Professional Documents

Culture Documents

Daily Updates - April 01

Uploaded by

rksapsecgrc010Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Updates - April 01

Uploaded by

rksapsecgrc010Copyright:

Available Formats

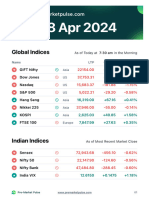

DAILY MARKET UPDATE – (01/04/2024)

Indian Stock Market Outlook for April 1

➢ The Indian stock market indices, Sensex and Nifty

INDICES CLOSE CHANGE %

50 are likely to see a positive opening on Monday

SENSEX 73,635.48 +0.88%

led by supportive global market cues.

NIFTY 50 22,326.90 +0.92%

➢ The Gift Nifty was trading around 22,530 level, a

premium of nearly 40 points from the Nifty futures’ BANKNIFTY 47,124.60 +0.72%

previous close. S&P 500 5,254.35 +0.11%

➢ The Sensex spiked 655.04 points to close at NASDAQ 16,379.46 -0.12%

73,651.35, while the Nifty 50 settled 203.25 points, NIKKEI 225 40,060.02 -0.77%

or 0.92%, higher at 22,326.90.

HANG SENG 16,541.42 +0.91%

Key Market Developments Overnight

➢ US Stock Market: The US stock market indices ended mixed on Thursday with the S&P 500 notching

its strongest first quarter in five years.

➢ Asian Markets: On Monday, Asian markets saw upward movement as investors evaluated significant

economic indicators from China and Japan. Nikkei 225 in Japan increased by 0.41%, although the

Topix experienced a slight decline of 0.28%. South Korea's Kospi saw a rise of 0.36%,the Kosdaq

added 0.63%. Notably, Hong Kong markets remained closed for Easter Monday.

➢ Indian Stock: Thursday witnessed a notable surge in the Indian stock market indices, propelled by

favorable global signals, thus concluding the fiscal year 2024 with substantial gains.

➢ Gift Nifty: Gift Nifty was trading around the 22,540 level, a premium of nearly 50 points from the

Nifty futures’ previous close, indicating a positive start for the Indian stock market indices.

➢ US Inflation: US inflation rose moderately in February, keeping a potential June interest rate cut by

the Federal Reserve on the table. The PCE price index increased by 0.3%, lower than expected,

following a 0.5% rise in January. Over the 12 months to February, PCE inflation advanced to 2.5%

from 2.4% in January.

➢ Oil Prices: On Monday, crude oil prices experienced a decrease while retaining the majority of their

recent increases. Brent crude declined by 0.21%, reaching $86.82 per barrel after experiencing a 2.4%

rise last week. Meanwhile, US West Texas Intermediate crude saw a decrease of 0.14% to $83.05 per

barrel, following a 3.2% increase last week.

Stocks to Watch: April 1

➢ HDFC Bank: HDFC Bank has entered into a binding term sheet to sell its entire equity stake in HDFC

Education and Development Services Pvt. Ltd. The sale will be conducted through a Swiss Challenge

method, with subsequent definitive agreements expected between the purchaser and HDFC Bank.

➢ Infosys: Infosys anticipates a refund of Rs 6,329 crore from the Income Tax Department. The company

is assessing the impact of these refunds on its financial statements for the quarter.

➢ Karnataka Bank: The lender partnered with ICICI Lombard General Insurance Company to offer its

general insurance products to bank customers. Additionally, the bank approved the allotment of Rs 600

crore worth of equity shares under qualified institutional placement (QIP) at Rs 227 per share to various

institutional investors, including Morgan Stanley, HSBC Mutual Fund, SBI Life Insurance Company,

Franklin India, and Max Life Insurance Company.

➢ Pharma Stocks: The National Pharmaceutical Pricing Authority (NPPA) has declared that prices of

essential medicines will escalate effective April 1. According to the announcement, there will be a

0.00551% augmentation in the (MRP) of scheduled formulations at the commencement of the fiscal

year 2024-25.

➢ Zomato: The food delivery giant has been served with an order demanding GST payment amounting

to Rs 11.27 crore, coupled with applicable interest and penalty totaling Rs 23.26 crore, by the Assistant

Commissioner of Commercial Taxes (Audit), Karnataka. The company is confident in its ability to

present a robust defense before the appellate authority and anticipates no financial repercussions.

***********************

You might also like

- Icici Bank StatementDocument22 pagesIcici Bank StatementVIJAY BHASAKAR100% (1)

- FMCG Industry AnalysisDocument20 pagesFMCG Industry AnalysisAshish Kumar82% (33)

- Daily Updates - March 28Document2 pagesDaily Updates - March 28rksapsecgrc010No ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Daily Market Briefing 21-03-2024Document5 pagesDaily Market Briefing 21-03-2024Shaikh ParvezNo ratings yet

- Sensex Rallies Over 400 Points in Early Trade Nifty Tops 14,800Document2 pagesSensex Rallies Over 400 Points in Early Trade Nifty Tops 14,800Abhijeet SinghNo ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- 1511 Market Closing CommentsDocument4 pages1511 Market Closing Commentssausudipta6No ratings yet

- Markets For You - 25 February 2015Document2 pagesMarkets For You - 25 February 2015Rahul SaxenaNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- Market HighlightDocument11 pagesMarket HighlightmanindarNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Derivatives Daily: Market SummaryDocument8 pagesDerivatives Daily: Market Summaryprasun1761No ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- Capstocks (Daily Reports) 29 Feb 2024Document13 pagesCapstocks (Daily Reports) 29 Feb 2024LaxmiNarasimhaa KrishnapurAnanthNo ratings yet

- Daily Post Market Briefing 20-03-2024Document9 pagesDaily Post Market Briefing 20-03-2024Kamal MeenaNo ratings yet

- Daily Equty Report by Epic Research - 29 June 2012Document10 pagesDaily Equty Report by Epic Research - 29 June 2012Arthur GentryNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Global FX StrategyDocument3 pagesGlobal FX StrategyFarhan ShariarNo ratings yet

- Treasury Daily 01 29 16Document5 pagesTreasury Daily 01 29 16patrick-lee ellaNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- Markets For You - 19 February 2015Document2 pagesMarkets For You - 19 February 2015Rahul SaxenaNo ratings yet

- Fund Flow Report-Week 23 Sept-MIDF-260922Document7 pagesFund Flow Report-Week 23 Sept-MIDF-260922Muhamad Norhafiz SallehNo ratings yet

- Markets For You - 24 March 2015Document2 pagesMarkets For You - 24 March 2015Rahul SaxenaNo ratings yet

- Weekly Macro Perspectives: February 11, 2006Document2 pagesWeekly Macro Perspectives: February 11, 2006satyamehtaNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Daily Currency Outlook: September 11, 2019Document7 pagesDaily Currency Outlook: September 11, 2019saran21No ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Erivati VE Eport RD ARDocument9 pagesErivati VE Eport RD ARAru MehraNo ratings yet

- MCX PDFDocument2 pagesMCX PDFDynamic LevelsNo ratings yet

- Week Ended September 21, 2012: Icici Amc Idfc Amc Icici BankDocument4 pagesWeek Ended September 21, 2012: Icici Amc Idfc Amc Icici BankBonthala BadrNo ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- T I M E S: Market Yearns For Fresh TriggersDocument22 pagesT I M E S: Market Yearns For Fresh TriggersDhawan SandeepNo ratings yet

- Morning Dailly Report - 5th AprilDocument1 pageMorning Dailly Report - 5th Aprilrajan0216guptaNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- Markets For You-April 13 2015Document2 pagesMarkets For You-April 13 2015Rahul SaxenaNo ratings yet

- LTMF Market Flash - Jan 17, 2022Document3 pagesLTMF Market Flash - Jan 17, 2022Rahul SukhramaniNo ratings yet

- Market Report: Index Close Change % ChangeDocument3 pagesMarket Report: Index Close Change % ChangeRonit SinghNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- Capitalbuilderdaily PDFDocument5 pagesCapitalbuilderdaily PDFCapital Buildr Financial ServicesNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- Daily 06.11.2013Document1 pageDaily 06.11.2013FEPFinanceClubNo ratings yet

- Markets For You: Global Indices Indices PerformanceDocument2 pagesMarkets For You: Global Indices Indices PerformanceRahulSaxenaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Stock Report For The WeekDocument9 pagesStock Report For The WeekDasher_No_1No ratings yet

- Markets For You - January 15 2015Document2 pagesMarkets For You - January 15 2015rps92No ratings yet

- Daily Newsletter Feb2Document10 pagesDaily Newsletter Feb2amjadyusuf118No ratings yet

- Financial Institutions, Valuations, Mergers, and Acquisitions: The Fair Value ApproachFrom EverandFinancial Institutions, Valuations, Mergers, and Acquisitions: The Fair Value ApproachNo ratings yet

- Money TimesDocument21 pagesMoney TimesAmit MehtaNo ratings yet

- Rev 1wp Name Contribution 1000Document22 pagesRev 1wp Name Contribution 1000Vilas ParabNo ratings yet

- Indian Stock MarketDocument91 pagesIndian Stock Marketsukhwindersinghsukhi70% (10)

- Minor ProjectDocument100 pagesMinor ProjectAnuj Lamoria100% (1)

- The Bombay Stock ExchangeDocument10 pagesThe Bombay Stock ExchangeJ SmitNo ratings yet

- Key Word RecordDocument11 pagesKey Word RecordJamie JordanNo ratings yet

- Stock Lot SizeDocument10 pagesStock Lot SizeBURJINo ratings yet

- A Project Study Report On: Indiabulls Securities Ltd. UdaipurDocument63 pagesA Project Study Report On: Indiabulls Securities Ltd. UdaipurYogita WaghNo ratings yet

- IT ParksDocument6 pagesIT ParksShahab Z AhmedNo ratings yet

- Delhi SNO File - No Unit - Nam AddressDocument9 pagesDelhi SNO File - No Unit - Nam AddressDexter Anki SinghNo ratings yet

- Weekly Performance 23mayDocument96 pagesWeekly Performance 23mayshailspatsNo ratings yet

- Commercial List of ProjectsDocument2 pagesCommercial List of ProjectsVikram RaviNo ratings yet

- Geologist050717 PDFDocument2 pagesGeologist050717 PDFKanha SatyaranjanNo ratings yet

- NSE FNO Lot Size As On 22.12.2022Document14 pagesNSE FNO Lot Size As On 22.12.2022Mahammad Rafi DNo ratings yet

- BSE Companies DataDocument31 pagesBSE Companies DatavinithaNo ratings yet

- A Comparative Study of BSE and NSE: Dr. Girbal Singh Lodhi, Dr. Kaustubh JainDocument6 pagesA Comparative Study of BSE and NSE: Dr. Girbal Singh Lodhi, Dr. Kaustubh JainNandita IyerNo ratings yet

- Ambit - Strategy - ERr GRP - The Rebooting of IndiaDocument25 pagesAmbit - Strategy - ERr GRP - The Rebooting of Indiaomkarb87No ratings yet

- Ifcb2009 68Document1,266 pagesIfcb2009 68Matam RajeshwariNo ratings yet

- Impact of Macroeconomic Variables On Indian Stock MarketDocument10 pagesImpact of Macroeconomic Variables On Indian Stock MarketAnindya MitraNo ratings yet

- 0609170312main - Afd DL - 6 Sep 17 - All PDFDocument267 pages0609170312main - Afd DL - 6 Sep 17 - All PDFNishant MishraNo ratings yet

- MPRA Paper 43313Document43 pagesMPRA Paper 43313Deepraj DasNo ratings yet

- Nifty 50 Stocks ListDocument2 pagesNifty 50 Stocks ListNaveen ShivegowdaNo ratings yet

- Review of LiteratureDocument8 pagesReview of LiteratureChandruNo ratings yet

- Parliamentary Election Impact W14299-PDF-ENGDocument8 pagesParliamentary Election Impact W14299-PDF-ENGHarshit ShubhankarNo ratings yet

- L Project of FiiDocument53 pagesL Project of Fiimanisha_mithibaiNo ratings yet

- Securities LawFinalDocument31 pagesSecurities LawFinalRaj Narayan VermaNo ratings yet

- Perception of Derivatives at SMC Investment Project ReportDocument108 pagesPerception of Derivatives at SMC Investment Project ReportBabasab Patil (Karrisatte)No ratings yet

- Site Id Site Name Circle Discom Consumer NoDocument15 pagesSite Id Site Name Circle Discom Consumer NoJay BachhaneNo ratings yet