Professional Documents

Culture Documents

Daily Updates - March 28

Uploaded by

rksapsecgrc010Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Updates - March 28

Uploaded by

rksapsecgrc010Copyright:

Available Formats

DAILY MARKET UPDATE – (28/03/2024)

Indian Stock Market Outlook for March 28

➢ The domestic equity indices, Sensex and Nifty 50,

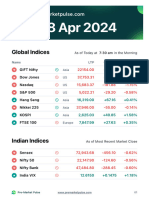

INDICES CLOSE CHANGE %

are expected to open on a flat note Thursday tracking

SENSEX 72,996.31 +0.73%

mixed global market cues.

NIFTY 50 22,123.65 +0.54%

➢ Gift Nifty was trading around the 22,173 level, a

premium of nearly 6 points from the Nifty futures’ BANKNIFTY 46,785.95 +0.40%

previous close. S&P 500 5,248.49 +0.86%

➢ The Sensex rallied 526.01 points, or 0.73%, to end NASDAQ 16,399.52 +0.51%

at 72,996.31, while the Nifty 50 settled 118.95 NIKKEI 225 40,268.08 -1.21%

points, or 0.54%, higher at 22,123.65.

HANG SENG 16,418.00 +0.15%

Key Market Developments Overnight

➢ US Stock Market: On Wednesday, the US stock market indices closed higher, with the S&P 500

reaching a new record high, anticipating the release of inflation data and commentary from the US

Federal Reserve that would provide insights into its future interest rate decisions.

➢ Asian Markets: On Thursday, Asian markets experienced a downturn, although Australian stocks

reached an all-time high. Japan's Nikkei 225 dropped by 0.98%, and the Topix saw a significant decline

of 1.08%. South Korea's Kospi decreased by 0.19%, while futures for Hong Kong's Hang Seng index

suggested a weaker opening.

➢ Indian Stock Market On Wednesday, the Indian stock market indices ended with decent gains led by

a rally in index heavyweights, with the benchmark Nifty 50 closing above the 22,100 level.

➢ Gift Nifty: Gift Nifty was hovering around the 22,173 mark, maintaining a premium of approximately

6 points compared to the previous close of Nifty futures. This suggests a neutral opening for the Indian

stock market indices.

➢ T+0 Settlement Cycle: The BSE and NSE stock exchanges have unveiled the roster of 25 stocks

qualifying for the abbreviated T+0 settlement cycle, effective from today, March 28th. This T+0

settlement option will be voluntary for these 25 stocks and will apply solely to trades conducted

between 9:15 am and 1:30 pm.

➢ Oil Prices: Crude oil prices climbed, poised for a robust quarterly increase driven by anticipations of

OPEC reducing supplies. West Texas Intermediate increased by 0.49% to $81.75 per barrel following

a slight decline over two days, while Brent crude rose by 0.31% to $86.36.

Stocks to Watch: March 28

➢ Dr Reddy’s Laboratories: Dr. Reddy's Laboratories has forged a distribution alliance with Sanofi

Healthcare India Private Limited. Through this partnership, Dr. Reddy's will market and distribute

Sanofi's vaccine brands in India, encompassing established pediatric and adult vaccines, thereby

enhancing healthcare provisions in the nation.

➢ Zydus Lifesciences: Zydus Lifesciences underwent a cGMP inspection by the USFDA at its

manufacturing facility in Ahmedabad from March 18 to March 27, 2024. The inspection resulted in

four observations, underscoring the company's dedication to quality compliance.

➢ Exide Industries: Exide Industries has infused Rs 34.99 crore through subscription into the equity

share capital of its wholly-owned subsidiary, Exide Energy Solutions (EESL), on a rights basis. With

this addition, the Company's total investment in EESL amounts to Rs. 2,000 crore. The acquisition does

not alter the Company's shareholding percentage in EESL.

➢ Bajaj Finance: According to sources familiar with the matter speaking to NDTV Profit, the non-

banking financial company is considering an initial public offering (IPO) with a potential size of $1

billion. Bajaj Finance is reportedly aiming for a valuation of $10 billion. However, discussions are still

in the early stages, and nothing has been finalized yet.

*******************************

You might also like

- R12 Month End and Year End Close User GuideDocument16 pagesR12 Month End and Year End Close User GuideHaslina Hasan100% (2)

- Notice To Pay or Quit 1Document3 pagesNotice To Pay or Quit 1AngieNo ratings yet

- E L D 20 A: Quity Research AB: Erivative TH PrilDocument9 pagesE L D 20 A: Quity Research AB: Erivative TH PrilAru MehraNo ratings yet

- Forex Assassin Outside DayDocument19 pagesForex Assassin Outside DayDavidNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- Internship Report On Meezan Bank LimitedDocument24 pagesInternship Report On Meezan Bank LimitedZIA UL REHMANNo ratings yet

- Growth GenerationDocument16 pagesGrowth Generationcguerin100% (2)

- Modern Project Management PDFDocument236 pagesModern Project Management PDFGift SimauNo ratings yet

- Daily Updates - April 01Document2 pagesDaily Updates - April 01rksapsecgrc010No ratings yet

- Daily Updates - March 27Document2 pagesDaily Updates - March 27rksapsecgrc010No ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- 1511 Market Closing CommentsDocument4 pages1511 Market Closing Commentssausudipta6No ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Sensex Rallies Over 400 Points in Early Trade Nifty Tops 14,800Document2 pagesSensex Rallies Over 400 Points in Early Trade Nifty Tops 14,800Abhijeet SinghNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Apr 25 Morning NewsDocument2 pagesApr 25 Morning Newssk5794657No ratings yet

- Daily Market Briefing 21-03-2024Document5 pagesDaily Market Briefing 21-03-2024Shaikh ParvezNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Markets Crosses Psychological Threshold On Cues From FIIs - Morning Outlook For 22 Sep by MansukhDocument5 pagesMarkets Crosses Psychological Threshold On Cues From FIIs - Morning Outlook For 22 Sep by MansukhMansukhNo ratings yet

- Market Outlook 13 September 2010Document5 pagesMarket Outlook 13 September 2010Mansukh Investment & Trading SolutionsNo ratings yet

- Strong Global Cues Regather The Bullish Sentiment - Markets Outlook For 7 Oct - by MansukhDocument5 pagesStrong Global Cues Regather The Bullish Sentiment - Markets Outlook For 7 Oct - by MansukhMansukhNo ratings yet

- Market Outlook For 30 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 30 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 04/06/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 04/06/2010MansukhNo ratings yet

- Market Outlook 27th February 2024Document2 pagesMarket Outlook 27th February 2024Pratham AgarwalNo ratings yet

- Markets For You - 19 February 2015Document2 pagesMarkets For You - 19 February 2015Rahul SaxenaNo ratings yet

- Market HighlightDocument11 pagesMarket HighlightmanindarNo ratings yet

- MCX PDFDocument2 pagesMCX PDFDynamic LevelsNo ratings yet

- Treasury Daily 01 29 16Document5 pagesTreasury Daily 01 29 16patrick-lee ellaNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Erivati VE Eport RD ARDocument9 pagesErivati VE Eport RD ARAru MehraNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Daily Equty Report by Epic Research - 29 June 2012Document10 pagesDaily Equty Report by Epic Research - 29 June 2012Arthur GentryNo ratings yet

- E R L D R 5: Quity Esearch AB Erivative Eport THDocument9 pagesE R L D R 5: Quity Esearch AB Erivative Eport THAru MehraNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- Morning Note 01 JULY 2011: Mansukh Securities and Finance LTDDocument5 pagesMorning Note 01 JULY 2011: Mansukh Securities and Finance LTDMansukh Investment & Trading SolutionsNo ratings yet

- Quity Research AB: Erivative Report ST Arch: E L D 1 MDocument9 pagesQuity Research AB: Erivative Report ST Arch: E L D 1 MAru MehraNo ratings yet

- Market Outlook For 28 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 28 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- 82 Smallcaps Gain Between 10-39 - As Record Rally ContinuesDocument2 pages82 Smallcaps Gain Between 10-39 - As Record Rally ContinuesmunniNo ratings yet

- Daily Post Market Briefing 20-03-2024Document9 pagesDaily Post Market Briefing 20-03-2024Kamal MeenaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- T I M E S: Market Yearns For Fresh TriggersDocument22 pagesT I M E S: Market Yearns For Fresh TriggersDhawan SandeepNo ratings yet

- E L D 18 A: Quity Rese Arch AB: Eriva Tive R Eport TH PrilDocument9 pagesE L D 18 A: Quity Rese Arch AB: Eriva Tive R Eport TH PrilAru MehraNo ratings yet

- Capitalbuilderdaily PDFDocument5 pagesCapitalbuilderdaily PDFCapital Buildr Financial ServicesNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Market Outlook For 04 Feb - Cautiously OptimisticDocument5 pagesMarket Outlook For 04 Feb - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- IT Heavyweights Under PressureDocument3 pagesIT Heavyweights Under PressureDynamic LevelsNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Markets For You - 24 March 2015Document2 pagesMarkets For You - 24 March 2015Rahul SaxenaNo ratings yet

- Daily 16.04.2014Document1 pageDaily 16.04.2014FEPFinanceClubNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Markets For You - March 24 2023Document2 pagesMarkets For You - March 24 2023annkrag786No ratings yet

- Market Report: Index Close Change % ChangeDocument3 pagesMarket Report: Index Close Change % ChangeRonit SinghNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Daily Equty Report by Epic Research - 10 July 2012Document8 pagesDaily Equty Report by Epic Research - 10 July 2012Raphael AndersonNo ratings yet

- Markets For You - 25 February 2015Document2 pagesMarkets For You - 25 February 2015Rahul SaxenaNo ratings yet

- Niveshdaily: From Research DeskDocument8 pagesNiveshdaily: From Research DeskRaunak MotwaniNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Stock Tips For The WeekDocument9 pagesStock Tips For The WeekDasher_No_1No ratings yet

- Problems On Bond and Equity ValuationDocument3 pagesProblems On Bond and Equity ValuationVishnu PrasannaNo ratings yet

- Internship Report On Loan & Advances of Bank Asia LimitedDocument48 pagesInternship Report On Loan & Advances of Bank Asia LimitedFahim100% (6)

- Laporan Tahunan 2019 PerusahaanDocument393 pagesLaporan Tahunan 2019 PerusahaanAnton SuryantoNo ratings yet

- NextDocument38 pagesNextSruthy MenonNo ratings yet

- Noble 8 CPlan N8 V 9Document7 pagesNoble 8 CPlan N8 V 9Kofi DanielNo ratings yet

- Intl Legal Guide To Corp Recovery & InsolvencyDocument257 pagesIntl Legal Guide To Corp Recovery & InsolvencyVJ FernandezNo ratings yet

- Ba323 - Exam 1 Study GuideDocument1 pageBa323 - Exam 1 Study Guideemily kleitschNo ratings yet

- 2021 Cfas Mte Wreviewer QuizletDocument144 pages2021 Cfas Mte Wreviewer QuizletCleofe Mae Piñero AseñasNo ratings yet

- 1454758423780Document3 pages1454758423780Deepak MishraNo ratings yet

- Practice Set 1 ABC-3Document3 pagesPractice Set 1 ABC-3reiNo ratings yet

- Ju 1Document1 pageJu 1lesly malebrancheNo ratings yet

- RFBT 8714 Banking LawsDocument13 pagesRFBT 8714 Banking LawsMarkNo ratings yet

- BECG.l-10A.cg Committees (Contd)Document12 pagesBECG.l-10A.cg Committees (Contd)abhishek fanseNo ratings yet

- Asx24 Contract SpecificationsDocument42 pagesAsx24 Contract SpecificationsJohn SalazarNo ratings yet

- Jadual PG Sept13Document2 pagesJadual PG Sept13Ibrahim ShareefNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document29 pagesWhy Study Money, Banking, and Financial Markets?Lazaros KarapouNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Revised AnnexureDocument2 pagesRevised AnnexureMohsin ShaikhNo ratings yet

- Abraaj Group ScandalDocument6 pagesAbraaj Group ScandalshahrukhNo ratings yet

- Understanding The Accounting Cycle in Trading BusinessDocument4 pagesUnderstanding The Accounting Cycle in Trading BusinessHafidzi Derahman100% (1)

- Financial Statement For Quiz 3 PDFDocument4 pagesFinancial Statement For Quiz 3 PDFJiaXinLimNo ratings yet

- Cambodia - in Depth Study On Electricity Cost and Supplies 2015Document89 pagesCambodia - in Depth Study On Electricity Cost and Supplies 2015Vibol SanNo ratings yet

- Pob BookDocument66 pagesPob BookGianna WalkerNo ratings yet