Professional Documents

Culture Documents

1 Principles of Taxation II

1 Principles of Taxation II

Uploaded by

Sarthak Jain0 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pages1 Principles of Taxation II

1 Principles of Taxation II

Uploaded by

Sarthak JainCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

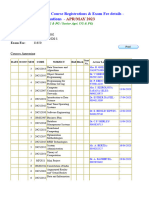

SVKM’s Narsee Monjee Institute of Management Studies

Name of School – Kirit P. Mehta School of Law

Program: B.A., LL.B. (Hons.) 8101 & B.B.A., LL.B. (Hons.) 8102 Semester: VIII

Module: Principles of Taxation II Module Code:

Teaching Scheme Evaluation Scheme

Tutorial Term End Examinations

Lecture Practical Internal Continuous

(Hours per (TEE)

(Hours (Hours Credit Assessment (ICA)

week) (Marks- 50 in Question

per week) per week) (Marks - 50)

Paper)

3 0 0 3 Marks Scaled to 50 Marks Scaled to 50

Pre-requisite: Constitution of India, Direct Tax.

Objectives:

1. Understanding the basis & various concepts of evolution of Taxation Law.

2. To analyze and examine the different codified indirect taxation laws and policies operating in the territory of

India.

3. Understand and analyse the contemporary issues affecting tax laws in India.

Course Outcomes:

On completion of this course, the students will be able to:

1. Identify, comprehend and understand the various basic principles of Indirect Taxation in India. (PLO1)

2. Illustrate & demonstrate the need of various taxation statutes in the nation. (PLO2)

3. Critically analyze the new regime of Indirect taxation laws in the Country. (PLO 3)

4. To develop understanding and acquire application-oriented knowledge for Rules, Notifications and Circulars

issued by Regulators from time to time to take care of contemporary and relevant issues (PLO4)

Detailed Syllabus: (Per session plan)

Unit Description Duration

1. Indirect Taxes: An overview 3 Hrs

- Introduction to GST

- Constitutional Aspects of GST

2. GST In India 3 Hrs

- Dual GST Model

- Types of GST

- Transition from multiple taxes to one tax regime

3. Concept of Supply under GST: Part 1 3 Hrs

- Concepts of supply including types of supply

4. Concept of Supply under GST: Part 2 3 Hrs

- Schedule I, Schedule II and Schedule III [CGST Act]

5. Charge of GST (Including reverse charge) 3 Hrs

6. Composition Scheme under GST 3 Hrs

7. GST Exemptions: An Overview 3 Hrs

- Legal services

- Government services

- Health care Services

SVKM’s Narsee Monjee Institute of Management Studies

Name of School – Kirit P. Mehta School of Law

8. Time of Supply 3 Hrs

9. Value of Supply: Basic provisions 3 Hrs

10. Place of Supply: Basic provisions 3 Hrs

11. Input tax credit: Basic provisions 3 Hrs

- Eligibility, Conditions & Time limit for claiming ITC

- Apportionment of Credit & Blocked Credit

12. Procedures for GST – Registration, Tax Invoice, Credit & Debit note 3 Hrs

13. Procedures for GST- Returns 3 Hrs

14. Procedures for GST- Payment 3 Hrs

15. Basics of Custom Duty 3 Hrs

- Important definitions

- Taxable event

- Types of Duties

Total 45 Hrs

Text Books:

1. Students Referencer On Indirect Taxes By G. Sekar. Commercial Law publishers [Latest edition]

2. Bangar's Comprehensive Guide to Indirect Tax Laws By Yogendra Bangar and Vandana Bangar. [Latest edition]

3. Taxmann’s Indirect Tax law, By V.S. Datey [Latest edition]

Any Other Information:

Latest Updated Statutes, Act, Rules and Regulations and Case Law to be taught after discussion in

Multi-Campus Program Coordination (MPC) Meeting.

Total Marks of Internal Continuous Assessment (ICA) - 50 Marks

Distribution of ICA Marks:

Description of ICA Marks

Test 1 20 Marks

Quiz 10 Marks

Group Discussion 10 Marks

Class Participation 10 Marks

Total Marks : 50 Marks

Signature Signature

(Prepared by Mr. Devendra Vyas) (Approved by Dean)

Updated: October 2023

You might also like

- Advanced Tax LawsDocument964 pagesAdvanced Tax Lawsneeraj goyalNo ratings yet

- Graphic Organizer TemplatesDocument38 pagesGraphic Organizer Templatesanna39100% (2)

- 7 HR Data Sets For People Analytics - AIHR AnalyticsDocument14 pages7 HR Data Sets For People Analytics - AIHR AnalyticsTaha Ahmed100% (1)

- Syllabus - GST BeginnerDocument4 pagesSyllabus - GST Beginnernayra khanNo ratings yet

- A Detailed Lesson Plan in Science III (Final Demo)Document7 pagesA Detailed Lesson Plan in Science III (Final Demo)Elizabeth Cabrina Butchayo89% (18)

- Jensen Studio HandbookDocument4 pagesJensen Studio Handbookrussrolen9127100% (3)

- UOI - Planner - Pyp-4 Final PresentedDocument30 pagesUOI - Planner - Pyp-4 Final Presentedkhadija safdar33% (3)

- Format Employers-Statement-Okp-And-Msp-Programmes For Mean ScholarshipDocument2 pagesFormat Employers-Statement-Okp-And-Msp-Programmes For Mean ScholarshipAwar NamanNo ratings yet

- Curriculum Development: B. EssentialismDocument9 pagesCurriculum Development: B. EssentialismIan Andres DulaogonNo ratings yet

- GST Book PDFDocument606 pagesGST Book PDFsaddamNo ratings yet

- Defects in The Old Indirect Tax Regime and Its Solution in The Form of GST: An AnalysisDocument18 pagesDefects in The Old Indirect Tax Regime and Its Solution in The Form of GST: An Analysisghost of a blockNo ratings yet

- Culture and PersonalityDocument17 pagesCulture and PersonalitySarthak Jain100% (1)

- Course Outlines - Sem I - Finance IDocument4 pagesCourse Outlines - Sem I - Finance ISAUMYA KUMARINo ratings yet

- Corporate Taxation For Managers 5.12.23Document2 pagesCorporate Taxation For Managers 5.12.23Vani BalajiNo ratings yet

- Test Schedule Unit Wise CS Executive Dec-23Document19 pagesTest Schedule Unit Wise CS Executive Dec-23Gungun ChetaniNo ratings yet

- 10 Course Outlines Sem - VIII Law Relating To Customs & Customs TariffDocument3 pages10 Course Outlines Sem - VIII Law Relating To Customs & Customs TariffSarthak JainNo ratings yet

- Advance Test Schedule CS Executive Dec-23Document22 pagesAdvance Test Schedule CS Executive Dec-23Gungun ChetaniNo ratings yet

- CMA Intermediate Law & Ethics: Section A 30%Document4 pagesCMA Intermediate Law & Ethics: Section A 30%M RafeeqNo ratings yet

- BCOM-502 CourseHandout IncomeTaxDocument11 pagesBCOM-502 CourseHandout IncomeTaxLoket SinghNo ratings yet

- Finance IDocument2 pagesFinance ISheetala HegdeNo ratings yet

- 39th GST Batch Schedule - 21st AprilDocument3 pages39th GST Batch Schedule - 21st AprilSaajan KhanNo ratings yet

- 19-63 Manasvi Pinge - Taxation - II FDDocument14 pages19-63 Manasvi Pinge - Taxation - II FDManasviNo ratings yet

- Jeetika Aggarwal-ICA-Tax LawDocument9 pagesJeetika Aggarwal-ICA-Tax Lawshivanjay aggarwalNo ratings yet

- Ibc PDFDocument5 pagesIbc PDFBADDAM PARICHAYA REDDYNo ratings yet

- 3COMTC0602Document2 pages3COMTC0602Deepak BaloriaNo ratings yet

- Course Outline IDTDocument12 pagesCourse Outline IDTcvcvNo ratings yet

- Certificate Course in Indian ConstitutionDocument2 pagesCertificate Course in Indian Constitutionsaran21No ratings yet

- Direct and Indirect Tax CourseDocument10 pagesDirect and Indirect Tax CourseKASHISH GUPTANo ratings yet

- CTPM Lesson Plan JIMS 23Document3 pagesCTPM Lesson Plan JIMS 23abh ljknNo ratings yet

- Course Manual TaxationDocument9 pagesCourse Manual TaxationShreshtha RaoNo ratings yet

- Work Book Paper18Document128 pagesWork Book Paper18vaishnavidixit724No ratings yet

- GST QB-CA Yachana Mutha Bhurat - May 2020 PDFDocument491 pagesGST QB-CA Yachana Mutha Bhurat - May 2020 PDFkishoreji0% (1)

- New Labour Code Reforms, 2021: 6-hrs Virtual Training Workshop OnDocument3 pagesNew Labour Code Reforms, 2021: 6-hrs Virtual Training Workshop OnStrategic Hr and Training -Synapsetech VentureNo ratings yet

- GST - The New Era of Taxation SystemDocument33 pagesGST - The New Era of Taxation SystemAmit KumarNo ratings yet

- Offences and Penalties Under Goods and Service Tax Act 2017 - An AnalysisDocument16 pagesOffences and Penalties Under Goods and Service Tax Act 2017 - An AnalysisRupal GuptaNo ratings yet

- Indirect Taxation: IntermediateDocument290 pagesIndirect Taxation: IntermediateShreya JainNo ratings yet

- Banking and Insurance LawDocument6 pagesBanking and Insurance LawpriyanandanNo ratings yet

- Ranjeetroyproject PDFDocument37 pagesRanjeetroyproject PDFMili DasNo ratings yet

- A Study On "Impact of Goods and Service Tax (GST) On Consumers in India" (PaulDocument44 pagesA Study On "Impact of Goods and Service Tax (GST) On Consumers in India" (Paulsomenbiswas2kNo ratings yet

- Volume I (BGM 16 04 2019) PDFDocument870 pagesVolume I (BGM 16 04 2019) PDFManoj GuptaNo ratings yet

- Lesson Plan Bcom-309Document3 pagesLesson Plan Bcom-309Anjali. 1999No ratings yet

- Bsl304goods and Services Tax (GST)Document2 pagesBsl304goods and Services Tax (GST)yagefi3101No ratings yet

- COURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationDocument6 pagesCOURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationNoor FatimaNo ratings yet

- Revised Commerce Indirect TaxexDocument4 pagesRevised Commerce Indirect Taxexlipsa PriyadarshiniNo ratings yet

- Area: Finance: Post-Graduate Diploma in Management (PGDM)Document4 pagesArea: Finance: Post-Graduate Diploma in Management (PGDM)Sagar KansalNo ratings yet

- GST Information BasicsDocument9 pagesGST Information BasicsmaakapyaarabetaNo ratings yet

- The New Era of Taxation SystemDocument35 pagesThe New Era of Taxation SystemRahul Kumar VishwakarmaNo ratings yet

- Course Outline For Direct Taxation 2022-2Document7 pagesCourse Outline For Direct Taxation 2022-2JiaNo ratings yet

- Edp Project Final 0103173271Document30 pagesEdp Project Final 0103173271kavitachandak12gNo ratings yet

- Certificate Course On Income Tax Return FillingDocument1 pageCertificate Course On Income Tax Return Fillingponnada sairamNo ratings yet

- Mudit - TL II FinalDocument18 pagesMudit - TL II FinalMudit BaliaNo ratings yet

- GST Inter CA Q&A BookDocument177 pagesGST Inter CA Q&A BookHetal BeraNo ratings yet

- Simran Sharma ProjectDocument56 pagesSimran Sharma ProjectSimranNo ratings yet

- CSF (19-24) (6th-A) (Land Laws II) (Code 325) (Zeeshan Rauf)Document9 pagesCSF (19-24) (6th-A) (Land Laws II) (Code 325) (Zeeshan Rauf)Hafiz Omer MirzaNo ratings yet

- ATL Practice Questions June 2023 290323Document84 pagesATL Practice Questions June 2023 290323sarang chawareNo ratings yet

- Background Material On GST - Volume II 04.02.2022Document518 pagesBackground Material On GST - Volume II 04.02.2022SunilsabatNo ratings yet

- Binder 3Document91 pagesBinder 3Tasmay Enterprises100% (1)

- Revised BGM On GST Vol2 PDFDocument503 pagesRevised BGM On GST Vol2 PDFJAINo ratings yet

- GST - The New Era of Taxation SystemDocument38 pagesGST - The New Era of Taxation SystemAditya SinghNo ratings yet

- Binder 1Document82 pagesBinder 1Tasmay EnterprisesNo ratings yet

- GST Training at NIFMDocument2 pagesGST Training at NIFMnitintshNo ratings yet

- Tamil Nadu National Law University: Course Syllabus Law of Indirect Taxation Course ObjectivesDocument5 pagesTamil Nadu National Law University: Course Syllabus Law of Indirect Taxation Course ObjectivesreshNo ratings yet

- Taxation Law II Final DraftDocument12 pagesTaxation Law II Final DraftMonica ChandrashekharNo ratings yet

- Business Taxation-1Document27 pagesBusiness Taxation-1Pranjal pandeyNo ratings yet

- Unit 2 - LAIR-1Document142 pagesUnit 2 - LAIR-1sreevalliNo ratings yet

- Mba Finance and Accounting Outlines For 5 UnitsDocument19 pagesMba Finance and Accounting Outlines For 5 UnitsMWANJE FAHADNo ratings yet

- PIL NotesDocument74 pagesPIL NotesSarthak JainNo ratings yet

- History-Ii: Taxation System Under The British Rule in IndiaDocument18 pagesHistory-Ii: Taxation System Under The British Rule in IndiaSarthak JainNo ratings yet

- Semester: 2 Subject: Philosophy Ii A Project On: Acid Attacks On Women in IndiaDocument15 pagesSemester: 2 Subject: Philosophy Ii A Project On: Acid Attacks On Women in IndiaSarthak JainNo ratings yet

- Sarthak Jain - Legal English - A038Document18 pagesSarthak Jain - Legal English - A038Sarthak JainNo ratings yet

- Semester: 2 Subject: Economics II A Project On:: Harshad Mehta Vs Union of India (Scam 1992) : An Economic AnalysisDocument19 pagesSemester: 2 Subject: Economics II A Project On:: Harshad Mehta Vs Union of India (Scam 1992) : An Economic AnalysisSarthak JainNo ratings yet

- Sarthak Jain - Law of Contracts - A038Document21 pagesSarthak Jain - Law of Contracts - A038Sarthak JainNo ratings yet

- Semester: 1 Subject: Economics A Project On Cashless Economy in India Submitted To: Ganesh MunnorcodeDocument11 pagesSemester: 1 Subject: Economics A Project On Cashless Economy in India Submitted To: Ganesh MunnorcodeSarthak JainNo ratings yet

- Semester: 1 Subject: Law of Torts A Project On Nervous ShockDocument10 pagesSemester: 1 Subject: Law of Torts A Project On Nervous ShockSarthak JainNo ratings yet

- Semester: 1 Subject: English A Short Story On Vishaka & Ors. V State of Rajasthan SUBMITTED TO: Rakesh NambiarDocument6 pagesSemester: 1 Subject: English A Short Story On Vishaka & Ors. V State of Rajasthan SUBMITTED TO: Rakesh NambiarSarthak JainNo ratings yet

- Firoz Shah Tughlaq's AdministrationDocument22 pagesFiroz Shah Tughlaq's AdministrationSarthak Jain0% (1)

- Logic Behind PunishmentsDocument16 pagesLogic Behind PunishmentsSarthak JainNo ratings yet

- Solving Quadratic InequalitiesDocument2 pagesSolving Quadratic InequalitiesAlan BanlutaNo ratings yet

- HRM Project Report Group 11Document18 pagesHRM Project Report Group 11Aditya GuptaNo ratings yet

- ITA CertificationRoadmap-MTA PDFDocument1 pageITA CertificationRoadmap-MTA PDFRemiBoudaNo ratings yet

- Hypothesis Testing: Learning OutcomesDocument4 pagesHypothesis Testing: Learning Outcomesmahyar777No ratings yet

- Passed-194-08-19-Tabuk City-Voices of Verb PDFDocument30 pagesPassed-194-08-19-Tabuk City-Voices of Verb PDFVergel Bacares BerdanNo ratings yet

- Activities For Personality AdjectivesDocument3 pagesActivities For Personality AdjectivesFabio CerpelloniNo ratings yet

- IJBIDM 4 (2) Paper 04Document16 pagesIJBIDM 4 (2) Paper 04Adrian SerranoNo ratings yet

- 2 and 3 Digit Addition and Subtraction Unravel The Fact FreebieDocument10 pages2 and 3 Digit Addition and Subtraction Unravel The Fact Freebiesafaa nadarNo ratings yet

- Open Space Brisbane Anglican Synod 2019 Book of ProceedingsDocument134 pagesOpen Space Brisbane Anglican Synod 2019 Book of ProceedingsPuella IridisNo ratings yet

- Counting Collections: Learning ObjectivesDocument3 pagesCounting Collections: Learning ObjectivesKaren KaynyNo ratings yet

- Amslinkenglishcenter Amslinkcambridgeexamchallenge: Cambridge Movers TestDocument20 pagesAmslinkenglishcenter Amslinkcambridgeexamchallenge: Cambridge Movers TestTrang PhamNo ratings yet

- Applied Bus Tools Amd TechnologiesDocument6 pagesApplied Bus Tools Amd TechnologiesQueen BeeNo ratings yet

- 9 27 9 28 Lesson Plan Great Plains Geography and Technology-2Document7 pages9 27 9 28 Lesson Plan Great Plains Geography and Technology-2api-687866367No ratings yet

- Communicative StyleDocument9 pagesCommunicative StyleShilla CaigoyNo ratings yet

- Indian Oil Corporation Limited (Refineries Division) (Barauni Refinery)Document8 pagesIndian Oil Corporation Limited (Refineries Division) (Barauni Refinery)Vishu MakwanaNo ratings yet

- Monitoring Sheet AdviserDocument12 pagesMonitoring Sheet AdviserRaquel Bona ViñasNo ratings yet

- Design A ClubhouseDocument4 pagesDesign A ClubhouseAr Shahanaz JaleelNo ratings yet

- Success Factors in New Service Development: A Literature ReviewDocument19 pagesSuccess Factors in New Service Development: A Literature ReviewhaiquanngNo ratings yet

- Hedging in ESL: A Case Study of Lithuanian Learners: Inesa Šeškauskien÷Document6 pagesHedging in ESL: A Case Study of Lithuanian Learners: Inesa Šeškauskien÷vi tiNo ratings yet

- New LI ReportDocument24 pagesNew LI ReportPutera BulanNo ratings yet

- What Is The 5E Learning Model?Document5 pagesWhat Is The 5E Learning Model?Le Hoang LamNo ratings yet

- AxoBus TimingDocument2 pagesAxoBus Timingwgjtjzj424No ratings yet

- The Primary World of SensesDocument15 pagesThe Primary World of SensesSmemnarNo ratings yet