Professional Documents

Culture Documents

HDFC Sec Note - Sovereign Gold Bond 2020-21 - Series XI

Uploaded by

baapkabadla2Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HDFC Sec Note - Sovereign Gold Bond 2020-21 - Series XI

Uploaded by

baapkabadla2Copyright:

Available Formats

Sovereign Gold Bond –

Series XI

Sovereign Gold Bond 2020-21 – Series XI

30-Jan-2021

Investment Products Team

Sovereign Gold Bond –

Series XI

Prologue:

Government of India, in consultation with the Reserve Bank of India, has decided to issue Sovereign Gold Bonds (SGB), 2020-21 Series XI. Applications for

the bonds will be accepted between February 01, 2021 and February 05, 2021. The Certificate of Bond(s) will be issued on February 09, 2021.

The issue price of the Sovereign Gold Bond for this Series has been fixed at Rs. 4,862 (Rupees four thousand eight hundred and sixty-two only) per gram

of gold for those who subscribe online and pay through digital mode and Rs. 4,912 (Rupees four thousand nine hundred and twelve only) per gram for

others.

Forthcoming Issues in FY 20-21:

Tranche Date of Subscription Date of Issuance

1 2020-21 Series XII Mar 01, 2021 - Mar 05, 2021 Mar 09, 2021

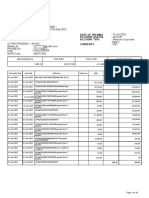

Details of all the tranche issues in FY20 & FY21:

Series Month Issue price/gram No. of units (grams)

FY20 - I Jun 2019 Rs. 3146 - 3196 4,59,789

FY20 - II Jul 2019 Rs. 3393 – 3443 5,35,947

FY20 - III Aug 2019 Rs. 3449 – 3499 10,24,837

FY20 - IV Sept 2019 Rs. 3840 - 3890 6,27,892

FY20 - V Oct 2019 Rs. 3738 – 3788 4,55,776

FY20 - VI Oct 2019 Rs. 3785 - 3835 6,93,210

FY20 - VII Dec 2019 Rs. 3745 - 3795 6,48,304

FY20 - VIII Jan 2020 Rs. 3966 – 4016 5,22,119

FY20 - IX Feb 2020 Rs. 4020 - 4070 4,05,957

FY20 - X Mar 2020 Rs. 4210 – 4260 7,57,338

FY21 - I Apr 2020 Rs. 4589 – 4639 17,72,874

FY21 - II May 2020 Rs. 4540 – 4590 25,44,294

FY21 - III June 2020 Rs. 4627 – 4677 23,88,328

FY21 - IV July 2020 Rs. 4802 - 4852 41,30,820

FY21 - V Aug 2020 Rs. 5284 - 5334 63,49,781

FY21 - VI Sept 2020 Rs. 5067 - 5117 31,90,133

FY21 - VII Oct 2020 Rs. 5001- 5051 18,59,518

FY 21 – VIII Nov 2020 Rs. 5127 – 5177 15,73,457

FY 21 – IX Dec 2020 Rs. 4,950 – 5000 28,69,886

FY 21 – X Jan 2021 Rs. 5,054 – 5,104 12,14,048

Offering gold bonds at a discount of Rs 50/gm for online/digital payment: Nominal value of per unit of bond is fixed basis the simple average of closing

price of 999 purity gold published by India Bullion and Jewelers Associations Ltd. (IBJA) for last 3 business days of the week preceding the subscription

period (Jan 27 – Jan 29). The current tranche is priced at Rs 4,912 per gram. Government of India, in consultation with the Reserve Bank of India, has

decided to offer a discount of Rs 50 per gram on the nominal value of the Sovereign Gold Bond those who subscribe online and pay through digital mode.

Gold update:

Gold price have remained range bound in January 2021, where it traded in a range

of ~ $1850-$1900 per ounce. Gold prices were mainly reacting to the movement in

U.S. dollar and U.S. Treasury yield, prompted by odd developments on the first

relief stimulus in the U.S. announced by President Joe Biden. For calendar year to

date, gold has delivered negative returns of 1.44% in dollar terms as of 29th January

2021.

Gold prices traded with a positive bias almost for calendar year 2020 amid

mounting concerns over the global economic slowdown, heightened geo-political

tensions, historically low and negative interest rates. Investment in gold should be

more of an asset allocation and diversification strategy (5-10% of portfolio) due to

its low correlation with other asset classes.

Investment Products Team

Sovereign Gold Bond –

Series XI

Key benefits:

The issue price that is fixed at Rs. 50 less than the nominal value for per gram for digital applications is beneficial for investors. This helps investors to get

slightly higher returns than that of the gold price in the spot market.

Sovereign Gold Bonds deliver two streams of returns. One in the form of regular interest of (2.50% p.a.) on invested capital every six months and the other

in the form of capital gains at the time of redemption in case the price at the time of redemption is higher.

Bonds are freely tradable on stock exchanges within a fortnight of the issuance on a date notified by the RBI.

The bonds will be available both in demat and paper form.

In Union budget 2016, Finance Minister exempted capital gains tax on redemption on such bonds (under normal case, LTCG tax is levied 20% with

indexation on gain). Indexation benefits will be provided to long term capital gains arising to any person on transfer of bond.

Basic Details:

Interest Rate: The Sovereign Gold Bonds offer an interest rate of 2.50% per annum payable semi-annually. Interest will be credited semi-annually to the

bank account of the investor.

Eligible Investors: The Bonds will be restricted for sale to resident Indian entities including Resident Individuals, HUFs, Trusts, Universities, Charitable

Institutions and minors applying (through their guardian).

Minimum application criteria: 1 unit (i.e. 1 gram of gold).

Maximum application limit: Not be more than 4kg for individuals/HUFs and 20kgs for trusts per fiscal year (April-March).

Tenor: The tenor of the Bond period is 8 years with exit option after the 5th year of the date of issue and such redemptions shall be made on the next

interest payment dates.

Redemption price: The sovereign gold bonds will be redeemed for cash at the end of the investment tenure. Redemption will take place at the prevailing

gold price (based on simple average of closing price of gold of 999 purity of previous 3 business days from the date of redemption, published by the IBJA),

giving the investor the value of the bond plus capital appreciation/depreciation from increase/fall in gold price.

Premature redemption: From 5th year, investors can approach the concerned bank/Post Office/agent thirty days before the coupon payment date.

Request for premature redemption can only be entertained if the investor approaches the concerned bank/post office at least one day before the coupon

payment date.

Liquidity: Liquidity is available from secondary markets as these bonds are mandated to be listed on BSE and NSE. However, the liquidity of the past issues

are quite low and restricted only to few tranches. Most of the past series of SGBs are trading at a discount to the gold prices due to lack of liquidity and

depth in the market.

Nomination facility: Yes. Nomination and its cancellation shall be made in Form ‘D’ and Form ‘E’, respectively.

Loan against Bonds: Available. The loan-to-value (LTV) ratio is to be set equal to ordinary gold loan mandated by the Reserve Bank from time to time.

Transfer: The Bonds shall be transferable by execution of an Instrument of transfer as in Form ‘F’.

Taxation: Interest on the Bonds shall be taxable as per the provisions of the Income-tax Act, 1961. Capital gains tax treatment (except in case of

redemption) will be the same as that for physical gold (20% tax after indexation benefit if held for three years). TDS is not applicable on the bond

interest/redemption proceeds.

The redemption of these sovereign gold bonds by an individual will be exempt from capital gains tax. Long-term capital gains to any person on transfer of

sovereign gold bonds shall be eligible for indexation benefits.

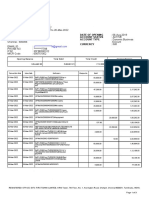

Issue Details of SGBs:

Issue Year Issue price/gram No. of units (grams)

2015 – 16 Rs. 2600 – 2916 49,03,285

2016 – 17 Rs. 2893 – 3150 1,13,87,765

2017 – 18 Rs. 2780 – 2987 65,24,691

2018 – 19 Rs. 3114 – 3326 20,30,873

2019 – 20 Rs. 3196 – 4260 61,31,169

2020 – 21 so far Rs. 4590 – 5334 2,78,93,139

What are the benefits of buying these bonds in comparison to physical gold?

No impurity risk – These bonds are denoted by 999 purity. When one buys physical gold from jeweller, purity of the metal could be a concern

No storage risk or cost of storage – Storing physical gold could be a risky affair and involves storage/locker/insurance charges. None of these are applicable

for SGBs

No default/counterparty risk – Physical gold holders could be exposed to counterparty risk, whereas SGBs are backed by the government and issued by

RBI on behalf of the central government

No GST or STT – Purchase of physical gold attracts GST. SGBs do not attract GST and there is no STT charged on SGB trades

Investment Products Team

Sovereign Gold Bond –

Series XI

Comparison between Sovereign Gold Bonds and Gold ETF:

Two Streams of Returns – SGBs deliver returns in form of interest income (2.50% p.a) on invested capital and in form of capital appreciation at the time

of redemption, in case the price at the time of redemption is higher. ETFs generate returns only through capital appreciation if the price at the time of

redemption is higher.

Transaction charges - Investors have to bear the transaction charges if they want to trade in Gold ETF while there is no such charge involved with SGBs.

Expenses - Gold ETF deducts some charges in the name of TER (Total Expenses Ratio) from the total assets. This expense ratio ranges from 0.35% - 1.17%

per annum of the total assets.

Liquidity - Gold ETFs scores over SGBs when it comes to liquidity. Investors can enter/exit from Gold ETF during any working day of the stock exchanges.

Liquidity will not be the constraint (though impact cost may be a hurdle) for the Gold ETF. On the other hand, the encashment/redemption of the Sovereign

Gold bond is allowed after fifth year from the date of issue on coupon payment dates. However, these bonds will be tradable on Exchanges, if held in

demat form (but, liquidity may be limited).

Taxation - No capital gains tax is payable if the sovereign gold bonds are held till maturity, while ETFs held for more than three years attract capital gains

tax (with indexation benefits).

Comparison among Sovereign Gold Bonds, Physical Gold and Gold ETF:

Sovereign Gold Bonds

Particulars Physical Gold Gold ETF

Higher than the price due

Total Return In line with the price Lower than price due to fund expenses

to additional interest payout

Sovereign guarantee Yes No No

Purity of Gold High Variable High

No (No dividend option provided

Interest on the investment Yes No

on Gold ETF)

Capital Appreciation/depreciation Yes Yes Yes

Annual fund management fees No No Yes

Brokers charge on buying No No Yes

Exit / redemption option Only from 5th year Any time exit Any time exit

Tradability Yes Yes Yes

Liquidity Limited Highly liquid Highly liquid

Storage/Insurance charges No Yes No

Quality check required No Yes No

Is capital gain tax payable on gains in SGB?

In case the SGBs are encashed by way of redemption by an individual from the RBI, no capital gains tax is payable.

In case the SGBs are sold before the maturity date on the exchanges, then this exemption is not available. In such a case, the Capital Gains will be levied

(Long term or Short term based on whether it is held for 3 years or more or less than 3 Years) at the applicable rates i.e. short term (at applicable rates to

the investor) and long term (20% after indexation).

Investment Products Team

Sovereign Gold Bond –

Series XI

Disclaimer

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This note has been prepared exclusively for the benefit and internal use of the recipient and does not carry any right of reproduction or disclosure. Neither this note nor any

of its contents maybe used for any other purpose without the prior written consent of HDFC Securities Ltd (HSL)

Information herein is believed to be reliable however HDFC Securities Ltd. does not warrant its completeness or accuracy. Although HDFC Securities Ltd. tries to ensure that

all information and materials in relation to the products, services, facilities, offerings or otherwise provided as part of its website or through any other source of communication,

is correct at the time of inclusion on the communication, it does not guarantee the accuracy of the information

Use of this presentation /note is at the sole risk of the user / client. The data and information provided on the website or in any presentation / note is not professional advice

and should not be relied upon as such. HDFC Securities Ltd. may at any time edit, alter and or remove any information in whole or in part that may be available and that it

shall not be held responsible for all or any actions that may subsequently result into any loss, damage and or liability. Nothing contained herein is to be construed as a

recommendation to use any product or process, and HDFC Securities Ltd. makes no representation or warranty, express or implied that, the use thereof will not infringe any

patent, or otherwise

HDFC Securities Ltd. would have an exclusive discretion to decide the clients who would be entitled to its investing services. HDFC Securities Ltd. also reserves the right to

decide on the criteria based on which clients would be chosen to participate in these services. HDFC Securities Ltd. is incorporated under the regulatory laws of India and

hence adheres to the same laws for entering into or executing an agreement with the client

This note does not purport to contain all the information that the recipient may require. Recipients should not construe any of the contents herein as advice relating to

business, financial, legal, taxation, or investment matters and are advised to consult their own business, financial, legal, taxation and other advisors concerning the company.

This note does not constitute an offer for sale, or an invitation to subscribe for, or purchase equity shares or other assets or securities of the company and the information

contained herein shall not form the basis of any contract. It is also not meant to be or to constitute any offer for any transaction.

As a distributor, HDFC Securities Ltd. does not assume any responsibility or liability arising from the sale of any product and the investor's contract for purchase/sale is directly

with the product provider. HDFC Securities Ltd. may earn a distribution fee from the product provider on completion of sale of such products. To reiterate, HDFC Securities

Ltd. only acts as a Distributor. There is no element of advisory involved.

Investment Products Team

You might also like

- Issue 36Document48 pagesIssue 36Anonymous JrCVpuNo ratings yet

- Welcome LetterDocument4 pagesWelcome LettershannuNo ratings yet

- Sovereign Gold Bond - by AdarshDocument21 pagesSovereign Gold Bond - by AdarshAadarsh ChaudharyNo ratings yet

- Gold Prices FluctuationsDocument6 pagesGold Prices Fluctuationskuldeep_chand10No ratings yet

- On Gems and JewelaryDocument32 pagesOn Gems and Jewelarydeepikakeerthichilkuri100% (1)

- Loan Agreement (Mar 07 2020)Document2 pagesLoan Agreement (Mar 07 2020)Mer DimaNo ratings yet

- Interest CertificateDocument1 pageInterest Certificatebhagyaraju67% (15)

- Gold Investment From Islamic Perspective: The Case of MalaysiaDocument7 pagesGold Investment From Islamic Perspective: The Case of Malaysiahaikal hafizNo ratings yet

- Statement of Account: Date of Opening Account Status Account Type Currency Itify Business ServicesDocument3 pagesStatement of Account: Date of Opening Account Status Account Type Currency Itify Business ServicesSiddharth JayaseelanNo ratings yet

- Buy the Dip?: Investing in Decentralized Finance and Trading Cryptocurrency, 2022-2023 - Bull or bear? (Smart & profitable strategies for beginners)From EverandBuy the Dip?: Investing in Decentralized Finance and Trading Cryptocurrency, 2022-2023 - Bull or bear? (Smart & profitable strategies for beginners)No ratings yet

- Gold ProjectDocument72 pagesGold ProjectSupriyadasguptaNo ratings yet

- 1800 FED - Gold Bullion ProcedureDocument2 pages1800 FED - Gold Bullion Procedureamarsdeo100% (3)

- Your Savings A/C Status:: Madina Fresh Chicken Center - Primary Account Holder NameDocument15 pagesYour Savings A/C Status:: Madina Fresh Chicken Center - Primary Account Holder NameZaika CateringNo ratings yet

- SGB - Product Note With PriceDocument9 pagesSGB - Product Note With PriceYash SoniNo ratings yet

- Loan Approval Letter: Reliance Finance GroupDocument4 pagesLoan Approval Letter: Reliance Finance GroupDracula hexorNo ratings yet

- Sovereign Gold Bonds (SGBS) - 2016 - Tranche - Iii Issue: Retail ResearchDocument3 pagesSovereign Gold Bonds (SGBS) - 2016 - Tranche - Iii Issue: Retail ResearchDinesh ChoudharyNo ratings yet

- SGB Scheme 2020-21 CalendarDocument3 pagesSGB Scheme 2020-21 Calendarkranti kiran kandimallaNo ratings yet

- WWRPL Oct-19Document12 pagesWWRPL Oct-19Sanjay KumarNo ratings yet

- 51 Talk Summary of Arrearages On Rent and CaumfDocument3 pages51 Talk Summary of Arrearages On Rent and CaumfRufo Daskeo Jr.No ratings yet

- Connect Connect Connect Connect: NRI NRI NRI NRIDocument7 pagesConnect Connect Connect Connect: NRI NRI NRI NRIramshankar16No ratings yet

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Document57 pagesWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Luke RobinsonNo ratings yet

- 306 StatmentPrinTLAc S SLPUB13064 16nov2021 023102 738Document1 page306 StatmentPrinTLAc S SLPUB13064 16nov2021 023102 738bajirav gavkarNo ratings yet

- Savings TrackerDocument34 pagesSavings TrackerVedant MahajanNo ratings yet

- Repayment Schedule: Agreement DetailsDocument2 pagesRepayment Schedule: Agreement DetailsNikhilesh MallickNo ratings yet

- Loan Repayment Schedule: Input ResultDocument7 pagesLoan Repayment Schedule: Input Resultbiswajit1989285No ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- Bonds Price Daily - WMGDocument1 pageBonds Price Daily - WMGAhmad DardaNo ratings yet

- Trends of C.P. MarketDocument14 pagesTrends of C.P. Marketmayankpoddar009No ratings yet

- Smart Investment 04 February 2024Document90 pagesSmart Investment 04 February 2024mittalashish001No ratings yet

- Amortization PNBDocument10 pagesAmortization PNBPiyushaNo ratings yet

- Ri NC 130320 000011Document12 pagesRi NC 130320 000011Raj Kothari MNo ratings yet

- Account Statement From 9 Nov 2019 To 9 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 9 Nov 2019 To 9 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDileep TeruNo ratings yet

- Smart Investment English EDocument58 pagesSmart Investment English Eram kiranNo ratings yet

- Assignment 2 28069Document8 pagesAssignment 2 28069Rishibha SinglaNo ratings yet

- Smart InvestmentDocument72 pagesSmart InvestmentGourab ChakrabortyNo ratings yet

- The Need To InvestDocument10 pagesThe Need To InvestÂj AjithNo ratings yet

- Second Merit List For Admission To The M.Sc. Neurosciences Course (2020-21)Document4 pagesSecond Merit List For Admission To The M.Sc. Neurosciences Course (2020-21)RashmiNo ratings yet

- FEDERALBankstatementDocument8 pagesFEDERALBankstatementVivek Kumar SharmaNo ratings yet

- Smart Investment (E-Copy) Vol 15 Issue No. 48 (8th January 2023)Document82 pagesSmart Investment (E-Copy) Vol 15 Issue No. 48 (8th January 2023)Keshav KhetanNo ratings yet

- Salling SkillsDocument2 pagesSalling SkillsAnjali ShahNo ratings yet

- ES LoanStatement B81a8afe6bDocument2 pagesES LoanStatement B81a8afe6bLohith BanothNo ratings yet

- Reliance Industries Limited: Company InformationDocument4 pagesReliance Industries Limited: Company Informationujjwalahuja072No ratings yet

- Smart 30-01Document75 pagesSmart 30-01humbleNo ratings yet

- Account Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Document6 pagesAccount Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Khaja Naseeruddin MuhammadNo ratings yet

- NRI NewsLetter December13Document8 pagesNRI NewsLetter December13Akshay NalawadeNo ratings yet

- Newsletter Oct 2023 Volume 22 FinalDocument15 pagesNewsletter Oct 2023 Volume 22 FinalFun thingsNo ratings yet

- Smart 17-04-22Document71 pagesSmart 17-04-22humbleNo ratings yet

- GPF Calculator 2020 PDFDocument7 pagesGPF Calculator 2020 PDFOfficial SAGNo ratings yet

- Smart Investment English E-Copy (Document63 pagesSmart Investment English E-Copy (ram kiranNo ratings yet

- Ministry of Finance of The Republic of IndonesiaDocument2 pagesMinistry of Finance of The Republic of IndonesiaToto PieterNo ratings yet

- Smart Investment (E-Copy) Vol 17 Issue No. 10 (14th April 2024)Document82 pagesSmart Investment (E-Copy) Vol 17 Issue No. 10 (14th April 2024)Vishwanath PatilNo ratings yet

- Financial Statements 2020: Half YearlyDocument2 pagesFinancial Statements 2020: Half Yearlyshahid2opuNo ratings yet

- Loan Details Charges: Customer Portal ExperiaDocument4 pagesLoan Details Charges: Customer Portal ExperiaAlpesh KuleNo ratings yet

- BoostDocument811 pagesBoostVeeranki DavidNo ratings yet

- VLPK PF StatementDocument1 pageVLPK PF StatementhariveerNo ratings yet

- Schema CWD200040004 FactSheetDocument6 pagesSchema CWD200040004 FactSheetIrfanNo ratings yet

- Account Statement From 1 Jun 2020 To 30 Jun 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jun 2020 To 30 Jun 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRavikumarGrkumarNo ratings yet

- Union - Sandesh August 2021Document5 pagesUnion - Sandesh August 2021Visnu SankarNo ratings yet

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Document54 pagesWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Lingesh SivaNo ratings yet

- Maturity Profile of Schemes (Cash Flow Projections) Basis Portfolio Holdings As On June 30, 2021Document3 pagesMaturity Profile of Schemes (Cash Flow Projections) Basis Portfolio Holdings As On June 30, 2021MF AssistantNo ratings yet

- Finance and AccountsDocument4 pagesFinance and AccountsNavneet AgrawalNo ratings yet

- Ifm Cia 1Document9 pagesIfm Cia 1Ari HaranNo ratings yet

- Ramesh GPFDocument2 pagesRamesh GPFSHARANUNo ratings yet

- Arrear JosephDocument1 pageArrear JosephChief Of AuditNo ratings yet

- Maturity - Profile - Holdings Asdecember152020Document3 pagesMaturity - Profile - Holdings Asdecember152020mahesh_mzp1954No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Buying Gold Gold Coins and Bullion OnlineDocument2 pagesBuying Gold Gold Coins and Bullion Onlinecarepatio6No ratings yet

- My ProjDocument105 pagesMy ProjvashishtagNo ratings yet

- Company Background: Stable of Funds IncludeDocument27 pagesCompany Background: Stable of Funds IncludeHakim IshakNo ratings yet

- SaranshYadav Project Report GoldDocument25 pagesSaranshYadav Project Report Goldanon_179532672No ratings yet

- Harte Gold Mda Ye 2019 FinalDocument30 pagesHarte Gold Mda Ye 2019 FinalNestor CordovaNo ratings yet

- Gold Forecast 2010Document12 pagesGold Forecast 2010Mohamed Said Al-QabbaniNo ratings yet

- Ebook - How To Buy Gold and SilverDocument14 pagesEbook - How To Buy Gold and SilverJawan StarlingNo ratings yet

- Gold Survey 2013 Update 2: Prepared by Thomson Reuters GFMSDocument44 pagesGold Survey 2013 Update 2: Prepared by Thomson Reuters GFMSVaggelis PanagiotopoulosNo ratings yet

- A Study On The Impact of Volatility in Gold Price On The CustomersDocument12 pagesA Study On The Impact of Volatility in Gold Price On The CustomersVishwas DeveeraNo ratings yet

- KISI PT Aneka Tambang TBK (ANTM) Steady Gold PricesDocument13 pagesKISI PT Aneka Tambang TBK (ANTM) Steady Gold PricesKacang GorengNo ratings yet

- Commerce Project Sem4Document10 pagesCommerce Project Sem4Sahil ParmarNo ratings yet

- EE Version 1.1Document26 pagesEE Version 1.1yoville5No ratings yet

- Final - Goldcorp Aif Sedar - v001 - M4a6xyDocument134 pagesFinal - Goldcorp Aif Sedar - v001 - M4a6xyukyo116No ratings yet

- Macroeconomics Project ReportDocument34 pagesMacroeconomics Project ReportAmrita DasNo ratings yet

- PMGT WhitepaperDocument56 pagesPMGT WhitepapermbidNo ratings yet

- Assignment Financial ManagementDocument6 pagesAssignment Financial ManagementMinh Hằng TrịnhNo ratings yet

- Part I II Worldbank Presentation 5607 - Frank VenerosoDocument52 pagesPart I II Worldbank Presentation 5607 - Frank VenerosoThorHollis100% (1)

- Commercial Bank of Ethiopia: Business Development DivisionDocument43 pagesCommercial Bank of Ethiopia: Business Development DivisionZenebe ZelelewNo ratings yet

- The Gold Standard Journal 12Document13 pagesThe Gold Standard Journal 12ulfheidner9103No ratings yet

- Physical Gold Is Not Physical Gold - Swiss GoldplanDocument2 pagesPhysical Gold Is Not Physical Gold - Swiss GoldplantigerkillerNo ratings yet

- Live Biography of Two Entrepreneur of Sylhet CityDocument30 pagesLive Biography of Two Entrepreneur of Sylhet CityShanu Uddin Rubel100% (1)

- FAQs On Sovereign Gold Bond SCHEME Annx1Document6 pagesFAQs On Sovereign Gold Bond SCHEME Annx1Alok Kr MishraNo ratings yet

- IIR Bluebook March 2017 v2 1Document73 pagesIIR Bluebook March 2017 v2 1Matt EbrahimiNo ratings yet

- Gold Price PredictionDocument14 pagesGold Price Predictionswetha reddy100% (1)