Professional Documents

Culture Documents

Indus Advantage

Uploaded by

subhasish paulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indus Advantage

Uploaded by

subhasish paulCopyright:

Available Formats

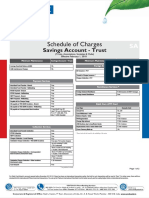

Schedule of Service Charges

Indus Advantage

Particulars Particulars Indus Grandé

Average Quarterly Balance Requirement Zero Balance Account Cash Withdrawals - Other Bank ATMs in India 5* Free Cash or Non-cash transactions (Balance Enquiry,

PIN Change and Mini Statement) per month.

Remittance Facilities through Own Bank Beyond 5 transactions, all Cash transactions would be charged

Demand Draft or Pay Order - Issuance Unlimited Free at `21/- per transaction. 3* in metro cities

DD/PO Cancellation/Duplicate Instrument Issuance `100/- per instrument Cash Withdrawals - Other Bank ATMs outside India `125/- for Cash Withdrawals

DD/PO Revalidation Free Exchange rate mark up on Foreign Currency Debit Card transaction 3.5%

Credit Card Payment through ATM/Net Banking Free ATM transaction decline fee: Transactions declined at Other `20/- per transaction

Bank ATMs due to insufficient funds

IMPS - Outward

Non-cash transactions - Other Bank ATMs outside India Outside India: `20/- for Balance Enquiry

NEFT - Outward No Charges @ Branch/Mobile Banking/Net Banking/Alexa/

Whatsapp Banking Daily POS Limit Titanium Card : `50,000

RTGS - Outward Titanium Card : `1,00,000

Other Savings Bank Account Facilities

Remittance Facilities through Other Bank

Account Statement Free Monthly E-Statement

DD - Issuance Free one draft (Correspondent Bank only) per day upto

`50,000/-; above this `1.5/- per `1,000 /-, Minimum of `50/- Issuance of Duplicate/Additional Statement Free

& Maximum of `5,000/- per instrument

Issuance of Loose Cheque Leaves Free

Non-correspondent Banks - At Actuals

Issuance of Duplicate Passbook Free

DD - Cancellation `100/- per instrument

Internal Transfer/ECS Return (Insufficient Balance) `450/-

DD - Revalidation `50/- per instrument

Miscellaneous

Foreign Exchange Remittance Alerts Free Transaction Alerts

Balance Certificate Limit Accounts - `25/- | Other Accounts - `100/-

Non-trade Remittance `250/- in addition to SWIFT charges

Interest Certificate Free

SWIFT/Wire Transfer `500/-

Standing Order/Balance Order/Instructions Free

FCY (Foreign Currency) Draft/DD issuance `350/-

Enquiry relating to Old Records `100/- per enquiry

FCY (Foreign Currency) Cheque Collection 0.25% on the cheque collection, Minimum of `25/-

Account Closure No Charge, if A/c closed within 14 days. Charge of `200/-,

or balance in the A/c whichever is lower, if account is closed

Cheque Collection post 14 days and within 6 months

Local Clearing Free Photo Attestation Free

Outstation Clearing through Own Bank Free Signature Attestation Free

Outstation Clearing through Correspondent Bank Up to and including 5,000: `25/-; Above 5,000 and upto and Cheque Stop Payment Free

including 10,000: `50/-; Above 10,000 and upto and including Inactive Account (>12 Months) `200/- per quarter

100,000: `100/-; Above 100,000: `150/- Phone Banking (@ Contact Centre) Free

Return of Cheque/s - Local Local Inward Clearing: `450/- per cheque Cheque Books

Only for Financial Reasons

Issuance of Cheque Books w.e.f 1st Aug'19 Unlimited Free

Local Outward Clearing: `100/- per cheque

Charges on Cash Withdrawal/Deposits at Branch/es

Return of Cheque/s - Outstation - through Own Bank Collection charges subject to a minimum of `100/- plus actual Cash Withdrawals at any branch in India Free

out of pocket expenses

Third Party Cash Withdrawals at non-home branch location Free Limit of `50,000/- per month;

Return of Cheque/s - Outstation - through Another Bank Collection charges subject to a minimum of `100/- plus actual

out of pocket expenses Above free limit, `2.5/- per `1,000/- subject to minimum of `100/-

Cash Deposit at home/non-home location Free Limit of `2,00,000/- per month or 5 times previous months AMB

Return of Cheque/s - Outstation Cheques Received in Inward `100/- plus out of pocket expenses (whichever higher) Charges will be levied if max transaction cap limit

Collection of 5 per month is breached, even if deposit limit is not breached

Above free limit, `4/- per `1,000/- subject to minimum of `100/-

Cards - Debit Card

Doorstep Banking

Card Issuance/Annual Titanium Chip Debit Card

Issuance Fees - Free Cashier's Cheque/Demand Drafts Delivery Free

As per regulatory directive, effective 01.09.2015 new cards

issued will be chip cards only Annual Fees - Free Cheque Pickup 1 request free per day; Minimum cheque consolidated value `10,000/-

For premium Debit Cards, please refer the Debit Card SOC Cash Delivery 1 request free per day; Minimum value of `10,000/- & Maximum `1 Lac;

Card Replacement Fee `249 + taxes Thereafter @ `50/- per request

Issuance of Duplicate PIN `20/- Cash Pickup 1 request free per week; Minimum value of `10,000/- & Maximum `1 Lac;

Thereafter @ `130/- per request

Non-cash transactions - Own ATMs (IndusInd Bank) Free

1. All charges indicated above are exclusive of Taxes (as per Government rules).

Cash Withdrawals - Own ATMs (IndusInd Bank) Free 2. For Senior Citizens and Differently Abled person Doorstep Banking is available across Savings Account variants free of cost subject to availability at branch.

Cash Withdrawal (ATMs) IndusInd Bank Network Free5* Free Cash or Non-cash transactions (Balance Enquiry, 3. Bank reserves the right to assess charges on transactions which are not covered by this schedule and to amend with prior notice the terms and conditions

Non-cash transactions - Other Bank ATMs in India

governing such services mentioned above and rates stated in this schedule. Any suspicious or unusual transaction activity can lead to levy of charges.

Cash Withdrawal at other ATMs FreePIN Change and Mini Statement) per month. 4. Any changes in the charge tariff will be applied after a notice of atleast 30 days.

Beyond 5 transactions, all Non-cash transactions would be

Cash Withdrawal outside India ATMs Freecharged at `10/- per transaction. * 3 in metro cities

Cash Withdrawal Limit at ATM Refer Debit Card Standard SoC

You might also like

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- YES FIRST Programme Criteria and Benefits w.e.f. February 1, 2020Document2 pagesYES FIRST Programme Criteria and Benefits w.e.f. February 1, 2020Ayush JadhavNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Common Charges For Current AccountsDocument2 pagesCommon Charges For Current AccountsHNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Schedule of Charges for Current AccountsDocument2 pagesSchedule of Charges for Current AccountsdhruvsaidavaNo ratings yet

- Yes Bank India ChargesDocument2 pagesYes Bank India ChargesRKNo ratings yet

- Institution Savings Account Exclusive PremiumDocument5 pagesInstitution Savings Account Exclusive Premiumjeffy yesudasNo ratings yet

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- SOC Indus Multiplier MaxDocument4 pagesSOC Indus Multiplier Maxmanoj baroka0% (1)

- Niyo SBM SOCDocument1 pageNiyo SBM SOCRobi RoboNo ratings yet

- Schedule of Benef Its: Savings Account Effective January 1, 2022Document2 pagesSchedule of Benef Its: Savings Account Effective January 1, 2022Aniket DubeyNo ratings yet

- HDFC Current Account ChargesDocument2 pagesHDFC Current Account ChargesRAGHAVA NAIDU .KNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- DCB Benefit Savings AccountDocument2 pagesDCB Benefit Savings AccountDesikanNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Parameter Au Samriddhi Current AccountDocument2 pagesParameter Au Samriddhi Current Accounthiteshmohakar15No ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Super Shakti Savings AccountDocument2 pagesSuper Shakti Savings Accountrcosmic1980No ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- SOC_RuPay_Select_Debit_CardDocument4 pagesSOC_RuPay_Select_Debit_Cardrichards.prabhu1817No ratings yet

- Au Royale: Schedule ofDocument2 pagesAu Royale: Schedule ofsahilNo ratings yet

- schedule of charges yes bank 5Document1 pageschedule of charges yes bank 5Sayantika MondalNo ratings yet

- CABCA_SOC_July 22 (1) (1)Document2 pagesCABCA_SOC_July 22 (1) (1)anjumNo ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Regular Salary AccountDocument3 pagesRegular Salary AccountPrashant KumarNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- Schedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Document2 pagesSchedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Badri ShaikhNo ratings yet

- PIONEER Current Account SOB Eff 1st Dec 2022Document2 pagesPIONEER Current Account SOB Eff 1st Dec 2022Rajat AgarwalNo ratings yet

- Au Digital Savings AccountDocument5 pagesAu Digital Savings AccountQuaint ZoneNo ratings yet

- Regular Business Account 1 LakhDocument2 pagesRegular Business Account 1 LakhNiraj PandeyNo ratings yet

- Manage savings account fees and charges with YES PROSPERITY Savings AccountDocument2 pagesManage savings account fees and charges with YES PROSPERITY Savings AccountJeyakumara Vel CNo ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- schedule of charges yes bank 6Document2 pagesschedule of charges yes bank 6Sayantika MondalNo ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDocument5 pagesCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Aman Singh Mofs 2019 0806 0001 0004Document88 pagesAman Singh Mofs 2019 0806 0001 0004AMAN SINGHNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- Service Charges (Non-Credit Related) : 1 Cheque Book FacilityDocument17 pagesService Charges (Non-Credit Related) : 1 Cheque Book FacilityOlety Subrahmanya SastryNo ratings yet

- Angel One ProfileDocument2 pagesAngel One ProfileAyush VermaNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- q1 2023 Pricing English VersionDocument6 pagesq1 2023 Pricing English VersionRickarldo FelrittoNo ratings yet

- Service Charges South Indian BankDocument18 pagesService Charges South Indian Bankmuthoot2009No ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- Ae SP Price Guide Conventional English v3Document13 pagesAe SP Price Guide Conventional English v3Shaikh Hassan AtikNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- Burgundy Fees and Charges 01042023Document7 pagesBurgundy Fees and Charges 01042023Nagaraj VukkadapuNo ratings yet

- Your Account Details Segment'S RegisteredDocument2 pagesYour Account Details Segment'S RegisteredManav GargNo ratings yet

- Yes First Eclectic Debit Card SocDocument2 pagesYes First Eclectic Debit Card Socraghav mehraNo ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- 2010 Marzo PDFDocument60 pages2010 Marzo PDFLiliany CarricarteNo ratings yet

- English Le-Q1 Week-1-2Document11 pagesEnglish Le-Q1 Week-1-2Leo Enriquez Jr.No ratings yet

- FNB Easy AccountDocument34 pagesFNB Easy AccountdenisdembskeyNo ratings yet

- 5 Receiving and Checking MoneyDocument25 pages5 Receiving and Checking MoneyLucio Indiana WalazaNo ratings yet

- Fabm2 Elements of SFPDocument30 pagesFabm2 Elements of SFPMylene SantiagoNo ratings yet

- CBSE Sample Papers For Class 12 Economics Set 2 WDocument4 pagesCBSE Sample Papers For Class 12 Economics Set 2 Wxpert shikshaNo ratings yet

- VoucherDocument11 pagesVoucherRoger Cabarles IIINo ratings yet

- Accounting Information Systems Basic Concepts and Current Issues 4th Edition Hurt Solutions ManualDocument15 pagesAccounting Information Systems Basic Concepts and Current Issues 4th Edition Hurt Solutions Manualmalabarhumane088100% (30)

- Money Pad - The Future Wallet Secures Digital PaymentsDocument27 pagesMoney Pad - The Future Wallet Secures Digital PaymentsAvin VinodNo ratings yet

- Project Report On Ewallets in NepalDocument41 pagesProject Report On Ewallets in NepalChandan YadavNo ratings yet

- FAR2 BANK RECONCILIATION StudentDocument7 pagesFAR2 BANK RECONCILIATION StudentCHRISTIAN BETIANo ratings yet

- Cash Flow Kunci BaruDocument1 pageCash Flow Kunci BaruDyah WinengkuNo ratings yet

- Cashand Cash Equivalents101Document38 pagesCashand Cash Equivalents101Wynphap podiotanNo ratings yet

- 7 Types of Journal Entries ExplainedDocument115 pages7 Types of Journal Entries ExplainedEnamul HaqueNo ratings yet

- Chapter 6: Overview of Transaction Processing and Financial Reporting SystemsDocument6 pagesChapter 6: Overview of Transaction Processing and Financial Reporting Systemsmostafakhaled333No ratings yet

- GSMA State of The Industry 2022 EnglishDocument114 pagesGSMA State of The Industry 2022 EnglishNoel AgbeghaNo ratings yet

- Screenshot 2023-06-16 at 10.17.17 AMDocument12 pagesScreenshot 2023-06-16 at 10.17.17 AMPatel KevalNo ratings yet

- 9 Ems Acc Revision Test Term 2 2022 GoDocument6 pages9 Ems Acc Revision Test Term 2 2022 GoEstelle EsterhuizenNo ratings yet

- Cash ConcentrationDocument8 pagesCash Concentrationraviteja009No ratings yet

- Capital budgeting analysis of plastic glasses productionDocument2 pagesCapital budgeting analysis of plastic glasses productionEkta AgarwalNo ratings yet

- Customer's Perception Towards Cashless Transaction and Information Security in The Digital EconomyDocument66 pagesCustomer's Perception Towards Cashless Transaction and Information Security in The Digital EconomyPriyanshi PatelNo ratings yet

- Far 03 Cash and Cash EquivalentsDocument22 pagesFar 03 Cash and Cash EquivalentsYuri CaguioaNo ratings yet

- Money Laundering Red Flags for Exchange CompaniesDocument2 pagesMoney Laundering Red Flags for Exchange CompaniescurioscowNo ratings yet

- Pre-Test or Discussion Questions - Cash and Cash EquivalentsDocument2 pagesPre-Test or Discussion Questions - Cash and Cash EquivalentsGaile YabutNo ratings yet

- Central Banking Functions (CBFDocument11 pagesCentral Banking Functions (CBFRohit YadavNo ratings yet

- Cash and Cash EquivalentsDocument20 pagesCash and Cash EquivalentsKing TaguibaoNo ratings yet

- Course Outline - 1439404738ethiopian Government Accounting and Financial ManagementDocument3 pagesCourse Outline - 1439404738ethiopian Government Accounting and Financial ManagementOthow Cham AballaNo ratings yet

- Than - Tun 1986 Royal - Orders - of - Burma 05 en Ocr To PDFDocument357 pagesThan - Tun 1986 Royal - Orders - of - Burma 05 en Ocr To PDFLwin HtooNo ratings yet

- AKD - Amboi CanteknyeDocument1 pageAKD - Amboi CanteknyePuspita SariNo ratings yet

- Chapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewDocument20 pagesChapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewAngel RosalesNo ratings yet