Professional Documents

Culture Documents

TIN - Country Sheet ES en

Uploaded by

Lidia MartinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TIN - Country Sheet ES en

Uploaded by

Lidia MartinCopyright:

Available Formats

ES – Spain en – English

TAX IDENTIFICATION NUMBERS (TINs)

Country Sheet: Spain (ES)

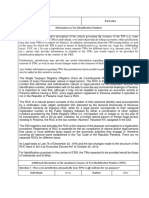

1. TIN structure

Format Explanation Comments

- 99999999L - 8 digits + 1 letter Spanish Natural Persons: DNI*

- L9999999L - L + 7 digits + 1 letter Non-resident Spaniards without

DNI*

- K9999999L - K + 7 digits + 1 letter Resident Spaniards under 14

without DNI*

- X ó Y ó Z 9999999 - X/Y/Z + 7 digits + 1 letter Foreigners with NIE**

- M9999999L - M + 7 digits + 1 letter Foreigners without NIE**

* DNI = Documento Nacional de Identidad (National Identity Card)

** NIE = Número de Identificación de Extranjero (Foreigners’ Identification Number)

2. TIN description

TIN for natural persons in Spain is unique for tax and customs purposes and contains nine

characters, the last of them is a letter for control.

- Natural persons of Spanish nationality: Generally, the TIN is the number on your

National Identity Card, issued by the Ministry of Internal Affairs (General Directorate of

Police). The Tax Administration will provide Spanish natural persons who are not obliged to

possess a National Identity Card (DNI) with a Tax Identification Number (TIN) starting with

an L (non-resident Spaniards) or a K (resident Spaniards under the age of 14 years), upon

request.

- Natural persons without Spanish nationality: Generally, their Tax Identification Number

(TIN) is the Foreigners’ Identification Number (NIE), likewise issued by the Ministry of

Internal Affairs. Natural persons without Spanish nationality who do not possess a

Foreigners’ Identification Number (NIE) but need a Tax Identification Number (TIN) because

they are going to engage in transactions involving Spanish taxation can obtain a Tax

Identification Number starting with the letter M, that will have a transitory nature, until they

obtain a Foreigners’ Identification Number (NIE), where appropriate, also issued by the Tax

Administration.

Version 07/09/2015 10:51:00 1/5

ES – Spain en – English

3. Where to find TINs?

TINs are reported on the following official identity documents:

3.1. Personal identity card

3.1.1. Regular identity card until 2006

Personal name

First family name

Second family name

DNI (TIN)

3.1.2. Electronic identity card

On March 2006 the electronic identity card has been introduced.

First family name

Second family name

Personal name

Date of birth

DNI (TIN)

3.1.3. Foreigners’ Resident Card

Version 07/09/2015 10:51:00 2/5

ES – Spain en – English

DNI (TIN)

3.2. New driving license

The new driving license is in use since November 2004. It has the size of a credit card (9 cm by 6 cm).

First family name

Second family name

Personal name

Date and country of birth

Personal Identification

Number (TIN)

3.3. Tax Identification Card

The tax identification card is sent enclosed to a letter to those natural persons who obtain a TIN. This

card shows an electronic code in order to verify its authenticity logging in the National Tax Agency’s

(Agencia Tributaria) website.

Version 07/09/2015 10:51:00 3/5

ES – Spain en – English

Besides, this card is sent enclosed to a letter of formal notice; there is a Safe Verification Code at the

bottom of the letter in order to be able to verify its authenticity, logging in the National Tax Agency’s

(Agencia Tributaria) website.

Example of the bottom of a letter of formal notice:

“Verifiable authenticity using the Safe Verification Code JKM7T8BDDSBSTNAX at

www.agenciatributaria.gob.es”.

3.4. Social Security Card

The card issued by the Public Health Service (Instituto Nacional de Gestión Sanitaria – INGESA)

shows -besides the Social Security personal identification code and membership code- the holder’s

DNI number, that is in addition his/her TIN.

4. TIN national website

Information on TIN: www.agenciatributaria.es

http://www.agenciatributaria.es/AEAT.internet/Inicio_es_ES/La_Agencia_Tri

butaria/Campanas/Censos__NIF_y_domicilio_fiscal/Censos__NIF_y_domici

lio_fiscal.shtml

TIN online check: If the concerned person has an electronic certificate recognized by the

National Tax Administration he/she can verify whether a third party’s TIN is

correct and registered, logging in the website www.agenciatributaria.gob.es

If the TIN holder shows the Tax Identification Card issued by the Tax

Agency, any person, even without an electronic certificate, can consult its

authenticity logging in the electronic code of the card in the Tax Agency

website, option: “verification of authenticity of the tax identification card by

means of an electronic code”. If he/she has the letter of formal notice,

logging in “Comparison of documents by means of Safe Verification Code”,

that can be found at the bottom of the letter.

5. TIN national contact point

Contact: Not available

Version 07/09/2015 10:51:00 4/5

ES – Spain en – English

6. Legal notice

The information on Tax Identification Numbers (TINs) and the use of the TIN online check module

provided on this European TIN Portal, are subject to a disclaimer, a copyright notice and rules relating

to the protection of personal data and privacy.

Specific copyright notice for Spain (2012)

Access to and use of content supplied by Spain on the European TIN Portal, the information contained

and the attached links and services are the prerogative of the Agencia de Tributaria or the bodies

collaborating with it and are protected by the appropriate intellectual and industrial property rights. The

use, reproduction, distribution, communication to the public or transformation of this content or any

other similar activity is totally prohibited without express authorisation by the Agencia de Tributaria.

The user's licence to use any content from this portal is limited to the downloading and private use of

that content, provided it remains intact.

Version 07/09/2015 10:51:00 5/5

You might also like

- Legal Entity Sheet (Natural Person)Document2 pagesLegal Entity Sheet (Natural Person)Anonymous XSixrIuNo ratings yet

- SM ATF400G-6 - EN - Intern Use OnlyDocument1,767 pagesSM ATF400G-6 - EN - Intern Use OnlyReinaldo Zorrilla88% (8)

- Easy Scrub Cap Pattern PayhipDocument8 pagesEasy Scrub Cap Pattern PayhipFang Fang100% (1)

- National Identification Numbers of Various CountriesDocument19 pagesNational Identification Numbers of Various CountriescomputerjinNo ratings yet

- Analytics-Based Investigation & Automated Response With AWS + Splunk Security SolutionsDocument37 pagesAnalytics-Based Investigation & Automated Response With AWS + Splunk Security SolutionsWesly SibagariangNo ratings yet

- Cis en Blanco (10 Febrero 2022)Document3 pagesCis en Blanco (10 Febrero 2022)jak100% (1)

- Form C1 Single Work Permit Renewal ApplicationDocument5 pagesForm C1 Single Work Permit Renewal ApplicationNaveen SoysaNo ratings yet

- CIS Customer Identification SheetDocument2 pagesCIS Customer Identification SheetFranck Asoum100% (3)

- CIS - Client Information Sheet CompanyDocument6 pagesCIS - Client Information Sheet CompanythmintllcNo ratings yet

- Buyer Information Sheet/AtvDocument2 pagesBuyer Information Sheet/AtvTim ShipleNo ratings yet

- Computer Vision - Ipynb - ColaboratoryDocument17 pagesComputer Vision - Ipynb - Colaboratoryzb laiNo ratings yet

- Spain TinDocument5 pagesSpain TinFemi BolatitoNo ratings yet

- Spain TINDocument5 pagesSpain TINRaden AndikaNo ratings yet

- Tin enDocument62 pagesTin enpathenderson.eduNo ratings yet

- Tax Identification Numbers (Tins) Country Sheet: Sweden (SE)Document6 pagesTax Identification Numbers (Tins) Country Sheet: Sweden (SE)13KARATNo ratings yet

- Croatia TINDocument4 pagesCroatia TINnolimit101No ratings yet

- Bulgaria - TINDocument4 pagesBulgaria - TINViktorNo ratings yet

- Tax ID Table 2023 Tax Identification NumbersDocument8 pagesTax ID Table 2023 Tax Identification NumbersGesound StudioNo ratings yet

- Norway TINDocument4 pagesNorway TINViet Anh LeNo ratings yet

- Ecuador TINDocument7 pagesEcuador TINboossrayrNo ratings yet

- Finland TINDocument3 pagesFinland TINeureka.net24No ratings yet

- Sweden TINDocument4 pagesSweden TINFungai GutusaNo ratings yet

- TIN - Country Sheet LV enDocument3 pagesTIN - Country Sheet LV enmohamedNo ratings yet

- Cis Word Ingles para DiligenciarDocument3 pagesCis Word Ingles para DiligenciarMaria OrtegaNo ratings yet

- TIN - Country Sheet UK enDocument3 pagesTIN - Country Sheet UK enWarrenNo ratings yet

- FATCA-TIN-Listing-updated Tata AiaDocument3 pagesFATCA-TIN-Listing-updated Tata AiaPraveen KumarNo ratings yet

- CIS - QFSModeloDocument3 pagesCIS - QFSModeloJamsyare MendozaNo ratings yet

- 715513e-Kyc Fatcacrs Pi Form Self-Certification IntranetDocument2 pages715513e-Kyc Fatcacrs Pi Form Self-Certification IntranetDavid NardaiaNo ratings yet

- Cis - International Business Polymers-1Document7 pagesCis - International Business Polymers-1mantanha066No ratings yet

- Colombia TINDocument4 pagesColombia TINEdwin GarciaNo ratings yet

- Documents Required When Applying For Naturalisation As A Citizen of Trinidad Tobago - Section 12Document1 pageDocuments Required When Applying For Naturalisation As A Citizen of Trinidad Tobago - Section 12cheNo ratings yet

- Turkiye TINDocument3 pagesTurkiye TINLuna AktaşNo ratings yet

- United States TIN PDFDocument2 pagesUnited States TIN PDFAldo Rodrigo AlgandonaNo ratings yet

- Hoja de Vida Moderna 2Document7 pagesHoja de Vida Moderna 2MARIMEL MARIMELNo ratings yet

- Broschuere eAT enDocument20 pagesBroschuere eAT enmayankumar5238No ratings yet

- CRS Doc EnglishDocument2 pagesCRS Doc EnglishsanjeevnnNo ratings yet

- Tax ID TableDocument9 pagesTax ID TableBernardoNo ratings yet

- Brazil TINDocument4 pagesBrazil TINMateus Lima FotógrafoNo ratings yet

- Pesel SloDocument3 pagesPesel Sloworkpagezero0No ratings yet

- Cos'è e Come Si Richiede Il Codice Fiscale - IngleseDocument2 pagesCos'è e Come Si Richiede Il Codice Fiscale - IngleseRebecca BlackNo ratings yet

- Carlos Enrique Hernández PinedaDocument6 pagesCarlos Enrique Hernández PinedaAnonymous wDlwHyYRNo ratings yet

- Kyc Actual - Modelo en Blanco 2020Document25 pagesKyc Actual - Modelo en Blanco 2020Gloria Patricia Lopez MarinNo ratings yet

- Extension of A Schengen Visa and New Entry eDocument3 pagesExtension of A Schengen Visa and New Entry eJOSEPH RAINER B. PESCASIOSANo ratings yet

- Answers Correct As at 19 February 2019Document26 pagesAnswers Correct As at 19 February 2019Anonymous ZM2nYv3100% (1)

- US - CBP Form 5106 (03-2019)Document4 pagesUS - CBP Form 5106 (03-2019)Regina HuiNo ratings yet

- Character PenalDocument88 pagesCharacter PenalDastan KhanNo ratings yet

- CIS - Client Information Sheet IndividualDocument2 pagesCIS - Client Information Sheet IndividualthmintllcNo ratings yet

- R.O.C. TinDocument3 pagesR.O.C. TinJannatul Mawa MeridhaNo ratings yet

- Form ID 1A Copy 2Document3 pagesForm ID 1A Copy 2Paul CNo ratings yet

- Eduardo Lamas Notary in and For LimaDocument163 pagesEduardo Lamas Notary in and For Limaromain12No ratings yet

- Italian Health Insurance Card (JUNE 2021)Document15 pagesItalian Health Insurance Card (JUNE 2021)michael.asanteNo ratings yet

- Form KDocument4 pagesForm KAman Nikhil MehtaNo ratings yet

- Costa Rica TINDocument3 pagesCosta Rica TINromeo nassaNo ratings yet

- 15-Formulario NIE y Certificados enDocument2 pages15-Formulario NIE y Certificados enPaweł SkorupińskiNo ratings yet

- 1904 January 2018 ENCS FinalDocument3 pages1904 January 2018 ENCS FinalFatima LunaNo ratings yet

- Instructions For Completing Form No. 22T34 (22.03.2022)Document11 pagesInstructions For Completing Form No. 22T34 (22.03.2022)zzzzzzNo ratings yet

- PPSN FAQ Document Updated September 2015Document2 pagesPPSN FAQ Document Updated September 2015solar_powerNo ratings yet

- TIN - Subject Sheet - 2 Structure and Specificities en PDFDocument12 pagesTIN - Subject Sheet - 2 Structure and Specificities en PDFalfatshaf01No ratings yet

- Beneficial Ownership Mandate FormDocument2 pagesBeneficial Ownership Mandate FormTiaan SmitNo ratings yet

- Luxembourg TINDocument2 pagesLuxembourg TINZarif Ahmed AnikNo ratings yet

- Panama TINDocument4 pagesPanama TINChelsea EspinosaNo ratings yet

- Web 100887 Kenmerkendoc 2017 EngDocument6 pagesWeb 100887 Kenmerkendoc 2017 EngPolo OaracilNo ratings yet

- Psychology of Color2Document33 pagesPsychology of Color2abdikani abdilaahiNo ratings yet

- Re Cri Retd de JagerDocument23 pagesRe Cri Retd de JagerMaitheNo ratings yet

- Md. Shahriar Haque Mithun: GPH Ispat LimitedDocument3 pagesMd. Shahriar Haque Mithun: GPH Ispat LimitedMd. Shahriar haque mithunNo ratings yet

- G95me c10 5Document4 pagesG95me c10 5KyinaNo ratings yet

- LAB 7: Functions: Student Name: Nathaneal Anak Biat Student ID: EP01081100 Section:02ADocument9 pagesLAB 7: Functions: Student Name: Nathaneal Anak Biat Student ID: EP01081100 Section:02AWilfredNo ratings yet

- B-0018-1-Al Khayal Gen. Cont. (Hordi Block) (Comp. Strength)Document1 pageB-0018-1-Al Khayal Gen. Cont. (Hordi Block) (Comp. Strength)Matrix LaboratoryNo ratings yet

- Emhart Inspection Defect GuideDocument1 pageEmhart Inspection Defect GuideBryan Nadimpally75% (4)

- SECTION 413-06 HornDocument3 pagesSECTION 413-06 HornTiến Phát Công ty TNHH Đầu Tư Xây DựngNo ratings yet

- A510 Instruction Manual PDFDocument459 pagesA510 Instruction Manual PDFPhops FrealNo ratings yet

- Supply Chain ManagementDocument16 pagesSupply Chain ManagementHaider AyyNo ratings yet

- SABA Migration RunBook v1.0 20210913xlsxDocument54 pagesSABA Migration RunBook v1.0 20210913xlsxZakaria AlmamariNo ratings yet

- AE 321 - Module 07 - FinalDocument14 pagesAE 321 - Module 07 - FinalJohn Client Aclan RanisNo ratings yet

- U19EC416 DSP Lab SyllabusDocument2 pagesU19EC416 DSP Lab SyllabusRamesh MallaiNo ratings yet

- Neeraj BitcellDocument2 pagesNeeraj BitcellPRANJAL RAJANNo ratings yet

- Jyotshana NewaDocument53 pagesJyotshana NewaInternship ReportNo ratings yet

- Comprehensive Comparison of 99 Efficient Totem-Pole PFC With Fixed PWM or Variable TCM Switching FrequencyDocument8 pagesComprehensive Comparison of 99 Efficient Totem-Pole PFC With Fixed PWM or Variable TCM Switching FrequencyMuhammad Arsalan FarooqNo ratings yet

- Temperature Control Systems: Product Reference Guide For Truck and Trailer ApplicationsDocument40 pagesTemperature Control Systems: Product Reference Guide For Truck and Trailer ApplicationsSaMos AdRiianNo ratings yet

- TM AHU 60R410A Onoff T SA NA 171205Document67 pagesTM AHU 60R410A Onoff T SA NA 171205Sam RVNo ratings yet

- MS Word Basics GuideDocument36 pagesMS Word Basics GuideCarmen NelNo ratings yet

- Postgresql 11 A4 PDFDocument2,621 pagesPostgresql 11 A4 PDFGiuliano PertileNo ratings yet

- Function: Maintenance & Repair at Operational LevelDocument2 pagesFunction: Maintenance & Repair at Operational LevelSHUSHEELNo ratings yet

- MS Disc Brake CaliperDocument2 pagesMS Disc Brake Caliperghgh140No ratings yet

- 9853 1213 01i Fluids and Lubricating GreasesDocument18 pages9853 1213 01i Fluids and Lubricating GreasespressisoNo ratings yet

- Medical Sensors MarketDocument2 pagesMedical Sensors MarketHarshada DoiphodeNo ratings yet

- Pelina PositionPaperDocument4 pagesPelina PositionPaperJohn Tristan HilaNo ratings yet

- Java Lab RecordDocument29 pagesJava Lab RecordCyberDootNo ratings yet