Professional Documents

Culture Documents

Accounting Simplified 2

Accounting Simplified 2

Uploaded by

kala19750 ratings0% found this document useful (0 votes)

3 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageAccounting Simplified 2

Accounting Simplified 2

Uploaded by

kala1975Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

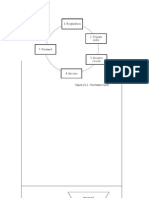

Supplier can issue Debit Note

to Customer if earlier invoice

Encourage had error or omission

BUSINESS DOCUMENTS bulk purchase

Documents Customer Supplier

i. Invoice sent by supplier Debit Customer (Trade

(Net off trade discount Receivables - TR)

and carriage) Credit Sales

ii. Invoice received by Debit Purchases

customer (Net off trade Credit Supplier (Trade

discount and carriage) Payables - TP)

iii. Debit Note by customer Debit Supplier (TP)

(when returning goods) Credit Purchase Returns

iv. Credit Note by supplier Debit Sales Returns

(upon receiving the Credit Customer (TR)

returned goods)

v. Cash discount received Debit Supplier (TP)

for early settlement from Credit Cash Discount

supplier Received

vi. Cash discount given Debit Cash Discount Given

when customers make Credit Customer (TR)

early settlement

vii. Payment made customer Debit Supplier (TP) [Purchases

less Purchases Returns & Cash

Discount Received]

Credit Bank

viii. Payment received by Debit Bank

supplier Credit Customer (TR)

[Sales less Sales

Returns & Cash

Discount Given]

You might also like

- Loans and Receivables - PresentationDocument71 pagesLoans and Receivables - PresentationIvy RosalesNo ratings yet

- English - DD - FT FormDocument1 pageEnglish - DD - FT Formcommercial azazoNo ratings yet

- Domestic Factoring GuidelinesDocument32 pagesDomestic Factoring GuidelinesAnkitmehra8No ratings yet

- FA 1 Chapter 1 Business Transactions and DocumentationDocument22 pagesFA 1 Chapter 1 Business Transactions and DocumentationS RaihanNo ratings yet

- Revision of Double Entry SystemDocument2 pagesRevision of Double Entry SystemHasan ShoaibNo ratings yet

- Columban College, Inc: The Following Are The Account Titles and Their Normal BalancesDocument3 pagesColumban College, Inc: The Following Are The Account Titles and Their Normal BalancesAriaiza SanpiaNo ratings yet

- Trade and Other ReceivablesDocument2 pagesTrade and Other Receivablesmastery90210No ratings yet

- AT 06-06 Transaction Cycles Part 1Document9 pagesAT 06-06 Transaction Cycles Part 1Eeuh100% (1)

- Receivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableDocument2 pagesReceivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableJonathan NavalloNo ratings yet

- Discounting & Factoring: (A Presentation of Banking & Financial Markets)Document28 pagesDiscounting & Factoring: (A Presentation of Banking & Financial Markets)syedasiftanveerNo ratings yet

- Control AccountDocument10 pagesControl AccountTeo Yu XuanNo ratings yet

- Accounting ConceptsDocument10 pagesAccounting ConceptsOmer AliNo ratings yet

- Unit 11Document14 pagesUnit 11deekshavkashyapNo ratings yet

- ReceivablesDocument2 pagesReceivablesSecond YearNo ratings yet

- Form4 App Closure AccountDocument1 pageForm4 App Closure Accountjeff mirandaNo ratings yet

- Loan and ReceivableDocument71 pagesLoan and ReceivableJhanelle Marquez0% (2)

- CH 3 - Accounting CycleDocument55 pagesCH 3 - Accounting Cyclemuhamad elmiNo ratings yet

- Accounting 101: Merchandising OperationsDocument14 pagesAccounting 101: Merchandising OperationsLove AmorNo ratings yet

- AE111 Unit 3 V2021-08-21Document28 pagesAE111 Unit 3 V2021-08-21DJAN IHIAZEL DELA CUADRANo ratings yet

- Non Financial Liabilities Provision and Contingencies.v2Document44 pagesNon Financial Liabilities Provision and Contingencies.v2Angelica Mingaracal RosarioNo ratings yet

- 3-1 AE111 NOTES Unit-3Document52 pages3-1 AE111 NOTES Unit-3Gab IgnacioNo ratings yet

- Ita - Chapter 2Document11 pagesIta - Chapter 2Ali aliNo ratings yet

- Accounting Analyzing Business Transaction ReviewerDocument7 pagesAccounting Analyzing Business Transaction Reviewerandreajade.cawaya10No ratings yet

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- Chart of Account TallyDocument4 pagesChart of Account TallyTesfa HunderaNo ratings yet

- Basic Documentation and Books of Account: Topic 3Document32 pagesBasic Documentation and Books of Account: Topic 3vickramravi16No ratings yet

- Factoring 1Document24 pagesFactoring 1ParthNo ratings yet

- Figure 21.1: Purchases CycleDocument12 pagesFigure 21.1: Purchases CyclesueernNo ratings yet

- ACCOUNT NotesDocument13 pagesACCOUNT Notesnabihah zaidiNo ratings yet

- CBM Final Project - Group 6BDocument18 pagesCBM Final Project - Group 6BANEESH KHANNANo ratings yet

- Revenue Recognition (IAS 18) : Cash Sale Credit SaleDocument28 pagesRevenue Recognition (IAS 18) : Cash Sale Credit Salecheapo printsNo ratings yet

- FS Unit 1 Module 2Document26 pagesFS Unit 1 Module 2Wahid SafiNo ratings yet

- Working Capital Management: Details in Fixed Income)Document1 pageWorking Capital Management: Details in Fixed Income)Ngân HàNo ratings yet

- Unit 3: Consignment: Learning OutcomesDocument35 pagesUnit 3: Consignment: Learning OutcomesDurga Prasad HNo ratings yet

- Professional Accounting PackageDocument72 pagesProfessional Accounting PackageAnmol poudelNo ratings yet

- Reserve Bank of India: Trade Receivable E-Discounting System (Treds)Document18 pagesReserve Bank of India: Trade Receivable E-Discounting System (Treds)omprakash padhi100% (1)

- Lending - A Core Banking Function: 1 BankDocument20 pagesLending - A Core Banking Function: 1 BankArslan Saeed100% (1)

- CH 06 Unit 03Document31 pagesCH 06 Unit 03ASIFNo ratings yet

- Particulars Amount: (A) Total Value of Clients Funds and Securities AvailableDocument1 pageParticulars Amount: (A) Total Value of Clients Funds and Securities AvailableAtul DeshmukhNo ratings yet

- Chapter 7 Cash: Learning ObjectivesDocument29 pagesChapter 7 Cash: Learning ObjectivesErana TerefaNo ratings yet

- Introduction To LiabilitiesDocument4 pagesIntroduction To LiabilitiesversNo ratings yet

- L2 - ABFA1173 POA (Lecturer)Document21 pagesL2 - ABFA1173 POA (Lecturer)Tan SiewsiewNo ratings yet

- Far 002LN PDFDocument10 pagesFar 002LN PDFwingsenigma 00No ratings yet

- Consignment PDFDocument31 pagesConsignment PDFBijay Aryan DhakalNo ratings yet

- Chapter 6-8 - Notes, Loans, and Receivable FinanceDocument7 pagesChapter 6-8 - Notes, Loans, and Receivable FinanceAvia Chelsy DeangNo ratings yet

- 2018-1383 Samsona, Melanie S.Document8 pages2018-1383 Samsona, Melanie S.Melanie SamsonaNo ratings yet

- 1 Updates LoanDocument7 pages1 Updates LoanFor PurposeNo ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- Revenue PrintingDocument19 pagesRevenue Printingayushmaharaj68No ratings yet

- Business Transactions and The Related Accounting Values or ElementsDocument6 pagesBusiness Transactions and The Related Accounting Values or ElementsAxel CabornayNo ratings yet

- Revenue CycleDocument7 pagesRevenue CycleArly Kurt TorresNo ratings yet

- Accounting For RECEIVABLES PDFDocument3 pagesAccounting For RECEIVABLES PDFZeus GamoNo ratings yet

- Current Liabilities - Revised (Warranties)Document14 pagesCurrent Liabilities - Revised (Warranties)Jerome_JadeNo ratings yet

- Cash Flow TemplateDocument19 pagesCash Flow TemplateRyou ShinodaNo ratings yet

- Ch04-Short-term DebtDocument22 pagesCh04-Short-term DebtHồ ThảoNo ratings yet

- Short Notes Financial AccountigDocument9 pagesShort Notes Financial AccountigNajihah AbNo ratings yet

- Factoring AND Forfaitin GDocument35 pagesFactoring AND Forfaitin GChinmayee ChoudhuryNo ratings yet

- BHT1333 Chapter 5Document14 pagesBHT1333 Chapter 5Weiqin ChanNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Unit 1 CHP 3Document3 pagesUnit 1 CHP 3kala1975No ratings yet

- Macroeconomics ObjectivesDocument1 pageMacroeconomics Objectiveskala1975No ratings yet

- Market Failure Model AnswerDocument7 pagesMarket Failure Model Answerkala1975No ratings yet

- PYQ FlashcardsDocument48 pagesPYQ Flashcardskala1975No ratings yet

- Marketing Does More Harm To Society Than GoodDocument15 pagesMarketing Does More Harm To Society Than Goodkala1975No ratings yet

- N14M79 Business EconomicsDocument18 pagesN14M79 Business Economicskala1975No ratings yet