Professional Documents

Culture Documents

Principles of Accounting - Lesson 7 - Cashbook - Petty Cashbk

Uploaded by

alanorules001Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of Accounting - Lesson 7 - Cashbook - Petty Cashbk

Uploaded by

alanorules001Copyright:

Available Formats

1|

Principles of

Accounting I

Dr. Maina Justus

Dr. Maina Justus

Revised

Kalasha Training Resource Dr. Maina Justus

2|

THE CASHBOOK

A cashbook records all the receipts (cash and cheques from customers and debtors or other sources

of income) and all the payments (to creditors or suppliers and other expenses) for a particular

financial period. The cashbook will also show us the cash at bank and cash in hand position of the

firm. There are two types of cashbooks:

i. Cash in hand cashbook, which records the cash transactions in the firm or business.

ii. Cash at bank cashbook, which records the transactions at/with, the bank.

The cashbook is the most important book of prime entry because it forms part of the general

ledger and records the source documents (receipts and cheques). The cash at bank cashbook and

cash in hand cashbook are combined together to get a two-column cashbook. The format is as

follows:

Two-column cashbook.

CASH BOOK

Date Details Cash Bank Date Details Cash Bank

(Sh.) (Sh.) (Sh.) (Sh.)

Additional columns for discounts allowed and discounts received can be included with the cash at

bank columns to get a 3 – column cashbook. The format is as follows:

The balance carried down (Bal c/d) for cash in hand and cash at bank will form part of the ledger

balances and the discounts allowed and discounts received columns will be added and the totals

posted to the respective discount accounts. The discount allowed total will be posted to the debit

side of the discount allowed account in the general ledger and the total of the discount received

will be posted to the credit side of the discount-received account of the general ledger. Cash at

bank can have either a credit or debit balance. A debit balance means the firm has some cash at

the bank and a credit balance means that the account at the bank is overdrawn. (The firm owes

the bank some money).

Illustration:

Write up a two-column cashbook from the following details, and balance off as at the end of the

month:

2003

May 1 Started business with capital in cash Sh.1, 000.

“ 2 Paid rent by cash Sh.100.

“ 3 F Lake lent us Sh.5, 000, paid by cheque.

“ 4 We paid B McKenzie by cheque Sh.650.

Kalasha Training Resource Dr. Maina Justus

3|

“ 5 Cash sales Sh.980.

“ 7 N Miller paid us by cheque Sh.620.

“ 9 We paid B Burton in cash Sh.220.

“ 11 Cash sales paid direct into the bank Sh.530.

“ 15 G Moores paid us in cash Sh.650.

“ 19 We repaid F Lake Sh.1, 000 by cheque.

“ 22 Cash sales paid direct into the bank Sh.660.

“ 26 Paid motor expenses by cheque Sh.120.

“ 31 Paid wages in cash Sh.970.

Cash Book

Cash Bank Cash Bank

Capital 1000 Rent 100

F. Lake (Loan) 5000 B McKenzie 650

Sales 980 B Burton 220

N Miller 620

Sales 530 F Lake (loan) 1000

G Moores 650 Motor Expenses 120

Sales 660 Wages 970

Balances c/d 1340 5040

2630 6810 2630 6810

Petty Cash Book and the imprest system of Accounting.

Petty Cash Book is a record of all the petty cash vouchers raised and kept by the cashier. The

petty cash vouchers will show summary expenses paid by the cashier and this information is listed

and classified in the petty cash book under the headings of the relevant expenses such as:

Postage and stationery

Traveling

Cleaning expenses.

The format is as shown:

Petty Cash Book

Expenses The Ledger

Stationery

Travelling

expenses

Telegram

Payment

Receipts

Amount

Postage

General

Details

Office

Date

and

The balance c/d of the petty cash book will signify the balance of cash in hand or form part of

cash in hand. The totals of the expenses are posted to the debit side of the expense accounts. If

a firm operates another cashbook in addition to the petty cash book, then the totals of the expenses

will also be posted on the credit side of the cash in hand cashbook.

The Imprest system

This system of accounting operates on a simple principle that the cashier is refunded the exact

amount spent on the expenses during a particular financial period. At the beginning of each

period, a cash float is agreed upon and the cashier is given this amount to start with. Once the

cashier makes payments for the period, he will get a total of all the payments made against which

Kalasha Training Resource Dr. Maina Justus

4|

he will claim a reimbursement of the same amount that will bring back the amount to the cash float

at the beginning of the period.

This is demonstrated as follows:

Sh.

Start with (float) 1,000

Expenses paid (720)

Balance 280

Reimbursement 720

Cash float 1,000

Illustration:

Given the information below write up a petty cash book with the following columns;

1. Postage and telegram

2. Stationery

3. Travelling

4. Office expenses

5. The ledger

October 1 received petty cash sh. 20,000

October 1 paid for sugar sh. 700

October 2 bought pencils and pens sh. 800

October 4 bus fare sh. 400

October 5 telegram sh. 1,500

October 8 envelopes sh. 900

October 9 paid David (trade creditor) sh. 6,000

October 9 coffee sh. 200

October 15 cleaning sh. 4,000

Solutions

Kalasha Training Resource Dr. Maina Justus

You might also like

- ACCOUNTING5Document9 pagesACCOUNTING5Natasha MugoniNo ratings yet

- Accounting Basics 3Document74 pagesAccounting Basics 3Mukund kelaNo ratings yet

- Unit 5: Cash Book: Learning OutcomesDocument16 pagesUnit 5: Cash Book: Learning Outcomessglory dharmarajNo ratings yet

- Problem On Loan ImpairmentDocument26 pagesProblem On Loan ImpairmentYukiNo ratings yet

- BRS (Bank Reconciliation Statement)Document23 pagesBRS (Bank Reconciliation Statement)Shruti KapoorNo ratings yet

- Accounting Cash Management & ControlDocument25 pagesAccounting Cash Management & ControlMd Jahid HossainNo ratings yet

- Cash Book and Bank Reconciliation Lecture IDocument10 pagesCash Book and Bank Reconciliation Lecture IDavidNo ratings yet

- Cash and CE Problems ExercisesDocument3 pagesCash and CE Problems ExercisesMa. Erika Charisse DacerNo ratings yet

- Cash Books To StudentsDocument8 pagesCash Books To StudentsIRUNGU BRENDA MURUGINo ratings yet

- BOOKKEEPING-Petty Cash BookDocument8 pagesBOOKKEEPING-Petty Cash Bookjosephinemusopelo1No ratings yet

- Unit 5: Cash Book: Learning OutcomesDocument20 pagesUnit 5: Cash Book: Learning OutcomesMonica NallathambiNo ratings yet

- Petty Cashbook NotesDocument6 pagesPetty Cashbook NotesBamidele AdegboyeNo ratings yet

- Accounting For Current Assets - Cash and ReceivablesDocument17 pagesAccounting For Current Assets - Cash and ReceivablesvladsteinarminNo ratings yet

- MC- Bank Reconciliation and Proof of CashDocument4 pagesMC- Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- Cash Book Theory and SumsDocument63 pagesCash Book Theory and SumsDubai SheikhNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Icpa - Ia1Document26 pagesIcpa - Ia1john paulNo ratings yet

- Cash - CRDocument14 pagesCash - CRpingu patwhoNo ratings yet

- Bank Reconciliation Statement PreparationDocument5 pagesBank Reconciliation Statement PreparationsteveNo ratings yet

- Current JSS 2 BUSINESS STUDIES 3RD TERMDocument34 pagesCurrent JSS 2 BUSINESS STUDIES 3RD TERMpalmer okiemuteNo ratings yet

- Unit 5: Cash Book: Learning OutcomesDocument17 pagesUnit 5: Cash Book: Learning Outcomesyash jainNo ratings yet

- 1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashDocument7 pages1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashSheidee ValienteNo ratings yet

- Principles of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashDocument12 pagesPrinciples of Financial Accounting: Chapter 7 - Fraud, Internal Controls, & CashAli Zain Parhar100% (2)

- Chapter 4-Cash & Cash EquivalentDocument14 pagesChapter 4-Cash & Cash EquivalentEmma Mariz Garcia75% (4)

- Manage Cash Flow with a Two-Column Cash BookDocument5 pagesManage Cash Flow with a Two-Column Cash BookAdika Denish0% (1)

- Cash and Cash Equivalents & Bank ReconciliationDocument20 pagesCash and Cash Equivalents & Bank ReconciliationHesil Jane DAGONDON100% (1)

- Bank Reconciliation NotesDocument25 pagesBank Reconciliation NotesJohn Sue HanNo ratings yet

- Reconciling Bank Statements and Cash BooksDocument12 pagesReconciling Bank Statements and Cash BooksAnita ZerafaNo ratings yet

- The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenueDocument35 pagesThe Effect of Profit or Loss On Capital and The Double Entry System For Expenses and Revenueshabanzuhura706No ratings yet

- Module 1.1 Cash and Cash Equivalent and Petty CashDocument29 pagesModule 1.1 Cash and Cash Equivalent and Petty Cashshopee 101No ratings yet

- Accounting 1Document88 pagesAccounting 1Rina Angeles EndozoNo ratings yet

- Accounting PPT ReportDocument27 pagesAccounting PPT ReportAbdullah AmjadNo ratings yet

- Accounting Test - IDocument3 pagesAccounting Test - IRahulNo ratings yet

- Everything about Cash Book and Petty Cash BookDocument22 pagesEverything about Cash Book and Petty Cash BookNabiha KhanNo ratings yet

- Petty CashDocument11 pagesPetty CashKim HaejinNo ratings yet

- CH 2 CompleteDocument114 pagesCH 2 CompleteSyeda ToobaNo ratings yet

- Business Studies Chapter 7 - Grade 10Document7 pagesBusiness Studies Chapter 7 - Grade 10Maneesha DulanjaliNo ratings yet

- Chapter 1 Cash and Cash Equivalent ProjectDocument8 pagesChapter 1 Cash and Cash Equivalent ProjectJohn Carlo DelorinoNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- Module AccountingDocument35 pagesModule AccountingNomthandazo SikhondeNo ratings yet

- DocxDocument11 pagesDocxYukiNo ratings yet

- DocxDocument11 pagesDocxYukiNo ratings yet

- Chapter 3the Accounting CycleDocument10 pagesChapter 3the Accounting CycleonakhogxamsheNo ratings yet

- Financial Accounting Cash Book, Bank ReconciliationDocument24 pagesFinancial Accounting Cash Book, Bank Reconciliationanon_154643438No ratings yet

- Warren SM Ch.02 FinalDocument68 pagesWarren SM Ch.02 FinalLidya Silvia Rahma50% (2)

- Audit Cash Equivalents Assertions ProceduresDocument7 pagesAudit Cash Equivalents Assertions Proceduresnicole bancoroNo ratings yet

- Warren SM CH 02 Final PDFDocument66 pagesWarren SM CH 02 Final PDFSandra0% (1)

- Accounting For Not For Profit OrganizationsDocument10 pagesAccounting For Not For Profit Organizationsakashyadavjee556No ratings yet

- Solution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsDocument21 pagesSolution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsJovel Paycana100% (5)

- Accounting10 (Reviewer)Document5 pagesAccounting10 (Reviewer)Erika Panit ReyesNo ratings yet

- CASH AND CASH EQUIVALENTS PROBLEMSDocument3 pagesCASH AND CASH EQUIVALENTS PROBLEMSShiela Mae SangidNo ratings yet

- CASH AND LIQUIDITY MANAGEMENT TECHNIQUESDocument44 pagesCASH AND LIQUIDITY MANAGEMENT TECHNIQUESBulls Bears FinancialsNo ratings yet

- Chapter 2 Review Sheet AnswersDocument7 pagesChapter 2 Review Sheet AnswersKenneth DayohNo ratings yet

- Accounting Fundamentals ExplainedDocument20 pagesAccounting Fundamentals Explained1986anuNo ratings yet

- AccounBM1 - Recording Business TransactionsDocument41 pagesAccounBM1 - Recording Business TransactionsKathlyn LabetaNo ratings yet

- Accounts Form 2 - 2021Document40 pagesAccounts Form 2 - 2021Tafaranashe100% (13)

- Processing Accounting Information: QuestionsDocument57 pagesProcessing Accounting Information: QuestionsYousifNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Mitigation of Orders and Cause For PriceDocument10 pagesMitigation of Orders and Cause For PriceAtharva Sawant100% (2)

- 6.FOREX Module 2.2Document12 pages6.FOREX Module 2.2alanorules001No ratings yet

- 7.b.fundamental Analysis - 230720 - 204624Document7 pages7.b.fundamental Analysis - 230720 - 204624alanorules001No ratings yet

- 8.b.FOREX Module 1.4Document13 pages8.b.FOREX Module 1.4alanorules001No ratings yet

- Fair Value Gaps - TTrades - EduDocument9 pagesFair Value Gaps - TTrades - EduFelipe CastañedaNo ratings yet

- Labor dispute and illegal dismissal caseDocument5 pagesLabor dispute and illegal dismissal caseRene ValentosNo ratings yet

- Draft Letter To Sophia Wisniewska (00131538xBF0F1)Document3 pagesDraft Letter To Sophia Wisniewska (00131538xBF0F1)sarah_larimerNo ratings yet

- 5 Pillars of IslamDocument4 pages5 Pillars of IslamTapiwa Asher MoyoNo ratings yet

- Multi Q!Document112 pagesMulti Q!collinmandersonNo ratings yet

- Pakistani Companies and Their CSR ActivitiesDocument15 pagesPakistani Companies and Their CSR ActivitiesTayyaba Ehtisham100% (1)

- ECON F211 Principles of Economics: Module 3 (RSG)Document51 pagesECON F211 Principles of Economics: Module 3 (RSG)Hritik LalNo ratings yet

- All 18 QSS in One-1 PDFDocument314 pagesAll 18 QSS in One-1 PDFkishan23100% (1)

- Sentinel Boom: Ensuring An Effective Solution To Your Oil Spill Requirements!Document2 pagesSentinel Boom: Ensuring An Effective Solution To Your Oil Spill Requirements!Adrian GomezNo ratings yet

- SnowflakeDocument6 pagesSnowflakeDivya SrijuNo ratings yet

- Act 4103 - The Indeterminate Sentence LawDocument3 pagesAct 4103 - The Indeterminate Sentence LawRocky MarcianoNo ratings yet

- Humantrafficking Logic ModelDocument1 pageHumantrafficking Logic Modelapi-341131818100% (1)

- Employment ContractDocument6 pagesEmployment ContractNemwel MogakaNo ratings yet

- ISO 9001 Quality Objectives - What They Are and How To Write ThemDocument7 pagesISO 9001 Quality Objectives - What They Are and How To Write ThemankitNo ratings yet

- CHAPTER 2 AnalysisDocument7 pagesCHAPTER 2 AnalysisJv Seberias100% (1)

- Constitutional Crisis in the PhilippinesDocument37 pagesConstitutional Crisis in the Philippineslee viceNo ratings yet

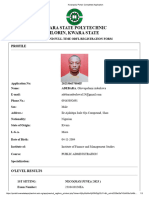

- Kwarapoly Portal - Completed ApplicationDocument3 pagesKwarapoly Portal - Completed ApplicationosinoluwatosinNo ratings yet

- Cos Salonshop PDFDocument3 pagesCos Salonshop PDFRahel EbottNo ratings yet

- Unit 4 - CSDocument32 pagesUnit 4 - CSyuydokostaNo ratings yet

- Hotel Invoice Details for $804.04 StayDocument2 pagesHotel Invoice Details for $804.04 StayTiana IrvineNo ratings yet

- Identification Parade AssignmentDocument10 pagesIdentification Parade AssignmentAbdul Rehman100% (1)

- Ôn tập ngữ pháp Tiếng Anh cơ bản với bài tập To V VingDocument10 pagesÔn tập ngữ pháp Tiếng Anh cơ bản với bài tập To V Vingoanh siuNo ratings yet

- The Value of Cleanliness in The View of The Students of Two Higher Education InstitutionsDocument7 pagesThe Value of Cleanliness in The View of The Students of Two Higher Education InstitutionsjueNo ratings yet

- March 17, 2019 CSE-PPT Professional List of Passers RO4Document67 pagesMarch 17, 2019 CSE-PPT Professional List of Passers RO4Faniefets SoliterogenNo ratings yet

- ESwitching PTAct 6 5 1Document4 pagesESwitching PTAct 6 5 1Wayne E. BollmanNo ratings yet

- Sarah BaartmanDocument6 pagesSarah Baartmanwebe789No ratings yet

- MPU22012 ENTREPRENEURSHIP REPORT SLIDE (Autosaved)Document20 pagesMPU22012 ENTREPRENEURSHIP REPORT SLIDE (Autosaved)Errra UgunNo ratings yet

- Manager, Corporate Strategy & Business Development, Payor and Care Markets - McKesson Canada - LinkedInDocument6 pagesManager, Corporate Strategy & Business Development, Payor and Care Markets - McKesson Canada - LinkedInshawndxNo ratings yet

- Chapter 6 Verification of Assets and Liabilities PM PDFDocument60 pagesChapter 6 Verification of Assets and Liabilities PM PDFVyankatrao NarwadeNo ratings yet

- Instant Download Communicate 14th Edition Verderber Test Bank PDF Full ChapterDocument32 pagesInstant Download Communicate 14th Edition Verderber Test Bank PDF Full ChapterCarolineAvilaijke100% (10)

- Grade 11 Religion Summative TestDocument5 pagesGrade 11 Religion Summative TestEngelbert TejadaNo ratings yet