Professional Documents

Culture Documents

I CAPITAL Equity

I CAPITAL Equity

Uploaded by

ovidiu.tisloveanuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I CAPITAL Equity

I CAPITAL Equity

Uploaded by

ovidiu.tisloveanuCopyright:

Available Formats

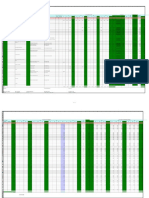

I CAPITAL / Equity

Done/ No/

paper ref.

Not appl.

Working

Task description

1. Obtain capital account analysis and reconcile totals (A)

Obtain an analysis of capital account balances segregated by class of stock, including balances at the beginning of the year,

additions, deductions and balances at the end of the period and trace the total against capital as per trial balance. Trace

opening to the previous year working papers. Test the mathematical accuracy of the analysis. Ensure there is no difference

between breakdown and capital and reserve account balance as per trial balance.

2. Agree share capital to articles of incorporation (A, E)

Trace all the items from the list obtained above against supporting documents (Company Set-up Statement, subsequent

increases in share capital). Investigate all the differences, if any.

Check the amount of share capital from trial balance by multiplying the number of shares with their nominal value as appear in

company incorporation documents (statutes). Take in calculation every additional increase in capital during the audit period.

Use also prior year working papers.

Check the cash increase in share capital against bank statements, if applicable.

3. Review reserve balances (A, E, V)

Obtain an analysis of reserve balances and (a) trace account balances to the trial balance and the previous year working papers; (b)

determine the nature of changes in the reserve balances from the prior year to the current year and examine, to an extent based on

materiality and inherent risk, supporting documentation; and (c) assess the adequacy of the year-end reserve balances.

4. Verify correctness of information for disclosure of capital items (PD)

Determine whether appropriate information for capital related accounts has been obtained for required disclosure in the financial

statements. Obtain the most recent version of articles of incorporation (statutes) and a recent certificate from the Trade Registry

(issued around the year-end). Check that information regarding shareholders and % of ownership is correctly presented in the

financial statements.

______________________________

A = accuracy / C= completeness / E = existence / V= valuation/ CO = cut off / PD = presentation & disclosure / RO = rights & obligations

You might also like

- In These Spreadsheets, You Will Learn How To Use The Following Excel FunctionsDocument53 pagesIn These Spreadsheets, You Will Learn How To Use The Following Excel FunctionsAshekin MahadiNo ratings yet

- Chart of Accounts For HotelDocument24 pagesChart of Accounts For HotelJonathan Oni100% (2)

- L FURNIZORI SuppliersDocument2 pagesL FURNIZORI Suppliersovidiu.tisloveanuNo ratings yet

- F - Creante Clienti - ReceivablesDocument2 pagesF - Creante Clienti - Receivablesovidiu.tisloveanuNo ratings yet

- K - DATORII PE TL - Non-Current LiabilitiesDocument1 pageK - DATORII PE TL - Non-Current Liabilitiesovidiu.tisloveanuNo ratings yet

- P - VENITURI SI CHELT FIN - Financial Inc&expDocument1 pageP - VENITURI SI CHELT FIN - Financial Inc&expovidiu.tisloveanuNo ratings yet

- G - Casa Si Banca - Cash and BankDocument1 pageG - Casa Si Banca - Cash and Bankovidiu.tisloveanuNo ratings yet

- Saroj Bala GPF - CompressedDocument33 pagesSaroj Bala GPF - CompressedbhagwantiNo ratings yet

- Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2020 FormDocument1 pageAnnual Procurement Plan-Common Supplies and Equipment (App-Cse) 2020 FormalexNo ratings yet

- O - CHELT EXPLOATARE Salarii - OPEX PayrollDocument1 pageO - CHELT EXPLOATARE Salarii - OPEX Payrollovidiu.tisloveanuNo ratings yet

- 1-Prepare Financial StatementsDocument7 pages1-Prepare Financial StatementsCristina YusonNo ratings yet

- Computer PROJECTFall 2012Document6 pagesComputer PROJECTFall 2012qhn9999_359999443No ratings yet

- Unit VI Part 1 General Journal, General Ledger, Trial BalanceDocument20 pagesUnit VI Part 1 General Journal, General Ledger, Trial BalancePatrick BernilNo ratings yet

- Post Closing TB & Reversing EntryDocument4 pagesPost Closing TB & Reversing EntryDonna Lyn BoncodinNo ratings yet

- The Work Sheet and Financial StatementsDocument29 pagesThe Work Sheet and Financial StatementsNavroopamNo ratings yet

- Adjusting Entries and The WorksheetDocument34 pagesAdjusting Entries and The WorksheetJean CastroNo ratings yet

- Supplemental Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2019 FormDocument2 pagesSupplemental Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2019 FormMarivic Sabangan DiazNo ratings yet

- Quick Sizer HANA Version Offline Questionnaire V238Document225 pagesQuick Sizer HANA Version Offline Questionnaire V238Krishna ChaitanyaNo ratings yet

- E1 - STOCURI PRODUCTIE - Inventories WIPDocument1 pageE1 - STOCURI PRODUCTIE - Inventories WIPovidiu.tisloveanuNo ratings yet

- Rev Acc 11 SampleDocument28 pagesRev Acc 11 Sampledlaminifanele903No ratings yet

- Definition of 'Ratio Analysis'Document12 pagesDefinition of 'Ratio Analysis'VikasDoshiNo ratings yet

- Tle 10 Entrepreneurship 2 Quarter 4 Module 5 Caligdong 1Document15 pagesTle 10 Entrepreneurship 2 Quarter 4 Module 5 Caligdong 1jamaicadaal2No ratings yet

- PEZA-Cavite Economic Zone Annual Procurement Plan-Common-Use Supplies (APP-CSE) For CY 2024 - FinalDocument15 pagesPEZA-Cavite Economic Zone Annual Procurement Plan-Common-Use Supplies (APP-CSE) For CY 2024 - FinalPatrickNo ratings yet

- SS-Annual Year End ProcedureDocument4 pagesSS-Annual Year End Procedurezakaria100% (1)

- 7.1 FibDocument19 pages7.1 FibKiệt Mai AnhNo ratings yet

- Final Sap Q A PaperDocument6 pagesFinal Sap Q A PaperSyed ArbiyaNo ratings yet

- 20mba1031 NPVDocument10 pages20mba1031 NPVKavitha prabhakaranNo ratings yet

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- First and Final Bill FormDocument2 pagesFirst and Final Bill Formsouranshu prasad SahooNo ratings yet

- The Smart Personal Budget Template v2Document27 pagesThe Smart Personal Budget Template v2Vijay ChanderNo ratings yet

- POA SBA Guidelines ChecklistDocument4 pagesPOA SBA Guidelines ChecklistFintonPaul100% (3)

- Accounts - Module 6 Provisions of The Companies Act 1956Document15 pagesAccounts - Module 6 Provisions of The Companies Act 19569986212378No ratings yet

- Color-Coding:: Preparer Name Company Name Starting Month Starting YearDocument42 pagesColor-Coding:: Preparer Name Company Name Starting Month Starting YearPrevita GresiaNo ratings yet

- Annual Procurement Plan - Commom-Use Supplies and Equipment (App-Cse) 2022 FormDocument12 pagesAnnual Procurement Plan - Commom-Use Supplies and Equipment (App-Cse) 2022 FormNenbon Natividad100% (3)

- Accounting FundamentalsDocument37 pagesAccounting FundamentalsRuhen Rj PanchoNo ratings yet

- Accounting Fundamentals - Session 6 - For ClassDocument25 pagesAccounting Fundamentals - Session 6 - For ClassPawani ShuklaNo ratings yet

- MAS FS Analysis 40pagesDocument50 pagesMAS FS Analysis 40pageskevinlim186No ratings yet

- 7110 w18 QP 21 PDFDocument20 pages7110 w18 QP 21 PDFMuhammad ImranNo ratings yet

- Job Order Case UV1726-PDF-ENGDocument4 pagesJob Order Case UV1726-PDF-ENGshayan.arif96No ratings yet

- Business Expense Budget1Document7 pagesBusiness Expense Budget1Kehan KhalidNo ratings yet

- ACC 111 Chapter 4 Lecture NotesDocument5 pagesACC 111 Chapter 4 Lecture NotesLoriNo ratings yet

- Board Reporting ToolDocument53 pagesBoard Reporting ToolJia HuiNo ratings yet

- S - ALR - 87012284 - Financial Statements & Trial BalanceDocument9 pagesS - ALR - 87012284 - Financial Statements & Trial Balancessrinivas64No ratings yet

- Accounting Fundamentals II: Lesson 8 (Printer-Friendly Version)Document7 pagesAccounting Fundamentals II: Lesson 8 (Printer-Friendly Version)gretatamaraNo ratings yet

- Notes On Chapter 7: 7.1 Purposes of The Trading and Profit and Loss AccountDocument3 pagesNotes On Chapter 7: 7.1 Purposes of The Trading and Profit and Loss AccountPriya SunderNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- RatiosDocument6 pagesRatiosFaisal AwanNo ratings yet

- App ShsDocument8 pagesApp ShsJezebel CayabyabNo ratings yet

- Preparing Adjusting Entries From A Worksheet: Closing The BooksDocument1 pagePreparing Adjusting Entries From A Worksheet: Closing The BooksTalionNo ratings yet

- App 2019 Combined PDFDocument257 pagesApp 2019 Combined PDFGlenn LapizNo ratings yet

- Accounting Project (Final Accounts)Document20 pagesAccounting Project (Final Accounts)PowerPoint GoNo ratings yet

- Department of Education: Fy 2018 Physical Plan / Financial Obligation / Monthly Disbursement ProgramDocument21 pagesDepartment of Education: Fy 2018 Physical Plan / Financial Obligation / Monthly Disbursement ProgramChristine De San JoseNo ratings yet

- Preparing Financial Statements: There Are Four Common Types of Financial StatementsDocument7 pagesPreparing Financial Statements: There Are Four Common Types of Financial StatementsHasanAbdullahNo ratings yet

- 2.define Chart of Accounts and Accounts GroupDocument18 pages2.define Chart of Accounts and Accounts GroupNASEER ULLAHNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Accounting: A Simple Guide to Financial and Managerial Accounting for BeginnersFrom EverandAccounting: A Simple Guide to Financial and Managerial Accounting for BeginnersNo ratings yet

- Jai MiniDocument63 pagesJai MiniJaimini PrajapatiNo ratings yet

- Quartlerly Statement of Bell Jar Operations (GC-7Q)Document5 pagesQuartlerly Statement of Bell Jar Operations (GC-7Q)Jacob GiffenNo ratings yet

- White Mail LablesDocument1 pageWhite Mail LablesCarolyn ClemNo ratings yet

- Economics of Markets: Market Equilibrium: ObjectivesDocument4 pagesEconomics of Markets: Market Equilibrium: Objectivesshandil7No ratings yet

- RM48,000 X 9% X 90/365Document4 pagesRM48,000 X 9% X 90/365Nurul SyakirinNo ratings yet

- Understanding The BCG Growth Share Matrix and How To Use ItDocument9 pagesUnderstanding The BCG Growth Share Matrix and How To Use ItRUCHIKA BAJAJNo ratings yet

- Platsic Ban Economy Vs EnvironmentDocument7 pagesPlatsic Ban Economy Vs EnvironmentAnudeep Chandra100% (1)

- 9 CMA Rev. Cash Flow StatementDocument15 pages9 CMA Rev. Cash Flow StatementSakshiNo ratings yet

- DownloadDocument1 pageDownloadGeeta shaghasiNo ratings yet

- Financial Statement Analysis Soubhagya PDFDocument79 pagesFinancial Statement Analysis Soubhagya PDFDaniel JacksonNo ratings yet

- Inventory & Supply Chain Management SlidesDocument4 pagesInventory & Supply Chain Management SlidesHello WorldNo ratings yet

- Industrial Location - SeminarDocument25 pagesIndustrial Location - SeminarmanimadhavanNo ratings yet

- SFM by CA Pavan Karmele SirDocument2 pagesSFM by CA Pavan Karmele SirPrerak JainNo ratings yet

- Economic Systems and Resource Allocation of UK and Sri LankaDocument3 pagesEconomic Systems and Resource Allocation of UK and Sri LankaBhakthi Sri JagodaarachchiNo ratings yet

- Std. VIII Ch.1 Resources Notes (22-23)Document2 pagesStd. VIII Ch.1 Resources Notes (22-23)Prachi PurswaniNo ratings yet

- Sectors On Indian EconomyDocument15 pagesSectors On Indian EconomyshagunNo ratings yet

- Case Study 3 Business Unit Shut DownDocument2 pagesCase Study 3 Business Unit Shut DownSharjeel Humayun HassanNo ratings yet

- Chaper 78Document4 pagesChaper 78Nyan Lynn HtunNo ratings yet

- Investment in Turkey 2015Document128 pagesInvestment in Turkey 2015Ana GhergheNo ratings yet

- Answers To Exercises Ch. 18Document7 pagesAnswers To Exercises Ch. 18H CNo ratings yet

- Illovo Sugar Malawi PLC Annual Report 31 Aug 2021Document168 pagesIllovo Sugar Malawi PLC Annual Report 31 Aug 2021deeNo ratings yet

- TEO - Fardapaper-Adopters-and-non-adopters-of-business-to-business-electronic-commerce-in-SingaporeDocument14 pagesTEO - Fardapaper-Adopters-and-non-adopters-of-business-to-business-electronic-commerce-in-SingaporeNonkuNo ratings yet

- Fined IncomeDocument15 pagesFined IncomeAvid HikerNo ratings yet

- Full Automatic Incense Stick Making MachineDocument9 pagesFull Automatic Incense Stick Making Machineprince kumarNo ratings yet

- Sample of Ceremony For Installation of Officers For Lions ClubsDocument9 pagesSample of Ceremony For Installation of Officers For Lions ClubsElston B. FernandesNo ratings yet

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Document6 pagesSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooNo ratings yet

- Harmony, Integrity, IndustryDocument6 pagesHarmony, Integrity, Industryjohn kevin pascuaNo ratings yet

- AIIB Chennai Peripheral Ring Road Sections 2 and 3 - PD - Board - Final 20230103Document47 pagesAIIB Chennai Peripheral Ring Road Sections 2 and 3 - PD - Board - Final 20230103Manoharan UbendiranNo ratings yet

- Document 6Document91 pagesDocument 6Mansi SuvariyaNo ratings yet

- Detailed StatementDocument2 pagesDetailed StatementtestNo ratings yet