Professional Documents

Culture Documents

Lecture 8

Uploaded by

Ryal GiggsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 8

Uploaded by

Ryal GiggsCopyright:

Available Formats

LECTURE 8 – CASH FLOW FORECAST PRACTICE

QUESTION

Poppy Patel runs a market stall selling fresh and dried flowers. She has a mix of

drop in customers and business contracts with hotels, conference centres and

restaurants. She estimates that 30% of sales revenue will come from drop in

customers who will pay in cash and the remaining 70% will come from business

contracts to whom she gives 2 months credit.

On the 1st January she has £400 in the bank and is owed £300 relating to previous

November sales and £450 relating to previous December sales.

Forecasts suggest that sales in the first quarter will be £750 per month and £1,000

per month in the second quarter (these figures include both cash and credit sales).

Poppy expects to make an extra £75 per month delivering flowers for special

occasions.

The cost of flowers and other materials will be approximately 60% of the monthly

sales per month. Her supplier gives her 1 month’s credit. At the 1 st January she owes

£280 to suppliers for purchases in previous December.

The rent of the stall is £2,000 per annum payable quarterly in advance on the first

day of each quarter. Advertising will cost £200 in the first month and £25 per month

subsequently, payable within the month.

She pays her cousin £300 per month cash to cover her times away from the stall.

Delivery costs are £50 per month payable in the month in which they are incurred.

Miscellaneous expenses will be £70 per month in the first quarter and £80 per month

thereafter, again payable in month in which they are incurred.

PREPARE A CASH FLOW FORECAST FOR POPPY PATEL FOR THE FIRST 6

MONTHS OF THE YEAR.

Does Poppy make any money and what can she do if she has a cash

deficit?

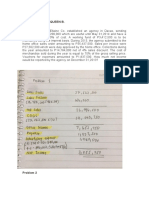

SALES JAN FEB MARCH APRIL MAY JUNE TOTAL

WORKING W1

Total Sales

Cash sales

receipts

Credit sales

receipts

Trade receivable

b/f

Total cash

received

PURCHASE JAN FEB MARCH APRIL MAY JUNE TOTAL

WORKING W2

Total purchases

Credit purchases

Trade payable

b/f

Total cash paid

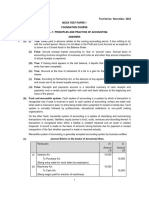

Poppy Patel Cash Flow Forecast for the Period from 1 January to 30 June

Fe

RECEIPTS/CASH IN Jan b March April May June Total

Sales cash received (W1)

Special Deliveries

TOTAL RECEIPTS/CASH IN

PAYMENTS/CASH OUT

Revenue Expenses:

Purchases cash paid (W2)

Rent

Delivery Costs

Miscellaneous expenses

Advertising

Salaries

TOTAL PAYMENTS/CASH OUT

NET RECEIPTS

OPENING BALANCE

CLOSING BALANCE

You might also like

- Budget Preparation ExampleDocument3 pagesBudget Preparation ExampleCHERIE MAY ANGEL QUITORIANONo ratings yet

- Cash BudgetDocument2 pagesCash BudgetYu BabylanNo ratings yet

- Cash Discount - Supplementary ProblemsDocument2 pagesCash Discount - Supplementary ProblemsRafael OcampoNo ratings yet

- CVP AnalysisDocument2 pagesCVP Analysisjhean dabatosNo ratings yet

- Course Project A - ACCT505Document3 pagesCourse Project A - ACCT505xlh1hdv50% (2)

- Instructions ACCT 505 Project ADocument3 pagesInstructions ACCT 505 Project ANot listingNo ratings yet

- Lecture 3 ExercisesDocument2 pagesLecture 3 ExercisesSam TaylorNo ratings yet

- God Is GoodDocument12 pagesGod Is GoodBekama Abdii Koo TesfayeNo ratings yet

- Selected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamDocument4 pagesSelected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamAdam Khaleel0% (1)

- Case Study 1Document4 pagesCase Study 1MariaNo ratings yet

- Master Budget With Supporting SchedulesDocument15 pagesMaster Budget With Supporting Schedulesanika fierroNo ratings yet

- Cash Flow PracticeDocument1 pageCash Flow PracticeShanai WilliamsNo ratings yet

- BA 115 - Master Budgeting ExercisesDocument2 pagesBA 115 - Master Budgeting ExercisesLance EstopenNo ratings yet

- Financial Management Practice Problem - Financial PlanningDocument4 pagesFinancial Management Practice Problem - Financial PlanningJeremy James AlbayNo ratings yet

- SMM335 Cash Budgeting Exercise 201920Document1 pageSMM335 Cash Budgeting Exercise 201920asdfNo ratings yet

- D NG BT Tong Hop Cuoi KyDocument1 pageD NG BT Tong Hop Cuoi KyNgọc Trung Học 20No ratings yet

- As A Preliminary To Requesting Budget Estimates of SalesDocument4 pagesAs A Preliminary To Requesting Budget Estimates of SalesChiodos OliverNo ratings yet

- Chapter 1 and 2 Additional ProblemsDocument3 pagesChapter 1 and 2 Additional ProblemsChristlyn Joy BaralNo ratings yet

- Tadena, Meleen Queen B. Problem 1Document2 pagesTadena, Meleen Queen B. Problem 1Meleen TadenaNo ratings yet

- Budgeted Cash Disbursements For Merchandise PurchasesDocument27 pagesBudgeted Cash Disbursements For Merchandise PurchasesMavis LiuNo ratings yet

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- Budget Preparation Abm BDocument3 pagesBudget Preparation Abm BCHERIE MAY ANGEL QUITORIANONo ratings yet

- FABM2 Sample ProblemsDocument2 pagesFABM2 Sample ProblemsnahatdoganNo ratings yet

- Modul Lab. Akuntansi Manajemen 2 - L22.23Document34 pagesModul Lab. Akuntansi Manajemen 2 - L22.23Aniedhea LissudaNo ratings yet

- BudgetingDocument2 pagesBudgetingGrace joNo ratings yet

- Cash Flow HWDocument1 pageCash Flow HWRavindran MenonNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- Budgeted Cash Disbursements For Merchandise Purchases Course Project ADocument19 pagesBudgeted Cash Disbursements For Merchandise Purchases Course Project AitlnkickerNo ratings yet

- Case 1Document3 pagesCase 1silvia_mousaNo ratings yet

- Performance Task No 2 - Group Work - Planning Concepts and Tools P1Document8 pagesPerformance Task No 2 - Group Work - Planning Concepts and Tools P1Corn SaladNo ratings yet

- Business Math Grade 12 Week 1Document1 pageBusiness Math Grade 12 Week 1jpauline922No ratings yet

- BFIN400 Quiz One V3Document1 pageBFIN400 Quiz One V3Mohammad Al AkoumNo ratings yet

- The Sharpe Corporation S Projected Sales For The First 8 MonthsDocument1 pageThe Sharpe Corporation S Projected Sales For The First 8 MonthsAmit PandeyNo ratings yet

- Cash Budget PDFDocument4 pagesCash Budget PDFRiteshHPatelNo ratings yet

- Cash BudgetDocument3 pagesCash BudgetJann Kerky0% (1)

- Problem 4Document1 pageProblem 4AlexNo ratings yet

- CP 7 TemplatesDocument13 pagesCP 7 Templatessunnitd10No ratings yet

- Part IIDocument11 pagesPart IINCTNo ratings yet

- Accounting 13: Midterm ExaminationDocument1 pageAccounting 13: Midterm ExaminationKarl Joseff Auxilio SarigumbaNo ratings yet

- Incomplete RecordsDocument2 pagesIncomplete RecordsOkasha AliNo ratings yet

- Quiz Budgeting and Standard CostingDocument2 pagesQuiz Budgeting and Standard CostingAli SwizzleNo ratings yet

- Three Column Cash BookDocument2 pagesThree Column Cash Bookdeklerkkimberey45No ratings yet

- DiscountsDocument3 pagesDiscountsMemory BwalyaNo ratings yet

- Investment in Equity Securities Additional ProblemsDocument1 pageInvestment in Equity Securities Additional Problemscristinelarita18No ratings yet

- Cash Budget Problem 1. Mercury Shoes IncDocument7 pagesCash Budget Problem 1. Mercury Shoes IncMaritess Munoz100% (1)

- BFIN - 10 Financial Planing Tools and Concepts Production BudgetDocument25 pagesBFIN - 10 Financial Planing Tools and Concepts Production BudgetAnne Reshier100% (2)

- Fin542 Individual AssDocument8 pagesFin542 Individual AssImran AziziNo ratings yet

- Toaz - Info Auditing PRDocument22 pagesToaz - Info Auditing PRAlbert pendangNo ratings yet

- Op Budget SampleDocument2 pagesOp Budget SampleAngelica MalpayaNo ratings yet

- Managing Tools ActivityDocument3 pagesManaging Tools ActivityCristelyn TomasNo ratings yet

- Buscmb - 3Rd FQ: How Much Is The Translated Profit or Loss?Document16 pagesBuscmb - 3Rd FQ: How Much Is The Translated Profit or Loss?melody gerongNo ratings yet

- Chapter2 Statement of Comprehensive IncomeDocument46 pagesChapter2 Statement of Comprehensive IncomeRonald De La Rama100% (1)

- Aletable (Antonio, Aguinaldo)Document2 pagesAletable (Antonio, Aguinaldo)Jherslley AntonioNo ratings yet

- Module 1 Assignment and QuizDocument2 pagesModule 1 Assignment and QuizKim Patrick VictoriaNo ratings yet

- Personal Budget Planner (James - Question)Document3 pagesPersonal Budget Planner (James - Question)tom willetsNo ratings yet

- Foreign Currency Transactions2019Document6 pagesForeign Currency Transactions2019Jeann MuycoNo ratings yet

- History Society 1Document24 pagesHistory Society 1isatreasurerNo ratings yet

- FIN1000 Module06 Budgeting AssignmentDocument2 pagesFIN1000 Module06 Budgeting AssignmentKenneth Kibata0% (1)

- Master Budget-WPS OfficeDocument12 pagesMaster Budget-WPS OfficeRean Jane EscabarteNo ratings yet

- Example To Accompany Tutorial 6 Walker Sweets Inc. (WSI) (Statement of Income and Statement of Financial Position)Document2 pagesExample To Accompany Tutorial 6 Walker Sweets Inc. (WSI) (Statement of Income and Statement of Financial Position)richelyn velardeNo ratings yet

- Tugas Ch.20Document9 pagesTugas Ch.20Chupa HesNo ratings yet

- Tibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRDocument33 pagesTibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRjoshuaNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Residential StatusDocument11 pagesResidential StatusSaurav MedhiNo ratings yet

- Salaries & Wages - Regular Payroll PERA . Due To BIRDocument7 pagesSalaries & Wages - Regular Payroll PERA . Due To BIRAyie RomeroNo ratings yet

- Income Tax RefundDocument3 pagesIncome Tax RefundAKHiiLESH BhamaNo ratings yet

- Accounting 3 4 Module 5bDocument2 pagesAccounting 3 4 Module 5bMariel Ann RebancosNo ratings yet

- Review MAS - Variable & Absorption CostingDocument6 pagesReview MAS - Variable & Absorption CostingRj ArevadoNo ratings yet

- Journal Entries: ACC111 Froilan LabausaDocument3 pagesJournal Entries: ACC111 Froilan LabausaDenise Ortiz ManolongNo ratings yet

- Tax July 21 SugesstedDocument28 pagesTax July 21 SugesstedShailjaNo ratings yet

- Small Business Cash Flow Projection1Document5 pagesSmall Business Cash Flow Projection1ziggyNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- So Sánh S Khác Nhau Gi A IFRS 15 Và VAS 14Document2 pagesSo Sánh S Khác Nhau Gi A IFRS 15 Và VAS 14Châu KhánhNo ratings yet

- BIR Ruling 293-2015 - Productivity Incentive (De Minimis)Document5 pagesBIR Ruling 293-2015 - Productivity Incentive (De Minimis)Jerwin DaveNo ratings yet

- Computation of Income Tax LiabilityDocument6 pagesComputation of Income Tax LiabilityAbdullah QureshiNo ratings yet

- Understanding and Analysis and Interpretation of Financial StatementsDocument18 pagesUnderstanding and Analysis and Interpretation of Financial StatementsLara FloresNo ratings yet

- FA AnswersDocument12 pagesFA AnswersErica XaoNo ratings yet

- Capital Gains Taxes and Offshore Indirect TransfersDocument30 pagesCapital Gains Taxes and Offshore Indirect TransfersReagan SsebbaaleNo ratings yet

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiNo ratings yet

- PD 1445 Chapter 4 Section 56 57 Jeremias F. Masapol Jr.Document4 pagesPD 1445 Chapter 4 Section 56 57 Jeremias F. Masapol Jr.Eric D. ValleNo ratings yet

- Taxes and CashFlow ExercisesDocument7 pagesTaxes and CashFlow ExercisesNelson NofantaNo ratings yet

- CBDT Circular No. 9 2023Document1 pageCBDT Circular No. 9 2023ABUBAKARNo ratings yet

- June 2021Document82 pagesJune 2021刘宝英100% (1)

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Fabm 2 Reviewer Statement of Financial Position (SFP)Document3 pagesFabm 2 Reviewer Statement of Financial Position (SFP)Bealou CastillonNo ratings yet

- Book ValueDocument57 pagesBook ValuebillyNo ratings yet

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- Gam EntriesDocument4 pagesGam EntriesjanineNo ratings yet

- TCS Payslip Jul-OctDocument4 pagesTCS Payslip Jul-OctSharad WasreNo ratings yet