Professional Documents

Culture Documents

OPT Transactions

Uploaded by

SAMANTHA GEL SABELA PANLILEOCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OPT Transactions

Uploaded by

SAMANTHA GEL SABELA PANLILEOCopyright:

Available Formats

OPT subject transactions 6.

6. If the transaction is subject to VAT, there is a question of what the applicable rate of VAT will be.

Difficulty: B The following rates are applicable:

Required prior skills: Introduction and Concept of business taxation, VAT exempt transactions a. 12%: this is the default VAT rate, applicable for most or all transactions.

Hardest topic: OPT on banks b. 0%: this applies to specific transactions, typically for exports.

c. Sales to government are treated slightly differently. The government will withhold 5% of

Business taxes in general the amount and this will be a creditable input VAT.

The two main business taxes are the value added tax (VAT) and the other percentage tax (OPT). Both

taxes impose a fixed rate. However, the rate to use depends on the kind of transaction. The tax basis is Nature of OPT

the gross selling price or gross receipts. A percentage tax is a tax imposed by a certain percentage (i.e. a fixed rate) on the tax basis. In the case

of Other Percentage Taxes, it is imposed on the gross selling price or on the gross receipts.

Business taxes in general

The two main business taxes are the value added tax (VAT) and the other percentage tax (OPT). Unlike VAT, there is no need for any added value to the product or service.

The following classifications can be inferred from the provisions on the tax code as to business tax: If an item is not VAT exempt, it may be subject to either VAT or OPT.

1. Specifically listed VAT-Exempt transactions (Sec 109(A) to Sec 109(BB) NIRC)

2. Specifically listed transactions subject to OPT (Sec 117 to Sec 127 NIRC) OPT Transactions

3. Transactions subject to 3% OPT for not reaching the 3,000,000 threshold (Sec 109(CC) NIRC) There are transactions specifically listed as being subject to OPT under Sec 117 to Sec 127 NIRC of the

4. VAT transactions in general (Sec 106 to Sec 108, excluding zero-rated VAT below) NIRC. These transactions will never be subject to VAT unless a particular condition applies.

5. Zero-rated VAT transactions (Sec 106(A)(2) and Sec 108(B) NIRC, other special laws)

6. VAT Sales to Government (Sec 114(C)) Each transaction listed below has a separate rate to be used.

The difficult question is determining the applicable tax. The following rules are important: 1. Domestic Carriers, keepers of garages, and international carriers transporting cargo to another

1. The determination of the applicable tax is on a transaction by transaction basis. Because the country.

classification depends on the kind of transaction, then a business may have some transactions

subject to VAT, some transactions subject to OPT, and some transactions that are VAT exempt. According to Article 1732 of the Civil Code, “Common carriers are persons, corporations, firms or

associations engaged in the business of carrying or transporting passengers or goods or both, by

2. If a specific transaction is listed as VAT Exempt, then it is never subject to either OPT or VAT(a land, water, or air, for compensation, offering their services to the public.”

few VAT exempt transactions, however, become subject to VAT after certain conditions are met;

in general though, a VAT exempt transaction will never be subject to business tax) . The rules on carriers are summarized below:

3. If a specific transaction is listed as subject to OPT, then the particular rate applicable to that TRANSPORT OPERATION

transaction is to be used. The transaction is never subject to VAT unless specified. Within PH Going out of PH Going into PH

Domestic carrier

4. If the taxpayer is VAT-registered, then transactions other than VAT-exempt above or specifically Passengers by Specifically listed as N/A N/A

listed as OPT above (#2 and #3) are subject to VAT. land OPT: 3%

All others 3,000,000 threshold 3,000,000 threshold VAT Exempt

5. If the taxpayer is NOT VAT-registered, AND the transactions are not VAT-exempt or specifically If subject to VAT, zero-rated

listed as OPT, the transaction is called a VATable transaction. 1 International

Passengers, air N/A VAT Exempt VAT Exempt

or sea

For VATable transactions, the taxpayer must compute the total VATable transactions throughout

Cargo, air or sea N/A Specifically listed as OPT: 3% VAT Exempt

the taxable year. If the total exceeds P3,000,000, all VATable transactions will be subject to VAT.

Otherwise, they will be subject to a 1% OPT*.

“Keepers of garages” would necessarily mean a carrier providing land transportation. The Code

* Applicable from July 1, 2020 until June 30, 2023; after this period it will be 3%.

specifies that only those transporting passengers would be subject to OPT.

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

For international carriers (those owned by foreign corporations), they are subject to a 3% OPT

SEC. 117. Percentage Tax on Domestic Carriers and Keepers of Garages. - Cars for rent or hire for transport of cargo from the Philippines to another country.

driven by the lessee, transportation contractors, including persons who transport passengers for

hire, and other domestic carriers by land, for the transport of passengers [except owners of SEC. 118 Percentage Tax on International Carriers.

bancas] and owners of animal-drawn two wheeled vehicle), and keepers of garages shall pay a Xxx on their gross receipts derived from transport of cargo from the Philippines to another

tax equivalent to three percent (3%) of their quarterly gross receipts. country shall pay a tax of three percent (3%) of their quarterly gross receipts.

This particular OPT is also called the Common Carrier’s Tax. There are no international carriers by land.

For domestic carriers by land, the Code sets a minimum presumed gross receipts. This means that Illustration

if the actual gross receipts for the quarter are lower than the below amounts, the domestic carrier American Airlines had the following transactions:

will pay the 3% OPT based on the below amounts instead: Receipts from transport of passengers:

From Philippines to United States P5,000,000

Jeepney for hire From United States to Philippines P2,000,000

1. Manila and other cities P 2,400 Receipts from transport of cargo:

2. Provincial 1,200 From Philippines to United States P3,000,000

From United States to Philippines P1,600,000

Public utility bus

Not exceeding 30 passengers P 3,600 The following business taxes are imposed:

Exceeding 30 but not exceeding 50 passengers 6,000

Exceeding 50 passengers 7,200 Cargo From PH to US 3,000,000

Multiply: 3%

Taxis OPT 900,000

1. Manila and other cities P 3,600

2. Provincial 2,400 All other transactions by American Airlines above are VAT exempt and subject to no business tax.

Car for hire (with chauffer) P 3,000 2. Radio or television broadcasting franchisees, and gas and water utilities

Car for hire (without chauffer) 1,800 A franchise is an agreement whereby one person (the franchisor) authorizes the grantee

(franchisee) to operate using the former’s logo, tradename, and so on. These taxes are also called

Illustration franchise taxes.

A taxi in Metro Manila had received only P3,000 of gross receipts during the quarter. His other

percentage tax of 3% will be computed using the minimum presumed receipts of P3,600. Under Philippine law, broadcasting companies must request and be granted a franchise by

Congress through the enactment of a law.

Receipts 3,600

Multiply: 3% A radio or television broadcasting franchise grantee is subject to an OPT of 3% if their annual

OPT 108 gross receipts do not exceed P10,000,000.

If the taxi’s actual gross receipts were P4,000, then the 3% OPT will be computed based on P4,000. Take note of the flowchart again:

For all other Domestic Carrier operations within the Philippines (other than domestic transporters

of passengers by land), since they are not listed under either VAT exempt or OPT, they are VATable

transactions. The question then will be whether that carrier is VAT registered or if its VATable

transactions exceed the 3,000,000 threshold.

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

3. Overseas Dispatch, Message or Conversation Originating from the Philippines

This refers to the use of communication equipment and services to deliver messages overseas or

to other countries. It is also known as the overseas communication tax.

This was primarily used for telephones, telegraphs, and telewriter exchanges, especially when

sending communications overseas was difficult and costly. Note that the law also covers “wireless

and other communication equipment services.”

This tax is paid by the user of the services, collected by the communication provider and remitted

to the BIR.

The OPT tax rate is 10%.

Messages sent by the following are not subject to the OPT:

a. Government: this is in line with the inherent limitation that the government is exempt

from taxes.

b. Diplomatic services: this refers to embassies and consular offices of foreign governments.

This is in line with the inherent limitation of international comity. Embassies and consular

offices are treated as extensions of foreign states. A state cannot tax another state.

Because the determination of whether a transaction is “specifically listed under OPT”, the c. International organizations that are exempted by treaties or agreements

question of the 3,000,000 threshold is irrelevant here. For as long as the total receipts of the d. News services, which messages deal exclusively with the collection of news items for, or

broadcasting franchise do not exceed P10,000,000, they are subject to the 3% OPT. the dissemination of news item

If the receipts exceed P10,000,000, then follow down the flowchart. That means the next question 4. Banks and Financial intermediaries performing Quasi-banking functions

is whether the business is either VAT registered or their VATable sales exceed P3,000,000. “Non-bank financial intermediaries” are entities whose principal function is the lending, investing,

or placement of funds. Banks are financial intermediaries. Under the law, banks are not only

Illustration: subject to control by the Bangko Sentral ng Pilipinas, but they are also required to be corporations.

A radio station had P9,000,000 in annual gross receipts for 2017. It is subject to an OPT of 3%.

Quasi-banking function refers to the borrowing of funds from 20 or more lenders at any one time.

If the radio station’s annual gross receipts amounted to P10,500,000, its sales are instead VATable. The borrowing is through the issuance, endorsement, or acceptance of debt instruments of any

Regardless of whether the station is VAT registered, its sales exceed P3,000,000. Thus, it must pay kind, other than deposits. It may also be through the issuance of certificates of assignment or

the VAT. similar instruments.

Optional VAT registration for broadcasting The following tax rates are applicable for income earned by the bank/quasi-bank:

A broadcasting franchisee may also opt to register under VAT. In such a case, it will pay the VAT; Interest income, commissions and discounts from lending

the 10,000,000 threshold is no longer used. Its VAT registration can never be cancelled, and the activities, income from financial leasing, on the basis of

franchisee will never be subject to OPT again. remaining maturity

a. Maturing in 5 years or less 5%

Gas and water utilities b. Maturing over 5 years 1%

Gas and water utilities are subject to a 2% OPT on their gross receipts. No threshold is imposed Dividend and equity shares in the net income of subsidiaries* 0%

on utilities. All other items of gross income** 7%

Net trading gains within the taxable year on foreign currency, 7%

debt securities, derivatives, and other similar financial

instruments**

*This applies only to dividends from subsidiaries.

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

**While this is listed separately in the NIRC, essentially, net trading gains would also be “all other 6. Tax on Premiums of Life Insurance Companies

items of gross income”. Thus, it would be easier to remember them as one item “all other items of Under the Insurance Code, a contract of insurance is “an agreement whereby one undertakes for

gross income” a consideration to indemnify another against loss, damage or liability arising from an unknown or

contingent event.”

The tax rate on interest income depends on the remaining years to maturity.

The “consideration” in the contract is called an insurance premium. The policyholder pays a

Illustration periodic premium to the insurer. In return, either the policyholder, his property, or some other

The bank received the following interest payments in 2021: person shall be covered by the policy. The policyholder generally must have an insurable interest

Loan Interest Rate Date loan released Date of maturity Amount of interest in the property or person covered.

Loan A 10% 2020 2023 200,000

Loan B 8% 2020 2028 80,000 Insurance companies profit because out of a large number of policyholders, only a very small

Loan C 9% 2020 2026 900,000 percentage of them will have valid claims to the payout (called insurance proceeds).

Loan D 11% 2019 2025 110,000

A 2% OPT is imposed on the premiums collected by life insurance companies, whether the

The OPT is computed as follows: premium is paid in cash, in credits, or even in substitutes for money. Life insurance policies are

Loan Years to maturity (from 2021) OPT rate Interest income OPT payable policies covering people: proceeds are paid out in the case of death, regardless of the cause of

Loan A 2 years 5% 200,000 10,000

death.

Loan B 7 years 1% 80,000 800

Loan C 5 years 5% 900,000 45,000

Loan D 4 years 5% 110,000 5,500 Due to the wording of the law, the OPT is imposed on premiums collected by companies offering

Although Loan C was originally for a period of 6 years, by 2021 only 5 years are left. The rate to be used will life insurance, not on the premiums on life insurance themselves.

be 5%.

SEC. 123. Tax on Life Insurance Premiums. - There shall be collected from every person, company

As previously discussed, the bank will still be subject to income tax on these items. or corporation (except purely cooperative companies or associations) doing life insurance

business of any sort in the Philippines

In case the maturity period is shortened thru pre-termination, then the maturity period shall be

reckoned to end as of the date of pre-termination for purposes of classifying the transaction and A life insurance company is a company dealing with the insurance on human lives and insurance

the correct rate of tax shall be applied accordingly. appertaining thereto or connected therewith. An insurance company will ordinarily not offer only

life insurance. It may also offer casualty insurance (which is payable even if the covered person is

5. Other financial intermediaries without quasi-banking functions merely injured, but the cause must specifically be an accident) or health insurance (which is

An example of such a financial intermediary is a pawnshop. It performs lending operations to payable when the covered person suffers specific diseases, even if it doesn’t result on death). On

customers, with various small items such as jewelry being used as collateral. However, it does not the other hand, life insurance is specifically paid out on the death of the insured, and is paid

borrow from 20 or more people at any one time. Neither does a pawnshop regularly issue, accept, regardless of the cause of death.

or endorse debt instruments like bonds or notes.

Accordingly, for as long as the company primarily offers life insurance and is thus a life insurance

The tax rates for such intermediaries are as follows: company, premiums on other insurance collected by said company are also subject to the tax.

Interest income, commissions and discounts

from lending activities, income from financial The following premiums will not be subject to OPT, even if received by a life insurance company:

leasing, on the basis of remaining maturity a. Premiums refunded within 6 months after payment on account of rejection of risk or

a. Maturing in 5 years or less 5% returned for other reasons

b. Maturing over 5 years 1% b. Re-insurance premiums. Insurance companies, in practice, will also insure each other. In

All other items of gross income 5% essence, the insurance company becomes a policyholder of another insurance company.

Part of the risk is passed to another insurance company. The latter, therefore, would also

demand premiums from the former company.

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

The practice is done so as to prevent a total collapse in the case of an extremely large 3. The promoter is a Filipino citizen, or a corporation which is at least 60% owned by Filipinos

event, such as a natural disaster covering the majority of a country. While this is rare,

insurance companies prepare for the possibility. Cabarets are discos, similar to clubs for dancing. If the club or cabaret is part of a larger

establishment, such as a hotel or a bowling alley, the receipts from the club or cabaret are treated

c. Premiums from life insurance of non-residents received by overseas branches. separately from the other services provided by the establishment.

d. Excess of premiums on vatable contracts in excess of the amounts necessary to insure the

lives of the variable contract owners Illustration

The sole proprietor operates a bowling alley which also has a disco. It reported the following:

7. Agents of foreign insurance companies

From the cabaret From the bowling alley

A foreign insurance company would ordinarily cover only foreigners, including foreign companies. Entrance fee 200,000 200,000

However, the latter foreign companies may be performing international operations. They may Sales of food and beverage 800,000 150,000

decide to obtain insurance for their international operations as well.

The OPT is imposed only on the receipts from the cabaret.

If they want to option is to obtain insurance from a foreign insurance company instead of a local

one, they will either obtain the services of a local person or company who will act as an agent of Other businesses may be renting space inside the amusement place, such as a food stand at a

the foreign insurer, or to obtain an international insurance policy directly from the foreign insurer. cockpit. The rent paid to the amusement place owner, lessor or operator will also be subject to

the OPT. The receipts by that food stand would not be subject to the amusement tax because he

The tax is imposed when the foreign insured company is not authorized to transact business in is not the lessor, operator or owner of the amusement place itself.

the Philippines. If the policy is obtained through an agent, the tax rate is 4%:

9. Tax on winnings in horse races

SEC. 124. Tax on Agents of Foreign Insurance Companies. - …shall pay a tax equal to twice the

tax imposed in Section 123… Here, the tax is imposed on the bettors and the horse owners. Racetracks are also subject to

amusement tax above. The amusement tax is imposed on the owner, operator or lessor of the

However, if the insured obtains the policy directly from the foreign insurer, the tax rate is instead racetrack.

5%.

The tax rates are as follows:

SEC. 124. Tax on Agents of Foreign Insurance Companies. - …In all cases where owners of Winnings of bettors 10%

property obtain insurance directly with foreign companies, it shall be the duty of said owners… Winnings from double, forecast/quinella and trifecta bets 4%

shall pay the tax of five percent (5%) on premiums paid, in the manner required by Section 123. Winnings of the horseowners 10%

8. Amusement Taxes The race winnings are explained below:

A. Combination bets (betting on at least two horses)

The proprietors (owners), lessors or operators of the following amusement places will pay an i. Double – selecting winners in two specific races

other percentage tax as follows: ii. Daily double – a bet for the first winning horse on two consecutive races

iii. Forecast – a bet for the first and second finisher in a particular race

Places of boxing exhibitions 10% iv. Exacta or perfecta – a bet to pick the first two finishers in exact order

Places of professional basketball games 15% v. Quinella – a bet where at least the first two finishers must be picked in either order

Cockpits, cabarets, night or day clubs 18% vi. Trifecta – a bet to predict the first three finishers in a race in exact order

Jai-alai and race tracks 30% B. Straight wagers

i. Win – the selected horse must finish in first place

For professional boxing, no OPT is imposed if the following conditions are present: ii. Place – the selected horse must finish in first or second place

1. It is a world or oriental championship match iii. Show – the selected horse must finish in first, second or third place

2. At least one of the contenders is a Filipino citizen

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

For bettors, the tax is imposed on the winnings after deducting the cost of the ticket. All taxes 11. NEW Gaming Tax on Offshore Gaming Licensees

here are withheld from the winnings. This tax was added in 2021 by RA 11590.

Illustration SECTION 125-A Gaming Tax on Services Rendered by Offshore Gaming Licensees

The racetrack had the following dividends for winning tickets during an event: The entire gross gaming revenue or receipts or the agreed predetermined minimum monthly

revenue or receipts from gaming, whichever is higher, shall be levied, assessed, and collected a

Total winnings on straight bets (cost of tickets 10,000) P80,000 gaming tax equivalent to (5%), in lieu of all other direct and indirect internal revenue taxes and

Total winnings in daily double (cost of tickets 600) 40,000 local taxes, with respect to gaming income.

A winner of trifecta (cost of ticket 200) 30,000

Prize for the owner of the winning horse 100,000 The Philippine Amusement and Gaming Corporation or any special economic zone authority or

tourism zone authority or freeport authority may impose regulatory fees on offshore gaming

The tax on the winnings are as follows: licensees which shall not cumulatively exceed two percent (2%) of the gross gaming revenue or

receipts derived from gaming operations and similar related activities of all offshore gaming

Straight Daily double Trifecta Owner licensees or a predetermined minimum guaranteed fee, whichever is higher:

Winnings 80,000 40,000 30,000 100,000

Cost (10,000) (600) (200) Gross gaming revenue or receipts shall mean gross wages less payouts: Provided, finally, That the

Net 70,000 39,400 29,800 100,000 taking of wagers made in the Philippines and the grave failure to cooperate with the third-party

Tax rate 10% 4% 4% 10% auditor shall result in the revocation of the license of the offshore gaming licensee.

7,000 1,576 1,192 10,000

The term ‘offshore gaming licensee’ shall refer to the offshore gaming operator, whether

The tax will be deducted from the winnings before they are paid out to the winners. organized abroad or in the Philippines, duly licensed and authorized, through a gaming license, by

the Philippine Amusement and Gaming Corporation or any special economic zone authority or

10. Sale of shares listed and traded through the local stock exchange tourism zone authority or freeport authority to conduct offshore gaming operations, including the

acceptance of bets from offshore customers, as provided for in their respective charters.

Not all stocks by corporations are listed in the Philippine Stock Exchange. Listed corporations are

called public corporations, because anyone can buy or sell the stocks through the PSE.

This OPT transaction refers to any sale of listed stocks other than by a dealer in security. In the

Philippines, no individual may directly transact in the stock exchange. All transfers of stock are

effected through security dealers, brokers, or other registered middlemen.

When the sale is said to be one by other than by a dealer in security, it means the owner of the

shares being sold is someone other than the dealer. Some dealers will buy or sell shares in their

own name for additional profits. However, when the owner is someone else, the dealer is merely

acting as an agent or middleman; the true seller would be the dealer’s client.

The sale of the stocks refers to sales between stockholders. It does not refer to the first time

issuance of a stock where the issuing corporation is the “seller”. The applicable tax is 0.6% of the

selling price.

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

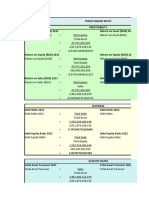

12. First issuance of shares in an Initial Public Offering A summary of the OPT rates are as follows

Business Tax rate

Under RA 11494 Bayanihan to Recover As One Act, signed into law on September 11, 2020, Banks and quasi-banks 5% on interest, maturity 5 yrs or less

this tax has been repealed and is no longer imposed. 1% on interest, maturity over 5 yrs

0% on dividends from subsidiaries

A corporation has what is called authorized share capital. This refers to the maximum possible 7% on all other gross income

shares that may be issued. However, not all shares are issued at once. Other financial intermediary without quasi-banking 5% on interest, maturity 5 yrs or less

1% on interest, maturity over 5 yrs

5% on all other gross income

If a corporation is listed in the stock exchange, the first time a share is issued to the public is called

Int’l carriers transporting passengers to overseas 3%

an Initial Public Offering. Here, the investors pay to the broker who will forward the proceeds to

Domestic carriers transporting passengers by land 3%

the issuing corporation. This is different from the sales above in that this is the first time the

Places of boxing exhibitions 10%

shares are being sold, and that the “seller” is the issuing corporation and not some other person.

Places of professional basketball games 15%

Night club, cabaret, cockpit 18%

The tax rate is imposed on the selling price of the share, depending on the number of shares sold: Jai alai, race tracks 30%

Winnings from race tracks 4% for double, forecast, trifecta

Proportion of shares sold Tax rate 10% for other bets

Up to 25% 4% 10% for owners of winning horse

Over 25%, but not over 33 1/3% 2% Sale of stocks through Phil Stock Exchange 0.6%

Over 33 1/3% 1% Sale of stocks by closeheld corp in an IPO 4%, 2%, 1%

Radio and broadcast franchise with gross receipts 3%

The “proportion” is computed as follows: not more than 10,000,000

Gas and water utilities 2%

Shares sold / Total shares outstanding after IPO Life insurance premiums 2%

Foreign insurance premiums collected thru agent 4%

The tax is imposed only for IPOs of closely-held corporations, which are corporations where at Premiums for foreign insurance directly from 5%

least 50% of the value of the outstanding capital stock is held by 20 individuals or less. insurer

Overseas communications 10%

Illustration

There are currently 100,000 shares. The corporation conducted an IPO issuing another 40,000

shares at P5 per share.

40,000

=

100,000 + 40,000

40,000

28.57% =

140,000

Shares sold 40,000

Multiply: selling price 5

Total 200,000

OPT rate 2%

OPT 4,000

CVGCastro S2 2023-2024 CVGCastro S2 2023-2024

You might also like

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- Module 5Document21 pagesModule 5Krisly Erica DALISAYNo ratings yet

- Business Tax Chapter 7 ReviewerDocument2 pagesBusiness Tax Chapter 7 ReviewerMurien LimNo ratings yet

- Other Percentage Taxes PDFDocument16 pagesOther Percentage Taxes PDFJociel De GuzmanNo ratings yet

- Chapter 1Document2 pagesChapter 1Trisha Mae BoholNo ratings yet

- Morales Taxation Topic 10 Other Percentages TaxDocument14 pagesMorales Taxation Topic 10 Other Percentages TaxMary Joice Delos santosNo ratings yet

- Other Percentage Taxes Summary: From UnderDocument4 pagesOther Percentage Taxes Summary: From UnderZee GuillebeauxNo ratings yet

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENERONo ratings yet

- Percentage TaxesDocument11 pagesPercentage TaxesAce Hulsey TevesNo ratings yet

- Business Taxes: ABAKADA Guro Party List v. ErmitaDocument21 pagesBusiness Taxes: ABAKADA Guro Party List v. ErmitaVincent john NacuaNo ratings yet

- Other Percentage Taxes (OPT)Document56 pagesOther Percentage Taxes (OPT)Vince ManahanNo ratings yet

- Vatable Transactions PDFDocument5 pagesVatable Transactions PDFJester LimNo ratings yet

- Introduction To Business Taxes 2022Document17 pagesIntroduction To Business Taxes 2022Navarro, April Rose P.No ratings yet

- Vat With TrainDocument16 pagesVat With TrainElla QuiNo ratings yet

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- TAX MIDTERM Reviewer PDFDocument19 pagesTAX MIDTERM Reviewer PDFVanda Charissa Tibon DayagbilNo ratings yet

- 1) JSK Has To Determine With Tax Method That It Wishes To Adopt Prior To We Being Able To Go Forward With The Tax SimulationsDocument2 pages1) JSK Has To Determine With Tax Method That It Wishes To Adopt Prior To We Being Able To Go Forward With The Tax SimulationsJSK1 JSK11No ratings yet

- Possibilities in Taxation For The 2017 Bar Examinations: (Project Phoenix)Document54 pagesPossibilities in Taxation For The 2017 Bar Examinations: (Project Phoenix)Ihon BaldadoNo ratings yet

- "VAT, VAT Audit and Statutory Role of Cost Accountant": Name - Richard D'silva Roll No - 09Document12 pages"VAT, VAT Audit and Statutory Role of Cost Accountant": Name - Richard D'silva Roll No - 09Richard DsilvaNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- Business Tax GuideDocument1 pageBusiness Tax GuideDrew BanlutaNo ratings yet

- Pdfcoffee Problems On VatDocument30 pagesPdfcoffee Problems On VatJunmar AMITNo ratings yet

- TAX102: Transfer and Business Taxation: Optional RegistrationDocument3 pagesTAX102: Transfer and Business Taxation: Optional Registrationaccounts 3 lifeNo ratings yet

- VAT GUIDE - ITC Accounting and Tax ConsultancyDocument15 pagesVAT GUIDE - ITC Accounting and Tax ConsultancymarketingNo ratings yet

- Value Added TaxDocument13 pagesValue Added TaxRyan AgcaoiliNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- Value Added TaxDocument20 pagesValue Added TaxJerlene Sydney Centeno100% (1)

- Introduction To Business Taxes 2022Document17 pagesIntroduction To Business Taxes 2022Trisha Mae BoholNo ratings yet

- Intro To Business TaxDocument5 pagesIntro To Business TaxLove RosalunaNo ratings yet

- Vat Summary Notes Business TaxationDocument34 pagesVat Summary Notes Business TaxationNinNo ratings yet

- Vat - 1Document20 pagesVat - 1biburaNo ratings yet

- CIR v. Seagate Technology PhilsDocument6 pagesCIR v. Seagate Technology PhilsL.A. ManlangitNo ratings yet

- Tax 43 - Business TaxationDocument8 pagesTax 43 - Business TaxationFemie AmazonaNo ratings yet

- PM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Document22 pagesPM Reyes Notes On Taxation 2 Valued Added Tax Working Draft Updated 22 Feb 2013Riel Picardal-VillalonNo ratings yet

- TAX 203 Other Percentage TaxesDocument9 pagesTAX 203 Other Percentage TaxesYess poooNo ratings yet

- GNotes2 VAT 2018 With TRAIN AmendmentsDocument31 pagesGNotes2 VAT 2018 With TRAIN AmendmentsKristine Bucu100% (4)

- Tax ReviewerDocument8 pagesTax ReviewerCharina NipesNo ratings yet

- Value Added Tax Ust PDFDocument23 pagesValue Added Tax Ust PDFcalliemozartNo ratings yet

- VAT Taxpayer Guide - VAT Return FilingDocument16 pagesVAT Taxpayer Guide - VAT Return FilingNeeyum Njaanum0021No ratings yet

- Value-Added Tax Nature of VatDocument22 pagesValue-Added Tax Nature of VatDiossaNo ratings yet

- Pa Tax Brief - March 2018Document11 pagesPa Tax Brief - March 2018Teresita TibayanNo ratings yet

- Value Added TaxDocument38 pagesValue Added TaxAhmad AbduljalilNo ratings yet

- Other Percentage Taxes (OPT) : By: Donna Lerma Janica A. PacoDocument48 pagesOther Percentage Taxes (OPT) : By: Donna Lerma Janica A. PacoNiña PacoNo ratings yet

- Nonresident Alien Engaged in Trade or BusinessDocument2 pagesNonresident Alien Engaged in Trade or BusinessHEARTHEL KATE BUYUCCANNo ratings yet

- PM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)Document22 pagesPM Reyes Notes On Taxation 2 - Valued Added Tax (Working Draft)dodong123100% (1)

- VAT Overview - RevDocument62 pagesVAT Overview - RevZachary BañezNo ratings yet

- Module 1Document30 pagesModule 1PAMELA EVANGELISTANo ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Nigeria WHT Need To KnowDocument6 pagesNigeria WHT Need To KnowphazNo ratings yet

- CPAR VAT (Batch 93) - HandoutDocument38 pagesCPAR VAT (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- Valued Added Tax Part 1Document10 pagesValued Added Tax Part 1DOMINGO, Ma. Eau Claire A.No ratings yet

- TAX.2904 Percentage Tax.Document12 pagesTAX.2904 Percentage Tax.Rodge Gabayoyo100% (2)

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- Tax.102 2 Other Percentage Taxes EEsDocument11 pagesTax.102 2 Other Percentage Taxes EEsJoana Lyn GalisimNo ratings yet

- Value Added TaxDocument29 pagesValue Added TaxSNLTNo ratings yet

- Chapter 8Document6 pagesChapter 8my miNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- PMS 3.1Document20 pagesPMS 3.1SAMANTHA GEL SABELA PANLILEONo ratings yet

- RFBT Chapter 5-8Document4 pagesRFBT Chapter 5-8SAMANTHA GEL SABELA PANLILEONo ratings yet

- PMS 1.1Document4 pagesPMS 1.1SAMANTHA GEL SABELA PANLILEONo ratings yet

- On The Dynamic Return and Volatility Connectedness of Cryptocurrency, Crude Oil, Clean Energy, and Stock Markets: A Time Varying AnalysisDocument12 pagesOn The Dynamic Return and Volatility Connectedness of Cryptocurrency, Crude Oil, Clean Energy, and Stock Markets: A Time Varying AnalysisSAMANTHA GEL SABELA PANLILEONo ratings yet

- Pagination ERSS 936Document14 pagesPagination ERSS 936SAMANTHA GEL SABELA PANLILEONo ratings yet

- Bitcoinsgrowinge WasteproblemDocument23 pagesBitcoinsgrowinge WasteproblemSAMANTHA GEL SABELA PANLILEONo ratings yet

- Laporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting DateDocument6 pagesLaporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting Datedok wahab siddikNo ratings yet

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288No ratings yet

- Capital Budgeting Test Bank Part 2Document167 pagesCapital Budgeting Test Bank Part 2AnnaNo ratings yet

- PNB Vs CA - DigestDocument2 pagesPNB Vs CA - DigestGladys Viranda100% (1)

- Consumer Durable LoansDocument10 pagesConsumer Durable LoansdevrajkinjalNo ratings yet

- Multipurpose: SPMC Employees' CooperativeDocument32 pagesMultipurpose: SPMC Employees' CooperativeVIVIEN BAYACAGNo ratings yet

- CR Sample L6 Module 2 PDFDocument4 pagesCR Sample L6 Module 2 PDFDavid JonathanNo ratings yet

- Doing Business in UAEDocument16 pagesDoing Business in UAEHani SaadeNo ratings yet

- 2624 Saipem Sem 13 Ing FiDocument116 pages2624 Saipem Sem 13 Ing FiRoxana ComaneanuNo ratings yet

- Crown Valley Financial Plaza 100% Leased!Document2 pagesCrown Valley Financial Plaza 100% Leased!Scott W JohnstoneNo ratings yet

- Chem Med CaseDocument6 pagesChem Med CaseChris100% (1)

- Sweetheart Loan - Florendo Vs CADocument2 pagesSweetheart Loan - Florendo Vs CAErmeline TampusNo ratings yet

- The Rule in Clayton's Case Revisited.Document20 pagesThe Rule in Clayton's Case Revisited.Adam Channing100% (2)

- Nealon, Inc. Solutions (All Questions Answered + Step by Step)Document7 pagesNealon, Inc. Solutions (All Questions Answered + Step by Step)AndrewVazNo ratings yet

- Chp4. Application of Islamic Lease FinancingDocument35 pagesChp4. Application of Islamic Lease FinancingUsaama AbdilaahiNo ratings yet

- Bangladesh University of Professionals: Course Name: Bank Management Course Code: FIN 4204 Topic NameDocument6 pagesBangladesh University of Professionals: Course Name: Bank Management Course Code: FIN 4204 Topic NameAnika TabassumNo ratings yet

- FM 415 Money MarketsDocument50 pagesFM 415 Money MarketsMarc Charles UsonNo ratings yet

- Application For Bank FacilitiesDocument4 pagesApplication For Bank FacilitiesChetan DigarseNo ratings yet

- Forensic Audit Report Press StatementDocument3 pagesForensic Audit Report Press StatementNation OnlineNo ratings yet

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiNo ratings yet

- Contingency Planning & Simulation Exercises Practical ApplicationsDocument11 pagesContingency Planning & Simulation Exercises Practical ApplicationsMustafa Shafiq RazalliNo ratings yet

- How To Know Fraud in AdvanceDocument6 pagesHow To Know Fraud in AdvanceMd AzimNo ratings yet

- What Is A Sales BudgetDocument5 pagesWhat Is A Sales BudgetCyril Jean-BaptisteNo ratings yet

- Lesson 1 Definition of Finance Goals of The Financial ManagerDocument14 pagesLesson 1 Definition of Finance Goals of The Financial ManagerJames Deo CruzNo ratings yet

- Acc 219 Notes Mhaka CDocument62 pagesAcc 219 Notes Mhaka CfsavdNo ratings yet

- Security Agreement - Secured PartyDocument7 pagesSecurity Agreement - Secured PartyCo100% (33)

- Insurance Law ProjectDocument14 pagesInsurance Law Projectlokesh4nigamNo ratings yet

- Bulkowsky PsicologiaDocument41 pagesBulkowsky Psicologiaamjr1001No ratings yet

- Cpa Questions Part XDocument10 pagesCpa Questions Part XAngelo MendezNo ratings yet

- Cgtmse MDocument82 pagesCgtmse MAnonymous EtnhrRvz0% (1)