Professional Documents

Culture Documents

Generic Form Preview Document

Uploaded by

elena.69.mxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Generic Form Preview Document

Uploaded by

elena.69.mxCopyright:

Available Formats

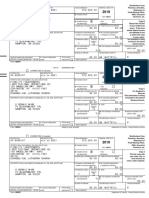

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Complete this form so that your employer can withhold the correct California state income tax from your paycheck.

Enter Personal Information

First, Middle, Last Name Social Security Number

Maria Elena Mariscal Rocha 633124536

Address Filing Status

Grove Street 1815 ✔ SINGLE or MARRIED (with two or more incomes)

City, State, and ZIP Code MARRIED (one income)

National City, CA, 91950 HEAD OF HOUSEHOLD

1. Total Number of Allowances you’re claiming (Use Worksheet A for regular withholding

allowances. Use other worksheets on the following pages as applicable, Worksheet A+B).

2. Additional amount, if any, you want withheld each pay period (if employer agrees), (Worksheet B and C)

OR

Exemption from Withholding

3. I claim exemption from withholding for 2020, and I certify I meet both of the conditions for exemption. Exempt

OR Write “Exempt” here

4. I certify under penalty of perjury that I am not subject to California withholding. I meet the conditions set

forth under the Service Member Civil Relief Act, as amended by the Military Spouses Residency Relief Act

and the Veterans Benefits and Transition Act of 2018. (Check box here)

Under the penalties of perjury, I certify that the number of withholding allowances claimed on this certificate does not exceed the number

to which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status.

Maria Elena Mariscal Rocha

Employee’s Signature ____________________________________________________________ Date 4/12/2021

Employer’s Section: Employer’s Name and Address California Employer Payroll Tax Account Number

Express Services Inc., 9701 Boardwalk Blvd, Oklahoma

City, Oklahoma 73162 324-4950-6

PURPOSE: This certificate, DE 4, is for California Personal 1. You did not owe any federal/state income tax last year, and

Income Tax (PIT) withholding purposes only. The DE 4 is used to 2. You do not expect to owe any federal/state income tax this

compute the amount of taxes to be withheld from your wages, year. The exemption is good for one year.

by your employer, to accurately reflect your state tax withholding

obligation. If you continue to qualify for the exempt filing status, a new DE 4

designating EXEMPT must be submitted by February 15 each year

Beginning January 1, 2020, Employee’s Withholding Allowance to continue your exemption. If you are not having federal/state

Certificate (Form W-4) from the Internal Revenue Service (IRS) will income tax withheld this year but expect to have a tax liability

be used for federal income tax withholding only. You must file the next year, you are required to give your employer a new DE 4 by

state form Employee’s Withholding Allowance Certificate (DE 4) December 1.

to determine the appropriate California Personal Income Tax (PIT)

withholding. Member Service Civil Relief Act: Under this act, as provided by the

Military Spouses Residency Relief Act and the Veterans Benefits and

If you do not provide your employer with a withholding certificate, Transition Act of 2018, you may be exempt from California income

the employer must use Single with Zero withholding allowance. tax on your wages if

CHECK YOUR WITHHOLDING: After your DE 4 takes effect, (i) your spouse is a member of the armed forces present in

compare the state income tax withheld with your estimated total California in compliance with military orders;

annual tax. For state withholding, use the worksheets on this form. (ii) you are present in California solely to be with your spouse;

and

EXEMPTION FROM WITHHOLDING: If you wish to claim

exempt, complete the federal Form W-4 and the state DE 4. You (iii) you maintain your domicile in another state.

may claim exempt from withholding California income tax if you If you claim exemption under this act, check the box on Line 4.

meet both of the following conditions for exemption: You may be required to provide proof of exemption upon request.

DE 4 Rev. 49 (2-20) (INTERNET) Page 1 of 4

The California Employer’s Guide (DE 44) (PDF, 2.4 MB) (edd.ca.gov/pdf_pub_ctr/de44.pdf) provides the income tax

withholding tables. This publication may be found by visiting Forms and Publications (edd.ca.gov/Payroll_Taxes/Forms_and_

Publications.htm). To assist you in calculating your tax liability, please visit the Franchise Tax Board (FTB) (ftb.ca.gov).

If you need information on your last California Resident Income Tax Return (FTB Form 540), visit the Franchise Tax Board

(FTB) (ftb.ca.gov).

NOTIFICATION: The burden of proof rests with the PENALTY: You may be fined $500 if you file, with no

employee to show the correct California income tax reasonable basis, a DE 4 that results in less tax being

withholding. Pursuant to section 4340-1(e) of Title 22, withheld than is properly allowable. In addition, criminal

California Code of Regulations (CCR), the FTB or the EDD penalties apply for willfully supplying false or fraudulent

may, by special direction in writing, require an employer to information or failing to supply information requiring an

submit a Form W-4 or DE 4 when such forms are necessary increase in withholding. This is provided by section 13101

for the administration of the withholding tax programs. of the California Unemployment Insurance Code and

section 19176 of the Revenue and Taxation Code.

DE 4 Rev. 49 (2-20) (INTERNET) Page 2 of 4

WORKSHEETS

INSTRUCTIONS — 1 — ALLOWANCES*

When determining your withholding allowances, you must consider your MARRIED BUT NOT LIVING WITH YOUR SPOUSE: You may check the

personal situation: “Head of Household” marital status box if you meet all of the following

— Do you claim allowances for dependents or blindness? tests:

— Will you itemize your deductions? (1) Your spouse will not live with you at any time during the year;

— Do you have more than one income coming into the household? (2) You will furnish over half of the cost of maintaining a home for the

entire year for yourself and your child or stepchild who qualifies as

TWO-EARNERS/MULTIPLE INCOMES: When earnings are derived your dependent; and

from more than one source, under-withholding may occur. If you have a (3) You will file a separate return for the year.

working spouse or more than one job, it is best to check the box “SINGLE

or MARRIED (with two or more incomes).” Figure the total number of HEAD OF HOUSEHOLD: To qualify, you must be unmarried or legally

allowances you are entitled to claim on all jobs using only one DE 4 form. separated from your spouse and pay more than 50% of the costs of

Claim allowances with one employer. maintaining a home for the entire year for yourself and your dependent(s)

or other qualifying individuals. Cost of maintaining the home includes such

Do not claim the same allowances with more than one employer. Your items as rent, property insurance, property taxes, mortgage interest, repairs,

withholding will usually be most accurate when all allowances are claimed utilities, and cost of food. It does not include the individual’s personal

on the DE 4 filed for the highest paying job and zero allowances are expenses or any amount which represents value of services performed by a

claimed for the others. member of the household of the taxpayer.

WORKSHEET A REGULAR WITHHOLDING ALLOWANCES

(A) Allowance for yourself — enter 1 (A)

(B) Allowance for your spouse (if not separately claimed by your spouse) — enter 1 (B)

(C) Allowance for blindness — yourself — enter 1 (C)

(D) Allowance for blindness — your spouse (if not separately claimed by your spouse) — enter 1 (D)

(E) Allowance(s) for dependent(s) — do not include yourself or your spouse (E)

(F) Total — add lines (A) through (E) above and enter on line 1 of the DE 4 (F) 0

INSTRUCTIONS — 2 — (OPTIONAL) ADDITIONAL WITHHOLDING ALLOWANCES

If you expect to itemize deductions on your California income tax return, you can claim additional withholding allowances. Use Worksheet B to determine

whether your expected estimated deductions may entitle you to claim one or more additional withholding allowances. Use last year’s FTB Form 540 as a

model to calculate this year’s withholding amounts.

Do not include deferred compensation, qualified pension payments, or flexible benefits, etc., that are deducted from your gross pay but are not taxed on this

worksheet.

You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by

which you expect your estimated deductions for the year to exceed your allowable standard deduction.

WORKSHEET B ESTIMATED DEDUCTIONS

Use this worksheet only if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage income not subject to

withholding.

1. Enter an estimate of your itemized deductions for California taxes for this tax year as listed in the schedules in the FTB Form 540 1.

2. Enter $9,074 if married filing joint with two or more allowances, unmarried head of household, or qualifying widow(er)

with dependent(s) or $4,537 if single or married filing separately, dual income married, or married with multiple employers – 2.

3. Subtract line 2 from line 1, enter difference = 3. 0

4. Enter an estimate of your adjustments to income (alimony payments, IRA deposits) + 4.

5. Add line 4 to line 3, enter sum = 5. 0

6. Enter an estimate of your nonwage income (dividends, interest income, alimony receipts) – 6.

7. If line 5 is greater than line 6 (if less, see below [go to line 9]);

Subtract line 6 from line 5, enter difference = 7. 0

8. Divide the amount on line 7 by $1,000, round any fraction to the nearest whole number 8. 0

Add this number to Line F of Worksheet A and enter it on line 1 of the DE 4. Complete Worksheet C, if needed, otherwise stop here.

9. If line 6 is greater than line 5;

Enter amount from line 6 (nonwage income) 9.

10. Enter amount from line 5 (deductions) 10. 0

11. Subtract line 10 from line 9, enter difference 11. 0

Complete Worksheet C

*Wages paid to registered domestic partners will be treated the same for state income tax purposes as wages paid to spouses for California PIT withholding

and PIT wages. This law does not impact federal income tax law. A registered domestic partner means an individual partner in a domestic partner

relationship within the meaning of section 297 of the Family Code. For more information, please call our Taxpayer Assistance Center at 1-888-745-3886.

DE 4 Rev. 49 (2-20) (INTERNET) Page 3 of 4

WORKSHEET C ADDITIONAL TAX WITHHOLDING AND ESTIMATED TAX

1. Enter estimate of total wages for tax year 2020. 1.

2. Enter estimate of nonwage income (line 6 of Worksheet B). 2.

3. Add line 1 and line 2. Enter sum. 3. 0

4. Enter itemized deductions or standard deduction (line 1 or 2 of Worksheet B, whichever is largest). 4.

5. Enter adjustments to income (line 4 of Worksheet B). 5.

6. Add line 4 and line 5. Enter sum. 6. 0

7. Subtract line 6 from line 3. Enter difference. 7. 0

8. Figure your tax liability for the amount on line 7 by using the 2020 tax rate schedules below. 8.

9. Enter personal exemptions (line F of Worksheet A x $134.20). 9. 0

10. Subtract line 9 from line 8. Enter difference. 10. 0

11. Enter any tax credits. (See FTB Form 540). 11.

12. Subtract line 11 from line 10. Enter difference. This is your total tax liability. 12. 0

13. Calculate the tax withheld and estimated to be withheld during 2020. Contact your employer to request

the amount that will be withheld on your wages based on the marital status and number of withholding

allowances you will claim for 2020. Multiply the estimated amount to be withheld by the number of pay

periods left in the year. Add the total to the amount already withheld for 2020. 13.

14. Subtract line 13 from line 12. Enter difference. If this is less than zero, you do not need to have additional

taxes withheld. 14. 0

15. Divide line 14 by the number of pay periods remaining in the year. Enter this figure on line 2 of the DE 4. 15.

NOTE: Your employer is not required to withhold the additional amount requested on line 2 of your DE 4. If your employer does not agree to withhold the

additional amount, you may increase your withholdings as much as possible by using the “single” status with “zero” allowances. If the amount withheld still

results in an underpayment of state income taxes, you may need to file quarterly estimates on Form 540-ES with the FTB to avoid a penalty.

THESE TABLES ARE FOR CALCULATING WORKSHEET C AND FOR 2020 ONLY

SINGLE PERSONS, DUAL INCOME

MARRIED WITH MULTIPLE EMPLOYERS MARRIED PERSONS

IF THE TAXABLE INCOME IS COMPUTED TAX IS IF THE TAXABLE INCOME IS COMPUTED TAX IS

OVER BUT NOT OF AMOUNT OVER... PLUS OVER BUT NOT OF AMOUNT OVER... PLUS

OVER OVER

$0 $8,809 1.100% $0 $0.00 $0 $17,618 1.100% $0 $0.00

$8,809 $20,883 2.200% $8,809 $96.90 $17,618 $41,766 2.200% $17,618 $193.80

$20,883 $32,960 4.400% $20,883 $362.53 $41,766 $65,920 4.400% $41,766 $725.06

$32,960 $45,753 6.600% $32,960 $893.92 $65,920 $91,506 6.600% $65,920 $1,787.84

$45,753 $57,824 8.800% $45,753 $1,738.26 $91,506 $115,648 8.800% $91,506 $3,476.52

$57,824 $295,373 10.230% $57,824 $2,800.51 $115,648 $590,746 10.230% $115,648 $5,601.02

$295,373 $354,445 11.330% $295,373 $27,101.77 $590,746 $708,890 11.330% $590,746 $54,203.55

$354,445 $590,742 12.430% $354,445 $33,794.63 $708,890 $1,000,000 12.430% $708,890 $67,589.27

$590,742 $1,000,000 13.530% $590,742 $63,166.35 $1,000,000 $1,181,484 13.530% $1,000,000 $103,774.24

$1,000,000 and over 14.630% $1,000,000 $118,538.96 $1,181,484 and over 14.630% $1,181,484 $128,329.03

UNMARRIED HEAD OF HOUSEHOLD

IF THE TAXABLE INCOME IS COMPUTED TAX IS

OVER BUT NOT OF AMOUNT OVER... PLUS

OVER

$0 $17,629 1.100% $0 $0.00

$17,629 $41,768 2.200% $17,629 $193.92

$41,768 $53,843 4.400% $41,768 $724.98

$53,843 $66,636 6.600% $53,843 $1,256.28

$66,636 $78,710 8.800% $66,636 $2,100.62

$78,710 $401,705 10.230% $78,710 $3,163.13

$401,705 $482,047 11.330% $401,705 $36,205.52

If you need information on your last California Resident Income Tax

$482,047 $803,410 12.430% $482,047 $45,308.27

Return, FTB Form 540, visit Franchise Tax Board (FTB) (ftb.ca.gov).

$803,410 $1,000,000 13.530% $803,410 $85,253.69

$1,000,000 and over 14.630% $1,000,000 $111,852.32

The DE 4 information is collected for purposes of administering the PIT law and under the authority of Title 22, CCR, section 4340-1, and the California

Revenue and Taxation Code, including section 18624. The Information Practices Act of 1977 requires that individuals be notified of how information they

provide may be used. Further information is contained in the instructions that came with your last California resident income tax return.

DE 4 Rev. 49 (2-20) (INTERNET) Page 4 of 4

You might also like

- Common Estate Planning TechniquesDocument35 pagesCommon Estate Planning TechniquesMcKenzieLawNo ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- Pet Kingdom Tax ReturnDocument26 pagesPet Kingdom Tax ReturnRaychael Ross100% (2)

- Screenshot 2022-04-15 at 9.52.17 PMDocument13 pagesScreenshot 2022-04-15 at 9.52.17 PMMalachov Andrew100% (1)

- File Your 2019 Federal Tax Return by July 15Document10 pagesFile Your 2019 Federal Tax Return by July 15Aquanis El-Bey50% (2)

- MH0ihh081h6754910230616041100202 PDFDocument2 pagesMH0ihh081h6754910230616041100202 PDFLogan GoadNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- 2021 W-2 and Earnings SummaryDocument2 pages2021 W-2 and Earnings SummaryKawljeet Singh KohliNo ratings yet

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument31 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnJose Miguel Hernandez CarelaNo ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Tax Return 2021Document4 pagesTax Return 2021Adam Clifton100% (4)

- 2014 IRS Form 1040-ES Guide for Estimated Tax PaymentsDocument12 pages2014 IRS Form 1040-ES Guide for Estimated Tax PaymentsClaudia MaldonadoNo ratings yet

- File by Mail Instructions For Your 2019 Federal Tax ReturnDocument10 pagesFile by Mail Instructions For Your 2019 Federal Tax ReturnArgenis GuilamoNo ratings yet

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- A2015 - Salvador - Tax 1 ReviewerDocument177 pagesA2015 - Salvador - Tax 1 ReviewerPatrick ManaloNo ratings yet

- Reviewer On Taxation - MamalateoDocument128 pagesReviewer On Taxation - MamalateoVada De Villa Rodriguez94% (17)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- LICOA Third Complaint ExhibitsDocument359 pagesLICOA Third Complaint ExhibitsNate TobikNo ratings yet

- CIR Vs BOAC Case DigestDocument1 pageCIR Vs BOAC Case DigestJamie BerryNo ratings yet

- Li Yao vs. CIRDocument4 pagesLi Yao vs. CIRVan John MagallanesNo ratings yet

- Taxation-for-Development-Narrative-Report Final ReportDocument40 pagesTaxation-for-Development-Narrative-Report Final ReportJackNo ratings yet

- 58 - Santos Jr. v. LlamasDocument2 pages58 - Santos Jr. v. LlamasPatch Magtanong100% (1)

- Edd AfDocument4 pagesEdd Afcsl K360No ratings yet

- Clear Form: Enter Personal InformationDocument4 pagesClear Form: Enter Personal InformationreddymspNo ratings yet

- California DE-4Document4 pagesCalifornia DE-4Tuğrul SarıkayaNo ratings yet

- California Employee Withholding Allowance Certificate FormDocument4 pagesCalifornia Employee Withholding Allowance Certificate FormAmandaNo ratings yet

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- De 4Document4 pagesDe 4fschalkNo ratings yet

- Emp WitholdingDocument4 pagesEmp WitholdingJohn A MerlinoNo ratings yet

- fw4 PDFDocument2 pagesfw4 PDFbikash PrajapatiNo ratings yet

- US Internal Revenue Service: fw4 - 1993Document2 pagesUS Internal Revenue Service: fw4 - 1993IRSNo ratings yet

- US Internal Revenue Service: fw4 - 1994Document2 pagesUS Internal Revenue Service: fw4 - 1994IRSNo ratings yet

- Income Based Repayment Plan Request and or RenewalDocument5 pagesIncome Based Repayment Plan Request and or RenewalaquarianflowerNo ratings yet

- US Internal Revenue Service: fw4 - 2002Document2 pagesUS Internal Revenue Service: fw4 - 2002IRSNo ratings yet

- 2024iaw-4 (44019) 0Document4 pages2024iaw-4 (44019) 0ahmedzahi964No ratings yet

- Payroll Setup ChecklistDocument4 pagesPayroll Setup ChecklistcaliechNo ratings yet

- Iowa W4Document2 pagesIowa W4ts0m3No ratings yet

- US Internal Revenue Service: fw4 - 1998Document2 pagesUS Internal Revenue Service: fw4 - 1998IRSNo ratings yet

- US Internal Revenue Service: fw4 - 2000Document2 pagesUS Internal Revenue Service: fw4 - 2000IRSNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocument4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSNo ratings yet

- std686 PDFDocument2 pagesstd686 PDFnmkeatonNo ratings yet

- Tax Form 2016Document2 pagesTax Form 2016Sharkman1234566100% (1)

- US Internal Revenue Service: fw4 - 1997Document2 pagesUS Internal Revenue Service: fw4 - 1997IRSNo ratings yet

- US Internal Revenue Service: fw4p - 2003Document4 pagesUS Internal Revenue Service: fw4p - 2003IRSNo ratings yet

- Webcam For AdultDocument2 pagesWebcam For AdultDixieojmwwNo ratings yet

- US Internal Revenue Service: fw4p07 AccessibleDocument4 pagesUS Internal Revenue Service: fw4p07 AccessibleIRSNo ratings yet

- US Internal Revenue Service: fw4p - 1994Document3 pagesUS Internal Revenue Service: fw4p - 1994IRSNo ratings yet

- US Internal Revenue Service: fw4p - 2000Document4 pagesUS Internal Revenue Service: fw4p - 2000IRSNo ratings yet

- Form W-4 (2009) : Employee's Withholding Allowance CertificateDocument1 pageForm W-4 (2009) : Employee's Withholding Allowance Certificateezra242No ratings yet

- US Internal Revenue Service: fw4p - 1995Document3 pagesUS Internal Revenue Service: fw4p - 1995IRSNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- US Internal Revenue Service: fw4p - 2001Document4 pagesUS Internal Revenue Service: fw4p - 2001IRSNo ratings yet

- Application to Unlock Alberta Funds Due to Financial HardshipDocument7 pagesApplication to Unlock Alberta Funds Due to Financial HardshipDanielle FiedlerNo ratings yet

- State Tax FormDocument2 pagesState Tax FormRon SchingsNo ratings yet

- Employment Eligibility Verification: U.S. Citizenship and Immigration ServicesDocument2 pagesEmployment Eligibility Verification: U.S. Citizenship and Immigration ServicesAnonymous xnDtZ93LNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Document4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)quylowNo ratings yet

- Form W-4 (2013) : Employee's Withholding Allowance CertificateDocument2 pagesForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706No ratings yet

- US Internal Revenue Service: fw4p - 2002Document4 pagesUS Internal Revenue Service: fw4p - 2002IRSNo ratings yet

- fw418510 0Document2 pagesfw418510 0ezra242100% (2)

- Employee's Withholding Certificate: Step 1: Enter Personal InformationDocument4 pagesEmployee's Withholding Certificate: Step 1: Enter Personal InformationRobert KettererNo ratings yet

- US Internal Revenue Service: fw4p - 1993Document3 pagesUS Internal Revenue Service: fw4p - 1993IRSNo ratings yet

- My1099 Notice703Document1 pageMy1099 Notice703Selina WalkerNo ratings yet

- FW 4Document2 pagesFW 4Ana MartinezNo ratings yet

- fw46707 0Document2 pagesfw46707 0ezra242No ratings yet

- FGHFHFGHFGHDocument4 pagesFGHFHFGHFGHxowef95250No ratings yet

- Alberta 2024Document2 pagesAlberta 2024jennamthoNo ratings yet

- To Complete A Financial StatementDocument19 pagesTo Complete A Financial StatementKirk DollmontNo ratings yet

- Instructions For Schedule 3 (Form 1040A) : Internal Revenue ServiceDocument4 pagesInstructions For Schedule 3 (Form 1040A) : Internal Revenue ServiceIRSNo ratings yet

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSNo ratings yet

- MW 507Document2 pagesMW 507anon-650325100% (1)

- MW507Document2 pagesMW507Thirunavukkarasu AnandanNo ratings yet

- Personal InformationDocument1 pagePersonal Informationelena.69.mxNo ratings yet

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- LOA SummaryDocument3 pagesLOA Summaryelena.69.mxNo ratings yet

- Honeywell - IT Security Terms & ConditionsDocument19 pagesHoneywell - IT Security Terms & Conditionselena.69.mxNo ratings yet

- Generic Form Preview DocumentDocument2 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- DBIDS - 2024 - Mariscal Rocha, MariaDocument3 pagesDBIDS - 2024 - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- Generic Form Preview DocumentDocument1 pageGeneric Form Preview Documentelena.69.mxNo ratings yet

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- UntitledDocument2 pagesUntitledNicky Aulia NissaNo ratings yet

- Generic Form Preview DocumentDocument1 pageGeneric Form Preview Documentelena.69.mxNo ratings yet

- Generic Form Preview DocumentDocument2 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- Consent 1Document1 pageConsent 1Albert TolleNo ratings yet

- DBIDS - 2024 - Mariscal Rocha, MariaDocument3 pagesDBIDS - 2024 - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- DBIDS - 2024 - Mariscal Rocha, MariaDocument3 pagesDBIDS - 2024 - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- 09 401K Form - Mariscal Rocha, MariaDocument1 page09 401K Form - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Direct Deposit EnrollmentDocument1 pageDirect Deposit Enrollmentelena.69.mxNo ratings yet

- Anti Harassment PolicyDocument2 pagesAnti Harassment Policyelena.69.mxNo ratings yet

- Employee's Withholding Certificate: Step 1: Enter Personal InformationDocument4 pagesEmployee's Withholding Certificate: Step 1: Enter Personal InformationSejar AiclNo ratings yet

- DBIDS - 2024 - Mariscal Rocha, MariaDocument3 pagesDBIDS - 2024 - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- 10 Vets Form - Mariscal Rocha, MariaDocument1 page10 Vets Form - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- 05 Assignment Offer - Mariscal Rocha, MariaDocument1 page05 Assignment Offer - Mariscal Rocha, Mariaelena.69.mxNo ratings yet

- Taxation Bar QuestionsDocument31 pagesTaxation Bar Questions0506sheltonNo ratings yet

- Pascual v. Commissioner GR. No. 78133 October 18, 1988 Doctrine: Distinction Between Co-Ownership and An Unregistered Partnership or JointDocument2 pagesPascual v. Commissioner GR. No. 78133 October 18, 1988 Doctrine: Distinction Between Co-Ownership and An Unregistered Partnership or JointBrylle Garnet DanielNo ratings yet

- Hhofma3e Ch10 Tif TestgenDocument42 pagesHhofma3e Ch10 Tif TestgenjindjaanNo ratings yet

- Module 1 Current Liabilities Provisions and ContingenciesDocument14 pagesModule 1 Current Liabilities Provisions and ContingenciesFujoshi BeeNo ratings yet

- Current Liabilities and Payroll Accounting: Learning ObjectivesDocument70 pagesCurrent Liabilities and Payroll Accounting: Learning ObjectivesHanifah Oktariza100% (1)

- Full Download Federal Taxation Basic Principles 2013 1st Edition Harmelink Test BankDocument19 pagesFull Download Federal Taxation Basic Principles 2013 1st Edition Harmelink Test Bankhudsonlosjames100% (38)

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- Revenue Act of 1951 (PL 82-183)Document119 pagesRevenue Act of 1951 (PL 82-183)Tax History100% (1)

- Solution Manual For Canadian Income Taxation 2019 2020 22th by BuckwoldDocument53 pagesSolution Manual For Canadian Income Taxation 2019 2020 22th by BuckwoldKeithClarknrjz100% (45)

- Chapter 19 Income Tax Accounting Self Test ReviewDocument17 pagesChapter 19 Income Tax Accounting Self Test ReviewRachel EnokouNo ratings yet

- Sadlier WH 2009 Annual ReportDocument17 pagesSadlier WH 2009 Annual ReportteriksenNo ratings yet

- p4012 (2018)Document349 pagesp4012 (2018)Center for Economic ProgressNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- Professional (Regular and COS/Job Order) Percentage Tax Expanded Withholding Tax Without Sworn Declaration 3% 10% With Sworn DeclarationDocument5 pagesProfessional (Regular and COS/Job Order) Percentage Tax Expanded Withholding Tax Without Sworn Declaration 3% 10% With Sworn Declarationblessa elaurzaNo ratings yet

- Module No. 2 - Special CorporationsDocument8 pagesModule No. 2 - Special CorporationsJohn Russel PacunNo ratings yet

- Estimated Tax for IndividualsDocument12 pagesEstimated Tax for IndividualsJob SchwartzNo ratings yet

- Cir Vs St. LukesDocument15 pagesCir Vs St. LukesLalaine FelixNo ratings yet

- Tuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceDocument4 pagesTuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceGeozzzyNo ratings yet

- 05 Activity 1Document1 page05 Activity 1Charise Oliva0% (1)