Professional Documents

Culture Documents

MANAC II, END TERM EXAM (Answer Booklet) : Answer To Question Number I

Uploaded by

SportspiritOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MANAC II, END TERM EXAM (Answer Booklet) : Answer To Question Number I

Uploaded by

SportspiritCopyright:

Available Formats

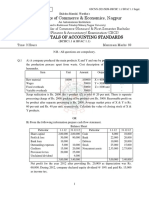

MANAC II, END TERM EXAM (Answer Booklet)

YOUR FULL NAME ROLL NO. DATE OF BIRTH YEAR OF BIRTH

MODEL SOLUTION 80 10th 2000

ANSWER TO QUESTION NUMBER I

THE SPECIFIC QUESTION YOUR RESPONSE

The inventory of finished goods of the concerned company 13080

as on 1st April 2020 amounted to, (in Kgs)

All supporting workings are given below for ready reference

Here Y = Rs 5.00 per kg and Z = 10000 Kgs. (Information about X is redundant in this case)

As profit computed under marginal costing system is greater than profit computed under

absorption costing system, opening inventory of finished goods (say K kgs) is more than

closing inventory of finished goods (10000 kgs – given) and such difference would arise

due to the treatment of fixed production overhead only.

Therefore, 5.00 (K – 10000) = 15400

(Rs 15400 being the difference between two given profit numbers)

Thus, K = 13080 Kgs (Answer).

ANSWER TO QUESTION NUMBER II

The circumstances under which the Production Unit of the company may consider

implementation of the new (and modified) costing system is given as under (i.e. inside

the rectangular box provided below),

The probability of existence of controllable factors is either equal to or

greater than 0.042 (Answer).

All supporting workings are given below for ready reference

Here X = Rs 200000, Y = Rs 10000 and 0.80 Y = Rs 8000

Let the probability of existence of controllable factors be “P”. Therefore, probability of existence of non

controllable factors is (1 – P).

If the new (and modified) costing system is implemented

Total Cost = 8000 * (1- P) + (10000 + 8000) * P

= 8000 – 8000 P + 18000 P

= 10000 P + 8000

Now, if the new (and modified) costing system is not implemented

There would be a possibility that the excess cost of Rs 200000 would continue to be incurred which may

be due to controllable factors.

Equating the above concepts, we get the following relationship

10000 P + 8000 = 200000 P

OR P = 0.042 Approximately (Answer).

ANSWER TO QUESTION NUMBER III

THE SPECIFIC QUESTION Your Response

The average selling price per kg of Product B may reduce to “Rs M per kg” in

order to sustain such increased sales. If it reduces to a number even lower 11.88

than “Rs M”, the proposal should ideally be rejected by the company. You are

required to compute the figure “M” (Rs per kg).

All supporting workings are given below for ready reference

Here P = Rs 6.00 Lakhs and Q = 100000 Kgs

As per the given case facts, Products A & B are joint products. Hence, an additional production of 100000

kgs of Product A would lead to simultaneous production of 200000 kgs of Product B (as well). Therefore,

in line with the case facts additional raw material requirement would be 300000 kgs of raw material Z.

Computation of Additional Cost for Such Additional Production

Raw Material Z = 300000 kgs * Rs 3 per kg = Rs 900000

Variable Processing Charges = 600000 * 3 / 9 = Rs 200000

Total Additional Cost = Rs 1100000

Additional revenue from sale of 100000 kgs of Product A @ Rs 6 per kg = Rs 600000

Additional Cost to be recovered = Rs (11 – 6) Lakhs = Rs 500000

Current Revenues from sale of Product B = (600000 * 15) = Rs 9000000

Total expected recovery from sell of all kgs of Product B = Rs 9500000

Total number of kgs of Product B = (600000 + 200000) Kgs = 800000 Kgs

Thus, minimum reduced average selling price per kg of Product B works out to,

= 9500000 / 800000 = Rs 11.88 per kg (Approximately).

ANSWER TO QUESTION NUMBER IV

While creating the “cash budget”, you are required to show “Collection from Customers” and “Payment

to Suppliers” as distinct line items (along with other relevant line items) in such “cash budget”.

“CASH BUDGET” is given below along with “supporting workings” (given in the next page).

DETAILS (All Figures in Rs Lakhs) Jan 2022 Feb 2022 Mar 2022

OPENING CASH & BANK BALANCES 500 320 1090

CASH RECEIPTS

Collection from Customers 1970 1800 1750

Sale of short term investments 700

Sale of Fixed Assets 70

TOTAL OF CASH RECEIPTS 1970 2500 1820

CASH PAYMENTS

Payment to Suppliers 1510 1250 1210

Purchase of short term investments 400 200

Capital Expenditure 300

Regular Business Expenses 240 180 160

TOTAL OF CASH PAYMENTS 2150 1730 1570

CLOSING CASH & BANK BALANCES 320 1090 1340

Workings in support of the cash budget provided in the previous page are given below.

Here X = Rs 2000 Lakhs and Y = Rs 500 Lakhs

The budgeted Profit Statement for 3 months (in Rs Lakhs) is provided below.

DETAILS Jan 2022 Feb 2022 Mar 2022

Sales (cent percent credit sales) 2000 1700 1600

(Material cost of merchandize goods sold) (1500) (1300) (1260)

(All other expenses except material cost of merchandize goods ) (300) (240) (220)

NET PROFIT 200 160 120

Statement showing collection from customers (Rs Lakhs)

DETAILS Jan 2022 Feb 2022 Mar 2022

Opening Receivables 2570 2600 2500

Credit Sales 2000 1700 1600

(Closing Receivables) (2600) (2500) (2350)

Collection from Customers 1970 1800 1750

Statement showing purchase of merchandize goods (Rs Lakhs)

DETAILS Jan 2022 Feb 2022 Mar 2022

Opening Inventory 1300 1200 1100

Purchase of merchandize goods 1400 1200 1160

(Closing inventory) (1200) (1100) (1000)

Material cost of merchandize goods sold (given in budgeted P/L) 1500 1300 1260

Statement showing payment to suppliers (Rs Lakhs)

DETAILS Jan 2022 Feb 2022 Mar 2022

Opening Payables 2110 2000 1950

Purchase of merchandize goods (computed above) 1400 1200 1160

(Closing Payables) (2000) (1950) (1900)

Payment to Suppliers 1510 1250 1210

ANSWER TO QUESTION NUMBER V

THE SPECIFIC QUESTIONS YOUR RESPONSES

Compute the cost per ton (in Rs) in case the company purchases 10 267.38

ton capacity trucks.

Compute the cost per ton (in Rs) in case the company purchases 8 262.17

ton capacity trucks.

Select the most cost effective option (write either A or B or C) C

All supporting workings are given below for ready reference

Here X = Rs 50.00 Lakhs, 1.25 X = Rs 62.50 Lakhs. Y = 20 Kms & 1.25 Y = 25 Kms.

DETAILS 10 ton capacity 8 ton capacity

Number of Round trips per month per truck (5 * 24) 120 120

Tons of iron ore transported per truck per month 1200 tons 960 tons

Plant requirement of iron ore per month 24000 tons 24000 tons

Number of trucks required in the fleet 20 trucks 25 trucks

Number of drivers required in the fleet (including back up) 24 drivers 30 drivers

Distance covered in one round trip (10 * 2) 20 Kms 20 Kms

Total Km run per month per truck (120 * 20) 2400 Kms 2400 Kms

Total Km covered per month by entire fleet 48000 Kms 60000 Kms

Total diesel requirement per month for entire fleet 2400 liters 2400 liters

Total Loan taken (Rs Lakhs) 1250 1250

TOTAL COST PER MONTH FOR ENTIRE FLEET 10 ton capacity 8 ton capacity

Fleet (Rs Lakhs) Fleet (Rs Lakhs)

Interest Cost (at the rate of 10% on loan amount) / 12 10.42 10.42

Depreciation charge per month 20.83 20.83

Diesel charges at the rate of Rs 80 per liter 1.92 1.92

Salary of all drivers 6.00 6.00

Other maintenance cost 20.00 18.75

Total fixed expenses per month 5.00 5.00

TOTAL 64.17 62.92

Total tons transported during the month by entire fleet 24000 tons 24000 tons

Cost Per Ton Rs 267.38 per ton Rs 262.17 per ton

You might also like

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- CashflowDocument8 pagesCashflowShubhankar GuptaNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- FinanceDocument22 pagesFinanceromit.jaink1No ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- Financial Accounting NotesDocument7 pagesFinancial Accounting NotessrishaaNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Chapter 5 Leverages - PracticeDocument10 pagesChapter 5 Leverages - PracticeAkshat SinghNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- IGNOU MCA MCS-035 Free Solved Assignments 2010Document11 pagesIGNOU MCA MCS-035 Free Solved Assignments 2010Deepti SainiNo ratings yet

- DAIBB Accounting 2020Document14 pagesDAIBB Accounting 2020BelalHossainNo ratings yet

- 3 - Recording of Transaction IDocument13 pages3 - Recording of Transaction IMai SalehNo ratings yet

- AccountingDocument5 pagesAccountingIhsan UllahNo ratings yet

- Assignment MIS320.1 SUBMITTED TO: Kabid MD Surid, Department of Management Date of Submission: 06.01.2021Document7 pagesAssignment MIS320.1 SUBMITTED TO: Kabid MD Surid, Department of Management Date of Submission: 06.01.2021Sk. Shahriar RahmanNo ratings yet

- PGP I 2021 Fra Quiz 1Document3 pagesPGP I 2021 Fra Quiz 1Pulkit SethiaNo ratings yet

- Assignment - Cash FlowsDocument9 pagesAssignment - Cash FlowsArshad ChaudharyNo ratings yet

- LCNRV and PURCHASE COMMITMENTS ExercisesDocument3 pagesLCNRV and PURCHASE COMMITMENTS Exercisesg.canoneo.59990.dcNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 3)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 3)Renee WongNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Accounts & FinanceDocument19 pagesAccounts & FinancerajibzzamanibcsNo ratings yet

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNo ratings yet

- Taxation AccountingDocument10 pagesTaxation Accountingjanahh.omNo ratings yet

- Account 1Document6 pagesAccount 1jean rousselinNo ratings yet

- 8.24.22 BfaDocument6 pages8.24.22 BfaRyben Ysabelle PadroniaNo ratings yet

- Boncolmo-Fabm 2nd SemDocument9 pagesBoncolmo-Fabm 2nd SemAprodithe BoncolmoNo ratings yet

- Comprehensive IllustrationDocument12 pagesComprehensive IllustrationNucke Febriana Putri RZNo ratings yet

- Semester-6 Chapter-5Document10 pagesSemester-6 Chapter-5bharatipaul42No ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Practice Set 5 Financial Statements of Sole ProprietorshipsDocument3 pagesPractice Set 5 Financial Statements of Sole ProprietorshipsBritney PetersNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- XI Accountancy Model Set 2078Document38 pagesXI Accountancy Model Set 2078kevin bhattaraiNo ratings yet

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Document5 pagesAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Institute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Document5 pagesInstitute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Mr V. Phaninder ReddyNo ratings yet

- R2.TAXM - .L Solution CMA June 2021 Exam.Document8 pagesR2.TAXM - .L Solution CMA June 2021 Exam.Pavel DhakaNo ratings yet

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDocument5 pagesVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- RIL Excel Sheet FRADocument56 pagesRIL Excel Sheet FRAAditi AgrawalNo ratings yet

- Acc.2023 Practical Exam Sample QN - PaperDocument5 pagesAcc.2023 Practical Exam Sample QN - PaperMidhun PerozhiNo ratings yet

- Acn 405Document22 pagesAcn 405Ahsanur Hossain TonmoyNo ratings yet

- Chapter 12 QR SolutionsDocument14 pagesChapter 12 QR SolutionsNAITIK SHARMANo ratings yet

- AssignmentDocument10 pagesAssignmentkulfamorNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Capital Structure (1) Solved ProbDocument8 pagesCapital Structure (1) Solved Prob121733601011 MADENA KEERTHI PRIYA100% (1)

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- 08chap 8 NP Farming Solutions 2020Document3 pages08chap 8 NP Farming Solutions 202044v8ct8cdyNo ratings yet

- Financial Accounting 2022 NeHu Question PaperDocument7 pagesFinancial Accounting 2022 NeHu Question PaperSuraj BoseNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Lembar Kerja AkuntansiDocument75 pagesLembar Kerja AkuntansifaiqNo ratings yet

- Acc Final 2Document15 pagesAcc Final 2Tanvir OnifNo ratings yet

- Acc Tut 12 Final JTDocument21 pagesAcc Tut 12 Final JTxhayyyzNo ratings yet

- Task 3 AccDocument4 pagesTask 3 Accbbang bbyNo ratings yet

- 4 Hoi and RobinDocument7 pages4 Hoi and RobinelizabetaangelovaNo ratings yet

- Tissue Paper Converting Unit Rs. 36.22 Million Mar-2020Document29 pagesTissue Paper Converting Unit Rs. 36.22 Million Mar-2020Rana Muhammad Ayyaz Rasul100% (1)

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- Day1 10daysaccountingchallengeDocument16 pagesDay1 10daysaccountingchallengeSeungyun ChoNo ratings yet

- Relevant CostingDocument40 pagesRelevant CostingUtsav ChoudhuryNo ratings yet

- Ceekay Daikin Ltd.Document39 pagesCeekay Daikin Ltd.TAHER3555No ratings yet

- I2BE-Morning Evening PDFDocument10 pagesI2BE-Morning Evening PDFusama sajawalNo ratings yet

- Bangladesh Gazette - Income Tax Act 2023Document319 pagesBangladesh Gazette - Income Tax Act 2023khaled mosharofNo ratings yet

- Made By: Olivia, Harshita, Rahul, Arnav, Aryan, Aryaman, Aarya Group Number: 2Document9 pagesMade By: Olivia, Harshita, Rahul, Arnav, Aryan, Aryaman, Aarya Group Number: 2Arnav PradhanNo ratings yet

- Deposit, Mutuum, CommudatumDocument33 pagesDeposit, Mutuum, CommudatumkimuchosNo ratings yet

- Far - First Preboard QuestionnaireDocument14 pagesFar - First Preboard QuestionnairewithyouidkNo ratings yet

- Rules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedDocument2 pagesRules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedemilsonusamNo ratings yet

- Ias 36 ImpairementDocument24 pagesIas 36 Impairementesulawyer2001No ratings yet

- Tata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12Document9 pagesTata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12AnirudhNo ratings yet

- Annual Report 2017 PDFDocument216 pagesAnnual Report 2017 PDFemmanuelNo ratings yet

- Transaction Summary - 10 July 2021 To 6 August 2021: Together We Make A DifferenceDocument2 pagesTransaction Summary - 10 July 2021 To 6 August 2021: Together We Make A Differencebertha kiaraNo ratings yet

- Accounting For Decision Making Mid TermDocument5 pagesAccounting For Decision Making Mid Termumer12No ratings yet

- FM AssignmentDocument9 pagesFM AssignmentNikesh Shrestha100% (1)

- QUIZ - PPE PART 1 Answer KeyDocument4 pagesQUIZ - PPE PART 1 Answer KeyRena Rose MalunesNo ratings yet

- Bansi Khakhkhar PDFDocument74 pagesBansi Khakhkhar PDFVishu MakwanaNo ratings yet

- 01 CA Inter Audit Question Bank Part 1 Chapter 0 To Chapter 3Document146 pages01 CA Inter Audit Question Bank Part 1 Chapter 0 To Chapter 3Yash SharmaNo ratings yet

- TENANCY AGREEMENT Pasar SegarDocument4 pagesTENANCY AGREEMENT Pasar SegarFade ChannelNo ratings yet

- Cover LetterDocument2 pagesCover LetterBilal AslamNo ratings yet

- Us Engineering Construction Ma Due DiligenceDocument52 pagesUs Engineering Construction Ma Due DiligenceOsman Murat TütüncüNo ratings yet

- Sunson Textile Manufacturer TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesSunson Textile Manufacturer TBK.: Company Report: January 2019 As of 31 January 2019Anisah AmeliaNo ratings yet

- Entrepreneurial Management - IIDocument7 pagesEntrepreneurial Management - IIEsha ShahNo ratings yet

- University of Michigan MATH 526 hw1 F2020Document2 pagesUniversity of Michigan MATH 526 hw1 F2020wasabiwafflesNo ratings yet

- FenchelDocument20 pagesFenchelgeertrui1234321100% (1)

- Ministry of Revenues: Tax Audit ManualDocument304 pagesMinistry of Revenues: Tax Audit ManualYoNo ratings yet

- Application and Declaration For Account Opening Form: Borang Permohonan Dan Perakuan Membuka AkaunDocument6 pagesApplication and Declaration For Account Opening Form: Borang Permohonan Dan Perakuan Membuka Akaunjin862100% (1)