Professional Documents

Culture Documents

Chapter 11 Extra

Uploaded by

minhhquyetOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 11 Extra

Uploaded by

minhhquyetCopyright:

Available Formats

ICAEW 2024 Question bank 1

Chapter 11: Company financial statements

1 Alto plc's share capital consists of 400,000 25p equity shares all of which were issued at a premium of 25%.

The market value of the shares is currently 70p each.

What is the balance on the share capital ledger account?

A £100,000

B £200,000

C £300,000

D £400,000 LO 1d, e; 3a, c

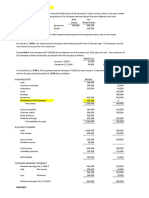

2 At 30 June 20X6 Ollie plc's equity contained the following balances:

£m

Equity shares of £1 each 80

Share premium account 40

During the year ended 30 June 20X7, the following transactions took place:

(1) 1 September 20X6 A 1 for 2 bonus issue, using the share premium account.

(2) 1 January 20X7 A fully subscribed 1 for 3 rights issue at £1.80 per share.

What are the balances on each account at 30 June 20X7?

Share Share

capital premium

£m £m

A 160 72

B 160 32

C 192 72

D 192 32 LO 1d, e; 3a, c

3 A company made an issue of shares for cash of 500,000 50p shares at a premium of 20p per share. Which of

the following journal entries correctly records the issue?

Debit Credit

£ £

A Share capital 250,000

Share premium 100,000

Cash at bank 350,000

B Cash at bank 350,000

Share capital 250,000

Share premium 100,000

C Cash at bank 700,000

Share capital 500,000

Share premium 200,000

D Share capital 500,000

Share premium 300,000

Cash at bank 200,000

LO 1d, e; 2c

ICAEW 2024 Question bank 2

4 At 30 June 20X6, a company's capital structure included the following items:

£

500,000 equity shares of 50p each 250,000

Share premium account 80,000

In the year ended 30 June 20X7 the company made a rights issue of 1 share for every 5 held at £1.20 per share

and this was taken up in full. Later in the year the company made a bonus issue of 1 share for every 5 held,

using the share premium account for the purpose.

What was the company's capital structure at 30 June 20X7?

Equity share Share

capital premium

£ £

A 400,000 90,000

B 360,000 90,000

C 360,000 150,000

D 400,000 150,000

LO 1d, e; 3a, c

5 A company has the following capital structure:

£

Equity share capital 300,000 shares of 25p 75,000

Share premium 50,000

It makes a 1 for 6 rights issue at £1.25, which is fully subscribed.

The balance on share premium following the rights issue is:

A £12,500

B £50,000

C £62,500

D £100,000 LO 1d, e; 3a, c

6 A company has a balance of £5,000 (debit) on its income tax account at 31 December 20X1 relating to the

income tax payable on the 20X0 profits. The company's estimated income tax liability for the year to 31

December 20X1 is £30,000.

The income tax expense in the statement of profit or loss for the year ended 31 December 20X1 is:

A £5,000

B £25,000

C £30,000

D £35,000 LO 1d; 3a, c

ICAEW 2024 Question bank 3

7 A company is preparing its financial statements for the year ending 31 March 20X4. The initial trial balance

has the following figures relating to income tax:

£

Income tax payable at 1 April 20X3 21,200

Income tax agreed with HMRC and paid during the year ended 31 March 20X4 19,500

The estimated income tax liability for the year ended 31 March 20X4 is £26,700.

The figure for income tax expense in the company's statement of profit or loss will be:

A £19,500

B £25,000

C £26,700

D £28,400 LO 1d; 3a, c

8 Which three of the following would be included in current liabilities in a company's financial statements?

A Allowance for receivables

B Bank overdraft

C Tax payable

D Share capital

E Accrued interest charges LO 1d, e; 3a, c

9 Which of the following accounting treatments derive from the accounting concept of accruals?

(1) Annual depreciation charges for non-current assets

(2) Opening and closing inventory adjustments

(3) Capitalisation and amortisation of development expenditure

A (1) and (2) only

B (1) and (3) only

C (2) and (3) only

D (1), (2) and (3) LO 1d; 3a, c

ICAEW 2024 Question bank 4

10 The following transactions occurred during a company's reporting period:

(1) A non-current liability was paid in full.

(2) A substantial amount was written off as irrecoverable debts.

(3) Depreciation was charged on non-current assets.

(4) A non-current asset was sold at its carrying amount.

Which of these transactions result in expense items appearing in the company's draft statement of profit or

loss?

A (1) and (2) only

B (2) and (3) only

C (3) and (4) only

D (1) and (4) only LO 1d; 3a, c

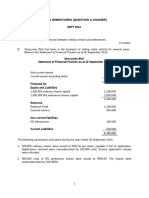

11 At 31 January 20X5, Watchet Ltd had issued share capital of £250,000 in 25p shares. All shares were issued at

par several years ago. During the year the following transactions took place.

1 May 20X5 500,000 shares issued at 75p

30 September 20X5 1 for 25 bonus issue

What is the balance on share premium after these transactions, assuming that share premium is used wherever

possible?

A £182,500

B £220,000

C £235,000

D £360,000 LO 1d, e; 3a, c

12 Wanda Ltd provides a warranty on goods sold which allows customers to return faulty goods within one year

of purchase. At 30 November 20X5, Wanda Ltd had a warranty provision of £6,548. During the year to 30

November 20X6, the cost of warranty claims was £3,720. At 30 November 20X6, the warranty provision was

calculated as £7,634.

What is the amount of the warranty expense that should be included in Wanda Ltd's statement of profit or loss

for the year to 30 November 20X6?

A £7,634

B £1,086

C £4,806

D £2,634 LO 1d

ICAEW 2024 Question bank 5

13 Mobiles Ltd sells goods with a one year standard warranty under which customers are covered for any defect

that becomes apparent within a year of purchase. In calendar year 20X4, Mobiles Ltd sold 100,000 units.

The company expects warranty claims for 5% of units sold. Half of these claims will be for a major defect,

with an average claim value of £50. The other half of these claims will be for a minor defect, with an average

claim value of £10.

What amount should Mobiles Ltd include as a provision in the statement of financial position for the year

ended 31 December 20X4?

A £125,000

B £25,000

C £300,000

D £150,000 LO 1d

14 Doggard Ltd is a business that sells cars. It offers a standard warranty under which, if a car develops a fault

within one year of the sale, Doggard Ltd will repair it free of charge.

At 30 April 20X4 Doggard Ltd had a warranty provision of £52,500. At 30 April 20X5 Doggard Ltd calculated

that the provision should be £48,700.

What is the journal entry to record the warranty provision at 30 April 20X5?

A DR Warranty expense £48,700; CR Warranty provision £48,700

B DR Warranty provision £48,700; CR Warranty expense £48,700

C DR Warranty provision £3,800; CR Warranty expense £3,800

D DR Warranty expense £3,800; CR Warranty provision £3,800 LO 1d; 2c

ICAEW 2024 Question bank 6

You might also like

- CFAB - Accounting - QB - Chapter 11Document15 pagesCFAB - Accounting - QB - Chapter 11Huy NguyenNo ratings yet

- QB 11,12,14,15Document59 pagesQB 11,12,14,15Giang Thái HươngNo ratings yet

- Quiz Chapter-10 She-Part-1 2021Document4 pagesQuiz Chapter-10 She-Part-1 2021Hafsah Amod DisomangcopNo ratings yet

- Partnership Dissolution LiquidationDocument14 pagesPartnership Dissolution Liquidationmartinez2331999No ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- Problem 2Document3 pagesProblem 2Scarlett ReinNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Answers To Reviewer in Acctg 2Document3 pagesAnswers To Reviewer in Acctg 2Fatima AsprerNo ratings yet

- 1 Treasury Shares: PROBLEM 21-1 Requirement 1Document11 pages1 Treasury Shares: PROBLEM 21-1 Requirement 1Bella RonahNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Group 6 PDFDocument14 pagesGroup 6 PDFramuxeNo ratings yet

- Finalchapter 21Document9 pagesFinalchapter 21Jud Rossette ArcebesNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- Documents - Tips Cpa Aditional CorlynDocument34 pagesDocuments - Tips Cpa Aditional CorlynCarol Ferreros PanganNo ratings yet

- Problem 1-8Document11 pagesProblem 1-8JPIA-UE Caloocan '19-20 AcademicsNo ratings yet

- QPractical Accounting Problems IIDocument34 pagesQPractical Accounting Problems IIZee GuillebeauxNo ratings yet

- Gold Company Provided The Following Trial Balance On June 30 PDFDocument3 pagesGold Company Provided The Following Trial Balance On June 30 PDFRengeline LucasNo ratings yet

- Quizzes Chapter 11 Partnership FormationDocument2 pagesQuizzes Chapter 11 Partnership FormationAmie Jane Miranda100% (1)

- Partnership FormationDocument12 pagesPartnership FormationAbc xyzNo ratings yet

- Review Materials For INTERM2Document10 pagesReview Materials For INTERM2Danna VargasNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Acctg301 PartnershipDissolutionDocument16 pagesAcctg301 PartnershipDissolutionTiu Voughn ImmanuelNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Duyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesDocument14 pagesDuyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesYvonne DuyaoNo ratings yet

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- Final Grading Exam Key Answers PDFDocument35 pagesFinal Grading Exam Key Answers PDFLeslie Mae Vargas ZafeNo ratings yet

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocument28 pagesICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- Bản inDocument23 pagesBản inTrang VũNo ratings yet

- Financial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesDocument5 pagesFinancial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesShilla Mae BalanceNo ratings yet

- CHAPTER 15 - CORPORATION - Problem 4 - Multiple Choice - Page 569-572Document7 pagesCHAPTER 15 - CORPORATION - Problem 4 - Multiple Choice - Page 569-572Penelope Palcon100% (5)

- This Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityDocument7 pagesThis Study Resource Was: Dr. Felimon C. Aguilar Memorial College Golden Gate Subd. Las Piñas CityAnne Marieline BuenaventuraNo ratings yet

- Class Practice - Company Accounting - SolvedDocument7 pagesClass Practice - Company Accounting - SolvedMarcoNo ratings yet

- Worked Example Chap12Document8 pagesWorked Example Chap12Giang Thái HươngNo ratings yet

- This Study Resource Was: Share Premium 2,000,000 Retained Earnings 500,000 Total Shareholders ' Equity 7,800,000Document3 pagesThis Study Resource Was: Share Premium 2,000,000 Retained Earnings 500,000 Total Shareholders ' Equity 7,800,000Alexis Kaye DayagNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasJyasmine Aura V. AgustinNo ratings yet

- 3internal Reconstruction 230725 165705Document6 pages3internal Reconstruction 230725 165705Ruchita JanakiramNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- Partnership Operations - AssignmentDocument6 pagesPartnership Operations - AssignmentRosmar AbanerraNo ratings yet

- Unit III Partnership LiquidationDocument20 pagesUnit III Partnership LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Chapter 6 Jan 2022Document7 pagesChapter 6 Jan 2022zjen3owrene3rongavilNo ratings yet

- 950k X 1/2 X 15 Per ShareDocument5 pages950k X 1/2 X 15 Per ShareNickey DickeyNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- ACW366 - Tutorial Exercises 6 PDFDocument7 pagesACW366 - Tutorial Exercises 6 PDFMERINANo ratings yet

- CFASDocument3 pagesCFASataydeyessaNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- Solution:: 500,000 Cash 500,000 - 800,00 800,000Document3 pagesSolution:: 500,000 Cash 500,000 - 800,00 800,000belle crisNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Sept 2014 - 230716 - 233727Document22 pagesSept 2014 - 230716 - 233727mohddanialhanaffimustaffiNo ratings yet

- Exercises CorporationDocument8 pagesExercises CorporationSelective MoonNo ratings yet

- Chap 6 ExercisesDocument15 pagesChap 6 ExercisesQuokka KyuNo ratings yet

- SheDocument12 pagesSheMark Anthony Tibule80% (5)

- BSA2BQuiz 3Document19 pagesBSA2BQuiz 3Monica Enrico0% (1)

- Partnership DissolutionDocument15 pagesPartnership DissolutionAbc xyzNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Horngren 9th Edition Solutions Ch2Document119 pagesHorngren 9th Edition Solutions Ch2flowerkm80% (5)

- CH 17Document32 pagesCH 17harry arkanNo ratings yet

- Sap Erp: - Balance Sheet - Income Statement - Statement of Cash FlowsDocument44 pagesSap Erp: - Balance Sheet - Income Statement - Statement of Cash FlowsSAM ANUNo ratings yet

- Solvency Ratio AnalysisDocument20 pagesSolvency Ratio AnalysispappunaagraajNo ratings yet

- Konsep Bisnis KSP IndonusaDocument5 pagesKonsep Bisnis KSP Indonusahanda2No ratings yet

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- Malinab Aira Bsba FM 2-2 Activity 5Document13 pagesMalinab Aira Bsba FM 2-2 Activity 5Aira MalinabNo ratings yet

- Capital StructureDocument34 pagesCapital StructureBerlian Leona SingarimbunNo ratings yet

- Resumos - APFDocument23 pagesResumos - APFMariana GomesNo ratings yet

- Financial Statement Analysis & Valuation: Nusrat Jahan BenozirDocument10 pagesFinancial Statement Analysis & Valuation: Nusrat Jahan BenozirTamzid Ahmed LikhonNo ratings yet

- Basic BookkeepingDocument80 pagesBasic BookkeepingCharity CotejoNo ratings yet

- Assets Liabilities & EquityDocument3 pagesAssets Liabilities & EquityJasmine ActaNo ratings yet

- @afar - Complete (Oct2021-Dec2021)Document39 pages@afar - Complete (Oct2021-Dec2021)Violet BaudelaireNo ratings yet

- JshdkjahsdDocument188 pagesJshdkjahsdBea Czarina NavarroNo ratings yet

- Ifrs 9 QuestionsDocument10 pagesIfrs 9 QuestionsKiri chrisNo ratings yet

- Books of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007Document3 pagesBooks of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007April Naida100% (1)

- ACT450 - Fa20 - Project Deliverable PDFDocument10 pagesACT450 - Fa20 - Project Deliverable PDFHassan SheikhNo ratings yet

- Supplier Profile QuestionnaireDocument5 pagesSupplier Profile QuestionnaireÖmer KarahanNo ratings yet

- Dayag BusinessCombDocument3 pagesDayag BusinessCombtaherehNo ratings yet

- Learn and Go This New Formula of Cost of Equity:: JMD TUTORIAL'S-Question BankDocument12 pagesLearn and Go This New Formula of Cost of Equity:: JMD TUTORIAL'S-Question BankSnehal PatelNo ratings yet

- Cpar - Ap 07.28.13Document12 pagesCpar - Ap 07.28.13KwonyoongmaoNo ratings yet

- HO.03 - Cost Accounting CycleDocument11 pagesHO.03 - Cost Accounting CycleChrizelyne MercadoNo ratings yet

- Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesRevision Notes Chapter-1 Introduction To Accountingyash siwachNo ratings yet

- Capital Budgeting: 2. Cost and Benefit AnalysisDocument12 pagesCapital Budgeting: 2. Cost and Benefit AnalysisIfraNo ratings yet

- Chapter 10 Share Capital Transactions Subsequent To Original Issuance Exercises 15 ItemsDocument7 pagesChapter 10 Share Capital Transactions Subsequent To Original Issuance Exercises 15 ItemsdmangiginNo ratings yet

- Far ExercisesDocument34 pagesFar ExercisesTrisha Mae CorpuzNo ratings yet

- Cash Flow Statement (CFS) : Fabm IiDocument11 pagesCash Flow Statement (CFS) : Fabm IiAlyssa Nikki VersozaNo ratings yet

- Intermediate Financial ManagementDocument13 pagesIntermediate Financial ManagementRoyhulAkbar100% (1)

- Dinar Annisa - 142180194 - Tugas 2Document4 pagesDinar Annisa - 142180194 - Tugas 2Salsa BilaNo ratings yet

- Depreciation and DepletionDocument5 pagesDepreciation and DepletionMohammad Salim HossainNo ratings yet