Professional Documents

Culture Documents

Cameroon Tax

Uploaded by

Amba Fred0 ratings0% found this document useful (0 votes)

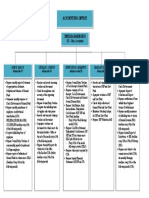

6 views1 pageThe document outlines the roles and procedures for a tax office principal. The principal is responsible for monthly tax declarations including VAT, DSF, patent and business licenses. The principal extracts tax performance data from accounting software, calculates draft tax returns, and sends them to entities for validation within 72 hours. Once validated, final returns are prepared and payments are processed and receipts sent back to the tax department. Regular reporting to senior management is also required.

Original Description:

Original Title

Cameroon tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the roles and procedures for a tax office principal. The principal is responsible for monthly tax declarations including VAT, DSF, patent and business licenses. The principal extracts tax performance data from accounting software, calculates draft tax returns, and sends them to entities for validation within 72 hours. Once validated, final returns are prepared and payments are processed and receipts sent back to the tax department. Regular reporting to senior management is also required.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageCameroon Tax

Uploaded by

Amba FredThe document outlines the roles and procedures for a tax office principal. The principal is responsible for monthly tax declarations including VAT, DSF, patent and business licenses. The principal extracts tax performance data from accounting software, calculates draft tax returns, and sends them to entities for validation within 72 hours. Once validated, final returns are prepared and payments are processed and receipts sent back to the tax department. Regular reporting to senior management is also required.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Role / Job Principal Procedure Recommendatio

Title duties

Tax office Monthly Extract information on performance for each entity from Odoo software.

declarations Determine the tax base

VAT Compute draft tax return in collaboration with each entity

DSF Sent the draft tax returns to GMs and financial department of each entity for

Patent validation within 72 hrs

Business After validation the draft is sent back to the tax department and the final returns

license are prepared and sent to entities to execute the payment

Rental tax For payments by cash, the cash must be available by the 10th of each month

Lease After payment a copy of the payment receipt is sent to the tax department

registration For VAT and monthly declarations draft tax returns must be sent to the entities

Payroll latest the 5TH of each month

taxes Draft returns for DSF must be sent to entities latest the 31st of January

(handled by VAT, payroll taxes and monthly declarations must be paid before the 15 th of each

CAMES) month (for the previous month)

Patent and business licenses payable before 28th February

DSF payable before 31st march.

Reporting Reports are prepared periodically and submit to PDG

Supervision /

Control

You might also like

- Compliance CalenderDocument4 pagesCompliance CalenderSubhash VishwakarmaNo ratings yet

- GurpreetDocument11 pagesGurpreetRahul MehraNo ratings yet

- Indian ComplianceDocument29 pagesIndian Compliancekundhavai nambiNo ratings yet

- Account Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDocument4 pagesAccount Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDipesh Jain100% (1)

- PEZA Reportorial RequirementsDocument25 pagesPEZA Reportorial RequirementsDarioNo ratings yet

- Relationship Between Tax Compliance and Tax Dispute (Including TP Documentation)Document37 pagesRelationship Between Tax Compliance and Tax Dispute (Including TP Documentation)ryu255No ratings yet

- Business Challenge - United GroupDocument10 pagesBusiness Challenge - United GroupJohan IswaraNo ratings yet

- Bangladesh Taxation Overview 2Document7 pagesBangladesh Taxation Overview 2Reznov KovacicNo ratings yet

- VALUE ADDED TAX Notes From BIRDocument30 pagesVALUE ADDED TAX Notes From BIREmil BautistaNo ratings yet

- Mandatory Compliance Checklist For Private Limited CompanyDocument14 pagesMandatory Compliance Checklist For Private Limited CompanyCA Mohit GargNo ratings yet

- CV - Abhishek SinglaDocument4 pagesCV - Abhishek SinglaMoHiT chaudharyNo ratings yet

- Webel Technology Limited - 188202395048947Document8 pagesWebel Technology Limited - 188202395048947shafaquesameen2001No ratings yet

- Mandatory Compliance Checklist For Private Limited CompanyDocument6 pagesMandatory Compliance Checklist For Private Limited CompanyParas03No ratings yet

- Compliance Calendar 2020-21Document10 pagesCompliance Calendar 2020-21Suraj SinghNo ratings yet

- Summary Report of Disbursements 2014 2ndqtrDocument2 pagesSummary Report of Disbursements 2014 2ndqtrtesdaro12No ratings yet

- Final AccountsDocument12 pagesFinal AccountsPraveenNo ratings yet

- Presentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Document44 pagesPresentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Franco DurantNo ratings yet

- Doing Business in IndiaDocument43 pagesDoing Business in IndiaSamrat JonejaNo ratings yet

- Private Limited Complinace PlanDocument5 pagesPrivate Limited Complinace PlanKumar NivasNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- Memorandum Order No. 2016-003 - PEZADocument19 pagesMemorandum Order No. 2016-003 - PEZAYee BeringuelaNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CityDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CityPrecious AnonuevoNo ratings yet

- Finance Department FunctionsDocument4 pagesFinance Department Functionsmuhammad saadNo ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- FISCAL PROCEDURE Cameroon TaxationDocument8 pagesFISCAL PROCEDURE Cameroon TaxationAmba FredNo ratings yet

- Vat TDocument29 pagesVat TJean Cristel De ClaroNo ratings yet

- TDS Understanding NotesDocument6 pagesTDS Understanding NotesnaysarNo ratings yet

- Accounts Payable Policy - Final-1Document4 pagesAccounts Payable Policy - Final-1TanzeelNo ratings yet

- Session 5 TDSDocument67 pagesSession 5 TDSsinthiakarim17No ratings yet

- 1 - CV - TaxDocument3 pages1 - CV - TaxFaisal MehmoodNo ratings yet

- WHAT YOU SHOULD KNOW ABOUT PEZAs REPORTORIAL REQUIREMENTSDocument5 pagesWHAT YOU SHOULD KNOW ABOUT PEZAs REPORTORIAL REQUIREMENTSPatrickNo ratings yet

- Ankur TripathiDocument2 pagesAnkur TripathiThe Cultural CommitteeNo ratings yet

- How To Submit Audited Financial StatementDocument4 pagesHow To Submit Audited Financial StatementMark Anthony CasupangNo ratings yet

- Checklist For Partnership ConcernDocument9 pagesChecklist For Partnership Concernm3788999No ratings yet

- Accounting Office: OIC - Mun. AccountantDocument1 pageAccounting Office: OIC - Mun. AccountantCharles Kevin MinaNo ratings yet

- Japonica Payroll PresentationDocument19 pagesJaponica Payroll Presentationoxeeco100% (1)

- Mohammed Khan (SR Accountant) KSA Wup CCDocument21 pagesMohammed Khan (SR Accountant) KSA Wup CCftimum1No ratings yet

- What Is A Prepayment?: PrepaymentsDocument3 pagesWhat Is A Prepayment?: PrepaymentsHuy VuNo ratings yet

- Renewal NoticeDocument7 pagesRenewal NoticeDS SystemsNo ratings yet

- Leida Kristin GardeDocument4 pagesLeida Kristin Garderealjosh21No ratings yet

- Submission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesDocument8 pagesSubmission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesBijiNo ratings yet

- Proposal - RBA Vietnam - Mr. Kevin FoxDocument6 pagesProposal - RBA Vietnam - Mr. Kevin FoxBurt ChutkanNo ratings yet

- TTP Auditing Company LimitedDocument6 pagesTTP Auditing Company LimitedNguyễn Quang SángNo ratings yet

- GST Year End Activities For FY 21-22Document2 pagesGST Year End Activities For FY 21-22saileepatankar3No ratings yet

- ATO STP Phase 2 Income Types-Country Codes Position Paper v1.0Document30 pagesATO STP Phase 2 Income Types-Country Codes Position Paper v1.0Ray WeiNo ratings yet

- Checklist For Partnership ConcernDocument9 pagesChecklist For Partnership Concernm3788999No ratings yet

- GST Returns: BackgroundDocument3 pagesGST Returns: BackgroundPrakash PalanisamyNo ratings yet

- Fi - BBP - 01 GLDocument15 pagesFi - BBP - 01 GLusasidharNo ratings yet

- FIN GL BBP 005 Extended Withholding TaxDocument12 pagesFIN GL BBP 005 Extended Withholding TaxSurani shaiNo ratings yet

- Regulatory Compliance in India PDFDocument6 pagesRegulatory Compliance in India PDFsherylNo ratings yet

- Company Compliances For StartupsDocument6 pagesCompany Compliances For StartupsKrishnendu BhattacharyyaNo ratings yet

- Due Date Calendar Oct 22Document1 pageDue Date Calendar Oct 22Kushal DabhadkarNo ratings yet

- Jasa Perpajakan Dan Pembukuan 3Document4 pagesJasa Perpajakan Dan Pembukuan 3Revli Meyhendra HarbangkaraNo ratings yet

- Accounting Resource 2019Document20 pagesAccounting Resource 2019simphiwemotaung671No ratings yet

- Value Added TaxDocument27 pagesValue Added TaxMark Joseph BajaNo ratings yet

- CK Foods Significant Accounting PoliciesDocument9 pagesCK Foods Significant Accounting PoliciesA YoungNo ratings yet

- VAT NotesDocument23 pagesVAT Notescz82h7z84tNo ratings yet

- POA - D. Adjusting EntriesDocument40 pagesPOA - D. Adjusting EntriesMariñas, Romalyn D.No ratings yet

- What Is Payroll?Document12 pagesWhat Is Payroll?vishnukant mishraNo ratings yet

- Finance and Business Support.Document6 pagesFinance and Business Support.Amba FredNo ratings yet

- 10 Things I've Learned in 10 Years of Running My Own BusinessDocument4 pages10 Things I've Learned in 10 Years of Running My Own BusinessAmba FredNo ratings yet

- Credit Union Document NkwacculDocument46 pagesCredit Union Document NkwacculAmba FredNo ratings yet

- 5 Little Business Practices I Started Doing To Generate Over $1 Million in RevenueDocument3 pages5 Little Business Practices I Started Doing To Generate Over $1 Million in RevenueAmba FredNo ratings yet

- FISCAL PROCEDURE Cameroon TaxationDocument8 pagesFISCAL PROCEDURE Cameroon TaxationAmba FredNo ratings yet