Professional Documents

Culture Documents

Zakat Calculator

Uploaded by

Erfan KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zakat Calculator

Uploaded by

Erfan KhanCopyright:

Available Formats

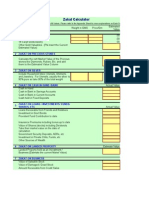

Zakat Calculation Spreadsheet Printed on 03/31/2024

Zakat Calculator Year -2024

(Use Only YELLOW cells to fill Values. Please read the Summary for details, before filling this)

Weight in

Price/Gm Estimated Value Zakat Payable

Grams

1 ZAKAT ON GOLD (2.5%) Currency

1a 24 Carat Gold/Jewelry - -

1b 22 Carat Gold/Jewelery - -

1c 18 Carat Gold/Jewelry - -

1d Other Gold Valuables. -

2 ZAKAT ON PRECIOUS STONES (2.5%) (Cont. subject. Refer Notes. Don’t Calculate if you disagree or uncomfortable.)

Net Market Value of the Precious stones -

Include Household Silver Utensils, Artefacts, and Jewelery.

3 Utensils,

For ZAKATusually

ON SILVER (2.5%)

the silver is 90% pure so take 90% of the

total weight - -

4 ZAKAT ON CASH IN HAND /BANK (2.5%) Actual Value

4a Cash in Hand -

4b Cash in Bank in Savings Accounts -

4c Cash in Bank in Current Accounts - -

4d Cash held in Fixed Deposits -

ZAKAT ON LOANS / INVESTMENTS/ FUNDS/

5

SHARES, ETC (2.5%) Actual Value

5a Loans Receivable from Friends and Relatives - -

5b Investment in Govt Bonds -

5c Provident Fund Contribution to date. -

Salary Receivable to date. -

5d Insurance Premiums including bonus up to date Date of start 3/1/2014 -

5e Value of Shares (stocks) including Dividends. Take

their market value on the date of calculation -

5f Government Security Deposits, ADRs, etc -

5g Investment in Private Chits, Funds, etc -

5f Other Sources of Wealth -

6 ZAKAT ON LANDED PROPERTY (2.5%) Estimate Value

6a Landed Property held as an Investment / Business (Estimate the current

Maket Value) -

6b Zakat on Rentals Coming from Property (After Deducting for all

expenses) -

7 ZAKAT ON BUSINESS (2.5%) ---------- (STOCK-IN-TRADE)

7a Value of Saleable Stock

7b Value of Damaged / Dead Stock

7c Amount Receivable from Credit Sales

7d LESS: Amount Payable to Suppliers (Credit taken from

suppliers for stocking goods)

7e LESS: Bad Debts -

TOTAL VALUE OF STOCK ( 7a+7b+7C-7d-7e) -

8 ZAKAT ON SHARE IN PARTNERSHIP FIRMS (2.5%)

8a Capital Balance as per Last balance Sheet

8b Loans Advanced by you to the Firm as of Date

8c LESS: Withdrawals made by you during the current Year.

ajameel@gmail.com Page 1 of 5 zakat.110mb.com

Zakat Calculation Spreadsheet Printed on 03/31/2024

Weight in

Price/Gm Estimated Value Zakat Payable

Grams

Accumulated Profit from the date of Balance Sheet to this Date

8d (Estimate the Profit Value as it is difficult to get exact figures in the

middle of Accounting Year) -

NETT TOTAL WORTH CALCULATED -

Value of Produce

ZAKAT ON AGRICULTURAL PRODUCE (10%, 7.5%,

9

5%)

9a Produce Dependent on Rain Water - @ 10% of product (crop) in Value

or Kind -

9b Produce totally dependent on Artificial Irrigation like Canal, Tank,

Borewell, etc. @ 5% of Produce (crop) in Value or in Kind -

9c Produce dependent Partially on Rain Water and Partially on Artificial

Irrigation @ 7.5% of the produce Value or in Kind -

Total Value

10 ZAKAT ON ANIMALS & POULTRY & FISH FARMING

Animals/ Birds more than 6 months Old - @ 1 Animal

or Bird PER 40 either in Kind or Value thereof. -

11 GENERAL LIABILITIES - You need to deduct your direct Payables or Liabilities which

have not been deducted earlier - Usage of the loan should have been on Zakatable

Wealth only. HOME & CAR Loans are not to be deducted -

11a Personal Loans/ Debts which are to be paid back -

Income Tax / Wealth Tax Payable (which is due and

11c

already counted towards your wealth) -

TOTAL LIABILITIES -

TOTAL ZAKAT PAYABLE -

IMPORTANT: PLEASE READ BELOW SUMMARY FOR INSTRUCTIONS & NOTES:

ajameel@gmail.com Page 2 of 5 zakat.110mb.com

Zakat Calculation Spreadsheet Printed on 03/31/2024

Weight in

Price/Gm Estimated Value Zakat Payable

Grams

Dear Brothers & Sisters,

Alhamdulillah, the month of Ramadhan has been

bestowed upon us by Allah. ZAKAT is one of the five

fundamental pillars of Islam, mandatory on all muslims

who are of eligible wealth. Zakat is due from and

It is difficult to calculate the completion of one year on

each item of wealth, because purchase dates may vary.

To overcome this difficulty, a practical method is to fix

a date (e.g. 1st of Ramadhan), compute your total

The attached spreadsheet is a humble attempt at

making the calculation process simple and

consolidated, for all brothers and sisters who are

fortunate to be worthy of paying Zakat. If there are any

errors, its purely due to my incomprehension and may

be

A lotbrought to myhave

of brothers notice immdtly

asked by email

me what at do I

Madhab

belong and whether this covers Shias, Barelvis, Jaffris,

Bohras and other sects. All I can say here is that let us

rise above all these covert little shells we have built

around us. We are Muslims first and the sincere one

will rise above all this secterianism, read the Quran

himself and get the facts firsthand, whenever in doubt.

Yours Brother in Islam, Arif Jameel.

Details of Each Section to be used in conjunction

with the Calculation Spreadsheet.

Zakat on Pure Gold and Gold Jewellery

Zakat should be calculated at 2.5% of the market value

as on the date of valuation (In our case we consider 1st

of Ramadhan). Most Ulema favour the Market Value

prevailing as on the date of Calculation and not the

Zakat on Precious and Semi-Precious

Stones

There is considerable contention on whether these are

to be considered for valuation. In my humble opinion if

they have a value, then they calculate towards your

wealth, and it is on the wealth that Zakat is mandatory.

However please consult with Ulema, before acting on

this section. Most Ulema contend that a diamond is a

One may calculate the Saleable Value of Items-at-hand

on the date of Zakat Calculation.

Zakat

Zakat ison Silver.

to be paid on Silver in Pure form or Jewellery,

Utensils, Decorative items and all household items

including crockery, cutlery made of silver at 2.5% of the

prevailing market rates.

Zakat on Cash and Bank Balances

Zakat should be paid at 2.5% on all cash balance and

bank balances in your savings, current or FD accounts.

The amount technically should be in the bank for one

year. Usually it happens that the balance keeps on

ajameel@gmail.com Page 3 of 5 zakat.110mb.com

Zakat Calculation Spreadsheet Printed on 03/31/2024

Weight in

Price/Gm Estimated Value Zakat Payable

Grams

You may make your best judgement and the best way

is to pay on remaining amount on the day of calculation

Zakat on Loans Given, Funds, etc

Zakat is payable by you on loans you have given to

your friends and relatives. It should be treated as Cash

in Hand. You may deduct Loans Payable by you to

arrive at the nett present value of your wealth.

However, if you are in doubt, on the return of your

Zakat is payable on all Govt Bonds, Public Sector

Bond, paid-up Insurance premiums, your paid-up

portion of Provident Funds, Govt Bills receivables, etc.

Pls remember you need to be aware of what the sharia

says about Insurance and other types of investments.

Zakat on Landed Property

Zakat is not payable on personal residential House

even if you have more than one and meant for

residential purpose only. Also Zakat is not applicable

on the value of Property given on rent irrespective of

how many. However Zakat is payable on the rental

However if your intention of holding properties is to sell

at a future date for a profit or as an investment, then

Zakat is payable on the Market Value of the property.

Also, if your intention of holding properties changes in

the current year, i.e. from self use to business then you

Zakat on Business:

This is for Business Persons only. No matter what

business you are into, you've got to pay Zakat on all

STOCK-IN-TRADE. The stock must be valued at its

Landed Cost Price. If you have any bills receivable

Deduct the Amounts due to your suppliers and deduct

the loans on stock on the date of calculation. Dead

Stock should be calculated on scrap value or its

saleable

Be honest value.

in theDamaged stock

calculations, as should

ZAKATalso

is anbe valued

INSURANCE on your STOCK directly from ALLAH and

who better an insurer than Him.

There is no Zakat on Factory Buildings or any kind of

machinery, but there is zakat on products produced in

the factory (i.e. finished goods value). Please refer to

competent Ulema or a scholar who can shed more light

Zakat on Partnership Firms.

Zakat can be paid EITHER by the firm OR separately

by the owners. If the firm is not paying, and the partner

wants to calculate his share, he should take the amount

standing to his capital and loan account as per the last

This can only be estimated as it is difficult to calculate

the exact profit or loss between an accounting year.

ajameel@gmail.com Page 4 of 5 zakat.110mb.com

Zakat Calculation Spreadsheet Printed on 03/31/2024

Weight in

Price/Gm Estimated Value Zakat Payable

Grams

Zakat on Agricultural Product

Zakat is payable on all Agricultural produce including

fruits, commercially grown flowers, vegetables and all

types of grains at the harvest time itself. The passing

of One year does not apply for agrultural produce. If

there are two or more crops on the same land per year,

The Consensus formula for Zakat calculation on

Agriculture is as follows:

On crops dependent purely on rain water it will be 10%

of produce, On crops not irrigated through rain water

but use Canal Water, Tank Water, Borewell and Open

wells, the Zakat is 5% of the produce. For Crops

Zakat on Animals

On all grazing animals like goats, sheep, camel, cows,

broiler chickens, the consensus Zakat payable is one

animal/bird for every 40 animals owned. However you

Please

may wish consult your

to give local

cash Scholar

in lieu of theoranimal/bird

Maulvi or Imaam

itself.

who can guide you to the right direction, or refer to

books of Fiqh if you would like to have first hand

confirmation of the situation.

Liabilities Deductions

If you have any pending tax payable to the govt, as of

the date of Zakat Calculation, then the same may be

deducted before arriving at the net worth. If you have

taken any loans from any person or institution, and if

you have not already deducted the same from any of

theLOANS taken onlythen

above sections, for Zakatable-Wealth

you can deduct yourshould be

Payables

deducted. Cars, Houses, etc are not Zakatable wealth.

So any loan/mortgate taken for these purposes are not

FOOTNOTE:toPleasebe made part

note of RIBA

that deductions.

in any form is

Haram and strictly prohibited. So please stay away

from taking Loans on Interests AND Collection of

Interests from any body or institution or other forms of

For those who would like more details please download

the free ebooklet www.zakatonomics.com

COPYRIGHT NOTICE: You are free to distribute this

Calculator, by email, by print or by posts over the

Internet. My intention in creating this was to make the

task of Zakat as simple and easy as the act of Zakat

itself. However if you are making any modifications or

ajameel@gmail.com Page 5 of 5 zakat.110mb.com

You might also like

- Zakat Calculation SpreadsheetDocument6 pagesZakat Calculation SpreadsheetelmechanaNo ratings yet

- Zakat Calculator For MuslimDocument10 pagesZakat Calculator For MuslimKhayaal100% (3)

- Zakat CalculatorDocument10 pagesZakat CalculatorAmliyatNo ratings yet

- Zakat CalculationDocument4 pagesZakat Calculationapi-19755136No ratings yet

- Zakat Calculator Ver 2005Document5 pagesZakat Calculator Ver 2005u1umarNo ratings yet

- Zakat CalculatorDocument3 pagesZakat Calculatorapi-3759337No ratings yet

- Zakat Calculator: 1a 1b 1c 1dDocument5 pagesZakat Calculator: 1a 1b 1c 1dsayeedkhanNo ratings yet

- Zakat Assessment FormDocument4 pagesZakat Assessment Formabdul ghafoorNo ratings yet

- Zakat Self-Assessment: Section 1 - Do You Have To Pay Zakat This Year ?Document3 pagesZakat Self-Assessment: Section 1 - Do You Have To Pay Zakat This Year ?Hasan Irfan SiddiquiNo ratings yet

- Zakat Calculator: Enter Your NameDocument12 pagesZakat Calculator: Enter Your Namehaja21No ratings yet

- ZakatDocument4 pagesZakattahirnqsh4596No ratings yet

- Capital Adequacy Regulations 2017 ENG PDFDocument5 pagesCapital Adequacy Regulations 2017 ENG PDFNelsonNo ratings yet

- Financial Position of Catbalogan City General FundDocument107 pagesFinancial Position of Catbalogan City General FundRoldz LariosNo ratings yet

- Acc2682 Chapter 6 ZakatDocument6 pagesAcc2682 Chapter 6 ZakatainonlelaNo ratings yet

- FAA Session 3 Live Session Notes ByKxomdWh9Document8 pagesFAA Session 3 Live Session Notes ByKxomdWh9karunakar vNo ratings yet

- Basics of Personal FinanceDocument10 pagesBasics of Personal FinanceAllur Sai Vijay KumarNo ratings yet

- Balance Sheet: Direct Appeal LLCDocument2 pagesBalance Sheet: Direct Appeal LLCJames VargaNo ratings yet

- PAS 1 Presentation on Financial StatementsDocument2 pagesPAS 1 Presentation on Financial StatementsVictor Vj NatividadNo ratings yet

- Investor Information: Published May 1, 2019Document40 pagesInvestor Information: Published May 1, 2019Sohini ChatterjeeNo ratings yet

- Delta4 122006Document8 pagesDelta4 122006mariaplacerda.fradeNo ratings yet

- MBA student research on Gujarat investment preferencesDocument8 pagesMBA student research on Gujarat investment preferencesharsh_rajwaniNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

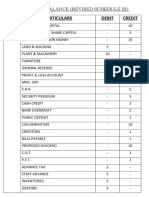

- Particulars Debit Credit: Trial Balance (Revised Schedule Iii)Document3 pagesParticulars Debit Credit: Trial Balance (Revised Schedule Iii)Rounak BasuNo ratings yet

- Project ReportDocument26 pagesProject ReportSHRUTI AGRAWALNo ratings yet

- Investor Information: Published July 24, 2019Document40 pagesInvestor Information: Published July 24, 2019Sohini ChatterjeeNo ratings yet

- PT Bank Muamalat Indonesia Neraca (Balance Sheets) Per Desember 2012 Dan 2011 (As at December, 2012 and 2011)Document40 pagesPT Bank Muamalat Indonesia Neraca (Balance Sheets) Per Desember 2012 Dan 2011 (As at December, 2012 and 2011)doel bassNo ratings yet

- Elements: Capital Adequecy Operating Performance Ratio (OPR)Document3 pagesElements: Capital Adequecy Operating Performance Ratio (OPR)HMS DeedNo ratings yet

- Zakat Calculation Form: (Copies of This Form May Be Made For Distribution)Document4 pagesZakat Calculation Form: (Copies of This Form May Be Made For Distribution)Hasan Irfan SiddiquiNo ratings yet

- Zakat Form PDFDocument6 pagesZakat Form PDFDan MichiNo ratings yet

- Goldman Sachs - Template - 2017Document17 pagesGoldman Sachs - Template - 2017Akshay PilaniNo ratings yet

- Profit and Loss statement, and Balance Sheet analyzedDocument3 pagesProfit and Loss statement, and Balance Sheet analyzedPRIYA SINGHNo ratings yet

- CAMELS RatingsDocument1 pageCAMELS RatingsAyush53No ratings yet

- Cash flow statement templateDocument5 pagesCash flow statement templateCarloNo ratings yet

- Cash Flow Statement Template: User To Complete Non-Shaded Fields, OnlyDocument4 pagesCash Flow Statement Template: User To Complete Non-Shaded Fields, OnlyGomv ConsNo ratings yet

- Mirae Asset Tax Saver Fund (G) - Direct PlanDocument21 pagesMirae Asset Tax Saver Fund (G) - Direct PlanParag ChaudhariNo ratings yet

- Cash Flow Template AS - 3Document142 pagesCash Flow Template AS - 3Dina100% (1)

- Axis Gold Fund - (Feb 2024) DPDocument2 pagesAxis Gold Fund - (Feb 2024) DPPraveen Kumar AnbuNo ratings yet

- Axis Bluechip Fund (G) - Direct PlanDocument22 pagesAxis Bluechip Fund (G) - Direct PlanParag ChaudhariNo ratings yet

- IC Balance Sheet Template 8897Document2 pagesIC Balance Sheet Template 8897bagirNo ratings yet

- Exhibit 1: Parent Company COC (2007, 2022)Document2 pagesExhibit 1: Parent Company COC (2007, 2022)Fath DiwirjaNo ratings yet

- BOP Category Guide PDFDocument29 pagesBOP Category Guide PDFsimbamikeNo ratings yet

- Microfinance Bank Limited: Capital Adequacy Ratio (As of - )Document6 pagesMicrofinance Bank Limited: Capital Adequacy Ratio (As of - )Muhammad AhmedNo ratings yet

- 3-Year Cash Flow Statement: User To Complete Non-Shaded Fields, OnlyDocument5 pages3-Year Cash Flow Statement: User To Complete Non-Shaded Fields, OnlySabeoNo ratings yet

- RECEIVABLESDocument7 pagesRECEIVABLESbona jirahNo ratings yet

- Contract Act, 1872: Case-1Document10 pagesContract Act, 1872: Case-1SuptoNo ratings yet

- Beheshti JewarDocument928 pagesBeheshti JewarErfan KhanNo ratings yet

- Pharmaceuticals Industry ReportDocument6 pagesPharmaceuticals Industry ReportErfan KhanNo ratings yet

- BRPD-14 PresentationDocument41 pagesBRPD-14 PresentationErfan KhanNo ratings yet

- Partnership Act 1932-Questions & Answers (BL)Document13 pagesPartnership Act 1932-Questions & Answers (BL)Erfan KhanNo ratings yet

- Chapter 8 Enterprise Business SystemsDocument6 pagesChapter 8 Enterprise Business SystemsErfan KhanNo ratings yet

- Partnership-Chapter 3Document5 pagesPartnership-Chapter 3Erfan KhanNo ratings yet

- Partnership Act 1932Document5 pagesPartnership Act 1932Erfan KhanNo ratings yet

- Behavioral FinanceDocument7 pagesBehavioral FinanceErfan KhanNo ratings yet

- CL It MCQDocument51 pagesCL It MCQErfan KhanNo ratings yet

- Bangladesh IFRS Profile PDFDocument5 pagesBangladesh IFRS Profile PDFErfan KhanNo ratings yet

- Ethical Principles, Quick Tests, and Decision-Making GuidelinesDocument18 pagesEthical Principles, Quick Tests, and Decision-Making GuidelinesErfan KhanNo ratings yet

- Bangladesh Finance Act 2018-19Document64 pagesBangladesh Finance Act 2018-19Erfan KhanNo ratings yet

- Foundations of Information Systems in BusinessDocument23 pagesFoundations of Information Systems in BusinessEsubalew GinbarNo ratings yet

- MJ16 Hybrid F8 QP Clean ProofDocument5 pagesMJ16 Hybrid F8 QP Clean ProofjoelvalentinorNo ratings yet

- The Global Financial Crisis of 2008Document14 pagesThe Global Financial Crisis of 2008Erfan KhanNo ratings yet

- MJ16 Hybrid F8 QP Clean ProofDocument5 pagesMJ16 Hybrid F8 QP Clean ProofjoelvalentinorNo ratings yet

- Modern Portfolio Theory and Investment Analysis by Elton Gruber Brown GoetzmanDocument19 pagesModern Portfolio Theory and Investment Analysis by Elton Gruber Brown GoetzmanErfan Khan100% (1)

- Category of Loans Recovery Target Amount RecoveredDocument1 pageCategory of Loans Recovery Target Amount RecoveredErfan KhanNo ratings yet

- EcoDev CH1TodaroDocument23 pagesEcoDev CH1TodaroErfan KhanNo ratings yet

- CA Assurance ManualDocument350 pagesCA Assurance ManualErfan Khan100% (1)

- Modern Portfolio Theory and Investment Analysis by Elton Gruber Brown GoetzmanDocument19 pagesModern Portfolio Theory and Investment Analysis by Elton Gruber Brown GoetzmanErfan Khan100% (1)

- Financial Management Assignment on HCL TechnologiesDocument21 pagesFinancial Management Assignment on HCL TechnologiesSudeepNo ratings yet

- Tracking of Implemented Strategy PlumbDocument8 pagesTracking of Implemented Strategy PlumbFITRA AGUNGNo ratings yet

- The Challenging Role of The Corporate TreasurerDocument4 pagesThe Challenging Role of The Corporate TreasurerYAKUBU ISSAHAKU SAIDNo ratings yet

- Caselet Master TV India Answers 2020Document2 pagesCaselet Master TV India Answers 2020shirley zhangNo ratings yet

- Need of FDI For IndiaDocument11 pagesNeed of FDI For IndiaNirjana Nayak80% (5)

- Chapter 8 (1) AnswDocument45 pagesChapter 8 (1) Answdung03062005.9a1No ratings yet

- CipherDocument2 pagesCipherAnonymous RXEhFb100% (1)

- CD Guide: Benefits, Rates, Usage & ProblemsDocument7 pagesCD Guide: Benefits, Rates, Usage & Problemsbhimber007No ratings yet

- SGVFS035342 : Universal Robina Corporation and Subsidiaries Consolidated Statements of Financial PositionDocument7 pagesSGVFS035342 : Universal Robina Corporation and Subsidiaries Consolidated Statements of Financial PositionHeidi OpadaNo ratings yet

- PERLINDUNGAN HUKUM TERHADAP PEMILIK SAHAM PERUSAHAAN YANG PAILIT-Abraham Gilbert SimatupangDocument15 pagesPERLINDUNGAN HUKUM TERHADAP PEMILIK SAHAM PERUSAHAAN YANG PAILIT-Abraham Gilbert SimatupangIMBHB UHNNo ratings yet

- Muthoot Finance as India's Largest Gold Loan NBFCDocument22 pagesMuthoot Finance as India's Largest Gold Loan NBFCLove IcanBeur'heroNo ratings yet

- Investment Pattern: A Psychographic Study of Investors' of Garhwal Region of UttrakhandDocument16 pagesInvestment Pattern: A Psychographic Study of Investors' of Garhwal Region of UttrakhandVandita KhudiaNo ratings yet

- Drillers and Dealers May 2011Document34 pagesDrillers and Dealers May 2011rossstewartcampbellNo ratings yet

- Web - Marty J. Schmidt - Whats - A - Business - CaseDocument15 pagesWeb - Marty J. Schmidt - Whats - A - Business - CaseSan HeNo ratings yet

- Ibbotson Classic Yearbook. Numerous Examples Are PresentedDocument15 pagesIbbotson Classic Yearbook. Numerous Examples Are PresentedWahyuniiNo ratings yet

- Amfi Fully Solved 500 QuestionsDocument81 pagesAmfi Fully Solved 500 Questionspratiush0785% (105)

- ABM Investama TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesABM Investama TBK.: Company Report: January 2019 As of 31 January 2019dhiladaikawaNo ratings yet

- Accountancy Set 3 Ms - DocxDocument7 pagesAccountancy Set 3 Ms - DocxKunal GauravNo ratings yet

- OTCEIDocument8 pagesOTCEIbhavna_v21100% (1)

- Galion Term Sheet Serie ADocument8 pagesGalion Term Sheet Serie AogrjkvdjNo ratings yet

- Afya 2021Document80 pagesAfya 2021Ayushika SinghNo ratings yet

- Financial ManagementDocument15 pagesFinancial Managementsoumyaviyer@gmail.comNo ratings yet

- Murray Scott 050111 ResumeDocument2 pagesMurray Scott 050111 Resumescottm8571No ratings yet

- Cricket BallDocument37 pagesCricket BallSanjaylalkiyaNo ratings yet

- ch10 Kopie PDFDocument19 pagesch10 Kopie PDFaadt91No ratings yet

- Lesson 2 The EMA BounceDocument32 pagesLesson 2 The EMA BounceVagueNo ratings yet

- Ass 1 Principle of FinanceDocument6 pagesAss 1 Principle of FinanceNurul hidayahNo ratings yet

- IM Academy WelcomeDocument1 pageIM Academy Welcomepaola perezNo ratings yet

- Status of The Railcar Leasing Marketplace David G. Nahass - Senior Vice PresidentDocument13 pagesStatus of The Railcar Leasing Marketplace David G. Nahass - Senior Vice PresidentazharamaNo ratings yet

- Group Statements of Cashflows PDFDocument19 pagesGroup Statements of Cashflows PDFObey SitholeNo ratings yet