Professional Documents

Culture Documents

Inter Audit 1122333

Uploaded by

Sarabjeet SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inter Audit 1122333

Uploaded by

Sarabjeet SinghCopyright:

Available Formats

AS PER

NEW COURSE

CA INTER AUDIT

Brahmashtra

This PDF contain extract of CA

Inter Audit Concept Book

Brahmastra by CA Sarthak Jain

Ch-1 Nature , Objective and

Scope of Audit

Ch-7 Completion & Review SA

560, 570, 450, 580, 260 & 265)

Ch-11 Ethics & Terms of Audit

Engagement(Covers SQC 1, SA

210 and SA 220)

CA SARTHAK JAIN

For Further Details-

Call us- 9828067111, 9214167111

Email: ca.point.jodhpur@gmail.com

Product Enquiries: capoint.in

Updates - Subscribe CA Point Youtube Channel

Free Resoursce- tiny.cc/interresources

For Audit Books Purchase - tiny.cc/interauditbooks

For Audit Lecture Purchase - tiny.cc/auditinter

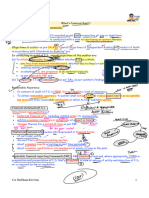

Nature, Objective & Scope of Audit

NATURE, OBJECTIVE AND

Chapter 01 SCOPE OF AUDIT

1 ORIGIN OF AUDITING

Kautilya’s Arthshastra (4th century BC) - Reference to auditing is found where

it talks about fixed accounting year, a process for closure of accounts and audit

for the same. Even there are references to misstatements in financial statements

(FS) due to abuse of power.

Origin of word “AUDIT” (Medieval times – 1100 to 1500 AD)

Auditors used to hear the accounts read out to them to check that employees were

not careless and negligent. This lead to use of word audit originating from Latin

word “audire” meaning “to hear”.

Industrial revolution in Europe (Late 18th / Early 19th Century)

Led to astronomical expansion in volume of trade and consequently demand of

auditors.

Auditor of Government Entities in India (1860)

The first Auditor General of India was appointed in British India in 1860 having

both accounting and auditing functions. Later on, office of Auditor General was

given statutory recognition. Presently, Comptroller and Auditor General of India

(C&AG) is an independent constitutional authority responsible for auditing govern-

ment receipts and expenditures.

Institute of Chartered Accountants of India (1949)

It was established as a statutory body under an Act of Parliament in 1949 for

regulating the profession of Chartered Accountancy in the country.

2 MEANING AND NATURE OF AUDITING

“An audit is an independent examination of financial information of any entity,

whether profit oriented or not, and irrespective of its size or legal form, when such

an examination is conducted with a view to expressing an opinion thereon”.

AB AUDIT HOGA SABSE SCORING FA S T 1.1

CHAPTER 1

Analysis

A Audit is an independent examination of financial information

Meaning of Independence - Judgement of a person is not subordinate to the wishes or

direction of another person who might have engaged him.

The auditor should be independent of entity under audit to form opinion without any in-

fluence.

Independence increases its ability to act objectively without any biases.

Example, Auditor appointed by a company which is owned managed by his brother or

company where he has invested in shares of the company, auditor should not

accept as his own self-interest gets involved.

B Audit can be of entity that is a

Business or a non-profit organization like an NGO or a charitable trust.

Small, medium or large organisation.

Any entity with any legal structure i.e. proprietary concern, a partnership firm, a LLP, a

private company, a public company, a society or a trust.

C The purpose of audit is to express an opinion on the FS.

Preparation and presentation of FS of an entity is responsibility of management.

The auditor expresses an opinion on FS by means of written audit report.

D Auditor to check that FS are not misleading anybody

He ensures that – (FS as per books → Supported by evidences → Nothing Omit →

Clearly → Class, disclosure, description as per AS → T&F View)

the accounts have been drawn up with reference to entries in the books of account;

the entries in the books of account are adequately supported by sufficient and ap-

propriate evidence;

none of the entries in the books of account has been omitted in the process of compilation;

the information conveyed by the statements is clear and unambiguous;

FS amounts are properly classified, described and disclosed in conformity with ac-

counting standards; and

the statement of accounts presents a true and fair picture of the operational results

and of the assets and liabilities.

1.2 FA S T CA INTER AUDIT - BY CA SJ

Nature, Objective & Scope of Audit

Auditing provides assurance. Its basic nature lies in providing assurance to users -

providing confidence to users of FS. Such an assurance lends credibility to FS.

3 AUDITING- RELATIONSHIP WITH OTHER DISCIPLINES

Auditing is interdisciplinary in nature and draws as well as make use of different

subjects. An auditor is required to have sound understanding of:

Accounting Auditing reviews the FS which are nothing but a result of the

overall accounting process hence a sound knowledge of accounting

principles is required.

Law An auditor should have a good knowledge of business laws and

taxation laws affecting the entity.

Economics Auditor is expected to be familiar with the overall economic

environment of the client in which the business is operating.

Behavioural Knowledge of human behaviour as auditor has to interact with

Science people for seeking information and making inquiries.

Statistics Knowledge of statistical sampling for meaningful conclusions.

Auditors uses statistical methods to draw samples in a scientific

manner. It is not possible for an auditor to check each and every

transaction. So, use of statistical methods to draw samples for

conducting audit is made.

Financial Auditor is expected to have knowledge about various financial

Management techniques such as working capital management, funds flow, ratio

analysis, capital budgeting etc. These also assist in applying some

audit procedures effectively. Knowledge of financial market is also

expected from auditor.

Mathematics For verification of inventories and other checks.

Data EDP auditing in itself is developing as a discipline in itself.

Processing

Good auditor is one who understands the client and his business

Production

functions such as production, cost system, marketing etc.

AB AUDIT HOGA SABSE SCORING FA S T 1.3

CHAPTER 1

4 OBJECTIVES OF AUDIT

SA-200 “Overall Objectives of the Independent auditor and the conduct of an audit

in accordance with Standards on Auditing”

In conducting audit of FS, objectives of auditor are: -

(a) To obtain reasonable assurance about whether the FS as a whole are free from

material misstatement, whether due to fraud or error, thereby enabling the

auditor to express an opinion on whether the FS are prepared, in all material

respects, in accordance with an applicable financial reporting framework; and

(b) To report on the FS, and communicate as required by the SAs, in accordance

with the auditor’s findings.

Analysis

Reasonable assurance is to be distinguished from absolute assurance.

Absolute assurance is a complete assurance or a guarantee that FS are free from

material misstatements.

However, reasonable assurance is not a complete guarantee. Although it is a high-

level of assurance but it is not complete assurance.

Audit is carried out with professional competence and skills in accordance with

Standards on Auditing.

Audit procedures are applied in accordance with SAs, audit evidence is obtained and evaluated.

On basis of that, conclusions are drawn and opinion is formed.

It leads to high level of assurance which is called as reasonable assurance but it is

not absolute assurance.

Misstatements in FS can occur due to fraud or error or both

The auditor seeks to obtain reasonable assurance whether FS as a whole are free

from material misstatements caused by fraud or error.

He has to see effect of misstatements on FS as a whole, in totality.

Opinion - FS as per applicable FRFW

Obtaining reasonable assurance that FS as a whole are free from material misstate-

ments enables the auditor to express an opinion on whether the FS are prepared, in

all material respects, in accordance with an applicable financial reporting framework.

Audit Report – As per findings

The opinion is reported and communicated in accordance with audit findings through

a written report as required by SAs.

1.4 FA S T CA INTER AUDIT - BY CA SJ

Nature, Objective & Scope of Audit

5 SCOPE OF AUDIT

(Scope refers to range or reach of something)

Purpose of an audit

To enhance the degree of confidence of intended users in the FS.

It is achieved by the expression of an opinion by the auditor on

whether the FS are prepared, in all material respects, in accord-

ance with an applicable financial reporting framework.

Users of FS

May be shareholders, employees, customers, government and

regulatory authorities, bankers etc.

Applicable financial reporting framework

Framework adopted in the preparation and presentation of the FS,

acceptable in view of the nature of the entity and the objective of

the FS, or that is required by law or regulation.

Example, in case of companies in India, financial reporting frame-

work is provided under Schedule III of Companies Act,2013.

A SCOPE OF AUDIT- WHAT IT INCLUDES

Scope of audit of FS:

(1) Coverage of all aspects of entity

All aspects of the entity relevant to the FS being audited are covered under audit.

(2) Reliability and sufficiency of financial information

By study and assessment of accounting systems and internal controls and by car-

rying out appropriate tests, enquiries and procedures auditor verifies information

contained in underlying accounting records and other source data (like bills, vouch-

ers, documents etc.) is reliable and sufficient basis for preparation of FS.

(3) Proper disclosure of financial information

FS should properly summarize transactions and events recorded therein. FS to

consider the judgments made by management in preparation of FS. For example,

choosing of appropriate accounting policies in relation to various accounting issues

like choosing method for valuation of inventories.

(4) Expression of Opinion on historical financial information

Auditor evaluates selection and consistent application of accounting policies by

AB AUDIT HOGA SABSE SCORING FA S T 1.5

CHAPTER 1

management. FS of an entity are prepared on historical financial information basis

hence audit is also based on historical financial information.

“Historical financial information” means information expressed in financial terms in

relation to a particular entity, derived primarily from that entity’s accounting sys-

tem, about economic events occurring in past time periods or about economic condi-

tions or circumstances at points in time in the past.

B SCOPE OF AUDIT- WHAT IT DOES NOT INCLUDES

Responsibility of preparation and presentation of FS – Lies with Management

Duties outside scope of competence of auditor - Auditor is not expected to perform

duties which fall outside domain of his competence, like:

Physical condition of certain assets like that of sophisticated machinery

Suitability and life of civil structures like buildings

Expertise in authentication of documents - The genuineness of documents cannot be

authenticated by him because he is not an expert in this field.

Investigation - Audit is distinct from investigation.

INVESTIGATION Vs AUDIT

An audit is not an official investigation into alleged wrong doing.

Auditors do not have any specific legal powers of search or recording statements of

witness on oath necessary for carrying out an official investigation.

Investigation is a critical examination of the accounts with a special purpose. For

example, if fraud is suspected and it is specifically called upon to check the accounts

whether fraud really exists, it takes character of investigation.

The objective of audit, is to obtain reasonable assurance about whether the FS as a

whole are free from material misstatement, whether due to fraud or error, thereby

enabling the auditor to express an opinion.

The scope of audit is general and broad whereas scope of investigation is specific and narrow

6 INHERENT LIMITATIONS OF AUDIT

Certain inbuilt limitations due to which an auditor cannot obtain an absolute assur-

ance that FS are free from misstatement due to fraud or error. These fundamental

limitations arise due to the following factors:

1.6 FA S T CA INTER AUDIT - BY CA SJ

Nature, Objective & Scope of Audit

A Nature of financial reporting

Preparation of FS involves making many judgments by management.

Management prepared FS free from material misstatements and devises internal

controls. Such controls also suffer from own limitations like lapse of control due to

collusion of employees.

B Nature of Audit procedures

The auditor carries out his work by obtaining audit evidence through performance

of audit procedures.

However, there are practical and legal limitations to obtain audit evidence like use of

sample testing or sometimes management may not provide complete information as

requested by auditor and auditor cannot force them, an example of legal limitation.

The management may indulge in frauds and conceal it to make it hard to detect

by the auditor. It may produce fabricated documents to auditor. An auditor may

not be an expert to detect unauthenticated documents

Entity may have entered into some transactions with related parties only paper

and auditor may not be able to detect probable wrong doings in such transactions.

C Not in nature of investigation

Audit is not an official investigation. Hence, auditor cannot obtain absolute assur-

ance that FS are free from material misstatements due to frauds or errors.

D Timeliness of financial reporting and decrease in relevance of information over time

The relevance of information decreases over time and auditors cannot verify each

and every matter.

E Future events

The business may cease to exist in future due to changes in market conditions, emer-

gence of new business models or products or due to onset of some adverse events.

In view of the above factors, an auditor cannot provide a guarantee that FS are free

from material misstatements due to frauds or errors.

7 WHAT IS AN ENGAGEMENT?

Engagement means an arrangement to do something.

AB AUDIT HOGA SABSE SCORING FA S T 1.7

CHAPTER 1

In audit, it means a formal agreement between auditor and client under which

auditor agrees to provide auditing services.

It takes the shape of an engagement letter.

External audit engagements

The purpose of external audit engagements is to enhance the degree of confidence

of intended users of FS. Such engagements are also reasonable assurance engage-

ments. For example, in India, companies are required to get their annual accounts

audited by an external auditor. Even non-corporate entities may choose to have

their accounts audited by an external auditor because of benefits of such an audit.

8 BENEFITS OF AUDIT-WHY AUDIT IS NEEDED?

Confidence to users that information on which they are relying is qualitative and as

per globally recognized Standards.

Shareholders interest is safeguarded by an audit of FS prepared by management.

Moral check on employees for the fear of discovering frauds by audit.

Audited FS are helpful to government authorities for determining tax liabilities.

Audited FS can be relied upon by lenders, bankers for making their credit decisions

i.e. whether to lend or not to lend to a particular entity.

An audit may also detect fraud or error or both.

An audit reviews existence and operations of controls operating in any entity.

Hence, it is useful at pointing out deficiencies.

9 AUDIT- MANDATORY OR VOLUNTARY?

Companies Act – Every company to get its accounts audited

IT Act – Audit needed if turnover crosses specified limits

School / Colleges, etc – Audit pre-requisite for availing grants from the Government.

Audit is not always mandatory. Many entities may get their accounts audited volun-

tarily because of benefits from the process of audit. Many such concerns have their

internal rules requiring audit due to advantages flowing from an audit.

10 WHO APPOINTS AN AUDITOR?

Company - Appointed by members (shareholders) in Annual General Meeting (AGM).

Government companies - Appointed by C&AG, an independent constitutional authority.

1.8 FA S T CA INTER AUDIT - BY CA SJ

Nature, Objective & Scope of Audit

Firm - Auditor is appointed by partners of firm.

Government Authority – Law may require to appoint auditor by government authorities.

11 TO WHOM REPORT IS SUBMITTED BY AN AUDITOR?

The outcome of an audit is written audit report with his opinion. The report is sub-

mitted to person making the appointment.

Example: Companies – Shareholders; Firm – Partners who have engaged him.

12 ASSURANCE ENGAGEMENT

“Assurance engagement” means an engagement in which a practitioner expresses

a conclusion designed to enhance the degree of confidence of the intended users

other than the responsible party about the outcome of the evaluation or measure-

ment of a subject matter against criteria.

A Elements of an Assurance Engagement

Following elements comprise an assurance engagement: -

1 Parties – 3 party - Practitioner, Responsible Party, and Intended Users

A practitioner is a person who provides the assurance (could be auditor of historical

financial information of report on prospective information).

A responsible party is the party responsible for preparation of subject matter.

Intended users are the persons for whom an assurance report is prepared.

2 Subject matter

It refers to the information to be examined by the practitioner. For example,

financial information contained in FS while conducting audit of FS.

3 Suitable criteria

These refer to benchmarks used to evaluate the subject matter like standards, guid-

ance, laws, rules and regulations.

4 Sufficient appropriate evidence

“Sufficient” - Quantity of evidence obtained by auditor.

“Appropriate” - Quality of evidence obtained by auditor.

One evidence may be providing more comfort to auditor than the other evidence.

AB AUDIT HOGA SABSE SCORING FA S T 1.9

CHAPTER 1

The evidence providing more comfort is qualitative and, therefore, appropriate. Evi-

dence should be both sufficient and appropriate.

5 A written assurance report in appropriate form

A written assurance report is the outcome of an assurance engagement.

B Meaning of Review; Audit Vs. Review

Audit is a reasonable assurance engagement. However, Review is a limited assurance

engagement. It provides:

lower level of assurance than audit, and

is based on fewer procedures; and

is useful for drawing limited conclusions.

Both are based on historical financial information.

C Types of Assurance Engagements- Reasonable assurance engagement vs. Limited

assurance engagement

Reasonable assurance engagement Limited assurance engagement

Reasonable assurance engagement Limited assurance engagement provides

provides high level of assurance. lower level of assurance than reasonable

assurance engagement.

It performs elaborate and extensive It performs fewer procedures as compared

procedures to obtain sufficient appro- to reasonable assurance engagement.

priate evidence.

It draws reasonable conclusions on the It involves obtaining sufficient appropri-

basis of sufficient appropriate evidence. ate evidence to draw limited conclusions.

Example of reasonable assurance en- Example of limited assurance engage-

gagement is an audit engagement. ment is review engagement.

D Prospective financial information

“Prospective financial information” means financial information based on as-

sumptions about events that may occur in the future and possible actions by an

entity. It can be in the form of a forecast or projection or combination of both.

1.10 FA S T CA INTER AUDIT - BY CA SJ

Nature, Objective & Scope of Audit

“Historical financial information” Vs “Prospective financial information.”

HFI - Information expressed in financial terms of an entity about economic events,

conditions or circumstances occurring in past periods. This is rooted in past events

PFI - Financial information based on assumptions about occurrence of future events

and possible actions by an entity. This is rooted in future events.

Assurance Reports Involving Prospective Financial Information

Practitioner obtains sufficient appropriate evidence that:

management’s assumptions on which the prospective financial information is

based are not unreasonable,

the prospective financial information is properly prepared based on the assumptions; and

it is properly presented and all material assumptions are adequately disclosed.

Prospective financial information relates to future events hence auditor cannot ex-

press an opinion as to whether the results shown in the prospective financial infor-

mation will be achieved. Hence, practitioner provides a report assuring that nothing

has come to practitioner’s attention to suggest that these assumptions do not

provide a reasonable basis for the projection, providing only a “moderate” level of

assurance.

Examples of assurance engagements

Example of engagement assurance Type of assurance engagement

Audit of financial statements Reasonable assurance engagement

Review of financial statements Limited assurance engagement

Provides assurance regarding reason-

Examination of Prospective financial

ability of assumptions forming basis of

information

projections and related matters

Report on controls operating at an Provides assurance regarding design and

organization operation of controls

13 QUALITIES OF AUDITOR

Personal qualities - Tact, caution, firmness, good temper, integrity, discretion,

industry, judgement, patience, clear headedness, and reliability are qualities which

AB AUDIT HOGA SABSE SCORING FA S T 1.11

CHAPTER 1

an auditor should have. In short, all personal qualities that make a good businessman.

Shine of culture for attaining a great height.

Highest degree of integrity backed by adequate independence.

Basic human qualities of being trustworthy.

Expert and exhaustive knowledge of accounting in all its branches is the sine qua

non of the practice of auditing. He must know thoroughly all accounting principles

and techniques.

14 ENGAGEMENT AND QUALITY CONTROL STANDARDS: AN OVERVIEW

The following Standards issued under authority of ICAI Council are collectively

known as Engagement Standards: -

Standards on auditing (SAs) which apply in audit of historical financial information.

Standards on review engagements (SREs) which apply in review of historical

financial information.

Standards on Assurance engagements (SAEs) which apply in assurance engage-

ments other than audits and review of historical financial information.

Standards on Related Services (SRSs) which apply in agreed upon procedures to

information, compilation engagements and other related service engagements.

The purpose of issue of these standards is to establish high quality standards and

guidance in the areas of FS audits and in other types of assurance services.

Limitations only live in our

minds. But if we use our

imagination, our possibilities

become limitless.

1.12 FA S T CA INTER AUDIT - BY CA SJ

Nature, Objective & Scope of Audit

Engagement Standards

Standards on auditing Standards on review Standards on Assurance Standards on Related

(SAs) engagements (SREs) engagements (SAEs) Services (SRS)

Apply in agreed

Apply in assurance upon procedures to

Apply in audit of engagements other

Apply in review of information,

historical financial than audits and review

historical financial compilation

information by in- of historicalfinancial

information. engagements and

dependent auditor. information. other related ser-

vice engagements.

For example, an en-

Covers overall objec- Review is a limit- gagement to perform

Assurance engage-

tives of independent ed assurance en- certain procedures

ments, examination

auditor, audit docu- gagement, hence concerning individu-

is not of historical

mentation, planning involves fewer pro- al items of financial

financial information

an audit, identifying cedures than audit. data, say, accounts

or may relate to pro-

and assessing risk of Since it provides payable, accounts

viding assurance re-

material misstate- assurance to users, receivable, purchas-

garding non-financial

ment, audit sampling, it involves obtaining esfrom related parties

matters like design

audit evidence and SAAE. Eg. Review and salesand profits

and operation of in-

forming an opinion of interim financial of a segment of an

ternal control in an

and reporting on FS. information of an entity, or a FS, say, a

entity.

entity. balance sheet or even

a complete set of FS.

SA 200 to 800 series SRE 2000 series SAE 3000 series SRS 4000 Series

Standards on Quality Control

Standards on Quality Control (SQCs) have been issued to establish standards and

provide guidance regarding a firm’s responsibilities for its system of quality control

It covers quality control of audit and review of historical financial information and

for other assurance and related service engagements.

SQC 1 has been issued in this regard.

AB AUDIT HOGA SABSE SCORING FA S T 1.13

CHAPTER 1

It requires auditors/practitioners to establish system of quality control so that firm

and its personnel comply with professional standards and regulatory & legal require-

ments and reports issued are appropriate.

Its basic objective is that while rendering services, to which engagement standards

apply, there should be a system of quality control with in firms to ensure complying

with professional standards/legal requirements.

System of quality control ensures issuing of appropriate reports in the circumstances.

Why are Standards needed?

Standards ensure carrying out of audit against established benchmarks at par with

global practices.

Standards improve quality of financial reporting thereby helping users to make dili-

gent decisions.

Standards promote uniformity as audit of FS is carried out following these Standards.

Standards equip professional accountants with professional knowledge and skill.

Standards ensure audit quality.

Duties in relation to Engagement and Quality Control Standards

It is the duty of professional accountants to see that Standards are followed in en-

gagements undertaken by them.

However, a situation may arise when a specific procedure as required in Standards

would be ineffective in a particular engagement.

In such a case, he is required to document how alternative procedures performed

achieve the purpose of required procedure.

Also, reason for departure has also to be documented unless it is clear. Further, his

report should draw attention to such departures.

It is also to be noted that a mere disclosure in the report does not absolve a profes-

sional accountant from complying with applicable Standards.

1.14 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

COMPLETION AND REVIEW

Chapter 07 (SA 560, 570, 450, 580, 260 & 265)

SUBSEQUENT EVENTS (SA 560)

Events Occurring After the date of FS

Many financial reporting frameworks specifically refer to such events ordinar-

ily categorising as two types of events, those that provide evidence of conditions

that:

&

Existed at the Arose after the

date of the FS date of the FS.

Examples of events providing evidence of conditions that:

Existed at the date of the FS Arose after the date of the FS

Insolvency of debtor Issue of new share capital

providing evidence on Planned merger of the

recoverability company.

Out of the court Destruction of substantial

settlement of a case inventories due to fire

at reduced amount, for between the date of

which provision has been the FS and the date of

already made auditor’s report.

Subsequent Events (SE)

Events occurring between the:

date of the FS facts that become known to

and the date the auditor after the date

of the auditor’s of the auditor’s report are

report and known as subsequent events.

AB AUDIT HOGA SABSE SCORING FA S T 7.1

CHAPTER 7

Subsequent events

01 02 03

Facts which become

Events occuring Facts which become

known to the auditor after

between the Date known to the auditor

the Date of auditor's

of FS and Date of after the FS have

report but before Date been issued

auditor's report

FS are issued

Lets Say A & B EVENTS Lets Say C EVENTS Lets Say D EVENTS

1 Objectives of auditor in accordance with SA 560

The objectives of the auditor are to: -

Obtain SAAE about Type A & B Events that require adjustment of, or disclosure in,

the FS are appropriately reflected in those FS and

Respond appropriately to facts that become known to the auditor after the date of

the auditor’s report, that, had they been known to the auditor at that date, may

have caused the auditor to amend the auditor’s report.

2 Audit procedures relating to Type A&B events

SAAE 1. Perform audit procedures to obtain SAAE that all such events that require

adjustment in FS have been identified.

AE of

other AP 2. The auditor not required to perform additional audit procedures if previously

audit procedures have provided evidences.

AP 3. The auditor shall perform following procedures -

Obtain understanding of management procedures to identify SE.

Inquiring of management and, TCWG as any adjusting SE have occurred

Reading minutes of entity’s owners, management and TCWG, and inquir-

ing matters discussed for meetings where minutes are not yet available.

Reading the entity’s latest subsequent interim FS, if any.

Entity

Records 4. Such information may also be obtained by auditor from accounting records per-

taining to period after date of FS, reading entity’s latest available budgets etc.

7.2 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

Account- 5. When, as a result of the procedures performed, the auditor identifies

ing

events that require adjustment of, or disclosure in, the FS, the auditor shall

determine whether each such event is appropriately reflected in those FS.

WR 6. Seek written representation from management & TCWG that all events

occurring subsequent to date of FS that require adjustment or disclosure as

per A-FRFW have been adjusted or disclosed.

“Date the FS are issued”

Meaning Date auditor’s report and audited FS are made available to third parties.

Generally depends on regulatory environment. Date to be after the date

auditor’s report is provided to the entity and not before that, as FS are issued

with auditor’s report only.

Type C Events - Facts which become known after date of auditor’s report but

3

before date when FS are issued

Auditor’s Responsibility

No obligation to perform any audit procedures after the date of auditor’s report.

But if a fact becomes know, that had if was known to the auditor earlier, may

lead o change in auditor’s report, the auditor shall:

Discuss the matter with management and, where appropriate, TCWG.

Determine whether the FS need amendment and, if so,

Inquire how management intends to address the matter in the FS.

Reporting Scenarios

1 If management amends the FS, the auditor shall

Reporting 2 Management amends FS but only for SE

identified

3

Scenarios:

When Law, regulation or the FRF/W does not

allow to issue amended FS

4 Management does not amend the FS at its option

AB AUDIT HOGA SABSE SCORING FA S T 7.3

CHAPTER 7

If management amends the FS, the auditor shall:

Carry out audit procedures on amendment.

If amendment is not restricted only to the SE causing amendment (See next para):

i. Extend the audit procedures, already referred, to the date of the new auditor’s

report and

ii. Provide a new auditor’s report on the amended FS.

The new auditor’s report shall not be dated earlier than the date of approval of

the amended FS.

Management amends FS but only for SE identified

When LorR or FRF/W does not prohibit management to amend and approve FS only

for effects of such SE, auditor is permitted to restrict audit procedures on SE to that

amendment. Auditor shall either: -

Dual

Date Amend the auditor’s report to include an additional date restricted to that

amendment that thereby indicates that the auditor’s procedures on SE are

restricted solely to the amendment of the FS described in the relevant note to

the FS OR

EOM/

OM Provide a new or amended auditor’s report with Emphasis of Matter or Other

Matter(s) that conveys that auditor’s procedures on SE are restricted solely to

the amendment of the FS as described in the relevant note to the FS.

3 When Law, regulation or the FRF/W does not allow to issue amended FS

Auditor need not provide an amended or new auditor’s report.

4 Management does not amend the FS at its option –

If auditor believes FS need to be amended, then: -

If the auditor’s report has not yet been provided to the entity - Modify the opinion

(SA 705) and then provide auditor’s report or

If the auditor’s report has already been provided to the entity - Notify manage-

ment, TCWG, not to issue the FS to third parties before the necessary amendments

have been made.

If FS are subsequently issued without the necessary amendments, auditor shall take

appropriate action, to prevent reliance on the auditor’s report.

7.4 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

Type D Events - Facts which become known to the auditor after the FS have

4

been issued

Auditor’s Responsibility

Same as in Type C events above

Reporting Scenarios

Same as in Type C however additionally when:

1. Management amends the FS - Auditor shall review management steps so that

anyone in receipt of FS and Auditor’s report is informed of the situation.

2. Management amends FS but only for SE identified

Same as in Type C above

3. When Law, regulation or the FRF/W does not allow to issue amended FS

Auditor need not provide an amended or new auditor’s report.

4. Management does not amend the FS at its option –

Auditor will seek to prevent future reliance on the auditor’s report.

If management or TCWG do not take necessary steps, auditor shall take

appropriate action to seek to prevent reliance on the auditor’s report.

GOING CONCERN (SA 570)

1 MEANING OF GOING CONCERN & ITS SIGNIFICANCE

Under this fundamental accounting assumption of accounting, going concern, FS

are prepared on the assumption that entity will continue its operations for the

foreseeable future. Unless management either intends or has no realistic alterna-

tive to liquidate the entity or to cease operations.

Assets and liabilities are recorded on the basis that entity will be able to realize

its assets and discharge its liabilities in the normal course of business.

When not a going concern, the FS are prepared on liquidation basis. For example,

inventories written down as may be sold at lower price, Assets recorded at likely

prices they will fetch.

AB AUDIT HOGA SABSE SCORING FA S T 7.5

CHAPTER 7

A. Responsibility for assessment as a going concern

MGT Management to assess entity’s ability to continue as a going concern even if

Responsible FRFW (Financial Reporting Framework) does not specifically demands so.

Judgment Involves making a judgment, at a particular point in time, about inherently

uncertain future outcomes of events or conditions.

Factors Factors relevant to judgment: -

Later The The degree of uncertainty associated withà outcome of an event or

Riskier condition à increases the further into the future it occurs.

Entity, Judgment regarding the outcome of events or conditions is affected by:

Business,

Ext. Factors

Size and Nature and Degree of influence

complexity of condition of its of EXTERNAL

the ENTITY BUSINESS and FACTORS

Info Judgment is based on available information and outcomes may be

Available

inconsistent with judgement made at earlier point in time.

B. Responsibilities of the auditor

(Obtain SAAE + Even if not specified in FRFW + Inherent Limitations)

Obtain SAAE on appropriateness of management’s use of the going concern (GC) basis

Conclude, based on audit evidence obtained, whether a material uncertainty (MU)

exists about the entity’s ability to continue as a GC.

Irrespective of FRFW explicit requirement, auditor responsible to obtain SAAE.

Inherent limitations of auditor:

Auditor’s ability to detect material misstatements (MM) are greater for future

events or conditions affecting entity’s GC status.

Hence auditor cannot predict them.

Accordingly, auditor’s report cannot be viewed as a guarantee as to the

entity’s ability to continue as a GC.

C. Objectives of auditor in accordance with SA 570

The objectives of the auditor are: -

SAAE Obtain SAAE on the appropriateness of management’s use of the GC;

7.6 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

MU Conclude whether MU exists related to events or conditions that may cast

significant doubt on entity’s ability to continue as a GC (EorC–SD-GC); &

Report Report in accordance with this SA.

2 Risk assessment procedures and related activities

When performing RAP (SA 315), auditor shall consider whether EorC-SD-GC.

RAP

Auditor shall remain

If MGT has already If MGT has NOT yet

alert throughout the

performed such an performed such an

audit for audit evidence

assessment- assessment-

of EorC-SD- GC.

Discuss and determine Discuss the basis for

whether individually or the intended use of

collectively, EorC-SD- the GC, and

GC identified and

Inquire of

management whether

Management plans to

whether individually or

address them

collectively, EorC-SD-

GC exists

A. Examples of EorC-SD-GC either individually or collectively

Financial Net liability or net current liability position

EorC Fixed-term borrowings approaching maturity without realistic prospects of

renewal or repayment; or excessive reliance on short-term borrowings to

finance long-term assets

Indications of withdrawal of financial support by creditors

Negative operating cash flows indicated by historical or prospective FS

Adverse key financial ratios

Substantial operating losses or significant deterioration in the value of

assets used to generate cash flows

Arrears or discontinuance of dividends

Inability to pay creditors on due dates

AB AUDIT HOGA SABSE SCORING FA S T 7.7

CHAPTER 7

Inability to comply with the terms of loan agreements

Change from credit to cash-on-delivery transactions with suppliers

Inability to obtain financing for essential new product development or other

essential investments

Operating Management intentions to liquidate the entity or to cease operations

EorC Loss of key management without replacement

Loss of a major market, key customer(s), franchise, license, or principal

supplier(s)

Labour difficulties

Shortages of important supplies

Emergence of a highly successful competitor

Other Non-compliance with capital or other statutory or regulatory requirements,

EorC such as solvency or liquidity requirements for financial institutions

Pending legal or regulatory proceedings against the entity that may, if

successful, result in claims that the entity is unlikely to be able to satisfy

Changes in law or regulation or government policy expected to adversely

affect the entity

Uninsured or underinsured catastrophes when they occur

B. Evaluating management’s assessment

The auditor shall evaluate management’s assessment of GC.

It is not the auditor’s responsibility to rectify the lack of analysis by management.

Auditor may conclude GC assumption is appropriate even if there is lack of detailed

analysis by management for example, when there is a history of profitable operations.

Where detailed analysis is made auditor to evaluate management’s:

ASSUMPTIONS PLANS for future

GC assessment on which the action and its

PROCESS; assessment is feasiblity.

based; and

Auditor to cover same period as that used by management to make its assessment unless:

A-FRFW, or law or regulation specifies a longer period, or

If management’s assessment is < 12 months from FS date, request management

to extend period to at least 12 months.

If EorC-SD-GC identified, auditor shall obtain SAAE to determine whether or not a

MU exists related to EorC-SD-GC through performing additional audit procedures,

including consideration of mitigating factors.

7.8 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

3 Additional audit procedures when events or conditions are identified

These procedures shall include: -

Ask to Where management has not yet performed an assessment of the

make

Assessment entity’s ability to continue as a GC, requesting management to make its

assessment.

Evaluate

Plan–Impact–

Evaluating management’s plans for future actions in relation to its

Feasibility GC assessment whether outcome of these plans is likely to improve

the situation and whether management’s plans are feasible in the

circumstances.

Cash Flow Where the entity has prepared a cash flow forecast, and analysis of the

Forecast

forecast is a significant factor in considering the future outcome of events

or conditions in the evaluation of management’s plans for future actions:

Reliability Evaluating the reliability of the underlying data generated to prepare

of data

the forecast; and

Support for Determining whether there is adequate support for the assumptions

assumption

underlying the forecast.

Subsequent Considering whether any additional facts or information have become

Facts

available since the date on which management made its assessment.

WR Requesting written representations from management and, TCWG,

regarding their plans for future actions and the feasibility of these plans.

Examples of AP Examples of audit procedures when EorC-SD-GC identified

Analyse & Read Inquire & Confirm Evaluate, Perform,

Review etc.

(Forecast, InterimFS, (L&C, Existence of (Order fulfilment, Reg.

Breach of loan, Minutes) Borrowings and 3rd party actions, SE, asset

fund support) disposal)

1 Analysing and 1 Inquiring of the entity’s 1 Evaluating the

discussing cash flow, legal counsel regarding entity’s plans to

profit and other the existence of litiga- deal with unfilled

relevant forecasts with tion and claims and the customer orders

management reasonableness of man-

agement’s assessments

of their outcome and

the estimate of their fi-

nancial implications

AB AUDIT HOGA SABSE SCORING FA S T 7.9

CHAPTER 7

2

Analysing and discussing 2 Confirming the 2 Obtaining and reviewing

the entity’s latest existence, terms and reports of regulatory

available interim FS adequacy of borrowing actions

facilities Performing audit

3 Reading the terms 3

of debentures and 3 Confirming the procedures regarding

loan agreements and existence, legality SE to identify those

determining whether and enforceability that either mitigate

any have been breached of arrangements to or otherwise affect

provide or maintain the entity’s ability to

4 Reading minutes financial support with continue as a GC

of the meetings of related and third 4 Determining the

shareholders, TCWG and parties and assessing adequacy of support for

relevant committees for the financial ability of any planned disposals of

reference to financing such parties to provide assets

difficulties additional funds

(Categorisation only for memorization)

4 Auditor’s conclusions

The auditor shall evaluate whether SAAE has been obtained regarding:

Appropriateness of MU exists related

management’s use to EorC-SD-GC

of the GC basis of individually or

accounting collectively.

(MU exists when the magnitude of its potential impact and likelihood of occurrence

is such that, in the auditor’s judgment, appropriate disclosure of the nature and

implications of the uncertainty is necessary)

Adequacy of disclosures when EorC have been identified and auditor

concludes

MU Exists No MU Exists

Determine whether FS disclose- Determine whether FS

(a) Adequately the principal EorC-SD-GC and disclose:

management’s plans to deal with these events Adequately these EorC as

or conditions and per A-FRFW

(b) Clearly that there is a MU related to EorC-

SD-GC and, therefore, that it may be unable to

realize its assets and discharge its liabilities in

the normal course of business.

7.10 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

5 Auditor’s Reporting

Implications for the auditor’s report

FS prepared using GC accounting assumption and…

1 It is INAPPROPRIATE Auditor shall express an adverse opinion

2 GC basis of

accounting is

(A) Adequate Disclosure of a MU is made in the FS

appropriate but a Express an unmodified opinion with separate section under the

MU exists heading “MU Related to GC” to:

Draw attention to note in FS that discloses such matters.

(B) Adequate Disclo- State that these:

sure of a MU is Not EorC indicate MU exists that may cast SD-GC and

Made in the FS Auditor’s opinion is not modified on the matter.

Express a qualified opinion or adverse opinion, as appropriate, in accordance with SA 705.

Basis for Qualified (Adverse) Opinion section state:

MU exists that may cast SD-GC and

FS do not adequately disclose this matter.

3 Management

unwilling to make

Consider a qualified opinion or a disclaimer of opinion in

the auditor’s report, because it may not be possible for

or extend its auditor to obtain SAAE regarding management’s use of

assessment when

the GC basis of accounting

requested by auditor

EVALUATION OF MISSTATEMENTS IDENTIFIED DURING THE AUDIT (SA 450)

1 Objectives of auditor in accordance with SA 450

To evaluate: -

The effect The effect of

of identified uncorrected

misstatements on misstatements (UMs),

the audit and if any, on the FS.

AB AUDIT HOGA SABSE SCORING FA S T 7.11

CHAPTER 7

2 Accumulation of misstatements identified during the audit

Accumulate misstatements identified during audit

Other than clearly trivial misstatements (Absolutely inconsequential)

Factors A misstatement may arise from a variety of factors for example,

inaccuracy in gathering or processing data or

omission of an amount or disclosure or

wrongly capitalized machinery repair expenses

3 Consideration of identified misstatements as audit progresses

Revise AS The auditor shall determine whether the overall audit strategy and audit plan

& AP

need to be revised if: -

Indicates Nature & circumstances indicate other misstatements may exist à

more MM

that could be material when aggregated with other misstatements

accumulated during audit, or

Nears Accumulated misstatements approaches materiality level (of SA 320).

Materiality

Request management to:

Examine a class of Perform procedures

transactions, account to determine the Make appropriate

balance or disclosure (T- amount of the adjustments to the

AB-D) & understand the actual misstatement FS.

cause of a misstatement in the class of

identified T-AB-D, and

If management performs above procedures, auditor to check what misstatements remain.

4 Communication and correction of misstatements

Communicate on timely basis with the management –

Misstatements accumulated during the audit and request them to correct.

Why Timely Communication?

It enables management to evaluate whether the items are misstatements, and

inform auditor if it disagrees.

It helps to take corrective actions, if any. Such corrections helps in maintaining

accurate accounting books and records and reduces the RoMM of future FS.

7.12 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

If management refuses to correct (some or all misstatements communicated to it)

Auditor to obtain an understanding of management’s reasons and

Take that understanding into account to evaluate whether FS as a whole are

free from MM.

5 Evaluating the effect of UMs

Reassess Materiality of SA 320 –

Whether it is appropriate in light of actual financial results

Evaluate the effect of UMs

Determine whether UMs are material, individually or in aggregate. For this consider:

Size, Na- The size and nature of the misstatements, both in relation to particular

ture & Cir- classes of T-AB-D & FS as a whole, and the particular circumstances of

cumstance

their occurrence and

Prior Period The effect of UMs related to prior periods on the relevant classes of T-AB-D,

Effects

and the FS as a whole.

6 Communication with TCWG

Communicate with TCWG the following:

Request that UMs be corrected.

Communicate all individually material UMs.

UMs and their individual and overall effect on the auditor’s opinion.

The effect of UMs related to prior periods on relevant classes of T-AB-D, and FS as a whole.

7 Written Representation from management regarding effects of uncorrected statements

Where management / TCWG believe the effects of UMs are immaterial, individually

and in aggregate, to the FS as a whole, seek a WR on it and attach the summary of

such items to the WR.

8 Documentation regarding misstatements identified during audit

The audit documentation shall include: -

The amount below which misstatements would be regarded as clearly trivial;

All misstatements accumulated during the audit and whether they have been corrected; and

The auditor’s conclusion as to whether UMs are material, individually or in aggre-

gate, and the basis for that conclusion.

AB AUDIT HOGA SABSE SCORING FA S T 7.13

CHAPTER 7

WRITTEN REPRESENTATIONS (SA 580)

1 Definition

A written representation is a written statement by management provided to the

auditor to confirm certain matters or to support other audit evidence. WR in this

context do not include FS, the assertions therein, or supporting books and records.

2 WR as audit evidence

(WR are AE, written better, Alerts if not provided, Not SAAE and OAP to apply)

AE WR are necessary information that auditor requires in connection with audit.

Accordingly, similar to responses to inquiries, WR are audit evidence.

If not If management modifies or does not provide requested written representations

provided

(WR), it may alert auditor to the possibility of significant issues.

Written Written, rather than oral, representations may prompt management to

Better

consider matters more rigorously, thereby enhancing the quality of the

Not

representations.

SAAE WR provide necessary audit evidence, they do not provide SAAE on their own

No impact The fact that management has provided reliable WR does not affect the

on N-E of

OAP nature or extent of other audit evidence that the auditor obtains.

3 Objectives - SA 580

The objectives of the auditor are to:

Support Respond if

Obtain WR Provided or

Other AE Refused

A B C

A. Obtain WR - From management TCWG that they believe that they have fulfilled

their responsibility for the preparation of the FS and for the completeness of the

information provided to the auditor;

B. Support other audit evidence – As relevant to the FS; and

C. Respond appropriately - To WR provided or not provided by management and TCWG,.

7.14 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

4 From whom WR are requested by auditor?

Request from management with appropriate responsibilities for the FS and

knowledge of the matters concerned.

5 WR Types

WR Types

WR about WR About

Management’s

Responsibilities Specific

Other WR Assertions

Addition to

WR read by

other SAs

Preparation of FS AE to evaluate man-

agement judgments

To support other AE and intentions

Completeness of

Information To support MGT Responsi-

AE supporting man-

bility acknowledgement

agement judgments

To support information

provided to the auditor

A. WR about management’s responsibilities

(I) (II)

Preparation of FS Completeness of

Information

This involves confirmation of fulfilment of management’s responsibilities in

following areas:

I Preparation of the FS

Prepared WR on management responsibility to prepare FS in accordance with

A-FRFW

A-FRFW, giving fair presentation, if applicable.

AB AUDIT HOGA SABSE SCORING FA S T 7.15

CHAPTER 7

MGT Re- Management has sufficient knowledge of the process followed by the entity

sponsibility

in preparing and presenting the FS due to its responsibility for preparation

and presentation of FS and conduct of the entity’s business.

MGT Management may also make inquiries of management experts, individuals

Experts

having specialized knowledge relating to matters about which WR are

requested. Such individuals may include:

An actuary responsible for actuarially determined measurements.

Staff engineers who may have responsibility for and specialized

knowledge about environmental liability measurements.

Internal counsel who may provide information essential to provisions for

legal claims.

Language Use of qualifying language in WR – Like, ‘to the best of its knowledge

and belief’, such WR are reasonable to accept if auditor is satisfied that

representations are being made by responsible and knowledgeable person.

After mak- Auditor may request that management include in WR, confirmation that it

ing inquiries

has made necessary inquiries to be able to make the requested WR.

II Information provided and completeness of transactions

The auditor shall request management to provide a WR that: -

It has provided the

auditor with all All transactions

relevant information have been recorded

and access as agreed and are reflected in

in the terms of the FS.

engagement; and

Why WR about management responsibilities are necessary?

Auditor is not able to judge solely on other audit evidence whether management

has fulfilled above responsibilities.

Hence such WR are required as an acknowledgement and understanding of

management of its responsibilities in the terms of the audit engagement. The

auditor may also ask management to reconfirm its acknowledgement and

understanding of those responsibilities in WR (Audit Premise).

7.16 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

This is particularly appropriate when: -

Person singing Engagement Indication of Changes in

the engagement terms were management circumstances

terms have prepared in misunderstanding its require it.

changed previous year/s; responsibilities; or

How to describe management’s responsibilities in the WR

“WR required about management responsibilities” – describe responsibilities as

described in the terms of the audit engagement.

B. Other WR

(i) (ii) (iii)

To support other To support MGT To support

AE Responsibility information provided

acknowledgement to the auditor

(i) In addition to WR required in other SAs, auditor can seek WR to support other audit

evidence relevant to FS / assertions in FS.

(ii) Auditor can also seek WR in addition to management’s responsibilities regarding

preparation of FS on matters like:

Whether selection and application of accounting policies are appropriate; and

Whether following matters have been recognized, measured, presented or dis-

closed as per A-FRFW:

Plans or intentions Liabilities

That affect carrying value or

classification of assets and 1 2 Both actual and

contingent

liabilities

Assets Laws, regulations and

contractual agreements

Title, Control, Liens or 3 4 Aspects affecting FS,

encumbrances, Pledged as including non-compliance.

collateral

(iii) Additional WR about information provided to the auditor

Example WR that it has communicated to the auditor all deficiencies in internal

control of which management is aware.

AB AUDIT HOGA SABSE SCORING FA S T 7.17

CHAPTER 7

C. WR about specific assertions

(i) When obtaining evidence, evaluating judgments and intentions, auditor considers:

The entity’s past history in carrying out its stated intentions.

The entity’s reasons for choosing a particular course of action.

The entity’s ability to pursue a specific course of action.

The existence or lack of any other information obtained during audit but

inconsistent with management’s judgment or intent.

(ii) WR about specific assertions in FS to support an understanding of management’s

judgment or intent on completeness of a specific assertion.

For example, if the intent of management is important to the valuation basis for

investments, it may not be possible to obtain SAAE without a written representation

from management about its intentions.

6 Date of and Period(s) covered by WR

WR are necessary audit evidence, hence auditor’s report cannot be dated, before the

date of the WR.

The date of the WR shall be as near as practicable to, but not after, the date of the

auditor’s report on the FS.

Why?

As auditor is concerned with events occurring up to the date of the auditor’s report the

WR are dated as near as practicable to, but not after, the date of the auditor’s report.

WR shall be for all FS and period(s) referred to in the auditor’s report.

Why? As management needs to reaffirm that the WR it previously made with respect to

prior periods remain appropriate.

When current management were not present during all periods referred to in the

auditor’s report

Such fact does not diminish such persons’ responsibilities for the FS as a whole. Ac-

cordingly, the requirement for the auditor to request from them WR that cover the

whole of the relevant period(s) still applies.

7 Form of WR

Letter addressed to the auditor.

Where law or regulation requires management to make written public statements

about its responsibilities, which are relevant to this SA then such statements need

not be included in the representation letter.

7.18 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

8 Doubt as to the reliability of WR

Doubt as to the reliability of WR

If the auditor has concerns about If WR are inconsistent with other

audit evidence the auditor shall

perform audit procedures to attempt

to resolve the matter.

competence, integrity, ethical values auditor shall reconsider the

or diligence of management, or about assessment of the competence,

its commitment to or enforcement of integrity, ethical values or diligence of

these, the auditor management, or of its commitment

to or enforcement of these, and

the auditor shall determine effect that such concerns may have on the

reliability of representations and audit evidence in general

If the auditor concludes that the WR are not reliable

auditor shall take appropriate actions, including qualifying opinion or considering

requirements of disclaimer of opinion (SA 705)

9 Requested WR not provided

If management does not provide one or more of the requested WR, the auditor shall: -

Discuss the matter with management;

Re-evaluate the integrity of management and evaluate the effect that this may

have on the reliability of representations and audit evidence in general; and

Take appropriate actions, including determining the possible effect on the opinion

in the auditor’s report in accordance with SA 705 having regard to the require-

ment of disclaimer of opinion.

Disclaimer of opinion in case of non-reliability of WR about management’s

10 responsibilities or failure to provide such WR

The auditor shall disclaim an opinion on the FS in accordance with SA 705 if WR

about management fulfilling its responsibilities regarding preparation of FS and

about information provided and completeness of transactions:

There is sufficient doubt about the integrity of management such that the are not

reliable; or

Management does not provide such WR

AB AUDIT HOGA SABSE SCORING FA S T 7.19

CHAPTER 7

COMMUNICATION WITH TCWG (SA 260)

1 Benefits of Two-Way Communication

Communication from auditor is important with TCWG. An effective two-way com-

munication is important in assisting: -

To Both To understand matters related to audit and developing constructive working

relationship alongwith maintaining auditor’s independence and objectivity.

To Auditor in obtaining from TCWG information relevant to the audit. For example,

TCWG may assist the auditor in

understanding identifying in providing

the entity and appropriate sources information about

its environment, of audit evidence, specific transactions

and or events; and

TO TCWG In fulfilling their responsibility to oversee the FR process, thereby reducing

the risks of MM of the FS.

2 Who are “TCWG”?

The person(s) or organization(s) (e.g., a corporate trustee) with responsibility for

overseeing the obligations related to

strategic direction the accountability of

the entity, this includes

of the entity and

overseeing the FR process.

Governance structures vary by entities. For example, in some entities,

a supervisory TCWG hold positions TCWG are involved in

board exists that as a part of entity’s managing the entity,

is separate from legal structure like, but in other entities

executive board. company directors. both are different.

7.20 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

Why it is not possible to specify for all audits persons with whom auditor is to

communicate particular matters of governing interest?

Most

Governance is the collective responsibility of a governing body, such as a BoD,

entities

Supervisory Board, Partners, Management Committee, Trustees, etc.

Smaller One person may be charged with governance, for example, the owner-manager

entities

or sole trustee.

Legal In some cases, TCWG may not be clearly identifiable from applicable legal

FW

framework or other engagement circumstances, for example family-owned

entities and some NPOs.

Agree with Due to such diversity, auditor may need to discuss and agree with the

Client

engaging party, relevant persons with whom to communicate, using his own

understanding of entity’s governance structure (SA 315).

Matter Persons with whom to communicate may vary depending on matter to be

communicated.

3 Scope

SA 260 deals with auditor’s responsibility to communicate with TCWG.

4 Objectives of auditor in accordance with SA 260

The objectives of the auditor are: -

Responsibility,

Panned Scope To communicate clearly with TCWG the responsibilities of the auditor in relation

& Timing

to the FS audit, and an overview of the planned scope and timing of the audit;

Info

Relevant To obtain from TCWG information relevant to the audit;

to Audit

Audit

To provide TCWG with timely observations arising from audit that are

Observa-

tion significant and relevant to their responsibility to oversee the FR process and

2-Way To promote effective two-way communication between the auditor and TCWG.

5 Determining appropriate persons with whom to communicate

Theauditor shall determine the appropriate person(s) within the entity’s governance

structure with whom to communicate.

AB AUDIT HOGA SABSE SCORING FA S T 7.21

CHAPTER 7

6 Matters to be communicated by auditor to TCWG

Auditor responsible for

Auditor’s opinion

responsibilities in

A relation to FS in Management or TCWG

Audit responsibilities for FS not

reduced by Audit.

Planned scope Overview, plan and

B and timing of significant risk areas

the audit

Accounting Esit- Judge- Deviation

Qualitative ments, required

practices Policies, mates &

with from FRFW

Significant difficulties, faced in audit;

Significant Unless all of Significant Circumstances

C findings from TCWG are matters WR affecting form

audit involved in communicat- auditor is and content of

managing ed with man- requesting the auditor's

the entity: - agement; report, and

Any either significant matters

arising during audit

Statement of complaince Eng. Team Network

Auditor’s Firm

with ethical requirements by & Others Firms

independence

D in case of listed Relationships Total For Audit By To

entities that may af- Fees / Non- Firm / Entity/

fect indepen- during Audit Nework Group

dence like the priod Services Firm entity

A. Auditor’s responsibilities in relation to FS audit

Auditor is responsible for opinion on FS prepared by management with

TCWG oversight and

The audit does not relieve management or TCWG of their responsibilities.

B. Planned scope and timing of the audit

Auditor shall communicate with TCWG overview of the planned scope and timing

of the audit including significant risks identified.

7.22 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

C. Significant findings from audit

Qualitative practices of entity’s accounting including:

Accounting policies,

Accounting estimates and

FS disclosures.

When a significant accounting practice, acceptable under FRFW, but not most

appropriate to the entity

Significant difficulties, if any, encountered during the audit;

Unless all of TCWG are involved in managing the entity: -

Significant matters arising during the audit that were discussed, or subject

to correspondence, with management;

WR the auditor is requesting

Circumstances affecting form and content of the auditor’s report, and

Any other significant matters arising during the audit that are relevant to the

oversight of the FR process.

D. Communication of auditor’s independence in case of listed entities (Independence

Communication)

In the case of listed entities, auditor to make communicate to TCWG:

1.

A statement of compliance with relevant ethical requirements regarding

independence by:

engagement team and

the firm and, network firms

others in the firm,

and

2. (i) All relationships that may bear on independence including:

total fees charged audit and non-

during FS period for 1 2 audit services

The effect of service

on the independence provided by the firm

6 3 and network firms

of the auditor,

Allocated to categorise

the effect of services to the entity and

appropriate to assist 5 4 components con-

TCWG in assessing trolled by the entity.

AB AUDIT HOGA SABSE SCORING FA S T 7.23

CHAPTER 7

and

(ii) Safeguards applied to eliminate or reduce identified threats to independence.

The auditor shall communicate with TCWG on timely basis the:

Form, timing and expected general content of communications.

In writing, significant findings from audit & auditor independence when

required in case of listed entities.

a. Adequacy of the communication process

Evaluate adequacy of 2-way communication. If not, re-evaluate RoMM and abil-

ity to obtain SAAE, and shall take appropriate action.

b. Documentation

Where matters communicated orally, document the such matters, and when and

to whom they were communicated.

Where matters have been communicated in writing, retain a copy.

Communicating Deficiencies in Internal Control to TCWG and

Management (SA 265)

1 Why communication of significant deficiencies in internal control is necessary?

It reflects the importance of these matters and assists TCWG in fulfilling their

oversight responsibilities.

2 Scope

Auditor’s responsibility to communicate appropriately to TCWG and management

deficiencies in IC the auditor has identified in an audit of FS.

Auditor when identifying and assessing the RoMM obtains understanding of IC

relevant to audit and accordingly designs audit procedures.

Such procedures on IC are not for the purpose of expressing an opinion on

effectiveness of IC.

Auditor may identify deficiencies in IC not only during this risk assessment

process but also at any other stage of the audit.

SA 265 specifies which identified deficiencies the auditor is required to

communicate to TCWG and management.

7.24 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

3 Objectives

To communicate appropriately to TCWG and management deficiencies in IC

identified during the audit and that, in the auditor’s professional judgment, are of

sufficient importance to merit their respective attentions.

4 Deficiency in IC and Significant Deficiency in IC

Deficiency in IC – This exists when: -

Ineffective i. A control is designed, implemented or operated in such a way that it is

unable to PorD&C, misstatements in the FS on a timely basis or

Non- ii. A control necessary to PorD&C, misstatements in the FS on a timely basis is

Existence

missing.

Significant deficiency in IC – A deficiency or combination of deficiencies in IC that,

in the auditor’s professional judgment, is of sufficient importance to merit the

attention of TCWG.

The significance depends not on whether a misstatement has actually occurred, and

even based on likelihood of a potential misstatement and its magnitude. Hence if

may exist even if there are no identified misstatements during the audit.

Matters Considered in Determining Whether Deficiency in IC Constitutes a

5

Significant Deficiency

Examples of matters that the auditor may consider in determining whether a

deficiency or combination of deficiencies in IC constitutes significant deficiency:

(Amount involved, volume, subjectivity, probability of loss,

potential loss, exceptions frequency & cause, IC importance &

cross-interaction)

The FS amounts exposed to the deficiencies.

The volume of activity that has occurred or could occur in the account balance or

class of transactions exposed to the deficiency or deficiencies.

The subjectivity and complexity of determining estimated amounts, such as fair

value accounting estimates.

The susceptibility to loss or fraud of the related asset or liability.

The likelihood of the deficiencies leading to MMs in the FS in the future.

The cause and frequency of the exceptions detected as a result of IC deficiencies.

AB AUDIT HOGA SABSE SCORING FA S T 7.25

CHAPTER 7

The importance of the controls to the FR process, for example:

General monitoring controls (such

as oversight of management).

Controls over the period-

end financial reporting

process (such as controls

1 Controls over the prevention

over non-recurring and detection of fraud.

journal entries). 6 2

Controls over the selection

Controls over significant

transactions outside the

5 3 and application of

significant accounting

entity’s normal course 4 policies.

of business.

Controls over significant

transactions with related parties.

The interaction of the deficiency with other deficiencies in IC.

6 Indicators of Significant Deficiencies in IC (Examples)

(Ineffective CE, RAP – No or ineffective, Response – Ineffective,

No Mgt oversight on FR, Misstatements in FS & PPI)

Evidence of ineffective aspects of the control environment, such as: -

Indications that significant transactions in which management is financially

interested are not being appropriately scrutinised by TCWG.

Identification of management fraud, whether or not material, that was

not prevented by the entity’s IC.

Management’s failure to implement appropriate remedial action on significant

deficiencies previously communicated.

Absence of a risk assessment process within the entity where such a process

would ordinarily be expected to have been established.

Evidence of an ineffective entity risk assessment process, such as management’s

failure to identify a RoMM that the auditor would expect the entity’s risk

assessment process to have identified.

7.26 FA S T CA INTER AUDIT - BY CA SJ

Completion And Review

Evidence of an ineffective response to identified significant risks (e.g., absence of

controls over such a risk).

Evidence of management’s inability to oversee the preparation of the FS.

Misstatements detected by the auditor’s procedures that were not prevented, or

detected and corrected, by the entity’s IC.

Disclosure of a MM due to error or fraud as prior period items in the current year’s SPL.

7 Determination of Significant Deficiencies in IC

If the auditor has identified deficiencies in IC, determine, whether, individually or in

combination, they constitute significant deficiencies.

8 Communication of Significant Deficiencies in IC to TCWG

The auditor shall communicate in writing significant deficiencies in IC identified

during the audit to TCWG on a timely basis.

Communication with Management on timely basis:

In writing, significant deficiencies in IC communicated or to be communicated

to TCWG; and

In any form, Other deficiencies in IC that have not been communicated to

management by other parties and are of sufficient importance to merit

management’s attention.

Written communication of significant deficiencies in IC to include: