Professional Documents

Culture Documents

Nbri Bill 1

Uploaded by

Vivek YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nbri Bill 1

Uploaded by

Vivek YadavCopyright:

Available Formats

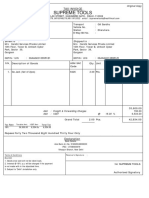

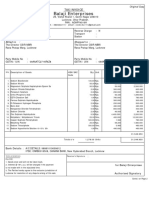

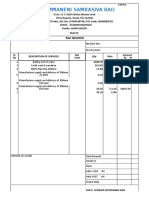

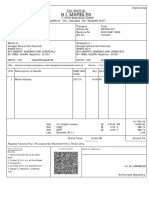

GSTIN : 09AGHPY4016H2Z3 Original Copy

TAX INVOICE

Balaji Enterprises

29, Vishal Khand 1, Gomti Nagar 226010

Lucknow, Uttar Pradesh.

PAN : AGHPY4016H

Tel. : 9889233111 email : vivek.lko111@gmail.com

Invoice No. : 03-24/2 Reverse Charge : N

Dated : 22-03-2024 Transport :

Place of Supply : Uttar Pradesh (09) Station :

Billed to : Shipped to :

The Director CSIR-NBRI The Director CSIR-NBRI

Rana Pratap Marg, Lucknow Rana Pratap Marg, Lucknow

Party Mobile No : Party Mobile No :

GSTIN / UIN : 09AAATC2716R6Z8 GSTIN / UIN : 09AAATC2716R6Z8

S.N. Description of Goods HSN/SAC Qty. Unit Price Amount ( ` )

Code

1. Nylon Material Cloth 300 Mesh Size 2 mtr 3.00 Units 1,800.000 5,400.000

2. Filter Cloth Bag 16*16*2 10.00 Units 180.000 1,800.000

3. Hung Curd Muslin Cloth 10.00 Units 200.000 2,000.000

4. Plastic Storage Container Box 25 Ltr 2.00 Units 700.000 1,400.000

5. Brass Sev Sancha Machine 6 Accerories 1.00 Units 1,100.000 1,100.000

6. Stainless Steel Pasta Maker Machine 1.00 Units 7,500.000 7,500.000

7. Swimming Pool Deep Leaf Rake With Handle 4.00 Units 1,000.000 4,000.000

23,200.000

Add : CGST @ 9.00 % 2,088.000

Add : SGST @ 9.00 % 2,088.000

Grand Total 31.00 Units ` 27,376.000

HSN/SAC Tax Rate Taxable Amt. CGST Amt. SGST Amt. Total Tax

18% 23,200.000 2,088.000 2,088.000 4,176.000

Rupees Twenty Seven Thousand Three Hundred Seventy Six Only

Bank Details : A/C DETAILS: 98881010000612

IFSC: CNRB0018508, CANARA BANK, New Hyderabad Branch, Lucknow

Terms & Conditions Receiver's Signature :

E.& O.E.

1. Goods once sold will not be taken back.

2. Interest @ 18% p.a. will be charged if the payment for Balaji Enterprises

is not made with in the stipulated time.

3. The Parties hereby agree to the exclusive jurisdiction of

Lucknow for resolution of any dispute arising of this sale. Authorised Signatory

You might also like

- Financial Report Provided by Baptist Children's HomeDocument12 pagesFinancial Report Provided by Baptist Children's HomeFOX80% (1)

- CH 4 Income Statement ProblemDocument12 pagesCH 4 Income Statement ProblemAnonymous kpnz5rw4YdNo ratings yet

- SupplyOutward CE 001Document1 pageSupplyOutward CE 001skgts787737No ratings yet

- 1089 V K Textiles IndustriesDocument1 page1089 V K Textiles IndustriesEglNo ratings yet

- Sales - 2018-19-01-324Document1 pageSales - 2018-19-01-324Rabindra SinghNo ratings yet

- Sales 2Document1 pageSales 2skgts787737No ratings yet

- S F Industrial Corporation: Billed To: Shipped ToDocument1 pageS F Industrial Corporation: Billed To: Shipped ToAyush SrivastavNo ratings yet

- Sales NI 23 24 06Document1 pageSales NI 23 24 06skgts787737No ratings yet

- Tax Inv No 004 KimplasDocument1 pageTax Inv No 004 KimplasserviceNo ratings yet

- ST SupO 2940 2022 23 183214Document1 pageST SupO 2940 2022 23 183214Rajat SharmaNo ratings yet

- FS00055 - Mohammad Parwez-188202215227Document3 pagesFS00055 - Mohammad Parwez-188202215227K DNo ratings yet

- Nbri Bill 2Document2 pagesNbri Bill 2Vivek YadavNo ratings yet

- Veerco SLQT PI - 2537 121617Document2 pagesVeerco SLQT PI - 2537 121617designNo ratings yet

- Ajtech Grafix: Tax InvoiceDocument1 pageAjtech Grafix: Tax InvoiceAjtech OfficeNo ratings yet

- Veerco SLQT PI - 2967 163749Document1 pageVeerco SLQT PI - 2967 163749designNo ratings yet

- ST SupO 3037 2022 23 183323 PDFDocument1 pageST SupO 3037 2022 23 183323 PDFRajat SharmaNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- Neena Advertiser: Order Form / QuotationDocument1 pageNeena Advertiser: Order Form / QuotationJoginder ChhikaraNo ratings yet

- Rubco Rubberised Coir Mattress Division (An Iso 9001:2008 Certified Company)Document1 pageRubco Rubberised Coir Mattress Division (An Iso 9001:2008 Certified Company)Thasreen sNo ratings yet

- Bill FormetDocument1 pageBill Formetshuklavishal135No ratings yet

- Mobitex Network: Billed To: Shipped ToDocument1 pageMobitex Network: Billed To: Shipped ToVijay SharmaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Kush Consultancy: Billed To: Shipped ToDocument1 pageKush Consultancy: Billed To: Shipped Toaditya kushNo ratings yet

- Shri Ram Garments: Tax InvoiceDocument1 pageShri Ram Garments: Tax InvoicePUNAM JAINNo ratings yet

- Bansilal Inv 1 1.3 PDFDocument1 pageBansilal Inv 1 1.3 PDFManya BhosaleNo ratings yet

- BTI-013 Bolt, Nut, Washer Park GroveDocument2 pagesBTI-013 Bolt, Nut, Washer Park GroveGARIMANo ratings yet

- ScrapDocument1 pageScrapVIKASH TIWARYNo ratings yet

- Ultratech8205046287 1632836303Document3 pagesUltratech8205046287 1632836303ElectricalNo ratings yet

- Screenshot 2023-05-19 at 6.37.49 PMDocument1 pageScreenshot 2023-05-19 at 6.37.49 PMtriloke pandeyNo ratings yet

- 158 Prathmesh Po-Ac22po0600141Document1 page158 Prathmesh Po-Ac22po0600141Prathmesh EntNo ratings yet

- Screenshot 2023-05-19 at 6.39.12 PMDocument1 pageScreenshot 2023-05-19 at 6.39.12 PMtriloke pandeyNo ratings yet

- SupplyOutward 015Document1 pageSupplyOutward 015Akash GuptaNo ratings yet

- #16/ 6, A.K Road Rudrappa Garden, Kasturibanagar, Bangalore-560 0026Document2 pages#16/ 6, A.K Road Rudrappa Garden, Kasturibanagar, Bangalore-560 0026Yeshwanth Enterprises Fire Fifhting PumpsNo ratings yet

- PISRVAS22230233Document1 pagePISRVAS22230233Rahul BajiNo ratings yet

- Sales 154 2022 23Document1 pageSales 154 2022 23Swapnil CallaNo ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- Keero MeeroDocument1 pageKeero MeeroK D HERBAL & UNANINo ratings yet

- Rabi Industries: Quotation/ ProformaDocument1 pageRabi Industries: Quotation/ ProformaNitinNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSurajitKarNo ratings yet

- Wa0014.Document2 pagesWa0014.communication pointNo ratings yet

- Sri Ummaneni Sambasiva Rao: Tax InvoiceDocument5 pagesSri Ummaneni Sambasiva Rao: Tax InvoicebhulakshmiNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceTechnetNo ratings yet

- BABULIA - Sales-8780Document1 pageBABULIA - Sales-8780NI KONo ratings yet

- InvoiceDocument2 pagesInvoicesagarshinde8812No ratings yet

- Sales - 188Document1 pageSales - 188Shrey GuptaNo ratings yet

- Item Material Qty Uom Customer Material No Material Description Hsn/Sac Unit Price Total Taxable Amt CGST Sgst/Utgst Igst GST Cess Discount Amt Rate (%) Rate (%) Rate (%) Rate (%)Document2 pagesItem Material Qty Uom Customer Material No Material Description Hsn/Sac Unit Price Total Taxable Amt CGST Sgst/Utgst Igst GST Cess Discount Amt Rate (%) Rate (%) Rate (%) Rate (%)Jay ShahNo ratings yet

- Sales - UDP-100-22-23 RachTR Chemicals PVT LTDDocument2 pagesSales - UDP-100-22-23 RachTR Chemicals PVT LTDRachTRNo ratings yet

- Digitally Signed by Gopichettipalayam Srinivasan Viswanathan Date: 2023-08-27 03:49Document6 pagesDigitally Signed by Gopichettipalayam Srinivasan Viswanathan Date: 2023-08-27 03:49shubhamNo ratings yet

- Indore Municipal Corporation 153Document2 pagesIndore Municipal Corporation 153Babyboy2010No ratings yet

- File RJ02 GC1237Document1 pageFile RJ02 GC1237vedanshu siddhaNo ratings yet

- Sales 32 2023 24Document1 pageSales 32 2023 24Bharat AutomobileNo ratings yet

- Sales 151Document1 pageSales 151skgts787737No ratings yet

- ST SupO 2944 2022 23 183233 PDFDocument1 pageST SupO 2944 2022 23 183233 PDFRajat SharmaNo ratings yet

- Technosales Multimedia Technologies PVT LTD - 36Document1 pageTechnosales Multimedia Technologies PVT LTD - 36Fbsix ApNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherSiv global MarineNo ratings yet

- Sales 5Document1 pageSales 5skgts787737No ratings yet

- 8018033943Document1 page8018033943AnushaNo ratings yet

- Quotation BalajiDocument1 pageQuotation BalajiakashNo ratings yet

- Chair BillDocument1 pageChair BillNAGARJUNANo ratings yet

- Bharat Sanchar Nigam Limited: (A Govt. of India Enterprise)Document2 pagesBharat Sanchar Nigam Limited: (A Govt. of India Enterprise)Jinto JacobNo ratings yet

- Tax Invoice - LBS 2022-23 116 - 10 - 11 - 22Document1 pageTax Invoice - LBS 2022-23 116 - 10 - 11 - 22Atul KhadkeNo ratings yet

- Nbri Bill 2Document2 pagesNbri Bill 2Vivek YadavNo ratings yet

- Transfer Money - Canara BankDocument2 pagesTransfer Money - Canara BankVivek YadavNo ratings yet

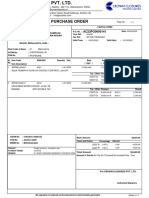

- Purchase Order 17Document2 pagesPurchase Order 17Vivek YadavNo ratings yet

- Cse UppclDocument44 pagesCse UppclVivek YadavNo ratings yet

- Hindu Calendar 2018 PDFDocument14 pagesHindu Calendar 2018 PDFVivek Yadav100% (1)

- c.11. Filipinas Synthetic Fiber Corp v. CADocument1 pagec.11. Filipinas Synthetic Fiber Corp v. CAArbie LlesisNo ratings yet

- Nava Vs CIRDocument9 pagesNava Vs CIRPia Christine BungubungNo ratings yet

- Cambridge IGCSE™: Economics 0455/22 May/June 2021Document23 pagesCambridge IGCSE™: Economics 0455/22 May/June 2021Tanay ModyNo ratings yet

- Bam 031 CfeDocument43 pagesBam 031 CfeMs VampireNo ratings yet

- Ab Bus HogayaDocument7 pagesAb Bus HogayaR. Shyaam PrasadhNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- OD428150379753135100Document1 pageOD428150379753135100Sourav SantraNo ratings yet

- Vardhaman Poly - Bill - VPDocument2 pagesVardhaman Poly - Bill - VPTechnetNo ratings yet

- Tax Invoice: (Original For Recipient)Document5 pagesTax Invoice: (Original For Recipient)ankit agrawalNo ratings yet

- Chairman's Letter - 1981Document14 pagesChairman's Letter - 1981Dan-S. ErmicioiNo ratings yet

- GuidelineforTax Exemption Reason CodesDocument2 pagesGuidelineforTax Exemption Reason CodesAnja TubinNo ratings yet

- BSAC Transit Paper PDFDocument20 pagesBSAC Transit Paper PDFThe Hamilton SpectatorNo ratings yet

- Ali Wahid Mustafa - CopieDocument1 pageAli Wahid Mustafa - Copiechrismas info gsmNo ratings yet

- Zurich Australian Insurance Limited: Annual ReportDocument58 pagesZurich Australian Insurance Limited: Annual ReportSriram Vasumathy SurendranNo ratings yet

- Pathfinder - Basic Economics of DD v0.1Document10 pagesPathfinder - Basic Economics of DD v0.1S. BalcrickNo ratings yet

- Impact of GST On Indian EconomyDocument6 pagesImpact of GST On Indian Economyavinash palNo ratings yet

- Ethiopian Sugar Industry ProfileDocument33 pagesEthiopian Sugar Industry Profilegetachew yetena100% (3)

- Ormoc City Comparative Statements of Financial Position: Total Current AssetsDocument6 pagesOrmoc City Comparative Statements of Financial Position: Total Current Assetssandra bolokNo ratings yet

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet

- Abhishek ResumeDocument3 pagesAbhishek ResumeAR COMPANYNo ratings yet

- Daily Opening and Closing Market RateDocument3 pagesDaily Opening and Closing Market RateRAMODSNo ratings yet

- SONA 2019 TranscriptDocument15 pagesSONA 2019 TranscriptBryan LongosNo ratings yet

- (1st Exam) Taxation 1 - DigestsDocument36 pages(1st Exam) Taxation 1 - DigestsAnonymous kDxt5UNo ratings yet

- Ascham 2022 Standard Maths Trials & SolutionsDocument66 pagesAscham 2022 Standard Maths Trials & SolutionsAdnan HameedNo ratings yet

- Rabbi's Speech Called Hateful: Llaacckk Ooff TtrruussttDocument28 pagesRabbi's Speech Called Hateful: Llaacckk Ooff TtrruussttSan Mateo Daily JournalNo ratings yet

- Solution Manual For Taxation For Decision Makers 2020 10th by Dennis EscoffierDocument5 pagesSolution Manual For Taxation For Decision Makers 2020 10th by Dennis EscoffierShawnPerryopke100% (34)

- Release Notes BUSY 18 PDFDocument37 pagesRelease Notes BUSY 18 PDFNik KukrejaNo ratings yet

- 2017 31 The Peshawar Development Authority Act 2017Document21 pages2017 31 The Peshawar Development Authority Act 2017Naveed Aman SafiNo ratings yet