Professional Documents

Culture Documents

1099 Pay Stub Template

Uploaded by

ramiroledererm963Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1099 Pay Stub Template

Uploaded by

ramiroledererm963Copyright:

Available Formats

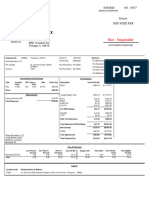

PAY STUB

This is a form summarizing an independent contractor wage, tax information, and other compensation for a given pay period for 1099 independent

contractors

CLIENT COMPANY NAME

[Street Address] [City, ST, ZIP]

[client@company.com] [Phone: (555)000-0000]

EMPLOYEE SSN

Donald Chang 000-000-12345

ADDRESS PHONE PERIOD

23 Contractor Avenue, 21323 Los Angeles (555) 123456789 01/05/2023-31/05/2023

EMAIL PAYMENT DATE TYPE OF COOPERATION

d.chang@independentcontract.com 01/06/2023 Project

EARNINGS HOURS/QTY RATE TOTAL

Gross Payment 168 $20.00 $3,360.00

Overtime Pay 12 $35.00 $420.00

Transport 1 $400.00 $400.00

Bonus 1 $300.00 $300.00

Total Payments $4,480.00

DEDUCTIONS TOTAL

FED TAX: Federal income tax $180.00

STATE TAX: State income tax $202.00

FICA SS TAX: The social security part of the FICA $155.00

FICA MED TAX: The Medicare part of FICA $85.00

LOANS $250.00

Total Deductions $872.00

BANK NAME & ACCOUNT NET PAY $3,608.00

West Rich Bank

1235-1254-5595-0000

Employee Signature Signature of the Client

© TemplateLab.com

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Self Employed Pay Stub TemplateDocument2 pagesSelf Employed Pay Stub TemplateItz AbexboyNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Jason Matheson Paystub 2Document1 pageJason Matheson Paystub 2wadewilliamsperling1992No ratings yet

- Employee Information Pay Stub InformationDocument1 pageEmployee Information Pay Stub Informationrenato pimentelNo ratings yet

- Pay Stub: Dorothy'S StoreDocument1 pagePay Stub: Dorothy'S Storemccallgregory5789081No ratings yet

- 2 - William Mcgarey Paystub 2022 02 28Document1 page2 - William Mcgarey Paystub 2022 02 28sulaimon2023No ratings yet

- 6670 Alexis 12-30-2022Document1 page6670 Alexis 12-30-2022Nego da NagaNo ratings yet

- Family Dollar Paystub 24-04-2020 PDFDocument1 pageFamily Dollar Paystub 24-04-2020 PDFLuis MartinezNo ratings yet

- PayslipDocument1 pagePaysliphienvvuNo ratings yet

- Paystub Green 03-25-2022Document1 pagePaystub Green 03-25-2022Juan Ignacio Ramirez Jaramillo100% (2)

- One Two Three MagicDocument1 pageOne Two Three Magickelle brassartNo ratings yet

- Noa-Iit Ob2220231215050837ibnDocument1 pageNoa-Iit Ob2220231215050837ibnFrankie TanNo ratings yet

- PayStubs 14628Document1 pagePayStubs 14628blackdaniel218No ratings yet

- Modern Paystyb Template PDF FormatDocument1 pageModern Paystyb Template PDF Formatbrenda smithNo ratings yet

- Invoice FormatDocument1 pageInvoice FormatArsalan HahaNo ratings yet

- Adp Pay Stub Template 2Document1 pageAdp Pay Stub Template 2enudo Solomon67% (3)

- Deaconess Homecare Inc: Payroll Advice OnlyDocument4 pagesDeaconess Homecare Inc: Payroll Advice OnlyDREE DREENo ratings yet

- Paystub Resilience Lab Medical PC 20231001 20231015Document1 pagePaystub Resilience Lab Medical PC 20231001 20231015samantha.vasquezNo ratings yet

- Act ch10 l02 EnglishDocument4 pagesAct ch10 l02 EnglishLinds Rivera100% (2)

- Consultant InvoiceDocument5 pagesConsultant InvoiceZafar AhmedNo ratings yet

- INV149344Document2 pagesINV149344accountingNo ratings yet

- Tax Return TranscriptDocument2 pagesTax Return TranscripttravisdemitriusNo ratings yet

- 2julio Gomez Paystub 2023-12-01Document1 page2julio Gomez Paystub 2023-12-0158swd2rmyxNo ratings yet

- Property Tax BillDocument2 pagesProperty Tax Billdipan.routNo ratings yet

- Gayla Poole PaystubDocument1 pageGayla Poole Paystubwadewilliamsperling1992No ratings yet

- Consultant InvoiceDocument2 pagesConsultant Invoicekokohermanto1993No ratings yet

- OWNERSHIP STATEMENT #25 - Kareema Taki & Dheyaa Ali: MR Kareema Taki 13 Manna Way Mill Park, Vic, 3082Document2 pagesOWNERSHIP STATEMENT #25 - Kareema Taki & Dheyaa Ali: MR Kareema Taki 13 Manna Way Mill Park, Vic, 3082Dheyaa AliNo ratings yet

- Salary Slip Format in PDF All PDFDocument3 pagesSalary Slip Format in PDF All PDFRajeev GunasekaranNo ratings yet

- Abigailnegradas : 0184purok2 Brgysanisidrosanpablocity 4000lagunaDocument4 pagesAbigailnegradas : 0184purok2 Brgysanisidrosanpablocity 4000lagunaAbby NegradasNo ratings yet

- Purchase Order 25Document1 pagePurchase Order 25NoviandryNo ratings yet

- Paycheck - 2022 04 24 - 2022 04 30Document1 pagePaycheck - 2022 04 24 - 2022 04 30Sandra RíosNo ratings yet

- Cheesecakefacory PDFDocument1 pageCheesecakefacory PDFTate YatesNo ratings yet

- USAA Stetement USADocument3 pagesUSAA Stetement USAЮлия ПNo ratings yet

- This Week Your Scheduled Hours Were Short of 0 Hours,: PAYROLL PERIOD: Apr 20-Apr 26, 2020Document2 pagesThis Week Your Scheduled Hours Were Short of 0 Hours,: PAYROLL PERIOD: Apr 20-Apr 26, 2020Ammarrylee R. WilliamsNo ratings yet

- Account Temporary ReceiptDocument5 pagesAccount Temporary ReceiptPD888No ratings yet

- Be 20230629Document4 pagesBe 20230629Emman GalangNo ratings yet

- Paycheck - 2022 05 08 - 2022 05 14Document1 pagePaycheck - 2022 05 08 - 2022 05 14Sandra RíosNo ratings yet

- This Is Not A Check: Deductions Current YTDDocument1 pageThis Is Not A Check: Deductions Current YTDJames ChaveNo ratings yet

- Salary Certificate TemplateDocument1 pageSalary Certificate TemplateMd shah JahanNo ratings yet

- Paycheck - 2022 09 18 - 2022 09 24Document1 pagePaycheck - 2022 09 18 - 2022 09 24Sandra RíosNo ratings yet

- Pbi C P 61 9707538 PDFDocument1 pagePbi C P 61 9707538 PDFMandar KshirsagarNo ratings yet

- Report 1Document2 pagesReport 1Raashid Qyidar Aqiel ElNo ratings yet

- Bcrms en r9 RealDocument4 pagesBcrms en r9 RealLao TruongNo ratings yet

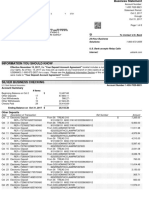

- Monthly Business Fees StatementDocument4 pagesMonthly Business Fees StatementLao TruongNo ratings yet

- KeypOint StatementDocument2 pagesKeypOint StatementPapa BoolioNo ratings yet

- Statement Date:: 4520 71XX XXXX 5156Document3 pagesStatement Date:: 4520 71XX XXXX 5156Dem ThomasNo ratings yet

- .archTP EdoctaResidencial B1-184691282T1-1Document3 pages.archTP EdoctaResidencial B1-184691282T1-1Emilio Reyes PerezNo ratings yet

- Reservation # Invoice # Invoice Date CustomerDocument1 pageReservation # Invoice # Invoice Date CustomerMandar KshirsagarNo ratings yet

- CrystalReportViewer1 3Document1 pageCrystalReportViewer1 3Mehedi HasanNo ratings yet

- Hensley, - Juan - Jaime SabinesDocument2 pagesHensley, - Juan - Jaime SabinesJuan HensleyNo ratings yet

- Alexander Hamilton Earnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 24, 2021Document2 pagesAlexander Hamilton Earnings Statement: Pay Period: Nov 5, 2021 - Nov 18, 2021 Pay Day: Nov 24, 2021Aditya AgrawalNo ratings yet

- July PAY STUB 03Document1 pageJuly PAY STUB 03enudo SolomonNo ratings yet

- Paycheck - 2022 08 28 - 2022 09 03Document1 pagePaycheck - 2022 08 28 - 2022 09 03Sandra RíosNo ratings yet

- Paystub 2Document1 pagePaystub 2Prosper DivignInLifeNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- Urvi Dhala Paystub 2021 12 31Document1 pageUrvi Dhala Paystub 2021 12 31uNo ratings yet

- Free Sample Freelance Budget TemplateDocument1 pageFree Sample Freelance Budget TemplateNikunj VaghasiyaNo ratings yet

- Paycheck - 2022 05 01 - 2022 05 07Document1 pagePaycheck - 2022 05 01 - 2022 05 07Sandra RíosNo ratings yet

- Paystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFDocument8 pagesPaystub E56da99c 5958 40f5 9b2a 8069ae22b175 PDFLuis MartinezNo ratings yet

- Your Electricity BillDocument8 pagesYour Electricity BillJonathan Seagull LivingstonNo ratings yet

- USA Wells Fargo Bank Statement 7 PagesDocument7 pagesUSA Wells Fargo Bank Statement 7 Pagesorbarsage77No ratings yet

- Business Statement Information You ShoulDocument10 pagesBusiness Statement Information You ShoulKenneth SchackaiNo ratings yet

- How To Read Your Gas Bill 2019Document4 pagesHow To Read Your Gas Bill 2019ramiroledererm963No ratings yet

- SWVA Second Harvest Food Bank Spring Newsletter 09Document12 pagesSWVA Second Harvest Food Bank Spring Newsletter 09egeistNo ratings yet

- Enidine Wire Rope IsolatorsDocument52 pagesEnidine Wire Rope IsolatorsJocaNo ratings yet

- ERP and Oracle E-Business Suite ConceptsDocument73 pagesERP and Oracle E-Business Suite ConceptsAlaa Mostafa100% (1)

- Science and Technology in Nation BuildingDocument40 pagesScience and Technology in Nation BuildingDorothy RomagosNo ratings yet

- Vanderbeck Solman ch01-10Document156 pagesVanderbeck Solman ch01-10Jelly AceNo ratings yet

- Dissertation Bowden PDFDocument98 pagesDissertation Bowden PDFmostafaNo ratings yet

- 090 - IRS Levys and LiensDocument4 pages090 - IRS Levys and LiensDavid E RobinsonNo ratings yet

- Metrobank (Strengths)Document6 pagesMetrobank (Strengths)Hera IgnatiusNo ratings yet

- Beverage Companies in PakistanDocument3 pagesBeverage Companies in PakistanZeeshan JavedNo ratings yet

- EY ScandalDocument3 pagesEY ScandalAndrea RumboNo ratings yet

- T3 Rapid Quantitative Test COA - F2311630AADDocument1 pageT3 Rapid Quantitative Test COA - F2311630AADg64bt8rqdwNo ratings yet

- Barangay San Pascual - Judicial Affidavit of PB Armando DeteraDocument9 pagesBarangay San Pascual - Judicial Affidavit of PB Armando DeteraRosemarie JanoNo ratings yet

- Progress Test 3Document7 pagesProgress Test 3Mỹ Dung PntNo ratings yet

- Beer Benefits From Aerator TreatmentDocument2 pagesBeer Benefits From Aerator TreatmentSam MurrayNo ratings yet

- Skott Marsi Art Basel Sponsorship DeckDocument11 pagesSkott Marsi Art Basel Sponsorship DeckANTHONY JACQUETTENo ratings yet

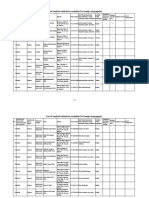

- List of Medical Institutions Available For Foreign Language(s)Document24 pagesList of Medical Institutions Available For Foreign Language(s)leithNo ratings yet

- Fisher C1 Series Pneumatic Controllers and TransmittersDocument12 pagesFisher C1 Series Pneumatic Controllers and TransmittersAnderson KundeNo ratings yet

- Fuzzy Based Techniques For Handling Missing ValuesDocument6 pagesFuzzy Based Techniques For Handling Missing ValuesFarid Ali MousaNo ratings yet

- American Bar Association American Bar Association JournalDocument6 pagesAmerican Bar Association American Bar Association JournalKarishma RajputNo ratings yet

- Crime MappingDocument13 pagesCrime MappingRea Claire QuimnoNo ratings yet

- Motion For Forensic Examination - Cyber CasedocxDocument5 pagesMotion For Forensic Examination - Cyber CasedocxJazz Tracey100% (1)

- Developing IT Security Risk Management PlanDocument5 pagesDeveloping IT Security Risk Management PlanKefa Rabah100% (3)

- UNIT V WearableDocument102 pagesUNIT V WearableajithaNo ratings yet

- List of Circulating Currencies by CountryDocument8 pagesList of Circulating Currencies by CountryVivek SinghNo ratings yet

- TD 3.6 L4 TCD 3.6 L4: Operation ManualDocument72 pagesTD 3.6 L4 TCD 3.6 L4: Operation ManualMajd50% (2)

- Bank Statement - Feb.2020Document5 pagesBank Statement - Feb.2020TRIVEDI ANILNo ratings yet

- Install GuideDocument11 pagesInstall GuideRodrigo Argandoña VillalbaNo ratings yet

- Multiple Linear Regression: Diagnostics: Statistics 203: Introduction To Regression and Analysis of VarianceDocument16 pagesMultiple Linear Regression: Diagnostics: Statistics 203: Introduction To Regression and Analysis of VariancecesardakoNo ratings yet

- Managing Digital Transformations - 1Document105 pagesManaging Digital Transformations - 1RamyaNo ratings yet

- Tendon Grouting - VSLDocument46 pagesTendon Grouting - VSLIrshadYasinNo ratings yet