Professional Documents

Culture Documents

Scope & Objectives of FM

Scope & Objectives of FM

Uploaded by

K. Mohammed NowfalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scope & Objectives of FM

Scope & Objectives of FM

Uploaded by

K. Mohammed NowfalCopyright:

Available Formats

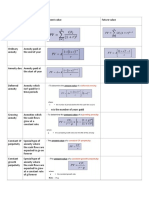

Scope and Objectives of Financial Management

Owned Funds Sources of Funds Borrowed Funds

Domestic International

GDR

Domestic

Internal International

negotiable certificates held

Retained Earnings Euro convertible bonds External Commercial

Preference Share Capital in the bank of one country FRN

-accumulated profits Development Bank Borrowings (ECB) Seed Capital

-Permanent capital -hybrid form of financing representing a specific -Provides an option to the holder

ploughed by company offer a number of -Up to 7 years maturity

-represents ownership -rate of dividend higher then rate of to convert bonds into equity shares Designed by IDBI for start-ups

number of shares of a concessions to foreign -adjustable interest rates -Commercial loans from non residents

back into business -May be callable or puttable -interest-free but carries a service charge of 1%

-residual interest in income and assets interest stock traded on the companies to invest to reflect exchange rates with minimum maturity of 3 years

-belongs to ordinary Euro convertible zero bonds for first five years & then at an increasing rate

-highest cost of capital -types are cumulative, non-cumulative, exchange of another country within their country -cheaper than foreign loans -lenders can be institutions like IFC,

shareholders and -Issued at a discount and -repayment and rate of interest charged depends

-Security to other fund providers redeemable, participating, and to finance ADB,etc or export credit agencies or

Advantages increases the net Euro bonds with equity warrants redeemed at premium on reaping capacity with the moratorium of up to

Nonparticipating, convertible exports from their suppliers of equipments or foreign

-permanent and irredeemable capital Advantages worth Regular bonds with -Usually five years maturity 5 years

countries e.g. EXIM collaborators etc

-increase financial base & help facilitate -no dilution in EPS detachable warrants -Conversion to equity on maturity

ADR IDR Bank of USA -Automatic route and approval route Zero Coupon bonds are no interest bond

additional borrowing -advantage of Leveridge at predetermined price issued at discount and redeemed at par

ADRs are issued by an approved

-no obligation to pay dividend -no risk of takeover foreign companies can

New York bank or trust company LT/MT -deep discount bonds are a type of ZCB

-rights issue -dividends are fixed and predecided issue IDRs to raise

against the deposit of the original

-redeemed after specified period funds from the Indian Secured premium notes are redeemable notes

Disadvantages shares of Non US company

Disadvantages Capital Market in the International agencies Medium term notes Euro commercial issued along with detachable warrants

-dividend income is taxable in the hands The process of buying new, International Commercial Banks

-preference dividend not tax deductible same lines as an Extend foreign currency loans for International finance Corporation -Several lots of bonds can be issued papers our Warrants need to be converted within time period

of shareholders issued ADRs goes through US

-cumulative preference dividend Indian company uses international operations International bank for Reconstruction all having different features W.R.T. short-term money notified by the company (usually 4 to 7 years)

-risky investment brokers, Helsinki Exchanges and

ADRs/GDRs to raise and development coupon rates, Currencies etc market instruments

-Reduction in EPS DTC as well as Deutsche Bank Euro Bonds Unsecured loans are provided by promoters ( quasi

foreign capital LT/ST/MT -Debt instruments which are not Asian development bank -Entire documentation and having a maturity

-dilution of ownership and control Wipro, MTNL, State Bank of India, equity) to meet promoters contribution norm

International monitory fund regulatory approvals can be taken at less than one year

Tata Motors, Dr. Reddy's Lab, denominated in the currency of the - ROI <=institutional rate & can be repaid only after

one point of time usually denominated

Ranbaxy, Larsen & Toubro, ITC, country in which they are issued repayment of institutional dues

LT MT in USD ST

ICICI Bank, Hindalco, HDFC Bank e.g. Rupee note issued in USA LT

and Bajaj Auto -generally issued in bearer form

than as registered bonds

Always long term

Name Currency Issued in Issuer

Commercial bank loans can be raised for Floating rate bonds are bonds on

non- US banks &

Venture Capital Financing Yankee Bond $ USA

corporations LT/ST/MT long-term medium-term or short-term

which the rate of coupon is

fluctuating depending on market

Non- Japanese Long-term loans for purchase of PPE,

These are equity finance to new companies which can be viewed as long-term investment in growth oriented small or medium firms. Venture capitalists Samurai Bond Tokyo, Japan

JPY short-term loans for working capital conditions.

Company

also provide support in the form of sales strategy business networking and management expertise Used for hedging against interest-rate

Bulldog Bond £ London, UK Non- UK Company Bridge finance is a loan for a short period

Some common methods of venture capital financing are as follows volatility and successfully issued by LT/MT

till disbursement of sanctioned loan

-The start-up may not be able to provide returns during the initial stages and therefore venture capitallist provide equity financing for such firms. financial institutions like IDBI and

However the Ownership does not exceed 49% ICICI Debentures

Variable Rate Government/

-conditional loan is repayable in the form of royalty after the firm is able to generate sales. No interest is paid on such loans. The rate of royalty FCCB Convertible FRN Drop Lock Bond Yield curve note Masala bonds Municipal bonds Treasury bonds

demand obligation -Issued by public limited companies as loan from public

ranges between 2% and 15% depending on gestation period cash flow pattern risk and other factors. A choice may be given to the firm to pay high a very low rate of an option to convert it This floating rate Municipal bonds Government or -Denominations ranging from hundred2000

Holder of the It is a inverse floater bonds issued

rate of interest instead of royalty once it becomes commercially sound interest into a longer term bond would be are used to -debenture trust deed lists the terms and conditions

floating rate note in which yield outside India Treasury bonds

-income note is a hybrid security which combines features of both conventional loan and conditional loan but at a substantially low rate issuer can get debt security with a automatically finance urban – maturity varies from 3 to 10 years

can sell the increases when but are bonds issued

-participating debentures carries charges in three phases. In the initial phase no interest is charged, in the next stage lower rate of interest is foreign currency at specified coupon converted into fixed infrastructure -Low cost of capital due to tax benefit

obligation back to prevailing denominated in by Government

charged up to a particular level of operation & after that higher rate of interest is required to be paid a very low cost Protection against rate bond if interest are increasingly of India, Reserve - can be nonconvertible or fully convertible or partly

the trustee at par interest-rate declines Indian Rupees

falling interest rate falls below a plus accrued and vice versa evident in India Bank of India, convertible

Export finance rate

Capital gain is not

predetermined level interest thus making any state -can be bearer or registered or mortgage or naked:

Inflation Bonds are the bonds in which interest rate is

which will stay till it more liquid than Government or

Pre-shipment finance (packing credit) applicable adjusted for inflation. For e.g. if the interest rate is 11

Post-shipment finance maturity normal FRN any other

per cent and the inflation is 5 per cent, the investor

-packing credit is an advance extended by banks to an exporter for the -Purchase/discounting of documentary export bills: Government

will earn 16 per cent meaning thereby that the investor

purpose of buying, manufacturing, processing, packing, shipping goods to Finance is provided to exporters by purchasing export bills department

is protected against inflation

overseas buyers drawn payable at sight or by discounting usance export Zero Interest Fully Convertible Debentures are

-An exporter having at hand a firm export order placed with him by his bills covering confirmed sales and backed by documents compulsorily and automatically converted after a specified

foreign buyer or an irrevocable letter of credit opened in his favour, can including documents of the title of goods such as bill of period of time and holders thereof are entitled to new

approach a bank for availing of packing credit lading, post parcel receipts, or air consignment notes. equity shares of the company at predetermined price

Securitisation

-advance so taken by an exporter is required to be liquidated within 180 - E.C.G.C. Guarantee: Post-shipment finance, given to an

days from the date of its commencement by negotiation of export bills or exporter by a bank through purchase, negotiation or ST

receipt of export proceeds discount of an export bill against an order, qualifies for

-Clean packing credit: This is an advance made available to an exporter post-shipment export credit guarantee. It is necessary,

Advances from Customers Trade Credit

only on production of a firm export order or a letter of credit without however, that exporters should obtain a shipment or

exercising any charge or control over raw material or finished goods. contracts risk policy of E.C.G.C. Banks insist on the Accrued Expenses and Deferred (Unearned) Income

Export Credit Guarantee Corporation (ECGC) cover should be obtained by exporters to take a contracts shipments (comprehensive

the bank risks) policy covering both political and commercial risks. Commercial Paper

-Packing credit against hypothecation of goods: Export finance is made The Corporation, on acceptance of the policy, will fix -an unsecured money market instrument issued in the form of a promissory note

available on certain terms and conditions where the exporter has pledge credit limits for individual exporters and the Corporation’s -issued by high rated corporates, PDs & All India Financial Institutions

able interest and the goods are hypothecated to the bank as security liability will be limited to the extent of the limit so fixed -denomination of 5 lacs or multiples thereof & ROI linked to yield on 1 year gov bond

with stipulated margin. At the time of utilising the advance, the exporter for the exporter concerned irrespective of the amount of -mandatory to obtain credit rating

is required to submit, along with the firm export order or letter of the policy.

credit relative stock statements and thereafter continue submitting them -Advance against export bills sent for collection: Finance T-Bill are short term gov securities with maturity ranging from 14 to 364 days

every fortnight and/or whenever there is any movement in stocks is provided by banks to exporters by way of advance The certificate of deposit is a document of title similar to a time deposit receipt

-Packing credit against pledge of goods: Export finance is made available against export bills forwarded through them for issued by a bank except that there is no prescribed interest rate on such funds.

on certain terms and conditions where the exportable finished goods are collection, taking into account the creditworthiness of the It is traded in the secondary market

pledged to the banks with approved clearing agents who will ship the party, nature of goods exported, usance, standing of A company can accept public deposits subject to the stipulations of Reserve Bank

same from time to time as required by the exporter drawee, etc. of India from time to time upto a maximum amount of 35 per cent of its paid up

-E.C.G.C. guarantee: Any loan given to an exporter for the manufacture, -Advance against duty draw backs, cash subsidy, etc.: To capital and reserves accepted for a period of six months to three years. They are

processing, purchasing, or packing of goods meant for export against a finance export losses sustained by exporters, bank unsecured loans used to finance working capital

firm order qualifies for the packing credit guarantee issued by Export advance against duty draw-back, cash subsidy, etc., Inter corporate deposits are short term borrowings from other corporates

Credit Guarantee Corporation receivable by them against export performance. Such who have surplus liquidity

-Forward exchange contract: Another requirement of packing credit advances are of clean nature; hence necessary precaution

facility is that if the export bill is to be drawn in a foreign currency, the should be exercised Overdraft Customers are allowed to withdraw in excess of credit balance in

The asset is purchased initially by the lessor (leasing company) and thereafter leased to the user (lessee current account up to a fixed limit. They are repayable on demand but generally

exporter should enter into a forward exchange contact with the bank,

thereby avoiding risk involved in a possible change in the rate of exchange

Lease Financing company) which pays a specified rent at periodical intervals continue for long periods by annual renewal of limit. Interest is charged on daily

balances.

Clean OD are unsecured overdraft which are granted only to financially sound and

Particulars Finance Lease Operating Lease

firms having reputation and integrity. They are generally granted for a short period

Risk & Reward Passed on to Leasee Remains with lessor

Other types of lease are and must not be continued for long. As a safeguard, banks take guarantees from

Risk of obsolescence Borne by Lessee Borne by lessor -sales and leaseback other persons who are credit worthy before granting this facility

lease cancellability Non-cancellable Cancellable -leveraged lease Cash credit is an arrangement under which a customer is allowed an advance up to

certain limit. The customer did not borrow the entire amount and he can only draw

CA JAGABANDHU PADHY

-sales aided lease to the extent of his requirement. Interest is charged only on the amount withdrawn.

Cost of repairs Borne by lessor

Borne by Lessee

and maintenance -closed ended and open-ended Generally cash credits are sanctioned against pledge/hypothecation of tradable

goods. Just like overdraft these limits are also renewed annually

and operations

lease Bills purchased or discounted is another Way of raising short-term funds. Even

lease is usually full lease is usually though bills are purchased by bank it can hold the owner of the bill liable in case of

payout, that non-payout, since the dishonour of bill

is, the single lease lessor expects to lease

Full payout

repays the cost of the same asset over and

the asset together over again to several

with the interest users

You might also like

- Credit Analysis and Lending Management (4th Edition) - Milind SathyeDocument525 pagesCredit Analysis and Lending Management (4th Edition) - Milind Sathyenah noh85% (13)

- CA Inter FM & ECO Charts, by CA Swapnil PatniDocument42 pagesCA Inter FM & ECO Charts, by CA Swapnil Patnijdh daveNo ratings yet

- Fixed IncomeDocument22 pagesFixed IncomeGeorge Shevtsov100% (3)

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Negotiable Instruments LawDocument50 pagesNegotiable Instruments LawAbigail Faye Roxas100% (1)

- Equity InvestmentsDocument23 pagesEquity InvestmentsAnonymous zNu6LtkH100% (3)

- TRP Change Ownership FormDocument2 pagesTRP Change Ownership Formambasyapare1100% (1)

- Dividend Decision NotesDocument6 pagesDividend Decision NotesSavya SachiNo ratings yet

- @cmalogics Paper 12 CAADocument605 pages@cmalogics Paper 12 CAAMehak KaushikkNo ratings yet

- Nomura US Vol AnalyticsDocument26 pagesNomura US Vol Analyticshlviethung100% (2)

- Retirement Options Sample ComputationDocument11 pagesRetirement Options Sample Computationluna acosta0% (1)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- EFM Chapter 10Document4 pagesEFM Chapter 10Arissa Kitchy Mababa DyNo ratings yet

- What Is Ecb?Document25 pagesWhat Is Ecb?Abhishek PanigrahiNo ratings yet

- Bond Valuation 17.11.22-SecA-v3-1Document114 pagesBond Valuation 17.11.22-SecA-v3-1Micky VirusNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter Questions PDFDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter Questions PDFNbua AhmadNo ratings yet

- New PPT For Euro Issue 1Document28 pagesNew PPT For Euro Issue 1Bravoboy Johny83% (6)

- Finance Clinic NotesDocument76 pagesFinance Clinic NoteschidoNo ratings yet

- Private EquityDocument9 pagesPrivate Equitysv798dctq9No ratings yet

- SBR IAS-21 Exchange Rates - Presentation - Joseph-Kariuki - KPMGDocument40 pagesSBR IAS-21 Exchange Rates - Presentation - Joseph-Kariuki - KPMGTana Jo100% (1)

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Premium FinancingDocument5 pagesPremium FinancingS.Guru PrasadNo ratings yet

- Bond ValuationDocument31 pagesBond ValuationVeena DixitNo ratings yet

- Lecture 12 - Multinational Capital Structure and Cost of CapitalDocument7 pagesLecture 12 - Multinational Capital Structure and Cost of CapitalTrương Ngọc Minh ĐăngNo ratings yet

- PPT-5 Corporate Action-Dividends, Bonus, Splits EtcDocument16 pagesPPT-5 Corporate Action-Dividends, Bonus, Splits EtcAmrita GhartiNo ratings yet

- Dividend QuestionDocument43 pagesDividend QuestionRehaan Shah100% (1)

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Introduction To Corporate FinanceDocument17 pagesIntroduction To Corporate Financem.gerryNo ratings yet

- IREF IV Brochure June 19 - 6 PagerDocument6 pagesIREF IV Brochure June 19 - 6 PagerSandyNo ratings yet

- Dividend Model NotesDocument8 pagesDividend Model NotesLumumba KuyelaNo ratings yet

- Level Up-CMPC 131 ReviewerDocument6 pagesLevel Up-CMPC 131 ReviewerazithethirdNo ratings yet

- 21Document24 pages21rizwan ahmedNo ratings yet

- K Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewDocument33 pagesK Kiran Kumar: Any Questions? Behavioral Finance, Netscape IPO, ReviewJohn DoeNo ratings yet

- Capital Structure and Cost of Capital - FinalDocument44 pagesCapital Structure and Cost of Capital - FinalManisha SanghviNo ratings yet

- Dayag Notes Partnership FormationDocument3 pagesDayag Notes Partnership FormationGirl Lang AkoNo ratings yet

- Ast Millan CH1Document2 pagesAst Millan CH1Maxine OngNo ratings yet

- ECBDocument19 pagesECBSACHIDANAND KANDLOORNo ratings yet

- In Tax LeveragedBuyouts (LBOs) NoexpDocument3 pagesIn Tax LeveragedBuyouts (LBOs) NoexpRAKSHIT CHAUHANNo ratings yet

- Indian Construction Equipment and Infra Finance Sector OverviewDocument60 pagesIndian Construction Equipment and Infra Finance Sector Overviewsunleon31No ratings yet

- Cost of CapitalDocument75 pagesCost of CapitalManisha SanghviNo ratings yet

- Financial Indicators For The StocksDocument4 pagesFinancial Indicators For The StocksFarhaan MutturNo ratings yet

- Security Analysis and Portfolio Management: Valuation of BondsDocument28 pagesSecurity Analysis and Portfolio Management: Valuation of BondsFranklin ArnoldNo ratings yet

- Chapter 10 - The Cost of CapitalDocument31 pagesChapter 10 - The Cost of CapitalNgọc MinhNo ratings yet

- Topic 4. Stock MarketDocument7 pagesTopic 4. Stock MarketЕкатерина КидяшеваNo ratings yet

- Unit II L1 Long Term Sources of FinanceDocument95 pagesUnit II L1 Long Term Sources of FinanceHari chandanaNo ratings yet

- LIBOR TransitionDocument10 pagesLIBOR TransitionMahek GoyalNo ratings yet

- Dividend Policy MindmapDocument4 pagesDividend Policy Mindmapnurul hamizah yang hamzahNo ratings yet

- Mcgraw-Hill/Irwin Corporate Finance, 7/EDocument16 pagesMcgraw-Hill/Irwin Corporate Finance, 7/EDamatNo ratings yet

- Financial Structure and International DebtDocument27 pagesFinancial Structure and International Debtshivakumar N100% (1)

- Afar NotesDocument8 pagesAfar NotesToni Rose AbreraNo ratings yet

- Nas 33 EpsDocument61 pagesNas 33 EpsbinuNo ratings yet

- Reading 24 - Understanding Balance SheetDocument1 pageReading 24 - Understanding Balance Sheetmaimaitaan120201No ratings yet

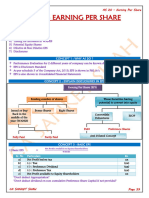

- Unit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToDocument55 pagesUnit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToMohammad Ehsan IrfanNo ratings yet

- 3.1 Sources of FinanceDocument28 pages3.1 Sources of Financeceline.pretorius2022No ratings yet

- Slides - Alternative Investments - Categories of Alternative InvestmentsDocument9 pagesSlides - Alternative Investments - Categories of Alternative InvestmentsjargonNo ratings yet

- Buyer's Credit Facility: RequirementsDocument1 pageBuyer's Credit Facility: RequirementsSalah AyoubiNo ratings yet

- Mutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh EditionDocument23 pagesMutual Funds and Other Investment Companies: Bodie, Kane, and Marcus Eleventh Editionirma makharoblidzeNo ratings yet

- Private Equity Valuation: FintreeDocument46 pagesPrivate Equity Valuation: FintreeAniket JainNo ratings yet

- Type of Finance MannualDocument17 pagesType of Finance MannualManisha NamaNo ratings yet

- To Test Name of Ratio Formula Parties Interested Industr y NormDocument4 pagesTo Test Name of Ratio Formula Parties Interested Industr y NormMohit SachdevNo ratings yet

- Investment Matrix For Phinvest (By U - Speqter and U - Tagongpangalan)Document5 pagesInvestment Matrix For Phinvest (By U - Speqter and U - Tagongpangalan)Tristan Tabago ConsolacionNo ratings yet

- FinMan WORKING CAPITAL MANAGEMENT - For PrintingDocument46 pagesFinMan WORKING CAPITAL MANAGEMENT - For PrintingLito Jose Perez LalantaconNo ratings yet

- 1.1 Sources of FinanceDocument63 pages1.1 Sources of FinanceKiran MohanNo ratings yet

- Assets - Based - Accounting - Standards - CH-5 AS-02 VALUATION OF INVENTORIESDocument81 pagesAssets - Based - Accounting - Standards - CH-5 AS-02 VALUATION OF INVENTORIESlucifersdevil68No ratings yet

- As 20 - Earning Per Share CH-4Document5 pagesAs 20 - Earning Per Share CH-4lucifersdevil68No ratings yet

- AS - 1 - Disclosure - of - Accounting - Policies CH-4Document7 pagesAS - 1 - Disclosure - of - Accounting - Policies CH-4lucifersdevil68No ratings yet

- As 24 - Discontinuing Operations CH-4Document3 pagesAs 24 - Discontinuing Operations CH-4lucifersdevil68No ratings yet

- Banking Law & PracticeDocument21 pagesBanking Law & PracticeSushovan RoyNo ratings yet

- Quiz 571Document6 pagesQuiz 571Haris NoonNo ratings yet

- Reading 36 Market Organization and StructureDocument40 pagesReading 36 Market Organization and StructureNeerajNo ratings yet

- Accountancy & Auditing Paper - 1-2015Document3 pagesAccountancy & Auditing Paper - 1-2015Qasim IbrarNo ratings yet

- ACstatementDocument15 pagesACstatementAfifa Syed0% (1)

- Cppi Model in Discrete Time - Academic PaperDocument28 pagesCppi Model in Discrete Time - Academic Papermwilliams72No ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- HONSDocument86 pagesHONSAkhilesh SinghNo ratings yet

- Management Accounting: Instructions To CandidatesDocument3 pagesManagement Accounting: Instructions To CandidatessumanNo ratings yet

- Soal Latihan Penilaian SahamDocument6 pagesSoal Latihan Penilaian SahamAchmad Syafi'iNo ratings yet

- OpTransactionHistory11 11 2022Document12 pagesOpTransactionHistory11 11 2022Bharath ANo ratings yet

- Robobryce - Key PointsDocument5 pagesRobobryce - Key PointsReabetswe BodigeloNo ratings yet

- Edoc - Pub - Jaiib Made Simple Paper 2 PDFDocument148 pagesEdoc - Pub - Jaiib Made Simple Paper 2 PDFSindhu Arauvinth RaajNo ratings yet

- Book International Financial ManagementDocument201 pagesBook International Financial ManagementasadNo ratings yet

- Access To Energy Services: Case StudiesDocument14 pagesAccess To Energy Services: Case StudiesmaveryqNo ratings yet

- What Is Human Resource AccountingDocument4 pagesWhat Is Human Resource AccountingLiza KhanamNo ratings yet

- Bài tập Unit 2 new PDFDocument9 pagesBài tập Unit 2 new PDFK60 Lê Ngọc HânNo ratings yet

- Investment Thesis ExampleDocument4 pagesInvestment Thesis ExampleNicole Heredia100% (2)

- Real Estate Investing Purchase AgreementDocument2 pagesReal Estate Investing Purchase Agreementbernel069100% (1)

- 2012 Business - Barker Trial With SolutionsDocument40 pages2012 Business - Barker Trial With SolutionsArpit KumarNo ratings yet

- Sale of A Motor Vehicle TEMPLATEDocument2 pagesSale of A Motor Vehicle TEMPLATEHANIS MAT HUSSINNo ratings yet

- PPP Loan Data - Key AspectsDocument2 pagesPPP Loan Data - Key AspectsJenn TomanyNo ratings yet

- FDIC v. Killinger, Rotella and Schneider - STEPHEN J. ROTELLA AND DAVID C. SCHNEIDER'S MOTION TO DISMISSDocument27 pagesFDIC v. Killinger, Rotella and Schneider - STEPHEN J. ROTELLA AND DAVID C. SCHNEIDER'S MOTION TO DISMISSmeischerNo ratings yet

- November 2020 BOLTDocument94 pagesNovember 2020 BOLTAditya AmbasthaNo ratings yet