Professional Documents

Culture Documents

P - VENITURI SI CHELT FIN - Financial Inc&exp

Uploaded by

ovidiu.tisloveanu0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

P_VENITURI SI CHELT FIN_Financial inc&exp

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageP - VENITURI SI CHELT FIN - Financial Inc&exp

Uploaded by

ovidiu.tisloveanuCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

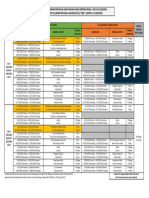

P – VENITURI SI CHELTUIELI FINANCIARE / Financial income and expense

Done/ No/

paper ref.

Not appl.

Working

Task description

1. Agree detail listing to the general ledger (C, A)

Obtain a detailed listing by type of interest income / expense to the general ledger. Test the mathematical accuracy

of the listing. Trace account balances to the general ledger.

2. Perform substantive analytical procedures (C, A, E, CO, V)

Perform, to an extent to achieve the desired degree of assurance (depending on the natural limitations of analytical

procedures and the rigor with which we apply the test), substantive analytical procedures: (a) develop an expectation,

based on appropriate data (assess the reliability of data, considering the extent of comfort from controls); (b)

determine the variation amount or % (threshold) to be used in the investigation of differences from expectations; (c)

compute the differences between recorded amounts and the expectations; and (d) investigate variations from

expectations by seeking relevant explanations from management or appropriate corroborating evidence.

Examples of analytical procedures: multiply the average outstanding loan balance / deposit balance by the interest

rate applicable and compare the results to the interest expense / income recorded in the income statement for

reasonableness; multiply the average outstanding assets / liabilities expressed in foreign currency with the increase /

decrease in fx rates during the year and compare the result with the net fx income or expense.

3. Verify accuracy of financial income and expense (C, A, RO)

Test, to an extent based on materiality and inherent risk the accuracy of amounts included in the financial income and

expense balance by:

- For interest income and expense: (a) recomputing or applying analytical procedures to test the calculation of the

interest expense or interest income recorded for the period and (b) tracing to supporting documents (e.g. debt

agreements, bank statements);

- For investment income and dividends: (a) recomputing or applying analytical procedures to test the calculation

of the interest income and dividends recorded for the period; (b) recomputing the accuracy of discount or

premium amortization; and (c) tracing to supporting documentation (e.g. investor statements, board minutes);

- For foreign exchange income and expense: (a) recomputing or applying analytical procedures to test the

calculation of fx differences for a selection of income and expense bookings resulted from revaluations and

transactions performed during the year; (b) tracing to supporting documentation significant amounts resulted

from transactions (e.g. invoices in foreign currency, payments).

4. Verify that cut-off was properly done (CO)

Recompute accrual amounts for interest due / interest receivable as at the year end and check that the respective expense

/ income was properly booked in the correct period.

5. Test completeness of financial income and expense balances (C)

Obtain sufficient information to test completeness, for example, debt agreements, bank statements, investment

statements, board minutes, derivative contracts, etc. and verify the total of the financial income and expense balances.

______________________________

A = accuracy / C= completeness / E = existence / V= valuation/ CO = cut off / PD = presentation & disclosure / RO = rights & obligations

You might also like

- K - DATORII PE TL - Non-Current LiabilitiesDocument1 pageK - DATORII PE TL - Non-Current Liabilitiesovidiu.tisloveanuNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Academy Trust External Audit Preparation ChecklistDocument8 pagesAcademy Trust External Audit Preparation ChecklistAyşe BalamirNo ratings yet

- G - Casa Si Banca - Cash and BankDocument1 pageG - Casa Si Banca - Cash and Bankovidiu.tisloveanuNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Sample Audit ProgramsDocument53 pagesSample Audit ProgramsMinhaj Sikander100% (2)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- C - IMOBILIZARI Nec&co - Fixed Assets Intg&tgDocument2 pagesC - IMOBILIZARI Nec&co - Fixed Assets Intg&tgovidiu.tisloveanuNo ratings yet

- Income Taxes ProgramDocument14 pagesIncome Taxes ProgramGodfrey JathoNo ratings yet

- AP 20 Prepaid Expenses and Other Assets PDFDocument5 pagesAP 20 Prepaid Expenses and Other Assets PDFmyangel_peach3305No ratings yet

- Property ProgramDocument18 pagesProperty ProgramSyarif Muhammad HikmatyarNo ratings yet

- Libby 4ce Solutions Manual - Ch04Document92 pagesLibby 4ce Solutions Manual - Ch047595522No ratings yet

- Intermediate Accounting Solutions Chapter 3Document27 pagesIntermediate Accounting Solutions Chapter 3jharris1063% (8)

- 4 Financial StatementsDocument130 pages4 Financial StatementsDeo CoronaNo ratings yet

- W-AP - Administration and Selling ExpensesDocument15 pagesW-AP - Administration and Selling ExpensesPopeye AlexNo ratings yet

- Audit Programme TaxDocument6 pagesAudit Programme Taxaah_mundrawalaNo ratings yet

- Property ProgramDocument18 pagesProperty ProgramGovind Shriram ChhawsariaNo ratings yet

- 2018 - COA-Audited-Financial Statements PDFDocument66 pages2018 - COA-Audited-Financial Statements PDFAnna Marie AlferezNo ratings yet

- Audit Program On Inter-Agency ReceivablesDocument2 pagesAudit Program On Inter-Agency ReceivablesHoven Macasinag100% (1)

- O - CHELT EXPLOATARE Salarii - OPEX PayrollDocument1 pageO - CHELT EXPLOATARE Salarii - OPEX Payrollovidiu.tisloveanuNo ratings yet

- Audit ProgrammesDocument11 pagesAudit ProgrammesSajjad CheemaNo ratings yet

- BADVAC3X MOD 5 Financial StatementsDocument9 pagesBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoNo ratings yet

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Document36 pagesFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1richardacostaqibnfpmwxd100% (23)

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Document107 pagesFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1sharon100% (44)

- © Ncert Not To Be Republished: Accounts From Incomplete RecordsDocument38 pages© Ncert Not To Be Republished: Accounts From Incomplete RecordsIas Aspirant AbhiNo ratings yet

- Audit Program For EquityDocument12 pagesAudit Program For EquityIra Jean DaganzoNo ratings yet

- Chapter 21 - Answer PDFDocument9 pagesChapter 21 - Answer PDFjhienellNo ratings yet

- Republic of The Philippines Commission On Audit Commonwealth Avenue, Quezon CityDocument2 pagesRepublic of The Philippines Commission On Audit Commonwealth Avenue, Quezon CityJD BallosNo ratings yet

- Accounting Cycle Applied To Servic BusinessDocument4 pagesAccounting Cycle Applied To Servic BusinessRhai zah MhayNo ratings yet

- Single EntryDocument38 pagesSingle EntryAbhishek MlshraNo ratings yet

- Lesson 2-Review of The Accounting Process: Objecii, ADocument12 pagesLesson 2-Review of The Accounting Process: Objecii, AAhmadnur JulNo ratings yet

- Keac 211Document38 pagesKeac 211vichmegaNo ratings yet

- (C) Substantive Procedures For Directors' BonusesDocument10 pages(C) Substantive Procedures For Directors' BonusesMD Sabuj SarkerNo ratings yet

- Audit Program For Revenues and Expenses: Form AP 70Document4 pagesAudit Program For Revenues and Expenses: Form AP 70The AmaezingNo ratings yet

- AP 15 Accounts Receivable and Sales PDFDocument8 pagesAP 15 Accounts Receivable and Sales PDFDicky Affri SandyNo ratings yet

- Auditing ProcessesDocument14 pagesAuditing Processessaleem.mNo ratings yet

- C8 Audit Question BankDocument15 pagesC8 Audit Question BankYash SharmaNo ratings yet

- 19l (12-00) Develop The Audit Program - RevenuesDocument2 pages19l (12-00) Develop The Audit Program - RevenuesAnh Tuấn TrầnNo ratings yet

- © Ncert Not To Be Republished: Accounts From Incomplete RecordsDocument38 pages© Ncert Not To Be Republished: Accounts From Incomplete RecordsJaffer SadiqNo ratings yet

- Trial Balance, Financial Reports and StatementsDocument19 pagesTrial Balance, Financial Reports and StatementsRoselie CuencaNo ratings yet

- Period End Closure ChecklistDocument8 pagesPeriod End Closure Checklistcm senNo ratings yet

- Pots and FlowersDocument3 pagesPots and FlowersStephen GithinjiNo ratings yet

- Particulars: Financial Statements Scope ObjectiveDocument40 pagesParticulars: Financial Statements Scope ObjectiveKm Brly FanoNo ratings yet

- Period End Closure ChecklistDocument8 pagesPeriod End Closure Checklistcm senNo ratings yet

- Revenues and Expenses AuditDocument4 pagesRevenues and Expenses Audithossainmz100% (1)

- Wp-Trade, Other Ar & RevDocument10 pagesWp-Trade, Other Ar & RevteresaypilNo ratings yet

- Balance Sheet Review Audit Work ProgramDocument7 pagesBalance Sheet Review Audit Work ProgramIrfan KhanNo ratings yet

- Chapter 6 - Adjusting Closing EntriesDocument5 pagesChapter 6 - Adjusting Closing EntriesSuzanne SenadreNo ratings yet

- Income Statement ProgramDocument24 pagesIncome Statement ProgramRosette G. Reyno100% (1)

- Chapter 3 Adjusting The Accounts PDFDocument56 pagesChapter 3 Adjusting The Accounts PDFJed Riel BalatanNo ratings yet

- Udit Rogram Client: Period: Subject: Accruals Est. Hrs - Procedures W/P Ref. by Comments/Explanation S Audit ObjectivesDocument2 pagesUdit Rogram Client: Period: Subject: Accruals Est. Hrs - Procedures W/P Ref. by Comments/Explanation S Audit Objectivesrussel1435No ratings yet

- Audit Working Papers-2Document28 pagesAudit Working Papers-2Joseph PamaongNo ratings yet

- Traning Material On Implementation of Accounting StandardsDocument308 pagesTraning Material On Implementation of Accounting StandardsAnupam GoyalNo ratings yet

- Chapter 30 - AnswerDocument9 pagesChapter 30 - AnswerjhienellNo ratings yet

- CPAR Financial StatementsDocument5 pagesCPAR Financial StatementsAnjo EllisNo ratings yet

- Audit Profit Loss AccountDocument9 pagesAudit Profit Loss Accountasgarali_maniarNo ratings yet

- Audit Program - Fixed AssetsDocument11 pagesAudit Program - Fixed Assetshamza dosani100% (3)

- Corporate FinanceDocument7 pagesCorporate FinanceMit BakhdaNo ratings yet

- Planning and Preparation For Export: Export-Import Theory, Practices, and Procedures Belay Seyoum 3 Edition (Or Newer)Document29 pagesPlanning and Preparation For Export: Export-Import Theory, Practices, and Procedures Belay Seyoum 3 Edition (Or Newer)Farhan TanvirNo ratings yet

- Module 3 - Social Responsibility and Ethics in ManagementDocument18 pagesModule 3 - Social Responsibility and Ethics in ManagementAaron Christopher SungaNo ratings yet

- Chapter ThreeDocument20 pagesChapter Threehenokt129No ratings yet

- Green Marketing LegislationDocument4 pagesGreen Marketing LegislationKehul GandhiNo ratings yet

- PEL PakistanDocument27 pagesPEL Pakistanjutt707100% (1)

- Kisi-Kisi Uts Enterprise System Tipe I - Kemungkinan Bisa KeluarDocument16 pagesKisi-Kisi Uts Enterprise System Tipe I - Kemungkinan Bisa KeluarwahyuNo ratings yet

- QUIZ 1 Absorption CostingDocument1 pageQUIZ 1 Absorption CostingJohn Carlo CruzNo ratings yet

- The Companies Act, 1956Document97 pagesThe Companies Act, 1956Ashish GandotraNo ratings yet

- Virgin Trains Case StudyDocument5 pagesVirgin Trains Case StudyPage MirerzNo ratings yet

- Income Taxation Quick NotesDocument3 pagesIncome Taxation Quick NotesKathNo ratings yet

- Answers HW17Document3 pagesAnswers HW17summanahNo ratings yet

- Points About Ledger ScrutinyDocument4 pagesPoints About Ledger ScrutinyRahul JainNo ratings yet

- Strategic Management MCQ and Answers For MBA StudentsDocument11 pagesStrategic Management MCQ and Answers For MBA Studentsmarieieiem100% (3)

- Statement IbblDocument1 pageStatement Ibblmamunkhan1216jNo ratings yet

- Internship Report Based On InsuranceDocument26 pagesInternship Report Based On InsuranceTesnimNo ratings yet

- Diploma in IFRS (Level 1 and 2) : Your Passport To Financial Reporting ExcellenceDocument8 pagesDiploma in IFRS (Level 1 and 2) : Your Passport To Financial Reporting ExcellenceMuhammad Imran JehangirNo ratings yet

- Quiz 4.2Document5 pagesQuiz 4.2Quân TrầnNo ratings yet

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseDocument6 pagesA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftNo ratings yet

- Acca F5Document133 pagesAcca F5Andin Lee67% (3)

- Takwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Document1 pageTakwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Raihana AzmanNo ratings yet

- Peachtree AccountingDocument170 pagesPeachtree AccountingKyaw Moe Hain100% (4)

- Robbins Fom8 Inppt01 GE VersionDocument34 pagesRobbins Fom8 Inppt01 GE VersionLynette LeeNo ratings yet

- A Case Study On RIL vs. RNRL DisputeDocument6 pagesA Case Study On RIL vs. RNRL DisputeAparajita SharmaNo ratings yet

- BEST PRACTICES IN LEADERSHIP (Aiza)Document14 pagesBEST PRACTICES IN LEADERSHIP (Aiza)Ian Michael BaangNo ratings yet

- Operam Academy BIM CoursesDocument19 pagesOperam Academy BIM CoursesShazad LatifNo ratings yet

- Paperwork Simulation PacketDocument11 pagesPaperwork Simulation PacketHadi P.No ratings yet

- Corporate Governance Government MeasuresDocument9 pagesCorporate Governance Government MeasurestawandaNo ratings yet

- H. Aronson & Co., Inc. v. Associated Labor UnionDocument4 pagesH. Aronson & Co., Inc. v. Associated Labor UnionChing ApostolNo ratings yet

- Foreign Exchange Management - An Overview of Current Account TransactionsDocument50 pagesForeign Exchange Management - An Overview of Current Account Transactionsrebalap15No ratings yet