Professional Documents

Culture Documents

Topic 1 - Introduction Topic 1 - Student

Uploaded by

nnmnghi1409Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 1 - Introduction Topic 1 - Student

Uploaded by

nnmnghi1409Copyright:

Available Formats

Principles of Auditing

Prescribed Reading

Course tittle: Principles of Auditing

Session Topic 1 Materials Exercises Notes

1 Introduction to Textbook (1): Chapter 1 Textbook (1): Chapter 1

Auditing &

Independent Textbook (2): Chapter 1 Workbook: Chapter 1

Topic 1 Auditing

Relevant Guidance (Quy định có liên quan)

Introduction to ISA200 Overall Objectives of the Independent Auditor, and the Conduct of an Audit

in Accordance with International Standards on Auditing

Auditing & Independent Auditing VSA200 Mục tiêu tổng thể của kiểm toán viên và doanh nghiệp kiểm toán khi thực

hiện kiểm toán theo chuẩn mực kiểm toán Việt Nam

Lecturer: Mai Đức Nghĩa

School of Accounting, UEH

2

Learning objectives of Topic 1

Contents of Topic 1

1.1 Understand the nature of auditing and assurance services.

1 Definition of Auditing & Assurance Service

1.2 Define auditing & distinguish different types of audits that can be provided by various auditors.

2 Classification of Audit

1.3 Appreciate the development of audit profession.

1.4 Understand the reasons giving rise to demand for the audit of financial statements. 3 Development of Audit Profession (Self-study)

1.5 Appreciate the objectives of of the Independent Auditor, and the Conduct of an Audit

1.6 Appreciate the role of auditing standards and a general auditing process. 4 Roles of Independent Audit Service (Self-study)

5 Auditors, Audit firms & Professional bodies 4

3

Mai Duc Nghia (UEH) 1

Principles of Auditing

How do we assure that accounting information is trustworthy?

Objectives of accounting

“Provide information that is useful to existing and

potential investors, lenders and other creditors in

making decisions about providing resources to

the entity”

The decisions made by users will involve:

Investment decisions

Financing decisions

Voting, or influencing management actions

6

5

Relationships Among Auditors, Client, and External Users

1. Definition of Auditing & Assurance Service

A Statement of Basic Auditing Concepts

Auditor issues (ASOBAC-the American Accounting Association) defines auditing as:

Client or audit

committee hires report relied assertions on financial statement

auditor Auditor upon by users to reduce (a statement that you strongly believe is true)

information risk

‘A systematic process of objectively obtaining and evaluating evidence

cơ sở dẫn liệu của bttc ( theo kế toán )

regarding assertions about economic actions and events to ascertain the

tT200, acc law

Provides capital degree of correspondence between those assertions and established criteria,

External

Client and communicating the results to interested users.’

Users

decree: nghị định

Client provides financial circular: thông tư

statements to users directive: chỉ thị

company

resoluton: nghị quyết

7

8

Mai Duc Nghia (UEH) 2

Principles of Auditing

Key terms of Audit definition Summary of Audit definition

The important parts of this

definition: assertions about economic

• Systematic process — audits are structured activities actions and events

• Objectivity — freedom from bias (thiên vị)

• Obtaining and evaluating evidence — allows the auditor

to determine the support for assertions or representations

Competent, obtains and

• Assertions about economic actions and events — describes the subject Determines the degree of communicates

independent evaluates

matter of an audit correspondence the results

person evidence

• Degree of correspondence … established criteria — the purpose of the audit

is to determine conformity

with some specified criteria

• Communicating results — the results must be

communicated to interested parties Established criteria

9 Các tiêu chuẩn được thiết tập 10

Fore reference (Tham khảo)

Audit of a Tax Return Example

Definition of auditing (Arens)

Auditing is the accumulation and evaluation of evidence about

information to determine and report on the degree of

correspondence between the information and established criteria.

Auditing should be done by a competent, independent person.

11 12

Mai Duc Nghia (UEH) 3

Principles of Auditing

2. Classification of Audit

Contents of Topic 1

Criteria of classifying

1 Definition of Auditing & Assurance Service

AUDITORS The purposes

of Audit

2 Classification of Audit assertions about economic

actions and events

3 Development of Audit Profession Competent, obtains and

Determines the degree of communicates

independent evaluates

correspondence the results

person evidence

4 Roles of Independent Audit Service

Established criteria

5 Auditors, Audit firms & Professional bodies 13

14

2.1. Types of Audit

2. Classification of Audit

Criteria of classifying

AUDIT PURPOSES (Phân loại theo Mục đích)

AUDIT PURPOSES (Mục đích) AUDITORS (Chủ thể)

2.1.1. Operational audit (Kiểm toán hoạt động)

OPERATIONAL AUDIT INTERNAL AUDITORS

efficiency and effectiveness of

2.1.2. Compliance audit (Kiểm toán tuân thủ)

are employed by organizations to audit for

operating procedures/methods. management with oversight by the board of

COMPLIANCE AUDIT kiểm toán tuân thủ directors

2.1.3. Financial Statement audit (Kiểm toán BCTC)

determine whether specific procedures, STATE AUDITORS kiểm toán nhà nước

rules, or regulations are followed or not. auditors who are working for the public

FINANCIAL STATEMENT AUDIT bodies (eg, audit tax returns)

determine whether financial statements INDEPENDENT/EXTERNAL AUDITORS

are true and fair. certified public accountant are responsible

for auditing the historical FSs.

15 16

Mai Duc Nghia (UEH) 4

Principles of Auditing

2.1.1. Operational audit (Kiểm toán hoạt động) 2.1.1. Operational audit (Kiểm toán hoạt động)

Examples:

evaluate the efficiency and accuracy of processing payroll transactions in a newly installed computer

hữu hiệu hiệu quả system (đánh giá tính hữu hiệu & chính xác của phần mềm tính lương)

Purpose (Mục tiêu): An operational audit evaluates the efficiency and effectiveness of evaluate the efficiency, accuracy, and customer satisfaction in processing the distribution of letters

any part of an organization’s operating procedures and methods. and packages by a company such as Federal Express. (đánh giá tính hữu hiệu, chính xác, mức độ hài

lòng của khách hàng trong việc sử dụng dịch vụ thư tín và giao hàng)

At the completion of an operational audit, management normally expects

recommendations for improving operations. Criteria: It is more difficult to objectively evaluate whether the efficiency and

effectiveness of operations meets established criteria than it is for compliance and

Audited Objects (Đối tượng được kiểm toán): They can include the evaluation of financial statement audits.

organizational structure, computer operations, production methods, marketing, and any Also, establishing criteria for evaluating the information in an operational audit is

other area in which the auditor is qualified. extremely subjective. (Operational auditing is more like management consulting than

what is usually considered auditing.)

hhieu :đánh giá về sluong, chất lượng, chi phí

Hiệu quả là sự so sánh giữa lợi ích và chi phí,

cp nào càng ít thì càng hiệu quả 17 18

Differentiate: Effectiveness & Efficiency 2.1.2. Compliance audit (Kiểm toán tuân thủ)

Tính hữu hiệu (Effectiveness): là mức độ hoàn thành các nhiệm vụ

hay các mục tiêu mong đợi. Purpose: A compliance audit is conducted to determine whether the auditee is following

specific procedures, rules, or regulations set by some higher authority.

Actual Results Objectives/Expectation

Effectiveness: fulfilling a specified function in fact Audited Objects:

Tính hiệu quả (Efficiency): đánh giá bằng cách so sánh giữa kết quả

đạt được và nguồn lực đã được sử dụng để tạo ra kết quả đó. Governmental units, such as school districts, are subject to considerable compliance auditing

because of extensive government regulation.

Many private and not-for-profit organizations have prescribed policies, contractual

Actual Results Resources/Output agreements, and legal requirements that may require compliance auditing.

Efficiency: achieving maximum productivity with minimum wasted effort or expense Compliance audits for funded grant programs are often done by CPAs.

19

20

Mai Duc Nghia (UEH) 5

Principles of Auditing

2.1.2. Compliance audit (Kiểm toán tuân thủ) 2.1.3. Financial Statement Audits (Kiểm toán BCTC)

Purpose: A financial statement audit is conducted to determine whether the financial

statements (the information being verified) are stated in accordance with specified

Criteria: prescribed procedures and regulations. criteria.

Purpose: Examples: Audited Objects: financial statements.

Determine whether accounting personnel are following the procedures prescribed by the company

controller (bộ phận kế toán có tuân thủ thủ tục hay không).

Review wage rates for compliance with minimum wage laws (tuân thủ quy định về mức lương tối thiểu

Examples:

theo luật lao động). Audit a set of financial statements as requirements of Securities and Exchange Commission.

Examine contractual agreements with bankers and other lenders to be sure the company is complying with

legal requirements (tuân thủ hợp đồng cho vay).

Criteria: accounting standards.

21 22

Example of Audit of Historical Financial Statements Exercise 1: Examples of the Three Types of Audits

Eg.: Annual audit of Boeing’s financial statements

-Efficiency of production Industry best practices

Review of a company's -Use of materials Company standards

manufacturing process -Quality control procedures Cost-effectiveness goals

Information Boeing's financial statements

Established Generally accepted accounting

Criteria principles

Available Documents, records, and outside

Evidence sources of evidence independent auditors mostly do FS audits

Please print it out & fill it by yourself, then take a picture of it and pots it to LMS assessment

23

submission.

24

Mai Duc Nghia (UEH) 6

Principles of Auditing

2.2. Types of Audit

2.2.1. Internal Auditor (Kiểm toán nội bộ)

AUDITORS (Phân loại theo CHỦ THỂ) Internal auditors: are employed by all types of organizations to audit for management with

oversight by the board of directors. (internal employees)

2.2.1. Internal auditor (Kiểm toán nội bộ)

Purpose: to conduct financial, internal control, compliance, operation and forensic audits

2.2.2. State auditor (Kiểm toán Nhà nước) within their organization ( Internal auditors’ responsibilities vary considerably,

depending on the employer.)

2.2.3. Independent auditor (Kiểm toán độc lập)

To maintain independence from other business functions, the internal audit group

typically reports directly to the president, another high executive officer, or the audit

committee of the board of directors.

Certification: Internal auditors often pursue certification as a certified internal

auditor (CIA), and some internal auditors pursue both the CPA and CIA designations.

25 26

2.2.2. State Auditor (Kiểm toán Nhà Nước) 2.2.3. Independent/External Auditor (Kiểm toán độc lập)

State auditors: are auditors working for public bodies.

Audited Objects: the primary responsibility is to perform the audit function for

Government, and it has many of the same audit responsibilities as a CPA firm. Accounting firms: are responsible for auditing the historical financial statements of all

publicly traded companies.

Examples: Audit of tax returns (thanh tra thuế), involving individual income taxes, gift taxes, estate taxes,

corporate taxes, and so on. Audited Objects: most other reasonably large companies, and many smaller companies

and noncommercial organizations.

Criteria: applied regulations.

27 28

Mai Duc Nghia (UEH) 7

Principles of Auditing

3.1. The development of Auditing Profession

Contents of Topic 1

Before 1900 After 1900

Objective To detect errors and frauds Give an opinion on truthfulness and

faithfulness of accounting figure

1 Definition of Auditing & Assurance Service

Method Verify in details the entire + Audit sampling (chọn mẫu)

2 Classification of Audit transactions + Rely on internal control system

+ Audit in the CIS environment.

(Kiểm tra chi tiết toàn bộ + Audit approach techniques based on

3 Development of Audit Profession nghiệp vụ) risk assessment.

4 Roles of Independent Audit Service User Owners Shareholders, investors, creditors.

5 Auditors, Audit firms & Professional bodies 29 30

3.2. The development of Auditing Profession in Vietnam International Market of Audit Profession (Big 4)

• 05/1991: The first audit firm in Vietnam (VACO) was established

• 01/1994: Issued the regulation on independent audit activities (Decree 07/CP).

• 09/1999: Issued the first 4 VSAs.

• 03/2004: Issue a new regulation on independent audit activities (Decree 105/2004/ND-CP)

• 04/2005: Establishment of VACPA.

• 12/2005: Issued 37 standards

• 01/2012: Decree 17/2012 / ND-CP, implementation of the Law on Independent Audit

• 12/2012: Re-issued 37 new auditing standards effective from January 1, 2014 (Circular

214/2012-TT_BTC)

31 32

Mai Duc Nghia (UEH) 8

Principles of Auditing

Revenue of the Big Four accounting/audit firms worldwide by region 2019

Contents of Topic 1

In billion U.S. dollars

1 Definition of Auditing & Assurance Service

2 Classification of Audit

3 Development of Audit Profession

4 Roles of Independent Audit Service

5 Auditors, Audit firms & Professional bodies 34

Source: https://www.statista.com/statistics/250944/big-four-accounting-firms-geographical-breakdown-of-revenues/ 33

4. The Roles of External Audit in the Economy 4.1. Attributes of accounting information

From AASB/IASB framework, the following attributes of accounting information

4.1. Attributes of accounting information provide the basis for the audit function:

4.2. Demand for assurance Fundamental characteristics

• relevance

4.3. Hypotheses explaining demand for assurance • faithful representation

Enhancing characteristics

• comparability

• verifiability

• timeliness

• understandability

35 36

Mai Duc Nghia (UEH) 9

Principles of Auditing

4.2. Economic Demand for assurance

Demand Driver Information risk

provide

Good attributes of the basis for the audit

accounting information function

What is meant

Fundamental Enhancing

by “Information risk”?

Relevance Comparability

Verifiability

Faithful Timeliness

Auditing can have a significant effect

Representation Understandability

on information risk. 38

4.2.1. Demand Driver Information Risk

Các nguyên nhân:

Demand Driver Information risk

• Động cơ của người cung cấp thông tin (Conflict of interest/motives of provider)

Demand arises because users are not in a position to establish the • Tầm quan trọng/hậu quả của thông tin cho việc ra quyết định (Consequence-the quality

of information)

credibility of the information they are presented with.

• Khối lượng và tính phức tạp của thông tin (Complexity)

• Sự khó khăn trong tiếp cận thông tin (Remoteness of information)

Information

is likely to

be

distorted.

39 40

Mai Duc Nghia (UEH) 10

Principles of Auditing

4.2.3. Solutions? Benefits of assurance

Consider these following

solutions?

Risky?

Characteristics of demand for assurance results in following

The users directly check the information benefits:

• Increased relevance and reliability of assured information means that

Strengthen the legal responsivities of shareholders and debtholders will invest with greater confidence,

the Board of Directors reducing information risk, and therefore a reduced cost of capital.

Compulsorily audited financial

statements

• Financial analysts will make more accurate and informed

recommendations.

Auditing can have a significant effect on information risk. Both should result in improved allocation of resources across range of

investment opportunities

41 42

Other benefits of assurance

Contents of Topic 1

An assurance service may also result in one or both of the

following:

1 Definition of Auditing & Assurance Service

• recommendations by the assurance provider to improve the efficiency and

effectiveness of operations

2 Classification of Audit

• a positive influence on the behaviour of people whose activities are being

assured. 3 Development of Audit Profession

4 Roles of Independent Audit Service

5 Auditors, Audit firms & Professional bodies 44

43

Mai Duc Nghia (UEH) 11

Principles of Auditing

5. Auditors, Audit firms & Professional bodies 5.1. Auditors in Vietnam (1)

Reference: Textbook 1: Chapter 2 Chapter 2. AUDITORS AND PRACTICING AUDITORS

for Australia CPA

Article 14. Standards of auditors

1. Auditors must meet the following standards:

1. Auditors (Kiểm toán viên)

a) Having full civil act capacity;

2. Audit firms (Doanh nghiệp kiểm toán) b) Having good morals, sense of responsibility, integrity, honesty, objectivity;

c) Having degree of university or higher to be of financial, banking, accounting, auditing

3. Professional bodies (Hội Nghề Nghiệp) disciplines or other disciplines as prescribed by the Ministry of Finance;

d) Having certificates of auditors in accordance with regulations the Ministry of Finance.

2. Where person who have foreign certificates recognized by the Ministry of Finance, passing

the examinations in Vietnamese on Vietnam law and meeting fully the standards specified in

point a and point b clause 1 of this Article shall be recognized as auditors.

45 Source: LAW ON INDEPENDENT AUDIT 46

5.1. Auditors in Vietnam (1) 5.1. Auditors in Vietnam (2)

Chương 2 KIỂM TOÁN VIÊN VÀ KIỂM TOÁN VIÊN HÀNH NGHỀ Chapter 2. AUDITORS AND PRACTICING AUDITORS

Điều 14. Tiêu chuẩn kiểm toán viên Article 14. Standards of auditors

1. Kiểm toán viên phải có đủ các tiêu chuẩn sau đây: 1. Auditors must meet the following standards:

a) Có năng lực hành vi dân sự đầy đủ;

b) Có phẩm chất đạo đức tốt, có ý thức trách nhiệm, liêm khiết, trung thực, khách quan; a) Having full civil act capacity;

c) Có bằng tốt nghiệp đại học trở lên thuộc chuyên ngành tài chính, ngân hàng, kế toán, kiểm b) Having good morals, sense of responsibility, integrity, honesty, objectivity;

toán hoặc chuyên ngành khác theo quy định của Bộ Tài chính; c) Having degree of university or higher to be of financial, banking, accounting, auditing

d) Có Chứng chỉ kiểm toán viên theo quy định của Bộ Tài chính. disciplines or other disciplines as prescribed by the Ministry of Finance;

d) Having certificates of auditors in accordance with regulations the Ministry of Finance.

2. Trường hợp người có chứng chỉ của nước ngoài được Bộ Tài chính công nhận, đạt kỳ thi

sát hạch bằng tiếng Việt về pháp luật Việt Nam và có đủ các tiêu chuẩn quy định tại điểm a và 2. Where person who have foreign certificates recognized by the Ministry of Finance, passing

điểm b khoản 1 Điều này thì được công nhận là kiểm toán viên. the examinations in Vietnamese on Vietnam law and meeting fully the standards specified in

point a and point b clause 1 of this Article shall be recognized as auditors.

Source: LAW ON INDEPENDENT AUDIT 47 48

Mai Duc Nghia (UEH) 12

Principles of Auditing

5.1. Auditors in Vietnam (2) 5.2. Audit firms (Certified Public Accounting Firms)

SPECIFIC PROVISIONS - Section 1 - Article 4 (Circular No: 91/2017/TT-BTC)

Article 4. Eligibility for taking exams There are many levels of audit firms:

An applicant for audit practicing certificate or accounting practicing certificate must have the following

eligibilities: – Big Four international firms

– National firms

1. Meet standards in professional ethics, truthfulness, integrity, and high sense of law observance;

– Regional and large local firms

2. Obtain at least a bachelor's degree in finance, banking, accounting, or audit; or a bachelor's degree in

other majors with total units of study (or classes) of subjects: Finance, accounting, audit, financial activity – Small local firms

analysis, or taxation accounting for at least 7% of total units of study (or classes) of the entire course; or

obtain a bachelor's degree in other majors and audit or accounting certificates or degrees awarded by

The largest international firms are known as the 'Big Four'. They are:

international audit or accounting associations as prescribed in Article 9 hereof;

– PricewaterhouseCoopers

3. Have at least 36 months’ experience in finance, accounting, or audit field, which is determined in the

period beginning from the month of graduation specified in the bachelor's degree (or postgraduate degree) – EY

to the time of application for taking exams. Actual working time includes the period of working as audit – KPMG

assistant at audit firms, as internal auditor at internal audit department, or as auditor at state audit

– Deloitte

agencies;

4. Submit sufficient and required application for examination and exam fees as prescribed;

5. Not subject to Clause 1 and Clause 2 Article 52 of the Law on Accounting. The Big Four dominate the practice of public accounting, especially for large listed clients.

49 50

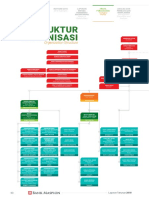

5.2. Organizational Structure 5.2. Services provided by Audit firms

Assurance service Audit

Review

Proprietorship (Doanh nghiệp tư nhân) Other assurance services

Related services Agreed-upon procedures regarding financial information

Compilation of financial information

Partnership (Công ty hợp danh)

Tax services Tax consultancy

Tax planning/reporting

Limited liability company (Công ty TNHH)

Management consultancy Financial consultancy

Strategy development

Other services Education/Training

51 Head hunting 52

Mai Duc Nghia (UEH) 13

Principles of Auditing

5.3. Professional bodies

Hierarchy of a Typical CPA Firm

International professional bodies:

Breadth of Experience The American Institute of CPAs (AICPA)

Chủ phần hùn

Partners 10+ years

The Association of Chartered Certified Accountants (ACCA)

Chủ nhiệm

Managers kiểm toán 5-10

Seniors CPA Australia, and so on.

2-5

Trưởng nhóm kiểm toán

In Vietnam

Staff/Assistants 0-2

Vietnam Association of Certified Public Accountants – VACPA

Trợ lý kiểm toán (established in 2005 and started to operate from 1/1/2006)

53 54

Mai Duc Nghia (UEH) 14

You might also like

- Internal Audit Check Sheet EnggDocument56 pagesInternal Audit Check Sheet EnggRamdas PaithankarNo ratings yet

- Auditing Text BookDocument600 pagesAuditing Text Bookpratik bhandariNo ratings yet

- EHQMS Integrated Internal Audit Procedure SampleDocument5 pagesEHQMS Integrated Internal Audit Procedure SampleShengrong Yee100% (1)

- Wiley CIA P1 MCQsDocument240 pagesWiley CIA P1 MCQsSameh Saber80% (5)

- CIA ReviewerDocument90 pagesCIA ReviewerKay Cee Tangalin100% (2)

- Forensic Audit ProceduresDocument6 pagesForensic Audit ProceduresIchsanNo ratings yet

- CA Inter Audit SA Revision Book @CA - Study - NotesDocument62 pagesCA Inter Audit SA Revision Book @CA - Study - Notessantosh pandeyNo ratings yet

- Improve Internal Audit MethodologyDocument48 pagesImprove Internal Audit MethodologyfaisalNo ratings yet

- ALA ISO 27000 Presentation Material Rev2Document113 pagesALA ISO 27000 Presentation Material Rev2drmohamed120No ratings yet

- ISO 22000 Internal AuditDocument1 pageISO 22000 Internal AuditPushpinder Kaur Dhatt0% (1)

- Chapter 1 The Nature of Internal AuditingDocument15 pagesChapter 1 The Nature of Internal Auditingdictus_sba5008100% (3)

- Automotive Quality Systems Handbook: ISO/TS 16949:2002 EditionFrom EverandAutomotive Quality Systems Handbook: ISO/TS 16949:2002 EditionRating: 3 out of 5 stars3/5 (5)

- Michel Audit ManajemenDocument15 pagesMichel Audit ManajemenLeo DanuartaNo ratings yet

- AUE Study Guide 001 - 2020 - 4 - BDocument170 pagesAUE Study Guide 001 - 2020 - 4 - BLindelwe NeneNo ratings yet

- ICAI - Fundamentals of Account TextDocument737 pagesICAI - Fundamentals of Account TextSalmanAnjans100% (1)

- Audit Report FormDocument2 pagesAudit Report FormAura Garcia-GabrielNo ratings yet

- ISO 9001 Quality Management System Lead Auditor IRCA PDFDocument5 pagesISO 9001 Quality Management System Lead Auditor IRCA PDFJeba Nadar100% (1)

- Topic 1 - Introduction Topic 1 - Student Kiểm toán căn abrnDocument14 pagesTopic 1 - Introduction Topic 1 - Student Kiểm toán căn abrnQUY VO TRONGNo ratings yet

- Auditing I Course OutlineDocument3 pagesAuditing I Course OutlineMeseret AsefaNo ratings yet

- 2017-1 Acct7103 01 L-BB PDFDocument7 pages2017-1 Acct7103 01 L-BB PDFStephanie XieNo ratings yet

- Topic 6 - Audit Report - Students PrintingDocument12 pagesTopic 6 - Audit Report - Students PrintingNhư YếnNo ratings yet

- Topic 2 - Audit Environment - Student - PrintingDocument7 pagesTopic 2 - Audit Environment - Student - PrintingXàm NguyễnNo ratings yet

- Topic 5 - Audit Evidence - StudentDocument9 pagesTopic 5 - Audit Evidence - StudentLan TrinhNo ratings yet

- Rps Audit Ii - Gasal 2022Document8 pagesRps Audit Ii - Gasal 2022Dania Amani YaponoNo ratings yet

- Topic 4 - Audit PlanningDocument9 pagesTopic 4 - Audit PlanningCường Trần MinhNo ratings yet

- Topic 3 - Internal Control SystemDocument13 pagesTopic 3 - Internal Control SystemCường Trần MinhNo ratings yet

- Chapter 1 Introduction.2022Document46 pagesChapter 1 Introduction.2022Cẩm Tú NguyễnNo ratings yet

- Slides - Efa - AuditingDocument24 pagesSlides - Efa - Auditinghuangtana13052003No ratings yet

- Chap 1 - An Introduction To AuditingDocument37 pagesChap 1 - An Introduction To AuditinghangNo ratings yet

- DBFS IA Course NotesDocument33 pagesDBFS IA Course NotesAnnie ChanNo ratings yet

- Audit and Internal Review Course Outline (New) - 1Document10 pagesAudit and Internal Review Course Outline (New) - 1emeraldNo ratings yet

- Quality ControlDocument20 pagesQuality ControlBijoy SalahuddinNo ratings yet

- Topic 5 - Audit Evidence Students PrintingDocument9 pagesTopic 5 - Audit Evidence Students PrintingNhư YếnNo ratings yet

- AF Course Outline Sem 2 201617Document10 pagesAF Course Outline Sem 2 201617Khairul AmirNo ratings yet

- Rps Audit Ii - Gasal 2022Document7 pagesRps Audit Ii - Gasal 2022Dania Amani YaponoNo ratings yet

- Part 1 - SU 1 Foundations of Internal AuditingDocument86 pagesPart 1 - SU 1 Foundations of Internal Auditingintern.hmdsNo ratings yet

- Delegates NotesDocument47 pagesDelegates NotesDiego MartínNo ratings yet

- PPA 5th ChapterDocument18 pagesPPA 5th Chapterprashanth jhaNo ratings yet

- Toc and Preface Principles of IAADocument21 pagesToc and Preface Principles of IAAPrincess AguilarNo ratings yet

- Sawyer Bab 1pptxDocument15 pagesSawyer Bab 1pptxanon_323651754No ratings yet

- Effective Internal Quality Auditing (Regional Centers)Document26 pagesEffective Internal Quality Auditing (Regional Centers)PCC ISONo ratings yet

- Chapter 3 - Internal ControlDocument20 pagesChapter 3 - Internal ControlMy DgNo ratings yet

- Iso 19011Document10 pagesIso 19011CristianGomez50% (2)

- New Standard Guides Internal and Supplier AuditsDocument6 pagesNew Standard Guides Internal and Supplier AuditsRamón G. PachecoNo ratings yet

- AuditingDocument164 pagesAuditingAbdul HadiNo ratings yet

- DASAR - Slide Fondasi Audit Internal - Hananto Widhiatmoko (PUBLISH)Document58 pagesDASAR - Slide Fondasi Audit Internal - Hananto Widhiatmoko (PUBLISH)Pingkan OmpiNo ratings yet

- Auditing I Course OutlineDocument2 pagesAuditing I Course OutlineAbdi Mucee TubeNo ratings yet

- Auditing - VI Sem B.Com (Elective)Document7 pagesAuditing - VI Sem B.Com (Elective)Romit SarkarNo ratings yet

- Aud Agile Eng m01 Pnotes Background Terms and DefinitionsDocument5 pagesAud Agile Eng m01 Pnotes Background Terms and DefinitionsMohamed ElsawyNo ratings yet

- CH 1 - Performing The IA EngagementDocument17 pagesCH 1 - Performing The IA EngagementSakhiwo MlumaNo ratings yet

- EMS Internal Audit GuidanceDocument3 pagesEMS Internal Audit GuidanceVelraj ParthibanNo ratings yet

- Auditing and Assurance Concepts and Application 1 FINALDocument8 pagesAuditing and Assurance Concepts and Application 1 FINALmhadzmpNo ratings yet

- ISMS - Lead Auditor Training CourseDocument3 pagesISMS - Lead Auditor Training CourseShuvo036No ratings yet

- Chapter+1+ +Overview+of+Audit+Process+and+Pre Engagement+ActivitiesDocument24 pagesChapter+1+ +Overview+of+Audit+Process+and+Pre Engagement+ActivitiesDan MorettoNo ratings yet

- Audit Ing and Assurance: Concepts and Applications 1 Chapter 1: Overview of The Audit Process and Pre-Engagement ActivitiesDocument24 pagesAudit Ing and Assurance: Concepts and Applications 1 Chapter 1: Overview of The Audit Process and Pre-Engagement ActivitiesDan MorettoNo ratings yet

- Auditing TechniquesDocument51 pagesAuditing Techniqueshrteam.kolkataNo ratings yet

- Course OutlineDocument3 pagesCourse Outlinefekadegebretsadik478729No ratings yet

- Details of Changes in ISO 19011 2018 20082020Document44 pagesDetails of Changes in ISO 19011 2018 20082020C P TiwariNo ratings yet

- Audit Process: - Phase 1: Audit Plan - Phase 2: Audit Implementation - Phase 3: Audit CompletionDocument5 pagesAudit Process: - Phase 1: Audit Plan - Phase 2: Audit Implementation - Phase 3: Audit CompletionMai LinhNo ratings yet

- Fundamentals OF Accounting: Common Proficiency TestDocument14 pagesFundamentals OF Accounting: Common Proficiency TestArvind RamanujanNo ratings yet

- Teaching Plan Auditing - PAS2183 - APRIL 2023Document3 pagesTeaching Plan Auditing - PAS2183 - APRIL 2023DIVA RTHININo ratings yet

- Professional Ethics: After Studying This Chapter, You Will Be Able ToDocument161 pagesProfessional Ethics: After Studying This Chapter, You Will Be Able ToMenuka SiwaNo ratings yet

- AMC Training ModuleDocument7 pagesAMC Training ModuleChristine EffendyNo ratings yet

- BSI Internal Audit TipsDocument12 pagesBSI Internal Audit TipsAdrian AustinNo ratings yet

- Audit RiskDocument5 pagesAudit RiskFermie Shell100% (1)

- Rinconada - Activity1 True or FalseDocument1 pageRinconada - Activity1 True or FalseRinconada Benori ReynalynNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument4 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- NC National Guard Audit ReportDocument17 pagesNC National Guard Audit ReportMark DavenportNo ratings yet

- TUGAS KELOMPOK Dan INDIVIDU SESI 7 KEL 4Document3 pagesTUGAS KELOMPOK Dan INDIVIDU SESI 7 KEL 4jessy rahayuNo ratings yet

- Group 1 Handout RectifiedDocument11 pagesGroup 1 Handout RectifiedNe BzNo ratings yet

- SA 700 (Revised) : F O R F SDocument36 pagesSA 700 (Revised) : F O R F SSugim Winata EinsteinNo ratings yet

- TB Chapter 3 PDFDocument25 pagesTB Chapter 3 PDFTaha Wael QandeelNo ratings yet

- Principles of Auditing and Other Assurance Services 20Th Edition Whittington Solutions Manual Full Chapter PDFDocument43 pagesPrinciples of Auditing and Other Assurance Services 20Th Edition Whittington Solutions Manual Full Chapter PDFAndrewRobinsonixez100% (10)

- Auditing: Integral To The EconomyDocument47 pagesAuditing: Integral To The EconomyPei WangNo ratings yet

- AUDITING THEORY Jan 3 2024Document39 pagesAUDITING THEORY Jan 3 2024Jamikka DistalNo ratings yet

- Chapter - 04, Process of Assurance - Evidence and ReportingDocument5 pagesChapter - 04, Process of Assurance - Evidence and ReportingSakib Ex-rccNo ratings yet

- MCQ Comprehensive ActivityDocument13 pagesMCQ Comprehensive ActivityMicaela MarimlaNo ratings yet

- Chapter 8 AuditDocument22 pagesChapter 8 AuditMisshtaCNo ratings yet

- Auditing Theory CPARDocument57 pagesAuditing Theory CPARCarla ZanteNo ratings yet

- Struktur Organisasi: Organization StructureDocument2 pagesStruktur Organisasi: Organization StructureRalila SejahteraNo ratings yet

- EY Engineering and Construction Internal Audit Benchmarking StudyDocument44 pagesEY Engineering and Construction Internal Audit Benchmarking StudyNaveen BansalNo ratings yet

- Icpa - Audit ReportingDocument8 pagesIcpa - Audit ReportingjaysonNo ratings yet

- Notes Link Notes Link: Risk Assessment Link Risk Response LinkDocument4 pagesNotes Link Notes Link: Risk Assessment Link Risk Response Linkmentor_muhaxheriNo ratings yet

- F8 - Audit and AssuranceDocument4 pagesF8 - Audit and Assuranceyousouf777No ratings yet

- Silabus Auditing EDP OBEDocument2 pagesSilabus Auditing EDP OBERizky Nugroho SantosoNo ratings yet

- SKV-FM-MR-03 Record Control Master List Filled For QADocument14 pagesSKV-FM-MR-03 Record Control Master List Filled For QASaurabh BhadouriyaNo ratings yet

- Auditing Solved MCQs (Set-3)Document6 pagesAuditing Solved MCQs (Set-3)Official vasitNo ratings yet

- ISA 720 MindMapDocument1 pageISA 720 MindMapA R AdILNo ratings yet