Professional Documents

Culture Documents

Loan - No Interest Paid

Uploaded by

vandenberghchanell0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

loan - no interest paid

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesLoan - No Interest Paid

Uploaded by

vandenberghchanellCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

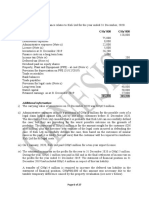

Revenue 227,800

Cost of sales 164,500

Construction contract (note (i)) 4,000

Distribution costs 13,500

Administrative expenses (note (iii) 16,500

Bank interest 900

Lease rental paid on 30 September 2013 (note (ii)) 9,200

Land ($12 million) and building ($48 million) at cost (note (ii)) 60,000

Owned plant and equipment at cost (note (ii)) 65,700

Leased plant at initial carrying amount (note (ii)) 35,000

Accumulated depreciation at 1 October 2012:

building 10,000

owned plant and equipment 17,700

leased plant 7,000

Inventory at 30 September 2013 26,600

Trade receivables 38,500

Bank 7,300

Insurance provision (note (iii)) 150

Deferred tax (note (iv)) 8,000

Finance lease obligation at 1 October 2012 (note (ii)) 29,300

Trade payables 21,300

Current tax (note (iv)) 1,050

Equity shares of 20 cents each 45,000

Loan note (note (v)) 40,000

Retained earnings at 1 October 2012 19,800

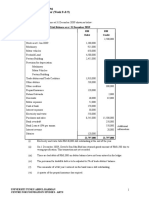

(v) The $40 million loan note was issued at par on 1 October 2012. No interest will be

paid on the loan; however, it will be redeemed on 30 September 2015 for $53,240,000

which gives an effective finance cost of 10% per annum.

open interest paid balance

40 4 - 44

You might also like

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial PositionElaine Fiona Villafuerte100% (2)

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Kandy Co Draft FSMT and MobyDocument4 pagesKandy Co Draft FSMT and MobyAliNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- QuestionDocument2 pagesQuestionKamoheloNo ratings yet

- Fs Preparation 2Document4 pagesFs Preparation 2Davis Deo KagisaNo ratings yet

- 1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramDocument3 pages1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramLê Minh TríNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Afa Unit 5 Tutorial Sheet 3 Acca Past PapersDocument5 pagesAfa Unit 5 Tutorial Sheet 3 Acca Past PapersJust for Silly UseNo ratings yet

- Assignment IV Advanced Financial Accounting Chapter 4&5Document6 pagesAssignment IV Advanced Financial Accounting Chapter 4&5Lidya AberaNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Section C - BOTH Questions Are Compulsory and MUST Be AttemptedDocument6 pagesSection C - BOTH Questions Are Compulsory and MUST Be AttemptedAliNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- AccountingDocument5 pagesAccountingIhsan UllahNo ratings yet

- Chapter 2 - Ia3Document11 pagesChapter 2 - Ia3Xynith Nicole RamosNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- MTP 19 48 Answers 1712221900Document12 pagesMTP 19 48 Answers 1712221900Nitin KumarNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- IAS 1 - Homework 1Document2 pagesIAS 1 - Homework 1abraham johannesNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- F7INT 2012 Jun Q PDFDocument10 pagesF7INT 2012 Jun Q PDFhokageNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Financial Reporting (United Kingdom) : Wednesday 13 June 2012Document10 pagesFinancial Reporting (United Kingdom) : Wednesday 13 June 2012Huệ LêNo ratings yet

- 2016 Vol 1 CH 8 AnswersDocument7 pages2016 Vol 1 CH 8 AnswersIsla PageNo ratings yet

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- Daf1301 Fundamentals of Accounting Ii - Digital AssignmentDocument6 pagesDaf1301 Fundamentals of Accounting Ii - Digital AssignmentcyrusNo ratings yet

- Icma.: PakistanDocument3 pagesIcma.: Pakistangfxexpert36No ratings yet

- Chapter 14 AnswersDocument6 pagesChapter 14 AnswersjoshualendiotamayoNo ratings yet

- Balance Sheet IAS 1Document3 pagesBalance Sheet IAS 1briankuria21No ratings yet

- 9.1 2. SOLUTIONS - Course ChallengeDocument21 pages9.1 2. SOLUTIONS - Course Challengedrey baxterNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Case StudyDocument21 pagesCase StudyTalib Hussain RajaNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- C Ons TR Uc Ted Res Ponse Questions - Section C: S E Cti On 3Document2 pagesC Ons TR Uc Ted Res Ponse Questions - Section C: S E Cti On 3Mazni Hanisah100% (1)

- Zenith LTD 4 8 2022Document12 pagesZenith LTD 4 8 2022XyzNo ratings yet

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- acctng-1-Quiz-FS Begino, Vanessa Jamila DDocument4 pagesacctng-1-Quiz-FS Begino, Vanessa Jamila DVanessa JamilaNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Acc3201 (F) Jan14Document7 pagesAcc3201 (F) Jan14natlyhNo ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- Accounts Revision QuestionDocument1 pageAccounts Revision QuestionZaara AshfaqNo ratings yet

- Jonel Sy, Cpa Statement of Cashflows DECEMBER 31, 2019Document1 pageJonel Sy, Cpa Statement of Cashflows DECEMBER 31, 2019Chriztoffer NacinoNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument10 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Is and BS For FinalsDocument5 pagesIs and BS For FinalsRehan FarhatNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHANo ratings yet