced 2,960 kg. finished product by using the followings:

Quantity Rate (3) )

Raw Material-DF 1,800 kg. 40 72,000

Raw Material-CE 1,300 kg. 30 39,000

Skilled labour 2,400 hours 35 84,000

Semiskilled labour 1,720 hours 20 34,400

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 9

You are required to CALCULATE:

(a) Material Cost Variance;

(b) Material Price Variance;

(c) Material Mix Variance;

(d) Material Yield Variance;

(e) Labour Cost Variance;

(f) Labour Efficiency Variance and

(9) Labour Yield Variance

Marginal Costing

13. The following data are available from the budget records of Finesign Women's Handbag

Company for the forthcoming budget period.

3

Selling Price per unit 1000

Variable cost per unit:

Cost of Material used 750.00

Sales commission 50.00

Total Variable Cost 800.00

Annual fixed expenses:

Rent 7,00,000

Salaries 11,00,000

Other fixed expenses 5,00,000

Total Fixed Cost 23,00,000

Although the firm manufactures Bags with different styles, they have identical purchase

costs and selling price.

Requirement:

(a) Whatis the annual break-even point both in terms of units and value?

(b) Ifthe store manager is paid 1 per cent commission on sales, what would be the annual

break-even point both in terms of units and value?

(c) If the firm decides to pay a fixed salary of ¥ 9,00,000 in lieu of sales commission,

what would be the annual break-even point in terms of units and value.

Considering break-even point in requirement (a), If the stores manager is paid 2 per

cent commission on each bag sold in excess of the break-even point, what would be

the profit if 20000 bags were sold.

© The Institute of Chartered Accountants of India

10 INTERMEDIATE EXAMINATION: MAY, 2023

Budget and Budgetary Control

14. EDF Ltd. produces two products using Skilled labour and two types of materials. Shown

below the information for the next month’s budget:

Product- A Product-B

Budgeted sales (in units) 4,080 6,120

Budgeted material consumption per unit (in kg):

Material-X 85 5.1

Material-Y 6.8 102

Standard labour hours allowed per unit of product 5.1 8.5

Material-X and Material-Y cost ¥8 and T10 per kg and labours are paid 30 per hour.

Overtime premium is 75% and is payable, if a worker works for more than 45 hours a week.

There are 400 direct workers.

The target efficiency ratio for the productive hours worked by the direct workers in actually

manufacturing the products is 85%. In addition the non-productive down-time is budgeted

at 15% of the productive hours worked.

There are four 6-days weeks in the budgeted period and it is anticipated that sales and

production will occur evenly throughout the whole period.

Itis anticipated that stock at the beginning of the period will be:

Product-A 550 units

Product-B 350 units

Material-X 1,200 kgs.

Material-Y 600 kgs.

The anticipated closing stocks for budget period are as below:

Product-A 5 days sales

Product-B 5 days sales

Material-X 10 days consumption

Material-Y 5 days consumption

Required:

CALCULATE the Material Purchase Budget and the Wages Budget for the direct workers,

showing the quantities and values, for the next month.

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 1"

Miscellaneous

15. (a) SUGGEST the unit of cost for following industries:

(a) Transport

(b) Power

(c) Hotel

(d) Hospital

(e) Steel

(f) Coal mining

(g9) Professional Services

(h) Gas

(i) Engineering

o oil

(b) DISCUSS the difference between Job costing and Batch costing.

(c) EXPLAIN what are the essential pre-requisite for Integrated Accounting system?

(d) DISCUSS the difference between cost control and cost reduction.

ANSWERS

1. (i) Calculation of Economic Order Quantity (E.O.Q)

1,50,000units _

Annual requirement (usage) of raw material in kg. (A) = Sunitsperkg. 50,000kg.

Ordering Cost (Handling & freight cost) (O) = 31,470 + 3770 = 32,240

Carrying cost per unit per annum (C) i.e. inventory carrying cost + working capital

cost= (I3 x 12 months) + 320 = T56 per kg.

_ [0 2x50,000

kgx 2,240 _

E0Q= [= = s T2000kg.

(ii) Frequency of placing orders for procurement :

Annual consumption (A) = 50,000 kg.

Quantity per order (E.0.Q) = 2,000 kg.

A _ 50,000kg

No. of orders per annum = =25 orders

EO.Q 2,000kg

© The Institute of Chartered Accountants of India

12 INTERMEDIATE EXAMINATION: MAY, 2023

60days

Frequency of placing orders (in days) = =14.4 Days

250rders

(iii) Percentage of discount in the price of raw materials to be negotiated:

Particulars On Quarterly Basis On E.O.Q Basis

1. Annual Usage (in Kg.) 50,000 kg. 50,000 kg.

2. Size of the order 12,500 kg. 2,000 kg.

3. No.of orders (1+2) 4 25

4. Cost of placing orders < 8,960 % 56,000

or Ordering cost

(No. of orders x Cost (4 order x 2,240) (25 orders x ¥ 2,240)

per order)

5. Inventory carrying ¥3,50,000 356,000

cost

(Average inventory x | (12,500 kg. x %2 x ¥ 56) | (2,000 kg. x %2 x X 56)

Carrying cost per unit)

6. Total Cost (4 +5) < 3,658,960 31,12,000

When order is placed on quarterly basis the ordering cost and carrying cost increased

by 2,46,960 (33,58,960 - ¥1,12,000). So, discount required = T 2,46,960

Total annual purchase = 50,000 kg. x 3190 = ¥95,00,000 So, Percentage of discount

too be negotiated = = =200 = 2.60%

t'td“mx‘lUU‘ZBO"/

2. Employee turnover rate:

It comprises of computation of Employee turnover by using following methods:

Number of employees seperated during the period

U] Separate Method: =

Average number of employees during the period onroll

100

_ Number of employees

left + Number of employees discharged

OR, x100

Average number of employees during the period onroll

. (eo+ed0) oo

(9,400+10,600) =

= 80 x100 =8%

10,000

Number of employees replaced during the period

(i) Replacement Method = - -

Average number of employees during the period onroll

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 13

= 400 x100 =4%

10,000

Number of employees joining ina period (excluding replacement)

(iii) New Recruitment = x100

Average number of employees during the period onroll

_ Number of Recruitments

- Number of Replacements %100

Average number of employees during the period on roll

_ 1500-400

x100

10,000

_ 1100

10,000 x100 =11%

Numberof separation + Numberof replacement + Numberof new joining

Flux Method = x100

Average number of employees during the period on roll

_ (800+400+1,100)

(9,400+10,600) =2

=flx100 =23%

10,000

3. (i) Overhead Distribution Summary

Basis | TotalR)] AR)| BQR)| CR)| XQ®| YR

Direct materials Direct - - - -|3,20,000| 1,60,000

Direct wages Direct - - - -|1,60,000| 3,20,000

Factory rent |Area 6,40,000| 1,60,000 | 80,000 | 1,60,000| 80,000 1,60,000

(2:1:21:2)

Power H.P. x| 4,00,000( 80,000 1,28,000|1,28,000| 24,000 40,000

(10:16:16:3:5) Machine

Hrs.

Depreciation Capital 1,60,000 32,000 64,000 32,000/ 16,000( 16,000

(2:4:2:1:1) value of

assets

Other overheads | Machine | 14,40,000| 1,60,000 | 3,20,000 | 6,40,000 | 1,60,000 | 1,60,000

(1:2:4:1:1) hrs.

Total 26,40,000 | 4,32,000 | 5,92,000 | 9,60,000| 7,60,000 | 8,56,000

*{(1600x80) : (3200x64) : (6400x32) : (1600x24) : (1600x40)}

(1,28,000 : 2,04,800 : 2,04,800 : 38,400 : 64,000)

(10:16:16:3:5)

© The Institute of Chartered Accountants of India

14 INTERMEDIATE EXAMINATION: MAY, 2023

(i) Redistribution of service department’s expense using repeated distribution

Method:

AR) BR) CR) XR®) Y (R)

Total overheads 4,32,000 | 5,92,000 | 9,60,000 | 7,60,000 | 8,56,000

Dept. X overhead | 3,42,000 | 1,14,000 | 2,28,000 | -7,60,000 76,000

apportioned in the ratio

(72:24:48: —16)

Dept. Y overhead | 559,200 | 3,26,200 - 46,600 | -9,32,000

apportioned in the ratio

(96:56: —8: —)

Dept. X overhead 20,970 6,990 13,980 -46,600 4,660

apportioned in the ratio

(72:24:48: —16)

Dept. Y overhead 2,796 1,631 - 233 -4,660

apportioned in the ratio

(96:56: —8: —)

Dept. X overhead 105 35 70 -233 23

apportioned in the ratio

(72:24:48: —16)

Dept. Y overhead 15 8 - - -23

apportioned in the ratio

(96:56: —8: —)

13,57,086 | 10,40,864 | 12,02,050 - -

Calculation of machine hour rate

A B c

A Total overheads (I) 13,57,086 10,40,864 | 12,02,050

B Machine hours 1,600 3,200 6,400

C | Machine hour rate (%) [A + B] 848.18 325.27 187.82

4. 1. The Total Production Overhead are 78,00,000

Items Labour Hour Overheads allocation on the

basis of direct Labour Hour (3)

Labour Hour Ratio (4.5:6:7.5)

Hand Wash 1,35,000 9,00,000

Detergent Powder 3,60,000 24,00,000

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 15

Dishwasher 6,75,000 45,00,000

Total 11,70,000 78,00,000

2. On the basis of ABC analysis this amount will be apportioned as follows:

Statement Showing "Activity Based Production Cost"

Activity Cost Cost Driver Ratio Total Hand | Detergent| Dishwas

Pool Amount | Wash ()| Powder her

®) R) R)

Goods Receiving | Dispatch order 06:09:10 | 8,88,000| 2,13,120| 3,19,680| 3,55,200

Inspecting and | Production Runs | 05:07:08 | 26,82,000 | 6,70,500| 9,38,700| 10,72,800

Testing costs

Dispatching Dispatch Order | 06:09:10 | 6,30,000| 1,51,200| 2,26,800| 2,52,000

Storage Cost Batches of [ 12:13:15 | 36,00,000 | 10,80,000 | 11,70,000 |13,50,000

material

Total Activity Cost 21,14,820 | 26,55,180 | 30,30,000

Quantity Produces 30,000 60,000 90,000

Unit Cost

(Overheads) 70.49 44.25 33.67

Add: Conversion

Cost (Material +

Labour) 195 180 195

Total 265.49 224.25| 228.67

Note: This question can also be solved by using cost driver rate

5. Calculation of Cost of Production of Motilal Ltd for the period.....

Particulars )

Raw materials purchased 64,00,000

Add: Opening stock 2,88,000

Less: Closing stock (4,46,000)

Material consumed 62,42,000

Wages paid 23,20,000

Prime cost 85,62,000

Repair and maintenance cost of plant & machinery 9,80,500

Insurance premium paid for inventories 26,000

Insurance premium paid for plant & machinery 96,000

Quality control cost 86,000

© The Institute of Chartered Accountants of India

16 INTERMEDIATE EXAMINATION: MAY, 2023

Research & development cost 92,600

Administrative overheads related with factory and production 9,00,000

1,07,43,100

Add: Opening value of W-I-P 4,06,000

Less: Closing value of W-I-P (6,02,100)

1,05,47,000

Less: Amount realised by selling scrap (9,200)

Add: Primary packing cost 10,200

Cost of Production 1,05,48,000

Notes:

(i) Other administrative overhead does not form part of cost of production.

(ii) Salary paid to Director (Technical) is an administrative cost.

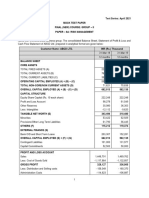

6. Statement of Reconciliation

SI. No. Particulars () )

Net loss as per Cost Accounts (88,500)

Additions

1 Factory O/H over recovered 3,37,500

2 Dividend Received 50,000

3 Bank Interest received 34,000

4 Difference in Value of Opening Stock 50,000

(4,12,500 - 3,62,500)

5 Difference in Value of Closing Stock 16,250

(3,30,000 - 3,13,7500)

6 Notional Rent of own Premises 1,50,000 6,37,750

Deductions

1 Administration O/H under recovered 63,750

2 Depreciation under charged 65,000

3 Loss due to obsolescence 42,000

4 Income tax Provided 1,09,000

5 Gooduwill written-off 62,500

6 Provision for doubtful debts 37,500 (3,79,750)

Net Profit as per Financial Alc. 1,69,500

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 17

7.

Particulars Jan. | Feb. | March | April | May | June | Total

®) ®) ®) ®) ®) ®) ®)

Batch output 210 200 220 180 200 220 | 1,230

(in pieces)

Sale value @ 380 16,80 | 16,00 | 17,60 | 1440 | 16,00 | 17,60 | 98,40

Material cost 6,500 | 6,400 | 6,800 | 6,300 | 7,000 | 7,200 | 40,20

Direct wages 1,200 | 1,400 | 1,500 | 1,400 | 1,500 | 1,600 | 8,600

Chargeable 6,000 | 6,720 | 6,720 | 6,210 | 7,800 | 8,000 | 4145

expenses*

Total cost 13,70 | 14,52 | 15,02 | 1391 16,30 | 16,80 | 90,25

Profit per batch 3,100 | 1,480 | 2,580 490 | (300) 800 | 8,150

Total cost per piece 65.2 726 68.3 773 815 76.4 734

Profit per piece 14.8 7.4 1.7 27| (19) 3.6 6.6

Overall position of the order for 1,200 pieces

Sales value of 1,200 pieces @ ¥ 80 per piece 396,000

Total cost of 1,200 pieces @ X 73.4 per piece 388,080

Profit 27,920

N Chargeable expenses

xDirect labour hours for batch

Direct labour hour for the month

8. School Contract Account

Particulars () | Particulars ®)

To Plant 2,40,000 | By Material returned 47,000

To Hire of plant 77,000 | By Plant c/d 1,65,000

To Materials 6,62,000 | By Materials c/d 50,000

To Direct wages 9,60,000 By WIP c/d:

Add: Accrued 40,000 10,00,000 Value of work certified | 24,00,000

To Wages related costs 1,32,000 Cost of work not certified | 1,80,000

To Direct expenses 34,000

To Supervisory staff:

Direct 90,000

© The Institute of Chartered Accountants of India

18 INTERMEDIATE EXAMINATION: MAY, 2023

Indirect 20,000 1,10,000

To Regional office 50,000

expenses

To Head office expenses 30,000

To Surveyors’ fees 27,000

To Notional profit c/d 4,80,000

28,42,000 28,42,000

9. (i) Statement of Equivalent Production

Particulars Input Particulars Output Equivalent Production

i i Milk | Labour & OH.

% | Units % Units

Opening WIP | 13,500 | Completed and| 1,18,500| 100 1,18,500| 100 | 1,18,500

transferred to Process-lI

Units 3,00,000 | Normal Loss (55%* of| 1,65,000| -- - - -

introduced 3,00,000)

Abnormal loss 3,000| 100 3,000 80 2400

Closing WIP 27,000| 100| 27,000{ 80| 21,600

3,13,500 3,13,500 1,48,500 1,42,500

*100 litre of milk extracts only 45 litre of standardized milk. Thus, normal loss = 100 — 45 = 55%

(i) Statement showing cost for each element

Particulars Milk (%) | Labour (%) | Overhead (X) | Total (%)

Cost of opening work-in- 1,50,000 45,000 1,35,000 3,30,000

process

Cost incurred during the | 15,00,000 6,00,000 18,00,000 | 39,00,000

month

Total cost: (A) 16,50,000 6,45,000 19,35,000 | 42,30,000

Equivalent units: (B) 1,48,500 1,42,500 1,42,500

Cost per equivalent unit: (C) 11111 4.526 13.578 29216

=(A+B)

(iii) Statement of Distribution of cost

®) ®)

1. Value of units completed and transferred (1,18,500 34,62,096

units x ¥ 29.216)

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 19

2. Value of Abnormal Loss: -

Milk (3,000 units x T 11.111) 33,333

Labour (2400 units x ¥ 4.526) 10,863

Overheads (2400 units x T 13.579) 32,590 76,786

3. Value of Closing W-I-P:

Milk (27,000 units x T 11.111) 299997

Labour (21,600 units x ¥ 4.526) 97,762

Overheads (21,600 units x ¥ 13.579) 2,93,306 6,91,065

(iv) Process-l Alc

Particulars Units | Amount Particulars Units | Amount

R®) R)

To Opening W.L.P: By Normal Loss 1,65,000 -

Milk 13,500 | 1,50,000 | By Abnormal Loss 3,000 76,839

(.44 difference due

to approximation)

Labour - 45,000 | By Process-Il Alc 1,18,500 | 34,62,096

Overheads - 1,35,000 | By Closing WIP 27,000 6,91,065

To Milk introduced | 3,00,000 | 15,00,000

To Direct Labour 6,00,000

To Overheads 18,00,000

3,13,500 | 42,30,000 3,13,500 | 42,30,000

10. Working Note:

Apportionment of joint costs on the basis of Net Realisable Value method

Products|Sales Value (%) Post separation|Net Realisable| Apportioned

Cost (%) Value (3) Cost (%)

A 3,12,50,000 31,25,000f 2,81,25,000( 67,74,563

(5,00,000units x ¥ 62.50)

B 31,87,500 3,75,000 28,12,500 6,77,456]

(75,000 units x ¥ 42.5)

c 18,75,000 1,25,000 17,50,000 4,21,528

(62,500 units x¥ 30)

D 12,50,000 12,50,000 3,01,092]

(50,000 units x¥ 25)

© The Institute of Chartered Accountants of India

20 INTERMEDIATE EXAMINATION: MAY, 2023

E 93,75,000 3,75,000 90,00,000 21,67,860

(1,87,500 units x ¥ 50)

4,29,37,500| 1,03,42,500

Total joint cost =Raw material costs + Manufacturing expenses = 89,75,000 +

313,67,500 =%1,03,42,500

Apportioned joint cost = (Total Joint Cost/ Total Net Realisable value of each X Net

Realisable value of each product)

Apportioned joint cost for Product A = (1,03,42,500 / 4,29,37,500 X 2,81,25,000) =

367,74,563.32

Similarly, the apportioned joint cost for products B, C, D and E are 36,77,456, T4,21,528,

¥3,01,092 and 321,67,860 respectively.

(a) Statement showing income forecast of the company assum-ing that none of its

products are further processed.

Products

AR) B CR| DE) ER)| Total ])

Sales revenue [2,12,50,000{ 24,37,500( 12,50,000| 12,50,000| 65,62,500| 3,27,50,000

(R425% | (325%| (X20%| (T25x (T35x

500,000) | 75000) 62,500) 50,000)| 1,87,500)

Less: Apportioned

Costs (Refer|

Working note) 67,74,563| 6,77,456| 4,21,528| 3,01,092| 21,67,860| 1,03,42,500

1,44,75,437| 17,60,044| 8,28472| 9,48,908| 43,94,640| 2,24,07,500

Less: Fixed Cost 11,82,500

Profit 2,12,25,000

(b) Statement showing income forecast of the company: assuming that products A, B, C

and E are further processed (Refer to working note)

Products

AR) BR) CR) D () E@®)| Total })

A. Sales revenue | 3,12,50,000 31,87,500| 18,75,000| 12,50,000{ 93,75,000| 4,69,37,500

B. Apportioned 67,74,563| 6,77,456| 4,21,528| 3,01,092 21,67,860| 1,03,42,500

Costs

C. Further 31,25,000| 3,75,000 1,25,000 -| 3,75,000| 40,00,000

processing cost

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 21

D. Total 98,99,563| 10,52,456| 546,528 3,01,092| 25,42,860| 1,43,42,500

processing cost

(B+C)

E. Excess of sales| 2,13,50,437 | 21,35,044| 13,28,472| 9,48,908| 68,32,140| 3,25,95,000

revenue (A-D)

F. Fixed Cost 11,82,500

G. Profit (E - F) 3,14,12,500

11. Total units generated 16,50,000 kWh.

Cost Statement of Panipat Thermal Power Station

Per annum (T) | Per kWh. ()

Fixed costs:

Plant supervision 4,35,000

Administration overheads 29,00,000

Insurance Charges 15,00,000

Depreciation (5% of ¥ 3,10,00,000 p.a.) 15,50,000

Total fixed cost: (A) 63,85,000 3.87

Variable costs:

Operating labour 21,75,000

Fuel Charges 8,00,000

Lubricants, spares and stores 5,80,000

Repairs & maintenance 7,25,000

Coal cost (Refer to working note) 11,19,643

Total variable cost: (B) 53,99,643 3.27

Total cost [(A) + (B)] 1,17,84,643 7.14

Working Note:

Coal cost (16,50,000 kWh. + 7 kWh) x T4.75 per kg. =311,19,643

12. Material Variance

Raw sQ SP |SQxSP| RSQ [RSQxSP| AQ | AQxSP | AP | AQx AP

Material | (kg.) (WN-2)

wN) | Q)| @ | k)| ) R R ®

DF 1879 50 | 93,950 | 1771 88,550 | 1800 | 90,000 | 40 | 72,000

CE 1410 35 | 49,350 | 1329 46,515 | 1300 | 45,500 30 | 39,000

3289 1,43,300 | 3,100 | 1,35,065 | 3100 | 1,35,500 1,11,000

© The Institute of Chartered Accountants of India

22 INTERMEDIATE EXAMINATION: MAY, 2023

WN-1: Standard Quantity (SQ):

1,600kg.

1879.365 or 1879 kg. = [W %2,960kg. J

.9%2,800kg.

1,200kg.

Raw Material DF = —_— %2,960kg. J

0.9x2,800kg.

Raw Material CE = 1409.52 or 1410 kg. [

1,200kg. x3,100 kg.J

2,800kg.

WN- 2: Revised Standard Quantity (RSQ):

Raw Material DF = 1,771.43 or 1,771 kg. [

1,200kg. x3,100 kg.J

2,800kg.

Raw Material CE = 1,328.57 or 1,329 kg.

(a) Material Cost Variance (A +B) ={(SQ x SP) - (AQ x AP)}

{143,300 -1,11,000 = 32,300(F) (F)

(b) Material Price Variance (A+B) = {(AQ x SP) - (AQ xAP)

{1,35500-1,11.000} = 24 500(F)

(c) Material Mix Variance (A + B) ={(RSQ x SP) - (AQ x SP)}

{1,35065 - 1,35500} = 435 (A)

(d) Material Yield Variance (A +B) ={(SQ x SP) - (RSQ x SP)}

{1,43,300 - 1,35 065} = 8,235 (F)

Labour Variances:

Labour SH SR(SHxSR| RSH [RSHxSR| AH | AHxSR | AR | AHx AR

wa) (@] @ WM @ (® ®

Skilled 2232| 40| 89,280| 2289 91,560| 2,400/ 96,000( 35/ 84,000

Semiskilled 1785| 25| 44,625 1831 45,775 1720| 43,000( 20| 34,400

4,017 hrs 1,33,905| 4,120| 1,37,335| 4,120| 1,39,000 1,18,400

WN- 3: Standard Hours (SH):

0.95x2,000hr

Skilled labour =2,231.746 or 2,232 hrsL x2,960kg

0.90x2,800kg

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 23

Semiskilled labour =1785.397 or 1785 hrs wx 2,960kg

0.90x2,800kg

WN- 4: Revised Standard Hours (RSH):

Skilled labour = 2,288.889 or 2,289 hrs. = 2,000hrsx41120 hrs

3,600kg

Semiskilled labour = 1831.11 or 1831 hrs. = 1'600hr8)<4,120hrs

3,600kg

(e) Labour Cost Variance (Skilled + Semiskilled) = {(SH x SR) — (AH x AR)}

{1,33,905 — 1,18 400} =15,505 (F)

(f) Labour Efficiency Variance (Skilled + Semiskilled) = {(SH x SR) — (AH x SR)}

{1,33,905 - 1,39,000} = 5,095 (A)

(g) Labour Yield Variance (Skilled + Semiskilled) = {(SH x SR) — (RSH x SR)}

={1,33,905 - 1,37,335} = 3,430 (A)

Salesper unit - Variable Cost per unit «

13. (a) P/V ratio: 100

Selling price per unit

_ 1000800

= ——x 100

1000

= fl><100 =20%

1000

Annual fixed cost

Annual BEP in units; ———————

Contribution per unit

- ¥23,00,000

23,00,000 =11,500 units

3 200

Annual fixed cost

Annual BEP in value:

P/V ratio

323,00,000

=31,15,00,000

3 20%

(b) Revised P/V ratio and BEP :

commission on sales per unit= 1% of 1,000= 310

© The Institute of Chartered Accountants of India

24 INTERMEDIATE EXAMINATION: MAY, 2023

1000 (750+50+10)

So, P/V ratio :

1000

= fi><100 =19%

1000

Annual fixed cost

BEP in terms of units; —————

Contribution per unit

_ 23,00,000

=12,106 units

190

Annual fixed cost

BEP in terms of value:

PIV

_ 23,00,000

=3%1,21,05,263

19%

(c) Break-even point under fixed salary plan:

Contribution per unit _ 1000—750X100 _ 25

P/V ratio = = = x100=25%

Selling price per unit 1000 1000 :

Revised fixed cost :

Original fixed cost % 23,00,000

Proposed fixed salary 39,00,000

Total ¥ 32,00,000

BEP in terms of units: —nual

fxed cost 3200000y, gy s

Contribution per unit 250

BEP in terms of value; Anual

red cost _ 3200000 _ ¢ 4 g9

P/v ratio 25%

(d) Annual break-even point under requirement (a) is 11,500 units.

Margin of safety at sales volume of 20,000 unit of bags (20,000 - 11,500) = 8500

units

Contribution on sales beyond break-even sales:

Revised contribution per unit: 200 - (2% of 1000) = 180

Profit = Margin of safety (in units) x Contribution per unit

= 8500 x 180 = ¥ 15,30,000

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING

14. Number of days in budget period = 4 weeks x 6 days = 24 days

Number of units to be produced

Product-A (units) Product-B (units)

Budgeted Sales 4,080 6,120

Add: Closing stock 850 1275

4,080 units 5 da SJ 6120units

i o

24 days 24 days

Less: Opening stock 550 350

4,380 7,045

(i) Material Purchase

Budget

Material-X (Kg.) Material-Y (Kg.)

Material required:

Product-A 37,230 29,784

(4,380 units x 8.5kg) | (4,380 units x 6.8 kg.)

Product-B 35,930 71,859

(7,045 units x 5.1 kg) | (7,045 units x 10.2kg.)

73,160 1,01,643

Add: Closing stock 30,483 21,176

73,160 kgs. 1,01,643kgs.

(Tays x 10 days) (Tays x5 days)

Less: Opening stock 1,200 600

Quantity to be purchased 1,02,443 1,22,219

Rate per kg. of Material 8 10

Total Cost 8,19,541 12,22,186

(i) Wages Budget

Product-A (Hours) Product-B (Hours)

Units to be produced 4,380 7,045

Standard hours allowed per 5.1 8.5

unit

Total Standard Hours 22,338 59,883

allowed

© The Institute of Chartered Accountants of India

26 INTERMEDIATE EXAMINATION: MAY, 2023

Productive hours required 22,383:;:ours 26,280 59,8::020urs

for production x70,450

Add: Non-Productive down 3942 10568

time hours (15% of 26,280 hours) (15% of 70,450 hours)

Hours to be paid 30,222 81,018

Total Hours to be paid = 1,11,240

Hours to be paid at normal 72000

rate (4 weeks x 45 hours x

400 workers) =

Hours to be paid at premium 39,240

rate

Total wages to be paid =3 21,60,000 + % 20,60,100 =T 42,20,100

= (72,000 hours x 30 +

39,240 hours x X 52.5)

15. (a) Cost units are as follows:

Industry or Product Cost Unit Basis

Transport Passenger- kilometer

Power Kilo-watt hour (kWh)

Hotel Room

Hospitals Patient day

Steel Ton

Coal mining Tonne/ton

Professional services Chargeable hour, job, contract

Gas Cubic feet

Engineering Contract, job

Oil Barrel, tonne, litre

(b) Differences between Job costing and Batch costing:

Sr.No | Job Costing Batch Costing

1. Method of costing used for non- | Homogeneous products

standard and non- repetitive | produced in a continuous

products produced as per customer | production flow in lots.

© The Institute of Chartered Accountants of India

PAPER - 3: COST AND MANAGEMENT ACCOUNTING 27

specifications and against specific

orders.

Cost determined for each Job. Cost determined in aggregate

for the entire Batch and then

arrived at on per unit basis.

Jobs are different from each other | Products produced in a batch

and independent of each other. | are homogeneous and lack of

Each Job is unique. individuality.

(c) Essential pre-requisites for Integrated Accounts: The essential pre-requisites for

integrated accounts include the following steps-

1. The management's decision about the extent of integration of the two sets of

books. Some concemns find it useful to integrate up to the stage of prime cost or

factory cost while other prefers full integration of the entire accounting records.

2. Asuitable coding system must be made available so as to serve the accounting

purposes of financial and cost accounts.

3. Anagreed routine, with regard to the treatment of provision for accruals, prepaid

expenses, other adjustment necessary for preparation of interim accounts.

4. Perfect coordination should exist between the staff responsible for the financial

and cost aspects of the accounts and an efficient processing of accounting

documents should be ensured.

(d)

S. No. Cost Control Cost Reduction

1 Cost control aims at maintaining Cost reduction is concerned with

the costs in accordance with the reducing costs. It challenges all

established standards. standards and endeavours to

improvise them continuously

Cost control seeks to attain lowest Cost reduction recognises no

possible cost under existing condition as permanent, since a

conditions. change will result in lower cost.

In case of cost control, emphasis In case of cost reduction, it is on

is on past and present present and future.

Cost control is a preventive Cost reduction is a corective

function function. It operates even when an

efficient cost control system exists.

Cost control ends when targets Cost reduction has no visible end and

are achieved. is a continuous process.

© The Institute of Chartered Accountants of India

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Vshzjxiccwixkbsbcc NXJXJXDocument27 pagesVshzjxiccwixkbsbcc NXJXJXchetanphalak.instagramNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- 3 - CostDocument27 pages3 - CostSONALI DHARNo ratings yet

- CA Inter Costing RTP May 2023Document27 pagesCA Inter Costing RTP May 2023karnimasoni12No ratings yet

- 3. Overheads & ABC - Questions Test 1Document4 pages3. Overheads & ABC - Questions Test 1jj4223062003No ratings yet

- Paper - 3: Cost Accounting and Financial Management Part-I: Cost Accounting Questions MaterialDocument45 pagesPaper - 3: Cost Accounting and Financial Management Part-I: Cost Accounting Questions MaterialRoshinisai VuppalaNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument30 pagesPaper - 3: Cost and Management Accounting Questions Material CostADITYA JAINNo ratings yet

- Lecture 2 - Practice QuestionDocument8 pagesLecture 2 - Practice QuestionBhunesh KumarNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETNo ratings yet

- 75568bos61147 p3Document25 pages75568bos61147 p3r79qwkxcfjNo ratings yet

- Combinepdf 2Document6 pagesCombinepdf 2saisandeepNo ratings yet

- Paper 3 Chapter 4 PractiseDocument11 pagesPaper 3 Chapter 4 PractiseAryan GuptaNo ratings yet

- Cost Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument39 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialAniket100% (1)

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- CA Inter Costing RTP Nov23 Castudynotes ComDocument25 pagesCA Inter Costing RTP Nov23 Castudynotes ComDhanesh ChauhanNo ratings yet

- Bos 45818 P 3Document25 pagesBos 45818 P 3Sourav ChamoliNo ratings yet

- Intermediate Cost Management em RTP Nov 19Document26 pagesIntermediate Cost Management em RTP Nov 19Akash TiwariNo ratings yet

- November 18 5Document27 pagesNovember 18 5Bharath Krishna MVNo ratings yet

- Finance RTP Nov 2023Document25 pagesFinance RTP Nov 2023Bijay AgrawalNo ratings yet

- Costing Overheads University Technology JamaicaDocument4 pagesCosting Overheads University Technology JamaicaJust for Silly UseNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument38 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialMinni BegumNo ratings yet

- Acct 321 - Managerial AccountingDocument6 pagesAcct 321 - Managerial AccountingNodeh Deh SpartaNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Course Work On Overheads EtcDocument5 pagesCourse Work On Overheads EtcAkello SuzanNo ratings yet

- Cma Mid TermDocument7 pagesCma Mid TermMehak RasheedNo ratings yet

- Tutorial 4 - Costing For OverheadDocument5 pagesTutorial 4 - Costing For OverheadMuhammad Alif100% (1)

- Activity Based Costing HCCDocument8 pagesActivity Based Costing HCCIhsan danishNo ratings yet

- 44767icaibos34551cp3 (Unlocked by WWW - Freemypdf.com)Document38 pages44767icaibos34551cp3 (Unlocked by WWW - Freemypdf.com)yash mallNo ratings yet

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerRahul AgrawalNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Cost Accounting (CC) (Code: 52414404) : AssignmentDocument4 pagesCost Accounting (CC) (Code: 52414404) : AssignmentAnkushNo ratings yet

- Ex3 Accounting For FOHDocument7 pagesEx3 Accounting For FOHLemuel ReñaNo ratings yet

- AC411 Practice QuestionsDocument44 pagesAC411 Practice QuestionsTiya AmuNo ratings yet

- 13 OhDocument12 pages13 OhLakshay SharmaNo ratings yet

- Handout ThreeDocument29 pagesHandout ThreeDhanushika SamarawickramaNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Accountancy and Management ACADEMIC YEAR 2020/2021 Bachelor of Accounting (Hons.)Document4 pagesUniversiti Tunku Abdul Rahman Faculty of Accountancy and Management ACADEMIC YEAR 2020/2021 Bachelor of Accounting (Hons.)Shi Yan LNo ratings yet

- May 2021 G1 Test2Document4 pagesMay 2021 G1 Test2Dipak UgaleNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions Short Answer Type Questions From Misc ChaptersDocument44 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions Short Answer Type Questions From Misc ChaptersVarinder AnandNo ratings yet

- 3 RTP Nov 21Document34 pages3 RTP Nov 21Bharath Krishna MVNo ratings yet

- 66088bos53351inter p3Document34 pages66088bos53351inter p3Asfarin ShaikhNo ratings yet

- Example - ABCDocument7 pagesExample - ABCFelicia ChinNo ratings yet

- Activity Based Cost Accounting ProblemsDocument3 pagesActivity Based Cost Accounting ProblemsVicky VigneshNo ratings yet

- b5 Special Solving Set 5Document6 pagesb5 Special Solving Set 5MSHANA ALLYNo ratings yet

- P8_Practice Test Paper Cost and Financial ManagementDocument5 pagesP8_Practice Test Paper Cost and Financial ManagementSparsh NandaNo ratings yet

- Costing MTP g1Document198 pagesCosting MTP g1Jattu TatiNo ratings yet

- 3 Process and Job Order Costing System 2019Document8 pages3 Process and Job Order Costing System 2019Abdallah SadikiNo ratings yet

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDocument5 pagesPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be Answeredapi-19836745No ratings yet

- 102.COAP - .L I Question CMA Special Examination 2021novemberDocument4 pages102.COAP - .L I Question CMA Special Examination 2021novemberleyaketjnuNo ratings yet

- 12914sugg_pe2_gp2_1Document33 pages12914sugg_pe2_gp2_1harshrathore17579No ratings yet

- HACC428 Tutorial QuestionsDocument36 pagesHACC428 Tutorial QuestionstapiwanashejakaNo ratings yet

- Afar CostDocument9 pagesAfar CostDiana Faye CaduadaNo ratings yet

- SCM Unit 2 ProblemsDocument6 pagesSCM Unit 2 ProblemsAASTHA BAJAJ 2117013No ratings yet

- Managerial Accounting - Mid Term Exam PDFDocument4 pagesManagerial Accounting - Mid Term Exam PDFNavya AgrawalNo ratings yet

- Q & A - Sept 2018 - ABCDocument5 pagesQ & A - Sept 2018 - ABCvipsc201505No ratings yet

- AFM JUNE 2003 QT ANSDocument25 pagesAFM JUNE 2003 QT ANSBijay AgrawalNo ratings yet

- AFM JUNE 2005 QT ANSDocument25 pagesAFM JUNE 2005 QT ANSBijay AgrawalNo ratings yet

- Yes BankDocument12 pagesYes BankBijay AgrawalNo ratings yet

- 5. SwapsDocument119 pages5. SwapsBijay AgrawalNo ratings yet

- AFM JUNE 2010 QT ANSDocument21 pagesAFM JUNE 2010 QT ANSBijay AgrawalNo ratings yet

- CHAPTER 14 INTEREST RATE AND CURRENCY SWAPS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSDocument15 pagesCHAPTER 14 INTEREST RATE AND CURRENCY SWAPS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSBijay AgrawalNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - AnswersDocument8 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - AnswersBijay AgrawalNo ratings yet

- QT MAY 2018Document24 pagesQT MAY 2018Bijay AgrawalNo ratings yet

- VODAFONE IDEADocument4 pagesVODAFONE IDEABijay AgrawalNo ratings yet

- 6A MTP OCT 2020Document13 pages6A MTP OCT 2020Bijay AgrawalNo ratings yet

- QT MAY 2019Document20 pagesQT MAY 2019Bijay AgrawalNo ratings yet

- AFMDocument27 pagesAFMBijay AgrawalNo ratings yet

- Strategic-Cost-mngt.-May-18Document33 pagesStrategic-Cost-mngt.-May-18Bijay AgrawalNo ratings yet

- QT JAN 2021Document24 pagesQT JAN 2021Bijay AgrawalNo ratings yet

- The Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveDocument12 pagesThe Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveMallesh ArjaNo ratings yet

- RM May 2020 MTP SDocument10 pagesRM May 2020 MTP SdsdsNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperDocument10 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperBijay AgrawalNo ratings yet

- FAFD ICAI Indentity Theft Investigation ReportDocument9 pagesFAFD ICAI Indentity Theft Investigation ReportArvind KumarNo ratings yet

- Private credit & private equity Decision drivers for today’s marketsDocument5 pagesPrivate credit & private equity Decision drivers for today’s marketsBijay AgrawalNo ratings yet

- f9 2006 Dec PPQDocument17 pagesf9 2006 Dec PPQMuhammad Kamran KhanNo ratings yet

- Vassili Joannidès de Lautour - Strategic Management Accounting, Volume I - Aligning Strategy, Operations and Finance-Springer (2018)Document320 pagesVassili Joannidès de Lautour - Strategic Management Accounting, Volume I - Aligning Strategy, Operations and Finance-Springer (2018)muhamad.ichwaniNo ratings yet

- AUDIT NOTES CA BOSDocument30 pagesAUDIT NOTES CA BOSBijay AgrawalNo ratings yet

- Strategic Management Accounting, Volume III Aligning Ethics, Social Performance and Governance (Vassili Joannidès de Lautour) (Z-Library)Document245 pagesStrategic Management Accounting, Volume III Aligning Ethics, Social Performance and Governance (Vassili Joannidès de Lautour) (Z-Library)Bijay AgrawalNo ratings yet

- 71467-exam57501-p3-nilDocument20 pages71467-exam57501-p3-nilBijay AgrawalNo ratings yet

- NMC GOLD FINANCE LIMITED - Forensic Report 1Document11 pagesNMC GOLD FINANCE LIMITED - Forensic Report 1Anand KhotNo ratings yet

- Forensic Report 2 - Gopal Jewellers LimitedDocument24 pagesForensic Report 2 - Gopal Jewellers LimitedMeena BhagatNo ratings yet

- A2.2 Strategic Performance Management (QP)Document10 pagesA2.2 Strategic Performance Management (QP)Bijay AgrawalNo ratings yet

- AUDIT KAMAL GARGDocument54 pagesAUDIT KAMAL GARGBijay AgrawalNo ratings yet

- CA_Intermediate_PAPER_–_5_AUDITING_AND_ETHICS_MTP_Series_2_QuestionDocument13 pagesCA_Intermediate_PAPER_–_5_AUDITING_AND_ETHICS_MTP_Series_2_QuestionBijay AgrawalNo ratings yet

- Answerstohomework 5 Summer 2013Document21 pagesAnswerstohomework 5 Summer 2013GoodnessNo ratings yet

- Tybaf Sem6 Fm-Iii Apr19Document6 pagesTybaf Sem6 Fm-Iii Apr19rizwan hasmiNo ratings yet

- Sri Fitri Wahyuni, SE.,M.M., Muhammad Shareza Hafiz.,SE.,M.AccDocument19 pagesSri Fitri Wahyuni, SE.,M.M., Muhammad Shareza Hafiz.,SE.,M.AccSuci JuniartikaNo ratings yet

- Finalcial Ratio Analysis of Padma Textile MillsDocument25 pagesFinalcial Ratio Analysis of Padma Textile Millsrehan18No ratings yet

- Capital and Commodity Market OverviewDocument62 pagesCapital and Commodity Market OverviewPradeep Pradip100% (1)

- ACT1205 Online Quiz 13 Shareholders Equity - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONS PDFDocument5 pagesACT1205 Online Quiz 13 Shareholders Equity - AUDITING AND ASSURANCE PRINCIPLES - CONCEPTS AND APPLICATIONS PDFjau chiNo ratings yet

- The Ultimate Guide To Profitable Option SellingDocument72 pagesThe Ultimate Guide To Profitable Option Sellingsatyansh blackNo ratings yet

- EPIC HY Report 2023Document54 pagesEPIC HY Report 2023Uday KiranNo ratings yet

- DRAFT RED HERRING PROSPECTUS FOR COMPUTER AGE MANAGEMENT SERVICES LIMITEDDocument275 pagesDRAFT RED HERRING PROSPECTUS FOR COMPUTER AGE MANAGEMENT SERVICES LIMITEDNihal YnNo ratings yet

- Chapter 14 Homework: Brief Exercise 14-8Document9 pagesChapter 14 Homework: Brief Exercise 14-8Nhel AlvaroNo ratings yet

- CVP Analysis QA AllDocument63 pagesCVP Analysis QA Allg8kd6r8np2No ratings yet

- The Search For Entrepreneurial CapitalDocument5 pagesThe Search For Entrepreneurial CapitalAngelie Anillo100% (1)

- TOA DRILL 3 (Practical Accounting 2)Document14 pagesTOA DRILL 3 (Practical Accounting 2)ROMAR A. PIGANo ratings yet

- Doing Business in DubaiDocument23 pagesDoing Business in DubaiAmira MohamedNo ratings yet

- Nifty 100 Quality 30Document4 pagesNifty 100 Quality 30Suhas SalehittalNo ratings yet

- Bank Management: 5Th Edition. Timothy W. Koch and S. Scott MacdonaldDocument36 pagesBank Management: 5Th Edition. Timothy W. Koch and S. Scott Macdonaldpisquito30No ratings yet

- Repici MuluDocument17 pagesRepici MuluDEVAN VITO VALENTINONo ratings yet

- Cambridge O Level: Accounting 7707/22 May/June 2022Document16 pagesCambridge O Level: Accounting 7707/22 May/June 2022Kutwaroo GayetreeNo ratings yet

- Tutorial Chapter 5 Agr323Document2 pagesTutorial Chapter 5 Agr323faiztarmiziNo ratings yet

- Mohnish Pabrai Chicago Meeting 2009 NotesDocument3 pagesMohnish Pabrai Chicago Meeting 2009 NotesalexprywesNo ratings yet

- 14239Document89 pages14239maxeytm_839061685No ratings yet

- Securities and Exchange Commission (SEC) - Form3Document2 pagesSecurities and Exchange Commission (SEC) - Form3highfinanceNo ratings yet

- Advanced Financial Accounting 8th Edition Baker Test BankDocument37 pagesAdvanced Financial Accounting 8th Edition Baker Test BankAlexisReedowjtfNo ratings yet

- India Post Conference Notes Day 1 Feb 12 EDELDocument104 pagesIndia Post Conference Notes Day 1 Feb 12 EDELjayantsharma04No ratings yet

- Presentation 1Document14 pagesPresentation 1john patraNo ratings yet

- Financial Management For Engineers Fall 2021 Calculating Yield (Bond) Using BA II Plus CalculatorDocument5 pagesFinancial Management For Engineers Fall 2021 Calculating Yield (Bond) Using BA II Plus CalculatorRussul Al-RawiNo ratings yet

- 5865489Document46 pages5865489Amit JhaNo ratings yet

- Unclaimed 1st Interim Dividend 2009 10 PDFDocument44 pagesUnclaimed 1st Interim Dividend 2009 10 PDFArvind R PissayNo ratings yet

- Income TaxDocument22 pagesIncome Taxrr520196No ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingGonzaloNo ratings yet

- Econ Chapter 5Document30 pagesEcon Chapter 5nunutsehaynuNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)