Professional Documents

Culture Documents

RBI Cautions Against Frauds in The Name of KYC Updation

RBI Cautions Against Frauds in The Name of KYC Updation

Uploaded by

Shivam SuryawanshiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI Cautions Against Frauds in The Name of KYC Updation

RBI Cautions Against Frauds in The Name of KYC Updation

Uploaded by

Shivam SuryawanshiCopyright:

Available Formats

�ेस �काशनी PRESS RELEASE

भारतीय �रज़व� ब�क

RESERVE BANK OF INDIA

वेबसाइट : www.rbi.org.in/hindi संचार िवभाग, क� �ीय कायार्लय, शहीद भगत �संह मागर्, फोटर्, मुंबई-400001

Website : www.rbi.org.in Department of Communication, Central Office, Shahid Bhagat Singh Marg, Fort,

ई-मेल/email : helpdoc@rbi.org.in Mumbai-400001 फोन/Phone: 022- 22660502

February 02, 2024

RBI cautions against frauds in the name of KYC updation

The Reserve Bank had cautioned members of public against frauds in the name of

KYC updation vide its Press Release dated September 13, 2021. In the wake of

continuing incidents/ reports of customers falling prey to frauds being perpetrated in the

name of KYC updation, RBI once again urges the members of public to exercise caution

and due care to prevent loss and safeguard themselves from such malicious practices.

The modus operandi for such frauds usually involves customers receiving unsolicited

communications, including phone calls/SMS/emails, through which they are manipulated

into revealing personal information, account/login details, or installing unauthorized or

unverified apps through links provided in the messages. Such communications often

employ tactics of creating a false urgency and threatening of account

freezing/blocking/closure, if the customer fails to comply. When customers share

essential personal or login details, fraudsters gain unauthorized access to their accounts

and engage in fraudulent activities.

In case of financial cyber frauds, members of public should immediately lodge a

complaint on the National Cyber Crime Reporting Portal (www.cybercrime.gov.in) or

through cybercrime helpline (1930). Further, in order to safeguard themselves, members

of public are encouraged to adopt the following measures:-

Do’s

• In the event of receiving any request for KYC updation, directly contact their bank/

financial institution for confirmation/ assistance.

• Obtain contact number/ customer care phone number of the bank/ financial

institution only through its official website/ sources.

• Inform their bank/ financial institution immediately in case of any cyber fraud incident.

• Enquire with their bank branch to ascertain available modes/ options for updating

KYC details.

• For more details or additional information on the requirements and channels for

updation/periodic updation of KYC, please read paragraph 38 of the RBI Master

Direction on KYC dated February 25, 2016, as amended from time to time.

Don’ts

• Do not share account login credentials, card information, PINs, passwords, OTPs

with anyone.

• Do not share KYC documents or copies of KYC documents with unknown or

unidentified individuals or organizations.

• Do not share any sensitive data/ information through unverified/unauthorized

websites or applications.

• Do not click on suspicious or unverified links received in mobile or email.

(Yogesh Dayal)

Press Release: 2023-2024/1794 Chief General Manager

You might also like

- Svcdotnet - Exe - DangerousDocument2 pagesSvcdotnet - Exe - DangerousRihlesh ParlNo ratings yet

- Acceptable Use Policy PDFDocument7 pagesAcceptable Use Policy PDFMuhammad Shahbaz KhanNo ratings yet

- Banking FraudsDocument33 pagesBanking FraudsJaanavee ThapaNo ratings yet

- Cybercrime Prevention TIpsDocument3 pagesCybercrime Prevention TIpsJohn Ariel FanaderoNo ratings yet

- Enterprise Security Nanodegree Program SyllabusDocument15 pagesEnterprise Security Nanodegree Program SyllabusRudrali HitechNo ratings yet

- Unit 3. Procedure For Opening & Operating of Deposit AccountDocument11 pagesUnit 3. Procedure For Opening & Operating of Deposit AccountBhagyesh ThakurNo ratings yet

- Vijeta October 2022 - MDIDocument333 pagesVijeta October 2022 - MDIMihira SwarnaNo ratings yet

- KYC AmlDocument44 pagesKYC Amlakshay2orionNo ratings yet

- Know Your CustomerDocument2 pagesKnow Your CustomerSAMEER100% (1)

- Configuration McAfee VirusScan Enterprise EnEN en-USDocument18 pagesConfiguration McAfee VirusScan Enterprise EnEN en-UShdswt_mNo ratings yet

- An Overview of Kyc NormsDocument5 pagesAn Overview of Kyc NormsArsh AhmedNo ratings yet

- VIJETA-2020 (विजेता) @MDI March2020 PDFDocument437 pagesVIJETA-2020 (विजेता) @MDI March2020 PDFpravesh_chandra7086100% (5)

- F5 Advanced WAF Customer DeckDocument37 pagesF5 Advanced WAF Customer Deckmemo_fdzsNo ratings yet

- Electronic Know-Your Customer (e-KYC)Document85 pagesElectronic Know-Your Customer (e-KYC)Chandrakanti SahooNo ratings yet

- Kyc & AmlDocument149 pagesKyc & AmlKailash SharmaNo ratings yet

- Manual 1044 31mar19 Revised PDFDocument232 pagesManual 1044 31mar19 Revised PDFRanjeet kumarNo ratings yet

- Cyberark 2023 Identity Security Threat Landscape Report FinalDocument16 pagesCyberark 2023 Identity Security Threat Landscape Report FinalSaurabh KapoorNo ratings yet

- 1 Kyc PDFDocument70 pages1 Kyc PDFMallikaNo ratings yet

- Grp3 FraudDocument11 pagesGrp3 Fraudsriraj.varanasiNo ratings yet

- Iepr 1261 VC 1213Document2 pagesIepr 1261 VC 1213api-225767662No ratings yet

- Stay Informed Stay AwareDocument10 pagesStay Informed Stay Awaresukhrajsingh211979No ratings yet

- Mumbai Police Safe Banking 19-10-2021Document3 pagesMumbai Police Safe Banking 19-10-2021asksameerkumarNo ratings yet

- Debit Notification From Axis BankDocument2 pagesDebit Notification From Axis Banklalashafeek123No ratings yet

- Reading 2 - Digital and Online Banking FraudsDocument20 pagesReading 2 - Digital and Online Banking Fraudsxayog34575No ratings yet

- Citizens Charter Cbi19Document20 pagesCitizens Charter Cbi19Movies BlogNo ratings yet

- ICICI Bank Existing Broker Account Signed Acknowledgement FalseDocument17 pagesICICI Bank Existing Broker Account Signed Acknowledgement FalseS W AkramNo ratings yet

- RBI Master Circular, 2014Document34 pagesRBI Master Circular, 2014Devendra VermaNo ratings yet

- KycDocument47 pagesKycVinod TiwariNo ratings yet

- Bank Terms and ConditionDocument5 pagesBank Terms and ConditionLibin VargheseNo ratings yet

- BSP Memo M-2022-015Document3 pagesBSP Memo M-2022-015IbbiNo ratings yet

- Digital Token Closure Letter - 240202053015668Document1 pageDigital Token Closure Letter - 240202053015668Vikrant vasaniNo ratings yet

- File Not Found - Your Enquiry On Karamjit Kaur Returned No Credit File. All of The Details Reflected in This No Hit Credit Report Are The Details You EnteredDocument2 pagesFile Not Found - Your Enquiry On Karamjit Kaur Returned No Credit File. All of The Details Reflected in This No Hit Credit Report Are The Details You EnteredGautam MahajanNo ratings yet

- Unit 3 TybbaDocument11 pagesUnit 3 TybbaChaitanya FulariNo ratings yet

- Beepedia Daily Current Affairs (Beepedia) 17th November 2023Document10 pagesBeepedia Daily Current Affairs (Beepedia) 17th November 2023hawking483No ratings yet

- Dispensing With No Due Certificate' For Lending by BanksDocument2 pagesDispensing With No Due Certificate' For Lending by BankschiranjoyNo ratings yet

- Kyc NormsDocument3 pagesKyc NormsShubhanjaliNo ratings yet

- MCB Internet Banking - TCs (Final)Document12 pagesMCB Internet Banking - TCs (Final)Moin Ul HassanNo ratings yet

- DD-Digital ProductsDocument58 pagesDD-Digital ProductsFaded JadedNo ratings yet

- PM Street Vendor'S Atmanirbhar NidhiDocument4 pagesPM Street Vendor'S Atmanirbhar NidhicloudNo ratings yet

- E KYC PDFDocument4 pagesE KYC PDFCRGB PersonnelNo ratings yet

- Ekyc PDFDocument4 pagesEkyc PDFSandeep KumarNo ratings yet

- RBI Cautions About Fictitious EmailsDocument2 pagesRBI Cautions About Fictitious EmailsRakesh SharmaNo ratings yet

- Ebanking Agreement MainDocument7 pagesEbanking Agreement MainQuaqu Ophori AsieduNo ratings yet

- Indian Institute of Banking & FinanceDocument6 pagesIndian Institute of Banking & FinancenaziaulfathNo ratings yet

- Policy For Credit Card Issuance and ConductDocument15 pagesPolicy For Credit Card Issuance and Conductetebark h/michaleNo ratings yet

- Opening of Bank Accounts in The Names of MinorsDocument2 pagesOpening of Bank Accounts in The Names of MinorsSatwik AcharyaNo ratings yet

- FMS ReportDocument17 pagesFMS ReportRudresh TrivediNo ratings yet

- IBReg FormDocument3 pagesIBReg FormMadan MaharanaNo ratings yet

- 7 YKIAXbl 782 BPC 9 QSF FHBI6 UUe 9 ZQ BT 8 o Ouquc BP Pooo 9 EvggeDocument2 pages7 YKIAXbl 782 BPC 9 QSF FHBI6 UUe 9 ZQ BT 8 o Ouquc BP Pooo 9 Evggekhan sakilNo ratings yet

- Opd English Claim FormDocument2 pagesOpd English Claim Formpriyapj1911No ratings yet

- Loan Closure LetterDocument1 pageLoan Closure Letterrahulkasera12.rkNo ratings yet

- J 24 JCLJ 2022 948 Abhishek11sepdla Gmailcom 20240228 143410 1 13Document13 pagesJ 24 JCLJ 2022 948 Abhishek11sepdla Gmailcom 20240228 143410 1 13gurdev1668No ratings yet

- DownloadDocument5 pagesDownloadhimanshiburana3465No ratings yet

- Unit II Part 1 KYCDocument100 pagesUnit II Part 1 KYCramyaNo ratings yet

- Safeguard Your Card/account From Frauds: Mon, Jul 5, 2021 at 11:05 AMDocument1 pageSafeguard Your Card/account From Frauds: Mon, Jul 5, 2021 at 11:05 AMRatnaPrasadNalamNo ratings yet

- E Banking Terms ConditionDocument6 pagesE Banking Terms ConditionMr AprilNo ratings yet

- My Account Number (S) Single/ Joint Accounts (Branch Use) Transaction Rights (Y/N) (Branch Use) Limited Transaction Rights (Y/N)Document3 pagesMy Account Number (S) Single/ Joint Accounts (Branch Use) Transaction Rights (Y/N) (Branch Use) Limited Transaction Rights (Y/N)anaga1982No ratings yet

- KYC Guide - Biz2Credit India PDFDocument9 pagesKYC Guide - Biz2Credit India PDFAnonymous QRtom4No ratings yet

- Kyc V6 22072021Document4 pagesKyc V6 22072021pxp2k8mdmfNo ratings yet

- Top Financial Scams in India - Forbes Advisor INDIADocument11 pagesTop Financial Scams in India - Forbes Advisor INDIAmadhavjadhav2018No ratings yet

- Presented By-Denish Mandaliya Pooja Bhandari Bhavesh Bhesaniya Hitesh DholakiyaDocument25 pagesPresented By-Denish Mandaliya Pooja Bhandari Bhavesh Bhesaniya Hitesh DholakiyaMandalia Pratik PratikNo ratings yet

- Public Notice: Tridib Ghosh Dastider - CFODocument2 pagesPublic Notice: Tridib Ghosh Dastider - CFOGosend GiftNo ratings yet

- Digital Banking Booklet Ver 1Document32 pagesDigital Banking Booklet Ver 1Anugat JenaNo ratings yet

- Banking Nothing Else) : State Bank of India (PureDocument7 pagesBanking Nothing Else) : State Bank of India (Pureabin tijoNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

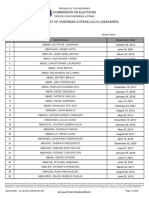

- Commission On Elections: Republic of The PhilippinesDocument676 pagesCommission On Elections: Republic of The PhilippinesGirly A. MacaraegNo ratings yet

- Ethical HackingDocument4 pagesEthical Hackingvirendrak11No ratings yet

- Information Security MaintenanceDocument14 pagesInformation Security MaintenanceHamza AliNo ratings yet

- Bsed-Filipinno Educ110 PortfolioDocument64 pagesBsed-Filipinno Educ110 PortfolioRichelle MendozaNo ratings yet

- 3D Password Sakshi 53Document17 pages3D Password Sakshi 53Shikhar BhardwajNo ratings yet

- FTNT Icon Library External July 2021Document46 pagesFTNT Icon Library External July 2021JaimeSaabNo ratings yet

- Oath-Hotp: Yubico Best Practices GuideDocument11 pagesOath-Hotp: Yubico Best Practices GuideFranzzNo ratings yet

- Creating RSA Keys Using OpenSSLDocument10 pagesCreating RSA Keys Using OpenSSLflorindoNo ratings yet

- Cover Pageof Lab Assignments CryptoDocument10 pagesCover Pageof Lab Assignments CryptoMaster ManNo ratings yet

- OWASP Application Security Verification Standard 4 0 2-EnDocument40 pagesOWASP Application Security Verification Standard 4 0 2-EnAmanda VanegasNo ratings yet

- EY Data Breach Notification To Maine AG 08-03-2023Document7 pagesEY Data Breach Notification To Maine AG 08-03-2023Adrienne GonzalezNo ratings yet

- Information Technology Act, 2000Document21 pagesInformation Technology Act, 2000Biren04No ratings yet

- Nexus 7K and 5K - BASH VulnerabilityDocument3 pagesNexus 7K and 5K - BASH VulnerabilityjarungasisNo ratings yet

- CHAPTER 5 Computer Fraud: TechniquesDocument3 pagesCHAPTER 5 Computer Fraud: TechniquesRomel BucaloyNo ratings yet

- Attracting Hackers - Honeypots For Windows (Books For Professionals by Professionals) PDFDocument2 pagesAttracting Hackers - Honeypots For Windows (Books For Professionals by Professionals) PDFmahendraNo ratings yet

- Evolution of Hacking - Ronit ChakrabortyDocument59 pagesEvolution of Hacking - Ronit ChakrabortyNull KolkataNo ratings yet

- Instance Security Best PracticeDocument23 pagesInstance Security Best PracticeLaura SuchonNo ratings yet

- SWOTEvaluationMLCyberRiskAnalysisConstructionIndustry CCC2021-Dy BgsDocument11 pagesSWOTEvaluationMLCyberRiskAnalysisConstructionIndustry CCC2021-Dy BgsĐức Lê VănNo ratings yet

- Security Lab PrintDocument38 pagesSecurity Lab PrintAni AnbuNo ratings yet

- Put Your Defenses To The Test: MetasploitDocument2 pagesPut Your Defenses To The Test: MetasploitJaimeNo ratings yet

- TLS & SSLv3 Renegotiation Vulnerability ExplainedDocument12 pagesTLS & SSLv3 Renegotiation Vulnerability ExplainedthierryzollerNo ratings yet

- 01WS-PAS-Install-CorePAS Review and SecurityDocument37 pages01WS-PAS-Install-CorePAS Review and SecurityNguyen AnhNo ratings yet

- DAY 6 - PPT - Supraja Technologies - MGIT & CBITDocument19 pagesDAY 6 - PPT - Supraja Technologies - MGIT & CBITVvnaikcseVvnaikcseNo ratings yet