Professional Documents

Culture Documents

Chapter 9

Chapter 9

Uploaded by

KeyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9

Chapter 9

Uploaded by

KeyCopyright:

Available Formats

Chapter 9

• Accrued liabilities - Expenses that have been incurred but have not been paid at the end of the accounting period.

• Annuity - A series of equal amounts of cash that are paid or received at equally distant points in time.

• Contingent liability - A possible liability that is created as a result of a past event; it is not an effective liability until

some future event occurs.

• Current liabilities - Short-term obligations that will be settled within the coming year by providing cash, goods, other

current assets, or services.

• Deferred revenue - Previously recorded liability that needs to be adjusted at the end of the accounting period to

reflect the amount of revenue earned.

• Future value - The sum to which an amount will increase as a result of compound interest.

• Liabilities - Present debts or obligations of the entity to transfer an economic resource as a result of past events.

• Liquidity - The ability to pay current obligations.

• Present value - The current cash equivalent of an amount to be received in the future, or a future amount

discounted for compound interest.

• Provision - A liability of uncertain timing or amount.

• Time value of money - Interest that is associated with the use of money over time.

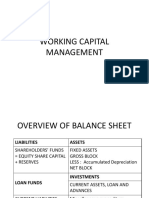

• Working capital - The difference between current assets and current liabilities.

You might also like

- FABM2 - Statement of Financial PositionDocument36 pagesFABM2 - Statement of Financial PositionVron Blatz100% (6)

- CH 25 - Provision, Contingent Liability and AssetDocument5 pagesCH 25 - Provision, Contingent Liability and AssetJm Sevalla100% (1)

- Major Type of AccountsDocument43 pagesMajor Type of AccountsAngelica Ross de LunaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- Actg Chapter 12 NotesDocument6 pagesActg Chapter 12 NotesTran Kim Tram PhanNo ratings yet

- Pelaporan Dan Akuntansi KeuanganDocument48 pagesPelaporan Dan Akuntansi KeuanganHechy HoopNo ratings yet

- Basic Accounting Module Final TermDocument9 pagesBasic Accounting Module Final TermCharizmae MadridNo ratings yet

- Cfas - ReceivablesDocument9 pagesCfas - ReceivablesYna SarrondoNo ratings yet

- Chapter 2Document22 pagesChapter 2John Edwinson JaraNo ratings yet

- ReviewerDocument4 pagesReviewervee.martinez9213No ratings yet

- Main Accounting Standards - Tutor SummaryDocument3 pagesMain Accounting Standards - Tutor SummaryReem JavedNo ratings yet

- (Liabilities) : Lecture AidDocument20 pages(Liabilities) : Lecture Aidmabel fernandezNo ratings yet

- LoansDocument18 pagesLoansAMukherjeeNo ratings yet

- Working Capital ManagementDocument52 pagesWorking Capital ManagementPrashanth GowdaNo ratings yet

- Fabm 1 - Week 4Document3 pagesFabm 1 - Week 4FERNANDO TAMZ2003No ratings yet

- Glossary of Terms Glossary of TermsDocument4 pagesGlossary of Terms Glossary of TermsDaisy Nana MillerNo ratings yet

- ULOa. Liabilities - 1Document47 pagesULOa. Liabilities - 1pam pamNo ratings yet

- Accounting Vocabulary: Illustrated Weekly NewspaperDocument10 pagesAccounting Vocabulary: Illustrated Weekly NewspaperPatricia FaneaNo ratings yet

- Cfas - Cash and Cash EquivalentsDocument5 pagesCfas - Cash and Cash EquivalentsYna SarrondoNo ratings yet

- Fabm Week 4 Study GuideDocument3 pagesFabm Week 4 Study GuideFERNANDO TAMZ2003No ratings yet

- 1 - Current LiabilitiesDocument4 pages1 - Current LiabilitiesAlex JeonNo ratings yet

- Lec 10Document27 pagesLec 10Ritik KumarNo ratings yet

- Financial Appraisal: - Adequacy of Rate of Return - Financing PatternDocument26 pagesFinancial Appraisal: - Adequacy of Rate of Return - Financing PatternTibebu MerideNo ratings yet

- c1 - LiabilitiesDocument44 pagesc1 - LiabilitiesRuiz, CherryjaneNo ratings yet

- FINMAN II - Time Value of MoneyDocument3 pagesFINMAN II - Time Value of MoneyAnne LunaNo ratings yet

- Module 1Document7 pagesModule 1Alextrasza LouiseNo ratings yet

- LECTURE 15 N 16 WORKING CAPITAL MANAGEMENTDocument31 pagesLECTURE 15 N 16 WORKING CAPITAL MANAGEMENTVishal AmbadNo ratings yet

- Ratio AnalysisDocument30 pagesRatio AnalysisSrujana GantaNo ratings yet

- Week 3 SlidesDocument38 pagesWeek 3 SlidesRogelio ParanNo ratings yet

- 1 LiabilitiesDocument39 pages1 LiabilitiesDiana Faith TaycoNo ratings yet

- Intermediate Accounting ReviewerDocument5 pagesIntermediate Accounting ReviewerBroniNo ratings yet

- Chapter 3 (A) -١Document25 pagesChapter 3 (A) -١Mary Y. GamilNo ratings yet

- FAR 2 - HandoutsDocument8 pagesFAR 2 - HandoutsKyle RonquilloNo ratings yet

- Financial AppraisalDocument54 pagesFinancial AppraisalAarsh SainiNo ratings yet

- Simple Interest - Principal AmountDocument4 pagesSimple Interest - Principal AmountAndreev ImutanNo ratings yet

- FAR Chapt. 7Document8 pagesFAR Chapt. 7Ryan GaniaNo ratings yet

- LOB 10 ReviewerDocument5 pagesLOB 10 ReviewernmabaningNo ratings yet

- Review - Short-Term FinanceDocument16 pagesReview - Short-Term FinancekerenkangNo ratings yet

- ShobhitDocument12 pagesShobhitAshutosh GuptaNo ratings yet

- Balance Sheet: - Assets - Liabilities - Stockholder's EquityDocument11 pagesBalance Sheet: - Assets - Liabilities - Stockholder's EquitySASWAT MISHRANo ratings yet

- IAS 12 - Income TaxesDocument1 pageIAS 12 - Income TaxesFeras ShreimNo ratings yet

- Topic7 Ch12 ReceivablesDocument29 pagesTopic7 Ch12 ReceivablesCẩm TúNo ratings yet

- Accounting From A Global PerspectiveDocument58 pagesAccounting From A Global PerspectivezelNo ratings yet

- Ent M5Document5 pagesEnt M5Fransesca ReyesNo ratings yet

- LiabilitiesDocument37 pagesLiabilitiesJamil RiveraNo ratings yet

- FARAP - Liabilities - Part 1Document26 pagesFARAP - Liabilities - Part 1vanNo ratings yet

- BUSI 1004 C - Lecture 10 NotesDocument3 pagesBUSI 1004 C - Lecture 10 Notesstray dog zineNo ratings yet

- Chapter 9 - Current Liabilities: Contingencies, and The Time Value of MoneyDocument8 pagesChapter 9 - Current Liabilities: Contingencies, and The Time Value of MoneyHareem Zoya WarsiNo ratings yet

- Assignment #1: Accounts Title 1. AssetsDocument2 pagesAssignment #1: Accounts Title 1. AssetsEvelyn GayosoNo ratings yet

- MAS Handout - Working Capital Management and Financing PDFDocument5 pagesMAS Handout - Working Capital Management and Financing PDFDivine VictoriaNo ratings yet

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunNo ratings yet

- 1st Quarter DiscussionDocument10 pages1st Quarter DiscussionCHARVIE KYLE RAMIREZNo ratings yet

- Discounted Cash Flows and ValuationDocument31 pagesDiscounted Cash Flows and ValuationkamranNo ratings yet

- Liability and ProvisionDocument45 pagesLiability and ProvisionDenise RoqueNo ratings yet

- Recognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationDocument7 pagesRecognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationMikaela LacabaNo ratings yet

- Ac41 - Chap 5-1Document7 pagesAc41 - Chap 5-1Kissey EstrellaNo ratings yet

- A Present Economic Resource Controlled by The Entity As A Result of Past EventsDocument11 pagesA Present Economic Resource Controlled by The Entity As A Result of Past EventsValeria PetrovNo ratings yet