Professional Documents

Culture Documents

FATCA-TIN-Listing-updated Tata Aia

Uploaded by

Praveen KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FATCA-TIN-Listing-updated Tata Aia

Uploaded by

Praveen KumarCopyright:

Available Formats

TAXPAYER IDENTIFICATION NUMBER (TIN) LISTING

1. What is TIN?

US taxpayers: Taxpayer Identification Number (TIN) is a nine-digit identification number used by the Internal Revenue Service (IRS) in the

administration of tax laws in US. It is issued either by the Social Security Administration (SSA) or by the IRS. A Social Security number (SSN)

is issued by the SSA whereas all other TINs are issued by the IRS.

Other than US taxpayers: TIN is any tax identification number or its functional equivalent. Nomenclature of TIN can vary from one country

to other. Detailed country wise list of acceptable TIN documents annexed.

2. Is it mandatory to obtain Tax Identification Number (TIN), if the individual or entity is identified as a US Person or Person resident

outside of India?

Yes, if the individual or entity is identified as US Person or Person resident outside of India, we should obtain TIN or its functional equivalent.

3. What are all the scenarios where TIN (Tax Identification Number) is mandatory for NRI Customer?

Country name declared by the customer is other than India then customer must mandatorily declare the TIN along with the issuance

country name.

Further, if the telephone / mobile number is out of India, TIN along with the issuance country name is mandatory.

4. What if customer does not have the TIN number whereas customer has declared the country name as other than India

In such cases, customer to declare the Functional equivalent of TIN of the country other than India. It is mandatory to mention the functional

equivalent document type name, number and issuance country.

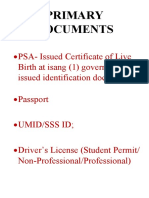

Functional Equivalent of TIN includes the following:

A social security/insurance number, citizen/personal identification/services code/national identification number, a resident / population

registration number, Alien card number, etc.

5. In which scenarios NRI customers need not submit TIN / Functional equivalent?

There can be scenarios where TIN / functional equivalent is not required, for instance:

a) Current residence country of customer is not issuing TIN/Functional equivalent.

b) Dependent visa holders

c) Student visa holders

d) Seafarers

e) Housewives who do not have TIN

f) Going abroad for first time

In such cases, please upload reasons as specified above with other identification number i.e. dependent visa number for a dependent,

student visa number for a student, etc.

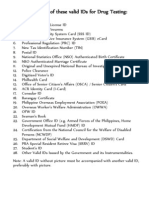

Acceptable documents as TIN / Functional equivalent TIN

Given below is the country wise list of acceptable documents as TINs / Functional Equivalents:

Country Primary Document Secondary Document

Afghanistan Any National Identification number

Argentina CUIT National Identity Document (DNI)

Tax File Driving License, Firearms license,

Australia Number 18+ card

Austria TIN ssPIN

Bahrain Bahrain ID Central Population Register Number

Belgium TIN or Numero National (NN)

Belize TIN

Registro Geral (RG), Cédula de

Brazil Cadastro de Pessoas Físicas (CPF) Identidade (Identity Card)

Canada TIN Social Insurance Number (SIN)

Chile Rol Unico Tributario (RUT)

China TIN Resident ID Number or card

Costa Rica TIN Any National Identification number

Cuba Any National Identification number

Czech Republic Personal Number Civil Card

Health Insurance Card, Central Personal

Denmark Personal Identification Number (PIN) Registration (CPR) Number

Falkland Islands Any National Identification number

Finland Finnish Social Security Number (SSN) Personal Identification Code or Number

Country Primary Document Secondary Document

France TIN SPI, INSEE code

Taxpayer Health

Germany Identification Number (TIN) Insurance Number

Guatemala Any National Identification number

Greece TIN Standard ID Card, SSN

Haiti Any National Identification number

Honduras Any National Identification number

Hong Kong Hong Kong Identity (HKID) Hong Kong Permanent Identity

India Permanent Account Number (PAN)

National ID Card (Nomor Induk

Indonesia Resident Card

Kependudukan)

Iran Any National Identification number

Ireland TIN Personal Public Service (PPS) Number

Fiscal Code, Identity Card

Italy TIN (Carta D' Identita)

Japan Social Security and Tax Number National Identity Number (My Number)

Kenya Personal Identification Number (PIN) National ID Card, Alien Card

Korea TIN Resident Registration Number (RRN)

Kuwait Civil ID Card

Tax Reference Number (Nombor National Registration Identification Card

Malaysia Rujukan Cukai) (NRIC) Number or MyKad

Mexico RFC CURP, Election ID

Myanmar Any National Identification number

Citizen's Service Number (BSN),

Netherlands TIN Population Registration Number

Inland Revenue Department (IRD)

New Zealand (NZ) National Health Index (NHI) Number

Number

Nicaragua Any National Identification number

Nigeria Taxpayer Identification Number (TIN) National Identification Number (NIN)

Birth Number (National

Norway National ID Number, D-Number

Population Register)

Oman Resident Card

Computerized National

Pakistan Identity Card (CNIC)

Panama Registro Único de Contribuyente (RUC)

Public Electronic Census System

Poland TIN Number (PESEL)

SSN, Civil Identification Number,

Portugal TIN Healthcare User Number, Voter's Number

Qatar Qatar ID Card SIDE

Russia (Russian Federation) INN (Taxpayer Identification Number)

Saint Pierre And Miquelon Any National Identification number

Saudi Arabia Residence Permit Residence Card

Singapore FIN NRIC, ASGD, ITR

South Africa Taxpayer Reference Number South Africa Identity Card

National ID Card (DNI), Foreigners'

Spain TIN Identification Number (NIE)

Country Primary Document Secondary Document

Sri Lanka Any National Identification number

Sweden Personal Identification Number in the

Population record (Personnumer)

Health Insurance Number,

Switzerland Social Security Number Swiss Identity Card

Population Identification Code,

Thailand TIN National ID Card

Turkey TIN

United Arab Emirates (U.A.E) Emirates ID Card

United Kingdom (UK) Unique Taxpayer Reference (UTR) National Insurance Number (NINO)

Individual Taxpayer Identification

United States (USA) Social Security Number (SSN) Number (ITIN), Employer Identification

Number (EIN)

Venezuela Any National Identification number

Tata AIA Life Insurance Company Limited (IRDAI Regn. No.110) CIN: U66010MH2000PLC128403. Registered & Corporate Office: 14th Floor, Tower A, Peninsula

Business Park, Senapati Bapat Marg, Lower Parel, Mumbai - 400013. Trade logo displayed above belongs to Tata Sons Ltd and AIA Group Ltd. and is used by Tata AIA Life

Insurance Company Ltd under a license. For any information including cancellation, claims and complaints, please contact our Insurance Advisor / Intermediary or visit Tata AIA Life’s

nearest branch office or call 1-860-266-9966 (local charges apply) or write to us at customercare@tataaia.com. Visit us at: www.tataaia.com. • L&C/Misc/2024/Feb/0072.

BEWARE OF SPURIOUS PHONE CALLS IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving

AND FICTITIOUS / FRAUDULENT OFFERS such phone calls are requested to lodge a police complaint

You might also like

- TIN - Country Sheet ES enDocument5 pagesTIN - Country Sheet ES enLidia MartinNo ratings yet

- National IdentificationDocument5 pagesNational IdentificationMavriskoni SofosNo ratings yet

- ID Check - Instructions (Non-U.S.)Document4 pagesID Check - Instructions (Non-U.S.)Shubham JainNo ratings yet

- Spain TinDocument5 pagesSpain TinFemi BolatitoNo ratings yet

- Tax ID TableDocument9 pagesTax ID TableBernardoNo ratings yet

- Supplier Registration Questionnaire 2023 (ENGLISH)Document20 pagesSupplier Registration Questionnaire 2023 (ENGLISH)fccordovaNo ratings yet

- PPSN FAQ Document Updated September 2015Document2 pagesPPSN FAQ Document Updated September 2015solar_powerNo ratings yet

- Legal Entity Sheet (Natural Person)Document2 pagesLegal Entity Sheet (Natural Person)Anonymous XSixrIuNo ratings yet

- Spain TINDocument5 pagesSpain TINRaden AndikaNo ratings yet

- Mifid II Factsheet National Id enDocument4 pagesMifid II Factsheet National Id enaleksandarnikolov988No ratings yet

- Domestic-Application-Form Citi Bank OdDocument16 pagesDomestic-Application-Form Citi Bank Odmadhukar sahayNo ratings yet

- Ecuador TINDocument7 pagesEcuador TINboossrayrNo ratings yet

- FATCA CRS DeclarationDocument4 pagesFATCA CRS Declarationashokdas test5No ratings yet

- Tin enDocument62 pagesTin enpathenderson.eduNo ratings yet

- Electronic Travel Authorization (eTA) : Application Help GuideDocument22 pagesElectronic Travel Authorization (eTA) : Application Help GuidefsdesdsNo ratings yet

- Individual-FATCA CRS FormDocument2 pagesIndividual-FATCA CRS FormlivesypicsNo ratings yet

- Domestic Application FormDocument16 pagesDomestic Application Formchandru chanduNo ratings yet

- National Identification Numbers of Various CountriesDocument19 pagesNational Identification Numbers of Various CountriescomputerjinNo ratings yet

- CKYC Declaration Form 25 11 2020Document2 pagesCKYC Declaration Form 25 11 2020Sudhakar BNo ratings yet

- IDFCDocument7 pagesIDFCVSR & AssociatesNo ratings yet

- HDFC Bank Resident Account To NRO Account Conversion FormDocument4 pagesHDFC Bank Resident Account To NRO Account Conversion FormHaroon MansooriNo ratings yet

- 7F - Change of Ownership - Trade NameDocument6 pages7F - Change of Ownership - Trade Nameakalove emmyNo ratings yet

- cKYC PDFDocument1 pagecKYC PDFTarun Modi100% (2)

- 1 Individual Customer Front PDFDocument1 page1 Individual Customer Front PDFyringlerNo ratings yet

- 1 Individual Customer Front PDFDocument1 page1 Individual Customer Front PDFDiana HudieresNo ratings yet

- 1 Individual Customer Front PDFDocument1 page1 Individual Customer Front PDFDiana HudieresNo ratings yet

- 1 Individual Customer FrontDocument1 page1 Individual Customer FrontHerschell Vergel de DiosNo ratings yet

- Valid IDsDocument1 pageValid IDsAlbert CongNo ratings yet

- IDFC FIRST Savings Account Form V14 210903 093845Document4 pagesIDFC FIRST Savings Account Form V14 210903 093845JeevanNo ratings yet

- Dac7 Fill in Form - Plitvice NestDocument2 pagesDac7 Fill in Form - Plitvice NestAnton JurNo ratings yet

- Aviva Crs FormDocument2 pagesAviva Crs FormAstroSunilNo ratings yet

- Nadra CardsDocument2 pagesNadra CardsAdvAleem KhanNo ratings yet

- NonLife - Requirements - Material Damage - All RisksDocument1 pageNonLife - Requirements - Material Damage - All RisksMarjoriz Tan IgnacioNo ratings yet

- Electronic Travel Authority Additional Information Form December 16Document1 pageElectronic Travel Authority Additional Information Form December 16Musa Mohamad100% (1)

- Know Your Customer (Kyc) Update Form Resident Customers: Important InformationDocument12 pagesKnow Your Customer (Kyc) Update Form Resident Customers: Important InformationChethan KumarNo ratings yet

- (In Case of Joint Accounts, Part-I (CIF) To Be Taken For Each Customer)Document20 pages(In Case of Joint Accounts, Part-I (CIF) To Be Taken For Each Customer)Jignesh V. KhimsuriyaNo ratings yet

- Reactivation+KYC 230328 184201Document4 pagesReactivation+KYC 230328 184201Vivek NesaNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- Getting TIN Id Online, How TosDocument3 pagesGetting TIN Id Online, How ToscyemaeNo ratings yet

- En Kundgoerelse Pas Og Visumforhold 01012014Document23 pagesEn Kundgoerelse Pas Og Visumforhold 01012014Kumar SunilNo ratings yet

- Sample Nps FormDocument8 pagesSample Nps Formvijay.939.975No ratings yet

- Sample Natl Id CardDocument16 pagesSample Natl Id Cardhighway123No ratings yet

- Tax Identification Numbers (Tins) Country Sheet: Sweden (SE)Document6 pagesTax Identification Numbers (Tins) Country Sheet: Sweden (SE)13KARATNo ratings yet

- PHILID RequirementsDocument3 pagesPHILID RequirementsNah ReeNo ratings yet

- National Identity Management System: Federal Republic of NigeriaDocument1 pageNational Identity Management System: Federal Republic of Nigeriamusnab1122No ratings yet

- Supporting Documents - Philippine Identification SystemDocument4 pagesSupporting Documents - Philippine Identification SystemAlmira NolascoNo ratings yet

- Non Raw Material - Vendor Introduction Request July 2023Document2 pagesNon Raw Material - Vendor Introduction Request July 2023NANANG AHMADNo ratings yet

- Account Opening FormDocument1 pageAccount Opening FormSK GNo ratings yet

- IDFC FIRST Savings Account Form V5Document4 pagesIDFC FIRST Savings Account Form V5xyzNo ratings yet

- 9998-82EDocument2 pages9998-82EDominic BertucciNo ratings yet

- Kyc - Customer Profile FormDocument1 pageKyc - Customer Profile FormAbhishek DANo ratings yet

- Ontario Health Insurance Coverage Document List: Canadian CitizensDocument2 pagesOntario Health Insurance Coverage Document List: Canadian CitizensbughostNo ratings yet

- Huduma Namba Data Capture ToolsDocument2 pagesHuduma Namba Data Capture ToolsThe Star Kenya100% (4)

- Addendum To The Common Proposal Form: Proposer DetailsDocument1 pageAddendum To The Common Proposal Form: Proposer DetailsG.R.AzhaguvelSaranya Professor MechanicalNo ratings yet

- D D Mmyyyy: Annexure-Ii (Co-Proposer Details) - CareDocument1 pageD D Mmyyyy: Annexure-Ii (Co-Proposer Details) - CareAadhish PathareNo ratings yet

- CIF FinalDocument2 pagesCIF FinalJohnny DNo ratings yet

- Bcia 8016Document4 pagesBcia 8016MichelleNo ratings yet

- Cba Livescan FormDocument4 pagesCba Livescan Formapi-631743204No ratings yet

- AW Company Registration Form - IntDocument1 pageAW Company Registration Form - IntWinnie Pamela KalpukaiNo ratings yet

- A Study On Factors Influencing Claims in General Insurance Business in IndiaDocument13 pagesA Study On Factors Influencing Claims in General Insurance Business in IndiaSuhas SiddarthNo ratings yet

- PRAGATILIF Annual Report 2016Document110 pagesPRAGATILIF Annual Report 2016Saram ShahNo ratings yet

- Rwallet Cash Card Application Form: Corporation/Company/Business Unit: Department: LocationDocument2 pagesRwallet Cash Card Application Form: Corporation/Company/Business Unit: Department: LocationJaynard AlejandrinoNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument3 pagesThe Institute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- WellsFargoDocument7 pagesWellsFargosayma kandafNo ratings yet

- Paytm Payments Bank Statement From 09-08-2020 To 05-11-2020Document4 pagesPaytm Payments Bank Statement From 09-08-2020 To 05-11-2020FUNNY VINESNo ratings yet

- (A) Mumbai (B) Chennai (C) Gwalior (D) VaranasiDocument4 pages(A) Mumbai (B) Chennai (C) Gwalior (D) VaranasiselvasrijaNo ratings yet

- Memorandum of Agreement For Livelihood Loan FacilityDocument9 pagesMemorandum of Agreement For Livelihood Loan Facilityglenn padernal100% (1)

- Online Material in Commercial Law ReviewDocument7 pagesOnline Material in Commercial Law ReviewbhinggwapsNo ratings yet

- Pas 37 - Provisions Contingent Liab Contingent AssetsDocument18 pagesPas 37 - Provisions Contingent Liab Contingent AssetsCyril Grace Alburo BoocNo ratings yet

- Term & ConditionDocument11 pagesTerm & ConditionNusaibah YusofNo ratings yet

- Group 8 Audit of Insurance Industry Including HMODocument16 pagesGroup 8 Audit of Insurance Industry Including HMOKyree VladeNo ratings yet

- Topic: Concealment Material Concealment: Incontestability Clause (1994)Document3 pagesTopic: Concealment Material Concealment: Incontestability Clause (1994)alyNo ratings yet

- SBI+Life+-+Shubh+Nivesh V04 Policy+Document Form+595Document52 pagesSBI+Life+-+Shubh+Nivesh V04 Policy+Document Form+595ANIL TIWARINo ratings yet

- J Senior Premium Rate Card 2022Document4 pagesJ Senior Premium Rate Card 2022dsesrNo ratings yet

- Audit of Insurance CompaniesDocument20 pagesAudit of Insurance CompaniesJoseph BarreraNo ratings yet

- Insurance Commission Exam ReviewerDocument5 pagesInsurance Commission Exam ReviewerApolinar Alvarez Jr.97% (38)

- Emedlife Insurance Broking Services Limited: Group Mediclaim PolicyDocument2 pagesEmedlife Insurance Broking Services Limited: Group Mediclaim PolicyYanamandra Radha Phani ShankarNo ratings yet

- Proposal Form New India Mediclaim Policy 01102021Document6 pagesProposal Form New India Mediclaim Policy 01102021abcdefabcNo ratings yet

- Tata Digital Super Top-Up - Plan SummaryDocument3 pagesTata Digital Super Top-Up - Plan SummarybusinessNo ratings yet

- Manjeet Singh Vs National Insurance Company LTDDocument30 pagesManjeet Singh Vs National Insurance Company LTDVANSHIKA SINGHNo ratings yet

- 1st Monthly Transfer TaxDocument13 pages1st Monthly Transfer TaxAlexandra Nicole IsaacNo ratings yet

- 15th March 2024 Commercial and Tax Cause ListDocument17 pages15th March 2024 Commercial and Tax Cause ListFaith NyokabiNo ratings yet

- Indemnity and GuaranteeDocument29 pagesIndemnity and GuaranteevimalNo ratings yet

- Taxation: TopicsDocument128 pagesTaxation: TopicsKudryNo ratings yet

- ACC Annual Report 2017Document152 pagesACC Annual Report 2017karim adelNo ratings yet

- Petitioner Respondent: Susan Co Dela Fuente, - Fortune Life Insurance Co., Inc.Document18 pagesPetitioner Respondent: Susan Co Dela Fuente, - Fortune Life Insurance Co., Inc.Christine Joyce SumawayNo ratings yet

- Cal Homeowners Insurance Valuation V2Document77 pagesCal Homeowners Insurance Valuation V2Melissa Maher100% (1)

- Employer - Registration NISDocument2 pagesEmployer - Registration NISKerisha WilliamsNo ratings yet

- Joe Childs' Superintendent ContractDocument4 pagesJoe Childs' Superintendent ContractinforumdocsNo ratings yet