Professional Documents

Culture Documents

Loan Application Form: Thanvir Bros. Pvt. LTD

Uploaded by

manishasurywanshi91Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Application Form: Thanvir Bros. Pvt. LTD

Uploaded by

manishasurywanshi91Copyright:

Available Formats

THANVIR BROS. PVT. LTD.

LOAN APPLICATION FORM

LOAN APPLICATION NUMBER 3333090550

CUSTOMER NAME Manisha Vijay Surywanshi

GENDER FEMALE

MOBILE NUMBER +918007981499

EMAIL ID manishasurywanshi91@gmail.com

DATE OF LOAN APPLICATION 27-12-2023

ADDRESS -

PERSONAL LOAN (NON-MICROFINANCE WITH CUSTOMER

LOAN TYPE

HOUSEHOLD ANNUAL INCOME MORE THAN INR 3,00,000)

PANCARD NUMBER HFOPS6843R

AADHAAR CARD NUMBER 755444287167

PURPOSE OF LOAN personal

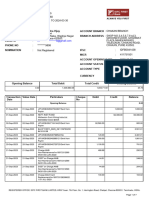

CUSTOMER BANK NAME Ujjivan Small Finance Bank Limited

CUSTOMER BANK ACCOUNT NUMBER (For

disbursement of loan amount and for NACH 4493110010008294

mandate for repayment of loan)

IFSC OF CUSTOMER BANK UJVN0004493

REFERENCE NAME 1 Vijay Surywanshi

REFERENCE NAME 1 MOBILE NUMBER +917385842177

REFERENCE NAME 2 Suraj Parve

REFERENCE NAME 2 MOBILE NUMBER +917498338989

LSP NAME FLEXIDIGITAL TECH INDIA PVT LTD (WWW.TRUSTPAISA.COM)

NBFC NAME THANVIR BROS PVT LTD

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

I hereby confirm my interest in availing loan from M/s. Thanvir Bros Pvt Ltd (“Lender”) and in

relation thereto I have applied for the loan facility by installing /through the Trustpaisa

Mobile App/Web App (“platform”) by submitting my application electronically, and declare

and undertake as under:

1. I confirm that the information submitted by me electronically are true, correct, complete

and up to date in all respects and that such information can be relied upon by the lender for

the purpose of extending loan.

2. I authorize the Lender and its business associates, agents, partners to exchange, share or

part with all the information and authorize to verify any information such as residence,

employment, telephone verification details relating to my existing loans /financial assistance

and/ or repayment history with credit bureaus, business associates, agencies, statutory bodies

etc, as may be required or as it may deem fit and shall not hold the Lender liable for use /

sharing of information.

3. I confirm that there is no insolvency/Bankruptcy proceedings or suits for recovery of

outstanding dues whatsoever and/or any criminal proceeding has been initiated and/or are

pending against me or no action nor other steps have been taken or legal proceedings started

by or against me in any Court of law which will materially adversely impact the availability /

repayment of loan.

4. I acknowledge that the rate of interest on the applied loan to the Lender which is currently

fixed and would be dependent upon market factors, which would be subject to change from

time to time.

5. I understand and acknowledge that the Lender, shall has the absolute discretion, without

assigning any reasons may reject our application and the Lender, not responsible / liable in

any manner whatsoever to me for such rejection and any costs, losses, damages or expenses

or other consequences caused by such rejection of loan application.

6. I understand and acknowledge that in case of rejection of my application, documents

submitted for the processing of my application shall not be returned to me.

7. I agree that the processing fees paid to the Lender or collected, shall not be refunded under

any circumstances if my application for loan is rejected by the Lender on any ground

whatsoever.

8. I We undertake to inform the Lender, regarding any change in my occupation /business/

employment/residence address.

9. I hereby undertake and provide my consent for sharing my details with Central KYC

Registry and/or with credit bureau and/or with regulators in terms of the applicable

laws/regulations. I hereby consent and authorised the Lender to receive KYC information

from Central KYC Registry or from UIDAI for verification and e-signature.

10. I undertake to inform that the funds shall be used for the purpose for which loan has been

applied and will not be used for any improper/illegal/ unlawful purposes.

11. I unconditionally agree and accept that such data which is so provided are inconsistent

may be construed as fraud/cheating/forgery/manipulation/fabrication of documents and agree

that The Lender shall have every right for reporting such Fraud to RBI and/or any other

entities/authorities and shall have liberty to not to process the Loan application/rejecting the

loan application and also taking the necessary action as prescribed by the RBI/or any other

entities/authorities.

12. I hereby authorize the Lender, its channel partners, agencies and/or affiliates to

communicate with me by email, call, SMS, electronic communication using digital media and

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

other channels or via any other means in relation to any of the products, services or

information of the Lender.

13. I am aware that my loan account is governed by various policies of the Lender and other

important information/Key Fact statement/MITC which are amended from time to time as per

directives from RBI, and that the same can be accessed through the Lender’s website i.e.,

www.thanvirbros.in. I shall keep my credentials including the login id and password/PIN

issued by the Lender and/or reset by me (“Credential”) as confidential and not to share the

same with any person/third party. Any use or misuse of the credentials including the

transactions carried out using the credentials shall be my sole responsibility and the Lender

shall not be held responsible for any loss/damage incurred on account of such use or misuse.

Contact Us: If you have any questions regarding the App, you can email us at

help@trustpaisa.com

Amendment:

The Lender may, in its sole discretion, change or modify loan terms and conditions of at any

time, with or without notice. Such changes or modifications shall be made effective for all

Users/Applicants/Co- applicants/Customers upon posting of the modified terms to the

Platform. You/customer is responsible to read this document from time to time to ensure that

your use of the Services remains in compliance with this T&C.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

SANCTION LETTER

This is with reference to your request for SHORT TERM UNSECURED LOAN submitted to M/s.

Thanvir Bros Private Limited via TrustPaisa mobile App/Web app (Platform) maintained by Lending

Service Provider (LSP) FLEXIDIGITAL TECH INDIA PVT LTD (formerly known as Fingular Tech India

Pvt Ltd) on 27-12-2023. We have great pleasure in welcoming you to our family and thank you for

choosing us for your SHORT-TERM UNSECURED LOAN requirement.

With reference to your above ref application, and based on the information provided therein, we, M/s.

Thanvir Bros Private Limited are pleased inform you that your loan has been sanctioned subject to the

terms and conditions specified here under:

KEY FACT STATEMENT

1 DATE OF LOAN APPLICATION 27-12-2023

2 LOAN APPLICATION NUMBER 3333090550

3 CUSTOMER/BORROWER NAME Manisha Vijay Surywanshi

4 GENDER FEMALE

5 MOBILE NUMBER +918007981499

6 EMAIL ID manishasurywanshi91@gmail.com

7 ADDRESS -

PERSONAL LOAN (NON-MICROFINANCE WITH

8 LOAN TYPE CUSTOMER HOUSEHOLD ANNUAL INCOME

MORE THAN INR 3,00,000)

PROOF OF IDENTITY: PANCARD

10 HFOPS6843R

NUMBER

PROOF OF ADDRESS: AADHAAR

11 755444287167

CARD NUMBER

LOAN SANCTION AMOUNT /

DISBURSEMENT TO CUSTOMER

ACCOUNT NUMBER WITH

12 THANVIR BROS PVT LTD INR 2500

(AMOUNT TO BE DISBURSED TO

THE BORROWER LOAN

ACCOUNT)

UPFRONT FEE CHARGES

13 NIL

PAYABLE BY CUSTOMER

NET DISBURSED AMOUNT TO

14 INR 2500

CUSTOMER BANK ACCOUNT

ALL IN COST FOR LOAN PRINCIPAL INR 2500

APPLICATION / INTEREST INR 75

15 BREAKUP OF EACH COMPONENT ACCOUNT

TO BE MANAGEMENT INR 863

GIVEN FEE

TOTAL AMOUNT TO BE PAID BY

16 INR 3593

BORROWER ON DUE DATE(S)

ANNUAL PERCENTAGE

RATE(APR) - EFFECTIVE

17 ANNUALISED INTEREST RATE IN 456

% TERM (Interest plus Account

Management Fee)

ANNUAL PERCENTAGE

18 RATE(APR) - EFFECTIVE 516

ANNUALISED INTEREST RATE IN

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

% TERM (Interest plus Account

Management Fee plus Late Payment

Fee)

19 LOAN TENURE (DAYS) 30

REPAYMENT FREQUENCY BY THE

20 ONE

BORROWER

NUMBER OF INSTALLMENT FOR

21 ONE

REPAYMENT

EMI payable /Amount of each

3593

instalment of repayment

INTEREST TYPE APPLICABLE FOR

22 LOAN FIXED

ACCOUNT

APPLICABLE INTEREST RATE IN %

23 PER 37%

ANNUM

Total interest charged during

3.0%

the entire tenure of the loan

DETAILS ABOUT CONTINGENT CHARGES, OVER AND ABOVE THE ONE WHICH IS

24

MENTIONED HERE IN BELOW

NO PREPAYMENT FEE SHALL BE CHARGED.

a) PREPAYMENT FEE ONLY RECEIPT OF ACCRUED INTEREST AND

SERVICE FEE SHALL BE CHARGED AT THE TIME

OF PREPAYMENT

FEE REFUNDABLE IF LOAN NOT

b) NO FEES BEING CHARGED

SANCTIONED / DISBURSED

60%

RATE OF ANNUALISED LATE

c) CHARGES IN The above rate of annualised late charges in case of

CASE OF DELAYED PAYMENTS delayed payments is applicable included in the APR

computation mentioned.

0.15% per day for 30 days to be accrued on a daily

basis on the monthly EMI with 2 repayment schedule

0.1% per day for 30 days to be accrued on a daily

basis on the monthly EMI with 3 repayment schedule

d) LATE PAYMENT FEE TABLE

0.2% per day for 30 days to be accrued on a daily

basis on the originated principal amount on loans with

single repayment schedule

Conversion charges for switching

from floating to fixed interest and Option Not applicable for present loan product

vice-versa

COOLING PERIOD - BORROWER

CAN REPAY THE PRINCIPAL

THREE CALENDAR DAYS FROM THE LOAN

25 AMOUNT WITHOUT ANY

DISBURSEMENT DAY

INTEREST OR

OTHER APPLICABLE CHARGES

ONLY THE PRINCIPAL AMOUNT BORROWER CAN

AMOUNT PAYABLE DURING REPAY THE PRINCIPAL AMOUNT AND

26 LOOKUP / PROPORTIONATE OF INTEREST ARP WITHOUT

COOL OF PERIOD ANY OTHER PANELTY OR APPLICABLE

CHARGES

NO OF TIME LOANS CAN BE 1

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

REAPPLIED IF CLOSED DURING

COOL OFFER PERIOD

APPLICATION GAP PERIOD

BETWEEN 2 LOANS REQUEST IF

1 DAY

LOAN CLOSED DURING COOL OFF

(POST 27)

Details of security/collateral

NIL

obtained

https://trustpaisa.com/ (WEBSITE / MOBILE

27 DIGITAL LENDING APP

APPLICATION)

DETAILS OF LENDING SERVICE

PROVIDER

(LSP) ASSISTING THANVIR BROS

28 PVT LTD [FLEXIDIGITAL TECH INDIA PVT LTD]

WITH CUSTOMER ON-BOARDING,

CUSTOMER SERVICE AND

CUSTOMER REPAYMENTS

29 CUSTOMER BANK NAME Ujjivan Small Finance Bank Limited

CUSTOMER BANK ACCOUNT

30 4493110010008294

NUMBER

31 IFSC OF CUSTOMER BANK UJVN0004493

32 REFERENCE NAME 1 Vijay Surywanshi

REFERENCE NAME 1 MOBILE

33 +917385842177

NUMBER

Relationship with Reference 1 PARENT

34 REFERENCE NAME 2 Suraj Parve

REFERENCE NAME 2 MOBILE

35 +917498338989

NUMBER

Relationship with Reference 2 FRIEND

36 NBFC NAME THANVIR BROS PVT LTD

1. For FLEXIDIGITAL TECH INDIA PVT LTD (LSP)

Name: Pushkar

Name, designation, email address Designation - Grievance Officer

and phone number of nodal Mob No: +91 8376901964

Email: help@trustpaisa.com

grievance redressal officer

37

designated specifically to deal with 2. For Thanvir Bros Pvt Ltd (NBFC)

FinTech/ digital lending related Name: Sumit

complaints/ issues Designation: Customer Service Department

Mob No: +91 9477664928

Email: cc@ thanvirbros. in

Terms and Conditions:

1. The rate of interest is arrived at based on the weighted average cost of funds,

administrative costs, risk premium and profit margin. The decision to extend

the loan and the interest rate applicable to each loan account is assessed on

a case to case basis, based on multiple parameters such as purpose of the

loan/the type of the asset being financed if any, borrower profile and

repayment capacity, borrower’s other financial commitments, past repayment

track record if any, loan to value ratio, mode of payment, tenure of the loan,

geography (location) of the borrower, end use of the asset etc. Such

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

information is collated based on borrower inputs and field inspection by the

lender or surveys.

2. Lender reserves its right to withdraw and/or amend any of the terms and

conditions hereof (including to reduce or cancel the loan) at its sole discretion,

in the event of any change in circumstances and/or downgrading of credit

score of the Borrower.

3. In case of any credit facility remaining unutilized, Lender shall have the right

in its absolute discretion to revoke and cancel, the unutilized portion of the

sanctioned limit without assigning any reason thereof after giving prior notice

to the Borrower.

4. Nothing contained in this sanction letter shall be deemed to create any right

or obligation or interest whatsoever in favour of or against any party and the

Borrower shall be liable to execute appropriate loan documents as required

by Lender. The applicable Stamp duty, if any on the loan documents shall be

borne and paid by the Borrower.

5. Lender reserves the right to review the facilities periodically with revised

terms at its sole discretion.

6. This sanction shall stand revoked and cancelled without any notice, if there

are material changes in your financial performance, any material facts

concerning borrower’s ability to make payments under the Loan document or

any relevant aspects of its request for loan facility are withheld, suppressed,

concealed, or are found to be incorrect or untrue or undisclosed new

information comes to the knowledge of the lender effecting credit.

7. This Sanction Letter will form part and parcel of the Loan

documents/Agreement. This Sanction Letter is subject to completion of all

pre-disbursement conditions as required by Lender.

8. The borrower/co-borrower shall notify Lender immediately of any:

a. Lawsuits, government proceedings or claims which, individually or in

the aggregate involve an amount exceeding 20% of the borrower’s/co-

borrower’s net worth or which may impair the borrower’s ability to

perform its loan obligations,

b. Occurrence of any event of default or any event which with the

passage of time or the giving of notice may result in an Event of

Default.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

9. Borrower accepts, confirm and consents for the disclosure and sharing by

Lender of all or any information and data relating to the borrower, the

facilities, any other transactions that the Borrower has with Lender, the

Borrower’s account, and the agreements and documents related to the loan

and transactions including but not limited to information relating to default, if

any, committed by the borrower in the discharge of the Borrower’s obligation

in relations to the loan or other transactions as Lender may deem appropriate

and necessary to disclose and furnish to the Reserve Bank of India and/or to

the Credit Information Bureaus and/or any other agency or body as

authorized in this behalf by RBI, to other bank and lender including assignees

and potential assignees, to its professional advisors and consultants and to its

service providers in relations to the loan and/or as required under law or any

applicable regulation, at the order of a court of law or at the request or order

of any statutory or regulator or supervisory authority with whom Lender

customarily complies.

10. Following are modes through which customers can raise a complaint

a. Email – Customer can write to us at help@trustpaisa.com

b. Website – Customer can find Grievance Redressal Mechanism of Service

Provider at below link: https://trustpaisa.com/grievance/

c. Website – Customer can find Grievance Redressal Mechanism of Lender

at below link: https://thanvirbros.in/policies/

This document is digitally generated and hence does not require any signature or

seal.

For any clarifications, please reach out to help@trustpaisa.com

Repayment Schedule

Instal Outstanding Principal Interest Account Management Repay

ment Principal (INR) (INR) Fee + GST (INR) ment

No (INR) Amount

(INR)

1 2500 2500 75 1018 3593

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

LOAN AGREEMENT

This Loan agreement executed on the day, month and year set out in the Schedule-I hereto by the

Borrower whose name and address is stated in the Schedule-I, hereinafter referred to as the

“Borrower” (which expression shall unless the context otherwise requires, includes the applicant

his/her/their legal heirs, executors, administrators) of One Part.

In favour of Thanvir Bros private limited, having registered office at Flat 43, 1st Floor, Palace court 1

kyd street Kolkata WB 700016 hereinafter referred to as the “Lender” (which expression shall unless

the context otherwise requires, includes the its successors and assigns) of other Part.

The Borrower and the Lender are hereinafter collectively referred to as “Parties” and individually as

the “Party”

WHEREAS:

1. The Lender is a registered NBFC and is in the business of providing financial support required to

its customer(s) for the purpose of extending loans in India and also extending financial facilities

through digital lending platform through its authorised Lending Service Provider partners (LSP).

2. The Borrower represented that he/she intends to avail the financial assistance and submitted an

application through webapp/Mobile app (“Platform”) whereof more fully set out in the schedule-II

herein, based on the request and representations of the borrower, the Lender has agreed to

grant/granted the financial assistance to the borrower for the purpose mentioned therein subject to the

terms and conditions of this agreement.

The Borrower hereby irrevocably and unconditionally agrees to abide by the

following terms and conditions:

1. DEFINITIONS: "Account" means the bank account/any other relevant account of the

Borrower where the Loan disbursement is requested and more specifically provided under the

Application Form; "Application Form" means the loan application form submitted by the

Borrower to the Lender for applying for this loan, together with all other information ,

particulars, clarifications and declarations, if any, furnished by the Borrower in connection with

this loan and sanctioned by the lender.; Annual Percentage Rate (APR) - APR means all-

inclusive cost of digital loan applied for the loan which is morefully set out in Key Fact

Statement.; “Agreement” shall mean this Loan agreement executed by the Borrower in favour

of the Lender which governing the terms and conditions of the Loan , Application Form,

sanction Letter and other loan documents executed by the Borrower in favour of the Lender

relating the Loan including any amendments made to them from time to time.; "Due Date"

means such date on which loan repayment becomes due and payable under the terms of the

Transaction Documents as specified by the Lender; "Loan" means disbursement made under

this Loan Agreement;” Interest Rate “ means the fixed interest rate as specified at the time of

applying for Loan and morefully set out in Schedule II (Schedule of Charges) of this

agreement and sanction letter; "Tax" means any tax, Goods and Service Tax ("GST"), levy,

impost, duty or other charge or withholding of a similar nature (including any penalty or

interest payable in connection with any failure to pay or any delay in paying the same); and

Capitalized terms not defined herein, shall have the meaning ascribed to such terms under

the Application Form; Loan Application Form, Standard Term, MITC is together referred as

"Transaction Document". Unless otherwise specified in our banking arrangement, interest is

calculated based on a 365 day year basis except in case of leap year when it will be 366 day

year.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

2. DISBURSEMENT : The Borrower authorises the Lender to disburse proceeds of the loan to

his/her bank account as specified in the Schedule II or through such other mode as the lender

deems fit in this regard. Disbursement made under this loan agreement shall mean any

payment of the Loan Amount, or any part thereof, made by the Lender to the Borrower via

RTGS transfer/ NEFT/ electronic mode of payments and the charges, if any, in respect of all

such mode of payments shall be borne by the Borrower; Notwithstanding anything contained

in these Terms & Conditions, Interest shall begin to accrue in as and from the date of the

disbursement of the Loan. Disbursements shall be deemed to have been made to the

Borrower on the date on which the Loan amount is transferred by the Lender to the

designated account by RTGS/NEFT as the case may be irrespective of the time taken in

transit/collection by the Borrower ; The Loan Amount, or any part thereof, shall be disbursed

as requested by the Borrower and agreed by Lender. The Lender at its sole discretion may

not disburse at any time, any further amount under the Loan, unless the conditions stipulated

in Sanction Letter and/or as mentioned hereto are complied with the Borrower to the

satisfaction of the Lender & the Lender reserves the right to revoke, cancel the Loan and/or

vary, modify, amend at any time the Terms & Conditions of the Loan with such notice to the

Borrower ; Any disbursal request made by the Borrower shall form an integral part of this

Terms & Conditions; The Borrower undertakes to acknowledge the receipt of Disbursement in

the form acceptable to Lender; Lender shall be entitled, at its sole discretion, to advance or

postpone any Disbursement, either at the request of the Borrower, or otherwise.

3. COOLING OFF/LOOK-UP PERIOD: If the Borrower disagrees with any of the terms of Loan,

he/she has an option to cancel the Loan within three (3) days of disbursement of Loan subject

to repayment of entire Loan amount along with proportionate APR, upon such full repayment

the Loan account will be cancelled. The Borrower agrees that processing fee will not be

refunded in case of such cancellation. All the rights under this Loan shall stand extinguished

immediately on the cancellation of the Loan and successful repayment of the Loan amount.

4. LOAN TERM, REPAYMENT, RATE OF INTEREST AND OTHER CHARGES : The Loan Term

shall be the period as stated in the Schedule -II or the period as revised/increased by Lender,

from time to time, at its sole discretion, or due to any regulatory scheme or package and/or

any other reason as the Lender may deem fit (hereinafter referred to as the “Loan Term”) ;

The Borrower shall promptly repay the loan amount along with applicable interest in

accordance with the terms set out in the repayment schedule (“Repayment Schedule”); The

Lender shall not be required to give any notice, reminder or intimation to the Borrower

regarding his/her obligation in respect of Borrower’s dues and it shall be the Borrower’s

responsibility to ensure prompt and regular payments to the Lender. Instalments shall be

rounded off to the next higher Rupee ; In case of an event of default to pay the EMI/instalment

within the due date the Borrower shall agree to pay penal on the overdue amount, for the

period from (and including) the original Due Date for payment to (but excluding) the date of

actual payment, at the Additional Rate of Interest which is morefully set out in Schedule-II.

The Borrower acknowledges and agrees that the rates of interest specified in the Transaction

Documents are reasonable and that they represent genuine pre-estimates of the loss

expected to be incurred by the Lender in the event of non-payment by the Borrower; and the

rate of interest payable by the Borrower shall be subject to change prospectively based on the

monetary policies as may be changed by the Reserve Bank of India ("RBI") and other factors

impacting the interest rates. The Borrower shall bear all Taxes in connection with the

Transaction Documents (as applicable). If any such cost is incurred or paid by the Lender,

Borrower shall forthwith reimburse the same. In the event of the Borrower failing to pay the

monies referred to above, the Lender shall be at liberty (but shall not be obliged) to pay the

same by directly debiting the account of the Borrower or otherwise subject to reimbursement

of all costs I incurred by the Lender.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

5. MODE OF PAYMENT: The loan may be repaid by the Borrower through any of the modes

specified in the Schedule. In case of the repayment through standing instruction (“SI”)/NACH,

the Borrower authorises the lender to debit his/her bank account (as provided in the

Schedule) towards the EMI/instalment/outstanding amount. The Borrower can be asked to

provide the security post-dated cheques (“SPDC”) to enable the lender to recover the

overdue/outstanding loan amount. The Borrower shall not be entitled to cancel or issue stop

payment instruction with the respect to the mode of payment as opted/provided by the

Borrower as long as the loan is outstanding and any such act of the Borrower shall be

deemed to an act of criminal breach of trust and cheating . Further, the lender shall be entitled

to initiate appropriated criminal proceedings including but not limited proceedings under

Negotiable Instruments Act, 1881, payment and settlement systems act 2007 and Indian

Penal Code, 1860 against the Borrower.

The Borrower hereby agrees, confirms and undertakes to replenish/ renew the Repayment

mode/ mandate (NACH or electronic funds transfer) after the NACH mandate provided by the

Borrower expires or there is change in NACH mandated bank of the Lender. The Borrower

further agrees and undertakes to submit new set of NACH documents for the repayment as

and when called upon to do so by the Lender. In case the Borrower does not replenish/renew

the Repayment mode on time, Additional Charges as mentioned in the Schedule hereto shall

be levied on the Borrower.

The Borrower shall make payment as per Due Date. The Borrower shall not prepay the

outstanding principal amounts of any of the Loan(s) in full or in part, before the Due Dates,

except during cool off period or with the prior written consent of the Lender and subject to

payment of applicable pre-payment charges as specified in the Schedule-II. All payments

shall be made in freely transferable funds without any set off, counter claim or any deduction

(except to the extent that the Borrower is required by law to make payment subject to any Tax

deduction at source under the applicable law). In case any such deductions are made the

Borrower agrees to deliver to the Lender, within 10 (ten) days of the payment being made,

satisfactory evidence that the Tax has been deducted at source and duly remitted to the

appropriate authority.

6. PROCESSING FEES/GST AND OTHER APPLICABLE CHARGES: The Borrower agrees to

pay a one-time, non-refundable processing fee (if mentioned on sanction) at such rate as

specified in the sanction letter and Schedule-II herein. Such processing fee shall be deducted

during disbursement. The Borrower agrees to incur applicable stamp duty charges and

documentation charges (if any) as provided in the Schedule. GST and other statutory duties,

wherever applicable, shall be charged extra as per the applicable rates, on all the applicable

charges and fees.

7. APPROPRIATION OF PAYMENTS: Notwithstanding any of the provisions of the Indian

Contract Act, 1872 or any other applicable law or anything contained in the loan Documents,

the amounts repaid by the Borrower shall be appropriated first towards cost, charges and

expenses and other monies; secondly towards interest on cost charges and expenses and

other monies; thirdly towards interest on the delayed payments; fourthly towards interest

payable under the loan Documents and lastly towards repayment of any principal amounts.

The Borrower shall from time to time, if required by the Lender, provide security, in a form and

manner satisfactory to the Lender.

Notwithstanding anything mentioned above, the Lender may, at its absolute discretion

appropriate any payment in any manner towards its dues, payable by the Borrower under

these terms and Conditions.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

8. REPRESENTATIONS AND WARRANTIES : The Borrower makes the representations and

warranties hereunder to the Lender (i)The Borrower has the competence to enter into and

perform under the loan Documents; (ii) The Loan once granted by the Lender under loan

Documents constitutes legal, valid and binding obligations of the Borrower enforceable in

accordance with its respective terms; (iii) The Borrower is in compliance with all laws

(including laws relating to environment, social and labor, Tax, anti-corruption and anti-money

laundering, anti-bribery) applicable to it; (v) The loan Documents, do not and will not conflict

with any law; or (b) with any document which is binding upon the Borrower or any of its asset;

(vi) Except to the extent disclosed to the Lender, no litigation, arbitration, administrative or

other proceedings nor has the Borrower been declared to be a willful defaulter or a non-

cooperative Borrower (vii) All information communicated to or supplied by or on behalf of the

Borrower to the Lender, are true and fair and correct and complete in all respects as on the

date on which it was communicated or supplied; and (b) Nothing has occurred since the date

of communication or supply of any information to the Lender which renders such information

untrue or misleading in any respect. (viii) The Borrower shall provide and complete payment

mandates, as and when requested by the Lender, to the Lender or to the Delegate (ix) The

Borrower shall not use the fund for purchase of gold in any form or bribe any person and for

illegal purpose (x) The Borrower shall ensure that the obligations under the loan Documents

shall at least rank pari passu with all its unsecured and unsubordinated obligations.

9. DISCLOSURE: The Lender reserves the unconditional right to cancel the loan sanctioned

without giving any prior notice to the Borrower. The Parties further agree that the Lender shall

have the right to disclose or publish any information regarding the Borrower or guarantor(s) (if

any) and any information and documents that it might possess to: (a) any of its branches or

with other banks, financial institutions, Credit Information Bureau of India Limited, credit

reference or rating agencies/bureaus or other individuals/entities either in response to their

credit inquiries directed to the Lender or in the event of the Borrower not complying with any

terms and conditions herein or otherwise and (b) the Reserve Bank of India and/or any other

statutory authority or official of the Government of India or that of any other state. (c)

Investigate and declare the borrower wilful defaulter or fraud as per applicable regulatory

guideline/circulars of government of India/RBI.

10. SET-OFF AND COUNTERCLAIM: All payments made by the Borrower under this Terms &

Conditions shall be made without any deduction, set off or counterclaim other than any

deduction which is required mandatorily under any law. The lender shall have the paramount

right of lien and set off, irrespective of any other lien or charge, present or future on the

amount of any kind and nature held or balances lying in any accounts of the Borrower,

whether held singly or jointly, and on any monies, securities, bonds and other assets,

documents and properties held by /under the control of the lender to the extent of all

outstanding dues arising under this Agreement. The lender shall be entitled to exercise such

set-off or lien without prior notice to the Borrower. The lender’s right hereunder shall not be

affected by the Borrower’s insolvency or bankruptcy.

11. EVENTS OF DEFAULT: The Borrower shall be deemed to have committed an act of default

on the occurrence of inter- alia but not limited to, any one or more of the following events

(hereinafter referred to as "Event of Default"): (i) Default has occurred in the payment of any

monies in respect of this Loan on the due date (whether at stated Due Date, by acceleration

or otherwise) under the terms of the loan Documents (ii) Default (other than a payment

default) has occurred in the performance of any covenant, condition, agreement or obligation

on the part of the Borrower under the loan Documents and such default has continued for a

period of 10 (ten) days after notice in writing thereof has been given to the Borrower or as the

case may be, to such other person, by the Lender (except where the Lender is of the opinion

that such default is incapable of remedy, in which event, no notice shall be required). (iii)

Breach of any representation, warranty, declaration or confirmation made or deemed to be

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

made under the loan Documents; (iv) Death of the Borrower or termination of the agreement

between the Borrower and the Platform provider or blacklisting from the platform provider or

the Security provided by the Borrower hereunder is under jeopardy. (v) The Borrower has, or

there is a reasonable apprehension that the Borrower would, voluntarily or involuntarily

become the subject of proceedings under insolvency law; (vi) Borrower is unable or has

admitted in writing its inability to pay any of its indebtedness as and when they mature or

become due upon becoming aware of the default the steps (vii) An event of default

howsoever described occurs under any agreement or any indebtedness of the Borrower

becomes, or becomes capable at such time of being declared, due and payable under such

agreements before it would otherwise have been due and payable.

12. CONSEQUENCES OF EVENT OF DEFAULT : Upon occurrence of any Event of Default the

Lender shall be entitled at its absolute discretion to inter alia call upon the Borrower to pay

forthwith the outstanding balance of this Loan together with interest and all sums payable by

the Borrower to the Lender under the loan documents; and call upon the Borrower to pay all

claims, costs, losses and expenses including legal cost and counsel fee that may be incurred

by the Lender because of any act or default on the part of the Borrower under the Transaction

Documents.

13. INDEMNITY: The Borrower shall, indemnify and keep the Lender harmless against any cost,

loss, damages, expenses, liability (including without limitation, liability under Tax laws whether

in form of Tax, interest, penalty or otherwise or third-party claims (including legal fees)

incurred by the Lender arising out of or in connection with this loan and /or due to any breach

under the Transaction Documents. The Borrower shall promptly notify the Lender of any

breach of any representations, warranties, covenants, undertakings or any other terms of

these Standard Terms together with the steps taken to remedy it. Upon the breach being

reported, the Lender may, without prejudice to any of its rights under law or contract, in its

sole discretion recommend implementation of corrective measures to remedy such breach in

a form, manner and time as may be necessary or desirable to the Lender.

14. DELEGATION: The Lender without prejudice to its rights to perform such activities itself or

through its office employees, be entitled to delegate to such person(s)/Service provider(s) the

right and authority to perform and execute all such acts, deeds, matters and things connected

herewith, or incidental thereto, as the Lender may deem fit. The Borrower recognizes, accepts

and consents to such delegation. The Borrower, (for its ease of operation and convenience)

requests to the Lender that below mentioned functions may be performed through the

Delegate (whether through its technology solutions or otherwise), which the Lender may in its

sole discretion choose to allow: (i) transmission of the Drawdown Request from the Borrower

to the Lender (ii) collection of certain deeds, documents, instrument or information and (iii)

collection towards repayments in a form and manner agreeable by the Lender. The Parties

further agree that Borrower shall promptly provide upon request of the Lender any further

document/information as may be required by the Lender, including but not limited to the end

user certificate and shall only use the Facility for the Purpose.

It is clarified that the lender shall be accountable for inappropriate behaviour by the Service

Providers and shall facilitate timely redressal of grievance to the Borrower. The Borrower may

contact the call centre of the Service provider by writing an email to help@trustpaisa.com .

The Borrower may further contact the lender if he/she is not satisfied with the response

offered by the Service provider. Grievance Redressal policy with contact details of concerned

persons is available at https://thanvirbros.in/policies

15. STATEMENT OF ACCOUNT: The Loan account statement shall be available in the Platform

and will be sent to the verified email of the Borrower. Any discrepancy in the Loan statement

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

of account should be brought to the notice of the lender within seven (7) days of receipt by the

Borrower.

16. NOTICE: Any notice or request to be given or made by a party to the other shall be in writing

and email communication to the registered email id’s/Address.

17. ASSIGNMENT: a) The Borrower accept that the lender has the authority to sell, assign

or securitize the Facility or any rights under this Agreement/loan document along with

underlying securities/payment instruments without providing any notice to the Borrower, to

any person(s), collection agency(ies) or institution/ institutions and the Borrower agrees to

repay the outstanding loan amounts as per the terms and conditions of this Agreement/loan

documents to such assignee/ other person, agency or institution as directed by the lender.

The Borrower shall not have the right to assign or transfer all or any of its rights, benefits or

obligations under this Agreement/loan documents.

18. GOVERNING LAW & JUSRISDICTION: a) All the disputes between the Borrower and the

lender in connection with the loan Documents or as to the rights and liabilities of the parties

shall be settled by a sole arbitrator as appointed by the lender, in accordance with the

Arbitration and Conciliation Act, 1996, or any statutory amendments thereto. The arbitration

proceedings shall be in English language and the place of arbitration shall be Kolkata. Cost of

arbitration shall be borne by the Borrower. Notwithstanding the foregoing, the lender reserves

the right to approach any court, tribunal or other appropriate forum of competent jurisdiction

as the lender deems fit in connection with any dispute arising out of the loa Documents. This

Agreement shall be governed by laws of India and subject to exclusive jurisdiction of courts at

Kolkata.

19. CONSENT TO ELECTRONIC DELIVERY AND DIGITAL SIGNATURE: Borrower(s)

specifically agree to execute, receive and/or obtain any and all loan related documents

"Electronic Communications" (as defined herein) via lender or its authorised e-signature

facility /service provider. The term "Electronic Communications" includes, but is not limited to

any and all current and future letters/communications relating to the loan sanction letter, loan

terms and condition/Key Fact statement, MITC, welcome letter., etc. Borrower accept

Electronic Communications provided via lender or its authorised service provider as

reasonable and proper notice, for the purpose of any and all laws, rules, and regulations, and

agree that such electronic form fully satisfies any requirement that such communications be

provided to the Borrower in writing or in a form that Borrower may keep.

Digital Signature: The Information Technology Act, 2000 provides legal recognition to

electronic documents and documents executed through electronic /digital signatures, this

agreement digitally executed by the Borrower(s) through Aadhaar authentication and other

loan documents related hereto are legally binding in the same manner as are hard copy

documents executed by hand signature.

The Borrower(s) hereby state that he/she is/are resident of India has no objection in

authenticating his/herself with Aadhaar based authentication system and provide his/her

Aadhaar number, biometric and/or OTP data and/or similar authentication mechanism for

Aadhaar based authentication for the purpose of availing the services from the lender.

20. e-mandate/e-NACH/e-SI: the Borrower hereby on behalf her/himself authorise and provide

consent for use of Aadhaar number for authentication and use of Aadhaar by the lender or its

authorsied service provider to use aadhaar/Virtual ID details (as applicable) for digital

signature/electronic signature of this loan agreement/documents pertains to thereto and

authenticate borrower(s) identity through the Aadhaar authentication system in accordance

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

with the provisions of the Aadhaar Act and allied rules and regulations and for no other

purpose.

21. Borrower confirms that he/she has read the Key Fact Statement and MITC along with other

documents and clearly understand the repayment amount and Annual Percent Rate (ARP)

and contingent cost/fees he has to pay incase he/she fails to repay the loan as per repayment

schedule.

22. Borrower acknowledges and accepts the following documents which will also be forwarded to

the registered email id of the borrower along with this loan agreement:

a. Loan Sanction letter with Terms and Condition of loan

b. Terms and conditions of this Loan Agreement

c. Privacy Policy of NBFC:

https://thanvirbros.in/wp-content/uploads/2022/05/8_thanvir_privacy.pdf

d. Privacy Policy of LSP: https://trustpaisa.com/privacy-policy

--- xxxxx ---

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

MOST IMPORTANT TERMS & CONDITIONS (MITC)

We refer to the application form dated ("Application Form") for grant of this Loan and sanction letter

dated 27-12-2023

The Borrower acknowledges and confirms that the information mentioned in Online Loan Application

Form filled through https://trustpaisa.com/ (WEBSITE / MOBILE APPLICATION) (Digital Lending

APP / DLA) are true and he accepts the most important terms and conditions in the application for this

Loan.

The Borrower understands that the Lender has adopted risk-based pricing, which is arrived by taking

into account, broad parameters like the customers financial and credit profile. Applicable interest rates

are arrived at taking into account the prevailing market rates at the time of sanctioning. The Borrower

acknowledges and confirms having received a copy of each Transaction Document and agrees that

this letter also forms part of the Transaction Document.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

DEMAND PROMISSORY NOTE DATE:

27-12-2023

I, the Manisha Vijay Surywanshi, hereby promise and undertake to pay Thanvir Bros Pvt. Ltd. (the

Lender) or its order, unconditionally and on demand, the principal amount of Rupees INR 3593 for

value received.

I further undertake to repay the principal amount and applicable interest and service fees (plus

applicable GST on service fees) mentioned in full by 26-01-2024.

Provided however, the Lender or its order shall be entitled to: (a) give notice of its intention to demand

and charge penalties, charges and other levies as it may specify and notify from time to time, and/or

(b) reduce the principal amount repayable under this promissory note by me

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

THANVIR BROS. PVT. LTD.

Digitally Signed by:

Name:Manisha Vijay Surywanshi

Location:Latur

Reason:Signing loan agreement

Date:Wed Dec 27 20:28:07

14:36:39 IST 2023

You might also like

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- Application Info.1713707531220Document18 pagesApplication Info.1713707531220sendittomeonmailNo ratings yet

- DMI DMI0039641986 Agreement 1710749451597Document20 pagesDMI DMI0039641986 Agreement 1710749451597Narendra Singh BeelwaNo ratings yet

- Consumer Loan - Application Form PDFDocument8 pagesConsumer Loan - Application Form PDFJay Prakash DwivediNo ratings yet

- Personal Loan Application Form: Applicant DetailDocument8 pagesPersonal Loan Application Form: Applicant DetailAkanksha GuptaNo ratings yet

- Loan Agreement2816235185296660242Document11 pagesLoan Agreement2816235185296660242gandhiburle2001No ratings yet

- DMI DMI0032889571 Agreement 1709816860556Document19 pagesDMI DMI0032889571 Agreement 1709816860556Shantanu MishraNo ratings yet

- Personal Loan Application FormDocument29 pagesPersonal Loan Application FormPabitra Kumar PrustyNo ratings yet

- Application FormDocument8 pagesApplication FormManoj KumarNo ratings yet

- Service AgreementDocument47 pagesService AgreementHarshad JathotNo ratings yet

- Loan - Agreement-2023-04-15 17-11-21Document14 pagesLoan - Agreement-2023-04-15 17-11-21Amresh SinghNo ratings yet

- Loan Agreement - Customer Copy - KB210819KGRDYDocument27 pagesLoan Agreement - Customer Copy - KB210819KGRDYBeing Raj100% (1)

- Apr2019Document19 pagesApr2019జెల్ల ఉమేష్ అను నేనుNo ratings yet

- Prefr Pincode ListDocument23 pagesPrefr Pincode ListVishal BawaneNo ratings yet

- Bitsyyloan: Loan AgreementDocument10 pagesBitsyyloan: Loan Agreementpintukumar rameshbhaiNo ratings yet

- AgreementDocument18 pagesAgreementrbking15081999No ratings yet

- Loan AgreementDocument10 pagesLoan AgreementManoj KolanNo ratings yet

- Signed SL4782458Document21 pagesSigned SL4782458Vishal BawaneNo ratings yet

- Premium Payment AcknowledgementDocument1 pagePremium Payment AcknowledgementRajan SinghNo ratings yet

- Application Reference Number: Emudra/032300/476529: Signature Not VerifiedDocument8 pagesApplication Reference Number: Emudra/032300/476529: Signature Not VerifiedMeditation IndiaNo ratings yet

- Provisional Certificate H402HHL0667970Document1 pageProvisional Certificate H402HHL0667970vindyttNo ratings yet

- Distributor Application FormDocument2 pagesDistributor Application FormSuraj JaiswalNo ratings yet

- PolicyCertificate T0498072Document4 pagesPolicyCertificate T0498072Mathi RTNo ratings yet

- Ram SHGDocument26 pagesRam SHGRAJAT CREATORSNo ratings yet

- Premium Payment Acknowledgement-1Document1 pagePremium Payment Acknowledgement-1Om PrakashNo ratings yet

- In The High Court of Delhi at New Delhi: Reserved On: 27 January, 2022 Date of Decision: 24 March, 2022Document43 pagesIn The High Court of Delhi at New Delhi: Reserved On: 27 January, 2022 Date of Decision: 24 March, 2022Sakina AbedinNo ratings yet

- True Credits Private Limited: Loan AgreementDocument18 pagesTrue Credits Private Limited: Loan Agreementvadapalli aravindkumarNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterOnis EnergyNo ratings yet

- Disbursement Terms - Customer Copy - KB221211ZHILLDocument33 pagesDisbursement Terms - Customer Copy - KB221211ZHILLsandymadhu712715114024No ratings yet

- Loan Sanction LetterDocument3 pagesLoan Sanction Lettergaurav sondhiNo ratings yet

- Viteee Vallore Admit CardDocument1 pageViteee Vallore Admit CardRachit MathurNo ratings yet

- BGC Form PS Address CriminalCheck Client-NISOURCEDocument2 pagesBGC Form PS Address CriminalCheck Client-NISOURCEuma mageswariNo ratings yet

- Loan DocumentDocument24 pagesLoan DocumentCshivakumarNo ratings yet

- Borrower Agreement-1Document4 pagesBorrower Agreement-1Keerthivasan KNo ratings yet

- True Credits Private Limited: Loan Sanction LetterDocument17 pagesTrue Credits Private Limited: Loan Sanction LetterSrinivasu Chintala100% (1)

- Loan Application Form: Borrower's Name Applied Credit Limit Max Tenure For The LimitDocument12 pagesLoan Application Form: Borrower's Name Applied Credit Limit Max Tenure For The LimitManish KumarNo ratings yet

- Signed AgreementDocument8 pagesSigned Agreementalamrashid1009No ratings yet

- Loan Sanction LetterDocument3 pagesLoan Sanction Lettergaurav sondhiNo ratings yet

- Premium Payment AcknowledgementDocument2 pagesPremium Payment Acknowledgementmadhur0006No ratings yet

- Sumanth Life IDocument2 pagesSumanth Life IMohan kishoreNo ratings yet

- INDIA First Insurance Private Limited 80D DEC 2016Document1 pageINDIA First Insurance Private Limited 80D DEC 2016rushikesh28No ratings yet

- Aditya GuptaDocument7 pagesAditya GuptaAditya GuptaNo ratings yet

- CF CD CDApplicationPDFDocument15 pagesCF CD CDApplicationPDFSHAM CHAUDHARINo ratings yet

- About BlankDocument1 pageAbout BlankDIGBIJOY DEBNo ratings yet

- BHU School Entrance Test Registration 2024Document2 pagesBHU School Entrance Test Registration 2024rsk38819No ratings yet

- Lokendra SinghDocument7 pagesLokendra SinghamarikbhargavNo ratings yet

- Policy Deposit Receipt: Kotak Assured Saving Plan Rs. 41112Document1 pagePolicy Deposit Receipt: Kotak Assured Saving Plan Rs. 41112sharmavansh732No ratings yet

- Loan AgreementDocument10 pagesLoan AgreementAashu GillNo ratings yet

- Personal Loan AgreementDocument10 pagesPersonal Loan AgreementchandanNo ratings yet

- Pa Individual Policy Schedule: Page 1 of 2Document2 pagesPa Individual Policy Schedule: Page 1 of 2Dipan MehtaNo ratings yet

- Twelve Thousand Seven Hundred: A Reliance Capital CompanyDocument1 pageTwelve Thousand Seven Hundred: A Reliance Capital CompanyAnupama SinhaNo ratings yet

- Loan - Agreement-2022-09-04 14-47-36Document12 pagesLoan - Agreement-2022-09-04 14-47-36Shyam DhurveNo ratings yet

- KW Legal NoticeDocument3 pagesKW Legal NoticeNANCY KESARWANINo ratings yet

- MR Ashu Yadav S/O Bhupendra Singh Mujjafarpur Tilyani Firozabad FIROZABAD - 205151 Uttar Pradesh - IndiaDocument1 pageMR Ashu Yadav S/O Bhupendra Singh Mujjafarpur Tilyani Firozabad FIROZABAD - 205151 Uttar Pradesh - IndiaAshuNo ratings yet

- Document 1Document2 pagesDocument 1osas RichardNo ratings yet

- AgreementDocument18 pagesAgreementVaishnaviNo ratings yet

- Vamsi Krishna Loan Sanction Letter 456Document7 pagesVamsi Krishna Loan Sanction Letter 456Venkatesh DoodamNo ratings yet

- SP0010494352 G7738Document2 pagesSP0010494352 G7738Gauri MittalNo ratings yet

- Loan Application Form: Borrower's Name Applied Credit Limit Max TenureDocument10 pagesLoan Application Form: Borrower's Name Applied Credit Limit Max TenureVãmßi LooserNo ratings yet

- E0DFDBD190277A4CE05F9A20Document1 pageE0DFDBD190277A4CE05F9A20wchirag524No ratings yet

- Dipankar BarmanDocument2 pagesDipankar Barmanmanishasurywanshi91No ratings yet

- Idfc Bank 4160Document7 pagesIdfc Bank 4160manishasurywanshi91No ratings yet

- M.S Jan Salary SlipDocument1 pageM.S Jan Salary Slipmanishasurywanshi91No ratings yet

- DigitalPassbook - Manisha Vijay Surywanshi - 77770135792063Document1 pageDigitalPassbook - Manisha Vijay Surywanshi - 77770135792063manishasurywanshi91No ratings yet

- Payslip For The Month March 2024: Maya Nagar, National Park RD, Lajpat Nagar IV, New Delhi, Delhi 110024Document1 pagePayslip For The Month March 2024: Maya Nagar, National Park RD, Lajpat Nagar IV, New Delhi, Delhi 110024manishasurywanshi91No ratings yet

- AccountStatement - 25 NOV 2023 - To - 25 DEC 2023Document1 pageAccountStatement - 25 NOV 2023 - To - 25 DEC 2023manishasurywanshi91No ratings yet

- StatementSun Mar 17 14 - 21 - 02 GMT+05 - 30 2024 1Document3 pagesStatementSun Mar 17 14 - 21 - 02 GMT+05 - 30 2024 1manishasurywanshi91No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsmanishasurywanshi91No ratings yet

- IDFCFIRSTBankstatement 10070894160 145741354Document10 pagesIDFCFIRSTBankstatement 10070894160 145741354manishasurywanshi91No ratings yet

- Dealership Pricelist Format1 On Road With Accessories Aug-23 - Individual-6Document17 pagesDealership Pricelist Format1 On Road With Accessories Aug-23 - Individual-6manishasurywanshi91No ratings yet

- (VCE Further) 2008 Insight Unit 34 Exam 2 Amended SolutionsDocument45 pages(VCE Further) 2008 Insight Unit 34 Exam 2 Amended SolutionsKawsarNo ratings yet

- Jackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005Document12 pagesJackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005levine_simonNo ratings yet

- TOPIC 1 Pengantar Manajemen KeuanganDocument14 pagesTOPIC 1 Pengantar Manajemen Keuanganbams_febNo ratings yet

- Tutorial Week 8-9 PSet 8 SolutionsDocument17 pagesTutorial Week 8-9 PSet 8 SolutionsAshley ChandNo ratings yet

- IandF CA11 201504 ExaminersReportDocument19 pagesIandF CA11 201504 ExaminersReportSaad MalikNo ratings yet

- E-Bulletin Foundation Sept 2019Document45 pagesE-Bulletin Foundation Sept 2019Vijay SharmaNo ratings yet

- 995892d36f2eac781e7d2ea109e7f82b_541c30957a2531eae2af31529517988fDocument10 pages995892d36f2eac781e7d2ea109e7f82b_541c30957a2531eae2af31529517988fGlorie Mae BurerosNo ratings yet

- Bangladesh Bank: Financial Stability DepartmentDocument165 pagesBangladesh Bank: Financial Stability DepartmentAsif NawazNo ratings yet

- Corizo Major ProjectDocument29 pagesCorizo Major ProjectPushkraj TalwadkarNo ratings yet

- Cfo10e Ch28 GeDocument29 pagesCfo10e Ch28 GeRd Indra AdikaNo ratings yet

- Amit Black Book Financial Analysis of Idbi BankDocument81 pagesAmit Black Book Financial Analysis of Idbi Bankamit100% (1)

- REIT Industry OutlookDocument49 pagesREIT Industry OutlookNicholas FrenchNo ratings yet

- TOPIC 3 - Exchange Rates and The Foreign Exchange Market-An Asset ApproachDocument42 pagesTOPIC 3 - Exchange Rates and The Foreign Exchange Market-An Asset ApproachYiFeiNo ratings yet

- Lecture 4 - Determining Foreign Exchange RatesDocument40 pagesLecture 4 - Determining Foreign Exchange RateslekokoNo ratings yet

- Research Corporate Governance of GATI LTDDocument33 pagesResearch Corporate Governance of GATI LTDUntuak Film100% (1)

- Exchange Rate Theories: Dr. Amit SinhaDocument69 pagesExchange Rate Theories: Dr. Amit SinhaAmit SinhaNo ratings yet

- Thesis All RightDocument14 pagesThesis All Rightdarodawa100% (1)

- Account Statement 030820 020822Document344 pagesAccount Statement 030820 020822AJAY ALAVALANo ratings yet

- Inflation and Capital BudgetingDocument11 pagesInflation and Capital BudgetingVaibhav Banjan100% (1)

- How Do Central Banks Control InflationDocument17 pagesHow Do Central Banks Control Inflationhafiz shoaib maqsoodNo ratings yet

- 8 Key Factors That Affect Foreign Exchange RatesDocument2 pages8 Key Factors That Affect Foreign Exchange RatesdhitalkhushiNo ratings yet

- Problems To Be Solved in ClassDocument4 pagesProblems To Be Solved in ClassAlp SanNo ratings yet

- CamelDocument21 pagesCamelSiva SankariNo ratings yet

- Analysis of Inflation and Its Effect On Economic Growth inDocument10 pagesAnalysis of Inflation and Its Effect On Economic Growth inGav InvestmentsNo ratings yet

- Chapter 6Document42 pagesChapter 6Laraib KhanNo ratings yet

- International FinanceDocument9 pagesInternational Financedivyakashyapbharat1No ratings yet

- MScFE 560 FM - Notes4 - M1 - U4Document3 pagesMScFE 560 FM - Notes4 - M1 - U4chiranshNo ratings yet

- Report On Monetary PolicyDocument26 pagesReport On Monetary PolicyPooja SharmaNo ratings yet

- FINMAN 1 RevDocument2 pagesFINMAN 1 RevPrincess Ann FranciscoNo ratings yet

- Advanced Investment AppraisalDocument64 pagesAdvanced Investment AppraisalAayaz Turi100% (2)