Professional Documents

Culture Documents

Adjusting Entries Discussion Problems

Uploaded by

micadeguzman.13130 ratings0% found this document useful (0 votes)

5 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesAdjusting Entries Discussion Problems

Uploaded by

micadeguzman.1313Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

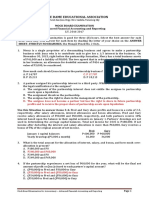

Prepare the necessary adjusting entries for the following transactions.

DATE

a. A life insurance policy examination showed $1,040 of expired insurance a

Originally, the company recorded it as prepaid insurance

DEFFERAL ASSET METHOD EXPIRED

b. An inventory count showed $210 of unused shop supplies still available b

Initially, company recorded a journal entry as debit to supplies expense.

DEFFERAL EXPENSE METHOD UNEXPIRED

c. Depreciation expense on shop equipment, $350 c

PROVISION DEPRECIATION

d. Depreciation expense on the building, $2,020 d

PROVISION

e. A beautician is behind on space rental payments, and this $200 of e

accrued revenues was unrecorded at the time the trial balance was

prepared

ACCRUALS ACCRUED INCOME

f. $2,800 of the Earned Rent account balance was still unearned by year-end f

DEFFERAL INCOME METHOD

g. Three months property taxes, totaling $450, have accrued. This g

additional amount of property taxes expense has not been recorded.

ACCRUALS ACCRUED EXPENSE

h. One month's interest on the note payable, $600, has accrued but is unrecorded. h

ACCRUALS ACCRUED EXPENSE

i. The one employee, a receptionist, works a five-day workweek at $50 i

per day. The employee was paid last week but has worked Tuesday

through Friday this week for which she has not been paid.

ACCRUALS ACCRUED EXPENSE

j. The company has not received a water and sewer services bill for j

December. Based on prior months’ bills, the bill is expected to be

prior months’ bills, the bill is expected to be $100

ACCRUALS ACCRUED EXPENSE

PARTICULARS PR DEBIT CREDIT

Insurance Expense 1040

Prepaid Insurance 1040

to adjust prepaid insurance

Supplies 210

Supplies Expense 210

to adjust supplies

Depreciation Expense 350

Accumulated Depreciation 350

to record depreciation expense- equipment

Depreciation Expense 2020

Accumulated Depreciation 2020

to record depreciation expense- building

Rent Receivable/Accounts Receivable 200

Rent Income/ Accrued Service Revenue 200

to record accrued revenue

Rent Income 2800

Unearned Rent Income 2800

to record earned rent income

Tax Expense 450

Accrued Tax Expense 450

to record tax expense

Interest Expense 600

Interest Payable 600

to record interest expense

Salaries Expense 200

Accrued Salaries Expense 200

to record salaries expense

Utilities Expense 100

Utilities Payable 100

to record utilities expense

You might also like

- Notre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong CityDocument15 pagesNotre Dame Educational Association: Purok San Jose, Brgy. New Isabela, Tacurong Cityirishjade100% (1)

- 07 Activity 1-EnTREPDocument2 pages07 Activity 1-EnTREPClar PachecoNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Practice Assessment 1 6Document22 pagesPractice Assessment 1 6kbassignmentNo ratings yet

- Beams Aa13e TB 15Document29 pagesBeams Aa13e TB 15Feby SinagaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CIR V SONY Case DigestDocument2 pagesCIR V SONY Case DigestAndrea TiuNo ratings yet

- Business Plan PDFDocument10 pagesBusiness Plan PDFMasiko JamesNo ratings yet

- Fs (Water Refilling) Jun 2Document17 pagesFs (Water Refilling) Jun 2Jun Ortizo81% (37)

- Accounting Compeleting The CycleDocument14 pagesAccounting Compeleting The CyclecamilleNo ratings yet

- 3B Adjusting EntriesDocument2 pages3B Adjusting EntriesRyoma EchizenNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesPhạm Hồng Trang Alice -No ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewUyenNo ratings yet

- M3A Expanded Accounting EquationDocument20 pagesM3A Expanded Accounting EquationCharles Eli AlejandroNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Exam Revision - 3 & 4 SolDocument6 pagesExam Revision - 3 & 4 SolNguyễn Minh ĐứcNo ratings yet

- Worksheet: Mohammed Moin Uddin Reza Nadim Bangladesh University of Professionals (BUP)Document13 pagesWorksheet: Mohammed Moin Uddin Reza Nadim Bangladesh University of Professionals (BUP)Mahmudul Hassan RohidNo ratings yet

- Abudla JournalDocument1 pageAbudla JournalMarvin MercadoNo ratings yet

- Adjusting The Accounts and Preparing Financial StatementsDocument20 pagesAdjusting The Accounts and Preparing Financial StatementsDrNaveed Ul Haq100% (1)

- Exam Revision - Chapter 3 4Document6 pagesExam Revision - Chapter 3 4Vũ Thị NgoanNo ratings yet

- Chapter 3 (My Slides)Document25 pagesChapter 3 (My Slides)clara2300181No ratings yet

- Midterm - Le Nhat Linh - 11202143Document3 pagesMidterm - Le Nhat Linh - 11202143moon loverNo ratings yet

- BX2011 Topic06 Workshop Solutions 2022Document10 pagesBX2011 Topic06 Workshop Solutions 2022yanboliu96No ratings yet

- ACCT1101 Week 5 Practical SolutionsDocument8 pagesACCT1101 Week 5 Practical SolutionskyleNo ratings yet

- 1 - Deferred Expense 2 - Deferred Revenue 3 - Deferred Expense 4 - Deferred Expense 5 - Accrued Revenue 6 - Accrued ExpenseDocument6 pages1 - Deferred Expense 2 - Deferred Revenue 3 - Deferred Expense 4 - Deferred Expense 5 - Accrued Revenue 6 - Accrued ExpenseSINEM GULERNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- I) Increase in Utilities Expense J) Decrease in LandDocument3 pagesI) Increase in Utilities Expense J) Decrease in LandRosendo Bisnar Jr.No ratings yet

- Answers - Adjusting Entries AssignmentDocument5 pagesAnswers - Adjusting Entries AssignmentJames Matthew LomongoNo ratings yet

- Date Description Debit $ Credit $Document7 pagesDate Description Debit $ Credit $Muntasir AhmmedNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- HW 3Document4 pagesHW 3Rakhimjon BakhromovNo ratings yet

- Accounting Principles and PracticesDocument10 pagesAccounting Principles and PracticesGaganpreet KaurNo ratings yet

- Q4. Module 1Document5 pagesQ4. Module 1Azadeh AkbariNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (Q4W1-2)Document3 pagesFundamentals of Accountancy, Business and Management 1 (Q4W1-2)tsukiNo ratings yet

- Adjusting Solution 1Document5 pagesAdjusting Solution 1Umer SiddiquiNo ratings yet

- Bacc210 Assig 1Document6 pagesBacc210 Assig 1TarusengaNo ratings yet

- GB255: Sage 50 Set Up Company With Skeleton Data - Chapter 4Document2 pagesGB255: Sage 50 Set Up Company With Skeleton Data - Chapter 4Num Num TastyNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Salapa P M I ChartDocument2 pagesSalapa P M I ChartGelo MoloNo ratings yet

- Chapter 3 ExercisesDocument8 pagesChapter 3 ExercisesNguyen Khanh Ly K17 HLNo ratings yet

- Topic 4 Class Discussion Question SolutionDocument3 pagesTopic 4 Class Discussion Question Solutionsyedimranmasood100No ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- Chapter 3Document3 pagesChapter 3Hussein BaidounNo ratings yet

- Completing The Accounting CycleDocument37 pagesCompleting The Accounting CycleTasim IshraqueNo ratings yet

- Silva Akun KuisDocument7 pagesSilva Akun Kuis2210103023.silvaNo ratings yet

- ABM 1-W6.M2.T1.L3.Student ActivityDocument2 pagesABM 1-W6.M2.T1.L3.Student ActivitymbiloloNo ratings yet

- ACC102 Final Examination ProblemDocument8 pagesACC102 Final Examination ProblemtygurNo ratings yet

- Test Sheet-Accounts v1Document6 pagesTest Sheet-Accounts v1Minaketan DasNo ratings yet

- Handout 3.studentDocument4 pagesHandout 3.studentVikrant KapoorNo ratings yet

- Chapter: Income Statement: - Adjusting EntriesDocument20 pagesChapter: Income Statement: - Adjusting Entriesaishwarya joshiNo ratings yet

- CH 04Document7 pagesCH 04Tien Thanh Dang50% (2)

- Lecture Week 7Document54 pagesLecture Week 7Muhammad HusseinNo ratings yet

- CH 04Document6 pagesCH 04Rabie Haroun0% (1)

- MGCR 211 Introduction To Financial Accounting Summer 2019 Assignment 2-Answer SheetDocument7 pagesMGCR 211 Introduction To Financial Accounting Summer 2019 Assignment 2-Answer SheetAnoosha SiddiquiNo ratings yet

- Completion of The Accounting Cycle: Weygandt - Kieso - KimmelDocument51 pagesCompletion of The Accounting Cycle: Weygandt - Kieso - KimmelAbdullah Al AminNo ratings yet

- F23 B01 Midterm Review QuestionsDocument9 pagesF23 B01 Midterm Review QuestionsDaniel OladejoNo ratings yet

- Lembar JasaDocument40 pagesLembar JasaSindi YulianiNo ratings yet

- PART B - SET A (Odd Groups - 1,3,5,7,9)Document4 pagesPART B - SET A (Odd Groups - 1,3,5,7,9)ngocanhhlee.11No ratings yet

- Accounting Worksheet: Business Name: Accounting PeriodDocument5 pagesAccounting Worksheet: Business Name: Accounting Periodhgiang2308No ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- Work Sheet On Financial AccountingDocument3 pagesWork Sheet On Financial AccountingFantayNo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- Kim Fuller: A Case Study in Managerial AccountingDocument12 pagesKim Fuller: A Case Study in Managerial AccountingSarju MaviNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessFrom EverandJ.K. Lasser's From Ebay to Mary Kay: Taxes Made Easy for Your Home BusinessNo ratings yet

- Hannah SchedDocument1 pageHannah Schedmicadeguzman.1313No ratings yet

- Edited MwahDocument1 pageEdited Mwahmicadeguzman.1313No ratings yet

- Pre - Assessment in MathDocument2 pagesPre - Assessment in Mathmicadeguzman.1313No ratings yet

- YesDocument1 pageYesmicadeguzman.1313No ratings yet

- Activity 1 Business LogicDocument1 pageActivity 1 Business Logicmicadeguzman.1313No ratings yet

- When Traveling AbroadDocument1 pageWhen Traveling Abroadmicadeguzman.1313No ratings yet

- APADocument2 pagesAPAmicadeguzman.1313No ratings yet

- Understanding of Compulsorily Convertible Debentures Vinod KothariDocument7 pagesUnderstanding of Compulsorily Convertible Debentures Vinod KothariNazir kondkariNo ratings yet

- Study Material For Advanced Financial Accounting II Year 2Document76 pagesStudy Material For Advanced Financial Accounting II Year 2Karthic Selvam KandavelNo ratings yet

- 06 Activity BADocument3 pages06 Activity BATyron Franz AnoricoNo ratings yet

- Advance Chaper 7 & 8Document27 pagesAdvance Chaper 7 & 8abel habtamuNo ratings yet

- Balance Sheet of Tata MotorsDocument6 pagesBalance Sheet of Tata Motorsnehanayaka25No ratings yet

- SAP IM Tutorial - SAP Investment Management Module Training TutorialsDocument3 pagesSAP IM Tutorial - SAP Investment Management Module Training TutorialsAnil KumarNo ratings yet

- Consolidated Financials Q4FY24Document10 pagesConsolidated Financials Q4FY24Akash KushwahaNo ratings yet

- Activity 2 - 4B UpdatesDocument3 pagesActivity 2 - 4B UpdatesAngelo HilomaNo ratings yet

- Cost Terms, Concepts and ClassificationsDocument22 pagesCost Terms, Concepts and Classificationssamuel debebeNo ratings yet

- Ayurvedic MedicineDocument29 pagesAyurvedic Medicineakki_6551No ratings yet

- ACC2001 Aug 2011 Practice Exam QuestionsDocument4 pagesACC2001 Aug 2011 Practice Exam QuestionsShin TanNo ratings yet

- Lotus Halal FIF - ProspectusDocument55 pagesLotus Halal FIF - ProspectusGbolahan OjuolapeNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 7 SpecialDocument30 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 7 Specialmahak guptaNo ratings yet

- PartnershipDocument41 pagesPartnershipBinex67% (3)

- Pivot The GreatDocument16 pagesPivot The GreatAngeline AcebucheNo ratings yet

- Nepal Tax Fact 2014/15Document33 pagesNepal Tax Fact 2014/15PANUMSNo ratings yet

- Acconuting ConceptsDocument35 pagesAcconuting ConceptsPiyush PatelNo ratings yet

- Question Number 1: Jeg Limited GroupDocument11 pagesQuestion Number 1: Jeg Limited GroupJalees Ul HassanNo ratings yet

- Valuation AssignmentDocument9 pagesValuation AssignmentNicole TaylorNo ratings yet

- Ch18 Answer KeyDocument20 pagesCh18 Answer KeyWed CornelNo ratings yet

- FormulaDocument10 pagesFormulaAngel Alejo Acoba100% (1)

- Xi Acts Ca (2022 23)Document197 pagesXi Acts Ca (2022 23)sara VermaNo ratings yet

- Analyze The Effects of The Transactions On The Accounting Equation.eDocument4 pagesAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanNo ratings yet