Professional Documents

Culture Documents

39th GST Batch Schedule - 21st April

39th GST Batch Schedule - 21st April

Uploaded by

Saajan Khan0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

39th GST Batch Schedule - 21st April.xlsx

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pages39th GST Batch Schedule - 21st April

39th GST Batch Schedule - 21st April

Uploaded by

Saajan KhanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

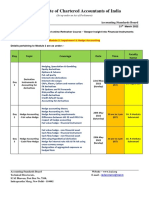

English Medium

Detail Content of 65 Hours GST Certificate Course

39th Batch - Wednesday, Saturday and Sunday

Wed (8-10 PM), Sat (7-10 PM) and Sunday (7-10 AM) from 21st April'24 to 3rd July'24

S.No Date Topic Time Duration Detailed Coverage

Module A - Basic to Advance - 35 Hours (Live)

Week 1

Basic GST Overview 3

How the GST Council Function

Important pillar of GST Council

1 Sunday, 21 April, 2024 GST Basics 7-10 AM 3 Hours

Provision related to Indian constitution

Tax treatment on ENA and Alcholic Liquor for Human consumption

Concept of cooperative federliasm

Concept of GST Council, Number of GST Act

Benefit of GST

Meaning of Certain important terminology

Different Type of Supply in GST

2 Sunday, 28 April, 2024 Supply Part 1 7-10 AM 3 Hours What is the Taxable Event in Pre GST vs Post GST 3

Detailed understanding of Supply (Section 7 of CGST Act)

Discussion of following schedule –

1. Schedule I – Supply without Consideration

2. Schedule II – Supply of Goods/Services

Week 2

3. Schedule III – Negative list

Composite Supply vs Mixed Supply

3 Wednesday, 1 May, 2024 Supply Part 2 2 Hour 2 Hour Definition - Inward vs Outward Supply, Continuous Supply of Goods vs

Services, Exempt vs Zero Rated supply 2

Relevant Advance Ruling and Judgement on Supply

Requirement of Registration in GST

Mandatory Registration – Section 22/24 of CGST 3

4 Saturday, 4 May, 2024 Registration 7-10 PM 3 Hours

Exemption from Registration – Section 23 of CGST

Meaning of effective date of registration

Amendment and cancellation of registration

Practical Exposure on how to take registration

Registration - part 2 1.50 Hours

Relevant Advance Ruling and Judgement on registration

Quick round of Q&A

5 Sunday, 5 May, 2024 7-10 AM Eligibility, Condition and Restriction for composition Levy 3

Procedure to opt for the composition levy

Composition Levy 1.50 Hours Input Tax Credit on switch over to composition levy

Rate of taxes, Meaning of Turnover in a State or UT and its implication on

Rate

Week 3

Time of Supply of Goods (Section 12 of CGST Act) along with Notification 2

Time of Supply 2 Hours No 40ofdated

Time 13thofOct’17

Supply & (Section

Services Notification NoCGST

13 of 66 dated

Act)15th Nov 2017

Time of Supply in case of change in Rate of Taxes (Section 14 of CGST

6 Wednesday, 8 May, 2024 8-10 PM Act)

Concept of Levy and Reverse Charge

Levy and Reverse Charge- Difference between RCM covered in 9(3) and 9(4) 1

1 Hours

Part 1 Deemed Supplier u/s 9(5)

List of goods covered under RCM - NN 4/2017 CT Rate

Discussion on all categories of RCM u/s 9(3) of CGST Act

Detail Discussion on GTA and Legal Service in details 3

Levy and Reverse Charge- Reverse Charge on Import Transaction

7 Saturday, 11 May, 2024 7-10 PM 3 Hours

Part 2 Reverse Charge Case Study

Relevant Advance Ruling and Judgement

Quick round of Q&A

What is the Eligibility and Condition for claiming ITC- Section 16

Time limt to claim the ITC and relevance of Debit Note 3

Concept of Claim - Reversal – Reclaim

8 Sunday, 12 May, 2024 Input tax credit – Part 1 7-10 AM 3 Hours Comaprison of rule 37 and rule 37A

Block ITC as per Sec 17(5)

Relevant Advance Ruling and Judgement

Quick round of Q&A

Week 4

Provision of Section 17 for reversal of common ITC and meaning of

Exempt

ReversalSupply

as per Rule 42/43 for Input, Input Service & Capital Goods

9 Wednesday, 15 May, 2024 Input tax credit – Part 2 8-10 PM 2 Hours Special Provision for Banking, Financial Institutions, NBFC's 2

ITC in case of special circumstances - Sec 18

Quick Round of Q&A

Payment of Taxes and restriction 3

Payment of Taxes 1.50 Hours Electronic Credit vs Electronic Cash Ledger

Transfer of cash balance between Distinct person and PMT-09

10 Saturday, 18 May, 2024 7-10 PM Value of Supply as per transaction value Section 15

Inclusion in the Transaction value Sec 15(2) of CGST Act

Value of Supply 1.50 Hours

When the Discount will be included / excluded from transaction value Sec

15(3) of CGST Act

English Medium

Detail Content of 65 Hours GST Certificate Course

10 Saturday, 18 May, 2024 39th Batch - Wednesday,

7-10 PM Saturday and Sunday

Wed (8-10 PM), Sat (7-10 PM) and Sunday (7-10 AM) from 21st April'24 to 3rd July'24

Value of Supply 1.50 Hours

S.No Date Topic Time Duration Detailed Coverage

Quick Round of Q&A

Circular 92, 102 and 72

Rule 27 to Rule 31 - Valuation Rule

Rule 32 – Margin Method

Foreign Exchange, Air Travel Agent, LIC and Buying and Selling of

11 Sunday, 19 May, 2024 Value of Supply 7-10 AM 3 Hours Second hand goods 3

Rule 33 – Pure Agent , Rule 34 and Rule 35

Rule 33B and Rule 33C - Valuation of Online gaming

Relevant Advance Ruling and Judgement

Quick Round of Q&A

Week 5

Defintion of Inter State Supply –Intra State Supply

SEZ unit vs Sec 12 = Intra/Inter State Supply

12 Wednesday, 22 May, 2024 Place of Supply – Part 1 8-10 PM 2 Hours Place of Supply of Goods – Section 10 of IGST

Place of Supply of Goods - Import/Export, 2

Concept of Section 12 - General provision

Place of Supply of Services when Location of Supplier and Location of

recipient both are in India (Sec 12 of IGST) 3

Section 13 of IGST Act à POS of Services when either the Location of

13 Saturday, 25 May, 2024 Place of Supply – Part 2 7-10 PM 3 Hours Supplier or Location of recipient is out of India

IGST Valuation Rules - Rule 3 to Rule 9

Relevant Advance Ruling and Judgement

Quick Round of Q&A

Exemption related to goods 2

14 Sunday, 26 May, 2024 Exemption in the GST 7-9 AM 2 Hours

Exemption related to services

Total 35 Hours

Module B - GST Practical Return Filling and Import/Export, Refund - 16 Hours (Live)

Week 6

Import/ Export of goods vs Import of services 2

Deemed Export - Sec 147 read with Notification No 48 CT

Merchant Export and condition to make sale @.10%

Import/Export and Refund - What is the condition for claiming refund – Section 54

15 Wednesday, 5 June, 2024 8-10 PM 2 Hour

Part 1 What is the concept of Inverted Duty Structure and Calculation as per Rule

89(5) read with Notification No 21 and Notification No 26

When exporters are not eligible for refund

No export /SEZ Supplies on payment of IGST

Time limit for refund application

Refund in case of Zero Rated Supply with LUT

Refund in case of Zero Rated Supply on Payment of IGST

Import/Export and Refund -

16 Saturday, 8 June, 2024 7-10 PM 3 Hour Refund pf Intra State treated as Inter state and Rule 89(1A) 3

Part 2

Master Circular 125 and other relevant circular like 135 etc

Relevant Advance Ruling and Judgement

Quick Round of Q&A

1. Basic About GST Return

a. Details of Outward Supply / Inward Supply / Monthly Return / Final

Return / Annual Return

GSTR Return Basic 2. New QRMP scheme of GST Return

17 Sunday, 9 June, 2024 Concept and New QRMP 7-10 AM 3 Hour a. What is IFF, Method of payment (Fixed Sum or Self assessment), PMT-06 3

Scheme and GSTR 3B b. Opt in Facility and live how to take in GST Portal

3. GSTR 3B

GSTR 3B - Table Wise discussion

Practical Live on GST Portal

Week 7

GSTR 1 - Table Wise discussion

Linking with GSTR 3B/ 9 /9C

18 Wednesday, 19 June, 2024 GSTR 1 8-10 PM 2 hours

Most common error for each table with solution 2

Practical Experience Live on GST Portal

GSTR 9 - Table Wise discussion

Linking with GSTR 3B/ 1 /9C

GSTR 9 - Annual Return Most common error for each table with solution

Relevant Rules / Provision of GST linking with respective table

19 Saturday, 22 June, 2024 7-10 PM 3 hours Practical Experience Live on GST Portal 3

GSTR 9C - Table Wise discussion

GSTR 9C - Reconciliation Linking with GSTR 3B/ 1 /9

Statement Most common error for each table with solution

Practical Experience Live on GST Portal

EWAY Bill provision

Documentation requirement for EWAY Bill

English Medium

Detail Content of 65 Hours GST Certificate Course

39th Batch - Wednesday, Saturday and Sunday

Wed (8-10 PM), Sat (7-10 PM) and Sunday (7-10 AM) from 21st April'24 to 3rd July'24

S.No Date Topic Time Duration Detailed Coverage

Exemption from EWAY Bill

EWAY Bill for Gold/Jewellery

20 Sunday, 23 June, 2024 E Way Bill in GST 7-10 AM 3 Hours Circular on EWay Bill for – Who will be owner

Live discussion on EWay Bill Portal 3

Penalties provision - section 129 and section 130

Relevant Advance Ruling and Judgement

Quick Round of Q&A

Total 16 Hours

Module C - Litigation Specific and how to Reply GST Notices - 8 Hours (Live)

Week 8

Penalties

Power to Arrest 2

Litigation / Advance Topics Advance Ruling

21 Wednesday, 26 June, 2024 8-10 PM 2 Hours

- Part 1 Appellate Authority

Invoice, Accounts and Records

Tax Collection at Source (TCS) & Tax Deduction at Source (TDS)

Assessment under GST

Litigation / Advance Topics Inspection, Search & Seizure in GST 3

22 Saturday, 29 June, 2024 7-10 PM 3 Hours

- Part 2 GST Audit

Assessment under GST

Inspection, Search & Seizure in GST

Litigation / Advance Topics

Proper Officer and other concept in GST

- Part 3

Discussion on various Principal (from Indian Constitution/ ) and drafting

the reply to GST Notice

23 Sunday, 30 June, 2024 7-10 AM 3 Hours

Drafting Reply 1st Discussion of GST Notice on Input Tax Credit having discrepancies on

1) GSTR 2A vs GSTR 3B,

2) Penalties u/s 74,

3) Penalty u/s 125 for GSTR 3B Penalties 3

24 Wednesday, 3 July, 2024 Doubt clearing Discussion Common discussion

Total 8 Hours

Module D Indepth analysis on return Filling (8 Hours)

Case Study on GSTR 3B

1&2 Recorded Lecture GSTR 1, 3B and 9 and 9C 3 Hours Case Study on GSTR 1 3

Case Study on GSTR 9

Return for composition levy

Table wise discussion of GSTR 4

GSTR 4 & CMP_08

Table wise discussion of CMP-08 4

Other compliance of Composition

3&4 Recorded Lecture 4 Hours Journal Entry to be passed for RCM Entry,

GSTR 2A, 2B

Reconciliation GSTR 2A vs. 2B

Reconciliation and JV

Journal Entry to be passed for above Reconciliation

GST Portal - Overview

GST Portal Overview

GST Portal - Various Matching Reports

Total (A+B+C+D) 65 Hours

Exam Preparation

1 Sunday, 21 July, 2024 Time 10 AM to 12 Noon 2 Hours 2 Hours Test - First Attempt (1st Sunday after the 15 days of completion of Batch)

2 Sunday, 28 July, 2024 Time 10 AM to 12 Noon 2 Hours 2 Hours Test - First Attempt - 2nd chance (Next Sunday after first Attempt)

Test - Second Attempt - Only 1 chance (Next Sunday after 2nd chance of

Sunday, 4 August, 2024 Time 10 AM to 12 Noon 2 Hours 2 Hours

3 first Attempt)

You might also like

- Black Book On GSTDocument70 pagesBlack Book On GSTHamza Masalawala71% (31)

- Case 78, "Beatrice Peabody"Document8 pagesCase 78, "Beatrice Peabody"seethurya0% (1)

- Reading Bank Unit 5: Answer KeyDocument1 pageReading Bank Unit 5: Answer KeyAlice DeiNo ratings yet

- Simple InterestDocument25 pagesSimple InterestRJRegio25% (4)

- Latihan Soal Kieso 2Document6 pagesLatihan Soal Kieso 2Dimas Samuel100% (3)

- 7th Evening Batch English Medium NewDocument2 pages7th Evening Batch English Medium NewlibinNo ratings yet

- 1 Principles of Taxation IIDocument2 pages1 Principles of Taxation IISarthak JainNo ratings yet

- Index - GST and Customs LawDocument9 pagesIndex - GST and Customs LawHeyy DreamNo ratings yet

- Paper 11 New PDFDocument443 pagesPaper 11 New PDFAnand KumarNo ratings yet

- DocScanner 26 Apr 2022 9 58 AMDocument82 pagesDocScanner 26 Apr 2022 9 58 AMSWAPNIL JADHAVNo ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- GST Understanding2Document13 pagesGST Understanding2sk mNo ratings yet

- Detailed Agenda Notes 3rd GSTCMDocument53 pagesDetailed Agenda Notes 3rd GSTCMAditya JaiswalNo ratings yet

- Roll No C 17 Prakash Ochwanni Sem XDocument10 pagesRoll No C 17 Prakash Ochwanni Sem XPRAKASH OCHWANINo ratings yet

- Changes From 1.1.2021 - GST - Adv. Gaurav GuptaDocument2 pagesChanges From 1.1.2021 - GST - Adv. Gaurav GuptaGaurav GuptaNo ratings yet

- Monthly Report Nov'2022Document4 pagesMonthly Report Nov'2022Rahul AmbawataNo ratings yet

- Tax Law - IIDocument19 pagesTax Law - IIAniket SharmaNo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- The Institute of Chartered Accountants of India: Accounting Standards BoardDocument2 pagesThe Institute of Chartered Accountants of India: Accounting Standards BoardHitesh KarmurNo ratings yet

- GST QB-CA Yachana Mutha Bhurat - May 2020 PDFDocument491 pagesGST QB-CA Yachana Mutha Bhurat - May 2020 PDFkishoreji0% (1)

- Training On GST - CAG - 20180221 PDFDocument287 pagesTraining On GST - CAG - 20180221 PDFSuresh Kumar YathirajuNo ratings yet

- Chapter 1 MCQsDocument6 pagesChapter 1 MCQsmpatra264No ratings yet

- U.O No.8/3/2023/S.1. 269: No25011/02/2021-AIS-II Dated 13.07.2023 (Pension) On The Subject CitedDocument5 pagesU.O No.8/3/2023/S.1. 269: No25011/02/2021-AIS-II Dated 13.07.2023 (Pension) On The Subject CitedrajknowledgehubNo ratings yet

- The Silent Professional Institute of Ca & CS: 7 Days Free Test Series ScheduleDocument8 pagesThe Silent Professional Institute of Ca & CS: 7 Days Free Test Series ScheduleArihant JainNo ratings yet

- Signage License For AdvertisementDocument3 pagesSignage License For AdvertisementRaghuNo ratings yet

- PradhiCADOT2.ONov2023CA FinalDocument39 pagesPradhiCADOT2.ONov2023CA FinalSumanasa SVNo ratings yet

- Screenshot 2023 Skieb Wooohs 378Document6 pagesScreenshot 2023 Skieb Wooohs 378Sunil MaharanaNo ratings yet

- Letter For VC On 24.01.2024Document10 pagesLetter For VC On 24.01.2024gstceraslmNo ratings yet

- Background Material On GST - Volume II 04.02.2022Document518 pagesBackground Material On GST - Volume II 04.02.2022SunilsabatNo ratings yet

- Cfap - 2 Certified Finance and Accounting Professional: Corporate LawsDocument3 pagesCfap - 2 Certified Finance and Accounting Professional: Corporate LawsIsmail yousufNo ratings yet

- Introduction and Supply Chart Notes Colour by CA Lijil LakshmanDocument33 pagesIntroduction and Supply Chart Notes Colour by CA Lijil LakshmanSATHISH KUMARNo ratings yet

- Disssertation - Saral GajjarDocument113 pagesDisssertation - Saral GajjarsdNo ratings yet

- NCR. P2 20 - 26 July 2022 FIXDocument7 pagesNCR. P2 20 - 26 July 2022 FIXeka suryaNo ratings yet

- Volume I (BGM 16 04 2019) PDFDocument870 pagesVolume I (BGM 16 04 2019) PDFManoj GuptaNo ratings yet

- Index: Chapter 1 - Overview of GSTDocument5 pagesIndex: Chapter 1 - Overview of GSTlibinNo ratings yet

- General ClarificationsDocument7 pagesGeneral ClarificationsRohan KulkarniNo ratings yet

- Operational and Expenditure Plan of Result Area 2 of Strive Spiu AssamDocument2 pagesOperational and Expenditure Plan of Result Area 2 of Strive Spiu AssamKaushik DasNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument15 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaNeeraj ChandrolNo ratings yet

- Notice To Member On Online CPE Training Program: Registration LinkDocument2 pagesNotice To Member On Online CPE Training Program: Registration LinkApilNo ratings yet

- Gujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalDocument14 pagesGujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalABCDefNo ratings yet

- Signed Minutes - 35th GST Council MeetingDocument76 pagesSigned Minutes - 35th GST Council Meetingvinod.sale1No ratings yet

- GST PPT (Group 5)Document20 pagesGST PPT (Group 5)Hanna GeorgeNo ratings yet

- Black Book On GSTDocument70 pagesBlack Book On GSTMrRishabh97No ratings yet

- Administrative Order No. 23 Compliance Report TemplateDocument3 pagesAdministrative Order No. 23 Compliance Report TemplateRichard Adrian0% (1)

- Procurement Plan For The .: II. Goods and Works and Non-Consulting ServicesDocument5 pagesProcurement Plan For The .: II. Goods and Works and Non-Consulting ServicesFaisal SunnyNo ratings yet

- Indirect Taxation: IntermediateDocument290 pagesIndirect Taxation: IntermediateShreya JainNo ratings yet

- GST - Super 75 - CA Amit MahajanDocument84 pagesGST - Super 75 - CA Amit Mahajanrohitkumar231202No ratings yet

- Compilation of ShortDocument3 pagesCompilation of Shortnandeesh2002mkn2002No ratings yet

- Show Cause NoticeDocument8 pagesShow Cause NoticeinfoNo ratings yet

- Pradhica Dot Marathon Nov2023 CafinalDocument40 pagesPradhica Dot Marathon Nov2023 Cafinalkr.kavyakala30No ratings yet

- Adjudication Order in The Matter of Inspection of Onepaper Research Analysts PVT LTDDocument22 pagesAdjudication Order in The Matter of Inspection of Onepaper Research Analysts PVT LTDcawojin576No ratings yet

- Ref. No. 293 - EXTENSION OF BENEFITS OF 12TH BIPARTITE SETTLEMENT & 9TH JOINT NOTEDocument2 pagesRef. No. 293 - EXTENSION OF BENEFITS OF 12TH BIPARTITE SETTLEMENT & 9TH JOINT NOTESanjeev SinghNo ratings yet

- A Brief Note On GSTDocument13 pagesA Brief Note On GSTM K PragyaNo ratings yet

- Revised Prelims Test Series 2023-24 ScheduleDocument7 pagesRevised Prelims Test Series 2023-24 Schedulelearntoempower24x7No ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- GST Question BankDocument359 pagesGST Question BankSiddhesh Kamat AzrekarNo ratings yet

- ITC 08022024191957 SE FineDocument3 pagesITC 08022024191957 SE FineKarunakara ReddyNo ratings yet

- Syllabus Ip MergedDocument9 pagesSyllabus Ip MergedSandeep BhandariNo ratings yet

- NCR. P2 20 - 26 July 2022 FindingDocument7 pagesNCR. P2 20 - 26 July 2022 Findingeka suryaNo ratings yet

- GST Compliance Booklet June 2023Document56 pagesGST Compliance Booklet June 2023taxqoof1No ratings yet

- Personal Data (Privacy) Law in Hong Kong: A Practical Guide on Compliance (Second Edition)From EverandPersonal Data (Privacy) Law in Hong Kong: A Practical Guide on Compliance (Second Edition)No ratings yet

- Bank SolvenceyDocument1 pageBank SolvenceySaajan KhanNo ratings yet

- Daily Report - 2024Document1 pageDaily Report - 2024Saajan KhanNo ratings yet

- Rent AggreementDocument1 pageRent AggreementSaajan KhanNo ratings yet

- Pay Slilp Saajan AliDocument1 pagePay Slilp Saajan AliSaajan KhanNo ratings yet

- Comparative Study On Services of Public Sector and Private Sector BanksDocument48 pagesComparative Study On Services of Public Sector and Private Sector BanksRanjan Kishor92% (13)

- ESG FinalDocument9 pagesESG FinalLidia GutiérrezNo ratings yet

- Receivables Discussion QuestionDocument17 pagesReceivables Discussion QuestionAngelica TalledoNo ratings yet

- Ce 351 A2Document12 pagesCe 351 A2IsraelNo ratings yet

- Capital Market and Portfolio ManagementDocument11 pagesCapital Market and Portfolio ManagementRohit SoniNo ratings yet

- IFRS 4 Insurance ContractsDocument5 pagesIFRS 4 Insurance Contractstikki0219No ratings yet

- Chapter c14Document27 pagesChapter c14DrellyNo ratings yet

- Acfn 1031 Chapter One Introduction To Accounting & BusinessDocument62 pagesAcfn 1031 Chapter One Introduction To Accounting & BusinessKaleab ShimelsNo ratings yet

- Internship Report On Askari Bank Limited Mansehra: Government College of Management Sciences MansehraDocument71 pagesInternship Report On Askari Bank Limited Mansehra: Government College of Management Sciences MansehraFaisal AwanNo ratings yet

- Numericals On National Income Accounting 2019-20Document2 pagesNumericals On National Income Accounting 2019-20NIKITA SONINo ratings yet

- PHD Thesis Topics in Financial ManagementDocument6 pagesPHD Thesis Topics in Financial Managementvsiqooxff100% (2)

- Afm New Topic CompiledDocument59 pagesAfm New Topic Compiledganesh bhaiNo ratings yet

- Audit of Property, Plant & EquipmentDocument51 pagesAudit of Property, Plant & EquipmentKristina KittyNo ratings yet

- University Entrepreneurship Report - CB InsightsDocument60 pagesUniversity Entrepreneurship Report - CB InsightsAlex LuceNo ratings yet

- Presentation IsfnDocument14 pagesPresentation IsfnAmirah ShukriNo ratings yet

- ECON 2123 Quiz 4Document4 pagesECON 2123 Quiz 4Charlie TsuiNo ratings yet

- HCA16ge IM CH06Document14 pagesHCA16ge IM CH06Ann MaNo ratings yet

- Boiler Rooms Cold CallingDocument11 pagesBoiler Rooms Cold CallingdarkavocateNo ratings yet

- REAL ESTATE PURCHASE AGREEMENT (Vidot)Document3 pagesREAL ESTATE PURCHASE AGREEMENT (Vidot)Ciera ColonNo ratings yet

- Reference 1: Mallin (2018), Ch. 6, 7 CHAPTER 6: The Role of Institutional Investors in Corporate GovernanceDocument7 pagesReference 1: Mallin (2018), Ch. 6, 7 CHAPTER 6: The Role of Institutional Investors in Corporate GovernanceBuat YoutubeNo ratings yet

- Notes EconomyDocument81 pagesNotes EconomySumit ChouhanNo ratings yet

- RM Music Worksheet For The Ended Period July, 31 2016Document25 pagesRM Music Worksheet For The Ended Period July, 31 2016AmandaNo ratings yet

- Peter Low - The Northern Pacific Panic of 1901Document4 pagesPeter Low - The Northern Pacific Panic of 1901Adrian KachmarNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document2 pagesFundamentals of Accountancy, Business and Management 2Sharlyn Marie An Noble-BadilloNo ratings yet

- Team PRTC Afar-Finpb - 5.21Document16 pagesTeam PRTC Afar-Finpb - 5.21Nanananana100% (2)

- Cash Management Models To Determine The Level of Cash BalanceDocument5 pagesCash Management Models To Determine The Level of Cash BalanceMohammed SazidNo ratings yet