Professional Documents

Culture Documents

EB-and-AIT

Uploaded by

Jade MasiragCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EB-and-AIT

Uploaded by

Jade MasiragCopyright:

Available Formats

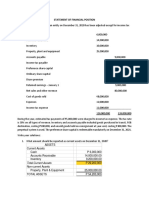

EMPLOYEE BENEFITS Effect of asset ceiling 300,000 800,000

DINA ENG Company reported a prepaid benefit cost of During the year, the entity recognized current service cost of

P1,500,000 on January 1, 2016. The entity provided the P1,000,000, actual return on plan assets of P400,000, and

following information related to a defined plan during the current contribution to the plan of P2,100,000. The discount rate is 10%.

year:

(6) What is the employee benefit expense for the current year?

Current service cost 3,000,000 (7) What is the net remeasurement loss for the current year?

Actual return on plan assets 1,200,000 (8) What is the defined benefit cost?

Interest cost 800,000 (9) What amount of prepaid benefit cost should be reported on

Settlement price of benefit 500,000 December 31?

obligation paid in advance

Present value of benefit 600,000 ACCOUNTING FOR INCOME TAX

obligation paid in advance

Interest income 1,000,000 CARL DE RETA Co. reported net income for the current year

2014 at P10,000,000 before taxes. Included in the determination

Actuarial gain on PBO 400,000

of the said net income were:

Past service cost 500,000

Benefits paid to retirees 2,500,000

Temporary differences:

Contribution to the plan 4,000,000 Accrued warranty expenses 250,000

Projected benefit obligation – 8,000,000 Rental payments made in advance 400,000

Jan. 1 Advance collections from customers 500,000

Fair value of plan assets – 10,000,000 Provision for probable losses 900,000

Jan. 1

Asset ceiling – January 1 1,500,000 Permanent differences:

Asset ceiling – December 31 2,000,000 Non-taxable income 500,000

Discount rate 10% Non-deductible expenses 100,000

(1) What is the 2016 benefit expense? *The income tax rate is 40% and is not expected to change in

(2) What is the fair value of the plan assets at December 31? the future.

(3) What is the projected benefit obligation at December 31?

(4) What is the net remeasurement gain or loss in OCI? REQUIRED:

DINO GUAN Company provided the following pension plan (1) How much is the current tax expense?

information for the current year: (2) How much is the total tax expense?

(3) What is the total deferred tax asset to be presented in the

January 1 Projected benefit obligation 3,500,000 2014 statement of financial position?

Accumulated benefit obligation 2,800,000 (4) What is the total deferred tax liability to be presented in the

During the year Pension benefits paid to 2014 statement of financial position?

retired employees 250,000 (5) Assuming that the expected income tax rate for the following

December 31 Projected benefit obligation 4,200,000 year is 35%, what is the total tax expense?

Accumulated benefit obligation 3,100,000

PICPA LEVEL 1 REVIEWER

Discount or settlement rate 10% LIAM POE Company reported the following carrying amount of

assets and liabilities at year-end:

(5) What is the current service cost?

Property 10,000,000

PENNY RITO Company provided the following information Plant and equipment 5,000,000

during the current year: Inventory 4,000,000

Trade receivables 3,000,000

January 1 December Trade payables 6,000,000

31 Cash 2,000,000

Fair value of plan assets 6,000,000 8,500,000

Projected benefit obligation 5,000,000 6,500,000 Additionally, a P1,000,000 impairment loss to trade receivables

Prepaid/accrued benefit cost 1,000,000 2,000,000 has been made. This charge will not be allowed in the current

– surplus year for tax purposes. The income tax rate is 30%. The entity

Asset ceiling 700,000 1,200,000 has made an inventory obsolescence provision of P2,000,000

which is not allowable for tax purposes. However, for tax

purposes, the amount of plant and equipment and property was

P4,000,000 and P7,000,000 respectively.

REQUIRED:

(6) What is the deferred tax liability at year-end?

(7) What is the deferred tax asset at year-end?

VINA GO-ONG Company reported in the first year of

operations pretax financial income of P6,000,000. The current

year tax rate is 30% and the enacted rate for future years is

25%. The following differences existed:

Tax return Accounting record

Uncollectible accounts expense 200,000 300,000

Depreciation expense 800,000 500,000

Tax exempt interest revenue -- 150,000

REQUIRED:

(8) What is the current tax expense?

(9) What is the total tax expense?

NELLIE CHUN Company provided the following information at

year-end:

Carrying amount Tax base

Accounts receivable 1,500,000 1,750,000

Motor vehicle 1,650,000 1,250,000

Provision for warranty 120,000 0

Deposit received in advance 150,000 0

An allowance for doubtful accounts of P250,000 has been

raised against accounts receivable for accounting purposes but

such doubtful accounts are deductible only when written off as

uncollectible. The enacted income tax rate is 30%.

In a nutshell, 25% and 15% are the depreciation rates for

taxation and accounting respectively. In addition, the provision

for warranty costs is deductible when paid and deposits

received in advance are taxable when received.

PICPA LEVEL 1 REVIEWER

REQUIRED:

(10) What amount should be reported as deferred tax liability?

(11) What amount should be reported as deferred tax asset?

GOD BLESS!

- END OF HANDOUT -

You might also like

- INCOME STATEMENT METHOD TAX CALCDocument37 pagesINCOME STATEMENT METHOD TAX CALCAngelaMariePeñarandaNo ratings yet

- Income Tax Expense and Deferred Tax Asset & Liability CalculationsDocument3 pagesIncome Tax Expense and Deferred Tax Asset & Liability Calculationskrisha millo0% (1)

- Practical Financial Accounting - Volume 1 (Condrado T. Valix)Document369 pagesPractical Financial Accounting - Volume 1 (Condrado T. Valix)Josh CruzNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Pressure Testing ProcedureDocument4 pagesPressure Testing Proceduredavideristix100% (1)

- Statement of Financial PositionDocument3 pagesStatement of Financial Positionlyka0% (1)

- B2B MARKETING (Business Marketing)Document6 pagesB2B MARKETING (Business Marketing)lynette_rodrigues88No ratings yet

- UI Business of UX MetricsDocument20 pagesUI Business of UX MetricshthompsoNo ratings yet

- TAX DEDUCTIONS GUIDEDocument4 pagesTAX DEDUCTIONS GUIDEAnonymous LC5kFdtcNo ratings yet

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- Cultural Studies GoldsmithsDocument8 pagesCultural Studies Goldsmithsmoebius70No ratings yet

- Calculating deferred tax assets and liabilitiesDocument3 pagesCalculating deferred tax assets and liabilitiesIrvin LevieNo ratings yet

- IPDA Lookback FinalDocument9 pagesIPDA Lookback Finalmessaoudi05ff100% (1)

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Accounting For Income Tax-1Document4 pagesAccounting For Income Tax-1CAINo ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Module 12 - Accounting For Income Tax - Leases - Employee BenefitsDocument7 pagesModule 12 - Accounting For Income Tax - Leases - Employee BenefitsMaha Bianca Charisma CastroNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- FAR PROBLEMS - 1 FinalDocument9 pagesFAR PROBLEMS - 1 FinalLouise GazaNo ratings yet

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionJay-L TanNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- Quiz Employee Benifits Income TaxDocument2 pagesQuiz Employee Benifits Income TaxMonica MonicaNo ratings yet

- Mockbiard Questions - Practical 1Document10 pagesMockbiard Questions - Practical 1Regina Clarete0% (1)

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- Single Entry and Error Correction QuizDocument2 pagesSingle Entry and Error Correction QuizMarii M.No ratings yet

- 11.25.2017 Accounting For Income TaxDocument5 pages11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Q2 Employee Benefits Pt.2Document4 pagesQ2 Employee Benefits Pt.2francine del rosarioNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Problem Quiz On IntermediateDocument3 pagesProblem Quiz On IntermediateReginald ValenciaNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- FAR ProblemsDocument7 pagesFAR ProblemsClaire GarciaNo ratings yet

- Illustrative Examples - Accounting For Income TaxDocument3 pagesIllustrative Examples - Accounting For Income Taxr3rvpaudit.nfjpia2324supaccNo ratings yet

- Calculate Income Tax Expense and Deferred TaxDocument10 pagesCalculate Income Tax Expense and Deferred Taxlana del reyNo ratings yet

- ABC Corp net income adjustmentsDocument4 pagesABC Corp net income adjustmentsAlvin John San JuanNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- ACT150-Assignment-DIMAAMPAODocument4 pagesACT150-Assignment-DIMAAMPAOJeromeNo ratings yet

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxRed YuNo ratings yet

- Accounting CycleDocument4 pagesAccounting CycleRommel Angelo AgacitaNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- Philippine corporate income tax problems and solutionsDocument2 pagesPhilippine corporate income tax problems and solutionsRandy Manzano100% (1)

- ACCTG Employee-BenefitDocument2 pagesACCTG Employee-BenefitMicaela EncinasNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- ACCTG 16 FAR W2 Problems PDFDocument5 pagesACCTG 16 FAR W2 Problems PDFLabLab ChattoNo ratings yet

- BS & Is (Questions)Document7 pagesBS & Is (Questions)Dale JimenoNo ratings yet

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Revenue recognition installment salesDocument3 pagesRevenue recognition installment salesReyn Saplad PeralesNo ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- PAMANTASAN NG LUNGSOD NG MAYNILA INTERMEDIATE ACCOUNTING 3 QUIZ NO. 1Document5 pagesPAMANTASAN NG LUNGSOD NG MAYNILA INTERMEDIATE ACCOUNTING 3 QUIZ NO. 1Trixie HicaldeNo ratings yet

- Quizbowl Practice: Financial Accounting - Practical Accounting 1Document9 pagesQuizbowl Practice: Financial Accounting - Practical Accounting 1MimiNo ratings yet

- Example Exercise - Postemployment BenefitsDocument5 pagesExample Exercise - Postemployment BenefitsYhana SarmientoNo ratings yet

- Exercise 10 Statement of Cash Flows - 054935Document3 pagesExercise 10 Statement of Cash Flows - 054935Hoyo VerseNo ratings yet

- Indolence of the FilipinosDocument12 pagesIndolence of the FilipinosJade MasiragNo ratings yet

- toaz.info-chap-15-problem-solutionsdocx-pr_28c875a425a4f69a58c4c4bf3c5e1fbeDocument32 pagestoaz.info-chap-15-problem-solutionsdocx-pr_28c875a425a4f69a58c4c4bf3c5e1fbeJade MasiragNo ratings yet

- BM Q2Wk5DLPDocument15 pagesBM Q2Wk5DLPJade MasiragNo ratings yet

- BM Q2Wk1DLPDocument10 pagesBM Q2Wk1DLPJade MasiragNo ratings yet

- Grade 12 Quantitative Research PacketDocument9 pagesGrade 12 Quantitative Research PacketJade MasiragNo ratings yet

- PAMPANGA HIGH SCHOOL BUSINESS MATH 12 WEEK 1-3 ASSESSMENTSDocument7 pagesPAMPANGA HIGH SCHOOL BUSINESS MATH 12 WEEK 1-3 ASSESSMENTSJade MasiragNo ratings yet

- Business Finance Modified Assessment Quarter 3 Weeks 1 7Document7 pagesBusiness Finance Modified Assessment Quarter 3 Weeks 1 7Jade MasiragNo ratings yet

- Orgbev MidtermsDocument17 pagesOrgbev MidtermsJade MasiragNo ratings yet

- Modified Assessment - Hope 4Document12 pagesModified Assessment - Hope 4Jade MasiragNo ratings yet

- Q3 W1 W7 Modified Assessment BESRDocument7 pagesQ3 W1 W7 Modified Assessment BESRJade MasiragNo ratings yet

- Q4 BUSINESS FINANCE Modified Assessment Weeks 1 4Document4 pagesQ4 BUSINESS FINANCE Modified Assessment Weeks 1 4Jade MasiragNo ratings yet

- Q4 Modified Assessment BUSINESS ENTERPRISEDocument3 pagesQ4 Modified Assessment BUSINESS ENTERPRISEJade MasiragNo ratings yet

- (Deep Cuts) Creative Direction Scope of WorkDocument3 pages(Deep Cuts) Creative Direction Scope of WorkIgor Araujo LiberatoNo ratings yet

- Instructional TechnologiesDocument16 pagesInstructional TechnologiesIhwanor AsrafNo ratings yet

- Business Law 34 Marks Revision - CTC ClassesDocument36 pagesBusiness Law 34 Marks Revision - CTC ClassesThe Real BNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Email: Address: 26 Elmer Avenue, Toronto, ON M4L 3R7: Operations Process Specialist-Project & Document ManagementDocument3 pagesEmail: Address: 26 Elmer Avenue, Toronto, ON M4L 3R7: Operations Process Specialist-Project & Document Managementsh tangriNo ratings yet

- Citi Union BankDocument15 pagesCiti Union BankDhina KaranNo ratings yet

- Pricing Decisions: Global MarketingDocument19 pagesPricing Decisions: Global MarketingAsif_Jamal_9320No ratings yet

- FS Final OutputDocument62 pagesFS Final OutputMariael PinasoNo ratings yet

- PIARB Pub - Strickland Vs Ernst and Young LLPDocument2 pagesPIARB Pub - Strickland Vs Ernst and Young LLPZSHAINFINITY ZSHANo ratings yet

- Final Assignment: Mct1074 Business Intelligence and AnalyticsDocument28 pagesFinal Assignment: Mct1074 Business Intelligence and AnalyticsAhmad Shahir NohNo ratings yet

- End of Unit Test Unit 9Document12 pagesEnd of Unit Test Unit 9DUC NGUYEN VANNo ratings yet

- Diya GDocument45 pagesDiya GDiya goyalNo ratings yet

- UNiDAYS-Meet Gen Z The Traveling GenerationDocument8 pagesUNiDAYS-Meet Gen Z The Traveling GenerationJason StoneNo ratings yet

- Exclusive Garnet Distributor MalaysiaDocument1 pageExclusive Garnet Distributor MalaysiaFarouq YassinNo ratings yet

- MEDICI RegTech Executive Summary PDFDocument16 pagesMEDICI RegTech Executive Summary PDFrenukaramaniNo ratings yet

- Current Asset Management Chapter SummaryDocument14 pagesCurrent Asset Management Chapter SummaryLokamNo ratings yet

- BBFT3024 T3 Ans 4a, B, C RPGT - RPCDocument2 pagesBBFT3024 T3 Ans 4a, B, C RPGT - RPCsomethingNo ratings yet

- Presentación CeramicsDocument13 pagesPresentación CeramicsJulio GalanNo ratings yet

- Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 8: Global StrategyDocument19 pagesStrategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 8: Global StrategyNigin G KariattNo ratings yet

- Bimtech Case Questions+ Project Details Phase 1+2Document5 pagesBimtech Case Questions+ Project Details Phase 1+2RetailNo ratings yet

- C243340 SalarySlipIncludeDocument1 pageC243340 SalarySlipIncludebenq78786No ratings yet

- Using Social Media for Recruitment: Pros, Cons and TrendsDocument47 pagesUsing Social Media for Recruitment: Pros, Cons and TrendsTrusha SharmaNo ratings yet

- Part 4B Investment Decision Analysis 216 QuestionsDocument62 pagesPart 4B Investment Decision Analysis 216 QuestionsFernando III PerezNo ratings yet

- Dhan Ki BaatDocument12 pagesDhan Ki Baattest hrmNo ratings yet

- 27 Flow Chart For Procurement Process Rev1Document1 page27 Flow Chart For Procurement Process Rev1Prasanta ParidaNo ratings yet