Professional Documents

Culture Documents

Session 1 Soln

Uploaded by

shubhamjob40 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

session1soln

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageSession 1 Soln

Uploaded by

shubhamjob4Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Session

1: Post class test (solutions)

1. F. All of the listed are corporate finance decisions, since they all

require financial resources. The one that comes closest to not making

it is the accounting reevaluation because it really is cosmetic. The only

reason I include it is because you have to pay the accountants to do

this cosmetic restatement.

2. c. That the firm is funded with primarily equity and pays little out

to its stockholders. If you are a firm that derives your value from

growth assets, you cannot afford debt (since you don’t have much in

existing assets & cash flows) and you need all your cash to go back

into the firm to generate future growth (and thus cannot return cash

to stockholders).

3. e. Firms should take investments that earn returns greater than

the risk adjusted hurdle rate. It is not enough that the investments

are profitable & increase growth or that they earn more than the risk

free rate. The projects earning the highest returns may not be good

enough, if they are very risky.

4. e. Debt in the same currency that your cash flows are in. Using the

cheapest debt, the longest term debt or the shortest term debt may

not make sense if the debt is not matched up to the cash flows on the

assets. Mismatching debt to assets increases default risk.

5. c. Firms that have high earnings and low growth potential will return

more cash to stockholders. It is a combination of having lots of

earnings (cash flows) and not that much to invest those cash flows in

that creates the opportunity to return more cash.

You might also like

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- Session 2 SolnDocument1 pageSession 2 Solnspamxacc7No ratings yet

- How Can A Firm Make Its Capital Structure Effective ?Document6 pagesHow Can A Firm Make Its Capital Structure Effective ?Deeksha ThakurNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceAvi AggarwalNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Chapter 1 FM IIDocument16 pagesChapter 1 FM IImelat felekeNo ratings yet

- LeverageDocument11 pagesLeverageAnshul AernNo ratings yet

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDocument26 pagesCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNo ratings yet

- Business Finance: Time: 1 HR MarksDocument5 pagesBusiness Finance: Time: 1 HR MarksSachin DhamijaNo ratings yet

- Unit 3 FMDocument8 pagesUnit 3 FMpurvang selaniNo ratings yet

- Individual AssignmentDocument5 pagesIndividual AssignmentIeyrah Rah ElisyaNo ratings yet

- Busines DDocument5 pagesBusines DMadhav SakhujaNo ratings yet

- Class 12 Business Studies Chapter - 9Document15 pagesClass 12 Business Studies Chapter - 9Ansh bhardwajNo ratings yet

- Chapter 9 FINANCIAL MANAGEMENTDocument34 pagesChapter 9 FINANCIAL MANAGEMENTLatha VarugheseNo ratings yet

- Individuals AssignmentDocument7 pagesIndividuals AssignmentQuỳnh NhưNo ratings yet

- The Other Questions 22052023Document33 pagesThe Other Questions 22052023Anjanee PersadNo ratings yet

- Chapter Five: Financing Decision: Gedewon Gebre (MSC Accounting and Finance, Certified Authorized Accountant-Ethiopia)Document12 pagesChapter Five: Financing Decision: Gedewon Gebre (MSC Accounting and Finance, Certified Authorized Accountant-Ethiopia)sosina eseyewNo ratings yet

- Financial ManagmentDocument34 pagesFinancial ManagmentDarsh AroraNo ratings yet

- Financial Management KangraDocument12 pagesFinancial Management Kangramanik_chand_patnaikNo ratings yet

- 1880 3727 Textbooksolution PDFDocument13 pages1880 3727 Textbooksolution PDFRisaNo ratings yet

- Factors Determining Optimal Capital StructureDocument8 pagesFactors Determining Optimal Capital StructureArindam Mitra100% (8)

- Financial ManagementDocument21 pagesFinancial ManagementsumanNo ratings yet

- Sources and Uses of Short Term and Long Term FundsDocument7 pagesSources and Uses of Short Term and Long Term FundsSyrill Cayetano0% (1)

- FM Assignment - 2Document7 pagesFM Assignment - 2ALEN AUGUSTINENo ratings yet

- 3 - Descriptive Questions With Answers (20) DoneDocument13 pages3 - Descriptive Questions With Answers (20) DoneZeeshan SikandarNo ratings yet

- DJMD SjdnajkDocument14 pagesDJMD Sjdnajksuhaib shaikhNo ratings yet

- Role of A Financial ManagerDocument15 pagesRole of A Financial ManagerAadi Jain -No ratings yet

- Chapter 15-FinanceDocument7 pagesChapter 15-Financeapi-3728461No ratings yet

- Unit Iii-1Document13 pagesUnit Iii-1Archi VarshneyNo ratings yet

- FIN701 Finance AS1744Document17 pagesFIN701 Finance AS1744anurag soniNo ratings yet

- FM Theory PDFDocument55 pagesFM Theory PDFJeevan JazzNo ratings yet

- Every Company Is Required To Take Three Main Financial Decisions, They AreDocument5 pagesEvery Company Is Required To Take Three Main Financial Decisions, They Areroyette ladicaNo ratings yet

- FM Material UNIT-IIDocument5 pagesFM Material UNIT-IIananthineevs7btsNo ratings yet

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocument10 pagesFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelNo ratings yet

- Selecting Sources of Finance For Business: Can The Necessary Finance Be Provided From Internal Sources?Document6 pagesSelecting Sources of Finance For Business: Can The Necessary Finance Be Provided From Internal Sources?Pawan_Vaswani_9863No ratings yet

- Ch9 Financial Management XII 2Document33 pagesCh9 Financial Management XII 2Keshvi AggarwalNo ratings yet

- Punjabi University Patiala: Assignment ONDocument5 pagesPunjabi University Patiala: Assignment ONParamvir DhotNo ratings yet

- Unit-Iv CefDocument43 pagesUnit-Iv CefAshish BokdeNo ratings yet

- Capital Struchoices (Modified)Document16 pagesCapital Struchoices (Modified)mogibol791No ratings yet

- Finance For ManagesDocument9 pagesFinance For ManagesKhadeja RemizNo ratings yet

- Corporate Finance AssignmentDocument5 pagesCorporate Finance AssignmentaditiNo ratings yet

- FINANCIAL MANGEMENT - Microsoft OneNote OnlineDocument6 pagesFINANCIAL MANGEMENT - Microsoft OneNote OnlineRajat SharmaNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsGrant LiNo ratings yet

- Generation and Allocation of FundsDocument2 pagesGeneration and Allocation of FundsTHUNDER STORMNo ratings yet

- Acct 504 Exam Question GuideDocument15 pagesAcct 504 Exam Question Guideawallflower1100% (1)

- Financial Management-Compre-ReviewerDocument22 pagesFinancial Management-Compre-ReviewerDaily TaxPHNo ratings yet

- Task 3Document3 pagesTask 3Yashmi BhanderiNo ratings yet

- Corporate FinanceDocument19 pagesCorporate FinanceNikhil TurkarNo ratings yet

- 1-Entrep. Keywords - 2ndDocument15 pages1-Entrep. Keywords - 2ndMohamed AdelNo ratings yet

- CF 3rd AssignmentDocument6 pagesCF 3rd AssignmentAnjum SamiraNo ratings yet

- Reading in Banking and Finance: March 2014Document52 pagesReading in Banking and Finance: March 2014iibjNo ratings yet

- Investments An Introduction 11Th Edition Mayo Solutions Manual Full Chapter PDFDocument38 pagesInvestments An Introduction 11Th Edition Mayo Solutions Manual Full Chapter PDFninhletitiaqt3100% (9)

- Finance Compendium PartI DMS IIT DelhiDocument29 pagesFinance Compendium PartI DMS IIT Delhinikhilkp9718No ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsDocument8 pagesA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertNo ratings yet

- chp1 Financial ManagementDocument14 pageschp1 Financial ManagementHuda ShahNo ratings yet

- s15 Miller Chap 8b LectureDocument19 pagess15 Miller Chap 8b LectureKartika FitriNo ratings yet

- Avid Final ProjectDocument2 pagesAvid Final Projectapi-286463817No ratings yet

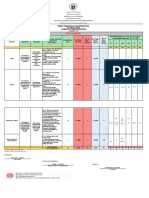

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- F5 Chem Rusting ExperimentDocument9 pagesF5 Chem Rusting ExperimentPrashanthini JanardananNo ratings yet

- Information Technology Project Management: by Jack T. MarchewkaDocument44 pagesInformation Technology Project Management: by Jack T. Marchewkadeeps0705No ratings yet

- Migne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Document516 pagesMigne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Patrologia Latina, Graeca et OrientalisNo ratings yet

- Ae - Centuries Before 1400 Are Listed As Browsable DirectoriesDocument3 pagesAe - Centuries Before 1400 Are Listed As Browsable DirectoriesPolNeimanNo ratings yet

- Catálogo MK 2011/2013Document243 pagesCatálogo MK 2011/2013Grupo PriluxNo ratings yet

- Microeconomics Term 1 SlidesDocument494 pagesMicroeconomics Term 1 SlidesSidra BhattiNo ratings yet

- Land of PakistanDocument23 pagesLand of PakistanAbdul Samad ShaikhNo ratings yet

- Hydrogeological Survey and Eia Tor - Karuri BoreholeDocument3 pagesHydrogeological Survey and Eia Tor - Karuri BoreholeMutonga Kitheko100% (1)

- Lecture Notes 3A - Basic Concepts of Crystal Structure 2019Document19 pagesLecture Notes 3A - Basic Concepts of Crystal Structure 2019Lena BacaniNo ratings yet

- 0 BA Design ENDocument12 pages0 BA Design ENFilho AiltonNo ratings yet

- A - PAGE 1 - MergedDocument73 pagesA - PAGE 1 - MergedGenalyn DomantayNo ratings yet

- Holiday AssignmentDocument18 pagesHoliday AssignmentAadhitya PranavNo ratings yet

- Fair & LovelyDocument10 pagesFair & LovelyAymanCheema100% (3)

- IIM L: 111iiiiiiiDocument54 pagesIIM L: 111iiiiiiiJavier GonzalezNo ratings yet

- Pt. Trijaya Agro FoodsDocument18 pagesPt. Trijaya Agro FoodsJie MaNo ratings yet

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- LS01 ServiceDocument53 pagesLS01 ServicehutandreiNo ratings yet

- Report On Marketing Strategy of Nestle MILKPAKDocument13 pagesReport On Marketing Strategy of Nestle MILKPAKAzeem Ahmad100% (1)

- Asim Kumar Manna - Business Mathematics and Statistics (2018, McGraw-Hill Education)Document624 pagesAsim Kumar Manna - Business Mathematics and Statistics (2018, McGraw-Hill Education)rerr50% (2)

- T-Tess Six Educator StandardsDocument1 pageT-Tess Six Educator Standardsapi-351054075100% (1)

- Uneb U.C.E Mathematics Paper 1 2018Document4 pagesUneb U.C.E Mathematics Paper 1 2018shafickimera281No ratings yet

- Mangas PDFDocument14 pagesMangas PDFluisfer811No ratings yet

- Properties of LiquidsDocument26 pagesProperties of LiquidsRhodora Carias LabaneroNo ratings yet

- Agile ModelingDocument15 pagesAgile Modelingprasad19845No ratings yet

- Toxemias of PregnancyDocument3 pagesToxemias of PregnancyJennelyn LumbreNo ratings yet

- Aquaculture - Set BDocument13 pagesAquaculture - Set BJenny VillamorNo ratings yet

- Ginger Final Report FIGTF 02Document80 pagesGinger Final Report FIGTF 02Nihmathullah Kalanther Lebbe100% (2)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterFrom EverandMind over Money: The Psychology of Money and How to Use It BetterRating: 4 out of 5 stars4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsFrom EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)From EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Rating: 4 out of 5 stars4/5 (5)