Professional Documents

Culture Documents

Paper 4 Taxation For Nov 2011

Uploaded by

ACHAL JAINOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper 4 Taxation For Nov 2011

Uploaded by

ACHAL JAINCopyright:

Available Formats

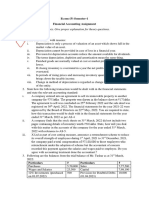

PAPER – 4 : TAXATION

QUESTIONS

Residential Status and Scope of total income

1. (a) Only individuals and HUFs can be resident, but not ordinarily resident in India; firms

and companies can be either a resident or non-resident. Discuss the correctness of

this statement.

(b) Ms Diana, a French national, got married to Mr. Ravi of India in Paris on 01.04.2009

and came to India for the first time on 01.12.2009. She remained in India up till

31.07.2010 and left for Paris on 01.08.2010. She returned to India again on

01.03.2011. While in India, she had purchased a commercial complex in Kolkata on

15.03.2010, which was leased out to a company on a rent of ` 30,000 p.m. from

01.04.2010 She had taken loan from a bank for purchase of this commercial

complex on which the bank had charged interest of ` 1,12,000 upto 31.03.11. She

had received the following gifts from her relatives and friends during 1.4.10 to

31.07.2010:

`

From father-in-law 47,000

From brother-in-law 9,000

From two very close friends of her in-laws, ` 1,67,000 and ` 25,000 1,92,000

Determine her residential status and compute the total income chargeable to tax

along with the amount of tax payable on such income for the Assessment Year

2011-12.

Salaries

2. Mr. Sinha, Finance Manager of DRF Ltd., Chennai, furnishes the following particulars for

the financial year 2010-11.

(i) Salary ` 51,000 per month

(ii) Value of medical facility in a hospital maintained by the company ` 8,000

(iii) Rent free accommodation owned by the company

(iv) Housing loan of ` 5,50,000 at the interest rate of 4% p.a. (No repayment made

during the year). The rate of interest charged by State Bank of India (SBI) as on

01.04.2010 in respect of housing loan is 10%.

(v) Gifts in kind made by company on the occasion of marriage of daughter of Mr.

Sinha ` 7,250.

© The Institute of Chartered Accountants of India

116 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

(vi) A Cupboard was provided to Mr. Sinha at his residence for his use. This was

purchased on 01.08.2007 for ` 75,000 and sold to Mr. Sinha on 01.05.2010 for

` 35,000.

(vii) Personal purchases through credit card provided by the company amounting to

` 12,000 was paid by the company. No part of the amount was recovered from

Mr.Sinha.

(viii) An maruti car which was purchased by the company on 21.06.2007 for ` 4,50,000

was sold to the assessee on 19.08.2010 for ` 1,80,000.

Compute the income chargeable under the head “Salaries” of Mr. Sinha for the

Assessment year 2011-12.

Income from house property

3. Mr. X and Y constructed their houses on a piece of land purchased by them at Mumbai.

The built up area of each house was 1,200 sq.ft. ground floor and an equal area in the

first floor. X started construction on 01.05.2008 and completed construction on

01.04.2010. Y started the construction on 01.04.2008 and completed the construction on

31.05.2010. X occupied the entire house on 01.04.2010. Y occupied the ground floor on

01.06.2010 and let out the first floor for a rent of ` 20,000 per month on 01.07.2010.

However, the tenant vacated the house on 28.02.2011 and Y occupied the entire house

during the period 01.03.2011 to 31.03.2011.

Following are the other information

Particulars ` (per annum)

(i) Fair rental value of each unit 1,20,000

(ground floor /first floor)

(ii) Municipal value of each unit 90,000

(ground floor / first floor)

(iii) Municipal taxes paid by X – 12,000

Y – 12,000

(iv) Repair and maintenance charges paid by X – 31,000

Y – 35,000

X has availed a housing loan of ` 30 lakhs @ 12% p.a. on 01.06.2008. Y has availed a

housing loan of ` 20 lakhs @ 12% p.a. on 01.07.2008. No repayment was made by

either of them till 31-03-11. Compute income from house property for X and Y for the

previous year 2010-11 (A.Y. 2011-12).

Profits and gains of business or profession

4. Mr Mahesh, a retail trader of Panaji gives the following Trading and Profit and Loss

Account for the year ended 31st March, 2011:

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 117

Trading and Profit and Loss Account for the year ended 31.03.2011

Particulars ` Particulars `

To Opening stock 1,10,000 By Sales 19,26,900

To Purchases 17,25,700 By Income from UTI 5,400

To Gross Profit 3,55,800 By Other business receipts 9,200

By Closing stock 2,50,000

21,91,500 21,91,500

To Salary 78,000 By Gross profit b/d 3,55,800

To Rent and rates 38,400

To Interest on loan 18,000

To Depreciation 1,47,500

To Printing & stationery 20,000

To Postage & telegram 1,720

To Loss on sale of shares 9,700

(Short term)

To Other general expenses 6,180

To Net Profit 36,300

3,55,800 3,55,800

Additional Information:

(i) Salary includes ` 12,000 paid to his brother-in-law, which is unreasonable to the

extent of ` 5,000.

(ii) The whole amount of printing and stationery was paid in cash by way of one time

payment.

(iii) The depreciation provided in the Profit and Loss Account ` 1,47,500 was based on

the following information :

The written down value of plant and machinery is ` 5,90,000. A new plant falling

under the same block of depreciation of 15% was bought on 01.09.2010 for `

90,000. Two old plants were sold on 21.05.2010 for ` 1,00,000.

(iv) Rent and rates includes sales tax liability of ` 5,600 paid on 3.10.2011.

(v) Other business receipts include ` 4,600 received as refund of sales tax relating to

2009-10.

(vi) Other general expenses include ` 6,000 paid as donation to an Electroral Trust.

© The Institute of Chartered Accountants of India

118 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

You are required to advise Mr. Mahesh whether or not he should offer his business

income under section 44AD i.e. presumptive taxation.

Capital Gains and Income from Other Sources

5. Mr. Ganesh submits the following information pertaining to the year ended 31st March,

2011.

(i) On 29.12.2010, when he attained the age of 70, his friends in India gave a flat at

Pune as a gift, each contributing a sum of ` 25,000 in cash. The cost of the flat

purchased using the various gifts was ` 3.75 lacs.

(ii) Mr. Ganesh sold the above flat on 30.1.2011 for ` 4.9 lacs. The Registrar’s

valuation for stamp duty purposes was ` 5.2 lacs. Neither Mr. Ganesh nor the

buyer questioned the value fixed by the Registrar.

(iii) His niece abroad sent him a cash gift of ` 55,000 through his brother for the above

occasion.

(iv) He had purchased some equity shares in Z Pvt. Ltd., on 8.4.2005 for ` 4.7 lacs.

These shares were sold privately on 20.8.2010 for ` 3.5 lacs.

(v) He also purchased a house from a friend in ` 2.5 lacs on 21.01.2011. (Stamp Duty

Valuation – ` 4 lacs).

(vi) Mr. Ganesh sold the above house on 23.3.2011 for ` 6 lacs.

(vii) He had purchased some equity shares in N Pvt. Ltd., on 8.6.2010 from his friend for

` 3.9 lacs (Fair Market Value ` 5.7 lacs). These shares were sold privately on

30.1.2011 for ` 6.3 lacs.

You are requested to calculate the total income of Mr. Ganesh for the assessment year

2011-12.

[Cost Inflation Index for F.Y. 2005-06 – 497, F.Y. 2009-10 – 632, 2010-11 – 711]

Set-off and Carry Forward of Losses

6. Mr. Nandit, a resident individual, furnishes the following particulars of his income and

other details for the previous year 2010-11:

Particulars `

(i) Income from salary 29,000

(ii) Net annual value of house property 77,000

(iii) Income from business 95,000

(iv) Income from speculative business 9,000

(v) Long term capital gain on sale of land 17,300

(vi) Loss on maintenance of race horse 11,000

(vii) Loss on gambling 5,000

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 119

Depreciation allowable under the Income-tax Act, 1961, comes to ` 17,000 for which no

treatment is given above.

The other details of unabsorbed depreciation and brought forward losses are:

Particulars `

(i) Unabsorbed depreciation (relating to A/Y 2000-01) 12,000

(ii) Loss from speculative business (relating to A/Y 2009-10) 18,000

(iii) Short term capital loss (relating to A/Y 2009-10) 9,200

Compute the gross total income of Mr. Nandit, for the Assessment year 2011-12, and the

amount of loss that can be carried forward.

Deductions from Gross Total Income

7. For the Assessment year 2011-12, the Gross Total Income of Mr. Tiwari, a resident in

India, was ` 4,12,690 which includes long-term capital gain of ` 55,000 and Short-term

capital gain of ` 13,000. The Gross Total Income also includes interest income from

banks of ` 18,000. Mr. Tiwari has invested in PPF ` 50,000, contribution to fixed

deposits for a period of 5 years amounted to ` 75,000 this year and also paid a medical

insurance premium ` 16,000. Mr. Tiwari also contributed ` 20,000 to Public Charitable

Trust eligible for deduction under section 80G. Compute the total income and tax there

on of Mr. Tiwari, who is 72 years old as on 31.3.2011.

Computation of Total Income and Tax liability of an individual

8. Praveen is a Chartered Accountant in practice. He maintains his accounts on cash basis.

He is a resident and ordinarily resident in India. His Income and Expenditure account for

the year ended March 31, 2011 reads as follows:

Expenditure ` Income `

Salary to staff 5,35,000 Fees earned:

Stipend to articled 27,000 Audit 7,68,200

assistants

Incentive to articled 3,000 Taxation services 5,47,400

assistants

Office rent 36,000 Consultancy 2,71,000 15,86,600

Printing and stationery 6,200 Dividend on shares of

Indian companies 10,524

(gross)

Meeting, seminar and Income from Unit Trust

conference 31,600 of India 7,600

Repairs, maintenance and 25,300 Profit on sale of shares 17,590

petrol of car

© The Institute of Chartered Accountants of India

120 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Subscription and 12,000 Honorarium received

periodicals from various institutions

for valuation of answer 14,510

papers

Postage, telegram and fax 28,800 Rent received from

residential flat let out 96,000

Travelling expenses 45,000

Municipal tax paid in 1,000

respect of house property

Net profit 9,81,924

17,32,824 17,32,824

Other information:

(i) The total travelling expenses incurred on foreign tour was ` 15,000 which was

within the RBI norms.

(ii) Incentive to articled assistants represent amount paid to two articled assistants for

passing IPCC Examination at first attempt.

(iii) Repairs and maintenance of car includes ` 2,000 for the period from 1.10.2010 to

30.09.2011.

(iv) Salary include ` 35,000 to a computer specialist in cash for assisting Mr. Praveen in

one professional assignment.

(v) ` 3,500, interest on loan paid to LIC on the security of his Life Insurance Policy and

utilised for repair of computer, has been debited to the drawing account of Mr.

Praveen.

(vi) Medical Insurance Premium on the health of:

Particulars Amount Mode of

` payment

Self 9,000 By Cheque

Dependent brother 6,000 By Cheque

Major son dependent on him 8,000 By Cash

Minor married daughter 5,000 By Cheque

Wife not dependant on assessee 5,000 By Cheque

(vii) Shares sold were held for 11 months before sale.

Compute the total income and tax payable of Praveen for the Assessment year

2011-12.

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 121

Provisions concerning Advance Tax and Tax Deducted at Source

9. (a) Discuss the provisions relating to payment of interest in case of failure to deduct or

pay tax at source.

(b) An amount of ` 50,000 was paid to Mr. Sudhir on 15.06.2010 towards fees for

professional services without deduction of tax at source. Subsequently, another

payment of ` 65,000 was due to Mr. Sudhir on 10.02.2011 from which tax @ 10%

(amounting to ` 11,500) on the entire amount of ` 1,15,000 was deducted.

However, this tax of ` 11,500 was deposited only on 25.07.2011. Compute the

interest chargeable under section 201(1A).

Provisions for filing of Return of Income

10. (a) The total income of a university without giving effect to exemption under section

10(23C) is ` 39 lacs. Its total income after providing the exemption is, however, nil.

Should the University file its return of income?

(b) Explain with brief reasons whether the return of income can be revised under

section 139(5) of the Income-tax Act, 1961 in the following cases:

(i) Defective or incomplete return filed under section 139(9).

(ii) Belated return filed under section 139(4).

(iii) Return already revised once under section 139(5).

(iv) Return of loss filed under section 139(3).

Computation of interest on delayed payment of service tax

11. Vibha Ltd. is engaged in providing management consultancy services. It was liable to

pay the service tax amounting to ` 10,000, electronically, for the month of August 2011.

However, due to some unavoidable circumstances, it could not pay the said amount on

due date and paid the service tax on 30th November, 2011. You are required to compute

the interest payable by Vibha Ltd. on delayed payment of service tax.

Taxability of transactions

12. State, with reasons, whether service tax is payable in the following cases:-

(a) Donations and grants-in-aid received by a Charitable Foundation imparting free

livelihood training to the youth.

(b) Representation of the client before any statutory authority in the course of

proceedings initiated under any law by a practicing Chartered Accountant.

Value of taxable services

13. Briefly provide the manner of determination of the value of taxable service for the

banking and other financial services relating to purchase or sale of foreign currency,

including money changing.

© The Institute of Chartered Accountants of India

122 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Special rate of service tax

14. Discuss the special rate of service tax leviable in case of an insurer carrying on life

insurance business.

Computation of value of taxable service

15. Rishabh Professionals Ltd. is engaged in providing services which became taxable with

effect from July 01, 2010. Compute the service tax payable by Rishabh Professionals

Ltd. on the following amounts (exclusive of service tax) received for the month of March,

2011:-

Particulars Amount (`)

Services performed before such service became taxable 5,00,000

Services provided to an International Organisation 1,50,000

Free services rendered to the friends 20,000

Advance received in March for services to be rendered in July, 2011 5,00,000

(The agreement got terminated in April, 2011. Hence, no services were

rendered in July. However, a sum of ` 3,50,000 was refunded in June,

2011)

Other receipts 12,00,000

Demerits of VAT

16. Can VAT be said to be non-beneficial as compared to single stage-last point system?

Composition Scheme for small dealers

17. What is the threshold exemption limit fixed for dealers to obtain VAT registration, as per

the White Paper?

Computation of VAT

18. Mr. Ram, a dealer in Tamil Nadu dealing in consumer goods, submits the following

information pertaining to the month of October, 2011:

Details of purchases of goods:-

Particulars (raw material purchased from within the State) Amount (`) Rate of VAT

Goods ‘A’ 10,00,000 Exempt

Goods ‘B’ 20,00,000 1%

Goods ‘C’ 30,00,000 12.5%

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 123

Details of sales of goods:-

Particulars (Sale of finished State in which goods Amount (`) Rate of VAT

goods) are sold

Tamil Nadu 5,00,000 12.5%

Produced from Goods ‘A’

Gujarat 7,00,000 1%

Produced from Goods ‘B’ Tamil Nadu 24,00,000 Exempt

Produced from Goods ‘C’ Tamil Nadu 35,00,000 4%

Compute the amount of Value Added Tax (VAT) payable by Mr. Ram for the relevant

month. There was no opening or closing inventory.

Inter-State stock transfer

19. Discuss the tax consequences of inter-state stock transfer under the VAT scheme.

Filing of returns

20. Discuss filing of return under VAT.

SUGGESTED ANSWERS/HINTS

1. (a) This statement is correct.

A person is said to be “not-ordinarily resident” in India if he satisfies either of the

conditions given in sub-section (6) of section 6. This sub-section relates to only

individuals and Hindu Undivided Families. Therefore, only individuals and Hindu

Undivided Families can be resident, but not ordinarily resident in India. All other classes

of assessees can be either a resident or non-resident for the purpose of income-tax.

Firms and companies can, therefore, either be a resident or non-resident.

(b) Under section 6(1), an individual is said to be resident in India in any previous year,

if she satisfies any one of the following conditions:

(i) She has been in India during the previous year for a total period of 182 days or

more, or

(ii) She has been in India during the 4 years immediately preceding the previous

year for a total period of 365 days or more and has been in India for at least 60

days in the previous year.

If an individual satisfies any one of the conditions mentioned above, she is a resident. If

both the above conditions are not satisfied, the individual is a non-resident.

© The Institute of Chartered Accountants of India

124 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Therefore, the residential status of Ms Diana, a French National, for A.Y.2011-12

has to be determined on the basis of her stay in India during the previous year

relevant to A.Y. 2011-12 i.e. P.Y.2010-11 and in the preceding four assessment year.

Her stay in India during the previous year 2010-11 and in the preceding four years

are as under :

P.Y.2010-11

01.04.2010 to 31.07.2010 - 122 days

01.03.2011 to 31.03.2011 - 31 days

Total 153 days

Four preceding previous years

P.Y.2009-10 [1.4.09 to 31.3.10] - 121 days

P.Y.2008-09 [1.4.08 to 31.3.09] - Nil

P.Y.2007-08 [1.4.07 to 31.3.08] - Nil

P.Y.2006-07 [1.4.06 to 31.3.07] - Nil

Total 121 days

The total stay of the assessee during the previous year in India was less than 182

days and during the four years preceding this year was for 121 days. Therefore,

due to non-fulfillment of any of the two conditions for a resident, she would be

treated as a non-resident for the Assessment Year 2011-12.

Computation of total income of Ms Diana for the A.Y. 2011-12

Particulars ` `

Income from house property

Commercial Complex located in Kolkata remained on rent

from 01.04.10 to 31.03.11 @ ` 30000/- p.m.

Gross Annual Value [30,000 x 12] (See Note 1 below) 3,60,000

Less: Municipal taxes -

Net Annual Value (NAV) 3,60,000

Less:Deduction under section 24

30% of NAV 1,08,000

Interest on loan 1,12,000 2,20,000 1,40,000

Income from other sources

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 125

Gifts received from non-relatives are chargeable to tax as

per section 56(2)(vii) if the aggregate value of such gifts

exceed ` 50,000.

- ` 47,000 received from her father-in-law would be

exempt, since father-in-law falls within the Nil

definition of “relative”, and gifts from a relative are

not chargeable to tax.

- ` 9,000 received from brother-in-law is exempt,

since brother-in-law falls within the definition of Nil

“relative" and gifts from a relative are not

chargeable to tax.

- Gift received from two friends of her in-laws

`1,67,000 and ` 25,000 aggregating to

` 1,92,000 is taxable under section 56(2)(vii)

since the aggregate of ` 1,92,000 exceeds

` 50,000. (see Note 2 below) 1,92,000 1,92,000

Total income 3,32,000

Computation of tax payable by Ms Diana for the A.Y. 2011-12.

Particulars `

Tax on total income of ` 3,32,000 (See Note 3 below) 17,200

Add: Education cess@2% 344

Add : Secondary and higher education cess @1% 172

Total tax liability 17,716

Total tax liability (rounded off) 17,720

Notes :

1. Actual rent received has been taken as the gross annual value in the absence

of other information (i.e. Municipal value, fair rental value and standard rent) in

the question.

2. If the aggregate value of taxable gifts received from non-relatives exceeds

` 50,000 during the year, the entire amount received (i.e. the aggregate value

of taxable gifts received) is taxable. Therefore, the entire amount of

` 1,92,000 is taxable under section 56(2)(vii).

3. The increased basic exemption limit of ` 1,90,000 is available only for resident

women. In this case, since the assessee is a non-resident, she cannot avail

the benefit of higher basic exemption limit of ` 1,90,000.

2. Computation of taxable salary of Mr. Sinha for the Assessment Year 2011-12

© The Institute of Chartered Accountants of India

126 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Particulars `

Income under the head “salaries”

Salary [` 51,000 x 12 ] 6,12,000

Medical facility in the hospital maintained by the company is exempt _

Rent free accommodation

[Rule 3(1) ] – 15% of salary is taxable 91,800

Valuation of perquisite of interest on loan (` 5,50,000 x 6%)

[ Rule 3(7)(i)] – 10% is taxable which is to be reduced by actual rate of 33,000

interest charged i.e. [ 10% - 4% = 6%] [See Note- (i)]

Gift received on occasion of marriage of daughter of Mr. Sinha 7,250

` 7,250 is taxable since its value is more than ` 5,000

[See Note – (iii)]

Use of Cupboard for 1 month

[` 75,000 x 10 /100 x 1 /12] 625

Perquisite on sale of cupboard

Cost 75,000

Less: Depreciation on straight line method @ 10% for 2 years 15,000

W.D.V 60,000

Less: Amount paid by the assessee 35,000 25,000

Personal purchase through credit card provided by Company – 12,000

Amount paid by Company is a taxable perquisite

Perquisite on sale of Motor Car to Mr. Sinha

Original cost of car 4,50,000

Less: Depreciation from 21.6.2007 to 20.6.2008 @ 20% 90,000

3,60,000

Less: Depreciation from 21.6.2008 to 20.6.2009 @ 20% on

WDV 72,000

2,88,000

Less: Depreciation from 21.6.2009 to 20.6.2010 @ 20% on

WDV 57,600

Value as on 19.08.2010- being the date of sale to employee 2,30,400

Less : Amount received from the assessee on 19.08.2010 1,80,000 50,400

Gross salary 8,32,075

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 127

Note :

(i) It is presumed that the housing loan was availed on 1.4.2010.

(ii) Under Rule 3(7)(viii), while calculating the perquisite value of benefit to the

employee arising from the transfer of any movable asset, the normal wear and tear

is to be calculated in respect of each completed year during which the asset was

put to use by the employer. In the given case, the third year of use of maruti car is

completed on 20.06.2010 and the car was sold to the employee on 19.08.2010. The

solution worked out above therefore provides for wear and tear for three years.

(iii) The value of any gift or voucher or token in lieu of gift received by the employee or

by member of his household from the employer not exceeding ` 5,000 in aggregate

during the previous year is exempt. In this case, the amount was received on the

occasion of daughter’s marriage and the sum exceeds the limit of ` 5,000.

Therefore, the entire amount of ` 7,250 is liable to be taxed as perquisite.

An alternative view possible is that only the sum in excess of ` 5,000 is taxable in

view of language of Circular No. 15/2001 dated 12.12.2001 that such gifts upto

` 5,000 in aggregate per annum would be exempt, beyond which it would be taxed

as a perquisite. As per this view, the value of the perquisite would be only ` 2,250.

In that case the gross salary would be ` 8,27,075.

3. Computation of income from house property of Mr. X for A.Y. 2011-12

Particulars ` `

Annual value is nil (since house is self occupied) Nil

Less : Deduction u/s.24(b)

Interest paid on borrowed capital ` 30,00,000 @ 12% 3,60,000

Pre-construction interest 1,32,000

30,00,000 x 12% x 22/12 = ` 6,60,000 4,92,000

` 6,60,000 allowed in 5 equal installments

6,60,000 / 5 = ` 1,32,000 per annum

As per second proviso to section 24(b), interest deduction

restricted to 1,50,000

Loss under the head “Income from house property” of Mr. X (1,50,000)

Computation of income from house property of Mr. Y for A.Y. 2011-12

Particulars Ground floor First

(Self occupied) floor

` `

Gross annual value (See note below) Nil 1,60,000

© The Institute of Chartered Accountants of India

128 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Less :Municipal taxes (for first floor)( 12,000/2) 6,000

Net annual value (A) Nil 1,54,000

Less : Deduction u/s.24

(a) 30% of net annual value 46,200

(b) Interest on borrowed capital

Current year interest

20,00,000 x 12% = 2,40,000 1,20,000 1,20,000

Pre-construction interest

20,00,000 x 12% x 21/12 = ` 4,20,000

` 4,20,000 allowed in 5 equal instalments

4,20,000 / 5 = ` 84,000 per annum 42,000 42,000

1,62,000 2,08,200

Total deduction u/s.24 (interest deduction restricted to 1,50,000 2,08,200

`1,50,000, in case of self occupied property) (B)

Income from house property (A)-(B) (1,50,000) (54,200)

Loss under the head “Income from house property” of

Mr.Y (both ground floor and first floor) (2,04,200)

Note : Computation of Gross Annual Value (GAV) of first floor of Y’s house – If a single

unit of property (in this case the first floor of Y’s house) is let out for some months and

self-occupied for the other months, then the annual letting value (ALV) of the property

shall be taken into account for determining the annual value. The ALV shall be

compared with the actual rent and whichever is higher shall be adopted as the annual

value. In this case, the actual rent shall be the rent for the period for which the property

was let out during the previous year.

The Annual Letting Value (ALV) is the higher of fair rent and municipal value. This

should be considered for 10 months since the construction of property was completed

only on 31.05.2010.

Annual letting value = ` 1,00,000 being higher of -

Fair rent = 1,20,000 x 10 /12 = ` 1,00,000

Municipal value = 90,000 x 10/12 = ` 75,000

Actual rent = ` 1,60,000 (` 20,000 p.m. for 8 months from July, 2010 to

February, 2011 )

Gross annual value = ` 1,60,000 (being higher of ALV of ` 1,00,000 and actual rent of

` 1,60,000)

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 129

4. Computation of business income of Mr. Mahesh for the A.Y. 2011-12.

Particulars ` `

Net Profit as per profit and loss account 36,300

Add Inadmissible expenses / losses

Salary paid to brother–in-law to the extent unreasonable

[Section 40A(2)] 5,000

Printing and stationery paid in cash [See Note-3] Nil

Depreciation (considered separately) 1,47,500

Short term capital loss on shares 9,700

Donation to electroral trust 6,000

Sales Tax Liability (According to section 43B)[Note 2] 5,600 1,73,800

2,10,100

Less: Income from UTI [Exempt u/s 10(35)] 5,400

Refund of sales tax [ Taxable u/s.41(1) – No adjustment

necessary] Nil 5,400

Business income before depreciation 2,04,700

Less: Depreciation (See Note 1) 87,000

1,17,700

Computation of business income as per section 44AD

As per section 44AD, the business income would be 8% of

turnover i.e., 19,26,900 x 8 /100 = ` 1,54,152.

The business income under section 44AD is ` 1,54,152.

Since, the business income under section 44AD is higher than

the business income as per the normal provisions of the Act,

Mr. Mahesh can offer his income under the normal provisions

of the Act, provided he maintains books of accounts under

section 44AA and get his accounts audited under section

44AB.

Note 1

Calculation of depreciation `

WDV of the block of plant & machinery as on 1.4.2010 5,90,000

Add :Cost of new plant & machinery 90,000

6,80,000

Less : Sale proceeds of assets sold 1,00,000

WDV of the block of plant & machinery as on 31.3.2011 5,80,000

© The Institute of Chartered Accountants of India

130 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Depreciation @ 15% 87,000

No additional depreciation is allowable as the assessee is not engaged

in manufacture or production of any article.

Note 2

Since sales-tax liability has been paid after the due date of filing return of income under

section 139(1), the same is not deductible.

Note 3

As per section 40A(3), any payment for an expenditure exceeding ` 20,000 made

otherwise than by way of an account payee cheque shall not be allowed as deduction. In

the aforesaid case, the payment for printing and stationery amounts to ` 20,000, hence,

the same shall be allowed.

5. Computation of total income of Mr. Ganesh for A.Y. 2011-12

Particulars ` ` `

Capital Gains

Short term capital gains (on sale of flat at pune)

(i) Sale consideration 4,90,000

(ii) Stamp duty valuation 5,20,000

Consideration for the purpose of capital gains as 5,20,000

per section 50C (stamp duty value, since it is higher

than sale consideration)

Less: Cost of acquisition [As per section 49(4),

value taken into consideration for 56(2)(vii) will be 3,75,000

the cost of acquisition]

Short term capital gains on sale of flat 1,45,000

Short term capital gains (on sale of house)

Sale consideration 6,00,000

Less: Cost of acquisition[See Note 3 below] 2,50,000

Short term capital gains on sale of house 3,50,000

Long term capital loss on sale of equity shares

of Z Pvt. Ltd

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 131

Sale consideration 3,50,000

Less: Indexed cost of acquisition

(4,70,000 × 711/497) 6,72,374

Long term capital loss to be carried forward 3,22,374

(See Note 1 below)

Short term capital gain on sale of equity shares

of N Pvt. Ltd

Sale consideration 6,30,000

Less: Cost of acquisition [As per section 49(4),

value taken into consideration for 56(2)(vii) will be 5,70,000

the cost of acquisition]

Short term capital gains on sale of shares 60,000 5,55,000

Income from other sources:

Gift from friends by way of immovable property on 3,75,000

29.12.2010 [See Note 2 below].

Gift received from niece [See Note 5 below ] 55,000

Excess of fair market value of shares of N Pvt. Ltd

over its purchase cost [ See Note 4 below]

[5,70,000 – 3,90,000] 1,80,000 6,10,000

Total income 11,65,000

Notes:

1. In the given problem, shares in Z Private Ltd. have been held for more than 12

month and hence, constitute a long term capital asset. The loss arising from sale of

such shares, is therefore a long-term capital loss. As per section 70(3), long term

capital loss can be set-off only against long-term capital gains. Therefore, long-

term capital loss cannot be set-off against short-term capital gains. However, such

long-term capital loss can be carried forward to the next year for set-off against

long-term capital gains arising in that year.

2. As per Section 56(2)(vii), where any immovable property is obtained without

consideration and if the stamp duty value of the property exceeds ` 50,000, the

stamp duty value of such property is chargeable to tax as income under the head

‘Income from other sources’.

3. If any immovable property is received for a consideration less than the stamp duty

value, then the provisions of Section 56(2)(vii) and Section 49(4) shall not be

attracted and the cost of acquisition shall be the actual amount paid for it.

© The Institute of Chartered Accountants of India

132 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

4. Receipt of property other than immovable property received for a consideration

which is less than the aggregate fair market value of the property by an amount

exceeding ` 50,000 would attract the provisions of Section 56(2)(vii).

5. Any sum/gift received from a relative will not be deemed as income from other

sources [Section 56(2)(vii)]. Niece is not covered in the definition of relative as per

the Explanation to section 56(2)(vii). So, the cash gift received of ` 55,000 received

from the niece is taxable as ‘Income from Other Sources’.

6. Computation of Gross Total Income of Mr. Nandit for the A.Y. 2011-12.

Particulars ` `

(i) Income from salary 29,000

(ii) Income from House Property

Net annual value 77,000

Less : Deduction under section 24 (30% of ` 77,000) 23,100 53,900

(iii) Profits and Gains of business and profession

(a) Income from business 95,000

Less : Current year depreciation 17,000

78,000

Less : Unabsorbed depreciation 12,000 66,000

(b) Income from speculative business 9,000

Less : Brought forward loss from speculative 9,000 Nil

business

(Balance loss of ` 9,000 (i.e. ` 18,000 –

` 9,000) can be carried forward to the next

year)

(iv) Income from capital gain

Long term capital gain on sale of land 17,300

Less : Brought forward short term capital loss 9,200 8,100

Gross total income 1,57,000

Amount of loss to be carried forward to the next year

Particulars `

Loss from speculative business (to be carried forward as per section 73) 9,000

Loss on maintenance of race horses [to be carried forward as per section

74A(3)] 11,000

Notes :

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 133

(i) Loss on gambling can neither be set-off nor be carried forward.

(ii) As per section 74A(3), the loss incurred on maintenance of race horses cannot be

set-off against income from any other source other than the activity of owning and

maintaining race horses. Such loss can be carried forward for a maximum period of

4 assessment years.

(iii) Speculative business loss can set off only against income from speculative business

of the current year and the balance loss can be carried forward to A.Y. 2012-13. It

may be noted that speculative business loss can be carried forward for a maximum

of four years as per section 73(4).

7. Computation of total income and tax payable by Mr. Tiwari

Particulars ` `

Gross total income including long term capital gain 4,12,690

Less : Long term capital gain 55,000

3,57,690

Less : Deductions under chapter VI-A:

u/s. 80C in respect of

- PPF deposit 50,000

- Contribution to Fixed deposits 75,000

1,25,000

Maximum deduction restricted to ` 1,00,000 [Section 80CCE] 1,00,000

u/s. 80D (it is assumed that premium is paid otherwise than by 16,000

way of cash. Since, Mr. Tiwari is a senior citizen, the maximum

limit for deduction is ` 20,000 )

u/s. 80G (See Working note below) 10,000 1,26,000

Total income (excluding long term capital gains) 2,31,690

Total income (including long term capital gains) 2,86,690

Tax on total income (including long-term capital gains of 9,338

` 55,000) [(2,86,690-2,40,000) x 20%]

Add : Education cess @ 2% 187

Add : Secondary and Higher Education cess @ 1% 93

Total tax liability 9,618

Total tax liability (rounded off) 9,620

Working Note:

© The Institute of Chartered Accountants of India

134 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Computation of deduction u/s.80G

Gross total income (excluding long term capital gains) 3,57,690

Less : Deduction u/s.80C and 80D 1,16,000

2,41,690

10% of the above 24,169

Contribution made 20,000

Lower of the two eligible for 80G deduction 20,000

Deduction u/s.80G – 50% of ` 20,000 10,000

Note: As per section 112, the unexhausted basic exemption limit can be exhausted

against long-term capital gains. Therefore, since the total income of ` 2,86,690 (inclusive

of long-term capital gains of ` 55,000) is more than the basic exemption limit of

` 2,40,000 by ` 46,690, there would be tax liability on the excess amount being the long

term capital gain taxable @ 20%.

8. Computation of Total Income of Mr. Praveen for Assessment Year 2011-12.

Particulars Working Amount in

Note Nos. `

Income from House Property 1 66,500

Profit and gains of Business or Profession 2 8,68,200

Short-term capital gains 3 17,590

Income from other sources 4 14,510

Gross Total Income 9,66,800

Less: Deduction under Chapter VI-A 5 14,000

Total Income 9,52,800

Tax on total income

Total Income 9,52,800

Less: Short-term capital gains (See Note 9 below) 17,590

Normal Income 9,35,210

Tax on normal income 1,34,563

Tax on short-term capital gains @15% 2,639

1,37,202

Add: Education cess @ 2% and SHEC @ 1% 4,116

Total tax liability 1,41,318

Total tax liability (rounded off) 1,41,320

Notes :

Particulars ` `

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 135

(1) Income from House Property

Gross annual value 96,000

Less: Municipal taxes paid by owner 1,000

Net Annual Value (NAV) 95,000

Less: Deduction under section 24 @ 30% of NAV 28,500 66,500

Rent received has been taken as the Gross Annual Value

in the absence of other information relating to Municipal

Value, Fair Rent and Standard Rent.

(2) Income under the head “Profits & Gains of Business

or Profession”

Net profit as per Profit & Loss Account 9,81,924

Add: Expenses debited to the Profit & Loss Account but

not allowable

(i) Salary paid to computer specialist in cash

disallowed under section 40A(3), since such cash 35,000

payment exceeds ` 20,000

(ii) Municipal Taxes paid in respect of residential flat let

out 1,000 36,000

10,17,924

Less: Expenses allowable but not debited to profit and

loss account

Interest paid on loan taken from LIC used for repair of

computer 3,500

10,14,424

Less: Income credited to Profit & Loss Account but not

taxable under this head:

(i) Dividend on shares of Indian companies 10,524

(ii) Income from UTI 7,600

(iii) Profit on sale of shares 17,590

(iv) Honorarium for valuation of answer papers 14,510

(v) Rent received from letting out of residential flat 96,000 1,46,224

8,68,200

(3) Capital gains:

Short term capital gain on sale of shares 17,590

(4) Income from other sources:

Dividend on shares of Indian companies 10,524

Less: Exempt under section 10(34) 10,524 Nil

© The Institute of Chartered Accountants of India

136 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

Income from UTI 7,600

Less: Exempt under section 10(35) 7,600 Nil

Honorarium for valuation of answer papers 14,510 14,510

(5) Deduction under Chapter VI-A :

Deduction under section 80D (Medical Insurance Premium)

Policy holder Amount of Amount

Premium eligible for

(`) deduction

(`)

Self 9,000 9,000

Dependent brother 6,000 Nil

Major son dependent on him 8,000 Nil

Minor married daughter 5,000 Nil

Wife dependent on assessee 5,000 _5,000

14,000

Amount of deduction(amount payable or ` 15,000 14,000

whichever is lower)

Total deduction under Chapter VI-A 14,000

Note –

(i) Premium paid to insure the health of brother is not eligible for deduction under

section 80D.

(ii) Premium paid to insure the health of son is not eligible for deduction since

payment is made in cash.

(iii) Premium paid to insure the health of minor married daughter is not eligible for

deduction as she is not dependent on Mr. Praveen.

(iv) Premium paid to ensure health of wife is eligible for deduction whether or not

she is dependent on the assesse.

(6) ` 15,000 expended on foreign tour is allowable as deduction assuming that it was

incurred in connection with his professional work. Therefore, it requires no further

treatment.

(7) Incentive to articled assistants passing IPCC examination in their first attempt is

deductible under section 37(1).

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 137

(8) Repairs and maintenance paid in advance for the period 1.4.2011 to 30.9.2011 i.e.

for 6 months amounting to ` 1,000 will be allowed since Mr. Praveen is following the

cash system of accounting.

(9) It is assumed that the transaction of sale of shares has been entered into in a

recognized stock exchange and that securities transaction tax has been paid on

such sale. Since the period of holding of these shares is less than 12 months, the

profit arising therefrom is a short-term capital gain chargeable to tax at 15% under

section 111A.

9. (a) Provisions of section 201(1A) are attracted in case of failure to deduct or pay tax at

source.

According to provisions of section 201(1A) any person, including the principal officer

of a company,—

(i) who is required to deduct any sum in accordance with the provisions of this

Act; or

(ii) referred to in sub-section (1A) of section 192, being an employer,

does not deduct the whole or any part of the tax or after deducting fails to pay the

tax as required by or under this Act, he or it shall be liable to pay simple interest,—

(i) at one per cent for every month or part of a month on the amount of such tax

from the date on which such tax was deductible to the date on which such tax

is deducted; and

(ii) at one and one-half per cent for every month or part of a month on the amount

of such tax from the date on which such tax was deducted to the date on which

such tax is actually paid,

and such interest shall be paid before furnishing the statement in accordance with

the provisions of sub-section (3) of section 200.

(b) Tax deductible but not deducted 10% on ` 50,000 = 5000

Period of Default :-

15.06.2010 to 14.07.2010 1 Month

15.07.2010 to 14.08.2010 1 Month

15.08.2010 to 14.09.2010 1 Month

15.09.2010 to 14.10.2010 1 Month

15.10.2010 to 14.11.2010 1 Month

15.11.2010 to 14.12.2010 1 Month

15.12.2010 to 14.01.2011 1 Month

© The Institute of Chartered Accountants of India

138 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

15.01.2011 to 09.02.2011 26 Days (1 Month as part of month)

8 Months

Tax deducted but not deposited 10% on ` 1,15,000 = 11,500

Period of Default :-

10.02.2011 to 9.03.2011 1 Month

10.03.2011 to 9.04.2011 1 Month

10.04.2011 to 9.05.2011 1 Month

10.05.2011 to 9.06.2011 1 Month

10.06.2011 to 9.07.2011 1 Month

10.07.2011 to 25.07.2011 16 Days (1 Month as part of month)

6 Months

Interest under section 201(1A) shall be as follows :- `

1% on tax deductible but not deducted i.e., 1% on

` 5,000 for 8 Months 400

1.50% on tax deducted but not deposited i.e., 1.50%

on ` 11,500 for 6 Months 1,035

1,435

10. (a) Section 139(4C) enjoins that, a university referred to in section 10(23C), should file

the return of income if its total income without giving effect to the exemption under

section 10, exceeds the basic exemption limit. The provisions of the Act will apply

as if it were a return required to be furnished under section 139(1). In the given

case, since the total income of the University before giving effect to the exemption

exceeds the basic exemption limit, it has to file its return of income.

(b) Any person who has furnished a return under section 139(1) or in pursuance of a

notice issued under section 142(1) can file a revised return if he discovers any

omission or any wrong statement in the return filed earlier. Accordingly,

(i) A defective or incomplete return filed under section 139(9) cannot be revised.

However, the defect can be removed.

(ii) A belated return filed under section 139(4) cannot be revised. Only a return

furnished under section 139(1) or in pursuance of a notice issued under

section 142(1) can be revised.

(iii) A return revised earlier can be revised again as the first revised return

replaces the original return. Therefore, if the assessee discovers any omission

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 139

or wrong statement in such a revised return, he can furnish a second revised

return within the prescribed time i.e. within one year from the end of the

relevant assessment year or before the completion of assessment, whichever

is earlier.

(iv) A return of loss filed under section 139(3) is deemed to be return filed under

section 139(1), and therefore, can be revised under section 139(5)

11. Computation of interest payable on delayed payment of service tax by Vibha Ltd.:-

Due date of payment of service tax 06.09.2011

Actual date of payment 30.11.2011

No. of days of delay (24+31+30) 85

Amount of service tax ` 10,000/-

Calculation of interest under section 75 @ 18% per 85 18

10,000 × ×

annum* 366 100

Amount of interest payable ` 418/-

*Note: With effect from 01.04.2011, the rate of interest under section 75 has been

increased to 18% per annum.

12. (a) No, service tax is not payable on donations and grants-in-aid received by a

Charitable Foundation imparting free livelihood training to the youth. Circular

No.127/09/2010 ST dated 16.08.2010 has clarified that donations and grants-in-aid

received from different sources by a Charitable Foundation imparting free livelihood

training to the poor and marginalized youth, will not be treated as ‘consideration’

received for such training and thus not subjected to service tax under ‘commercial

training or coaching service’ as donation or grant-in-aid is not specifically meant for

a person receiving such training or to the specific activity, but is in general meant

for the charitable cause championed by the registered Foundation. There is no

relationship other than universal humanitarian interest between the provider of

donation/grant and the trainee. In such a situation, service tax is not leviable, since

the donation or grant-in-aid is not linked to specific trainee or training.

(b) Yes, service tax is payable on the representation of the client before any statutory

authority in the course of proceedings initiated under any law by a practicing

Chartered Accountant.

Earlier, the taxable services provided or to be provided by a practicing Chartered

Accountant in his professional capacity, to a client, relating to representing the

client before any statutory authority in the course of proceedings initiated under any

law for the time being in force, by way of issue of notice, were exempt from the

© The Institute of Chartered Accountants of India

140 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

whole of service tax leviable thereon vide Notification No. 25/2006 ST dated

13.07.2006. With effect from 01.05.2011, the said exemption stands withdrawn.

13. With effect from 01.04.2011, rule 2B inserted after rule 2A provides the manner of

determination of the value of taxable service for the banking and other financial services

so far as it pertains to purchase or sale of foreign currency, including money changing.

The value of service shall be determined as follows:-

(a) For a currency, when exchanged from, or to, Indian Rupees (INR)

For a currency, when exchanged from, or to, Indian Rupees (INR), the value shall

be equal to the difference in the buying rate or the selling rate, as the case may be,

and the Reserve Bank of India (RBI) reference rate for that currency at that time,

multiplied by the total units of currency.

(b) Where the RBI reference rate for a currency is not available

Where the RBI reference rate for a currency is not available, the value shall be 1%

of the gross amount of Indian Rupees provided or received, by the person changing

the money.

(c) Where neither of the currencies exchanged is Indian Rupee

Where neither of the currencies exchanged is Indian Rupee, the value shall be

equal to 1% of the lesser of the two amounts the person changing the money would

have received by converting any of the two currencies into Indian Rupee on that day

at the reference rate provided by RBI.

14. With effect from 01.05.2011, the insurer carrying on life insurance business would have the

option to pay service tax on the gross premium charged from a policy holder reduced by the

amount allocated for investment, or savings on behalf of policy holder, if such amount is

intimated to the policy holder at the time of providing of service. In all other cases, the insurer

may pay service tax @ 1.5% of the gross amount of premium charged from a policy holder.

However, such option would not be available if the entire premium is only towards risk cover

in life insurance.

15. Computation of service tax payable by Rishabh Professionals Ltd.:-

Particulars Amount (`)

Services performed before such service became taxable (Note-1) Nil

Services provided to an International Organisation (Note-2) Nil

Free services rendered to the friends (Note-3) Nil

Advance received for the services to be rendered in July, 2011 (Note-4) 5,00,000

Other receipts 12,00,000

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 141

Total 17,00,000

Less: Exemption available to small service providers (Note-5) 10,00,000

Value of taxable services 7,00,000

Service tax @10% 70,000

Add: Education cess @ 2% 1,400

Add: Secondary and higher education cess @ 1% 700

Service tax payable 72,100

Notes:-

1. No service tax is payable for the value of services, which is attributable to services

provided during the period when such services were not taxable even if the amount

is realized after such services have become taxable.

2. Services provided to an International Organisation are exempt from the service tax

vide Notification No. 16/2002 ST dated 02.08.2002.

3. No service tax is payable when value of service is zero as the charging section 66

provides that service tax is chargeable on the value of taxable service. Hence,

service tax on free services provided is nil.

4. Advance received for t0he services to be rendered in July, 2011 is liable for service

tax. The amount of service tax included in the amount refunded in the next financial

year i.e. June 2011 would be adjusted against service tax liability of subsequent

periods. [It is assumed that ` 3,50,000 refunded in June, 2011 after the termination

of agreement includes the amount of service tax payable thereon].

5. Since, services provided by Rishabh Professional Ltd. became taxable on July 01,

2010, aggregate value of taxable services rendered in preceding financial year

2009-10 is Nil. Hence, Rishabh Professional Ltd. is eligible for exemption under

Notification No. 6/2005 ST dated 01.03.2005.

16. VAT system has many advantages like no tax evasion, transparency, certainty, reduction

in cascading effect of taxes etc. However, since the VAT is imposed or paid at various

stages and not at last stage, it increases the working capital requirements and the

interest burden on the same. In this way, it may be considered to be non-beneficial as

compared to the single stage-last point taxation system though to a certain extent, this

rigour can be brought down through input credits on purchases.

17. The threshold limit for small traders, as per the White Paper is ` 5 lakh. The same was

subsequently increased to ` 10 lakh.

18. Computation of VAT payable by Mr. Ram for the month of October, 2011:-

Particulars `

© The Institute of Chartered Accountants of India

142 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

(A) Output tax payable

(i) On sale of finished goods produced from Goods ‘A’ within the 62,500

State (` 5,00,000 × 12.5%)

(ii) On taxable sale of finished goods produced from Goods ‘C’ within

the State (` 35,00,000 × 4 %) 1,40,000

Total (A) 2,02,500

(B) Input tax credit available

(i) Goods ‘A’ (Exempt) Nil

(ii) Goods ‘B’ (Note-1) Nil

(iii) Goods ‘C’ (` 30,00,000×12.5%) 3,75,000

Total (B) 3,75,000

Net VAT payable = (A)-(B) (1,72,500)

CST payable on inter-state sale of goods produced from Goods ‘A’

(` 7,00,000 × 1%) shall be paid from the balance of credit of ` 1,72,500. 7,000

Balance of input credit carried forward to next month 1,65,500

Notes:

1. Since, there is no opening and closing inventory, it implies that entire purchase of

the Goods ‘B’ is used to manufacture the finished goods (which are exempt from

tax). Further, purchases of goods, which are being utilized in the manufacture of

exempted goods, are not eligible for input tax credit. Hence, no input tax credit is

available in respect of VAT paid on purchase of Goods ‘B’.

2. If finished goods are sold in the course of inter-state trade and commerce, credit is

allowed.

19. Inter-State stock transfers do not involve sale and, therefore they are not subjected to

sales tax. The same position is continued under VAT.

However, the tax paid on:

(i) inputs used in the manufacture of finished goods which are stock transferred; or

(ii) purchases of goods which are stock transferred

is available as input tax credit after retention of 2% of such tax by the State

Governments.

20. VAT returns are to be filed monthly/quarterly/annually along with tax paid challans

according to the provisions of the State Acts. They should contain details of output tax

liability, value of input tax credit and payment of VAT and should be filed within the

prescribed time schedule. In case of any mistakes, revised returns may be filed. The

returns will be checked and any deficiency in payment of tax may have to be made good.

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 143

Filing of returns is designed with a view:

(i) to reduce cost of compliance

(ii) to encourage businesses to comply with their obligations; and

(iii) to ensure efficient processing of data.

© The Institute of Chartered Accountants of India

144 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

SIGNIFICANT CIRCULARS & NOTIFICATIONS ISSUED BETWEEN 1.5.2010 AND 30.4.2011

Students may note that the Study Material for IPCC Group I Paper 4: Taxation A.Y. 2011-12

has been updated with the law as amended by the Finance Act, 2010 and notifications and

circulars issued upto 30.04.2010. This study material is relevant for the students of IPCC

appearing for November 2011 examination. The following are the amendments which have

been made between 01.05.2010 and 30.04.2011. It may carefully be noted that for the

students appearing in November 2011 examination, the amendments made by Notifications,

Circulars etc. up to 30.04.2011 are relevant.

I INCOME TAX

CIRCULARS

1. Circular No. 4/2010 dated 18.5.2010

Clarification regarding definition of new infrastructure facility for the purpose of

section 80-IA(4)

The CBDT has, vide this Circular, clarified that widening of an existing road by

constructing additional lanes as a part of a highway project by an undertaking

would be regarded as a new infrastructure facility for the purpose of section

80-IA(4)(i). However, simply relaying of an existing road would not be

classifiable as a new infrastructure facility for this purpose.

2. Circular No. 6/2010 dated 20.9.2010

Regional Rural Banks not eligible for deduction under section 80P

The CBDT has, through this circular, reiterated that Regional Rural Banks are not eligible

for deduction under section 80P of the Income-tax Act, 1961 from the assessment year

2007-08 onwards. It has also been clarified that the Circular No. 319 dated 11-1-1982

deeming any Regional Rural Bank to be cooperative society stands withdrawn for

application with effect from A.Y.2007-08.

This is consequent to the amendment in section 80P by the Finance Act, 2006, providing

specifically that w.e.f. 1-4-2007, the provisions of section 80P will not apply to any co-

operative bank other than a Primary Agricultural Credit Society or a Primary Cooperative

Agricultural and Rural Development Bank. The same has been further clarified by this

circular.

3. Circular No. 7/2010 dated 27.10.2010

Clarification regarding period of validity of approvals issued under section

10(23C)(iv), (v), (vi) or (via) and section 80G(5)

For the removal of doubts about the period of validity of various approvals granted by the

Chief Commissioners of Income-tax or Directors General of Income-tax under sub-

clauses (iv), (v), (vi) and (via) of section 10(23C) and by the Commissioners of Income-

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 145

tax or Directors of Income-tax under section 80G(5) of the Income-tax Act, 1961, the

CBDT has, through, this circular clarified the following:-

(1) For the purposes of sub-clauses (iv) and (v) of section 10(23C), any notification

issued by the Central Government under the said sub-clauses, on or after 13-7-

2006 will be valid until withdrawn and there will be no requirement on the part of the

assessee to seek renewal of the same after three years.

(2) For the purposes of sub-clauses (vi) and (via) of section 10(23C), any approval

issued on or after 1-12-2006 under the said sub-clauses would be a one time

approval and would be valid till it is withdrawn.

(3) For the purposes of section 80G(5), existing approvals expiring on or after 1st

October, 2009 shall be deemed to have been extended in perpetuity unless

specifically withdrawn. Further, any approval under section 80G(5) on or after 1-10-

2009 would be a one time approval which would be valid till it is withdrawn.

NOTIFICATIONS

1. Ceiling for gratuity exemption raised to ` 10 lakhs

Section 10(10)(ii) exempts any gratuity received under the Payment of Gratuity Act,

1972, to the extent it does not exceed an amount calculated in accordance with the

provisions of sub-sections (2) and (3) of section 4 of that Act. The limit specified under

sub-section (3) of section 4 has been increased from ` 3,50,000 to ` 10,00,000 by the

Payment of Gratuity (Amendment) Act, 2010 dated 17th May, 2010.

Thereafter, the Central Government has enhanced the notified limit under section

10(10)(iii) from ` 3,50,000 to ` 10,00,000 in relation to employees who retire or become

incapacitated prior to such retirement or die on or after 24th May, 2010 or whose

employment is terminated on or after the said date. In effect, the ceiling for gratuity

exemption under section 10(10)(iii), which is relevant for employees not covered under

the Payment of Gratuity Act, 1972, has also been increased to ` 10 lakh vide Central

Government Notification No.43/2010 dated 11th June, 2010.

2. Notification No.41/2010 dated 31.05.2010

Substitution of Rules 30, 31, 31A, in the Income-Tax Rules, 1962.

Rule 30 – Time and mode of payment to Government account of TDS or tax paid

under section 192(1A)

(a) All sums deducted in accordance with Chapter XVII-B by an office of the

Government shall be paid to the credit of the Central Government on the same day

where the tax is paid without production of an income-tax challan and on or before

seven days from the end of the month in which the deduction is made or income-tax

is due under section 192(1A), where tax is paid accompanied by an income-tax

challan.

© The Institute of Chartered Accountants of India

146 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

(b) All sums deducted in accordance with Chapter XVII-B by deductors other than a

Government office shall be paid to the credit of the Central Government on or

before 30th April, where the income or amount is credited or paid in the month of

March. In any other case, the tax deducted should be paid on or before seven days

from the end of the month in which the deduction is made or income-tax is due

under section 192(1A).

(c) In special cases, the Assessing Officer may, with the prior approval of the Joint

Commissioner, permit quarterly payment of the tax deducted under section 192/

194A/194D/194H on or before 7th of the month following the quarter, in respect of

first three quarters in the financial year and 30th April in respect of the quarter

ending on 31st March. The dates for quarterly payment would, therefore, be 7th

July, 7th October, 7th January and 30th April, for the quarters ended 30th June,

30th September, 31st December and 31st March, respectively.

Rule 31 – Certificate of TDS to be furnished under section 203

(a) The certificate of deduction of tax at source to be furnished under section 203 shall

be in Form No.16 in respect of tax deducted or paid under section 192 and in any

other case, Form No.16A.

(b) Form No.16 shall be issued to the employee annually by 31st May of the financial

year immediately following the financial year in which the income was paid and tax

deducted. Form No.16A shall be issued quarterly within 15 days from the due date

for furnishing the statement of TDS under Rule 31A.

Rule 31A – Statement of deduction of tax under section 200(3)

(a) Every person responsible for deduction of tax under Chapter XVII-B shall deliver, or

cause to be delivered, the following quarterly statements to the DGIT (Systems) or

any person authorized by him, in accordance with section 200(3):

(1) Statement of TDS under section 192 in Form No.24Q;

(2) Statement of TDS under sections 193 to 196D in Form No.26Q in respect of all

deductees other than a deductee being a non-resident not being a company

or a foreign company or resident but not ordinarily resident in which case the

relevant form would be Form No.27Q.

(b) The time limit for furnishing such quarterly statements shall be 15th of the month

following each quarter in respect of the first three quarters and 15th May for the last

quarter ending on 31st March. The due dates would therefore be 15th July, 15th

October, 15th January and 15th May for the quarters ending 30th June, 30th

September, 31st December and 31st March, respectively.

3. Notification Nos. 48/2010 dated 9.7.2010 & 77/2010 dated 11.10.2010

Notification of long-term infrastructure bonds by the Central Government, subscription to

which would qualify for deduction under section 80CCF

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 147

Section 80CCF provides that an assessee, being an individual or a Hindu Undivided

Family, shall get a deduction of up to rupees twenty thousand in computing his total

income if he subscribes to long-term infrastructure bonds as may be notified by the

Central Government for this purpose.

Consequently, the Central Government has, vide these notifications, specified the long-term

infrastructure bonds, subscription to which would qualify for deduction under section 80CCF.

Accordingly, subscription to long-term infrastructure bonds of Industrial Finance Corporation

of India, Life Insurance Corporation of India, Infrastructure Development Finance Company

Limited and a non-banking Finance Company classified as an Infrastructure Finance

Company by the Reserve Bank of India would qualify for deduction under section 80CCF.

Further, subscription to long-term infrastructure bonds of India Infrastructure Finance

Company Ltd. would also qualify for deduction under section 80CCF.

4. Notification No. 59/2010 dated 21.07.2010

Cost Inflation Index of financial year 2010-11 notified

Clause (v) of Explanation to section 48 defines “Cost Inflation Index”, in relation to a

previous year, to mean such Index as the Central Government may, by notification in the

Official Gazette, specify in this behalf, having regard to 75% of average rise in the

Consumer Price Index for urban non-manual employees.

Accordingly, the Central Government has, in exercise of the powers conferred by clause

(v) of Explanation to section 48, specified the Cost Inflation Index for the financial year

2010-11 as 711.

S. No. Financial Year Cost Inflation Index

1. 1981-82 100

2. 1982-83 109

3. 1983-84 116

4. 1984-85 125

5. 1985-86 133

6. 1986-87 140

7. 1987-88 150

8. 1988-89 161

9. 1989-90 172

10. 1990-91 182

11. 1991-92 199

12. 1992-93 223

13. 1993-94 244

14. 1994-95 259

© The Institute of Chartered Accountants of India

148 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

15. 1995-96 281

16. 1996-97 305

17. 1997-98 331

18. 1998-99 351

19. 1999-2000 389

20. 2000-01 406

21. 2001-02 426

22. 2002-03 447

23. 2003-04 463

24. 2004-05 480

25. 2005-06 497

26. 2006-07 519

27. 2007-08 551

28. 2008-09 582

29. 2009-10 632

30. 2010-11 711

5. Notification No. 80/2010 dated 19.10.2010 (as amended by Notification No.20/2011

dated 21.4.2011)

Notification of annuity plan for deduction under section 80C

Deduction under section 80C is available in respect of any sum paid or deposited to

effect or to keep in force a contract for such annuity plan of the Life Insurance

Corporation or any other insurer as the Central Government may, by notification in the

Official Gazette specify in this behalf.

Accordingly, the Central Government, has, through this notification specified the Tata

AIG Easy Retire Annuity plan of the Tata AIG Life Insurance Company Limited as the

annuity plan of the Tata AIG Life Insurance Company Limited for the purposes deduction

under section 80C.

6. Notification No.84/2010 dated 22.11.2010

Salaried persons entitled to act as Tax Return Preparers

In exercise of the powers conferred under section 139B(1), the CBDT had framed the

Tax Return Preparer Scheme, 2006 for the purpose of enabling any specified class or

classes of persons in preparing and furnishing their return of income. “Specified class or

classes of persons” means any person, other than a company or a person, whose

accounts are required to be audited under section 44AB or under any other law for the

time being in force, who is required to furnish a return of income under the Act.

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 149

Paragraph 2(f) of the Tax Return Preparer Scheme, 2006 defining a Tax Return

Preparer, specifically provided that a person who is in employment and income from

which is chargeable under the head “Salaries” shall not be entitled to act as a Tax Return

Preparer. This disqualification has now been removed by amending paragraph 2(f).

Consequently, a salaried person is now eligible to act as a Tax Return Preparer.

Consequential amendment has been made in Paragraph 11(1)(xii), which provided for

withdrawal of certificate given to the Tax Return Preparer in case he, after issue of Tax

Return Preparer Certificate to him, takes up an employment, income from which is

chargeable under the head “Salaries”. Henceforth, taking up a salaried employment

would not result in withdrawal of certificate given to the Tax Return Preparer.

However, it may be noted that as per section 139B(3) of the Income-tax Act, 1961, an

employee of the “specified class or classes of persons” is not authorized to act as a Tax

Return Preparer. A combined reading of section 139B(3) with the amended Tax Return

Preparer Scheme, 2006 reveals that employees of companies and persons whose

accounts are required to be audited under section 44AB or any other law for the time

being in force, are eligible to act as Tax Return Preparers.

7. Notification No.85/2010 dated 22.11.2010

Increase in exemption limit for allowance granted to employees working in a

transport system to meet their personal expenditure during the course of duty

Section 10(14)(ii) exempts any such allowance granted to the assessee either to meet

his personal expenses at the place where the duties of his office or employment of profit

are ordinarily performed by him or at the place where he ordinarily resides, or to

compensate him for the increased cost of living as may be prescribed and to the extent

as may be prescribed.

Rule 2BB(2) prescribes the allowances for the purposes of exemption under section

10(14)(ii). As per this rule, the exemption allowable in respect of any allowance granted

to an employee working in any transport system to meet his personal expenditure during

his duty performed in the course of running of such transport from one place to another

place (provided he is not in receipt of daily allowance) is 70% of such allowance, subject

to a maximum of ` 6,000 per month.

The monthly limit of ` 6,000 has been increased to ` 10,000 with retrospective effect

from 1st September, 2008. Therefore, with effect from 1st September, 2008, the

exemption would be 70% of such allowance, subject to a maximum of ` 10,000 per

month.

8. Notification No. 12/2011 dated 25.02.11

United Stock Exchange of India Ltd. notified as a recognized stock exchange

Clause (d) of the proviso to section 43(5) provides that an eligible transaction in respect

of trading in derivatives referred to in section 2(ac) of the Securities Contracts

© The Institute of Chartered Accountants of India

150 INTEGRATED PROFESSIONAL COMPETENCE EXAMINATION : NOVEMBER, 2011

(Regulation) Act,1956 carried out in a recognised stock exchange, which is notified by

the Central Government for this purpose, shall not be deemed to be a speculative

transaction.

Accordingly, in exercise of the powers conferred under section 43(5) read with Rule

6DDB, the Central Government has notified the United Stock Exchange of India Limited

as a recognised stock exchange for the purpose of the said clause. The notification also

lays down certain conditions to be fulfilled by the stock exchange.

It may be noted that at present, there are three other stock exchanges notified as

recognized stock exchanges for the purposes of section 43(5), namely, the National

Stock Exchange, Bombay Stock Exchange and MCX Stock Exchange.

9. Notification No. 14/2011 dated 9.3.2011

Conditions to be fulfilled for a stock exchange to qualify as a recognized stock

exchange for the purposes of section 43(5) - Modification of cash and derivative

market transactions registered in the system permitted in case of genuine error

Clause (d) of proviso to section 43(5) provides that an eligible transaction in respect of

trading in derivatives referred to in section 2(ac) of the Securities Contracts (Regulation)

Act,1956 carried out in a recognised stock exchange shall not be deemed to be a

speculative transaction. Rule 6DDB provides for notification of recognised stock

exchange for the purposes of said clause.

Further, Rule 6DDA provides the conditions that a stock exchange is required to fulfil to

be notified as a recognised stock exchange for the purpose of abovementioned clause.

One of the conditions, specified in clause (iv) of Rule 6DDA, is that the stock exchange

shall ensure that transactions once registered in the system cannot be erased or

modified. This clause has been substituted to provide that the stock exchange shall

ensure that transactions (in respect of cash and derivative market) once registered in the

system are not erased.

Another condition has been stipulated by insertion of clause (v), which provides that the

stock exchange shall ensure that the transactions (in respect of cash and derivative

market) once registered in the system are modified only in cases of genuine error. The

stock exchange should maintain data regarding all transactions (in respect of cash and

derivative market) registered in the system which have been modified and submit a

monthly statement in Form No. 3BB to the Director General of Income-tax (Intelligence),

New Delhi within fifteen days from the last day of each month to which such statement

relates.

Corresponding amendment has been made in Rule 6DDB requiring that the application

for notification of a recognised stock exchange should be accompanied by inter alia,

confirmation regarding fulfilling the conditions referred to in clauses (ii) to (v) of Rule

6DDA.

© The Institute of Chartered Accountants of India

PAPER – 4 : TAXATION 151

10. Notification No. 18/2011 dated 5.4.2011

Notification of return forms for A.Y.2011-12

The CBDT has notified the new income-tax return forms for the Assessment year 2011-12.

Rule 12 of the Income-tax Rules, 1962 has been amended in respect of the following :-

(1) Reference to return of fringe benefits has been removed.

(2) Form Saral-II (ITR-1) has been substituted by the Form “SAHAJ” (ITR-1), which

would be applicable for individuals, whose total income includes income chargeable

under the head –

(i) “Salaries” or income in the nature of family pension under section 57(iia); or

(ii) “Income from house property”, where the assessee does not own more than one

house property and does not have any brought forward loss under the head; or

(iii) “Income from other sources”, except winnings from lottery or income from race

horses.

(3) The return of income in case of a person being an individual and HUF deriving

business income and such income is computed on presumptive basis under section

44AD and section 44AE to be in Form SUGAM (ITR-4S) and be verified in the

manner indicated therein.

SAHAJ and SUGAM Forms notified by CBDT are the simplest, technology enabled and

taxpayer friendly return forms. These have been designed to facilitate error free and faster

digitization. This is expected to curtail processing cycle and expedite issue of refunds.

11. Notification No. 24/2011 issued in supersession of Notification No. 69/2010 dated

26.8.2010

9.5% notified as the interest rate on RPF, the interest in excess of which would be

taxable as salary