Professional Documents

Culture Documents

19aavca6757a1za - 092022 - GSTR-3B M

Uploaded by

SheksOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19aavca6757a1za - 092022 - GSTR-3B M

Uploaded by

SheksCopyright:

Available Formats

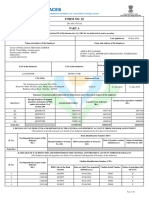

FORM GSTR-3B

[See rule 61(5)]

Year 2022

Month SEPTEMBER

Filed Date 21-10-2022

1. GSTIN 19AAVCA6757A1ZA

2. Legal name of the registered person ANSARI AND BEERA INDUSTRIES PRIVATE LIMITED

3.1 Details of Outward Supplies and Inward Supplies liable to reverse charge

Total Taxable

IGST CGST SGST/UTGST Cess

value

(a) Outward taxable supplies (other than zero rated, nil rated

2,10,136 9,685 411 411 0

and exempted)

(b) Outward taxable supplies (zero rated ) 0 0 0 0 0

(c) Other outward supplies (Nil rated, exempted) 0 0 0 0 0

(d) Inward supplies (liable to reverse charge) 1,00,600 0 2,515 2,515 0

(e) Non-GST outward supplies 0 0 0 0 0

Total 3,10,736 9,685 2,926 2,926 0

3.2 Of the supplies shown in 3.1 (a) above, details of inter-State supplies made to unregistered persons,

composition taxable persons and UIN holders

Place of Supply Amount of Integrated Tax

Nature of Supplies Total Taxable value

(State/UT)

Supplies made to Unregistered Persons Dadra and Nagar Haveli and

400 20

Daman and Diu

Supplies made to Unregistered Persons

Mizoram 400 20

Supplies made to Unregistered Persons

Arunachal Pradesh 1,205 60

Supplies made to Unregistered Persons

Sikkim 1,230 61

Supplies made to Unregistered Persons

Chhattisgarh 1,289 64

Supplies made to Unregistered Persons

Tripura 3,370 168

Supplies made to Unregistered Persons

Manipur 2,885 144

Supplies made to Unregistered Persons

Odisha 17,780 889

Supplies made to Unregistered Persons

Meghalaya 3,736 187

Supplies made to Unregistered Persons

Nagaland 2,115 106

Supplies made to Unregistered Persons

Punjab 2,106 105

Supplies made to Unregistered Persons

Bihar 10,125 506

Supplies made to Unregistered Persons

Telangana 6,412 321

Supplies made to Unregistered Persons

Maharashtra 14,176 709

Supplies made to Unregistered Persons

Kerala 10,626 531

Supplies made to Unregistered Persons

Gujarat 6,368 318

Supplies made to Unregistered Persons

Rajasthan 4,483 224

Supplies made to Unregistered Persons

Goa 790 40

Supplies made to Unregistered Persons Andaman and Nicobar Islands

1,186 59

Supplies made to Unregistered Persons

Andhra Pradesh 16,379 819

Supplies made to Unregistered Persons

Jharkhand 6,035 302

Supplies made to Unregistered Persons

Delhi 2,784 139

Supplies made to Unregistered Persons

Haryana 2,000 100

Supplies made to Unregistered Persons

Himachal Pradesh 818 41

Supplies made to Unregistered Persons

Karnataka 11,649 583

Supplies made to Unregistered Persons

Tamil Nadu 12,673 634

Supplies made to Unregistered Persons

Assam 24,953 1,248

Supplies made to Unregistered Persons

Uttar Pradesh 19,552 978

Supplies made to Unregistered Persons

Uttarakhand 2,423 121

Supplies made to Unregistered Persons

Madhya Pradesh 3,735 187

Total 1,93,683 9,685

4. Eligible ITC

Details IGST CGST SGST/UTGST Cess

(A) ITC Available (whether in full or part)

8,136 4,460 4,460 0

(1) Import of goods 0 0 0 0

(2) Import of services 0 0 0 0

(3) Inward supplies liable to reverse charge

0 2,515 2,515 0

(other than 1 and 2 above)

(4) Inward supplies from ISD 0 0 0 0

(5) All other ITC 8,136 1,945 1,945 0

(B) ITC Reversed 34 0 0 0

(1) As per rules 42 and 43 of CGST Rules

0 0 0 0

(2) Others 34 0 0 0

(C) Net ITC Available (A) – (B) 8,102 4,460 4,460 0

(D) Ineligible ITC 0 0 0 0

(1) As per section 17(5) 0 0 0 0

(2) Others 0 0 0 0

5. Values of exempt, nil-rated and non-GST inward supplies

Nature of supplies Inter-State supplies Intra-State supplies

From a supplier under composition scheme,

0 0

Exempt and Nil rated supply

Non GST supply 0 0

Total 0 0

5.1 Interest and Late Fee Payable

IGST CGST SGST/UTGST Cess

Interest 0 0 0 0

Late Fees 0 0 0 0

6.1 Payment of tax

Tax Payable Tax Paid

Description Paid Through ITC Tax/Cess Paid in Cash

Tax Paid

Total Tax Interest Late Fee

IGST CGST SGST/UTGST Cess Tax Paid Interest Late Fee TDS/TCS

Other than Reverse

Charge

IGST 0 0 0 8,102 1,579 0 0 4 0 0 0

CGST 0 0 0 0 411 0 0 0 0 0 0

SGST/UTGST 0 0 0 0 0 411 0 0 0 0 0

Cess 0 0 0 0 0 0 0 0 0 0 0

Total 0 0 0 8,102 1,990 411 0 4 0 0 0

Reverse Charge

IGST 0 0 0 0 0 0 0 0 0 0 0

CGST 0 0 0 0 0 0 0 2,515 0 0 0

SGST/UTGST 0 0 0 0 0 0 0 2,515 0 0 0

Cess 0 0 0 0 0 0 0 0 0 0 0

Total 0 0 0 0 0 0 0 5,030 0 0 0

Grand Total 0 10,503 5,034 0

6.2 TDS/TCS Credit

Details IGST CGST SGST/UTGST

TDS 0 0 0

TCS 0 0 0

Total 0 0 0

7. System Calculated Interest

Summary

Description Integrated Tax Central Tax State/ UT Tax Cess

Interest null null null null

Tax Period Wise Interest Liabilities

Breakup of System computed interest liability - Current Tax period [ As per provisio to subsection 1 of section 50, CGST

Interest payable to portion of Liability paid by debiting electronic cash ledger

As per notification - Cenral Tax Dated:

Tax Liability Breakup

Verification (by Authorised signatory)

I hereby solemnly affirm and declare that the information given herein above is true and

correct to the best of my knowledge and belief and nothing has been concealed there from.

Instructions:

1) Value of Taxable Supplies = Value of invoices + value of Debit Notes – value of credit

notes + value of advances received for which invoices have not been issued in the same

month – value of advances adjusted against invoices

2)Details of advances as well as adjustment of same against invoices to be adjusted and not

shown separately

3)Amendment in any details to be adjusted and not shown separately.

You might also like

- FX Options Hedging Strategies PDFDocument43 pagesFX Options Hedging Strategies PDFmarijana_jovanovikNo ratings yet

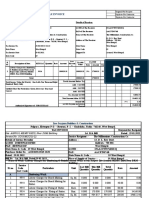

- Jay - Kashyap@vedanta - Co.in F16Document8 pagesJay - Kashyap@vedanta - Co.in F16Jay kashyapNo ratings yet

- Contract of SaleDocument2 pagesContract of SaleJanz CJ67% (3)

- Breakdown EV AnalysisDocument11 pagesBreakdown EV AnalysisHimanshu Aditya BhattNo ratings yet

- Form 16Document2 pagesForm 16Kushal MalhotraNo ratings yet

- SPI HSE FR 02 Tower Erection ChecklistDocument1 pageSPI HSE FR 02 Tower Erection ChecklistChandan KumarNo ratings yet

- Akshay - Dev@vedanta - Co.in F16Document10 pagesAkshay - Dev@vedanta - Co.in F16Akshay DevNo ratings yet

- Salry DecDocument1 pageSalry DecAnkush KumarNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Classification of TaxesDocument16 pagesClassification of TaxesJo-Al Gealon100% (1)

- Old and New InstitutionalismDocument10 pagesOld and New InstitutionalismPinto BuanaNo ratings yet

- Chap 9 - 12 SolutionsDocument51 pagesChap 9 - 12 SolutionsSasank Tippavarjula81% (16)

- 19aavca6757a1za - 122022 - GSTR-3B MDocument5 pages19aavca6757a1za - 122022 - GSTR-3B MSheksNo ratings yet

- 19jdaps4566m1zn - 082023 - GSTR-3B MDocument4 pages19jdaps4566m1zn - 082023 - GSTR-3B MSheksNo ratings yet

- PIIX00260 Dev AutomationDocument1 pagePIIX00260 Dev AutomationSabhyaNo ratings yet

- 19blwph6736c1zo - 062023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 062023 - GSTR-3B MSheksNo ratings yet

- 24BHNPP5843B1ZB - 032019 - GSTR-3B MDocument4 pages24BHNPP5843B1ZB - 032019 - GSTR-3B MGST Range5 Division1No ratings yet

- 19kxcps4738e1zy - 0102023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 0102023 - GSTR-3B MSheksNo ratings yet

- 19kxcps4738e1zy - 082023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 082023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 032023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 032023 - GSTR-3B MSheksNo ratings yet

- GSTR3B 09DTRPK4163B1ZI 092023 SystemGeneratedDocument9 pagesGSTR3B 09DTRPK4163B1ZI 092023 SystemGeneratedmohdhaneef12347No ratings yet

- Oct22-Dec 22internet BillDocument1 pageOct22-Dec 22internet Billhanuman sqlboyNo ratings yet

- 19blwph6736c1zo - 072023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 072023 - GSTR-3B MSheksNo ratings yet

- 19kxcps4738e1zy - 062023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 062023 - GSTR-3B MSheksNo ratings yet

- Inv 232409Document1 pageInv 232409Sneha SharmaNo ratings yet

- 19kxcps4738e1zy - 092023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 092023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 092022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 092022 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 012023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 012023 - GSTR-3B MSheksNo ratings yet

- Invoice Id 5995599Document1 pageInvoice Id 5995599chachaleeluNo ratings yet

- 10acapy9067d1zn - 0102023 - GSTR-3B MDocument4 pages10acapy9067d1zn - 0102023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 112022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 112022 - GSTR-3B MSheksNo ratings yet

- Bhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0Document4 pagesBhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0mukesh singhal537No ratings yet

- 19blwph6736c1zo - 122022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 122022 - GSTR-3B MSheksNo ratings yet

- 19kxcps4738e1zy - 032023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 032023 - GSTR-3B MSheksNo ratings yet

- 19jdaps4566m1zn - 092023 - GSTR-3B MDocument4 pages19jdaps4566m1zn - 092023 - GSTR-3B MSheksNo ratings yet

- GSTR 3BDocument2 pagesGSTR 3BShruti RastogiNo ratings yet

- Participating in Return Tables 512 No Direct Implication in Return Tables 0Document2 pagesParticipating in Return Tables 512 No Direct Implication in Return Tables 0ROHIT SHARMA DEHRADUNNo ratings yet

- Invoicef 2 K 1 Bibdfh 2 RPWKZ 2 JP 5 Nku 4Document1 pageInvoicef 2 K 1 Bibdfh 2 RPWKZ 2 JP 5 Nku 4sandeep sainiNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document6 pagesForm GSTR-3B (See Rule 61 (5) )Asma KhanNo ratings yet

- GST3BDocument1 pageGST3BParshad SankheNo ratings yet

- April 3bDocument2 pagesApril 3bUjjwal GoyalNo ratings yet

- January 23 Broadband BillDocument1 pageJanuary 23 Broadband BillAtashee PaulNo ratings yet

- 19blwph6736c1zo - 022023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 022023 - GSTR-3B MSheksNo ratings yet

- Participating in Return Tables 212 No Direct Implication in Return Tables 0Document1 pageParticipating in Return Tables 212 No Direct Implication in Return Tables 0Dharmendra RoutNo ratings yet

- FORM47Document2 pagesFORM47Kotyada Srinu RaoNo ratings yet

- Tax Invoice: Details of Contractor Details of ReceiverDocument6 pagesTax Invoice: Details of Contractor Details of ReceiverVijay DubeyNo ratings yet

- TYBAF - Indirect Taxation - GST - Set1 - SolutionDocument6 pagesTYBAF - Indirect Taxation - GST - Set1 - Solutionamityadav865783No ratings yet

- Form GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse ChargeDocument4 pagesForm GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse ChargeBHAVNABEN ROYNo ratings yet

- GSTR3B 18acvpa7546a1zk 032023Document4 pagesGSTR3B 18acvpa7546a1zk 032023SUBHASH MOURNo ratings yet

- Dinkar Thakur - ATBPT9919P - 2023-24Document11 pagesDinkar Thakur - ATBPT9919P - 2023-24Dinkar Prasad ThakurNo ratings yet

- Form GSTR-3B (August'21) : Particulars Total Taxable Value Igst CGST Sgst/UtgstDocument3 pagesForm GSTR-3B (August'21) : Particulars Total Taxable Value Igst CGST Sgst/UtgstDost BhawanaNo ratings yet

- IP - UK - Sericulture Sector Profile-2019-05-21Document42 pagesIP - UK - Sericulture Sector Profile-2019-05-21azeem saifiNo ratings yet

- IP UK IT Sector Profile 2019-05-21Document23 pagesIP UK IT Sector Profile 2019-05-21Not So SenseLessNo ratings yet

- Form GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse ChargeDocument4 pagesForm GSTR-3B: 3.1 Details of Outward Supplies and Inward Supplies Liable To Reverse Chargeanand nfzmjNo ratings yet

- GSTR - 3b - POPPAT JAMALS ANNA NAGAR - 2021 - 2022 - 11Document2 pagesGSTR - 3b - POPPAT JAMALS ANNA NAGAR - 2021 - 2022 - 11annanagarstoreNo ratings yet

- GSTR3B 27aaypj1435a1zt 102022Document2 pagesGSTR3B 27aaypj1435a1zt 102022vijayjoshitempNo ratings yet

- Tax Invoice: Akbar & CompanyDocument1 pageTax Invoice: Akbar & CompanyTTIPLNo ratings yet

- Adobe Scan 15 Nov 2022Document1 pageAdobe Scan 15 Nov 2022Indika PravindaNo ratings yet

- IP-UK-Biotechnology Sector Profile-2019-05-21Document20 pagesIP-UK-Biotechnology Sector Profile-2019-05-21azeem saifiNo ratings yet

- GSTR3B April 2022Document2 pagesGSTR3B April 2022Ashtavinayak AutomobilesNo ratings yet

- GST-Challan ReceiptDocument1 pageGST-Challan Receipttiwariitr1No ratings yet

- GSTR3B 27aaaca6166g1zr 032022Document4 pagesGSTR3B 27aaaca6166g1zr 032022MANISHA SINGHNo ratings yet

- Invoice Id 6418028Document1 pageInvoice Id 6418028pruthvicharan.iasramNo ratings yet

- B2B 062021 19bejpr5281n1zl GSTR2B 17092022Document7 pagesB2B 062021 19bejpr5281n1zl GSTR2B 17092022Suman MondalNo ratings yet

- 19aavca6757a1za - 092021 - GSTR-3B MDocument3 pages19aavca6757a1za - 092021 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 032023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 032023 - GSTR-3B MSheksNo ratings yet

- 19AAVCA6757A1ZA 09-2022 GSTR1 Excel DownloadDocument3 pages19AAVCA6757A1ZA 09-2022 GSTR1 Excel DownloadSheksNo ratings yet

- 19AAVCA6757A1ZA 03-2022 GSTR1 Excel DownloadDocument3 pages19AAVCA6757A1ZA 03-2022 GSTR1 Excel DownloadSheksNo ratings yet

- 19AAVCA6757A1ZA 06-2022 GSTR1 Excel DownloadDocument6 pages19AAVCA6757A1ZA 06-2022 GSTR1 Excel DownloadSheksNo ratings yet

- 19AAVCA6757A1ZA 03-2023 GSTR1 Excel DownloadDocument6 pages19AAVCA6757A1ZA 03-2023 GSTR1 Excel DownloadSheksNo ratings yet

- 19blwph6736c1zo 2022 B2BDocument12 pages19blwph6736c1zo 2022 B2BSheksNo ratings yet

- 19jdaps4566m1zn - 042023 - GSTR-3B MDocument3 pages19jdaps4566m1zn - 042023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 092022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 092022 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 082022 - GSTR-3B MDocument3 pages19blwph6736c1zo - 082022 - GSTR-3B MSheksNo ratings yet

- 19jdaps4566m1zn 2023 B2BDocument27 pages19jdaps4566m1zn 2023 B2BSheksNo ratings yet

- 19jdaps4566m1zn - 062023 - GSTR-3B MDocument3 pages19jdaps4566m1zn - 062023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo 2023 B2BDocument9 pages19blwph6736c1zo 2023 B2BSheksNo ratings yet

- 19kxcps4738e1zy - 072023 - GSTR-3B MDocument3 pages19kxcps4738e1zy - 072023 - GSTR-3B MSheksNo ratings yet

- 19KXCPS4738E1ZY 09-2023 GSTR1 Excel DownloadDocument12 pages19KXCPS4738E1ZY 09-2023 GSTR1 Excel DownloadSheksNo ratings yet

- 19kxcps4738e1zy 2023 B2BDocument15 pages19kxcps4738e1zy 2023 B2BSheksNo ratings yet

- Scrutiny Format 19KXCPDocument2 pagesScrutiny Format 19KXCPSheksNo ratings yet

- 19kxcps4738e1zy - 0102023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 0102023 - GSTR-3B MSheksNo ratings yet

- 19kxcps4738e1zy - 112022 - GSTR-3B MDocument3 pages19kxcps4738e1zy - 112022 - GSTR-3B MSheksNo ratings yet

- 19kxcps4738e1zy - 092023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 092023 - GSTR-3B MSheksNo ratings yet

- 19KXCPS4738E1ZY 10-2023 GSTR1 Excel DownloadDocument16 pages19KXCPS4738E1ZY 10-2023 GSTR1 Excel DownloadSheksNo ratings yet

- 836266503Document1 page836266503SheksNo ratings yet

- 10acapy9067d1zn - 092023 - GSTR-3B MDocument3 pages10acapy9067d1zn - 092023 - GSTR-3B MSheksNo ratings yet

- 10acapy9067d1zn 10-2023 Gstr1 Excel DownloadDocument12 pages10acapy9067d1zn 10-2023 Gstr1 Excel DownloadSheksNo ratings yet

- 10acapy9067d1zn - 052023 - GSTR-3B MDocument3 pages10acapy9067d1zn - 052023 - GSTR-3B MSheksNo ratings yet

- 10acapy9067d1zn - 082023 - GSTR-3B MDocument3 pages10acapy9067d1zn - 082023 - GSTR-3B MSheksNo ratings yet

- 10acapy9067d1zn - 042023 - GSTR-3B MDocument3 pages10acapy9067d1zn - 042023 - GSTR-3B MSheksNo ratings yet

- 19BLDocument5 pages19BLSheksNo ratings yet

- China, US To Push Forward Phase-One Deal: Nation Remains Committed To Reform, Opening-UpDocument20 pagesChina, US To Push Forward Phase-One Deal: Nation Remains Committed To Reform, Opening-UpJackZhangNo ratings yet

- Lesson 2 Weeks 3 5 The Structures of Globalization 10 Sept 2021 For Class Sharing 1 PDFDocument140 pagesLesson 2 Weeks 3 5 The Structures of Globalization 10 Sept 2021 For Class Sharing 1 PDFPong MartilloNo ratings yet

- 5 - UNIT 5 - Rural Industrialization and Entrepreneurship - BY MANISH KUMAR SHARMADocument37 pages5 - UNIT 5 - Rural Industrialization and Entrepreneurship - BY MANISH KUMAR SHARMAmanish kumar sharmaNo ratings yet

- Environmental ScienceDocument1 pageEnvironmental ScienceLovely Cañon100% (1)

- B Com (Industry Int) 1st To 6th Sem Session 2011-12Document53 pagesB Com (Industry Int) 1st To 6th Sem Session 2011-12विवेक तलवारNo ratings yet

- Cut Off/dispatch 12 Noon, Mon-Fri. Royal Mail 1st Class Signed For, Next Day Delivery, International TrackedDocument22 pagesCut Off/dispatch 12 Noon, Mon-Fri. Royal Mail 1st Class Signed For, Next Day Delivery, International TrackedKamagra UKNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePrateek HaksarNo ratings yet

- How To Compute Withholding Tax On CompensationDocument7 pagesHow To Compute Withholding Tax On CompensationJessica GabejanNo ratings yet

- WWW - Referat.ro England5093366fDocument13 pagesWWW - Referat.ro England5093366fJoanne LeeNo ratings yet

- Engleski Vjezbanje 2Document13 pagesEngleski Vjezbanje 2qckq9qnkfgNo ratings yet

- Monthly Disbursement ProgramDocument8 pagesMonthly Disbursement ProgramEdwin MasicatNo ratings yet

- Roll Nos. of Candidates Shortlisted For The Interview For The Post of Assistants For Which Written Examination Was Held On April 29, 2012Document38 pagesRoll Nos. of Candidates Shortlisted For The Interview For The Post of Assistants For Which Written Examination Was Held On April 29, 2012Thomas SebastianNo ratings yet

- AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Document3 pagesAFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Judith CastroNo ratings yet

- Heckscher-Ohlin's Theory of International TradeDocument13 pagesHeckscher-Ohlin's Theory of International TradeGerald CaasiNo ratings yet

- Rudrali General PresentationDocument48 pagesRudrali General PresentationshrikantNo ratings yet

- TSL Audited Results For FY Ended 31 Oct 13Document2 pagesTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- Locon UI Delegates MailingDocument14 pagesLocon UI Delegates MailingNurul ArumNo ratings yet

- Impact of GST On Indian Logistics SectorDocument12 pagesImpact of GST On Indian Logistics SectorRahul SNo ratings yet

- Data 08-05-2023 Daftar Nama-Nama CPMI Yang Berhasil RefundDocument18 pagesData 08-05-2023 Daftar Nama-Nama CPMI Yang Berhasil RefundMatondang LimNo ratings yet

- Design Thinking - Component Wise MarksDocument2 pagesDesign Thinking - Component Wise Marksdashing_siddarthNo ratings yet

- Formal Informal EnglishDocument20 pagesFormal Informal EnglishThinn Thinn OoNo ratings yet

- 01 CPE Entry TestDocument8 pages01 CPE Entry TestMilaNo ratings yet

- Forestry PresentationDocument48 pagesForestry PresentationAlok JaisNo ratings yet