Professional Documents

Culture Documents

FABM2 Sample Problems

Uploaded by

nahatdoganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FABM2 Sample Problems

Uploaded by

nahatdoganCopyright:

Available Formats

FABM 2 - INCOME AND BUSINESS TAXATION

(Purely from compensation income, Income from business- Self-employed and or professionals, and Mixed

income earners)

ILLUSTRATION #1

Rosario San Pedro, single and a resident citizen, is a minimum wage earner (MWE) with a gross

compensation income for the year 2018 of P180,000. She works as a finance assistant of BIG Corporation in

the Philippines. In addition to her basic salary, Ms. San Pedro also earned a 13th month pay of P15,000,

overtime pay amounting to P100,000, night shift differential of P30,000, and holiday pay of P25,000. Ms. San

Pedro also paid for her mandatory contributions in Social Security System (SSS), Philhealth, and Pag-IBIG, for

a total of P6,000. How much is her taxable income and income tax due?

ILLUSTRATION #2

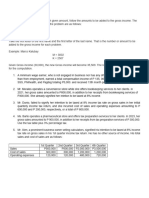

Mr. Jose Gantimpala, 33, Filipino, single, is a regular employee of Wise Marketing. He receives an annual

salary of P300,000. For 2019, he also earned an overtime pay of P50,000 and hazard pay of P57,250. He also

received his 13th month pay of P25,000 as well as other benefits amounting to P72,000. His mandatory

contributions are as follows:

SSS P9,600.00

Pag-ibig & Philhealth 4,125.00

HDMF 1,200.00

Total P14,925.00

ILLUSTRATION #3

Mrs. Rhea Alvarez, married and a resident Citizen, is a regular employee of Health is Wealth Company. She

receives monthly salary of P52,000 or P624,000 annually. For 2019, she has also received her 13th month

pay and other benefits amounting to P109,000. Her mandatory contributions are as follows:

SSS P9,600.00

Philhealth 8,250.00

Pag-IBIG 1,200.00

Total P19,050.00

ILLUSTRATION #4

Ms. Terry operates a convenience store while she offers bookkeeping services to her clients.

In 2018, her gross sales amounted to P800,000.00, in addition to her receipts from bookkeeping services of

P300,000.00. She already signified her intention to be taxed at 8% income tax rate in her 1st quarter return.

Her income tax liability for the year will be computed as follows:

ILLUSTRATION #5

Ms. Terry above, failed to signify her intention to be taxed at 8% income tax rate on gross sales in her initial

Quarterly Income Tax Return, and she incurred cost of sales and operating expenses amounting to

P600,000.00 and P200,000.00, respectively, or a total of P800,000.00.

The income tax shall be computed as follows:

ILLUSTRATION #6

Christy operates an online retail store and works as a freelancer providing digital marketing services. This year

she earned P1,200,000 from her retail activity and P700,000 from her freelancing work. Her cost of sales for

the retail activity is P650,000 on top of other operating expenses amounting to P230,000.

Compute the income tax due:

a. 8% tax rate

b. Graduated rate

ILLUSTRATION #7

Mr. Madz, a Financial comptroller of JAC Company, earned annual compensation in 2018 of P1,500,000.00,

inclusive of 13th month and other benefits in the amount of P120,000.00 but net of mandatory contributions to

SSS and Philhealth. Aside from employment income, he owns a convenience store, with gross sales of

P2,400,000. His cost of sales and operating expenses are P1,000,000.00 and P600,000.00, respectively, and

with non-operating income of P100,000.00.

CONTINUATION OF SAMPLE ILLUSTRATION 1

On February 2019, taxpayer tendered his resignation to concentrate on his business. His total compensation

income amounted to P150,000.00, inclusive of benefits of P20,000.00. His business operations for the taxable

year 2019 remains the same. He opted for the eight percent (8%) income tax rate.

ILLUSTRATION #8

Mr. Wayne, an officer of BATS International Corp., earned in 2018 an annual compensation of P1,200,000.00,

inclusive of the 13th month and other benefits in the amount of P120,000.00. Aside from employment income,

he owns a farm, with gross sales of P3,500,000. His cost of sales and operating expenses are P1,000,000.00

and P600,000.00, respectively, and with non-operating income of P100.000.00. His tax due for 2018 shall be

computed as follows:

ILLUSTRATION #9

Belle, an accounting clerk in ABC Marketing generated an annual compensation income of P615,000. Her

statutory contributions are as follows:

SSS-P6,975.60; Philhealth-P5,250; Pag-ibig-P1,200; 13th month pay and other bonuses-P61,250.

She has also a grocery store with gross sales of P475,000.00 every quarter of the taxable year. The annual

cost of sales is 40% of annual gross sales and operating expenses is 60% of gross profit. Compute the

taxable income and total tax due if:

a. Belle availed of the 8% Tax Rate

b. Belle opted to Graduated Rate

C. How much is her total due (PIT and Business Tax)?

D. Which option is favorable to Belle?

You might also like

- SW03Document11 pagesSW03Nadi HoodNo ratings yet

- 1099-K SampleDocument1 page1099-K SampleAnonymous FR8yGDSVgNo ratings yet

- 1 Condidional Acceptance IRS 3176C VerdanaDocument6 pages1 Condidional Acceptance IRS 3176C VerdanaKenneth Michael DeLashmuttNo ratings yet

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Income Tax Finals Sample Questions Final ExamDocument19 pagesIncome Tax Finals Sample Questions Final ExamAnie P. Martinez0% (1)

- Tax-on-Individuals PhilippinesDocument21 pagesTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- INCOME TAX OF INDIVIDUALS Part 2 PDFDocument3 pagesINCOME TAX OF INDIVIDUALS Part 2 PDFADNo ratings yet

- Council Tax Bill 2023/24Document2 pagesCouncil Tax Bill 2023/24shahin.imani69No ratings yet

- A Complete Thrift Store Business Plan: A Key Part Of How To Start A Resale ShopFrom EverandA Complete Thrift Store Business Plan: A Key Part Of How To Start A Resale ShopRating: 3.5 out of 5 stars3.5/5 (2)

- Computation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineDocument1 pageComputation Details: Ali Hassan M. Lucman Jr. Hermeno A. PalamineKobi SaibenNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- Tax On Idividuals: Practice ProblemsDocument17 pagesTax On Idividuals: Practice ProblemsLealyn CuestaNo ratings yet

- Final Examination BUSCOMDocument21 pagesFinal Examination BUSCOMToni Marquez100% (1)

- Payslip: Employee Details Payment & Leave DetailsDocument1 pagePayslip: Employee Details Payment & Leave DetailsKushal MalhotraNo ratings yet

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Incotax Quiz 1Document7 pagesIncotax Quiz 1Claire RecioNo ratings yet

- Laguna College of Business and Arts Midterm Exam Tax 202: Income TaxationDocument3 pagesLaguna College of Business and Arts Midterm Exam Tax 202: Income TaxationPam G.No ratings yet

- FABM2 Sample ProblemsDocument2 pagesFABM2 Sample ProblemsnahatdoganNo ratings yet

- Seatwork On Income Taxation NameDocument2 pagesSeatwork On Income Taxation NameVergel MartinezNo ratings yet

- Mixed Income QuestionDocument1 pageMixed Income QuestionJohn Alfred CastinoNo ratings yet

- Income Tax Seatwork OnDocument8 pagesIncome Tax Seatwork OnVergel Martinez100% (1)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- Enabling Assessment 4Document7 pagesEnabling Assessment 4Nicole BatoyNo ratings yet

- Enabling Assessment 4 1Document6 pagesEnabling Assessment 4 1Lhulaan OrdanozoNo ratings yet

- TaxDocument4 pagesTaxCielito AlvarezNo ratings yet

- IllustrationsDocument3 pagesIllustrationsKristine Ira ConcepcionNo ratings yet

- Assignment Do It Yourself (Diy)Document3 pagesAssignment Do It Yourself (Diy)Marites AmorsoloNo ratings yet

- RIT IndividualsDocument1 pageRIT IndividualsMary Jane MaralitNo ratings yet

- Tax Revenue Regulation Illustrative Problems Compilation iCPA NotesDocument13 pagesTax Revenue Regulation Illustrative Problems Compilation iCPA Notesmendoza.adrianeNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Income Tax On Individuals (Part 3)Document13 pagesIncome Tax On Individuals (Part 3)Jamielene TanNo ratings yet

- 0H9SNRYTRDocument16 pages0H9SNRYTRLoey ParkNo ratings yet

- SeatworkDocument1 pageSeatworkZtrick 1234No ratings yet

- Fabm 2 Supplementary ActivityDocument2 pagesFabm 2 Supplementary ActivityFranzel Tiu MartinezNo ratings yet

- Income Taxes For IndividualsDocument30 pagesIncome Taxes For IndividualsDarrr RumbinesNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Income Tax On Individuals (Part 2)Document7 pagesIncome Tax On Individuals (Part 2)Jamielene TanNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- Income Taxation: Tabian, Jieza Syra A. 2018-017-4883Document30 pagesIncome Taxation: Tabian, Jieza Syra A. 2018-017-4883WAYNENo ratings yet

- GT1 IncotaxDocument10 pagesGT1 IncotaxAndree PereaNo ratings yet

- Sample Tax ComputationEXDocument2 pagesSample Tax ComputationEXAngelica RubiosNo ratings yet

- Activity 1Document4 pagesActivity 1LFGS Finals50% (2)

- Practical QuizDocument4 pagesPractical QuizKathlyn PostreNo ratings yet

- Assignment No. 3 Income Taxation 2nd Sem AY 2020 2021Document12 pagesAssignment No. 3 Income Taxation 2nd Sem AY 2020 2021Gabrielle Marie RiveraNo ratings yet

- PWC NotesDocument2 pagesPWC NotesDave Mar IdnayNo ratings yet

- Quiz 1 IntaxDocument5 pagesQuiz 1 IntaxTOMAS, JACKY LOU C.No ratings yet

- TAXDocument20 pagesTAXkate trishaNo ratings yet

- Tax Pre TestDocument40 pagesTax Pre TestjohnlerrysilvaNo ratings yet

- Tax Sem OuputDocument43 pagesTax Sem OuputAshlley Nicole VillaranNo ratings yet

- Module 7 - Tax ExercisesDocument3 pagesModule 7 - Tax ExercisesjessafesalazarNo ratings yet

- Week 4 Individual-Taxpayer ActivityDocument1 pageWeek 4 Individual-Taxpayer Activityjemybanez81No ratings yet

- Income Tax - HycDocument23 pagesIncome Tax - HycRacelle FlorentinNo ratings yet

- Taxation of IndividualsDocument12 pagesTaxation of Individualsaj lopezNo ratings yet

- Answer The Following:: Airon Marwyn P. Bendaña Bsais - Ii Inclusions and Exclusions of Gross IncomeDocument3 pagesAnswer The Following:: Airon Marwyn P. Bendaña Bsais - Ii Inclusions and Exclusions of Gross IncomeAiron BendañaNo ratings yet

- TAXATIONDocument10 pagesTAXATIONJericho PapioNo ratings yet

- Department of Accountancy Income Taxation - Quizzer Answer Key Case 1Document11 pagesDepartment of Accountancy Income Taxation - Quizzer Answer Key Case 1Dominic BulaclacNo ratings yet

- Taxation On IndividualsDocument20 pagesTaxation On Individualsmisonim.eNo ratings yet

- Tax Quiz 2Document5 pagesTax Quiz 2Garcia Alizsandra L.No ratings yet

- Tax Lecture Gross IncomeDocument6 pagesTax Lecture Gross IncomeAngelojason De LunaNo ratings yet

- Problem Solving (3 Points Each) .: Father Saturnino Urios UniversityDocument3 pagesProblem Solving (3 Points Each) .: Father Saturnino Urios UniversityErykaNo ratings yet

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- ST Magdalene Completed FinalDocument10 pagesST Magdalene Completed FinalnahatdoganNo ratings yet

- FABM2 Quarter2 Notes FinalDocument15 pagesFABM2 Quarter2 Notes FinalnahatdoganNo ratings yet

- Las Fabm1 Q4 W2Document31 pagesLas Fabm1 Q4 W2nahatdoganNo ratings yet

- UCSP ReviewerDocument4 pagesUCSP ReviewernahatdoganNo ratings yet

- PHILOSOPHY Quarter 2Document8 pagesPHILOSOPHY Quarter 2nahatdoganNo ratings yet

- Applied Economics Reviewer-FinalDocument6 pagesApplied Economics Reviewer-FinalnahatdoganNo ratings yet

- FABM Notes 1 Bank ReconciliationDocument4 pagesFABM Notes 1 Bank ReconciliationnahatdoganNo ratings yet

- Income Tax Pan Services UnitDocument1 pageIncome Tax Pan Services UnitSatish NNo ratings yet

- HPCL Vizag - Price 01-05-2022Document1 pageHPCL Vizag - Price 01-05-2022rishi1122No ratings yet

- GSTR 3B Calculation Summary - JushTNDocument6 pagesGSTR 3B Calculation Summary - JushTNShail MehtaNo ratings yet

- Symphony 12 L Room /personal Air Cooler: Grand Total 5599.00Document1 pageSymphony 12 L Room /personal Air Cooler: Grand Total 5599.00Amol HalkudeNo ratings yet

- Nepal Open University: Faculty of Management and Law Office of The Dean Final Exam-2077Document2 pagesNepal Open University: Faculty of Management and Law Office of The Dean Final Exam-2077Diksha PaudelNo ratings yet

- Katyuri Chemicals & Instruments: Tax InvoiceDocument3 pagesKatyuri Chemicals & Instruments: Tax InvoiceHaridwar DepotNo ratings yet

- TC Report Annexures 28122021Document205 pagesTC Report Annexures 28122021manoharNo ratings yet

- Accounting TaxationDocument2 pagesAccounting TaxationAia Sophia SindacNo ratings yet

- Estimate #2023-125963Document1 pageEstimate #2023-125963Karthik DNo ratings yet

- Answer Keys For Midterm Exam PART 2Document3 pagesAnswer Keys For Midterm Exam PART 2Angel MaghuyopNo ratings yet

- BIR Ruling DA - (C-257) 658-09Document2 pagesBIR Ruling DA - (C-257) 658-09Aris Basco DuroyNo ratings yet

- Tax Invoice Nxg-20220032: Nextgen BroadbandDocument1 pageTax Invoice Nxg-20220032: Nextgen BroadbandKaranNo ratings yet

- DaffodilsDocument1 pageDaffodilschristyjaiNo ratings yet

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceJosty NJNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrNo ratings yet

- Range of State Corporate Income Tax RatesDocument2 pagesRange of State Corporate Income Tax Ratesgrishma14No ratings yet

- Deloitte Tax Challenge 2012Document4 pagesDeloitte Tax Challenge 2012伟龙No ratings yet

- Payslip 202001 ICP595Document1 pagePayslip 202001 ICP595Jagdhara KarthiNo ratings yet

- 270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)Document3 pages270 Fin Treasuries &accounts Dep 15-Jun-1998: Government of Tamilnadu Treasury Bill For Salary (Employee)yogarajanNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- Billing FormatDocument1 pageBilling FormatParag KhandelwalNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- Ewaybill - Master Steel - 01112019Document1 pageEwaybill - Master Steel - 01112019AshishNo ratings yet