Professional Documents

Culture Documents

Computation Details: Ali Hassan M. Lucman Jr. Hermeno A. Palamine

Uploaded by

Kobi Saiben0 ratings0% found this document useful (0 votes)

627 views1 pageOriginal Title

ONETT_EWT.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

627 views1 pageComputation Details: Ali Hassan M. Lucman Jr. Hermeno A. Palamine

Uploaded by

Kobi SaibenCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

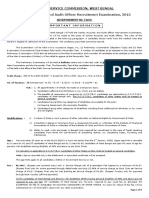

ONETT COMPUTATION SHEET

EXPANDED WITHHOLDING TAX (EWT) and DOCUMENTARY STAMP TAX (DST)

SALE OF REAL PROPERTY CONSIDERED AS ORDINARY ASSET

Revenue Region No. 16, Revenue District Office No. 100, Ozamiz City

Seller(s) Name: Adrs: TIN:

Buyer(s) Name: Adrs: TIN:

Transaction Date: Due Date (EWT): Feb 09, 1900 Due Date (DST): Feb 04, 1900

OCT/TCT/ Tax Declaration Zonal Fair Market Value Selling Tax Base (Higher of

Location Class Area (m2) ZV/sqm.

CCT No. No. (TD) Value (ZV) (FMV) per TD Price (SP) ZV/FMV/SP)

- -

- -

- -

- -

- -

TOTAL -

COMPUTATION DETAILS Per Audit Per Review

1.) EXPANDED WITHHOLDING TAX (EWT) - BIR Form 1606

TAX DUE Tax Base Rate

Legal basis: RR No. 2-98/RR No. 6-2001 (CTRP) NIRC ₱ - 1.5% -

Habitually engaged (registered with HLURB/HUDCC/6 or more transactions)? : YES

Below P500,000.00 = 1.5% 0 1.50%

P500,000.00 to P 2M = 3.0% ### 3.00%

P2M and above = 5.0% ### 5.00%

Not habitually engaged = 6.0%

LESS: Tax paid per return, if return was filed -

EWT STILL DUE / (OVERPAYMENT) -

Add: 25% Surcharge -

20% Interest per annum February 10, 1900 to Oct 29, 2020 44092 -

Compromise penalty Failure to pay: - 1,000.00 1,000.00

TOTAL AMOUNT STILL DUE ON EWT Failure to file: 1,000 1,000.00

2.) DOCUMENTARY STAMP TAX (DST) - BIR Form 2000-OT

TAX DUE

Legal basis: Sections 196 (CTRP) NIRC

- x P 15.00 for every P 1,000 or a fraction thereof -

(Tax Base)

LESS: Tax paid per return, if return was filed -

DST STILL DUE / (OVERPAYMENT) -

Add: 25% Surcharge 0 -

20% Interest per annum February 05, 1900 to Oct 29, 2020 44097 -

Compromise penalty - -

TOTAL AMOUNT STILL DUE ON DST -

TOTAL AMOUNT OF 1 & 2 1,000.00

Remarks:

To be accomplished by ONETT Team Payment verified by: To be accomplished upon review

Computed by: Reviewed by:

HOBAIB A. SAIBEN ELSIE S. VASAYA ADORA L. SIJO

ONETT Officer ONETT Member/Collection Section Chief - Assessment Division

(Signature Over Printed Name) OR No. Tax Type Payment Date (Signature Over Printed Name)

Approved by: Approved by:

ALI HASSAN M. LUCMAN JR. HERMENO A. PALAMINE

OIC- Chief, Assessment Section Reference: Regional Director

(Signature Over Printed Name) (Signature Over Printed Name)

The BIR is not precluded from assessing and collecting my deficiency internal revenue tax(es) that maybe found from the taxpayer after examination or review.

Conforme:

TAXPAYER/AUTHORIZED REPRESENTATIVE Contact Number Date

(Signature Over Printed Name)

Instruction: Prepare in duplicate and ascertain that ONETT Computation Sheet is signed by Head ONETT Team before release to taxpayer. Please attached additional sheet, if necessary.

You might also like

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- 40 NCR-SF050 - Complaint FormDocument4 pages40 NCR-SF050 - Complaint FormAnel ArenalNo ratings yet

- RDO No. 44 - Taguig-Pateros4850195872301349928Document428 pagesRDO No. 44 - Taguig-Pateros4850195872301349928Karla Katigbak100% (1)

- Affidavit Land Transfer CoopDocument1 pageAffidavit Land Transfer CoopHoward UntalanNo ratings yet

- DAR Form 1 BDocument2 pagesDAR Form 1 BJaja TamayoNo ratings yet

- Waiver of Rights To Claim: Zamora Roson That I Executed This Waiver, Freely and Voluntarily To Attest ToDocument2 pagesWaiver of Rights To Claim: Zamora Roson That I Executed This Waiver, Freely and Voluntarily To Attest ToPatricia anne CarzanoNo ratings yet

- Philippine Joint Affidavit of Transferor and Transferee Land Ownership AffidavitDocument2 pagesPhilippine Joint Affidavit of Transferor and Transferee Land Ownership AffidavitAnonymous kJPBOi0HNo ratings yet

- Affidavit of UndertakingDocument2 pagesAffidavit of UndertakingMA. JEANETTE TOLENTINONo ratings yet

- Affidavit of IntermentDocument1 pageAffidavit of IntermentRobert marollanoNo ratings yet

- Affidavit - Improvement Not Included in Sale - GuiritanDocument1 pageAffidavit - Improvement Not Included in Sale - GuiritanDeil L. NaveaNo ratings yet

- Affidavit of Loss of Sim GlobeDocument1 pageAffidavit of Loss of Sim Globejv1412No ratings yet

- Zonal Values for Properties in Roxas City, CapizDocument225 pagesZonal Values for Properties in Roxas City, CapizPaul Pabilico PorrasNo ratings yet

- Zonal Values Notice for RDO 57 - Biñan CityDocument298 pagesZonal Values Notice for RDO 57 - Biñan CitySu San100% (1)

- Affidavit of No Pending Case (DAR)Document1 pageAffidavit of No Pending Case (DAR)Rajiv Cabueñas DayNo ratings yet

- Affidavit of Non Tenancy, No Improvement, & Total Landholdings Jclarita AwasDocument1 pageAffidavit of Non Tenancy, No Improvement, & Total Landholdings Jclarita AwasJaime Gonzales100% (1)

- Deed of Absolute Sale015 7Document2 pagesDeed of Absolute Sale015 7Vince CuevasNo ratings yet

- Extra Judicial Settlement of The EstateDocument3 pagesExtra Judicial Settlement of The EstateEnerita AllegoNo ratings yet

- RDO No. 39 - South Quezon CityDocument376 pagesRDO No. 39 - South Quezon CityNotario PrivadoNo ratings yet

- Deed of SaleDocument3 pagesDeed of Salebhem silverio100% (1)

- AFFIDAVIT OF DESISTANCE - C.ViñasDocument1 pageAFFIDAVIT OF DESISTANCE - C.ViñasMai peeNo ratings yet

- Affidavit of Self-Adjudicaiton With QuitclaimDocument2 pagesAffidavit of Self-Adjudicaiton With QuitclaimDiazNo ratings yet

- Affidavit For Claiming Funeral BenefitDocument4 pagesAffidavit For Claiming Funeral BenefitRobin NicoNo ratings yet

- Affidavit of Identity of PropertyDocument1 pageAffidavit of Identity of PropertyLyn OlitaNo ratings yet

- Revised MOA Paul Andrew Pilapil Lot 1181-BDocument3 pagesRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoNo ratings yet

- Affidavit of LossDocument12 pagesAffidavit of LossKriska Herrero TumamakNo ratings yet

- Self AdjudicationDocument2 pagesSelf AdjudicationJohn Patrick IsraelNo ratings yet

- Deed of Sale of Motor VehicleDocument2 pagesDeed of Sale of Motor VehicleVicky SedanoNo ratings yet

- Affidavit Middle Name CorrectionDocument2 pagesAffidavit Middle Name Correctioncess_rmtNo ratings yet

- Deed of Sale NHADocument1 pageDeed of Sale NHAIvy Veronica Torayno Negro-Tablando100% (2)

- SPECIAL POWER OF ATTORNEY ExampleDocument2 pagesSPECIAL POWER OF ATTORNEY ExampleJohn David MontillaNo ratings yet

- RDO-Zarraga, IloiloDocument823 pagesRDO-Zarraga, IloiloDoni June Almio100% (1)

- Declaration of Heirship With SPA To Sell The Property AdjudicatedDocument2 pagesDeclaration of Heirship With SPA To Sell The Property AdjudicatedJoemar CalunaNo ratings yet

- Affidavit of Vendee To Maintain Agricultural ProductivityDocument1 pageAffidavit of Vendee To Maintain Agricultural ProductivityJ-sar CaballesNo ratings yet

- Affidavit of InsertionDocument2 pagesAffidavit of InsertionMae De GuzmanNo ratings yet

- Affidavit Change Motorcycle DenominationDocument1 pageAffidavit Change Motorcycle DenominationArkim llovitNo ratings yet

- Affidavit Request For Cancellation - MikeDocument2 pagesAffidavit Request For Cancellation - Mikemichael lumboyNo ratings yet

- Revenue Code of Las Pinas City PDFDocument105 pagesRevenue Code of Las Pinas City PDFKriszan ManiponNo ratings yet

- Republic of The Philippines Department of Justice REGISTRY OF DEEDS OFDocument2 pagesRepublic of The Philippines Department of Justice REGISTRY OF DEEDS OFAybern Phone0% (1)

- Deed of Absolute SaleDocument3 pagesDeed of Absolute SaleOgnirg OlivaNo ratings yet

- Affidavit of Change AddressDocument2 pagesAffidavit of Change Addressjoonee09100% (1)

- Affidavit of Loss-Metro Reward CardDocument2 pagesAffidavit of Loss-Metro Reward CardAljunBaetiongDiazNo ratings yet

- Special Power of Attorney TransferDocument1 pageSpecial Power of Attorney TransferOmnibus MuscNo ratings yet

- Request Affidavit Subdivide Land Tarlac PhilippinesDocument2 pagesRequest Affidavit Subdivide Land Tarlac Philippinesmichael lumboyNo ratings yet

- Affidavit of No EarningsDocument1 pageAffidavit of No EarningsPrince NeyraNo ratings yet

- OUT-OF-TOWN-AFFIDAVIT SampleDocument1 pageOUT-OF-TOWN-AFFIDAVIT SamplecathylopezNo ratings yet

- Deed of Heirship and Sale - EstinopoDocument3 pagesDeed of Heirship and Sale - EstinopoRJ BanqzNo ratings yet

- Affidavit Low Income Commercial Firm Covid-19 Generated 2020Document1 pageAffidavit Low Income Commercial Firm Covid-19 Generated 2020Rose O. DiscalzoNo ratings yet

- Joint Affidavit of Heirship (With Special Power of Attorney)Document1 pageJoint Affidavit of Heirship (With Special Power of Attorney)Agang Molina Columnas100% (1)

- Affidavit To Use PropertyDocument1 pageAffidavit To Use Propertyleomar laysonNo ratings yet

- Secretary's Certificate ReceiptsDocument1 pageSecretary's Certificate ReceiptsImelda PurificacionNo ratings yet

- Joint Affidavit of Two Disintered PersonDocument2 pagesJoint Affidavit of Two Disintered Personpaolo llegoNo ratings yet

- Affidavit documents for insurance claimsDocument22 pagesAffidavit documents for insurance claimsAn DinagaNo ratings yet

- Estate Tax Description: BIR Form 1801Document5 pagesEstate Tax Description: BIR Form 1801Razz LimpiadaNo ratings yet

- Waiver of Land RightsDocument3 pagesWaiver of Land Rightscris jaluageNo ratings yet

- Affidavit of Cancellationwith No Financial ObligationDocument1 pageAffidavit of Cancellationwith No Financial Obligationvangie alonzoNo ratings yet

- Joint Affidavit of One and The Same PersonDocument1 pageJoint Affidavit of One and The Same PersonCharisse TomaroNo ratings yet

- Affidavit of Supplemental SAMPLEDocument1 pageAffidavit of Supplemental SAMPLEErto Jaranilla100% (1)

- Retirement of Business Form-FinalDocument1 pageRetirement of Business Form-Finalfrancis helbert magallanesNo ratings yet

- Affidavit of Undertaking - Food Handlers For Business PermitDocument1 pageAffidavit of Undertaking - Food Handlers For Business PermitFrances SanchezNo ratings yet

- Onett Developer TemplateDocument6 pagesOnett Developer Templatejoeye louieNo ratings yet

- Barangay Seminar With TrainDocument31 pagesBarangay Seminar With TrainMarcial BonifacioNo ratings yet

- Acct ProDocument131 pagesAcct ProkedgeNo ratings yet

- Barangay Seminar With TrainDocument31 pagesBarangay Seminar With TrainMarcial BonifacioNo ratings yet

- Pananaw 2020 PDFDocument93 pagesPananaw 2020 PDFKobi SaibenNo ratings yet

- Rmo 35-1995Document5 pagesRmo 35-1995Juan Duma - RestauroNo ratings yet

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- Rmo 41-1991Document1 pageRmo 41-1991Kobi SaibenNo ratings yet

- 21171rr05 14Document54 pages21171rr05 14Sy HimNo ratings yet

- Microsoft CorporationDocument6 pagesMicrosoft CorporationKobi SaibenNo ratings yet

- I Am A Filipino - SkceDocument1 pageI Am A Filipino - SkceKobi SaibenNo ratings yet

- ITAD BIR Ruling No. 141-13 Dated May 21, 2013Document9 pagesITAD BIR Ruling No. 141-13 Dated May 21, 2013KriszanFrancoManiponNo ratings yet

- Module2 AE26 ITDocument7 pagesModule2 AE26 ITJemalyn PiliNo ratings yet

- Module 1-2Document24 pagesModule 1-2Jennica YoonNo ratings yet

- Karlson Software Company Is Located in State H Which EnablesDocument1 pageKarlson Software Company Is Located in State H Which EnablesMuhammad ShahidNo ratings yet

- Act ch10 l04 EnglishDocument7 pagesAct ch10 l04 EnglishLinds Rivera100% (1)

- Payroll ProjectDocument3 pagesPayroll ProjectAniyah AlonzoNo ratings yet

- Contemporaray Taxation Acc: 300: PerquisitesDocument5 pagesContemporaray Taxation Acc: 300: PerquisitesALEEM MANSOORNo ratings yet

- Front - Maintain Training FacilitiesDocument5 pagesFront - Maintain Training FacilitiesRechie Gimang AlferezNo ratings yet

- FRS 112 Defered Tax AnswersDocument10 pagesFRS 112 Defered Tax AnswersMed DausNo ratings yet

- Einvoice 1673085561210Document1 pageEinvoice 1673085561210VINIth UDHAYANo ratings yet

- DGT - 1 (Blank) PDFDocument4 pagesDGT - 1 (Blank) PDFDarwinNo ratings yet

- PriceDocument2 pagesPriceKumar GauravNo ratings yet

- Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFDocument1 pageSolved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFAnbu jaromiaNo ratings yet

- Republic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiDocument2 pagesRepublic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiHanabishi RekkaNo ratings yet

- PDF 808478730140722Document1 pagePDF 808478730140722Vishakha BhureNo ratings yet

- 1040 Tax Return SummaryDocument4 pages1040 Tax Return SummaryTrish Hit50% (2)

- Business Tax Final ExamDocument4 pagesBusiness Tax Final ExamLove RosalunaNo ratings yet

- Duties and liabilities of withholding agentsDocument2 pagesDuties and liabilities of withholding agentsAnselmo Rodiel IVNo ratings yet

- Company Budget Summary Earnings Statement Name of Hotel DateDocument1 pageCompany Budget Summary Earnings Statement Name of Hotel DatePermata Inn Hotel SlawiNo ratings yet

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Divisible Income/ (Loss) : Computation of Tax Payable For Each PartnerDocument1 pageDivisible Income/ (Loss) : Computation of Tax Payable For Each PartnerNURAISHA AIDA ATANNo ratings yet

- Bureau of Internal Revenue: Chief, Litigation DivisionDocument4 pagesBureau of Internal Revenue: Chief, Litigation DivisionGregorio de LimaNo ratings yet

- Taxpack 2004: To Help You Prepare and Lodge Your Tax ReturnDocument132 pagesTaxpack 2004: To Help You Prepare and Lodge Your Tax ReturnRanji SoulNo ratings yet

- Declaration for Remittance under Specified ListDocument1 pageDeclaration for Remittance under Specified ListSonu YadavNo ratings yet

- Final Test 1 Sol.Document3 pagesFinal Test 1 Sol.Akanksha UpadhyayNo ratings yet

- Provisions for Income Tax Article 25 InstallmentsDocument2 pagesProvisions for Income Tax Article 25 InstallmentsDaisy Anita SusiloNo ratings yet

- Kinds of Income TaxesDocument9 pagesKinds of Income TaxesRon RamosNo ratings yet

- Samity Accounts 250415Document8 pagesSamity Accounts 250415Sumanta DeNo ratings yet

- Income TaxationDocument11 pagesIncome TaxationMicah Julienne100% (1)

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023TARUN PRASADNo ratings yet