Professional Documents

Culture Documents

Return On Equity

Uploaded by

misgana birhanuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Return On Equity

Uploaded by

misgana birhanuCopyright:

Available Formats

Return on Equity

ROE tells you how well your company is using shareholder's equity -- potentially your own equity --

to generate profits. Take net income from the income statement and divide it by the shareholder's

equity from the balance sheet to attain ROE. The ratio is tracked over time -- computing the figure

quarterly or yearly -- to see if return on equity is increasing or decreasing. An increasing ROE is

preferable as it shows the company is more efficiently using shareholder's equity to produce profits.

Business owners typically want to maximize ROE to sustain or attract investors. Asset turnover, or

sales-to-asset ratio, shows how efficiently your company is converting its assets into sales. Find your

company's sales on the income statement and divide it by total assets from the balance sheet. The

higher the ratio the better; a reading of one or higher indicates the company is generating more than

$1 in sales for each $1 in assets. New start-ups may take time to generate significant sales, therefore

track the quarterly or yearly trend of the figure. A rising asset turnover ratio over time shows assets

are being utilized more effectively. Asset turnover, or sales-to-asset ratio, shows how efficiently your

company is converting its assets into sales. Find your company's sales on the income statement and

divide it by total assets from the balance sheet. The higher the ratio the better; a reading of one or

higher indicates the company is generating more than $1 in sales for each $1 in assets. New start-ups

may take time to generate significant sales, therefore track the quarterly or yearly trend of the figure.

A rising asset turnover ratio over time shows assets are being utilized more effectively. Asset

turnover, or sales-to-asset ratio, shows how efficiently your company is converting its assets into

sales. Find your company's sales on the income statement and divide it by total assets from the

balance sheet. The higher the ratio the better; a reading of one or higher indicates the company is

generating more than $1 in sales for each $1 in assets. New start-ups may take time to generate

significant sales, therefore track the quarterly or yearly trend of the figure. A rising asset turnover

ratio over time shows assets are being utilized more effectively. Asset turnover, or sales-to-asset

ratio, shows how efficiently your company is converting its assets into sales. Find your company's

sales on the income statement and divide it by total assets from the balance sheet. The higher the

ratio the better; a reading of one or higher indicates the company is generating more than $1 in sales

for each $1 in assets. New start-ups may take time to generate significant sales, therefore track the

quarterly or yearly trend of the figure. A rising asset turnover ratio over time shows assets are being

utilized more effectively. Asset turnover, or sales-to-asset ratio, shows how efficiently your company

is converting its assets into sales. Find your company's sales on the income statement and divide it by

total assets from the balance sheet. The higher the ratio the better; a reading of one or higher

indicates the company is generating more than $1 in sales for each $1 in assets. New start-ups may

take time to generate significant sales, therefore track the quarterly or yearly trend of the figure. A

rising asset turnover ratio over time shows assets are being utilized more effectively.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio Analysisapi-299265916No ratings yet

- Chevening Study in The UK Winning Essay Sample - EssaysersDocument4 pagesChevening Study in The UK Winning Essay Sample - EssaysersFaris RezkNo ratings yet

- Asset 4Document2 pagesAsset 4misganabbbbbbbbbbNo ratings yet

- Credit 3Document2 pagesCredit 3misganabbbbbbbbbbNo ratings yet

- Debt 3Document3 pagesDebt 3misganabbbbbbbbbbNo ratings yet

- Asset TurnoverDocument1 pageAsset Turnovermisgana birhanuNo ratings yet

- Debt 5Document2 pagesDebt 5misganabbbbbbbbbbNo ratings yet

- Asset 1Document3 pagesAsset 1misganabbbbbbbbbbNo ratings yet

- Assets 3Document2 pagesAssets 3misganabbbbbbbbbbNo ratings yet

- Credit 4Document2 pagesCredit 4misganabbbbbbbbbbNo ratings yet

- Ere 11Document5 pagesEre 11misganabbbbbbbbbbNo ratings yet

- Ereee 23311Document3 pagesEreee 23311misganabbbbbbbbbbNo ratings yet

- Ere 122231Document6 pagesEre 122231misganabbbbbbbbbbNo ratings yet

- Credit 5Document2 pagesCredit 5misganabbbbbbbbbbNo ratings yet

- Debt 2Document2 pagesDebt 2misganabbbbbbbbbbNo ratings yet

- Return On AssetsDocument1 pageReturn On Assetsmisgana birhanuNo ratings yet

- Stock Analysis - Learn To Analyse A Stock In-DepthDocument19 pagesStock Analysis - Learn To Analyse A Stock In-DepthLiew Chee KiongNo ratings yet

- Earnings: The Indispensable Element of General Stocks: Elements of Stock Market & AnalysisDocument20 pagesEarnings: The Indispensable Element of General Stocks: Elements of Stock Market & AnalysisjosesmnNo ratings yet

- Ratios Interpretation and CalculationDocument8 pagesRatios Interpretation and CalculationG-Str Sounds EntertainmentNo ratings yet

- What Are Profitability RatiosDocument2 pagesWhat Are Profitability RatiosDarlene SarcinoNo ratings yet

- Key Ratios For Picking Good Stocks: 1. Ploughback and ReservesDocument6 pagesKey Ratios For Picking Good Stocks: 1. Ploughback and ReservesAnonymous YkDJkSqNo ratings yet

- Finding Growth Stock Winners: Focus On 8 Fundamental FactorsDocument4 pagesFinding Growth Stock Winners: Focus On 8 Fundamental FactorsjpbankzNo ratings yet

- Return On EquityDocument7 pagesReturn On EquitySyed JawwadNo ratings yet

- Financial Ratios Are Useful Indicators of A Firm's Performance and FinancialDocument5 pagesFinancial Ratios Are Useful Indicators of A Firm's Performance and FinancialSef Getizo CadoNo ratings yet

- Financial Ratio Analysis: List of Financial RatiosDocument3 pagesFinancial Ratio Analysis: List of Financial RatiosshahbazsiddikieNo ratings yet

- Annual Turnover Is A Term Used When Describing The Amount of Securities Removed From ADocument6 pagesAnnual Turnover Is A Term Used When Describing The Amount of Securities Removed From AElitsa DermendzhiyskaNo ratings yet

- Chapter 3 FinanceeDocument4 pagesChapter 3 FinanceeLeilaabotiraNo ratings yet

- An Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Document23 pagesAn Introduction To Fundamental Analysis: Jason O Bryan 19 September 2006Saumil ShahNo ratings yet

- Introduction To Stock ValuationDocument22 pagesIntroduction To Stock ValuationManash SharmaNo ratings yet

- FSA Chapter 8 NotesDocument9 pagesFSA Chapter 8 NotesNadia ZahraNo ratings yet

- RatioDocument5 pagesRatiomob1022No ratings yet

- Du-Pont Analysis: Learning ObjectivesDocument11 pagesDu-Pont Analysis: Learning ObjectivesBabulalNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisAnonymous EsqOXNeaW8No ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisZeshan MustafaNo ratings yet

- Business Accounting RatiosDocument18 pagesBusiness Accounting RatiosAhmed AdelNo ratings yet

- Ratios Gross Profit MarginDocument7 pagesRatios Gross Profit MarginBrill brianNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio AnalysisDia Mae GenerosoNo ratings yet

- ROEDocument7 pagesROEfrancis willie m.ferangco100% (1)

- ACC - ACF1200 Topic 6 SOLUTIONS To Questions For Self-StudyDocument3 pagesACC - ACF1200 Topic 6 SOLUTIONS To Questions For Self-StudyChuangjia MaNo ratings yet

- Fundamental AnalysisDocument6 pagesFundamental AnalysisanandhvvvNo ratings yet

- Current Ratio Liquidity Working CapitalDocument3 pagesCurrent Ratio Liquidity Working CapitalAldren Delina RiveraNo ratings yet

- AUD Financial RatiosDocument3 pagesAUD Financial RatiosNick HuynhNo ratings yet

- Financial Ratio HANDOUTSDocument3 pagesFinancial Ratio HANDOUTSMichelle GoNo ratings yet

- AssignmentDocument4 pagesAssignmentRithik TiwariNo ratings yet

- Analyzing The Income StatementDocument2 pagesAnalyzing The Income StatementHardian Buchori BarkahNo ratings yet

- What Is Working Capital TurnoverDocument2 pagesWhat Is Working Capital TurnoverDarlene SarcinoNo ratings yet

- Clo-3 Assignment: Chemical Engineering Economics 2016-CH-454Document9 pagesClo-3 Assignment: Chemical Engineering Economics 2016-CH-454ali ayanNo ratings yet

- Icicidirect Centre For Financial Learning Equity: Chapter 2 Module 7 Do It Yourself Basic Investment StrategiesDocument6 pagesIcicidirect Centre For Financial Learning Equity: Chapter 2 Module 7 Do It Yourself Basic Investment StrategiesKSNo ratings yet

- There Are So Many Fundamental Analysis ParametersDocument8 pagesThere Are So Many Fundamental Analysis Parametersanimesh dasNo ratings yet

- What Do Efficiency Ratios MeasureDocument2 pagesWhat Do Efficiency Ratios MeasureDarlene SarcinoNo ratings yet

- RatiosDocument1 pageRatiosSanthosh MathewNo ratings yet

- Net Block DefinitionsDocument16 pagesNet Block DefinitionsSabyasachi MohapatraNo ratings yet

- Profitability Ratios: and Allowances) Minus Cost of SalesDocument2 pagesProfitability Ratios: and Allowances) Minus Cost of Salesrachel anne belangelNo ratings yet

- Ratios IBMIDocument17 pagesRatios IBMIhaz002No ratings yet

- Smart Task 1 Vardhan ConsultingDocument10 pagesSmart Task 1 Vardhan Consulting2K19/PS/053 SHIVAMNo ratings yet

- RATIOAnalysisDocument2 pagesRATIOAnalysisnarak_putraNo ratings yet

- What Is An Activity Ratio?: Key TakeawaysDocument5 pagesWhat Is An Activity Ratio?: Key TakeawaysTao TmaNo ratings yet

- Financial AnalysisDocument8 pagesFinancial Analysisneron hasaniNo ratings yet

- Short-Term Solvency or Liquidity Ratios: Current RatioDocument18 pagesShort-Term Solvency or Liquidity Ratios: Current RatioSachini Dinushika KankanamgeNo ratings yet

- Financial Ratios....Document19 pagesFinancial Ratios....carlNo ratings yet

- Return On AssetsDocument1 pageReturn On Assetsmisgana birhanuNo ratings yet

- The Bottom Line These Calculations Demonstrate That Time Literally Is MoneyDocument1 pageThe Bottom Line These Calculations Demonstrate That Time Literally Is Moneymisgana birhanuNo ratings yet

- Present Value of A Future Payment Lets Add A Little Spice To Our Investment KnowledgeDocument1 pagePresent Value of A Future Payment Lets Add A Little Spice To Our Investment Knowledgemisgana birhanuNo ratings yet

- Appropriate Methods and Carry Out Financial CalculationsDocument2 pagesAppropriate Methods and Carry Out Financial Calculationsmisgana birhanuNo ratings yet

- The Components of Total Compensation Program: and Written ProceduresDocument2 pagesThe Components of Total Compensation Program: and Written Proceduresmisgana birhanuNo ratings yet

- Director of OperationsDocument3 pagesDirector of Operationsapi-121436634No ratings yet

- Chapter 12Document25 pagesChapter 12varunjajooNo ratings yet

- Executive Order 000Document2 pagesExecutive Order 000Randell ManjarresNo ratings yet

- Beers of The World - EuropeDocument17 pagesBeers of The World - EuropeVy NguyenNo ratings yet

- MarriageDocument15 pagesMarriageHimanshu SangtaniNo ratings yet

- To: Michael Cullen From: Damineh AkhavanDocument4 pagesTo: Michael Cullen From: Damineh AkhavanDamineh AkhavanNo ratings yet

- Transport Fundamentals: When The Chinese Write The Word "Crisis," They Do So in Two Characters - One Meaning, The OtherDocument17 pagesTransport Fundamentals: When The Chinese Write The Word "Crisis," They Do So in Two Characters - One Meaning, The OtherWahjoe WitjaksonoNo ratings yet

- Cha v. CA 277 SCRA 690Document4 pagesCha v. CA 277 SCRA 690Justine UyNo ratings yet

- Site of The First MassDocument18 pagesSite of The First MassKim Arielle GarciaNo ratings yet

- GovernpreneurshipDocument10 pagesGovernpreneurshipDr-Mohammed FaridNo ratings yet

- Alternative InvestmentsDocument63 pagesAlternative InvestmentsAspanwz SpanwzNo ratings yet

- Effect of Corona On Common ManDocument2 pagesEffect of Corona On Common ManMUSKAN DUBEYNo ratings yet

- SBI Current Account Form For Other Than Sole Proprietorship FirmDocument16 pagesSBI Current Account Form For Other Than Sole Proprietorship FirmKartik KumarNo ratings yet

- An Ideal Roommate: Fik 3042: English For Communication 2Document4 pagesAn Ideal Roommate: Fik 3042: English For Communication 2Noor Azhar AhmadNo ratings yet

- Worshipping God Again: (Keys To Refocusing The Object and Subject of OurDocument28 pagesWorshipping God Again: (Keys To Refocusing The Object and Subject of OurMica Gay TagtagonNo ratings yet

- Succession Main Theme - C Minor - notesDocument9 pagesSuccession Main Theme - C Minor - notessakkuturdeNo ratings yet

- Higher Education Commission: Address ToDocument7 pagesHigher Education Commission: Address Toharoon khanNo ratings yet

- Risk Return Analysis of InvestmentDocument3 pagesRisk Return Analysis of InvestmentAnju PrakashNo ratings yet

- Rastogi (2013) Working Capital Management Nasional FertilizerDocument4 pagesRastogi (2013) Working Capital Management Nasional FertilizerRahmadhani PutriNo ratings yet

- Connecticut - Federal Rental Assistance FactsDocument1 pageConnecticut - Federal Rental Assistance FactsPatricia DillonNo ratings yet

- M. Yunus Abu Bakar - Konsep EsensialismeDocument12 pagesM. Yunus Abu Bakar - Konsep EsensialismeLISA ANJARSARINo ratings yet

- Controles Iso 27001-2013Document9 pagesControles Iso 27001-2013Juan Carlos Torres AlvarezNo ratings yet

- Elpidio Vega Vs Joy LegaspiDocument13 pagesElpidio Vega Vs Joy LegaspiElpidioVegaNo ratings yet

- Instagram Post Test No. 11Document4 pagesInstagram Post Test No. 11Roel VirayNo ratings yet

- Balance of Payment ParkinDocument37 pagesBalance of Payment ParkinHaroonNo ratings yet

- 21-064 Dean Hall Cooling Tower RFPDocument37 pages21-064 Dean Hall Cooling Tower RFPvyshakhNo ratings yet

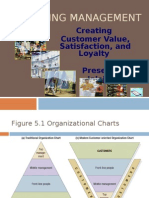

- Customer Value, Satisfaction & LoyaltyDocument27 pagesCustomer Value, Satisfaction & LoyaltyJalaj Mathur88% (8)

- A Summary of The SilappathikaramDocument2 pagesA Summary of The Silappathikaramجوحانة ابي فيندليديNo ratings yet

- Applicant Endorsement FormDocument5 pagesApplicant Endorsement Formsat258No ratings yet