Professional Documents

Culture Documents

NN

NN

Uploaded by

Sisay AD0 ratings0% found this document useful (0 votes)

8 views7 pagesBTC-USD

Original Title

nn

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBTC-USD

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views7 pagesNN

NN

Uploaded by

Sisay ADBTC-USD

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

414924, 1:23 PM Bitcoin Price Prediction - Colaboratory

import nusay a8 np

import pandas as pd

import matplotlib.pyplot as plt

From datetine import datetine

fro keras.nodels import Sequential

from keras. layers import Dense, LSTM, Dropout, GRU

ros keras.layers import *

From sklearn.preprocessing import MinMaxScaler

from sklearn.netrics import mean_squared error, ean_absolute_error

from sklearn.nodel_selection import train_test_split

From keras.callbacks import farlyStopping

From keras.optinizers inport Adam, SGD

AF = pd.read_csv(*/content/8TC-USD.csv" )

AF = df. sort_values(“Date').reset_index(drop=True)

af. head()

pate open High Low Close Adj Close vo

0 ‘172015 320434998 320.434998 914,002091 314.240093 914.248093 80

1 11172018 430.721008 436.248002 427.515015 434.334015 434.934015 3627

2 1W1R017 —969.658020 1002.080017958.698075 998.925012 998925012 14777

3 wiz018 14142.200200 14112.200200 13184,700200 19687.200200 12667,200200 1029120

411172019 3748.713379_3850.913818 3707.231201 _3843.520020 3843520020 432420

Next steps: Generate code with d¢ | € View recommended plots

af. shape

(2123, 7)

Select the column ‘Close" for daily price

af[ close")

4F{ "Close" J astype( float)

ple. Figure(Figsiz«

28,7))

plt.plot(4f[ Date" J.values, df{ Close" ].values, label = ‘Bitcoin Stock Price’, color = ‘red")

plt.xticks(np.arange(see,d¢.shape(@],22@))

plt.xlabel(‘Date')

plt.ylabel( ‘Close ($)")

plt.legend()

plt.show()

Intps:icolab research google. cordrve/gONuTZDhThishmemgMUSVBGWo8U3JIEMh=en#scrolT

raxglnfogkSSpriniMode=true

wr

414924, 1:23 PMA Bicoin Price Prediction - Colaboratory

—_

¥ Data Preprocessing

hnun_shape = 2008

train = df.tloc{:num_shape, 1:2].values

test = dF -iloc{nue_shape:, 1:2].values

‘Scaling our features using normalization. Normalizing data helps the algorithm in converging Le. to find local/ global minimum

efficiently.

sc = Minvaxscaler(feature_range = (8, 1))

train_scaled = sc. fit_transform( = 4s 227s /step - loss: 0.0051

vy Prediction

aF_volune = np.vstack((train, test))

Anputs = df_volune[éf_volune.shape[@] - test.shape[e] - window:]

inputs = inputs.reshape(-1,1)

Anputs = se. transfora(inputs)

hhum_2 = df_volune.shape[@] ~ num_shape + window

1

for 4 in range(windox, mum 2):

X test_= np.reshape(input

X_kestappend(X test_)

[i-window:i, @], (window, 1))

X test = np.stack(x test)

predict = model.predict(x test)

predict = sc.inverse_transform(predict)

4b

= 25 2985/step

Intps:ifolab research google. comdrvegONuTZDhThishmemgMUoVBGWoSLU3IEhy

iscroITO=TeXgHrfogKSSprintMode=true

414924, 1:23 PMA Bitcoin Price Prediction - Colaboratory

GFF = predict - test

print("AMSE:", np.sert(np-nean(4iffr*2)))

fwse: 2127.1281081885868

plt.figure(Figsize=(28,7))

plt.plot(df[ 'Date®].values[17@0:], df_velune[17@@:], color = ‘red', label = ‘Real Bitcoin Price’)

plt.plot(dfl ‘bate®][-predict.snape[@):].values, predict, color = ‘blue’, label = ‘Predicted Bitcoin Price’)

plt.xticks(np-arange(220,df{ 1808: ].shape[@],28))

plt.title(’Bitcoin Price Prediction’)

plt.xlabel(‘Date')

plt.ylabel( ‘Price ($)")

pit. Legend()

plt.show()

y GRU

4 The GRU architecture

‘nodelGRU = Secuential()

‘nodelGRU.add(GRUCunits#50, return_sequences*Toue, input_shapes(X train, shape(],1)))

‘sode1GRU.add(Dropout (@.2))

‘nodelGRU.ad4(cRUCunits=58, return_sequence:

‘nodelGRV. add(oropout (@.2))

rue, Anput_shape=(X_train.shape[1],1)))

snodelGRU.ad4(cRU(units=58, return_sequences=Toue, input_shape=(X_train.shape[1],1)))

ssodelGRU.adé(oropout (8.2))

snodelGRU.add(6RU(units=5@))

‘modelGRU.add(oropout (@.2))

‘modelGRU.add(Dense(units=1))

‘nodelGRU. susmary()

Model: “sequential_

“Tayer (ype) —=~=~*~*~*~*~*~C«S Rp Shape S*S*«éi ra

cru (GRU) (Wore, 68, 50) 7950)

ropout_4 (Dropout) (Wore, 68, 58) °

Intps:ilolab research google. convdrvegONuTZDhThishmemgMUsVBGWoSUU3JIEh=en#scroTo=T@XglnfogkSspriniMode=true

414924, 1:23 PMA Bicoin Price Prediction - Colaboratory

erat (ot) (one, 68, 50) 15300

dropout_s (Oropout) (one, 68, 50) °

era (Gt) (one, 68, 50) 15300

dropout_6 (Oropout) (one, 68, 50) °

eras (ot) (one, 50) 15300

éropout_7 (Oropout) (one, 50) °

dense_a (Derse) (one, 2) su

Total parans: 52981 (210.55 KB)

Trainable parans: 53901 (218.55 KB)

Non-trainable parans: @ (2.80 Byte)

node1GRU.conpile(optinizer='adan’, loss='nean_squared_error')

modelGRU.fit(X train, y_train, epochs=160, baten_size=128)

Intps:ifolab research google. comdrvegONuTZDhThishmemgMUoVBGWoSLU3IEhy

iscroITO=TeXgHrfogKSSprintMode=true

414924, 1:23 PMA

36/26 [~

Epoch 97/108

26/16

Epoch 98/108

36/16 [

Epoch 59/108

36/36 [~

Epoch 180/180

36/36 [+

Bitcoin Price Prediction - Colaboratory

45 243ns/step

35 177es/step

3s 76ns/step

3s 17ans/step

45 2450s/step

‘ckeras.src.callbacks.istory at @x7a7@8e250fa0>

predict = modelGRu.predict(x test)

predict ~ sc.inverse_transferm(predict)

st

GiFF = predict - test

Print("RNSE:", np.sqrt(np-nean(4itfe*2)))

pit.

pit.

pit.

pit.

pit.

pit.

pit.

pit.

pit.

as

2127.2281081885868

Figure(Figsize=(28,7))

plot (df[ "Date" J.values[1700:], df_volune[17#0:], color =

+ 15 2305/step

oss

loss:

loss:

oss:

oss:

“red!

plot (df{ "Date" ]{-predict.shape[@]:].values, predict, color =

xticks (np. arange( 200, 4f(1800:

title("Bitcoin Price Prediction’)

xlabel( Date")

ylabel('Price ($)")

egend()

show)

-shape[@],28))

+ 0.0045,

2.0083

e000

0.0039

0.0039

|) label = "Real Biteoin Price”)

blue’, label = “Precicted Bitcoin Price")

Intps:ilolab research google. convdrvegONuTZDhThishmemgMUsVBGWoSUU3JIEh=en#scroTo=T@XglnfogkSspriniMode=true

uw

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bitcoin Price Prediction 5 - ColaboratoryDocument5 pagesBitcoin Price Prediction 5 - ColaboratorySisay ADNo ratings yet

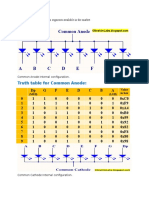

- Truth Table For Common AnodeDocument3 pagesTruth Table For Common AnodeSisay ADNo ratings yet

- April 16th Presentation-JSDocument7 pagesApril 16th Presentation-JSSisay ADNo ratings yet

- Chap. 5 Basic Computer Org. and Design: 5-1 Instruction CodesDocument21 pagesChap. 5 Basic Computer Org. and Design: 5-1 Instruction CodesSisay ADNo ratings yet

- Advanced Design For Robot in Mars ExplorationDocument6 pagesAdvanced Design For Robot in Mars ExplorationSisay ADNo ratings yet

- Chapter OneDocument27 pagesChapter OneSisay ADNo ratings yet

- Interface LCD and Keypad With 8051 MicroDocument7 pagesInterface LCD and Keypad With 8051 MicroSisay ADNo ratings yet

- Introduction To Artificial Intelligence: By: Getaneh TDocument55 pagesIntroduction To Artificial Intelligence: By: Getaneh TSisay ADNo ratings yet

- Office2007 Excel TrainfffingDocument65 pagesOffice2007 Excel TrainfffingSisay ADNo ratings yet

- 0 BBDocument6 pages0 BBSisay ADNo ratings yet

- FishggDocument63 pagesFishggSisay ADNo ratings yet