Professional Documents

Culture Documents

Suen-SimpleAnalyticsProductive-1994

Uploaded by

AvinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suen-SimpleAnalyticsProductive-1994

Uploaded by

AvinCopyright:

Available Formats

Simple Analytics of Productive Consumption

Author(s): Wing Suen and Pak Hung Mo

Source: Journal of Political Economy , Apr., 1994, Vol. 102, No. 2 (Apr., 1994), pp. 372-

383

Published by: The University of Chicago Press

Stable URL: https://www.jstor.org/stable/2138666

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

The University of Chicago Press is collaborating with JSTOR to digitize, preserve and extend

access to Journal of Political Economy

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

Simple Analytics of Productive Consumption

Wing Suen

University of Hong Kong

Pak Hung Mo

Hong Kong Baptist College

Productive consumption adds to utility and income at the same time.

The shadow price of a productive good is equal to its money price

less its marginal product. As more of the good is consumed, its

shadow price rises because of diminishing productivity, and the con-

sumer's full income also rises because the marginal product is posi-

tive. This paper uses a simple method to derive the comparative

statics of the demand system when shadow prices and full income

are endogenous. The direction of the overall bias induced by endog-

enous prices and income is found to be determinate. We demon-

strate that the demand for productive goods tends to be relatively

unresponsive to exogenous changes in prices and income. We also

show that labor supply will be relatively unresponsive to wage and

unearned income if market work causes fatigue.

Preferences and technology are the two basic building blocks of neo-

classical economics. Yet consumption and production activities are

not always easy to separate. As Becker (1965) makes clear, a lot of the

commodities people consume are produced at the household level.

Equally important but less widely recognized is the fact that the com-

modities households consume often contribute to production at mar-

ket work. An example that easily comes to mind is the effect of nutri-

We would like to thank Doug Allen, Leigh Anderson, Yoram Barzel, Dean Lueck,

Eugene Silberberg, Alan Siu, Daniel Wang, Richard Wong, and Xiaokai Yang for

useful suggestions. Julia Cheung offered able research assistance.

[Journal of Political Economy, 1994, vol. 102, no. 2]

? 1994 by The University of Chicago. All rights reserved. 0022-3808/94/0202-0006$01.50

372

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

PRODUCTIVE CONSUMPTION 373

tion on productivity. Some efficiency wage models (e.g., Stiglitz 1976)

are based on the premise that better nutrition raises productivity;

Strauss (1986) has found strong evidence of such an effect using data

from Sierra Leone. Closer to home, academic economists probably

regard reading journal articles a consumption activity and a produc-

tion activity at the same time. Lazear (1977) argues that education is

ajoint product that produces utility (or disutility) and enhanced earn-

ing power; health enters into both the production function and the

utility function (e.g., Grossman 1972); children contribute to parents'

satisfaction as well as income security at old age (e.g., Ehrlich and

Lui 1991); expensive clothes are valued for consumption as well as

for career concerns; the list could continue.

Since productive commodities appear nonlinearly in the budget

constraint, the effect of prices and income on the demand for these

commodities is tangled. Suppose, for example, that consuming food

can contribute to productivity and hence income. The true cost of

food is its money price less its marginal value product. When there

is an exogenous increase in the consumer's money income, there are

two contradictory effects. (1) Higher income leads to the consumption

of more food (food is assumed to be a normal good, to be specific).

The law of diminishing marginal product implies that the true cost

of food will then rise. This tends to mitigate the initial effect of in-

come on consumption. (2) As food consumption raises consumers'

income, they will demand still more food (food is assumed to be

normal). This will tend to reinforce the initial effect. It appears that

the balance of these forces is indeterminate. This paper develops a

very simple method of analyzing the demand for productive com-

modities. In the example on food, we demonstrate that the former

effect (a rise in true cost) always dominates the latter effect (a rise in

earned income) so that the effect of exogenous income on consump-

tion will be smaller than what preferences alone imply. This conclu-

sion holds regardless of whether food is a normal good or an inferior

good. We also show that the effect of prices on consumption is smaller

in the presence of productive consumption than in a pure consump-

tion model.

The theory of productive consumption can also be applied to labor

supply and leisure choice. We model leisure as a commodity that

raises both productivity and utility. Our model explains why the

shadow value of leisure is lower than the market wage. Moreover, if

long hours of work lower productivity, the shadow price of leisure will

fall whenever the worker increases work hours. The model therefore

suggests that labor supply will be relatively unresponsive to wage and

income when the productive role of leisure is an important consider-

ation.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

374 JOURNAL OF POLITICAL ECONOMY

Economists have no theory about the size of income and price elas-

ticities. Engel's law on the income elasticity of demand for food, for

instance, is an empirical regularity in search of an explanation.' Even

within the commodity category labeled "food," the demand elasticities

for "taste" and "nutrition" are systematically different (Silberberg

1985). We hope that bringing in a workable model of productive

consumption will be a step toward understanding the determinants of

the size of demand elasticities. In the development literature, several

authors (e.g., Singh, Squire, and Strauss 1986) have modeled produc-

tion/consumption decisions in agricultural households. In those mod-

els, an increase in crop prices will raise farm income, thereby produc-

ing an income effect that counteracts the substitution effect. Such

models are recursive: production and consumption can be analyzed

in a two-stage manner via the separation theorem. In our model, on

the other hand, such separation is impossible because goods jointly

produce utility and income. Pollak and Wachter's (1975) comment

on the household production approach notwithstanding, our model

exhibits properties of joint production and nonconstant returns to

scale but still gives definite results.

While our analysis focuses on productive consumption, similar

techniques can be applied to situations involving, say, quantity dis-

counts or progressive taxes. The methods we develop here are consid-

erably simpler than the comparative static analysis of nonlinear con-

straints in Edlefsen (1981) or the analysis of endogenous prices in

Diewert (1981). In fact this paper falls under Blomquist's (1989) gen-

eral theory of nonlinear budget constraints, but we are able to derive

strong results under our specifications.

I. The Basic Model

In the simplest case, all commodities except one are pure consump-

tion goods. Labor supply is exogenous. (Labor-leisure choice is dis-

cussed in Sec. II; the case of many productive goods is dealt with

in the Appendix.) The consumer's income consists of two parts: an

exogenous unearned income M and earned income E. Earned income

depends on the amount of productive commodity xl consumed: E =

E (x1).2 We assume that xl has a positive but diminishing marginal

product, that is, E1 2 0 and E II < O.

Note that xl is a commodity that jointly produces income and utility.

1 See Houthakker (1957) for international evidence on Engel's law.

2 Earned income also depends on a host of other factors (e.g., talent or the state of

the business cycle) that are exogenous to the individual. The functional dependence

of E on these other factors is suppressed for notational economy.

3 See, e.g., Strauss (1986) for evidence of diminishing returns to nutrition.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

PRODUCTIVE CONSUMPTION 375

The case in which xl has to be allocated between production and

consumption does not require elaborate analysis. If xl = xa + xlj,

where xJ enters in the production function and xl enters in the uti

function, then the separation theorem ensures that the consumer's

decision problem can be described by a two-stage method in which

xP is chosen to maximize income and then xl is chosen to maximize

utility.

With standard notation, the consumer's choice problem can be writ-

ten as

maximize U(x1, *. *,x) (1)

n

subject to Zpixi 'Z M + E(xi1) (2)

The budget constraint (2) is a convex set, so this is a concave problem.

Let A be the Lagrange multiplier for the budget constraint. Then the

first-order conditions are

U1 = X(PI -E);

Ui = Xpi, i = 2, ... ...,n; (3)

n

(PI - EI)x1 + pixi=M + E - x1E1.

2

Let xr(pl, . * ., pn M), i = 1, * . , n, be the solution to the choice

problem. Also let x (7r1,.. ., 7Tn, F) be the demand functions resulting

from maximizing (1) subject to a standard budget constraint without

productive consumption: XTn -rrX c F. The form of the function

xlq() depends on preferences alone, and that of x8{() depends on the

production side as well.

We define the shadow prices ITI = PI - El and -ri = pi for i =A

Full income is F = M + E - xIE1. Since xI is a joint product, we

can think of PI -E E as the Lindahl price for consumption and E I a

the Lindahl price for production (Samuelson 1954). At input price

E1, profits to the person as a producer are E - xI E1; hence fu

income is unearned income plus profits. It is also important to note

that n I and F are themselves functions of the amount of xI chos

that is, full income and shadow prices are endogenous in this model.

With the relevant price and income variables defined, the functions

x$( ) and xQ( ) are related by the identity

xI(P1,P2, ... Pn, M) x? II(xl ( )), T2, 2 , n, F(xt ))) (4)

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

376 JOURNAL OF POLITICAL ECONOMY

y

U

0M" M' F' X

FIG. 1

The relationship in equation (4) is illustrated in figure 1. In the

figure, X is the productive good and MM' is the budget constraint

(MM" would be the budget constraint if X were not productive). Max-

imizing utility subject to MM' (the x*(.) function) yields the same

solution value as maximizing utility subject to the virtual budget con-

straint FF' (the x0(Q) function). The virtual budget constraint FF' is

flatter than MM" because the shadow price of X is only Px - E'(X*).

The vertical distance FM represents the "profits" from using X* units

of productive input, E(X*) -X*E'(X*).4

To determine the effect of an exogenous increase in unearned

income, we differentiate equation (4) with respect to M:

ax*I ax'l a I ax~ *i &xlF ax *Iax'

ax, ax, dw~dxt + dx1 dF dxt + dx1 (5)

aM aTl ax1 IM &F axOM aF

Now, lx-Idxl = -El, > 0 and aFIax, = -xlEll > 0. An increase

in consumption of the productive commodity raises its shadow price

and raises the full income. It appears that nothing definite can be said

about the overall bias from these two effects. However, substitution of

the partial derivatives into (5) yields

4 If the marginal product were constant rather than diminishing, MM' would be

linear and the virtual budget constraint FF' would coincide with it. The analysis here

assumes a strictly diminishing marginal product.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

PRODUCTIVE CONSUMPTION 377

ax* dax, ax* dx*dxI a x

-= -E11 d dM-Xlx1E11- + -

dxl~d &Fl

axi* ax,

= -1E11 (6)

_ 1 dxo

1 + S01E11 &F

In (6), Sol = (ax~l/ul) + (xlax~lIF) is the negative Slutsky substitu-

tion effect for the standard demand function x l(). Thus 1/(1 +

S01E11) < 1. Consumption of the productive commodity is less

sponsive to changes in income than what a pure consumption model

implies.5 This conclusion holds regardless of the relative size of the

income and substitution effects, and the conclusion applies to both

normal and inferior goods.

It is straightforward to follow equations (4)-(6) to show that the

demand for the productive commodity is also less responsive to

changes in its money price than that in a pure consumption model.

In particular, we have

ax* _ 1

dxt 1 dX, ~~~~~~~~(7)

ap1 1 + S1E11all1l(

Thus laxlIapl| < laxo/darn1 .6 If the marginal productivity of, say

declines and then remains flat, an implication of the analysis is that

the demand for food by low-income people will be less responsive to

prices and income than the demand by the high-income group.

II. Leisure as a Productive Good

Fatigue is a problem that affects the workplace. Factories and offices

often have scheduled breaks to deal with worker fatigue. Over the

longer horizon, vacations and holidays may serve a similar purpose.

At the same time, these breaks and holidays directly add to utility. It

is then appropriate to model leisure as a joint product that enhances

both productivity and utility. Biddle and Hamermesh (1990), for ex-

ample, use this approach to analyze sleep.

5 We are comparing changes in demand rather than the level of demand. Since

productive consumption increases income and lowers price, the level of demand for

the productive commodity will be higher than that suggested by a pure consumption

model.

6 This conclusion depends on the assumption that earned income E is strictly concave

in xl. If E is linear, the magnitudes of the partial derivatives of xQ( ) and xq(Q) will be

equal. If E is locally convex, the inequality will be reversed. Also note that the inequality

applies to Giffen goods as well. If ax'/ala is positive, axt/ap, will be less positive.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

378 JOURNAL OF POLITICAL ECONOMY

We assume that total time, T, is allocated between leisure, 1, and

market work, h. The market wage is W = w + f(l). If the person

consumes more leisure, his productivity in market work increases, so

f > 0. Also assume ' 0.7 The optimization problem can then be

written as

maximize U(x1, * . , x. , 1) (8)

n

subject to Zpixi ' M + [w + f(l)](T - 1). (9)

It is easy to see that the shadow price of leisure, ar, is equal to W -

f'(l)(T - 1). The shadow price of leisure is less than the market wage

because working long hours hurts productivity. This is consistent with

most value of time studies (e.g., Earp, Hall, and McDonald 1976) that

find the shadow value of nonmarket time to be substantially below

the market wage.

With the definition of nlr, it can easily be verified that the budget

constraint (9) can be rewritten as

n

EPixi + sel ---F, (10)

where full income F is M + WT - f'(l)(T - 1)1. Note that nrI and F

are both endogenous functions of 1. If we let l0(p , . . . , Pn, n1, F) be

the leisure demand function from maximizing (8) subject to (10),

treating -rr and F as fixed, then the optimal leisure demand is charac-

terized by the following identity:

N}P, . n . ) .,nwM) 1?(P, . ... ) Pn, iT ~}-)F(I() (1 1

To find the response of leisure demand to an exogenous increase

in wage, we differentiate (11) with respect to w:

ai* ale alTd ad* + alo aF al* + alo (12)

aw adr al aw aF al aw adar

Since d ia Il = 2f' -f"h and dFIal d = 1(2f' -f "h), equation (1 2) can

be simplified to

al* 1 al (13)

dw 1 - So (2f '-f h) (t1

Theory restricts So (the pure substitution effect for leisure) to be

negative, and our assumptions about the effect of fatigue on produc-

7 In contrast to the model in Sec. I, it is not necessary to assume that f(-) is strictly

concave. Our results will still hold if f" is positive but not too large.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

PRODUCTIVE CONSUMPTION 379

tivity imply that 2f

When there is an exogenous increase in wage, people tend to work

more. However, as increased work causes fatigue, their productivity

falls and the opportunity cost of leisure is reduced. This will counter-

act the initial effect of a rise in wage. The presence of the fatigue

effect then makes leisure demand (and hence labor supply) less re-

sponsive to wage.9 If older workers are more prone to fatigue than

young workers, the model would predict a relatively steep labor sup-

ply curve for older workers.

III. Applications and Extensions

A. Counterproductive Consumption

Consumption of commodities such as cigarettes and drugs may re-

duce rather than increase earnings. The analysis of consumption be-

havior in the presence of these counterproductive commodities, how-

ever, does not pose any new problems. While the consumption level

of a commodity depends on whether it is productive or counterpro-

ductive, the consumption response to changes in prices and income

depends only on the curvature (i.e., the second derivatives) of the

earnings function. For example, assume that the marginal reduction

in earnings due to cigarette consumption rises as more cigarettes are

consumed. An exogenous increase in the price of cigarettes will curb

their consumption. As consumption is reduced, the marginal harm

of cigarettes falls. Thus the increase in the real price of cigarettes will

be less than the initial rise in price. As a result, the demand for

cigarettes will be less responsive to prices and income than what is

implied by a pure consumption model. For another example, if the

marginal damage of alcoholic beverages increases sharply at high

consumption levels, the model would imply that the demand for li-

quor would be highly inelastic for people who consume a lot of alco-

hol and less inelastic for mild users.

B. Joint Family Consumption

Within the household, some commodities (e.g., the dinner table) have

the attribute of a public good and others (e.g., food) are characterized

by rival consumption. The model developed in this paper can be

applied to the analysis of joint family consumption when household

decisions are made by an altruistic head.

8 If the labor supply function 1PO is backward bending, the function 1*(0) will b

so.

9See Pencavel (1986) for evidence of the inelasticity of male labor supply.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

380 JOURNAL OF POLITICAL ECONOMY

Specifically, suppose that the

Xk), where xp is the vector of public goods in the family and Xk is the

vector of private consumption goods for the child. Let Pk be the

corresponding price vector for Xk. Then we can define the condi-

tional cost function

Ck(Pk, Xp, Uk) = min {p xkU(Xp, Xk) ? uk}k. (14)

Xk

This cost function is analogous to Pollak's (1969) conditional demand

functions. Expenditure minimization implies that C(, xP, Uk) is con

vex in Pk. Moreover, C(pk, ) is convex in xP and uk if and only if th

child's utility function Uk(.) is concave. The latter assumption

amounts to a diminishing marginal rate of substitution between the

parent's consumption and the child's consumption.

If the child's income is Mk and the father wants to choose a utility

level uk for the child, his transfers will be Ck(Pk, Xp, Uk) - Mk. Thus

the father's choice problem can be written (with obvious notation) as

maximize Uf(xp, Xf, Uk) (15)

subject to pXp + p; Xf + Ck(Pk, Xp, Uk) < Mf +

Since an increase in xp raises the father's utility and reduces his neces-

sary transfers, the problem is identical to our model of productive

consumption. All our conclusions will apply as long as Ck(Pk, *)

convex in xp and uk. One implication of this analysis, for example, is

that the demand for joint family goods will be less price sensitive in

large households than in small households.

Appendix

The case of more than one productive commodity is more complicated than

the simple case because shadow prices and full income are functions of more

than one variable. Our conclusions about the uncompensated effect of

changes in income and prices need not hold in general. Since the cross-

substitution effects are not signed, one might expect to find no definite re-

sults. However, the methods we employ in Section I still prove to be useful.

Using elementary matrix algebra, we obtain simple analytic results for the

compensated effect of price changes.

Let xp = (x . xm) be the vector of productive commodities (1 ' m

n) and let xc = (Xm+, . xn) be the pure consumption goods. The corre-

sponding price vectors are pp and p, Denote x = (xp, xc) and p = (Pp. pc).

Earned income is a strictly concave function of the quantity of the productive

commodities: E = E(xp). Subscripts of E denote partial derivatives and dou-

ble subscripts denote cross partials. We also denote E the m X m Hessian

matrix of E(-).

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

PRODUCTIVE CONSUMPTION 381

With this notation, consider the problem

minimize p'x - E(xp) (A1)

subject to U(x) 2 u. (A2)

Let s*(p, u), i = 1. n, be the solut

be the solution to minimizing A' x subject to (A2). Then the two compensated

demand functions are related by the following identity:

s*(p, U) Si(7r) I *S * r , 7rk(j (S)) , 7k+1 .I I '. u), (A3)

where Tr= P- E for i = 1, m and 7rj = p for j = m + 1, n.

Differentiating (A3) with respect to pj gives, for i, j = 1,.

as:?

aP1asq -M~a

ar1 + 7kS

. E4E aSk ak a7 (A4)

ai ai k= 1 1= 1 81rk aX1 alj'

In matrix form, let as*Iapj be the (ij)th

gously. (Both matrices have dimension m X

tion (A4) can be written compactly as

S* = So- SpES*. (A5)

Note that standard consumer theory implies that SO is negative definite; E is

also negative definite since E(-) is assumed to be strictly concave.

We shall show that S* is negative definite, so its inverse exists. If we post-

multiply (A5) by S' and premultiply it by Sol, we get

Sp-1 = S*-1 - E. (A6)

Two properties of the matrix S* can be established from equation (A6):

(1) S* is negative definite and (2) S* - So is positive definite. Property 1

follows because S* = (So' + E)- l. The sum of two negative-definite matri-

ces is negative definite. The inverse of a negative-definite matrix is also nega-

tive definite. Property 2 follows because So- S - l = - E is positive defi-

nite. Thus S* - is also positive definite (see Dhrymes [1974, pp. 581-84]

for a proof).

Let us also define S* to be the matrix of the partial derivatives as*lapp, for

i,= m + 1, . . ., n (i.e., S * is the Slutsky submatrix for the pure consumption

goods). Similarly, let S* be the matrix of the partial derivatives asMlapj, for

i = 1,...,im, j = m + 1, . n. Define So and So, analogously as the Slutsky

submatrices for the model without productive consumption. Then differenti-

ation of (A3) gives

S*= So - SpES*c (A7)

and

S* = - SO'ESp* (A8)

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

382 JOURNAL OF POLITICAL ECONOMY

Equation (A7) implies Sp = (I

S* =S S" E(I + S'E)-'Ss

= So -Sps[(1 + SpE)E-'PSp.

= - SpC(E-' + S)-'So. (A9)

The term in parentheses is negative definite. Thus the second term on the

right side of (A9) is negative definite. We hence establish another property:

(3) S* - So is positive definite. Among other things, properties 2 and 3 imply

las*l/apl < | asqIanil for both the productive commodities and the pure co

sumption goods. That is, pure substitution effects are smaller in magnitude

than they are when productive consumption is absent.

References

Becker, Gary S. "A Theory of the Allocation of Time." Econ. J. 75 (September

1965): 493-517.

Biddle, Jeff E., and Hamermesh, Daniel S. "Sleep and the Allocation of

Time."J.P.E. 98, no. 5, pt. 1 (October 1990): 922-43.

Blomquist, N. Soren. "Comparative Statics for Utility Maximization Models

with Nonlinear Budget Constraints." Internat. Econ. Rev. 30 (May 1989):

275-96.

Dhrymes, Phoebus J. Econometrics: Statistical Foundations and Applications. New

York: Springer-Verlag, 1974.

Diewert, W. Erwin. "The Elasticity of Derived Net Supply and a Generalized

Le Chatelier Principle." Rev. Econ. Studies 48 (January 1981): 63-80.

Earp, John H.; Hall, Richard D.; and McDonald, Michael. "Modal Choice

Behavior and the Value of Travel Time: Recent Empirical Evidence." In

Modal Choice and the Value of Travel Time, edited by Ian G. Heggie. Oxford:

Clarendon, 1976.

Edlefsen, Lee E. "The Comparative Statics of Hedonic Price Functions and

Other Nonlinear Constraints." Econometrica 49 (November 1981): 1501-20.

Ehrlich, Isaac, and Lui, Francis T. "Intergenerational Trade, Longevity, and

Economic Growth." J.P.E. 99 (October 1991): 1029-59.

Grossman, Michael. The Demand for Health: A Theoretical and Empirical Investi-

gation. New York: Columbia Univ. Press (for NBER), 1972.

Houthakker, Hendrik S. "An International Comparison of Household Ex-

penditure Patterns: Commemorating the Centenary of Engel's Law."

Econometrica 25 (October 1957): 532-51.

Lazear, Edward. "Education: Consumption or Production?"J.P.E. 85 (June

1977): 569-97.

Pencavel, John H. "Labor Supply of Men: A Survey." In Handbook of Labor

Economics, vol. 1, edited by Orley Ashenfelter and Richard Layard. Amster-

dam: North-Holland, 1986.

Pollak, Robert A. "Conditional Demand Functions and Consumption The-

ory." QJ.E. 83 (February 1969): 60-78.

Pollak, Robert A., and Wachter, Michael L. "The Relevance of the Household

Production Function and Its Implications for the Allocation of Time."

J.P.E. 83 (April 1975): 255-77.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

PRODUCTIVE CONSUMPTION 383

Samuelson, Paul A. "The Pure Theory of Public Expenditure." Rev. Econ.

and Statis. 36 (November 1954): 387-89.

Silberberg, Eugene. "Nutrition and the Demand for Tastes."J.P.E. 93 (Octo-

ber 1985): 881-900.

Singh, Inderjit; Squire, Lyn; and Strauss, John, eds. Agricultural Household

Models: Extensions, Applications, and Policy. Baltimore: Johns Hopkins Univ.

Press, 1986.

Stiglitz, Joseph E. "The Efficiency Wage Hypothesis, Surplus Labour, and

the Distribution of Income in L.D.C.s." Oxford Econ. Papers 28 (July 1976):

185-207.

Strauss, John. "Does Better Nutrition Raise Farm Productivity?" J.P.E. 94

(April 1986): 297-320.

This content downloaded from

136.158.39.204 on Fri, 29 Sep 2023 04:59:51 +00:00

All use subject to https://about.jstor.org/terms

You might also like

- Production Function - What and WhyDocument21 pagesProduction Function - What and WhyteshomeNo ratings yet

- Baumol 1967Document13 pagesBaumol 1967Juani TroveroNo ratings yet

- Teoria de Productividad PDFDocument70 pagesTeoria de Productividad PDFNeto Paucar ChancaNo ratings yet

- Productive ConsumptionDocument15 pagesProductive ConsumptioncfvdfvdsvNo ratings yet

- Principle of Economics - Case, Fair, Oster - Ch. 32-35Document22 pagesPrinciple of Economics - Case, Fair, Oster - Ch. 32-35Ray Andhika PutraNo ratings yet

- The Effect of PromotionDocument28 pagesThe Effect of PromotionJennebie Endrenal-de GuzmanNo ratings yet

- Tests of Competing Theories of Consumer Choice and the Representative Consumer HypothesisDocument16 pagesTests of Competing Theories of Consumer Choice and the Representative Consumer HypothesisDANIEL LIZARAZO FERRONo ratings yet

- Banerjee and Newman (1993), Occupational Choice and The Process of DevelopmentDocument26 pagesBanerjee and Newman (1993), Occupational Choice and The Process of DevelopmentVinicius Gomes de LimaNo ratings yet

- Concentration and Price-Cost Margins in Manufacturing IndustriesFrom EverandConcentration and Price-Cost Margins in Manufacturing IndustriesNo ratings yet

- Jones RDBased 1995Document27 pagesJones RDBased 1995shachirai17No ratings yet

- Using labor supply elasticities to learn about the role of productivities versus preferences in income inequalityDocument73 pagesUsing labor supply elasticities to learn about the role of productivities versus preferences in income inequalityjustowrNo ratings yet

- The University of Chicago PressDocument25 pagesThe University of Chicago PressJanet VictoriaNo ratings yet

- Sustainable Innovation: The impact on the success of US large capsFrom EverandSustainable Innovation: The impact on the success of US large capsNo ratings yet

- SaintPaul PoliticalEconomyEmployment 2002Document34 pagesSaintPaul PoliticalEconomyEmployment 2002SameerNo ratings yet

- IMPLICATIONS OF FERTILITY THEORIES ON HOW LOW FERTILITY CAN GODocument20 pagesIMPLICATIONS OF FERTILITY THEORIES ON HOW LOW FERTILITY CAN GOKk GgNo ratings yet

- Stages of Economic Diversification and SpecializationDocument24 pagesStages of Economic Diversification and Specializationadolfo555No ratings yet

- Transitional Dynamics in Two-Sector Models of Endogenous Growth.Document36 pagesTransitional Dynamics in Two-Sector Models of Endogenous Growth.skywardsword43No ratings yet

- Sat TDocument8 pagesSat TSamuelNo ratings yet

- The Macroeconomics of Low Inflation.Document77 pagesThe Macroeconomics of Low Inflation.skywardsword43No ratings yet

- Hall (1978)Document18 pagesHall (1978)wololo7No ratings yet

- Natural Resources and Economic Growth Theory & EvidenceDocument23 pagesNatural Resources and Economic Growth Theory & EvidenceEduardoMendozaNo ratings yet

- Review On A Theory of ProductionDocument6 pagesReview On A Theory of ProductionGeremew workuNo ratings yet

- Running Head: Principles of Microeconomics 1Document5 pagesRunning Head: Principles of Microeconomics 1Anonymous in4fhbdwkNo ratings yet

- Research on Welfare, Equilibrium and GDPDocument5 pagesResearch on Welfare, Equilibrium and GDPleanzyjenel domiginaNo ratings yet

- Micro Economics NotesDocument28 pagesMicro Economics NotestawandaNo ratings yet

- 0 Workers Prefer WageDocument19 pages0 Workers Prefer Wageturkish pizzaNo ratings yet

- Review On A Theory of ProductionDocument6 pagesReview On A Theory of ProductionGeremew workuNo ratings yet

- Islam (1995) - Growth Empirics A Panel Data ApproachDocument45 pagesIslam (1995) - Growth Empirics A Panel Data ApproachvinitusmendesNo ratings yet

- Romer IncreasingReturnsLongRun 1986Document37 pagesRomer IncreasingReturnsLongRun 1986shachirai17No ratings yet

- The University of Chicago Press Journal of Political EconomyDocument41 pagesThe University of Chicago Press Journal of Political EconomyJoseph JungNo ratings yet

- ECON 203 Intermediate MicroeconomicsDocument104 pagesECON 203 Intermediate Microeconomicsbilge100% (1)

- Determinants of Total Consumption in SudanDocument22 pagesDeterminants of Total Consumption in SudanDonald PatrickNo ratings yet

- MPRA Paper 107787Document22 pagesMPRA Paper 107787SadaticloNo ratings yet

- Capital Expansion, Rate of Growth, and Employment - Evsey D. DomarDocument12 pagesCapital Expansion, Rate of Growth, and Employment - Evsey D. DomarAzzahraNo ratings yet

- Concept and Measurement of Productivity: BY Gboyega A. OyerantiDocument24 pagesConcept and Measurement of Productivity: BY Gboyega A. Oyerantikrystale_1ttt11No ratings yet

- Artículo NearyDocument26 pagesArtículo NearyLeo AlvarezNo ratings yet

- Entropy Law Economic ProcessDocument28 pagesEntropy Law Economic Processapi-26190745No ratings yet

- Chap 3. HET II Class NotesDocument14 pagesChap 3. HET II Class NotesFetsum LakewNo ratings yet

- Sustainable Living Standards and Adaptive Economizing in Economic GrowthDocument40 pagesSustainable Living Standards and Adaptive Economizing in Economic GrowtheeeeewwwwwwwwNo ratings yet

- Cremer1994 Commodity Taxation in A Diff OligopolyDocument22 pagesCremer1994 Commodity Taxation in A Diff Oligopoly李毓恒 YuhengNo ratings yet

- Food Price Changes and Consumer Welfare in Ghana in The 1990sDocument38 pagesFood Price Changes and Consumer Welfare in Ghana in The 1990sRahmat PasaribuNo ratings yet

- Ec101 NotesDocument60 pagesEc101 NotesSylvesterNo ratings yet

- Concepts and Measures of ProductivityDocument20 pagesConcepts and Measures of ProductivityJuan Esteban GarciaNo ratings yet

- Microeconomics Notes (Ec101) : Department of Economics Midlands State UniversityDocument60 pagesMicroeconomics Notes (Ec101) : Department of Economics Midlands State UniversityNyasha GweruNo ratings yet

- QUT Digital RepositoryDocument33 pagesQUT Digital RepositoryFernando UribeNo ratings yet

- Management Science Featuring Micro-Macro Economics and Management of Information Technology: Enhancing Management in ItFrom EverandManagement Science Featuring Micro-Macro Economics and Management of Information Technology: Enhancing Management in ItNo ratings yet

- Economics Choices and ScarcityDocument4 pagesEconomics Choices and ScarcitymalyksNo ratings yet

- The Price Is Not Always Right: Policy Research Working Paper 7583Document50 pagesThe Price Is Not Always Right: Policy Research Working Paper 7583Congresso Mundial Bioética e Direito AnimalNo ratings yet

- MSC Thesis Topics in Agricultural EconomicsDocument9 pagesMSC Thesis Topics in Agricultural Economicsallysonthompsonboston100% (2)

- Strauss e Thomas - 1998 - Health, Nutrition, and Economic DevelopmentDocument53 pagesStrauss e Thomas - 1998 - Health, Nutrition, and Economic Developmentdayane.ufpr9872No ratings yet

- Eco EncyclopedieaDocument110 pagesEco EncyclopedieaBhavya RawalNo ratings yet

- Fundamental Concepts of EconomicsDocument66 pagesFundamental Concepts of EconomicsUwuigbe UwalomwaNo ratings yet

- American Economic AssociationDocument13 pagesAmerican Economic AssociationFanta CuneoNo ratings yet

- Optimal Fiscal and Monetary Policy - Equivalence (2008)Document31 pagesOptimal Fiscal and Monetary Policy - Equivalence (2008)FábioNo ratings yet

- DestructionDocument30 pagesDestructionKubicangelNo ratings yet

- Increasing Returns and Long-Run GrowthDocument36 pagesIncreasing Returns and Long-Run GrowthFábio Rasche Jr.No ratings yet

- Diamond, P. A., & Mirrlees, J. A. (1971) - Optimal Taxation and Public Production I, Production EfficiencyDocument21 pagesDiamond, P. A., & Mirrlees, J. A. (1971) - Optimal Taxation and Public Production I, Production EfficiencyGerald HartmanNo ratings yet

- Superscalper PDFDocument27 pagesSuperscalper PDFNguyễn VươngNo ratings yet

- ChaldalDocument6 pagesChaldalsanzida akter0% (1)

- Internet Coffee Shop Marketing PlanDocument25 pagesInternet Coffee Shop Marketing PlanPalo Alto Software100% (10)

- Micro Assigniment 1Document7 pagesMicro Assigniment 1keting0806No ratings yet

- A Term Paper On Marketing ManagementDocument46 pagesA Term Paper On Marketing ManagementRenesa Haque SarmiNo ratings yet

- Candle TradingDocument2 pagesCandle Tradingkaushikpoojari1012No ratings yet

- Kinked Demand Curve: OligopolyDocument10 pagesKinked Demand Curve: OligopolyREJIN TSNo ratings yet

- Betelhem.b Final - EditedDocument102 pagesBetelhem.b Final - EditedSolomon AnemawNo ratings yet

- Carfit Autoparts Marketing StrategyDocument4 pagesCarfit Autoparts Marketing StrategyStella KazanciNo ratings yet

- Data and QuestionsDocument7 pagesData and QuestionsSrikar_Gundaba_6062No ratings yet

- Past Year Eco Question PaperDocument11 pagesPast Year Eco Question PaperzaniNo ratings yet

- ECON 1010 - F - 21-Course Outline Memorial UniversityDocument8 pagesECON 1010 - F - 21-Course Outline Memorial UniversityArooz Paul Paul SinghNo ratings yet

- Module/Unit 1: Assessment Task Questions:: AnswerDocument22 pagesModule/Unit 1: Assessment Task Questions:: AnswerPeter Cranzo MeisterNo ratings yet

- 1 (First Paragraph), Provide Other Possible Answers.)Document1 page1 (First Paragraph), Provide Other Possible Answers.)Joennel SemillaNo ratings yet

- Managerial Economics: David Besanko, Ronald Braeutigam: MicroeconomicsDocument8 pagesManagerial Economics: David Besanko, Ronald Braeutigam: MicroeconomicsMoidin AfsanNo ratings yet

- SALES MANAGEMENT - With Personal Selling and Salesmanship (PDFDrive)Document344 pagesSALES MANAGEMENT - With Personal Selling and Salesmanship (PDFDrive)Pratik Patil100% (1)

- Individual and Group Marketing AssignmentsDocument2 pagesIndividual and Group Marketing Assignmentsyordanosezerihun07100% (1)

- What Is A 'Greenshoe Option': Underwriting Agreement UnderwriterDocument2 pagesWhat Is A 'Greenshoe Option': Underwriting Agreement UnderwriterpratyushaNo ratings yet

- Marketing - Module 9 The Marketing Mix - PROMOTIONDocument12 pagesMarketing - Module 9 The Marketing Mix - PROMOTIONKJ Jones100% (3)

- DerivativeDocument143 pagesDerivativebbNo ratings yet

- Establishing Objectives and Budgeting For The Promotional ProgramDocument31 pagesEstablishing Objectives and Budgeting For The Promotional ProgramannNo ratings yet

- BCG MatrixDocument33 pagesBCG Matrixshambhavi sinhaNo ratings yet

- Hindustan Copper Limited Pricing Summary of CC Rod 8mm As OnDocument2 pagesHindustan Copper Limited Pricing Summary of CC Rod 8mm As OnJames ValenzuelaNo ratings yet

- Pyndyck 13Document38 pagesPyndyck 13Hanif NugrahadiNo ratings yet

- Grofers Marketing StrategyDocument8 pagesGrofers Marketing StrategyRahul Gupta50% (2)

- Marketing Management - POS Solutions ProjectDocument13 pagesMarketing Management - POS Solutions Projectlushcheese100% (2)

- Your Personal Trading ProgramDocument18 pagesYour Personal Trading ProgramMax MudaliarNo ratings yet

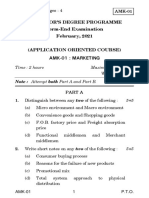

- AMK-1 (Dec-2020)Document4 pagesAMK-1 (Dec-2020)Sudarshan BhatNo ratings yet

- Micro Ch15 PresentationDocument31 pagesMicro Ch15 PresentationZakaria SakibNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/22Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/22Tinotenda DubeNo ratings yet